4. Recording an Instruction

A product is a specific service that you offer your customers. For example, you may process periodic insurance payments, account sweeps subject to a specific balance, etc. These services should be defined as products.

A product, you will notice, helps you classify the standing instruction services that you offer, according to broad similarities. The advantage of defining a product is that you can define certain general attributes for a product that will default to all instructions involving it.

Every time you have to process an instruction for a customer you need not specify its general attributes since they are inherited from the product involved. Some of these attributes may have to be changed for an instruction. Further, attributes specific to an instruction, like the accounts involved, the currency and amount of transfer, etc. have to be specified when an instruction is initiated.

This chapter contains the following section:

4.1 Standing Instruction Details

This section contains the following topics:

- Section 4.1.1, "Invoking Standing Instruction Details Screen"

- Section 4.1.2, "Operations on Instruction"

- Section 4.1.3, "Features of SI Input Details Screen"

- Section 4.1.4, "Charges Button"

- Section 4.1.5, "Settlement Button"

- Section 4.1.6, "Advices Button"

- Section 4.1.7, "Tax Button"

- Section 4.1.8, "Events Button"

- Section 4.1.9, "Duplication Details Button"

- Section 4.1.10, "Viewing SI Contract"

- Section 4.1.11, "Authorizing SI Contract"

- Section 4.1.12, "SI Amendment Upload"

- Section 4.1.13, "SI Batch Processing"

- Section 4.1.14, "Processing of Limit Check during SI Batch"

- Section 4.1.15, "Printing of DD/BC"

4.1.1 Invoking Standing Instruction Details Screen

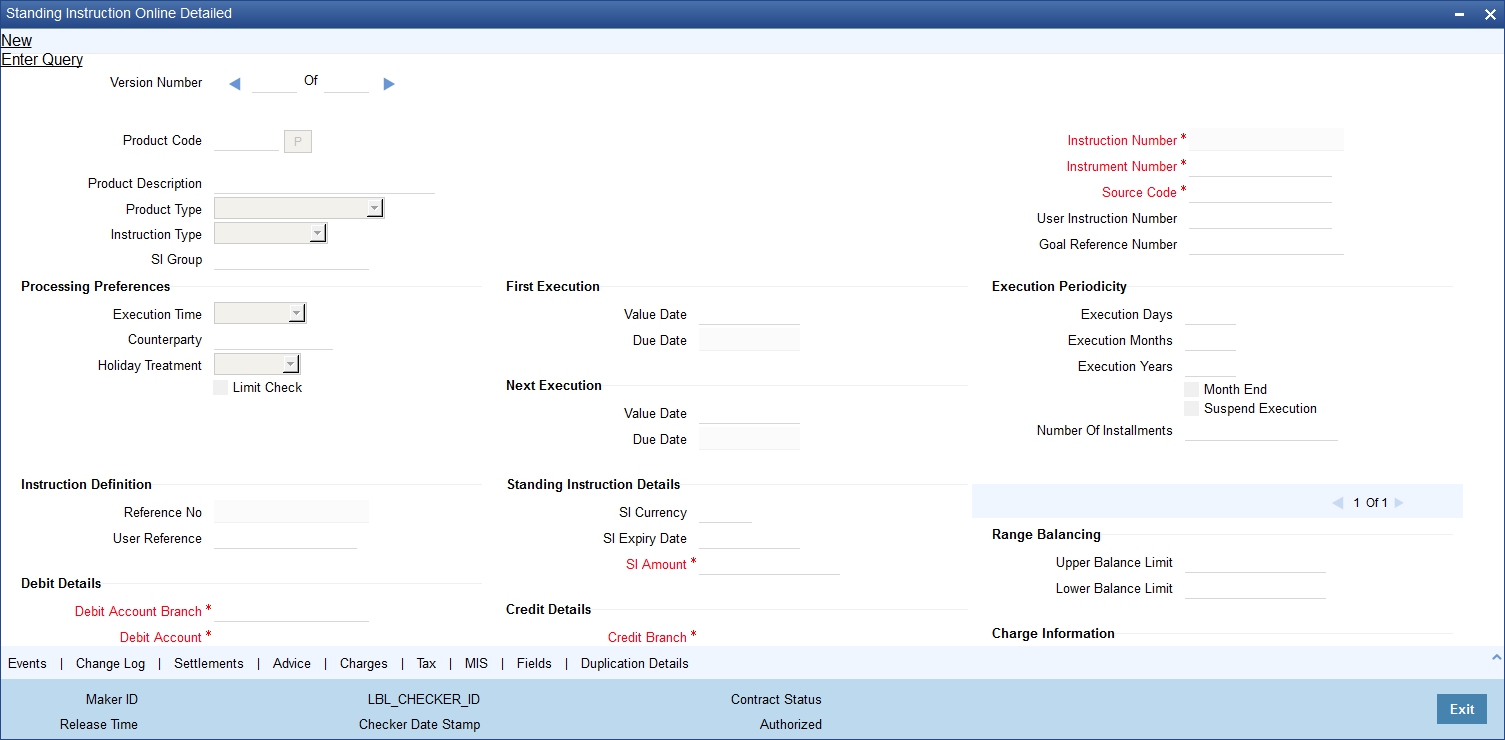

The details of an instruction are recorded in the ‘Standing Instruction Online Detailed’ screen.

You can invoke this screen by typing ‘SIDTRONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

From this screen, you can navigate to the following screens that will contain values that are applicable by default depending on the product involving the instruction:

- SI Advices screen

- SI Charges screen

- SI Tax Details screen

You can choose to modify or waive the charges, suppress the generation of an advice, or waive a tax.

While saving a standing instruction contract, the contract details needs to be passed on to the FATCA accounts and obligations maintenance. This will be done if the customer who is the beneficiary of the instruction has a reportable FATCA classification and the product code used to book the standing instruction is present in FATCA Products, account class and Instruments maintenance.

If the SI contract is closed or liquidated completely, then the corresponding row in FATCA accounts and obligations maintenance will be archived. If you delete the SI contract before authorization, then you should also delete the corresponding entry in FATCA accounts and obligations maintenance.

4.1.2 Operations on Instruction

The following are the related activities that you can perform on an instruction:

- Open an instruction

- Delete the details of an instruction

- Amend the details of an instruction

- Authorize an instruction

- Close an instruction

- Reopen an instruction

Refer to the user manual on common procedures for details on these procedures.

4.1.3 Features of SI Input Details Screen

Every product that is created in your bank has certain general attributes. An instruction that you record acquires the general attributes that were defined for the product that it involves. These general attributes are:

- The product code, description, slogan, start and end date for the product and remarks

- How the instruction is to be processed in case the processing date falls on a holiday

- The mode of payment and the currency rate that is to be used in case it is a cross-currency transaction

- The frequency of the execution

- The action to be taken if the account to be debited for an instruction does not have sufficient funds

- Details of charges applicable on an instruction

- Other tax details like the component being taxed, the type of tax and the event (opening, execution, etc.) upon which it is applied

- The accounting roles and the General Ledgers for accounting purposes when an event (execution, partial execution, etc.) takes place, and the advices to be generated

- The customer categories and customers for whom you can process instructions involving the product

The branch and currency restrictions. An instruction that you record acquires the details specified for the product that it involves. However, you also need to enter information that is specific to the instruction. You can enter details specific to an instruction in the SI Contract Details screen. You have to specify the following details for each instruction:

- Counterparty on behalf of whom the instruction is being recorded

- Currency of the instruction

- Amount that has to be transferred during each cycle

- Account that has to be debited

- Account that has to be credited

- Date on which the instruction has to be executed (first due date)

- Date until which the instruction has to be executed (expiry date)

- If the debit account is involved in more than one instructions falling due on the same day, you can allot the priority with which an instruction has to be processed.

The following attributes will be inherited from the product and you can change them:

- Maximum retry count

- Action code applicable if the instruction cannot be processed due to insufficient funds in the debit account

- Execution Periodicity

For charges, you should indicate who bears the charge: the remitter or the beneficiary.

You can also indicate the events that should be charged: successful execution (SUXS), partial execution (PEXC), or rejection (REJT).

Every instruction that you record would involve a specific service that you offer (which you defined as a product). When recording an instruction, you should specify the product that it involves.

All the attributes of the product that you specify will apply to the instruction. However, you can change some of these attributes.

The Instruction Number identifies the instruction. It is automatically generated by the system for each instruction. The Instruction Number is a combination of the three character branch code, the four character instruction code, the date on which the instruction is recorded (in Julian format) and a running serial number.

The Julian Date has the following format:

YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of days that have elapsed in the year.

For example, January 31, 1998 translates into the Julian Date: 98031. Similarly, February 5, 1998 becomes 98036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those that elapsed in February (31+5=36).

User Instruction Number

An instruction can be identified by two different numbers: one is allotted by Oracle FLEXCUBE while the other one can be a number input by you, which should typically be the number with which your customer identifies the instruction, called the User Instruction Number. No two instructions can have the same User Instruction Number.

By default, the Instruction Number allotted by Oracle FLEXCUBE and the User Instruction Number will be the same.

SI Group

Specify the SI group from the option list. The list displays all the SI groups maintained in static type maintenance (CODTYPES) under type ‘SIGROUP’.

Note

This value has to be selected only if the SI product used has Intraday type of execution else, the system will display an error.

Tanked Status

The standing instruction requests are processed with the ‘Tanked’ status if the branch is not available when the transaction was received. When the branch is available, the status is changed.

Specifying Counterparty

When entering the details of an instruction, you should specify the counterparty on whose behalf you are recording it. The category of counterparties (or the customers themselves) who can record standing instructions is defined for the product. Specify the code of a counterparty who falls into a category allowed for the product.

Execution Periodicity

The execution periodicity defined for the product will be picked up automatically. A customer can pay the insurance premium on a monthly basis, a quarterly basis or on an annual basis. You can define the periodicity for execution of the standing instructions using the following fields:

Execution Days

The system displays the execution days defined at the product level. However, you can modify this. For eaxmple, 30 days, 90 days and 365 days

Execution Months

The system displays the execution months defined at the product level. However, you can modify this. For example month, 3 months and 12 months.

Execution Years

The system displays the execution years defined at the product level. However, you can modify this. This is not possible for the first two years. For the third cycle you can choose 1 year.

Month End

Check this box to indicate that the instruction should be executed on the month-end day.

Note

The Execution Periodicity for the Product Type ‘Range Balancing Sweep’ should be Oneday.

Specifying Period for which Instruction should be Executed

Each instruction is valid for a specific period of time. This must be defined for the instruction. The first due date and the expiry date will mark the life-span of the instruction.

First Value Date

The value date for the first execution is usually the same date as the first due date, unless that is a holiday. In that case, the First Value Date will be computed based on the holiday handling specifications for the product.By default, the First Due Date will be today s date. You can change it to a date in the future. Oracle FLEXCUBE will automatically compute the next due date and next value date based on the periodicity defined for the product. The first value date of the SI should be greater than or equal to the account opening date + the value provided in the ‘Block Duration after Opening Date’ field (STDACCLS>Deposit>Block Duration After Opening Date).

SI Expiry Date

The Expiry Date will be the date until when the instruction will be processed. This field needs to be mandatorily updated if the TD account is the Credit Account. The SI Expiry Date entered for TD accounts should be less than the maturity date of the deposit.

When user enters both number of Installments and Expiry date then the system recalculates the expiry date based on Number of Installments.

Specifying Instruction Currency and Amount

SI Amount

Specify the SI amount in this field.

Note

- For TD Accounts, the ‘SI Amount’ entered should be in multiples of the value entered in the ‘Top up Units’ field in the Account Class Maintenance (STDACCLS > Deposit > Deposit Amount Currency Wise Limits). If this criteria is not met, then the system displays an error message. For example, if the value provided is 1000 in “Top-Up Units” field, then the SI amount can be 1000, 2000, 3000, and so on.

- For Product Type ‘Range Balancing Sweep’, the SI Amount wont be applicable. This field will be defaulted to zero.

First Installment Amount

Specify the amount executed at the first installment. This cannot be modified after first execution.

Final Installment Amount

Specify the final installment amount executed.

Calculate SI Amount

Check this box to calculate the standing instruction amount.

The SI amount that you specify while processing an instruction has different interpretations, depending on the type of SI, as follows:

Payment

This is the amount that should be transferred whenever the instruction is executed.

Collection

This is the amount that would be coming in for the customer, for every cycle. This amount is for information purposes only and no accounting entries will be passed for it.

Sweep in

This is the balance in the credit account that should trigger a sweep in of funds. The sweep transaction will be executed if the balance in the credit account goes below this amount.

Sweep out

This is the balance in the debit account that should trigger a sweep out of funds. The sweep transaction will be executed if the balance in the debit account becomes greater than this amount.

SI Currency

Specify the currency in which the transactions take place.For Product Type, ‘Range Balancing Sweep’, the SI currency maintained cannot be different from the Child Account currency (Debit Currency).

Variable Payment

This is the amount that should be processed for the next cycle of the variable payment transaction. Every time a cycle of the variable payment instruction is executed, the SI Amount field is reset to zero. You should put in the SI Amount applicable for the next cycle through the Amend operation on the SI Input Detailed screen.

If the amount is not changed and it remains as zero on the Value Date of the instruction, Oracle FLEXCUBE will not process it; it will allot it an unprocessed status. You should change the amount through the SI Cycle Details table before the variable payment can be processed during a subsequent retry.

Note

The instruction currency is the one in which the instruction should be executed. The SI amount that you specify is taken to be in the instruction currency. The currency of the debit and credit accounts, can, however, be different from this currency. In such a case, Oracle FLEXCUBE will use the conversion rate specified for the product. Further, the holiday checking for an instruction will be done for the instruction currency.

Suspend Execution

Check this box to temporarily suspend the execution of the standing instruction. The system will not execute the standing instruction as long as the box is checked. If you do not check this box, the system calculate the next execution dates based on the first execution date and the periodicity and execute the instruction on that date.

In order to start or re-start execution of the standing instruction, you need to uncheck this option manually.

Even if you suspend the execution, the system will continue to calculate the next execution date based on the periodicity. However, the instruction will not be executed unless this box is unchecked.

You can check/uncheck this field during standing instruction modification.

- If you uncheck this box during modification, the system will execute the instruction from the next execution date.

- If you check this box during modification, the system will suspend execution of the instruction from next execution date.

Note

When you uncheck this box, if the next execution date is a past date, then you need to modify the first execution date to current system date or a future date. The system will calculate the next execution date accordingly.

You can suspend the execution and modify the first value date only if the product type is ‘Payment’. This is not applicable to other product types including variable payment.

Number Of Installments

Specify the number of installments.

It displays override message in case both, no of installment and expiry date are not blank and recalculates expiry date based on no of installment.

Range Balancing

Range balancing limits can be provided using the below values. These fields are applicable and mandatory only if the SI product selected is ‘Range Balancing Sweep’.

Upper Balance Limit

Specify the upper balance limit amount for the product. Any amount above this value will be swept out of the Child Account to the Parent Account.

Lower Balance Limit

Specify the lower balance limit amount for the product. If the balance of the Child Account falls below this amount, the deficit amount will be swept in from the Parent Account.

4.1.3.1 Value and Due Dates

The First Execution Value Date is the date you should specify while processing an instruction. This date is used by Oracle FLEXCUBE for the following purposes:

- The first execution of the instruction is done on this date, and

- The value dates for subsequent executions will be computed based on this date and the frequency of the instruction.

Thus, the Next Execution Value Date is the date on which the next cycle of the instruction falls due.

The First Execution Due Date and the Next execution Due Date is relevant only if any of the value dates fall on a holiday in the instruction currency. In such a case, the Due Date will be the date adjusted according to the holiday handling specifications for the product under which the instruction is being processed.

The holiday handling specification could be to move the Value Date either backwards or forwards. However, for a goal tracking account the holiday treatment is always ‘Forward’. On a rare occasion, an instruction cycle that falls on a holiday will be ignored, if the holiday rules so specifies.

For a TD account, the first value date of the SI should be greater than or equal to the Account Opening Date, which includes the value provided in the ‘Block Duration after Opening Date’ field in the Account Class Maintenance screen (STDACCLS>Deposit).

Goal Account Details

Goal Reference Number

A facility to set up a goal is provided in the external channels. This goal tracking TD account is identified with a goal reference number which is received from the external channels. You can specify the goal reference number in this field. This helps in identifying the SI for a goal tracking TD account.

If the credit account selected is a goal tracking TD account, then the goal reference number should be specified.

Specifying Debit and Credit Accounts

In the case of one-to-one instructions, you should define one debit and one credit account. For a many-to-one or one-to-many instruction, the first account you specify will be defaulted, and they can be changed.

Note

If you have specified an account that uses an account class that is restricted for the product, an override is sought when you attempt to save the contract.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Debit Account or Credit Account field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in the Core User Manual.

Debit Account Description

The system displays the description of the corresponding debit account based on the Customer Number or Customer Account selected. If the debit account number keyed in has only one value matching it in the option list, then system will not open the option list on tab out and the description of the debit account will be automatically displayed when you click the ‘Enrich’ button.

For the Product Type ‘Range Balancing Sweep’, this account will signify the Child Account.Credit Account Description

The system displays the description of the corresponding credit account based on the Customer Number or Customer Account selected.

If the credit account number keyed in has only one value matching it in the option list, then system will not open the option list on tab out and the description of the credit account will be automatically displayed when you click the ‘Enrich’ button.

Term deposit account numbers are also listed in the ‘Credit Account’ field. All the TD accounts will be listed in the LOV, however only the TD accounts with “Allow Top Up of Deposit” flag enabled in the ‘Account Class (STDACCLS > Deposit)’ screen, will be allowed to create standing instructions. If a TD account is selected, which does not have “Allow Top Up of Deposit” flag enabled, then an error message “TD accounts with allow Top Up or RD are only allowed in the credit leg” is displayed.

When the credit account selected is the TD account, then in a SI contract the credit is made into the TD account using the ‘Top up of Term Deposit (STDTDTOP)’ screen.

For the Product Type ‘Range Balancing Sweep’, this account will signify the Parent Account.

Specifying Charges

The charges applicable for an instruction are defined for the product under which the instruction is processed. These charges will be defaulted for the instruction you are processing. A charge can be applied for the following events:

- Opening an SI (OPEN),

- Successful execution (SUXS),

- Partial execution (PEXC), or

- Rejection (REJT)

You should specify the party who bears the charge: the remitter or the beneficiary.

4.1.3.2 Action Code

The Action Code indicates the action to be taken if the account to be debited in order to execute an instruction does not have the necessary funds. This applies to a payment or a variable payment type of product. This Action Code is defined for the product under which an instruction is processed. You can change it for the instruction you are processing.

The following are the Action Codes that can be specified:

Action Code |

Description |

Partial Liquidation |

If the account has insufficient funds (Available Balance < SI Amount), the SI is executed to the extent of the funds available. This is known as partial execution. The event ‘PEXC’ is triggered during a partial liquidation/execution. The event ‘PEXC’ is triggered during a partial liquidation/execution. The rest of the amount will be collected during subsequent retries, subject to the ‘Maximum Retries’ defined for the instruction. The system will attempt SUXS only once during the day (first time). If it fails, only PEXC will be attempted on every subsequent retry. Therefore, if between the SUXS and PEXC events, the available balance increases to cater to the full SI, the PEXC event ONLY will be triggered. This means that the entire SI amount may be posted for the PEXC event as well. Thus, an SI can have many PEXC events (as many re-tries) for a cycle, whereas SUXS event will be triggered only once for a cycle. However, the event ‘PEXC’ is triggered only if the ‘Action Code’ is specified as ‘Partial Liquidation’. |

Full Pending |

The SI is not executed until there are sufficient funds in the account. The system will re-execute the instruction daily, for the number of times defined as ‘Maximum Retries’. If the debit account is not sufficiently funded, system will trigger the ‘REJT’ event during the first try and also on the subsequent retries. In this case, only an ‘SUXS’ is triggered subject to the availability of funds to the extent of the SI amount. The event ‘PEXC’ will not be triggered even if partial funds are available in the account. |

Ignore |

The current installment is not executed at all and system will trigger the REJT event.. The next cycle will be processed on the next due date based on the availability of funds. |

Await further instructions |

The instruction is not processed again until its action code is changed in the Instructions Due Table. The SI Cycle Details table is automatically created when the automatic processing of SIs for the day takes place (for details on this, please refer to the chapter on Automatic Processing). For an instruction, you can change the action code in this table so that you may process an unsuccessful SI. |

Force |

In this case, the instruction is executed, even though the debit account has inadequate funds. This results in a negative balance in the debit account. |

Note

For the ‘Product Type’, Range Balancing Sweep, the Action Code should be ‘Ignore’.

4.1.3.3 Maximum Retry Count

If the Action Code for an instruction indicates that the full amount should be kept pending, or the partial amount has to be liquidated, you can define the maximum number of times for which Oracle FLEXCUBE should try to re-execute the instruction.

This attribute is defined for the product and will be defaulted for the instruction, and you can modify it.

Note

For the ‘Product Type’, Range Balancing Sweep, the Maximum Retry Count cannot be more than one.

4.1.3.4 Retries for Advice

Number of retries for generating failure advice is captured here. Clicking on Enrich button defaults retry count for advice from products. You can modify the count. ‘Retries for Advice’ should be lesser than the ‘Maximum Retries’.

Failure Advice is generated when SI retries reaches ‘Retry for Advice’.

4.1.3.5 Specifying Minimum Balance after Sweep

For a sweep in type of instruction, you should specify the amount that should be left in the debit account after the sweep is executed. A sweep in instruction will be executed when the balance in the credit account goes below the SI Amount. The minimum balance after sweep ensures that a certain balance is left in the debit account and only excess amount is swept.

For Product Type, ‘Range Balancing Sweep’, this value will be applicable for sweep-in. When the balance in the Child Account is less than the Lower balance limit, system will try to credit the Child account by debiting the parent account. “Minimum Balance After sweep” will ensure that there is a minimum balance left in the parent account after the sweep.

If the balance in the parent account is going to be less than the “Minimum Balance After sweep” after the debit, system will sweep only the excess balance available in the parent account over and above the “Minimum Balance After sweep”.It will also consider the ‘Minimum Sweep Amount’ set that can be swept from the parent account to child account. If this condition is not met then the sweep does not happen.

4.1.3.6 Specifying Minimum Sweep Amount

This applies for a sweep out type of product. You should define the minimum amount that is to be transferred in an account sweep. If the amount in the Sweep From account is more than the defined SI amount but the sweep amount is less than the minimum sweep amount, the sweep will not be executed.

For the Product Type, ‘Range Balancing Sweep’, this value will be applicable for sweep-out when the Child Account has balance more than the Upper balance Limit. If the excess balance above upper balance limit is less than the minimum sweep amount, no sweep out will happen.

4.1.3.7 Specifying Your Remarks

You can enter information describing the instruction that you are recording. This will be available when you retrieve information on the instruction as well as on the account statement of the debit or credit accounts.

4.1.3.8 Specifying Limit Check

Check this box to consider OD limit for customer accounts. On selecting the ‘Limit Check’ check box the system performs the following validations:

- This checkbox is applicable only for Payment Type products.

- This checkbox is applicable only for below mentioned action codes

- Full Pending

- Ignore

- Partial Execution

- Waiting

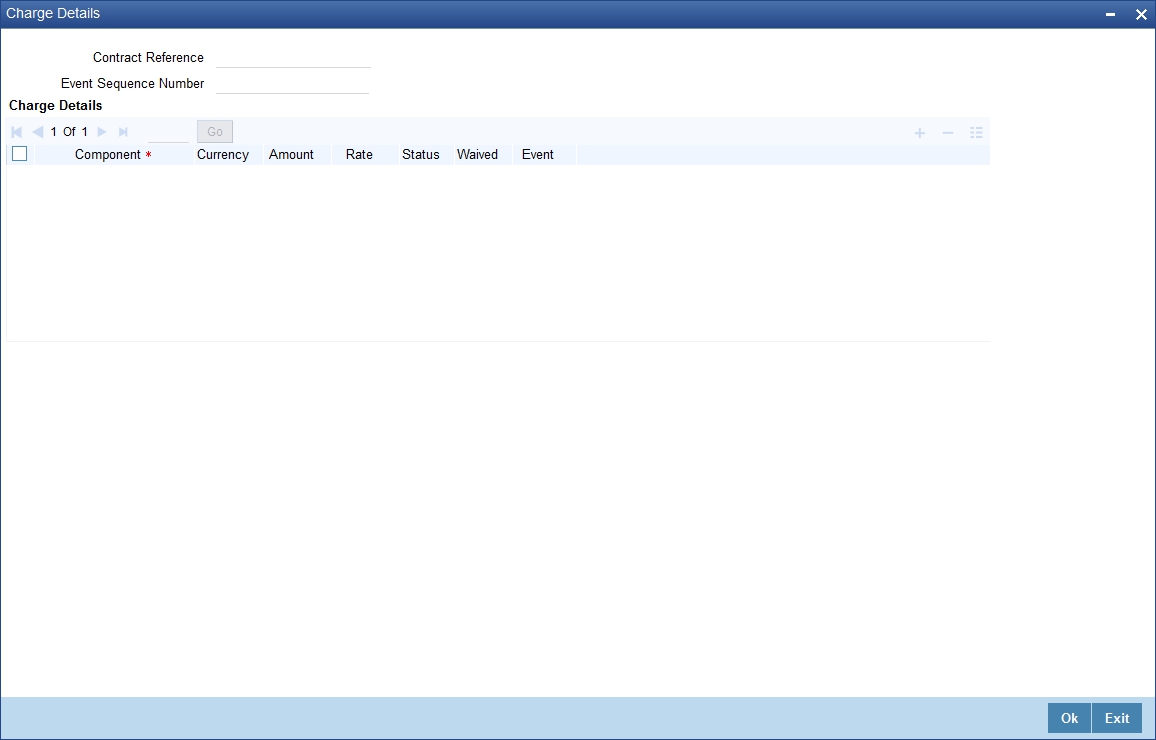

4.1.4 Charges Button

If you want to waive the charges for further executions of a particular event, you will have to uncheck the box in the ‘Standing Instruction Online Detailed’ screen. Click ‘Charges’ button in the Standing Instructions Online Detailed screen. The ‘Charge Details’ screen will be displayed.

The charges applicable for the events that have been processed till date will be displayed here. You cannot waive the charges which have already been collected.

For more details on Charge Details sub screen refer Charges and Fees user manual.

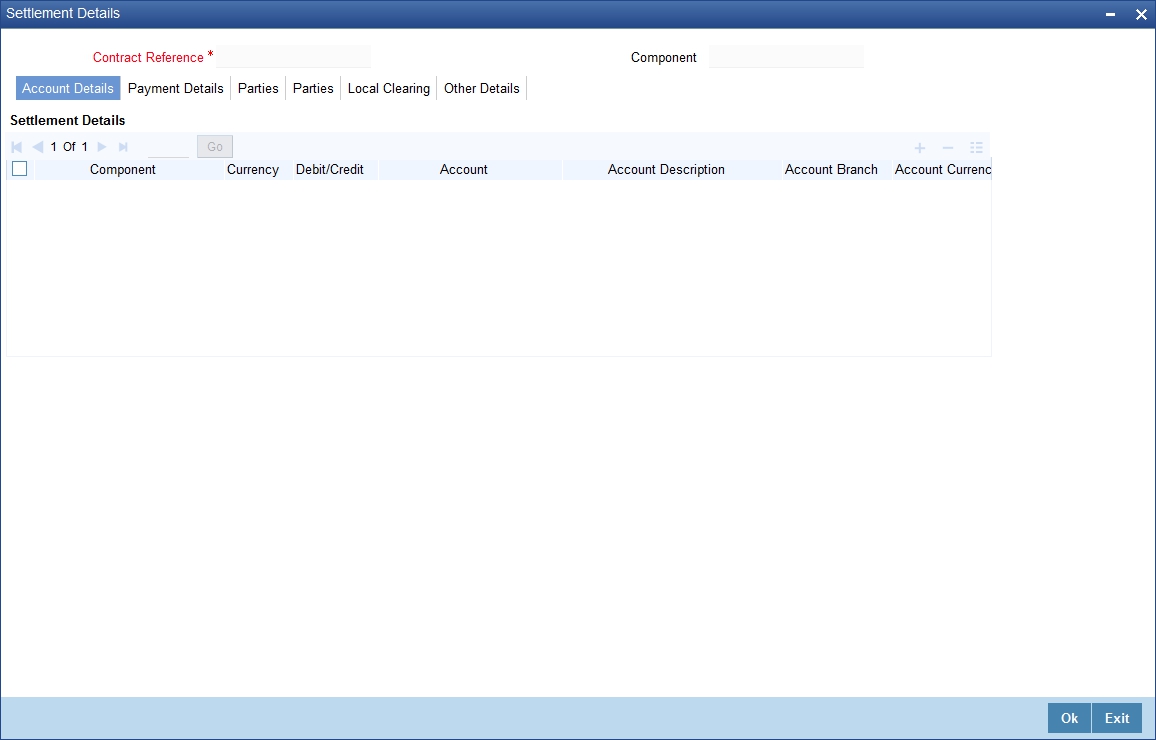

4.1.5 Settlement Button

The account(s) through which a customer wishes to settle the charges have to be indicated through the SI Settlements screen.

Click ‘Settlements’ button in the SI Input -- Detailed screen to invoke the ‘Settlements Details’ screen.

Besides the account details, the other details that are available include the currency in which the component is expressed, its Account Branch, Account Number, Account Description, Account Currency, Debit/Credit, Original Exchange Rate (in the case of the component currency being different from the account currency), Rate Code (Mid/ buy/sell), Spread Definition, Customer Spread, Euro in Currency, Euro in Amount, Generate Message, Netting Indicator, IBAN Account Number, Negotiated Cost Rate, Negotiation Reference.

Note

If you have specified an account that uses an account class that is restricted for the product, an override is sought when you attempt to save the contract.

You can specify the mode of payment (by SWIFT or by an instrument), and also verify customer signatures through the Settlement Instructions screen.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product.

Negotiated Reference Number

Specify the unique reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

4.1.6 Advices Button

The advices to be sent for an event are defined for the product under which the instruction is processed. These advices will, by default be generated for an instruction after the product is authorized. However, while processing an instruction you have the option to suppress the generation of an advice.

Click ‘Advices’ button in the SI Input Detailed screen. The ‘Contract Advices’ screen will be displayed.

The screen will contain the details of the advices applicable for the event you are processing. If you want to suppress an advice, select ‘Yes’ in the Suppress column. Since an advice for a standing instruction is always sent by mail, the priority column does not apply.

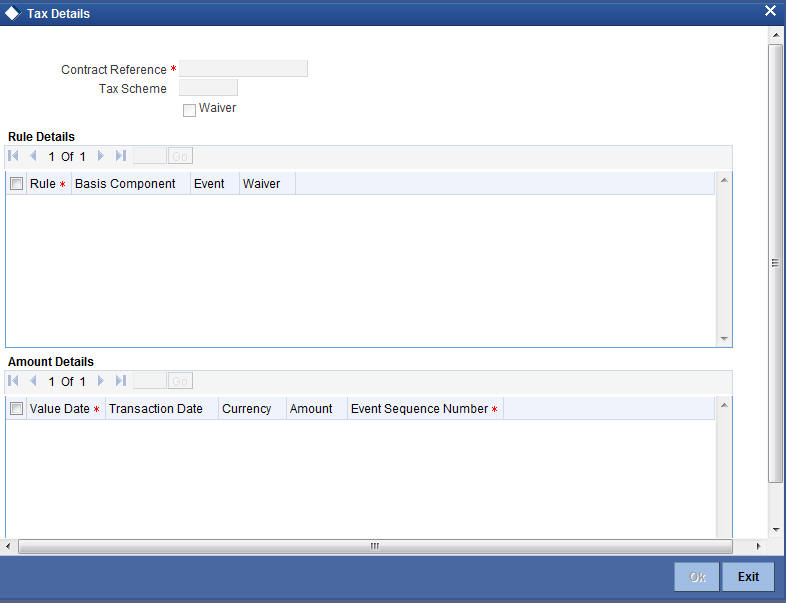

4.1.7 Tax Button

You can process tax on the charges that you earn for an instruction and on the instruction amount itself. Tax is applied based on the tax scheme linked to the product, under which the instruction is processed.

While processing an instruction, you can choose to waive the tax applicable. Click ‘Tax’ button. The ‘Tax Details’ screen will be displayed.

Tick the Waiver button if you want to waive the taxes applicable.

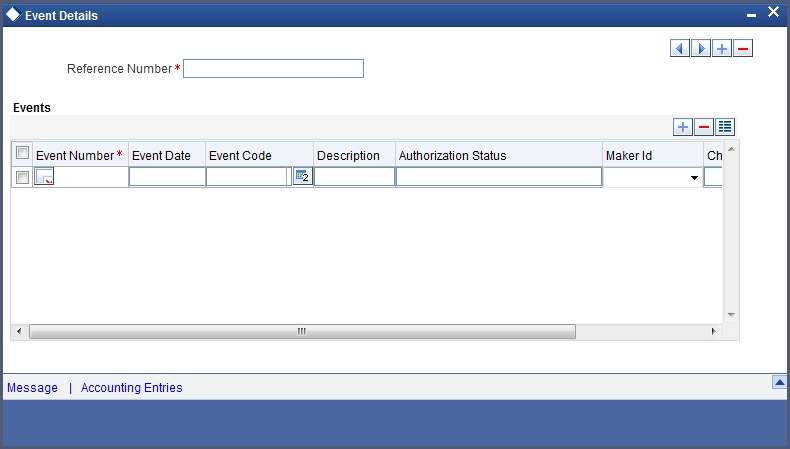

4.1.8 Events Button

The event details screen of instruction processing will show the details of the accounting entries generated for an instruction.

Click ‘Events’ button in the SI Input Detailed View screen to go to the SI Contract - Events, Accounting Entries and Overrides screen.

For the event that is highlighted, the details of accounting entries and the overrides that were given when the event was stored are shown. For each accounting entry, the following details are provided:

- Branch

- Account

- Transaction Code

- Booking Date

- Value Date

- Dr/Cr indicator

- CCY (Currency)

- Conversion rate

- Amount in contract CCY

- Amount in local currency

- Whether the instruction is still active (meaning that cycles are being executed for the instruction)

- Whether the last activity on the instruction is authorized

You can use the arrow buttons to navigate through the various events.

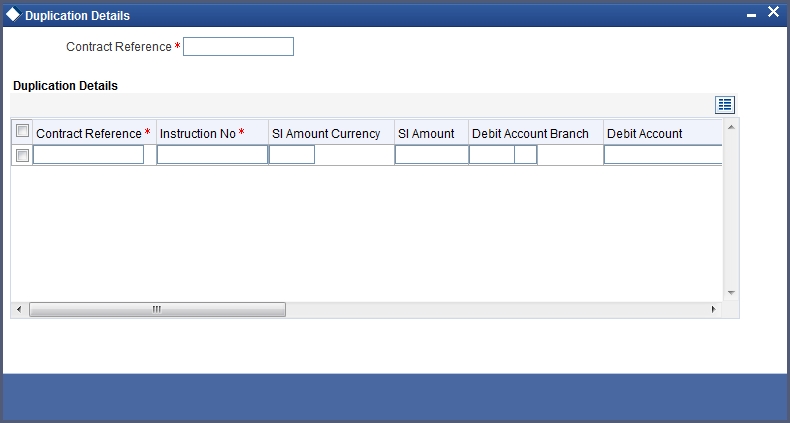

4.1.9 Duplication Details Button

The system checks for duplicates while booking instructions based on the number of days for duplicate check maintained at the ‘Branch Parameters Maintenance’ screen and the duplication preferences set at the product preference level. The system displays the duplicate contract reference number if there is a single match else it displays the override message “ ‘Duplicate Instructions recognized based on the product preference”.

You can view all the duplicate instructions in the ‘Duplication Details’ screen. Click ‘Duplication Details’ button in the ‘Standing Instruction Online Detailed’ screen to invoke this screen.

Here, the following details are displayed:

- Contract Reference

- Instrument Number

- SI Currency

- SI Amount

- Debit Account Branch

- Debit Account

- Debit Currency

- Credit Account Branch

- Credit Account

- Transfer Currency

- User Reference

- Expiry Date

Note

Duplication check is done based on the following criteria:

- Number of days that are maintained for duplicate check at the ‘Branch Parameters Maintenance’ screen.

- Duplication recognition that is selected at the ‘Standing Instruction Product Definition’ screen.

- The duplication details are persistent and can be viewed by the authorizer too.

- Duplication Check is done against the contract level and not at the instruction level.

- If duplication details are not maintained at branch level for Standing Instructions, no duplicate checks will be carried out.

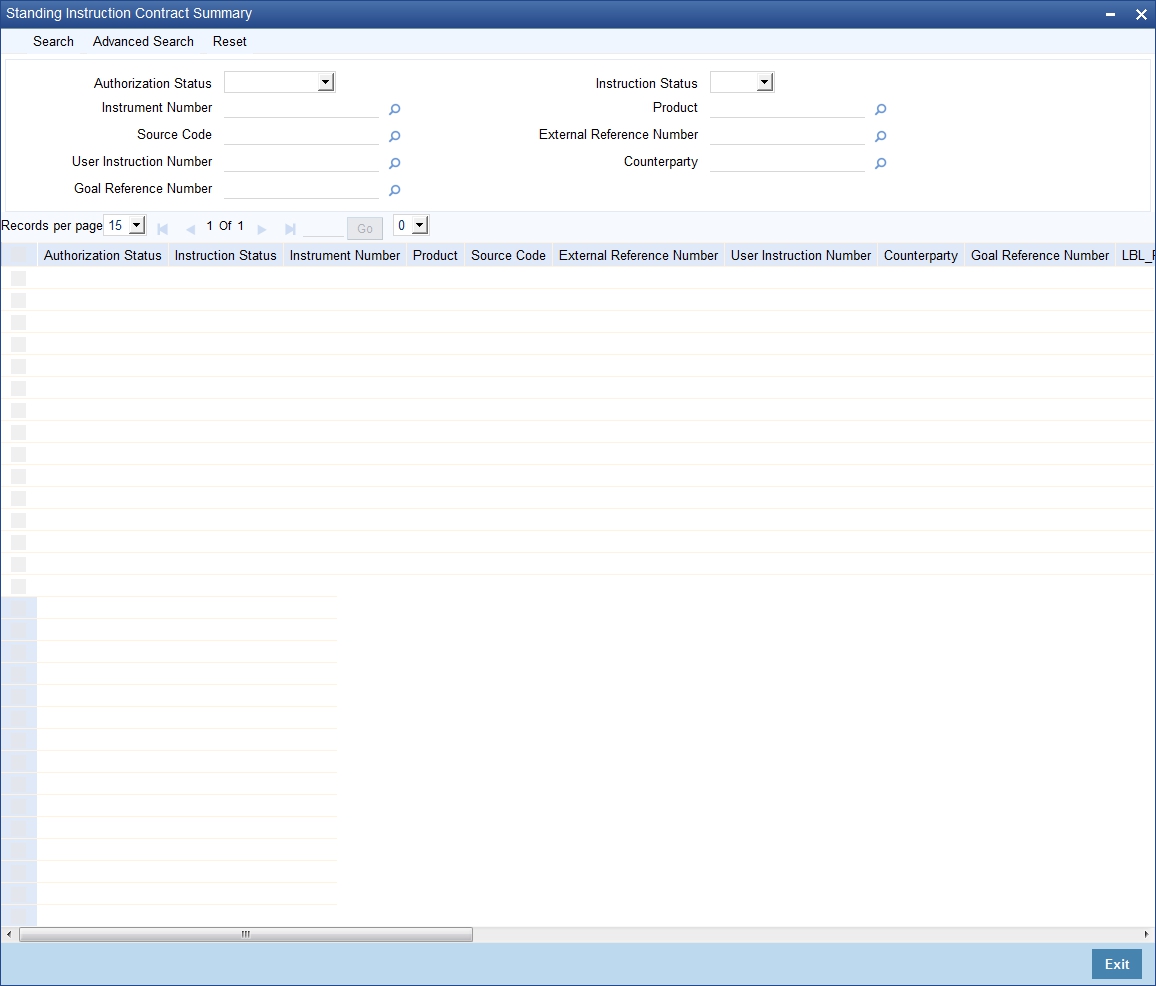

4.1.10 Viewing SI Contract

You can view the SI contract using ‘Standing Instruction - Contract Input - Summary’ screen. To invoke this screen, type ‘SISTRONL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can click ‘Search’ button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

Authorization Status

Select the authorization status of the contract from the drop-down list.

Instruction Number

Select the instruction number from the option list.

Source Code

Select the source code from the option list.

User Instruction Number

Select the user instruction number from the option list.

Instruction Status

Select the instruction status of the contract from the drop-down list.

Product

Select the product code from the option list.

External Reference

Select the user instruction number from the option list.

Counterparty

Select the contract amount from the option list.

Goal Reference Number

Specify the goal reference number as received from external channels.

When you click ‘Search’ button the records matching the specified search criteria are displayed. For each record fetched by the system based on your query criteria, the following details are displayed:

- Authorization Status

- Instruction Status

- Instruction Number

- Product Code

- Source Code

- External Reference

- User Instruction Number

- Counterparty

- Goal Reference Number

You can modify or amend other branch transactions only through summary screen.

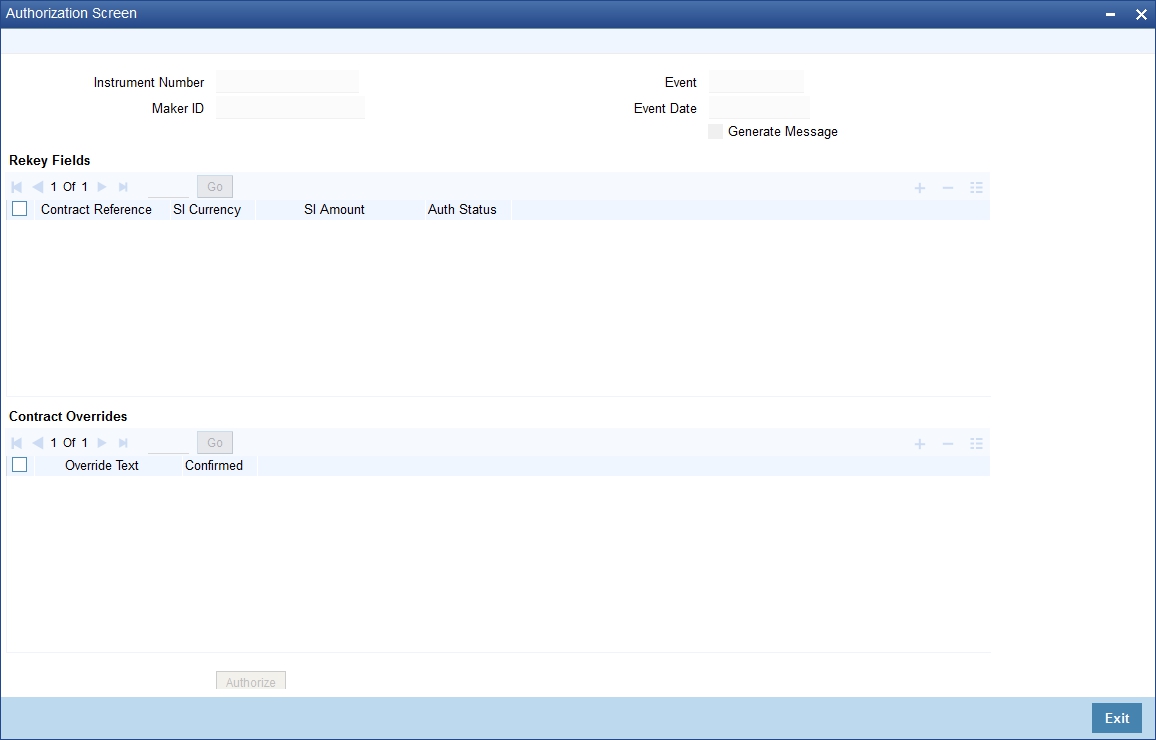

4.1.11 Authorizing SI Contract

You can authorize a standing instruction using ‘Standing Instruction Contract Authorization’ screen. To invoke this screen, type ‘SIDTRAUT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details.

Instrument Number

Specify the instrument number. The system will display the details of the instrument.

You can verify the details and click ‘Authorize’ button to authorize the instruction.

If you have enabled rekey fields, you need to enter the rekey details (rekey currency and rekey amount). The system validates these values against the original values entered by the maker of the contract. If the details match, the system authorizes the instruction. If the details do not match, an appropriate message will be displayed and the instruction will not be authorized.

If you have not enabled the rekey fields, the system authorizes the instruction immediately.

4.1.12 SI Amendment Upload

Oracle FLEXCUBE supports the amendment upload of Standing Instructions by way of the FLEXML interface.

Oracle FLEXCUBE allows amendment of only authorized instructions.

The following fields will be made available for amendment at the instruction level:

- Counterparty

- Execution frequency (Days, Months, Year)

Changing the counterparty will lead to re-pickup of subsystems.

The following fields will be made available for amendment at the contract level:

- Action Code

- Charge On Success

- Charge On Partial Success

- Charge On Reject

- Retry Count

- Charge Whom

- Minimum Sweep Amount

- Minimum Balance After Sweep

- SI Amount

- SI Amount Ccy

- Dr Account Branch

- Dr Account

- Cr Account Branch

- Cr Account

The FLEXML interface will carry out the following as a part of the amendment upload:

- A new version of the instruction is created and based on the data that is being amended, replication / re-pickup for subsystem is carried out. Subsequently the accounting and advice generation based on the amendment event maintenance in product definition will be processed.

- The post upload auth status will be accepted as a parameter to the amendment service.

- The action to be taken on override and exception is similar to the processing done as in the case of Save of a new instruction.

4.1.13 SI Batch Processing

The standing instructions batch processing is given below.

- The system would initially post the accounting entries by debiting the customer account and crediting the payable GL for the SI transaction amount.

- The system would prepare the instrument transaction data to be uploaded and the same would be uploaded to create the instrument transaction.

- By debiting Payable GL, DD/BC transaction would be created as per the Instrument ARC maintenance.

- Once DD/BC issue transaction is created, the transactions would be available as a part of Web Branch DD/BC issued data stores

- After that system would do the message handoff to generate the DD/PO

- After successful generation of instrument message system would internally update the instrument number for the contract

- In case of foreign currency instruments, the system would generate MT110 along with the Draft/PO

- MT110 would be created with the message type as ‘DD_ISSUE’

The following setting needs to be done for SI Transaction:

- In SI details screen, any instruction for issuing DD/PO, the ‘Credit Account’ will be selected as a ‘Payable GL’.

- During SI save ,when the user selects ‘Credit Account’

as ‘Payable GL’ and ‘Payment Mode’ as ‘Instrument’,

the system performs following validations:

- Instrument Type should not be null

- Ultimate beneficiary details are mandatory (Name and Address)

- Payable Bank and Branch should not be null

- In SI Settlements, the user has to select the appropriate Instrument Type to generate DD/PO. For issuing Demand Drafts and Banker’s Cheque instrument types should be DDG/DDA and BCG/BCA respectively.

- In SI settlements ‘Other Details’ tab ,option ‘Waive Charges on Instrument Issue’ has to be selected to waive-off any instrument charges maintained at ARC maintenance.

- SI batch that executes would create DD/BC issue transaction

The population of the tags of MT110 is as follows:

Explanation |

Message Contents |

Message Type |

110 |

Receiver |

BIC of the customer corresponding to the NOSTRO account of the Liquidation product’s ARC setup |

Message Text |

|

Transaction reference number |

:20:Contract Ref no of the DD/PO transaction |

Number of the Cheque |

:21: Instrument Number from the DD Transaction |

Date the Cheque was issued |

:30:Instrument Date from DD/PO transaction |

Currency and Amount of cheque |

:32B: Instrument Currency Instrument Amount |

Payee of the Cheque |

:59: Beneficiary Name |

Sender to Receiver Information |

:72: Sender to Receiver information |

End of Message text/trailer |

|

Note

The standard SWIFT validations on field 72 are carried out in Sender receiver information of Settlement subsystem in SI for amount tag SI_AMT. The system will create MT110 in the SI batch with the message type as ‘DD_ISSUE’. Field 72 will not be populated if the sender to receiver info is empty.

4.1.14 Processing of Limit Check during SI Batch

If the Limit check flag has been checked at SI online screen (SIDTRONL), the debit account balance will be considered after adding the Limit amount available to the debit account maintained at customer account level. Therefore, the derived available balance of the Debit account is arrived as:

Debit Account available balance = Available Balance in the account on the instruction Date + Limit amount available to the debit account.

System will then check for the below mentioned cases:

For Action code "Full Pending"

If the derived Debit Account available balance is greater than or equal to the SI amount pending for execution , The payment will process successfully and the SI execution status will be successful , else the payment for the cycle will be marked as Retry. The payment cycle details can be viewed from Standing Instruction Cycle Detail (SIDXCYCL) screen.

For Action code "Ignore"

If the derived Debit Account available balance is greater than or equal to the SI amount pending for execution , The payment will process successfully and the SI execution status will be successful, else the payment for the cycle will be marked as Ignored.

The details can be viewed from Standing Instruction Cycle Detail (SIDXCYCL) screen.

For Action code "Partial Execution"

If the derived Debit Account available balance is greater than or equal to the SI amount pending for execution , The payment will process successfully and the SI execution status will be successful, else the payment for the cycle will be process partially and will be marked as Retry. If the Retry level exceeds the maximum retry available for the Debit account then the cycle is ignored. The details can be viewed from Standing Instruction Cycle Detail (SIDXCYCL) screen.

For Action code "Waiting”:

Here following cases will be handled:

With Processing time as BOD, referral required flag checked at customer account level for the debit account and Limit check flag checked at SI online screen (SIDTRONL), system will not make any referral entry, instead it will check whether the derived Debit Account available balance is greater than or equal to the SI amount pending for execution. If the balance is greater than or equal to the SI amount pending for execution , the payment cycle will process successfully and the SI execution status will be successful, else payment for the cycle will be marked as Wait.

The payment cycle details can be viewed from Standing Instruction Cycle Detail (SIDXCYCL) screen.

With processing time as BOD, referral required flag checked at customer account level for the debit account and Limit check flag unchecked at SI online screen (SIDTRONL) , system will make referral entry of the SI pending amount for execution, if the Debit Account available balance including the limits is less than the SI amount pending for execution . The referral entry can be viewed from Referral Queue screen (STDREFQU)

The payment cycle details can be viewed from Standing Instruction Cycle Detail (SIDXCYCL) screen.

With Processing time as EOD , referral required flag unchecked at customer account for the debit account and Limit check flag checked at SI online screen, if the derived Debit Account available balance is greater than or equal to the SI amount pending for execution , the payment cycle will process successfully and the SI execution status will be Successful else Payment for the cycle will be marked as Wait.

The payment cycle details can be viewed from Standing Instruction Cycle Detail (SIDXCYCL) screen.

With Processing time as EOD and limit check flag checked at SI online screen , if the derived Debit Account available balance including Limit is greater than or equal to the SI amount pending for execution, the payment cycle will processed successfully and the SI execution status will be successful else payment for the cycle will be marked as Wait.

The payment cycle details can be viewed from Standing Instruction Cycle Detail (SIDXCYCL) screen.

4.1.15 Printing of DD/BC

All the generated Drafts/Banker’s Cheques will be spooled to a file (based on Instrument type) and these spooled files would be sent to designated DD printing system in bank.

Note

- The ‘Message Printing’ (MSDPRINT) screen would be used to spool the generated DD/PO s during SI batch.

- The instruments for DD and PO would be identified with the message type ‘DEMDRAFT’ and ‘MCK’ respectively.

- The ‘Message Printing’ screen has the provision to spool instruments based on Customer. That is ‘Customer Account’ and ‘Instrument’.