8. Reports

The following are the reports that you can generate for the Standing Instructions module:

- Successful Standing Instructions Report

- Unsuccessful Standing Instructions

- Standing Instruction Pending Collections Report

- Standing Instructions by Customer Report

- Standing Instructions by Product Type Report

- Standing Instructions Due/Pending Report

- SI Executed for external Acc, DD, and Banker’s Cheques Report

- Standing Orders Placed Today Report

- Amendment of Standing Orders Report Stale Cheque Report

- Closed Standing Orders Report

- Penalty on Rejected Standing Orders Report

Note

The SI reports will not display the details of standing instructions whose execution is in suspended status.

This chapter contains the following sections:

- Section 8.1, "Standing Instructions Report"

- Section 8.2, "Unsuccessful Standing Instructions Report"

- Section 8.3, "Standing Instruction Pending Collections Report"

- Section 8.4, "Standing Instructions by Customer Report"

- Section 8.5, "Standing Instructions by Product Type Report"

- Section 8.6, "Standing Instructions Due/Pending Report"

- Section 8.7, "SI Executed for External A/C, DD, and Banker’s Cheques Report"

- Section 8.8, "Standing Orders Placed Today Report"

- Section 8.9, "Amendment of Standing Orders Report Stale Cheque Report"

- Section 8.10, "Closed Standing Orders Report"

- Section 8.11, "Penalty on Rejected Standing Orders Report"Section 8.12, "SI Attached to Closed TD Account"

8.1 Standing Instructions Report

This section contains the following topics:

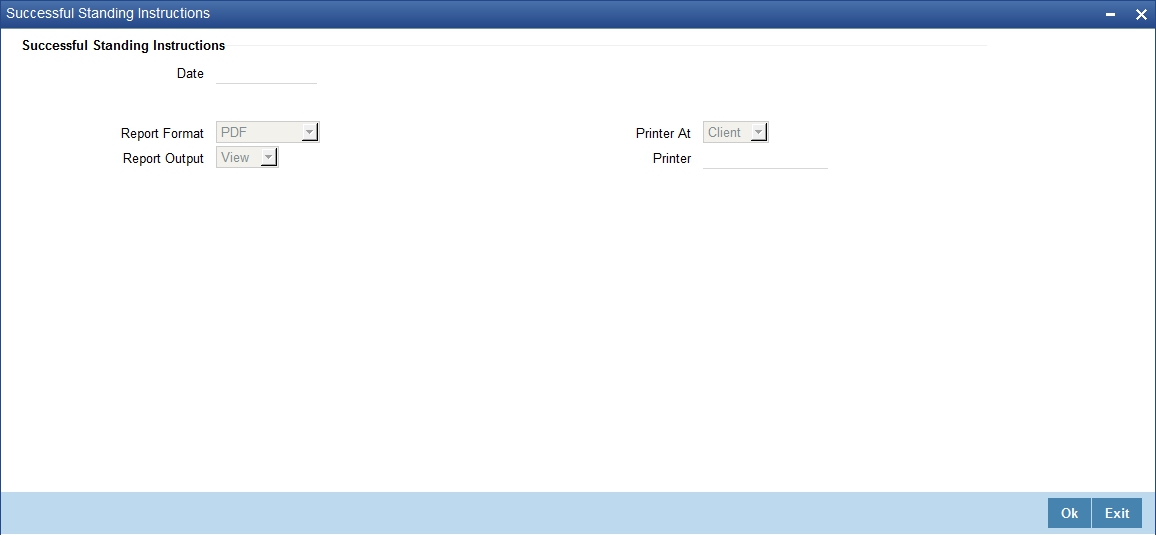

8.1.1 Generating Standing Instructions Report

This report should be ideally generated after the EOD run of the SI batch processes has been completed, so that complete information for the day is reported. The report gives details of instructions that were successfully processed during the day. Thus, the original due date of an instruction can be different from the date as of which the report was generated.

Selection options

The report can be generated for any day in the past or today.

You can invoke this screen by typing the code ‘SIRPSUXS’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

Specify the following details.

Date

Specify the date.

Click ‘OK’ to generate the report.

8.1.2 Contents of Report

Header

The Header carries the title of the report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of Report

The report is sorted by the product code, the product type and the SI type in the ascending order. The following information is provided for each contract:

Field Name |

Field Description |

Product Code |

The product under which the instruction is processed |

Product Type |

The type of product under which the SI is processed. It could be: payment, collection, sweep, or variable payment |

SI Type |

The type of standing instruction. It could be: one to one, many to one, one to many, or many to many |

Instruction Number |

This is the instruction number |

Process Time |

The time of instruction processing |

SI Value Date |

The date as of which the next cycle of the instruction will fall due. This date will be different from the Next Due Date if the former fell on a holiday and the SI was executed on a different date |

Contract Reference |

The reference number for the particular cycle of the instruction that is due or pending |

Cycle Sequence Number |

This is the cycle sequence number |

SI Exec Date |

The date on which the next execution of the instruction will be processed |

SI Exec Status |

The status of the instruction - due or pending. |

Action Code |

Indicates the action that is to be taken in case the instruction is not processed on the due date due to lack of funds in the debit account |

SI Currency |

The currency in which the instruction is processed |

SI Amount |

The amount that is transferred when the instruction is processed |

Retry Sequence Number |

Indicates retry sequence number. |

Instrument Number |

Indicates instrument number. |

Priority |

If the debit account is involved in more than one instruction during the same day, you should allot the order in which they should be processed. The priority allotted for this instruction is shown here. |

Amount Pending |

This is the pending amount |

Amount Executed |

This is the amount that will be transferred if the execution is executed |

Charges on Success/ Rejection/Partial Execution |

Indicates whether any charges have to be levied when this instruction is processed - on successful execution, partial execution or on rejection |

Debit and credit- Branch, Currency, Account, Name, Amount |

These are the details of the debit and credit account of the transaction - the branch, the account currency, the account number, the customer’s name and the amount transferred. |

8.2 Unsuccessful Standing Instructions Report

This section contains the following topics:

- Section 8.2.1, "Generating Unsuccessful Standing Instructions Report"

- Section 8.2.2, "Contents of Report"

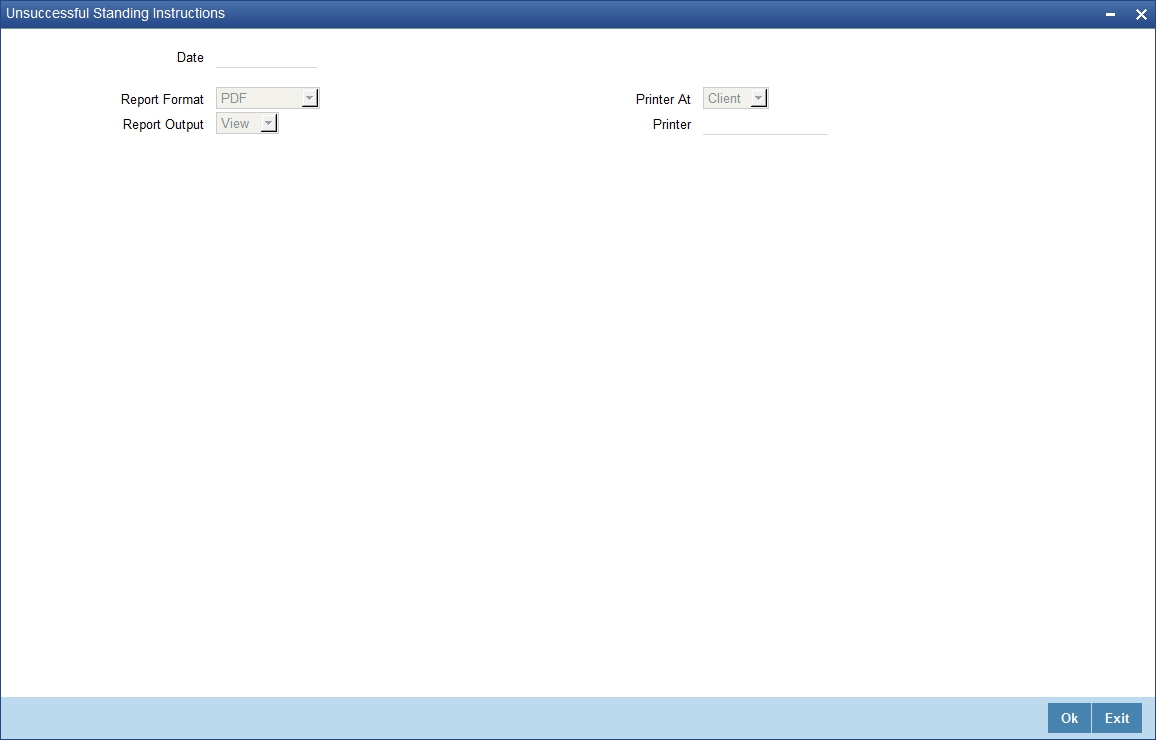

8.2.1 Generating Unsuccessful Standing Instructions Report

This report should be ideally generated after the EOD run of the SI batch processes has been completed, so that complete information for the day is reported. The report gives details of instructions that were scheduled for the day but were not processed for some reason.

This report can be generated for a date in the past also.

Selection options

The report can be generated for any day in the past or today.

You can invoke this screen by typing the code ‘SIRPUNSC’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

Specify the following details.

Date

Specify the date.

Click ‘OK’ to generate the report.

8.2.2 Contents of Report

Header

The Header carries the title of the report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of Report

The report is sorted by the product code, the product type and the SI type in the ascending order. The following information is provided for each contract:

Field Name |

Field Description |

Product Code |

The product under which the instruction is processed |

Product Type |

The type of product under which the SI is processed. It could be: payment, collection, sweep, or variable payment |

SI Type |

The type of standing instruction. It could be: one to one, many to one, one to many, or many to many |

Instruction Number |

This is the instruction number |

Process Time |

The time of day when the instruction is to be processed |

SI Exec Status |

The status of the instruction - due or pending |

SI Value Date |

The date as of which the next cycle of the instruction will fall due. This date will be different from the Next Due Date if the former fell on a holiday and the SI was executed on a different date. |

Contract Reference |

The reference number for the particular cycle of the instruction that is due or pending |

Cycle Sequence Number |

This is the cycle sequence number |

Retry Sequence Number |

Indicates retry sequence number. |

SI Exec Date |

The date on which the next execution of the instruction will be processed |

SI Exec Status |

The status of the instruction – due or pending |

Action Code |

Indicates the action that is to be taken in case the instruction is not processed on the due date due to lack of funds in the debit account. |

SI Currency |

The currency in which the instruction is processed |

SI Amount |

The amount that is transferred when the instruction is processed |

Retry Sequence Number |

The maximum number of times that the instruction will be retried for execution |

Instrument Number |

Indicates instrument number. |

Priority |

If the debit account is involved in more than one instruction during the same day, you should allot the order in which they should be processed. The priority allotted for this instruction is shown here. |

Amount Pending |

The amount that is pending |

Amount Executed |

If the instruction is executed the amount is transferring |

Charges on Success/ Rejection/Partial Execution |

Indicates whether any charges have to be levied when this instruction is processed - on successful execution, partial execution or on rejection |

8.3 Standing Instruction Pending Collections Report

This section contains the following topics:

- Section 8.3.1, "Generating Standing Instruction Pending Collections Report"

- Section 8.3.2, "Contents of Report"

8.3.1 Generating Standing Instruction Pending Collections Report

The standing collection orders that are pending execution as of a date are reported by this report. The report can be generated either for today or a date in the past.

Selection options

The report can be generated as of a specific date.

You can invoke this screen by typing the code ‘SIRPCOLL’ on the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

Specify the following details.

Date

Specify the date for which the report needs to be generated.

Click ‘OK’ to generate the report.

8.3.2 Contents of Report

The report options that you selected while generating the report are printed at the beginning of the report.

Header

The Header carries the title of the report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the report

The report is sorted on the customer number and instruction number in the ascending order.

The following information is provided for each instruction:

Field Name |

Field Description |

Instruction Number |

This is the instruction number. |

Value Date |

The date as of which the first execution of the instruction was done. This date will be different from the First Due Date if the former fell on a holiday and the SI was executed on a different date |

SI Type |

The type of standing instruction. It could be: one to one, many to one, one to many, or many to many |

Product Type |

This is the type of product under which the SI is processed. It could be payment, collection, sweep, or variable payment |

Inst Status |

Indicates whether one or more cycles for an instruction is pending for execution |

Due Date |

The date as of which the first execution for the instruction was processed |

Contract Reference |

This is the reference number of the contract. |

Counterparty |

This is the counterparty number. |

Counterparty Name |

This is the name of the counterparty. |

SI Currency |

This is the SI currency code. |

Action Code |

This code indicates the status of the action. |

Priority |

This indicates the priority of the action. |

Amount |

This is the contract amount. |

Debit |

This shows the debit details. |

Credit |

This shows the credit details. |

Branch |

This is the code of the branch from which debit and credit is done. |

Currency |

This is the currency code in which debit and credit is done. |

Account |

This shows the account number from which credit and debit is done. |

Name |

The name of the debtor or creditor |

8.4 Standing Instructions by Customer Report

This section contains the following report:

- Section 8.4.1, "Generating Standing Instructions by Customer Report"

- Section 8.4.2, "Contents of Report"

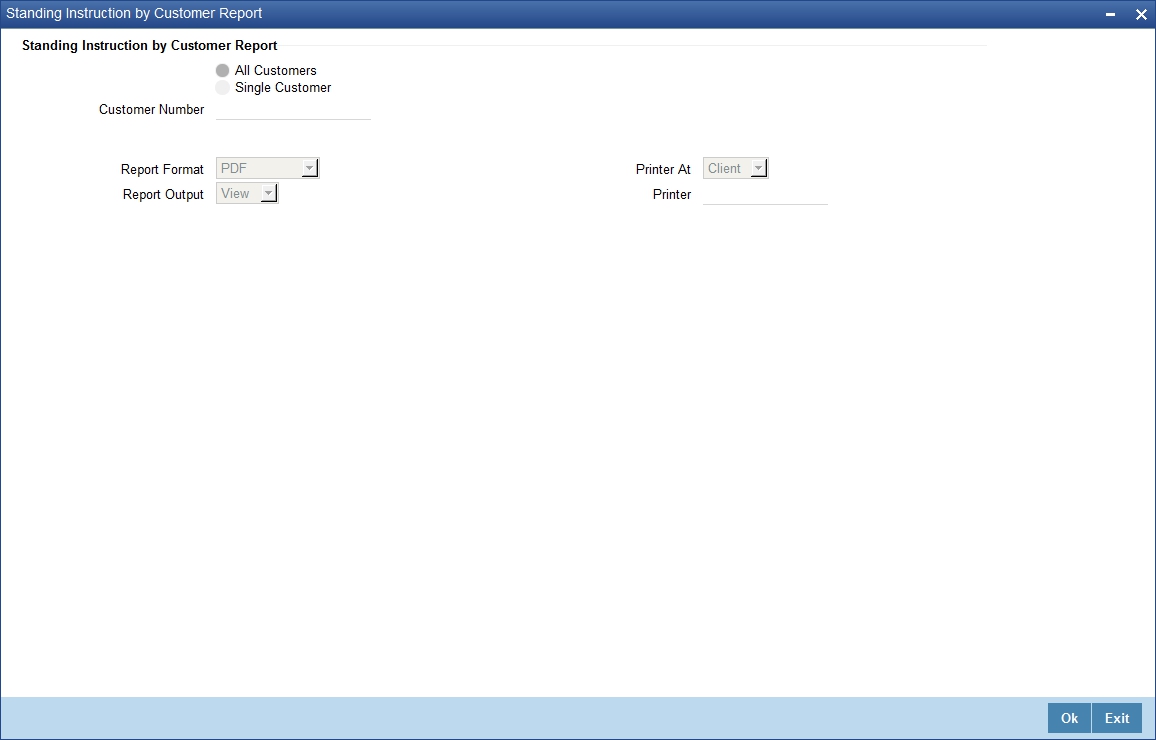

8.4.1 Generating Standing Instructions by Customer Report

This report gives the details of SIs that have been defined for different customers. You can choose to generate the report for are a specific customer or all the customers of your branch.

Selection Options

You can select the specific customer for whom you want the report. Alternatively, you can generate the report for all the customers of your branch.

You can invoke this screen by typing the code ‘SIRPCUST’ on the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

Specify the following details.

Standing Instruction by Customer Report

Indicate whether the reports should be generated for all customers or single customer.

If you choose ‘Single Customer’, you need to specify the customer number for which the report needs to be generated. The option list provided displays all valid customer number maintained in the system. You can select the appropriate one.

Click ‘OK’ to generate the report.

8.4.2 Contents of Report

The report options that you selected while generating the report are printed at the beginning of the report.

Header

The Header carries the title of the report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the report

The report is sorted on the customer number and instruction number in the ascending order.

The following information is provided for each instruction:

Field Name |

Field Description |

Customer Number |

The customer number |

Customer Name |

The customer name |

Instruction Number |

The number to identify an instruction |

SI Type |

This is the type of standing instruction. It could be: one to one, many to one, one to many, or many to many. |

Processing |

This indicates the time to process the instruction. |

Product Code |

The code of the product under which the instruction is processed |

Product Type |

This is the type of product under which the SI is processed. It could be payment, collection, sweep, or variable payment. |

Auth Status |

The status of the instruction -- authorized or unauthorized. Unauthorized instructions will not be processed. |

Inst Status |

Indicates whether one or more cycles for an instruction is pending for execution |

Contract Reference |

Each execution of the instruction will be allotted a reference number by Oracle FLEXCUBE. This number will be shown here. |

Max Retry Count |

For a payment type of product with an Action Code of Keep full amount pending or Liquidate partially, you would define the maximum number of times the system should re-execute the instruction. This number is shown here. |

Priority |

If a debit account is involved in more than one instruction during the day, you would have allotted a priority for each instruction. This priority is shown here. |

Charge Borne By |

This indicates the party who will bear the charges for the instruction. |

Action Code |

For a payment type of product, you should define the action to be taken when an instruction is not executed because of lack of funds. The action code defined for this instruction is shown here. |

Rate Type |

If the currency of the instruction and the currency of the accounts involved in it are different, a conversion rate will be used. The rate type defined for this conversion for the product will be shown here. |

First Value Date |

The date as of which the first execution of the instruction was done. This date will be different from the First Due Date if the former fell on a holiday and the SI was executed on a different date. |

First Due Date |

The date as of which the first execution for the instruction was processed. |

Next Value Date |

The date as of which the next cycle of the instruction will fall due. This date will be different from the Next Due Date if the former fell on a holiday and the SI was executed on a different date. |

Next Due Date |

The date on which the next execution of the instruction will be processed. |

Month End |

Indicates whether the instruction is always processed on a month-end. |

User Reference |

The user reference number |

Beneficiary |

The name of the customer who is the beneficiary of the instruction |

SI Expiry Date |

The date after which the instruction will not be processed |

SI Currency |

The currency in which the instruction is processed |

Amount |

For a payment and collection type of product, this is the amount defined for the instruction. |

Min Sweep Amt |

This applies for a sweep type of product. This is the minimum amount that has been defined for a sweep to be executed. |

Min Bal After Sweep |

The minimum amount that should be available in the Sweep From account after the sweep has been executed. |

User Instruction Number |

An instruction can be identified by two different numbers: one is allotted by Oracle FLEXCUBE while the other one can be a number input by you which should typically be the number with which your customer identifies the instruction, called the User Instruction Number. By default, the Instruction Number allotted by Oracle FLEXCUBE and the User Instruction Number will be the same. It is the User Instruction Number of the instruction. |

Holiday Exception |

This is the action defined to be taken if an instruction processed under a product falls on a holiday. It could be: forward, backward, or lapse. |

Frequency |

This is the frequency at which the instruction is processed -- it will be indicated in days, months and years. |

Charge on Success Partial Exec/ Reject |

Indicates whether charges are to be applied for instruction when it has been successfully executed, or partially executed or rejected |

Debit |

Indicates debit account of the transaction. |

Credit |

Indicates credit account of the transaction. |

Branch |

Indicates branch. |

Account |

Indicates account number. |

Currency |

Indicates currency transferred. |

8.5 Standing Instructions by Product Type Report

This section contains the following topics:

- Section 8.5.1, "Generating Standing Instructions by Product Type Report"

- Section 8.5.2, "Contents of the Report"

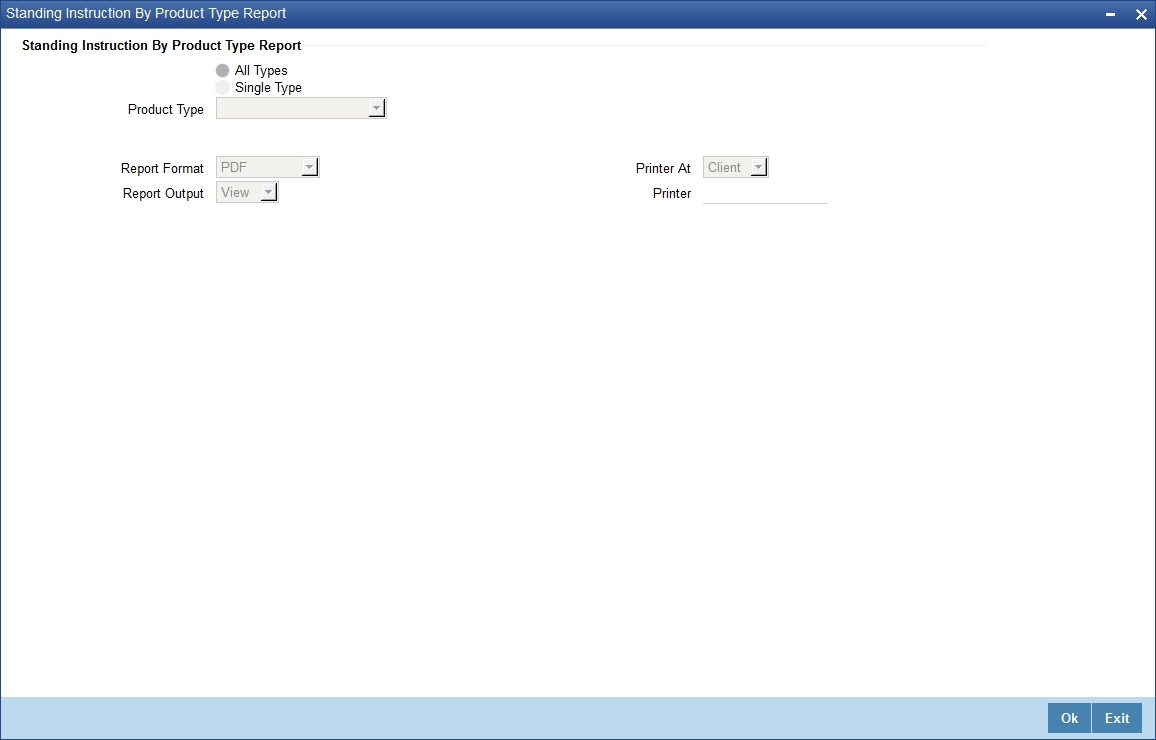

8.5.1 Generating Standing Instructions by Product Type Report

Standing instructions are grouped into different product types: payments, sweeps, collections, and variable payments. You can generate a report on instructions that are processed under each product type.

Selection Options

The report can be generated either for a specific product type or for all of them.

You can invoke this screen by typing the code ‘SIRPTYPE’ on the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

Specify the following details.

Standing Instruction by Product Type

Indicate whether the reports should be generated for all types or single type.

If you choose ‘Single Type’, you need to specify the product type for which the report needs to be generated. The option list provided displays all valid product types maintained in the system. You can select the appropriate one.

Click ‘OK’ to generate the report.

8.5.2 Contents of the Report

The report options that you selected while generating the report are printed at the beginning of the report.

Header

The Header carries the title of the report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the report

The report is sorted first on the product type and then on the instruction number in the ascending order. The following information is provided for each instruction:

Field Name |

Field Description |

Product Type |

The type of product under which the SI is processed. It could be: payment, collection, sweep, range balancing sweep or variable payment |

Product Code |

The product under which the instruction is processed |

Instruction Number |

Indicates instruction number of the SI. |

SI Type |

The type of standing instruction, which could be ‘One to one’, ‘Many to one’, ‘One to many’, or ‘Many to many’. |

Counterparty Customer Name Frequency |

Indicates counterparty, customer name and frequency (in days, month and year). |

Processing |

The time of day when the instruction is to be processed |

Auth Status |

The status of the instruction -- authorized or unauthorized. Unauthorized instructions will not be processed |

Inst Status |

Indicates whether the instruction is pending for execution |

Month End |

Indicates month end. |

Rate Type |

If the currency of the instruction and the currency of the accounts involved in it are different, a conversion rate will be used. The rate type defined for this conversion for the product will be shown here. |

First Value Date |

The date as of which the first execution of the instruction was done. This date will be different from the First Due Date if the former falls on a holiday and the SI was executed on a different date. |

First Due Date |

The date as of which the first execution for the instruction was processed. |

Next Due Date |

The date on which the next execution of the instruction will be processed |

Month End |

Indicates whether the instruction is always processed on a month-end |

User Instruction Number |

An instruction can be identified by two different numbers: one is allotted by Oracle FLEXCUBE while the other one can be a number input by you which should typically be the number with which your customer identifies the instruction, called the User Instruction Number. By default, the Instruction Number allotted by Oracle FLEXCUBE and the User Instruction Number will be the same. This is the User Instruction Number of the instruction. |

Contract Reference |

Each execution of the instruction will be allotted a reference number by Oracle FLEXCUBE. This number will be shown here. |

Max Retry Count |

For a payment type of product with an Action Code of Keep full amount pending or Liquidate partially, you would define the maximum number of times the system should re-execute the instruction. This number is shown here. |

Priority |

If a debit account is involved in more than one instruction during the day, you would have allotted a priority for each instruction. This priority is shown here. |

Charge Borne By |

Indicates the party who will bear the charges for the instruction |

Action Code |

For a payment type of product, you should define the action to be taken when an instruction is not executed because of lack of funds. The action code defined for this instruction is shown here. |

User Reference |

Indicates user reference |

Beneficiary |

It is the name of the customer who is the beneficiary of the instruction. |

SI Currency |

The currency in which the instruction is processed |

Amount |

For a payment and collection type of product, this is the amount defined for the instruction. |

Min Sweep Amount |

Applies for a sweep type of product. This is the minimum amount that has been defined for a sweep to be executed. |

Min Bal after Sweep |

The minimum amount that should be available in the Sweep From account after the sweep has been executed |

Charge on Success/ Partial execution/ Reject |

Indicates whether charges are to be applied for instruction when it has been successfully executed, or partially executed or rejected |

Debit - Branch, Account, Currency |

The details of the debit account -- the branch, account number and currency |

Credit |

The details of the credit account -- the branch, account number, and currency |

Product Type |

Indicates product type. |

Count |

Indicates count. |

Total no of instructions |

Indicates total no of instructions. |

8.6 Standing Instructions Due/Pending Report

This section contains the following topics:

- Section 8.6.1, "Generating Standing Instruction Due/Pending Report"

- Section 8.6.2, "Contents of Report"

8.6.1 Generating Standing Instruction Due/Pending Report

The Standing Instructions Due/Pending for Execution Report is ideally generated during the Beginning of Day operations. It provides information about the instructions that fall due today, and those that are pending from previous days.

The information given by this report depends on when the report is generated, as follows:

- Before the SI Batch function is run during beginning of day, the instructions due for execution during the day -- either during BOD or EOD -- will be reported, along with those pending from previous days.

- After the SI Batch function is run during beginning of day, the instructions due to be processed during EOD that day, and those pending execution, will be processed.

- After end of financial input (EOFI) has been marked, the instructions that are due for the next day, and those pending from previous days, will be reported.

Note

Sweeps will not be reported in this report as whether a sweep is due for execution depends on the balance in an account at the time of execution.

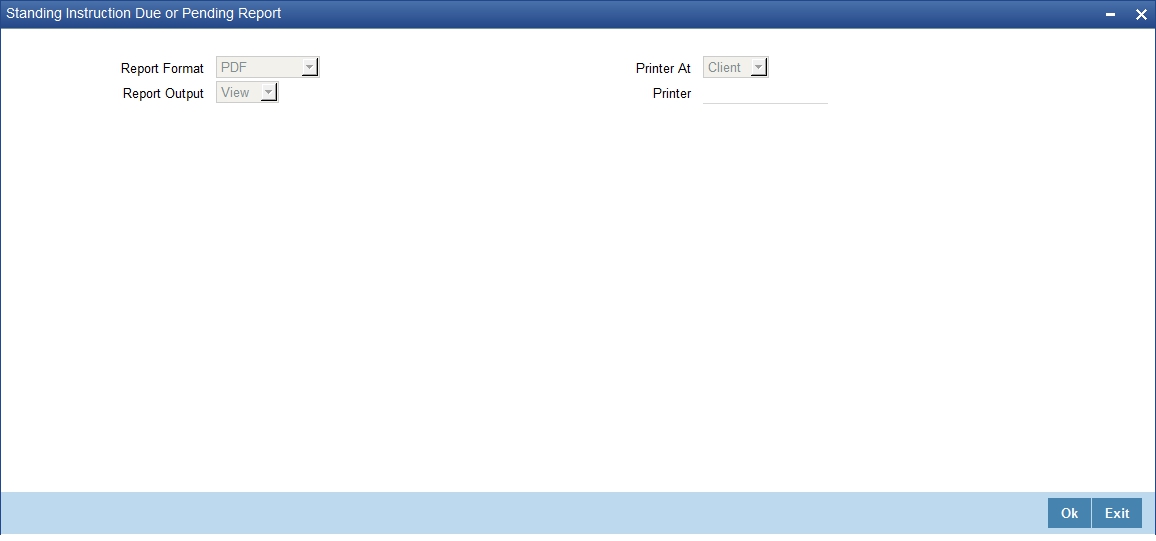

You can invoke this screen by typing the code ‘SIRPDUE’ on the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

8.6.2 Contents of Report

Header

The Header carries the title of the report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of Report

The report is sorted by the product code, the product type and the SI type in the ascending order. The following information is provided for each contract:

Field Name |

Field Description |

Processing Time |

The time of day when the instruction is to be processed |

Product Code |

The product under which the instruction is processed |

Product Type |

The type of product under which the SI is processed. It could be: payment, collection, sweep, or variable payment. |

SI Type |

The type of standing instruction. It could be: one to one, many to one, one to many, or many to many. |

Instruction Number |

This is the instruction number. |

Status |

The status of the instruction - due or pending. |

Due Details |

|

Next Value Date |

The date as of which the next cycle of the instruction will fall due. This date will be different from the Next Due Date if the former fell on a holiday and the SI was executed on a different date. |

Next Exec Date |

The date on which the next execution of the instruction will be processed. |

Counterparty |

The code for the customer |

Name |

The customer’s name on behalf of whom the instruction is being processed. |

Contract Reference |

The reference number for the particular cycle of the instruction that is due or pending. |

SI Value Date |

The date as of which the next cycle of the instruction will fall due. This date will be different from the Next Due Date if the former fell on a holiday and the SI was executed on a different date. |

SI Expiry Date |

The date as of which the cycle falls due. |

Max Retry Count |

The maximum number of times that the instruction will be retried for execution |

Action Code |

Indicates the action that is to be taken in case the instruction is not processed on the due date due to lack of funds in the debit account. |

Charge Borne By |

Indicates the Charge borne by. |

Priority |

If the debit account is involved in more than one instruction during the same day, you should allot the order in which they should be processed. The priority allotted for this instruction is shown here. |

SI Amount Currency |

The currency in which the instruction is processed |

SI Amount |

The amount that is transferred when the instruction is processed |

Charges on Success/ Rejection/Partial Execution |

Indicates whether any charges have to be levied when this instruction is processed – on successful execution, partial execution or on rejection. |

Debit and credit- Branch, Currency, Account, Name, Amount |

These are the details of the debit and credit account of the transaction - the branch, the account currency, the account number, the customer’s name and the amount transferred. |

Processing Time |

The time of day when the instruction is to be processed |

Pending Details |

|

Instruction Number |

This is the instruction number. |

Status |

The status of the instruction - due or pending. |

Counterparty |

Indicates the identification of the counterparty |

Customer Name |

Indicates the name of the customer |

Contract Reference |

This is the reference number of the contract |

SI Value Date |

The date as of which the next cycle of the instruction will fall due. This date will be different from the Next Due Date if the former fell on a holiday and the SI was executed on a different date |

Retry Date |

Indicates the date of the retry. |

SI Exec Date |

Indicates SI execution date. |

Retry Count |

Indicates the count of retries |

Max Retry Count |

Indicates the maximum retry count |

SI Exec Status |

Indicates status of the execution (Unprocessed) |

Priority |

Indicates the priority |

SI Currency |

Indicates the currency of the SI |

SI Amount |

Indicates the SI amount |

SI Amount Pending |

Indicates the pending amount to be executed for SI |

SI Amount Executed |

Indicate amount executed. |

Charges on Success/ Rejection/Partial Execution |

Indicates whether any charges have to be levied when this instruction is processed - on successful execution, partial execution or on rejection. |

Debit and credit- Branch, Currency, Account, Name, Amount |

These are the details of the debit and credit account of the transaction - the branch, the account currency, the account number, the customer’s name and the amount transferred. |

8.7 SI Executed for External A/C, DD, and Banker’s Cheques Report

This section contains the following topics:

- Section 8.7.1, "Generating SI Executed for External A/C, DD, and Banker’s Cheques Report"

- Section 8.7.2, "Contents of the Report"

8.7.1 Generating SI Executed for External A/C, DD, and Banker’s Cheques Report

Oracle FLEXCUBE facilitates you to view the list of standing instruction executed for external account and banker cheques for a given branch code and process date. Branches accept the standing instructions (SI) for credit in their own accounts, as well as for other bank accounts. They also accept by means of remittances like bankers cheque etc. If there are no exceptions, during BOD system successfully executes SI transactions, and you can generate a SI Instruction Executed for External Acc, DD, and BC Report to view the information of the branches.

This report lists CASA accounts in which SI has been executed for external accounts and bankers cheques on the day of generation. The accounts are grouped based on payment mode and beneficiary. You can invoke ‘SI Instruction Executed for External Acc, DD, and BC Report’ screen by typing ‘SIRACCBC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

Process Date

Specify a date for which you want to generate a SI executed report from the adjoining calendar.

8.7.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the SI Instruction Executed for External Acc, DD, and BC Report is as follows:

Header

The Header carries the title of the Report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Ben Account No |

Indicates Beneficiary Account Number |

Beneficiary details |

Indicates Beneficiary Name |

Customer |

Indicates Customer ID |

Short name |

Indicates the short name of the customer |

Account no |

Indicates Remitter Account No |

SI CCY |

Indicates Standing Instruction Currency |

SI Amount |

Indicates Standing Instruction Amount |

SC Amount |

Indicates Service Charge Amount |

Total Amount |

Indicates Total SI amount and SC amount |

8.8 Standing Orders Placed Today Report

This section contains the following topics:

- Section 8.8.1, "Generating Standing Orders Placed Today Report"

- Section 8.8.2, "Contents of the Report"

8.8.1 Generating Standing Orders Placed Today Report

During the day, branches input the standing instructions given by the customers. Branches enter the Debit account no, frequency, amount etc based on the details provided by the customer. After these details are entered, during EOD the standing instructions are carried out according to the start date, frequency, priority, etc. You can list these successful standing orders placed through out the day in ‘Standing Order Placed Today Report’.

You can invoke ‘Standing Order Placed Today Report’ screen by typing ‘SIRPLTOD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

Date

Specify a date for which you want to generate standing orders placed report from the adjoining calendar.

Product Type

Select a valid type of the product for which the standing orders were placed from the adjoining drop-down list. This list displays the following values:

- Sweep-in – Select if the product is sweep-in product

- Collection

- Sweep Out

- Payment

- Variable Payment

- Range Balancing Sweep

8.8.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Standing Order Placed Today Report is as follows:

Header

The Header carries the title of the Report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Account no. |

Indicates Debit account number |

Customer name |

Indicates Customer name |

Priority |

Indicates Priority |

Product Type |

Indicates SI product type |

Frequency |

Indicates Instruction frequency |

Next Due Date |

Indicates Next Instruction scheduled date |

CCY |

Indicates Standing Instruction amount currency |

Payment Amount |

Indicates Standing Instruction Amount |

Beneficiary Name |

Indicates Credit Account holder name |

Beneficiary Ac No |

Indicates Credit Account Number |

8.9 Amendment of Standing Orders Report Stale Cheque Report

This section contains the following topics:

- Section 8.9.1, "Generating Amendment of Standing Order Report Stale Cheque Report"

- Section 8.9.2, "Contents of the Report"

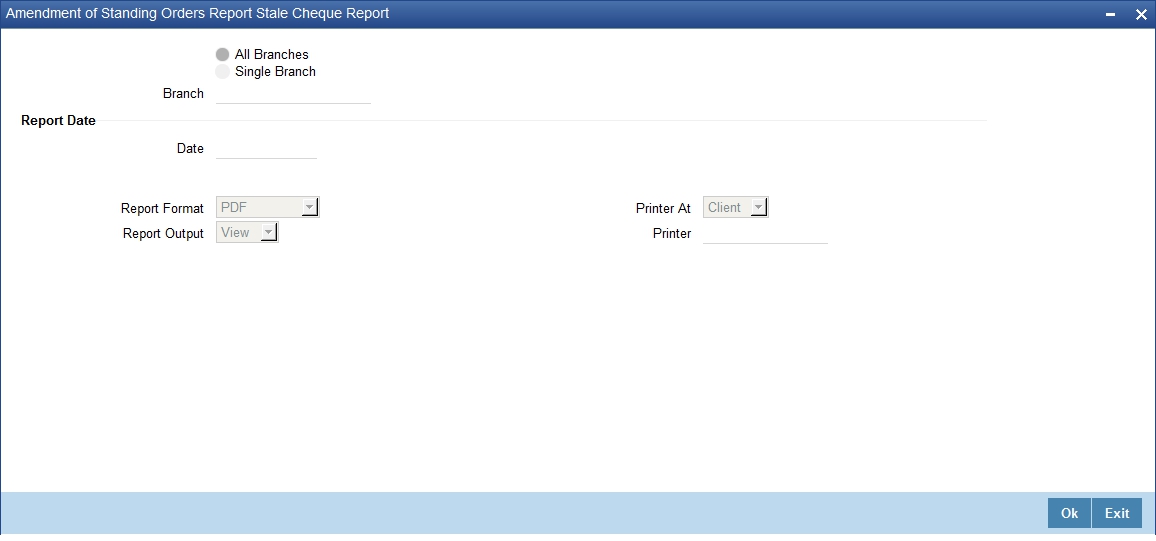

8.9.1 Generating Amendment of Standing Order Report Stale Cheque Report

This report gives details on amendment of Standing Orders Report Stale Cheque.

You can invoke ‘Standing Order Placed Today Report’ screen by typing ‘SIRPAMND’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch

Specify a valid name of the Branch in which report is being generated, from the adjoining option list.

Date

Specify a date for which you want to generate standing orders placed report from the adjoining calendar.

8.9.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Amendment of Standing Orders Report Stale Cheque Report is as follows:

Header

The Header carries the title of the Report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Reference Number |

Indicates reference number |

Dr. Customer Account Number |

Indicates Dr. customer account number |

Customer Title |

Indicates the title of the customer |

Event Sequence Number |

Indicates event sequence number |

Frequency |

Indicates Instruction frequency |

Cr Account Number |

Indicates Cr account number |

Cr Account Title |

Indicates Cr account title |

Booking Date |

Indicates booking date |

Start Date |

Indicates start date |

End Date |

Indicates end date |

Previous Value Date |

Indicates previous value date |

Type of Standing Instruction |

Indicates the type of standing instruction. |

8.10 Closed Standing Orders Report

This section contains the following topic:

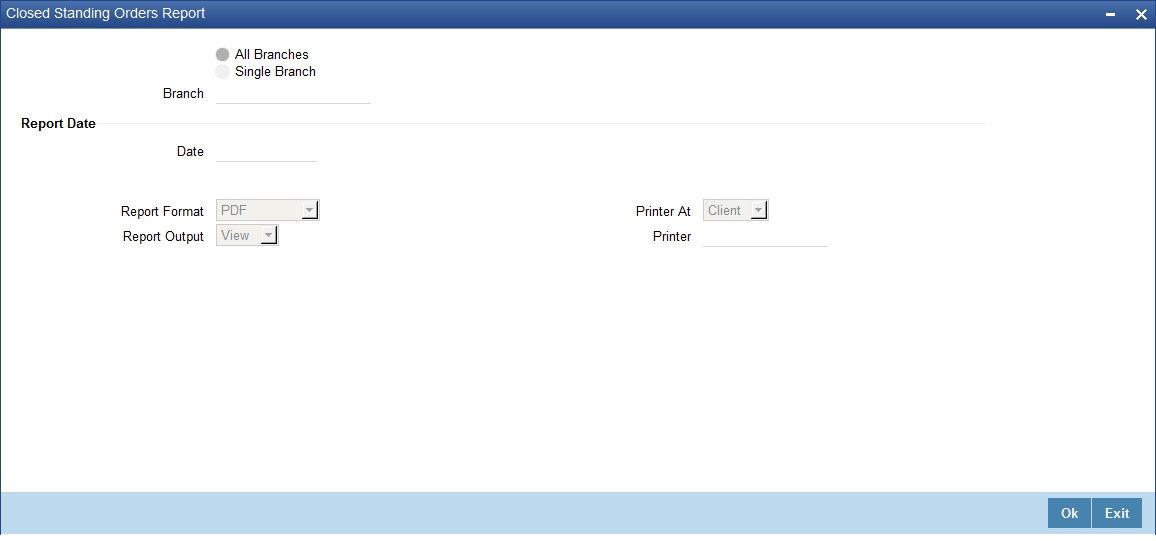

8.10.1 Generating Closed Standing Orders Report

This report gives details on closed standing orders.

You can invoke ‘Standing Order Placed Today Report’ screen by typing ‘SIRPDELT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch

Specify a valid name of the Branch in which report is being generated, from the adjoining option list.

Date

Specify a date for which you want to generate standing orders placed report from the adjoining calendar.

8.10.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Closed Standing Orders Report is as follows:

Header

The Header carries the title of the Report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Sr. No. |

Field Name |

Field Description |

1 |

Reference Number |

Indicates reference number |

2 |

Dr Customer Account Number |

Indicates Dr. customer account number |

3 |

Customer Title |

Indicates the title of the customer |

4 |

Event Sequence Number |

Indicates event sequence number |

5 |

Frequency |

Indicates Instruction frequency |

6 |

Cr Account Number |

Indicates Cr account number |

7 |

Cr Account Title |

Indicates Cr account title |

7 |

Booking Date |

Indicates booking date |

8 |

Start Date |

Indicates start date. |

9 |

End Date |

Indicates end date. |

10 |

Previous Value Date |

Indicates previous value date. |

11 |

Type of Standing Instruction |

Indicates the type of standing instruction. |

8.11 Penalty on Rejected Standing Orders Report

This section contains the following topics:

- Section 8.11.1, "Generating Penalty on Rejected Standing Orders Report"

- Section 8.11.2, "Contents of the Report"

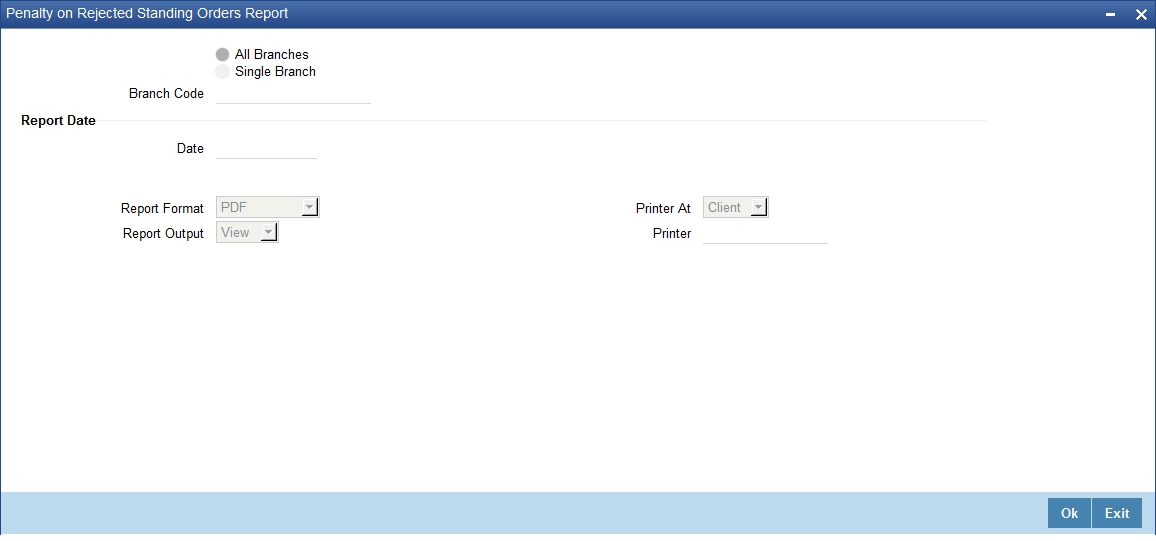

8.11.1 Generating Penalty on Rejected Standing Orders Report

This report gives details on penalty on rejected standing orders.

You can invoke Penalty on Rejected Standing Orders Report screen by typing ‘SIRPREJT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

Date

Specify a date for which you want to generate standing orders placed report from the adjoining calendar.

8.11.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Closed Standing Orders Report is as follows:

Header

The Header carries the title of the Report, information on the branch code, branch date, the user id, the module name, run date and time and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Account Number |

Indicates account number. |

Title of Account Number |

Indicates the title of account number. |

Amount |

Indicates the amount. |

Currency |

Indicates the currency. |

Start Date |

Indicates the start date |

End Date |

Indicates the end date |

Frequency of Standing Order |

Indicates the Frequency of Standing Order |

8.12 SI Attached to Closed TD Account

This section contains the following topics:

- Section 8.12.1, "Generating SI Attached to Closed TD Account Report"

- Section 8.12.2, "Contents of the Report"

8.12.1 Generating SI Attached to Closed TD Account Report

This report provides details on the list of Standing Instructions attached to a closed TD in the SI contract. You can invoke the ‘Closed Term Deposit Open Standing Instruction Report’ screen by typing ‘SIRLISTC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details in this screen:

TD Account Number

Select the TD account number of the SI Contract, from the adjoining option list. This field lists all the TD account numbers in the SI contract that have been closed.

Branch Code

The branch of the selected account number is defaulted. However, if multiple branches are linked to the account, then select the appropriate value from the adjoining option list.

Date

Specify the date of the report.

8.12.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other contents displayed in the report are as follows:

Header

The Header carries the title of the Report, information on the branch code, branch date, the user id, the module name, run date and time, and the page number of the report.

Body of the Report

The following details are displayed as body of the generated report:

Field Name |

Field Description |

Branch Code |

Indicates the branch code of the account. |

TD Account Number |

Indicates the closed TD account number. |

Credit Account Currency |

Indicates the currency of the closed TD account |

Instruction Number |

Indicates the settlement instruction number. |

Source Code |

Indicates the source code. |

Goal Reference Number |

Indicates the reference number of the goal as received from external channels. |

SI Currency |

Indicates the currency of the settlement instruction. |

SI Amount |

Indicates the settlement instruction amount. |

SI Expiry Date |

Indicates the expiry date of the settlement instruction. |

Execution Periodicity |

Indicates the frequency at which the standing instruction is executed. |

Next Execution Value Date |

Indicates the date on which the next cycle of the instruction falls. |

Next Execution Due Date |

Indicates the date adjusted according to the holiday handling specifications under which the instruction is being processed. |

Contract Status |

Indicates the status of the contract such as authorized. |