2. The Settlements Service

2.1 Introduction

The Settlements sub-system is part of the core of Oracle FLEXCUBE. This system is a central money settlement service that interfaces with the other modules of Oracle FLEXCUBE.

In Oracle FLEXCUBE, the Settlements and Messaging systems are closely associated. The Settlements system provides for a common set up of money settlement accounts and routes. The Messaging system, on the other hand, handles the generation of settlement messages.

To handle money settlements in Oracle FLEXCUBE, you have to:

- Maintain Bank Identifier Codes (BIC)

- Maintain Ultimate Beneficiary details

- Maintain Settlement Preferences for a Customer/Module/Currency/Branch or for a combination of any of the entities.

This chapter contains the following sections:

- Section 2.2, "IBAN Additional Maintenances"

- Section 2.3, "Ultimate Beneficiary Details"

- Section 2.4, "Multi Mode Settlement Details"

- Section 2.5, "Settlement Preferences of a Customer"

- Section 2.6, "The Sequence in which Settlement Instructions are Resolved"

- Section 2.7, "Processing Settlements"

- Section 2.8, "Generation of MT920 Messages"

2.2 IBAN Additional Maintenances

This section contains the following topics:

2.2.1 Viewing IBAN Exclusions Summary

Banks exclude certain IBAN national IDs from being used as bank codes in Oracle FLEXCUBE. The exclusion list must be uploaded into the system using ‘BIC Upload’ screen. When an IBAN national ID is excluded, the IBAN is considered to be invalid.

The invalid IBANs specified in the exclusion will not be available for selection while you enter a bank code during any operation in the system. That is, whenever you try to enter an IBAN in the system, it will be validated against the IBAN national ID exclusion list as of that date.

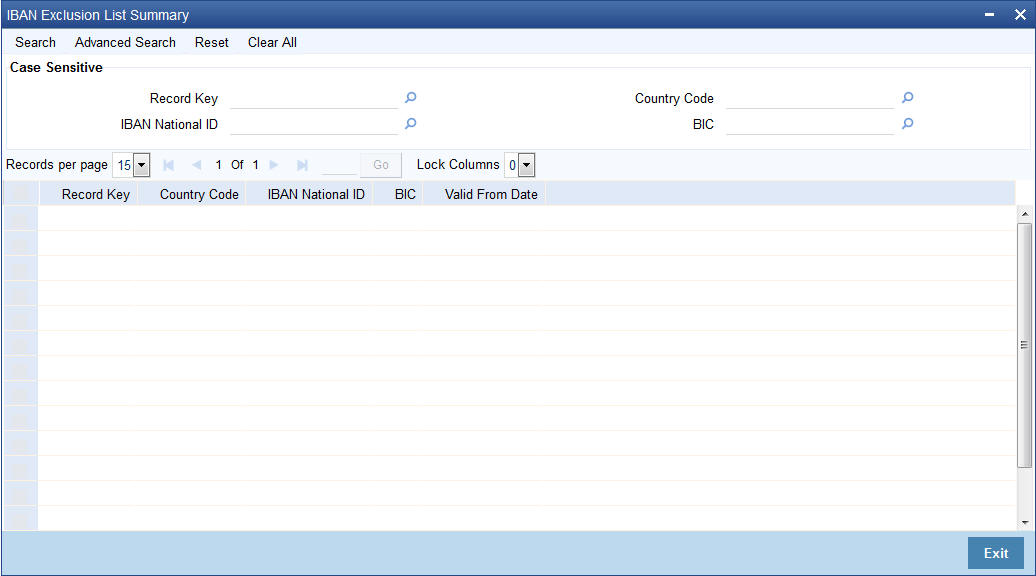

You can view a summary of IBAN national ID exclusions using ‘IBAN Exclusion List Summary’ screen. To invoke the screen, type ‘ISSIBEXC’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Even if you have uploaded the exclusion list, you can see the IBAN national ID in this screen only from the date of activation of the exclusion.

You can search for the records based on one or more of the following parameters:

- Record key

- Country code

- IBAN national ID

- BIC

Once you have specified the search criteria, click ‘Search’ button. The system displays the above details of excluded IBAN national IDs that match the search criteria.

2.2.1.1 Viewing IBAN Exclusions

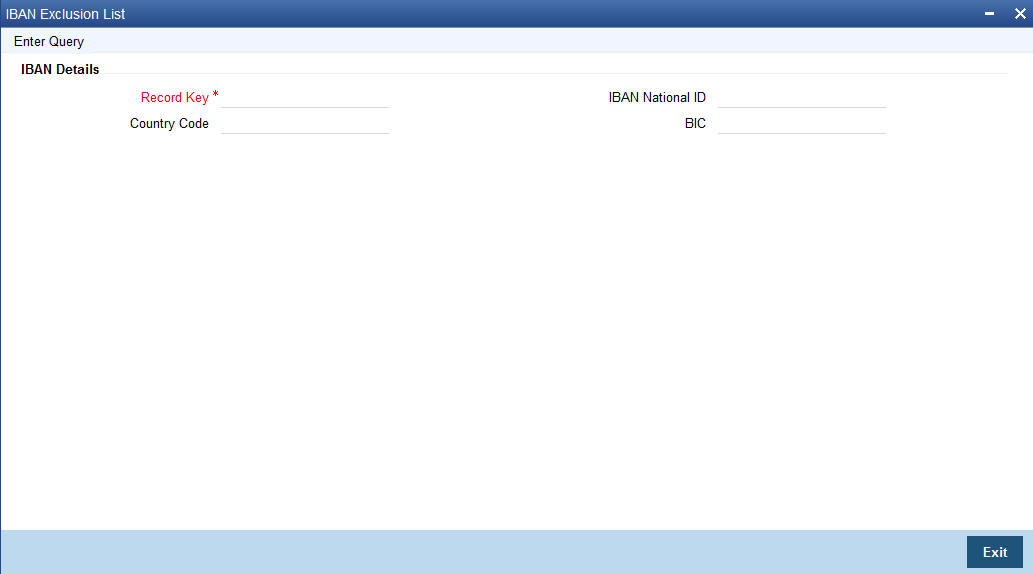

The IBAN national IDs in the exclusion list is uploaded to the system can be viewed in ‘IBAN Exclusion List’ screen. From the ‘IBAN Exclusion List Summary’ screen, you can double-click a record to view the detailed screen. You may also type ‘ISDIBEXC’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

If you have directly accessed this screen, you may enter a query by clicking ‘Enter Query’ button. You can specify the record key and click ‘Execute Query’ button to view the details.

The following details are displayed:

- Record Key

- Country Code

- IBAN National ID

- BIC

2.2.1.2 Customer IBAN Validations

The customer IBAN number is validated for the length, IBAN check digit and national ID. For the IBAN to be considered as valid, following conditions should be satisfied.

- IBAN ISO country code in the IBANPlus and the country code in IBAN must match

- IBAN national ID should not be present in the exclusion list.

2.2.1.3 Beneficiary IBAN Validations

The beneficiary IBAN number is validated for the length, IBAN check digit and national ID.

IBAN check digit and national ID validations are applicable only if the global parameter ‘IBANPLUS_REQD’ is set to ‘Y’.

For the IBAN to be considered as valid, following conditions should be satisfied.

- The check digit value computed by the system should match with the check digit value extracted from IBAN.

- IBAN ISO country code in the IBANPlus and the country code in IBAN must match

- IBAN national ID should not be present in the exclusion list.

2.3 Ultimate Beneficiary Details

This section contains the following topics:

2.3.1 Maintaining Ultimate Beneficiary Details

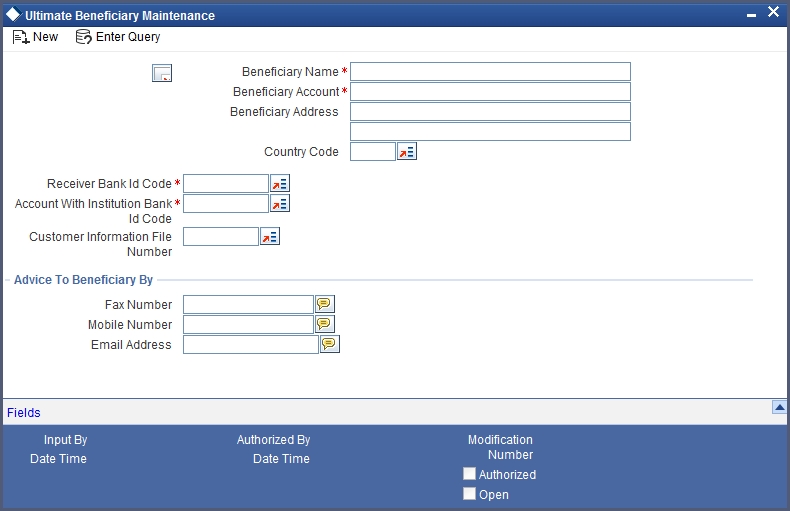

You can maintain the details related to the beneficiary of transaction through ‘Ultimate Beneficiary Maintenance’ screen. You can invoke this screen by typing ‘ISDUTBEN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. If you are maintaining details of a new beneficiary, select ‘New’ from the Actions Menu in the Application toolbar or click new icon.

You can specify the following details in this screen:

Beneficiary Name

Specify the name of the ultimate beneficiary for whom you are maintaining details. You can maintain several settlement combinations for an Ultimate Beneficiary

Beneficiary Account

Specify the account number of the ultimate beneficiary to which funds need to be credited. The account number should be a valid account with the bank that you specify in the BIC Code field.

Beneficiary Address

Specify the address of the ultimate beneficiary. Each row can contain a maximum of thirty five alphanumeric characters.

Country Code

Specify country code of the ultimate beneficiary for whom you are maintaining details or select the country code from the option list provided.

Receiver Bank Identification Code

Specify the Bank Identification Code (BIC) of the receiver bank or select the BIC from the option list provided.

Account With Institution Bank Identification Code

Specify the Bank Identification Code (BIC) of the Account with Institution bank or select the BIC from the option list provided.

Customer Information File Number

Specify the CIF number of the ultimate beneficiary for whom the details are being maintained or select the CIF number from the option list provided.

Advice to Beneficiary By

You can indicate the mode of sending advice to beneficiary here. The following options are available:

Fax Number

Specify the fax number of the ultimate beneficiary for whom you are maintaining details.

Mobile Number

Specify the mobile number of the ultimate beneficiary for whom you are maintaining details.

Email Address

Specify the email address of the ultimate beneficiary for whom you are maintaining details.

Note

You can specify only one of the options among fax number, mobile number and e-mail address.

2.4 Multi Mode Settlement Details

This section contains the following topics:

2.4.1 Maintaining Multi Mode Settlement Details

Multimode settlement is applicable only for Consumer lending module of Oracle FLEXCUBE. All settlements are, typically, made using accounts. However, in Oracle FLEXCUBE, settlements can be done through different modes in addition to the account level settlement. The different modes can be:

- Cash

- Instruments

- External Accounts

- Pay Orders

- Internal Cheque

- Clearing

- Debit Card

- Credit Card

You can also make settlements using a combination of any of the modes mentioned above i.e. part by cash, part by cheque and the rest by credit card or any other combination of your choice.

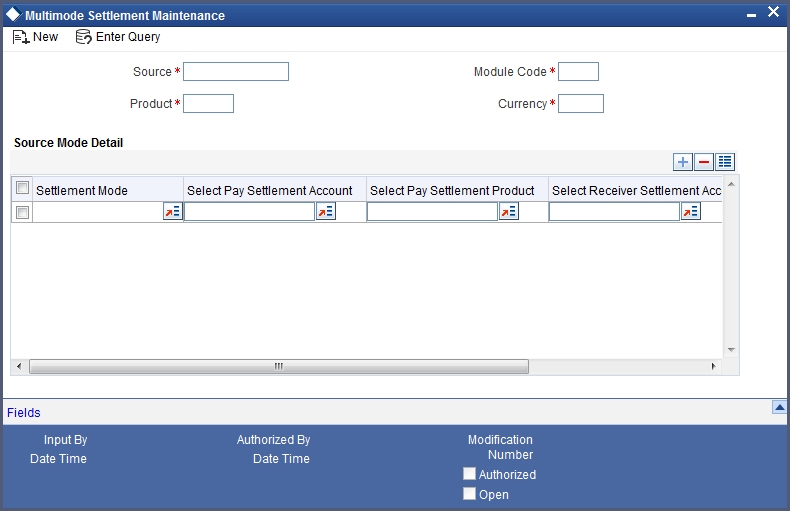

You can capture the different modes of settlement through the ‘Multimode Settlement Maintenance’ screen. You can invoke this screen by typing ‘ISDSRCMD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The modes are captured for a Source, Module, Product and Currency combination.

The following details have to be captured in this screen:

Source

Oracle FLEXCUBE interfaces with other external systems of your bank. Transactions originating in external systems may require to be uploaded into Oracle FLEXCUBE for further processing. For maintaining the settlement modes for such transactions, you have to indicate the source code of the external system here. The source codes of all external systems are available in the option-list provided from where you can make the appropriate selection.

You may use the Source Code ‘Oracle FLEXCUBE’ to maintain settlement modes for transactions originating in Oracle FLEXCUBE.

Module

You have to specify the module of the transactions that have to be settled using different modes. The value of this field is defaulted to CL (Consumer Lending). You cannot modify this value.

Product

Here, you have to indicate the product of the transactions that have to be settled using different modes. The option-list will display the different products available under the selected module. You may also use the wild character ‘****’ as the product code. The system will use this information if settlement mode maintenance is not available for a product under the selected module.

Currency

You have to specify the currency of the transactions that have to be settled using different modes. You may also use the wild character ‘***’ for a currency. This will be used if maintenance for a specific currency is not available.

For the above combination of Source, Module, Product and Currency, you can maintain multiple settlement modes and the associated details given below:

Setl Mode

For the selected combination, you have to specify the settlement mode. The list of available modes is predefined in the system and you can select a mode from the drop-down list. Since CL is the module used for the multimode settlement the different modes available are:

- CASA

- Cash/Teller

- Instrument

- External Account

- Electronic Pay Order

- Internal Cheque

- Clearing

- Debit Card

- Credit Card

Pay Setl Ac

For the selected settlement mode, you have to specify the Suspense/Control GL into which the transactions (that satisfy the selected combination) need to pass the accounting entry. This GL will be used only when the bank is making a payment. The settlement account gets credited in this case.

Pay Setl Prod

For the selected settlement mode, if the originating transaction results in a linked transaction, you need to specify the product that should be used to create the linked transaction. This product will be used when the settlement account gets credited. For example, if the settlement mode is ‘DD’, you have to specify the product code (i.e. the DD instrument type) for creating the corresponding instrument transaction in Oracle FLEXCUBE.

Recv Setl Ac

Just as you specify the pay settlement account for the mode selected, you also have to indicate the Suspense/Control GL into which transactions (that satisfy the selected combination) need to pass the accounting entry when the bank receives a payment. The selected account gets debited in this case.

Recv Setl Prod

If the originating transaction (payment received) results in a linked transaction, you have to specify the product to be used to create the linked transaction. This product will be used when the settlement account gets debited. For instance, if the settlement mode is ‘External Cheque’, you have to specify the clearing product to be used for creating the clearing transaction.

For details on multi mode settlement processing, refer the heading titled ‘Processing settlements’ in this chapter.

2.5 Settlement Preferences of a Customer

This section contains the following topics:

- Section 2.5.1, "Invoking Settlement Instructions Maintenance Screen"

- Section 2.5.2, "Pay Parties Tab"

- Section 2.5.3, "Receive Parties"

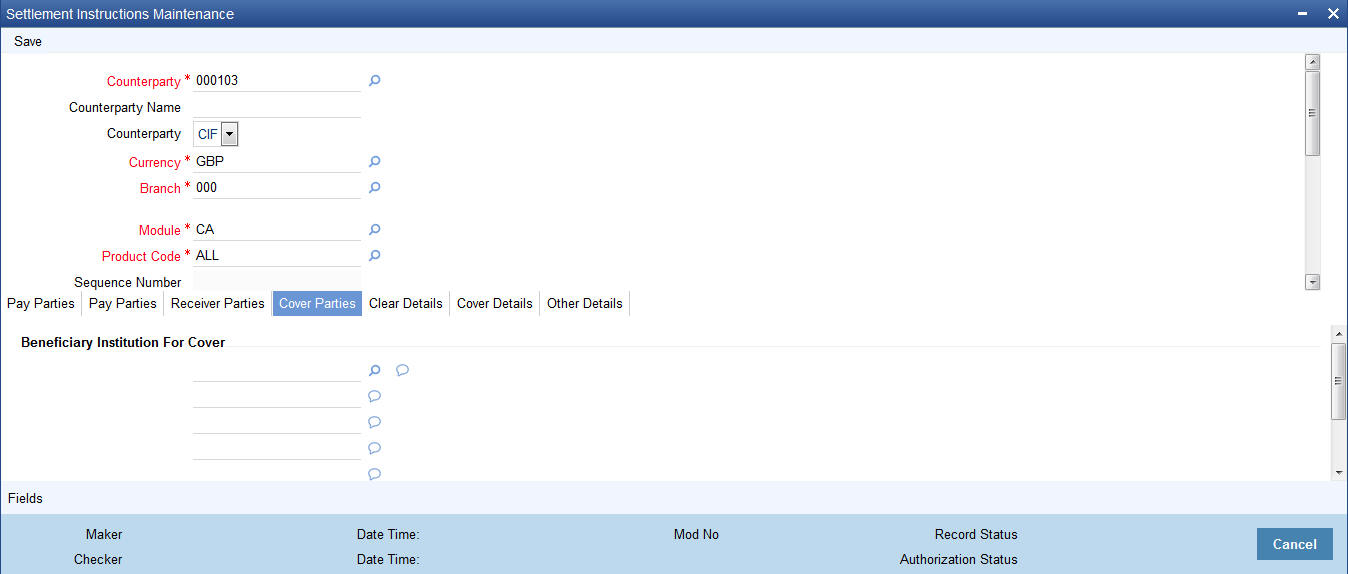

- Section 2.5.4, "Capturing Cover Details"

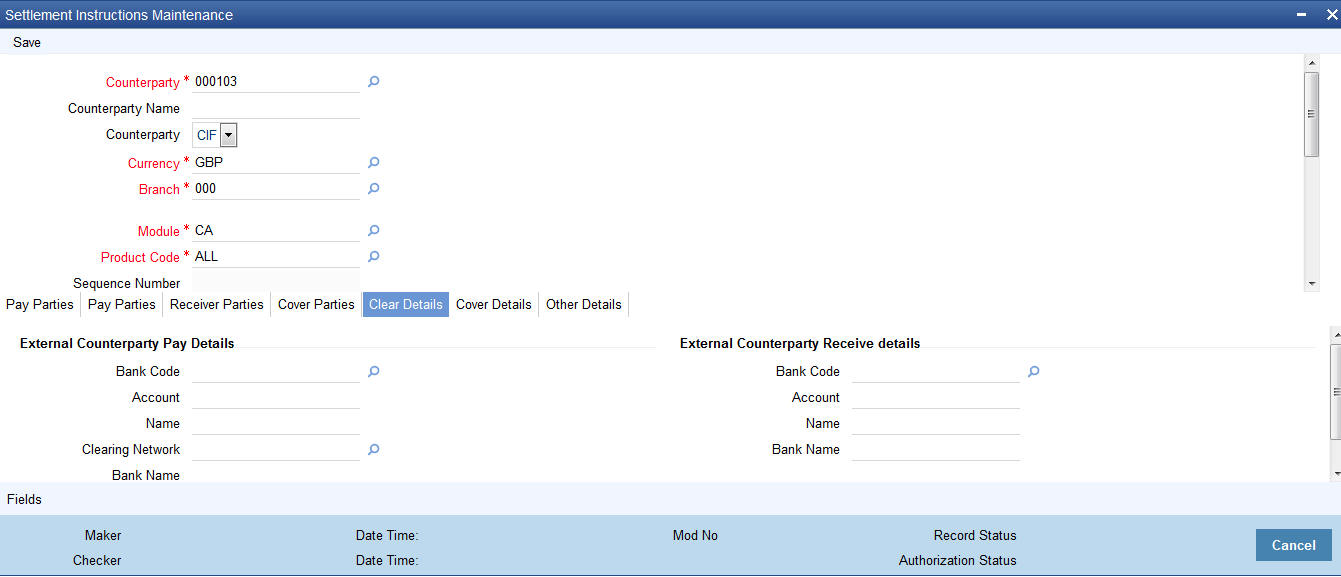

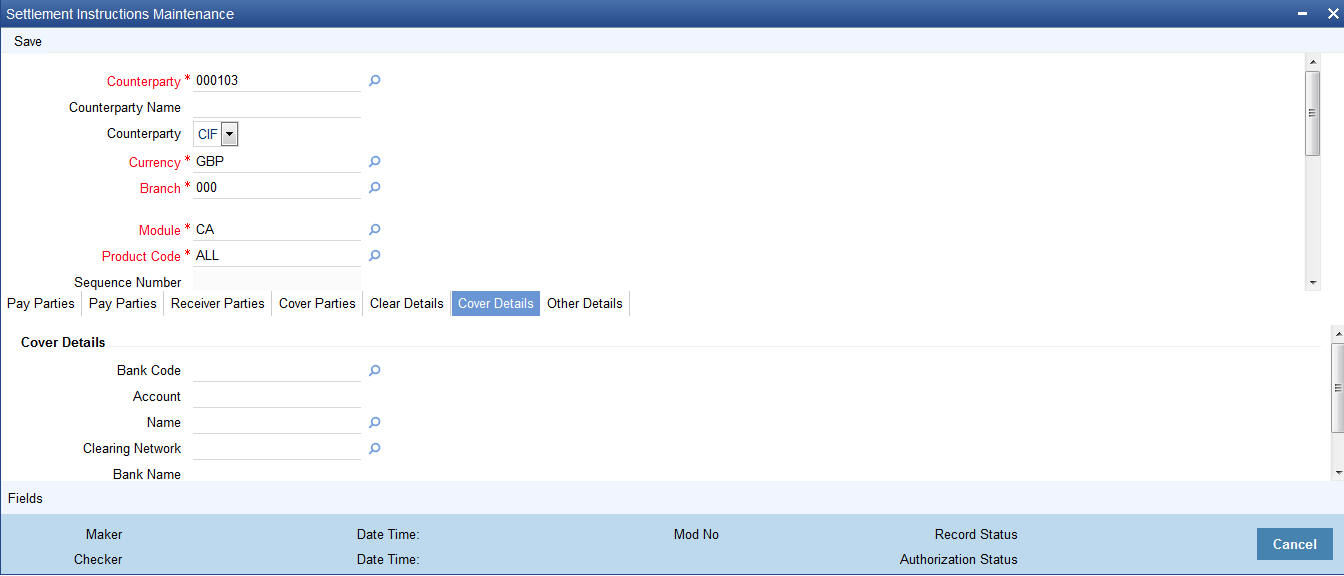

- Section 2.5.5, "Maintaining Local Clearing Details and Cover Details for Customer Settlement Instructions"

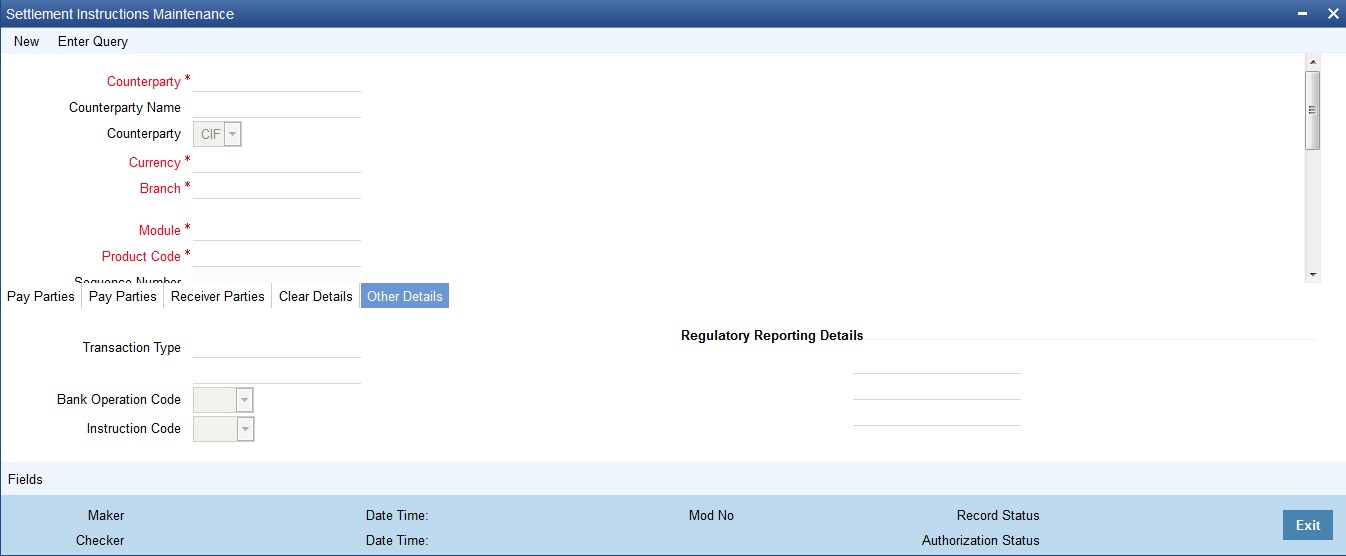

- Section 2.5.6, "Other Details Tab"

2.5.1 Invoking Settlement Instructions Maintenance Screen

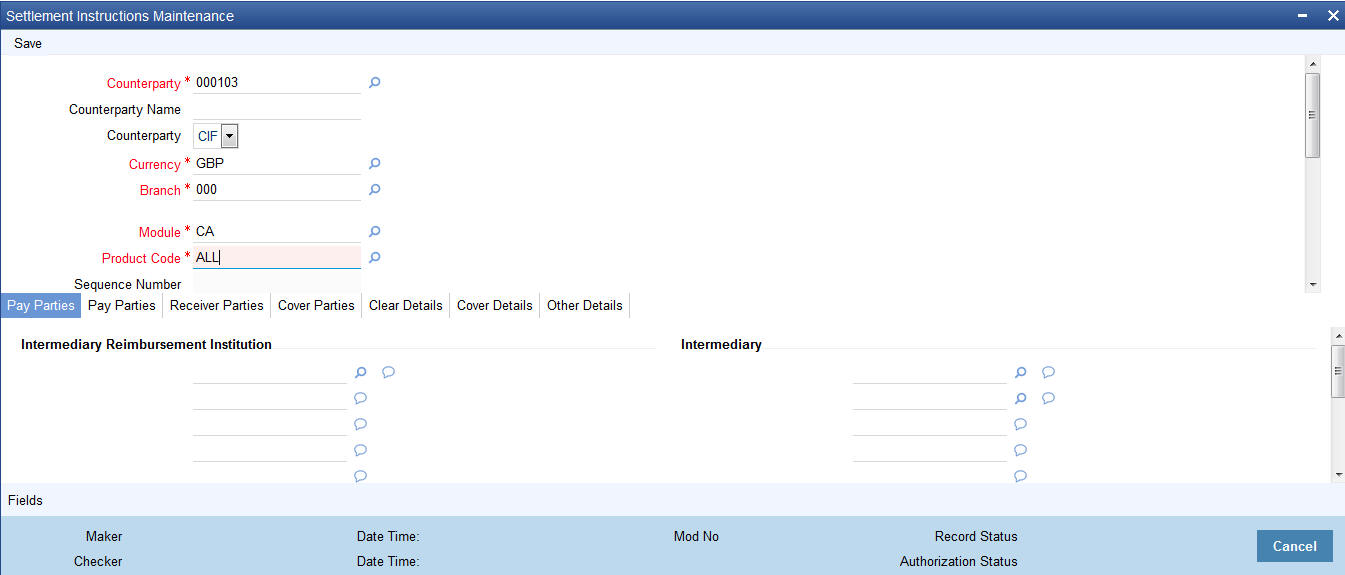

You can maintain the settlement preferences of a customer or a bank in the ‘Settlement Instructions Maintenance’ screen. You can invoke this screen by typing ‘ISDINSTN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Indicating preferences for an entity means defining the settlement accounts and a detailed settlement route comprising the correspondent accounts and the intermediaries through which payment is to be routed. (The party information you can capture adheres to SWIFT standards).

You can maintain the following basic settlement preferences for an entity (Customer /BIC), module, currency, product, Sequence Number and branch combination.

- The Pay (out) Account, Branch and Currency

- The Receive Account (for incoming payments), Branch and Currency.

- If a Cover is required to be sent for SWIFT messages

- If the charge (for the message) is to be borne by the bank or the beneficiary, or shared between them

- The charge account, which will be used as the default account for all charges during contract input

- If a receive notice (MT 210) has to be generated for money settlements made in a specific currency

Counter Party

You can maintain settlement instructions for all the customers or for specific customers only. From the option list select the specific customer number or choose the ALL option.

Counterparty Type

The Counterparty Type can either be CIF or BIC depending on whether your bank has an accounting relationship with the party for whom the instruction is being maintained or whether it only has a SWIFT messaging relationship. If the counterparty is a CIF in Oracle FLEXCUBE, you will have to select CIF as the party type and choose the relevant CIF ID in the adjacent field.

However, if the entity is not an actual customer of your bank but you would be sending/receiving payment messages to/from that party, you will have to choose BIC as the counterparty type and specify the counterparty’s address as well. As a result, you will need to identify the preferred Nostro/ Vostro accounts for that currency and BIC code combination.

Note

- If you opt to generate receive notices for settlements made in all currencies, involving all counterparties, and transactions in all modules of Oracle FLEXCUBE, an MT 210 will automatically be generated for any money settlement made by your branch.

- If you are defining settlement instructions for a customer related to the FT module you have to indicate the charge account, which will be used as the default account for deducting all charges involved in processing the FT.

While processing an FT for the customer the appropriate charge account is picked up depending on the customer, currency and branch processing the FT.

In addition, you can maintain the details of the various intermediaries involved in payments and receipts. The preferences maintained for an entity determine the manner in which money settlements are made on behalf of the entity.

Counterparty Name

The system displays the name of the specified counterparty based on the details maintained at ‘Customer Maintenance’ level.

Module

You can maintain different settlement instructions for different products. If you choose Module as ‘ALL,’ then the Product must also be chosen as ‘ALL’. If you choose a specific module for maintaining settlement instructions, then you can choose any Product available under the module from the option list provided. You can also choose ‘All’ to maintain settlement instructions for all products under the selected module.

Product Code

Indicate a specific product code or choose All from the option list. However, if you have chosen All in the Module field, this field will be defaulted to ALL. You will not be allowed to change this.

Currency

You can maintain settlement instructions for a particular currency or for all the currencies From the option list select the particular currency code or choose the ALL option.

Branch

You can maintain settlement instructions for all the branches or for a particular branch. From the option list select the particular branch code or choose the ALL option.

Payment By

Indicate the method of payment for both Outgoing as well as Incoming Payments, for a Branch, Account and Currency combination. The following options are available:

- Instrument (settlement is done through a Check, MCK etc.)

- Message (payment is made by means of a SWIFT Message)

- Clearing (the transaction is a local payment transaction and the settlement is routed through the Clearing House of the bank)

Note

You can indicate the payment method as ‘Clearing’ only,

- If the payment currency is the local currency of the branch

- If it is one of the clearing currencies defined for the branch

- If you have selected ‘ALL’ in the currency field

No payment message will be generated for settlements routed through a Clearing House.

Note

You can select ‘Payment By’ as ‘Instrument’, to ensure the payment by Instrument in SI settlements screen and then the system would look for the instrument type.

Charge Details

Specify whether charges for the message are to be borne by the bank (ourselves) or the beneficiary, or will be shared. This information is inserted in Field 71A of an MT103 message involving the combination for which settlement instructions are being maintained. You can select one of the following options:

- Ourselves – It is displayed as ‘OUR’ in the message and it indicates that all transaction charges are to be borne by the ordering customer.

- Beneficiary – It is displayed as ‘BEN’ in the message and it indicates that all transaction charges are to be borne by the beneficiary customer.

- Shared – It is displayed as ‘SHA’ in the message and it indicates that the transaction charges on the Sender’s side are to be borne by the ordering customer and the transaction charges on the Receiver’s side are to be borne by the beneficiary customer.

Cover Required

This indicates whether the payment has to be sent with a cover message. Check this box to enable this option.

Cover By

If you have indicated that a cover is required for payments involving the customer, then, in this field, you can indicate whether the cover is through messaging or through local clearing. Accordingly, you can choose the required option in this field.

If you indicate that cover is through messaging, and the payment is through local clearing, you need to maintain the local clearing counterparty details in the Local Clearing tab.

If you indicate that cover is through local clearing, you need to maintain the cover details in the Cover Details tab.

2.5.1.1 Maintaining settlement instructions for CLS deals

When maintaining settlement instructions for CLS deals, you should specify the module as ‘FS’ (FX Settlements). This will indicate that they are meant exclusively for CLS deals.

The pay and receive accounts specified for the settlement instructions will be used as the ‘Control Accounts’ for CLS deals.

Refer the ‘Continuous Linked Settlements’ chapter of the Foreign Exchange User Manual for details on the following:

- Maintaining settlement instructions for CLS deals,

- Other maintenances required to be CLS compliant

- The processing involved in the settlement of CLS deals in Oracle FLEXCUBE

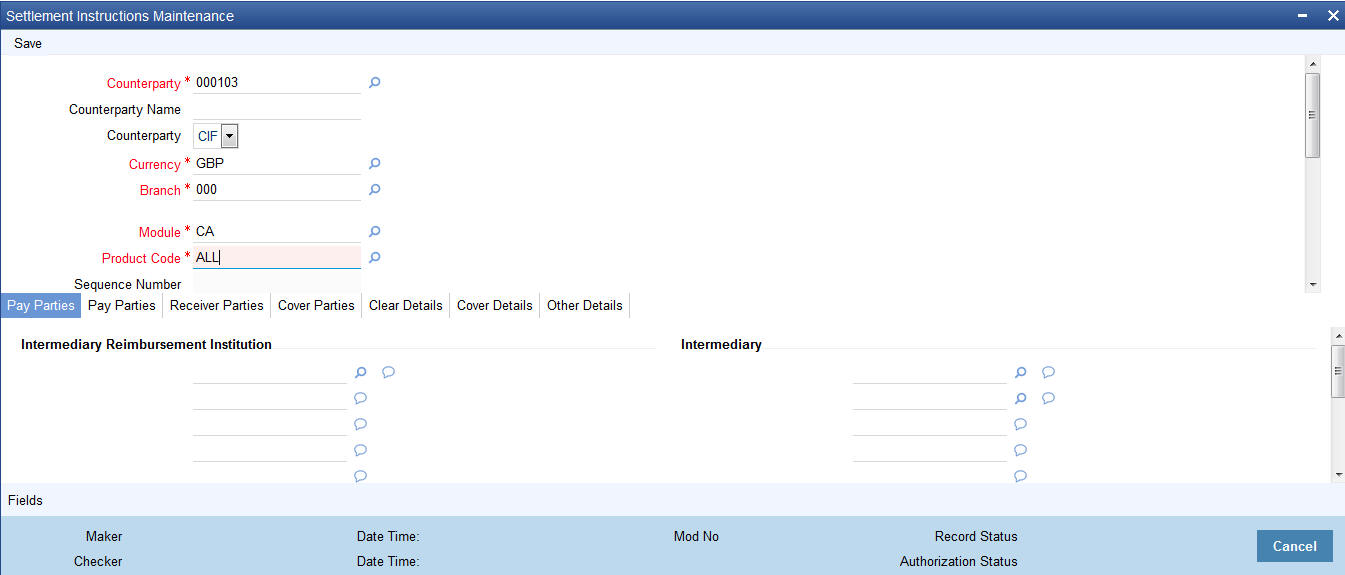

2.5.2 Pay Parties Tab

Before funds actually reach the Ultimate Beneficiary of a payment, it may have to pass through several other banks or parties. You can capture details of the parties involved in a payment in the ‘Pay Parties’ sections of the ‘Settlement Instructions Maintenance’ screen.

These screens contain fields that mark possible routes of a payment.

Intermediary Reimbursement Institution

An ‘Intermediary Reimbursement Institution’ is the financial institution between the Sender’s Correspondent and the Receiver’s Correspondent, through which the reimbursement of the transfer takes place.

Country

Specify the country of the intermediary reimbursement institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Intermediary

The ‘Intermediary’ in a payment refers to the financial institution, between the ‘Receiver’ and the ‘Account With Institution’, through which the transfer must pass.

The Intermediary may be a branch or affiliate of the Receiver or the account with Institution, or an entirely different financial institution. This field corresponds to field 56a of a SWIFT message.

You can either enter the:

- ISO Bank Identifier Code of the bank

- The Name and address of the Bank

Country

Specify the country of the intermediary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Note

The country information is captured to enable Mantas to analyse the transactions for possible money laundering activities.

For more details on Mantas, refer 'Mantas' interface document.

RTGS Payments

If the settlement chosen is one of the RTGS Nostro that is, RTGS outgoing Nostro account in case of Outgoing customer and Bank transfer and RTGS incoming Nostro in case of outgoing Direct Debit transfer then the system will check this check box as per the validations done in RTGS Network. You cannot change this value.

RTGS Network

If in a RTGS Network the accounts are maintained as ‘Pay account’ or ‘Receiver Account’ while saving the settlement instruction, then a set of validations will be performed as mentioned below:

For Pay message, system will validate whether the intermediary (if intermediary is not present, the Account with Institution (AWI) will be validated and if the AWI is also not present then receiver will be validated) is a RTGS participant.

For Pay+ Cover message, system will validate if the receiver correspondent is a RTGS network participant.

If the above conditions are satisfied, the RTGS Network will be updated and the system will check RTGS Payments check box.

Receiver’s Correspondent

The ‘Receiver’s Correspondent’ is the branch of the Receiver, or another financial institution, at which the funds will be made available to the Receiver.

Receivers Correspondent

This field corresponds to field 54a of S.W.I.F.T. Enter the branch of the Receiver or another financial institution at which the funds will be made available to the Receiver. You can enter any one of the following:

- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

Country

Specify the country of the branch of the receiver / institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Sender to Receiver Information

The sender to receiver information maintained in the settlement instructions can be defaulted in the field 72 in the confirmation messages. The adjoining option lists displays the following values:

- //

- /ACC/ - Account with Institution

- /BNF/ - Beneficiary

- /BUP/ - Backup Payment

- /CHEQUE/ - Pay only by cheque

- /CLSTIME/ - CLS Time

- /INS/ - Instructing Institution

- /INT/ - Intermediary

- /MANPAY/ - Mandated Payment

- /PHON/ - Deal by Phone

- /PHONBEN/ - Contact beneficiary by phone

- /PHONIBK/ - Contact intermediary by phone

- /RCB/ - Receiver’s correspondent

- /REC/ - Receiver

- /REJT/ - /REJT/

- /RETN/ - /RETN/

- /TELE/ - /TELE/

- /TELEBEN/ - /TELEBEN/

- /TELEIBK/ - /TELEIBK/

- /TSU/ - Trade Services Utility transaction

- /BROKER/ - Broker negotiating the contract

- / ELEC/ - Deal has been arranged via an electronic means

- /TELEX/ - Deal by TELEX

- /TIME/ - Time of transaction execution

- /VENU/ - Venue of transaction execution

If you choose, ‘/TSU/’, the code placed between slashes ('/') must be followed by the invoice number, a slash ('/') and the amount paid.

Account With Institution

An ‘Account with Institution’ refers to the financial institution, at which the ordering party requests the Beneficiary to be paid. The Account With Institution may be a branch or affiliate of the Receiver, or of the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution.

This field corresponds to Field 57A of a SWIFT message. You can enter one of the following:

- ISO Bank Identifier Code of the bank

- Branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)

Country

Specify the country of the account with institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one

Note

The country information is captured to enable Mantas to analyse the transactions for possible money laundering activities.

For more details on Mantas, refer 'Mantas' interface document.

Receiver

You can specify the final Receiver as apart from the Account With Institution if the Ultimate Beneficiary desires that the payment message should be sent there. If this is not maintained, the Account With Institution becomes the default Receiver.

You can also capture the Sender to Receiver Information in this screen.

For more details relating to specific parties, please refer to the SWIFT manuals.

ERI Currency

For every Counterparty and 'In' Currency (combination) for which you maintain settlement instructions, you can define an Euro Related Information (ERI) Currency. The ERI Currency can be:

- 'In' currency

- Euro

This is used during the transition period, settlements of components in 'In' currencies can be made either in the same currency or in the Euro (EUR) depending on the settlement account(s) maintained. Similarly, components in Euro can either be settled in EUR or in an 'In' currency. In the settlement messages that are generated (MT 100, MT202), the settlement amount would be reported in the Settlement Account Currency. However, you can opt to additionally furnish the value of the component in an ERI currency.

The ERI Currency that you specify for a Counterparty and 'In' currency (combination) will default in the ERI CCY field in the Settlements Message Details screen.

Settlement Through an Instrument or Message

When the actual settlement event for a contract (involving the entity) takes place, the payment and receive message details are updated in a message hand-off table. The Messaging system picks up the details from this table, and based on the formats set up, generates the messages.

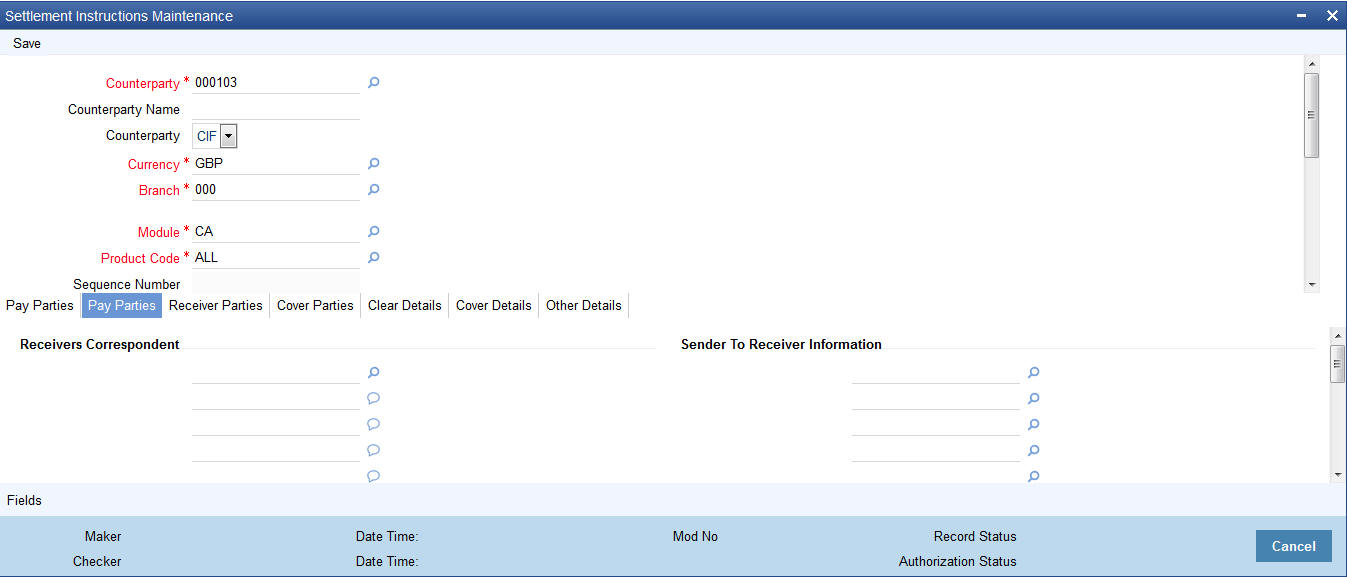

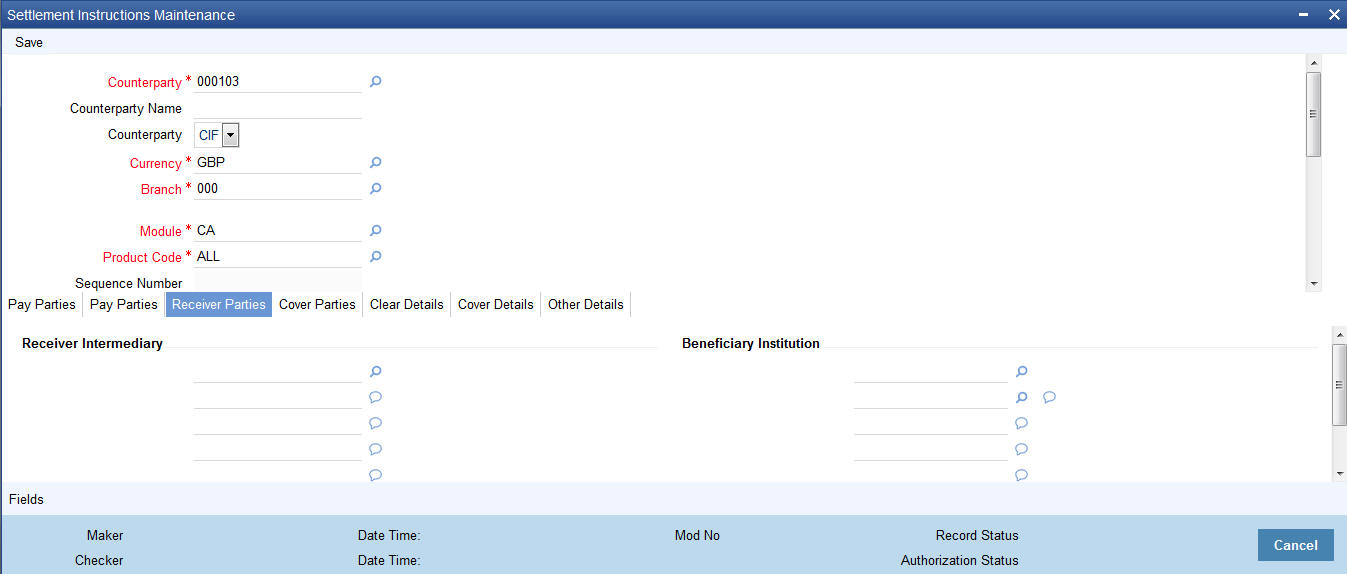

2.5.3 Receive Parties

Depending on the route funds take when you receive (incoming) payments, you can maintain Intermediary and Beneficiary Institutions in the ‘Receive Parties’ section of the ‘Settlements Instructions Maintenance’ screen.

Receiver Intermediary

This field corresponds to field 56a of S.W.I.F.T. Specify details of the financial institution between the ‘Receiver’ and the ‘Account With Institution’, through which the amount must pass. The Intermediary may be a branch or affiliate of the Receiver or of the Account With Institution, or an entirely different financial institution.

In this field you can choose to enter the:

- ISO Bank Identifier Code of the bank

- Name and address of the Bank

Country

Specify the country of the receiver’s intermediary. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Beneficiary Institution

This field corresponds to field 58a of S.W.I.F.T. Enter details of the institution in favor of which the payment is made. It is in reality the bank, which services the account of the ultimate beneficiary. You will be allowed to make entries into this field only for Bank transfers (MT 200 or MT 202). In this field you can enter either the:

- The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

Country

Specify the country of the beneficiary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Note

- If you have already maintained this information in the Settlement Instructions Maintenance screen, then it will be picked up and reflected here.

- The country information is captured to enable Mantas to analyse the transactions for possible money laundering activities.

For more details on Mantas, refer 'Mantas' interface document.

2.5.4 Capturing Cover Details

The Cover details are defaulted from the ‘Contract Online’ screen only for Outgoing Customer Transfers with Cover.

You can specify the following details:

Country

Specify the country of the beneficiary institution for cover. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

2.5.5 Maintaining Local Clearing Details and Cover Details for Customer Settlement Instructions

When you specify settlement instructions for a customer, you can indicate whether payment for local currency transactions is to be effected via messaging or over the local clearing network. You can also indicate whether a cover is required for payment, and whether the cover is through messaging or over the local clearing network.

You can specify these details in the Settlement Instructions screen. In the Payment By field, indicate the mode of payment, either Message or Clear Details; and in the Cover By field, indicate the mode through which cover must be available.

If you indicate payment over a clearing network, you must specify the account details of the external counterparties (both pay and receive accounts) in the ‘Clear Details’ tab in the ‘Settlement Instructions Maintenance’ screen. In case you choose the option ‘Clearing’, then the system calls External Payments Interface to process the payments. .

For the counterparty details, you can specify the bank code, account and account name.

External Counterparty Pay Details

The description of the selected bank, where the external counterparty account resides, is displayed here.

External Counterparty Receive Details

The description of the selected bank, where the external counterparty account resides, is displayed here.

If you indicate cover for payment via the local clearing network, you must specify the account details of the cover party, in the ‘Cover Details’ tab in the ‘Settlement Instructions Maintenance’ screen.

For the cover party account details, you can specify the bank code, account and account name.

The following scenarios are possible:

Cover Required |

Cover By |

Payment By |

Local Clearing Counterparty Details? |

Cover Details? |

Yes |

Message |

Message |

No |

No |

Yes |

Local Clearing |

Message |

No |

Yes |

No |

|

Message |

No |

No |

No |

|

Local Clearing |

Yes |

No |

Clearing Network for Local Clearing in Settlement Instructions

You can specify a clearing network during settlement instruction maintenance for the Pay Leg and the Cover details. This will be defaulted as part of Settlement pick-up during Contract input.

The Counter-party name shows the list of Bank Codes for Cover Transfer and Bank Transfer. The system will validate that the Bank Code Type for both the Counter-party name and Counter-party Bank Code is the same. For Customer transfers, this would be a user enterable field.

2.5.6 Other Details Tab

You can define the default values for fields in MT 103 messages that are generated in respect of contracts involving the customer. When a contract is entered for the customer in any module, the values that you maintain here will be defaulted for MT 103 generation in respect of the contract.

You can maintain these details in the ‘Other Details’ tab in the ‘Settlement Instructions Maintenance’ screen.

You can maintain the default MT 103 values for the following fields:

Bank Operation Code

You can indicate the bank operation code that will be inserted in Field 23B of the MT 103 message. The options available are SPRI, SSTD, SPAY and CRED.

Note

If the Bank Operation Code contains SPAY, SSTD or SPRI, the following validations will be done:

- C11: If account with institution is used with D option, then party identifier is mandatory. (Either Clearing code or account has to be specified in the account line).

- C12: Account is mandatory in field 59

Instruction Code Description

You can specify the additional information, if any, which would be inserted to qualify the Instruction Code in Field 23E of the MT103 message. The instruction code description can only be maintained for the instruction codes PHON, PHOB, PHOI, TELE, TELB, TELI, HOLD or REPA.

For instance, if the Instruction Code is REPA and the description is ‘Repayment’ then the text ‘REPA/Repayment’ is inserted in Field 23E.

Transaction Type

You can indicate the Transaction Type that will be inserted in Field 26T of the MT103 message.

Regulatory Reporting Details

Specify the Regulatory Reporting Details

The entered value will be inserted in Field 77B of the MT103 message.

Charges Details

You can indicate whether charges for the message are to be borne by the bank (ourselves) or the beneficiary, or will be shared. You can specify this in the Charges Details section, in the main Settlement Instructions screen.

This information is inserted in Field 71A of the MT103 message.

2.6 The Sequence in which Settlement Instructions are Resolved

While processing contracts in Oracle FLEXCUBE, the settlement instructions maintained are resolved in the following sequence:

Level |

Counterparty |

CCY |

Module |

Branch |

1 |

Counterparty |

CCY |

MOD |

Branch |

2 |

Counterparty |

CCY |

Mod |

ALL |

3 |

Counterparty |

CCY |

ALL |

Branch |

4 |

Counterparty |

CCY |

ALL |

ALL |

5 |

Counterparty |

ALL |

MOD |

Branch |

6 |

Counterparty |

ALL |

MOD |

ALL |

7 |

Counterparty |

ALL |

ALL |

Branch |

8 |

Counterparty |

ALL |

ALL |

ALL |

9 |

ALL |

CCY |

MOD |

Branch |

10 |

ALL |

CCY |

MOD |

ALL |

11 |

ALL |

CCY |

ALL |

Branch |

12 |

ALL |

CCY |

ALL |

ALL |

13 |

ALL |

ALL |

MOD |

Branch |

14 |

ALL |

ALL |

MOD |

ALL |

15 |

ALL |

ALL |

ALL |

Branch |

16 |

ALL |

ALL |

ALL |

ALL |

2.7 Processing Settlements

This section contains the following topics:

- Section 2.7.1, "Invoking Settlement Details Screen"

- Section 2.7.2, "Account Details Tab"

- Section 2.7.3, "Payment Details Tab"

- Section 2.7.4, "Party Details Tab"

- Section 2.7.5, "Other Details Tab"

- Section 2.7.6, "Default MT 103 Details"

- Section 2.7.7, "Amending Settlement Details"

- Section 2.7.8, "Processing Settlements for Track Receivable or Payable Amount Tags"

2.7.1 Invoking Settlement Details Screen

The Settlement details for a contract or deal get defaulted based on the maintenance of settlement instructions for the Customer/BIC code involved in the transaction.

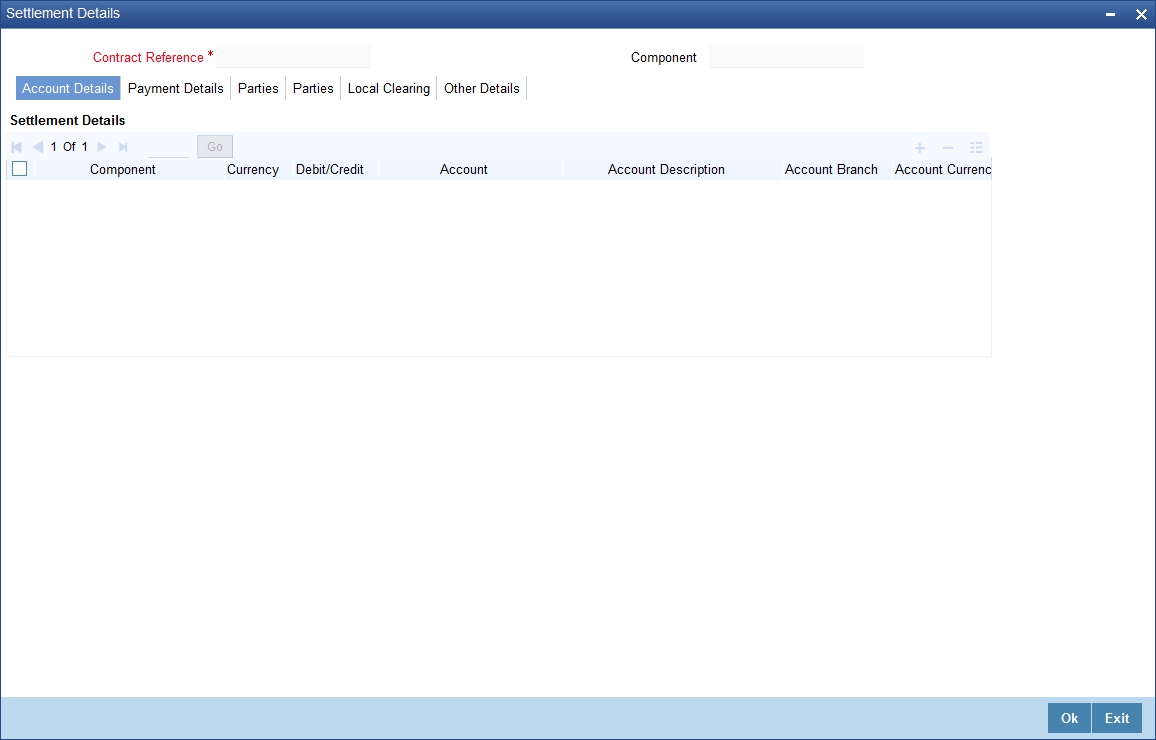

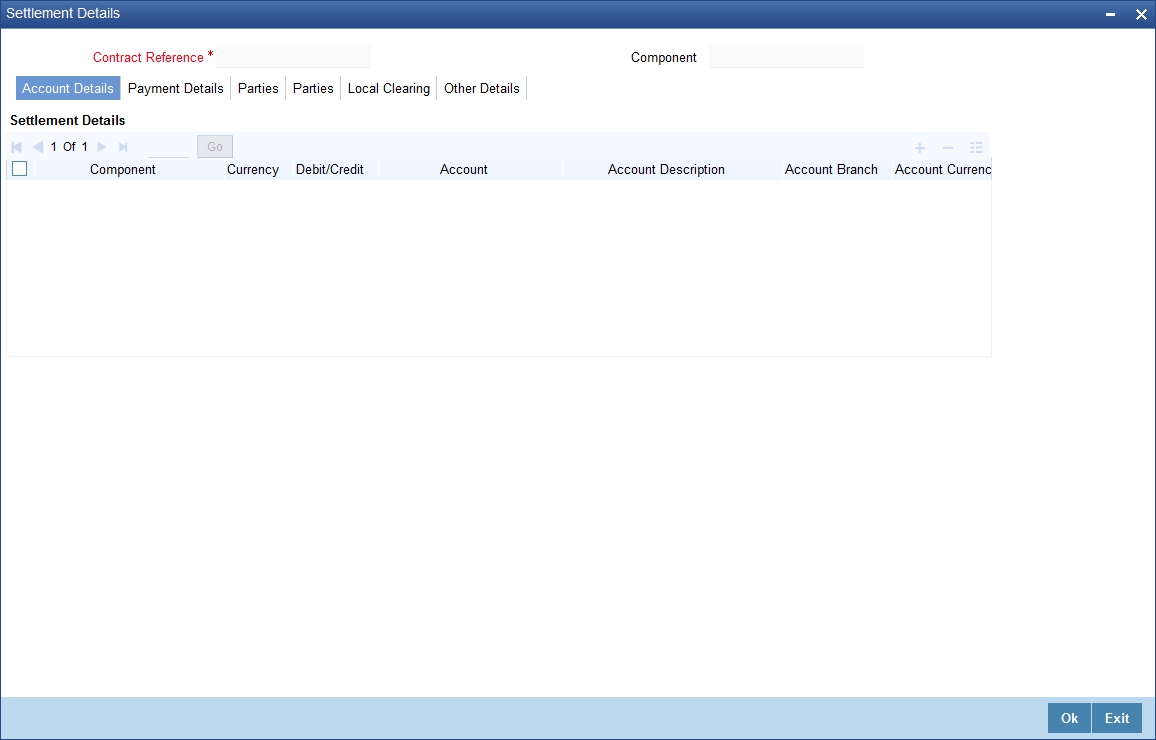

To invoke the ‘Settlement Details’ screen, click ‘Settlement’ button in the Contract Main screen of a module.

By default the settlement details of all components of a contract which affect a customer type of account (the Role Types can be Customer, Remitter, Beneficiary for all the events associated to the product for which the Role-to-Head mapping has not been provided to the product associated with the contract) are displayed in this screen.

For example,

As per the maintenance that you have done for a Product the following accounting entries will be posted during the initiation of a contract.

Accounting Role |

Amount Tag |

Dr/ Cr Indicator |

ASSETGL |

PRINCIPAL |

Debit |

CUSTOMER |

PRINCIPAL |

Credit |

To achieve this, in the Role to Head mapping sub-screen of the Product Definition screen you would have mapped the Accounting Role ASSETGL to an actual internal leaf GL of your Chart of Accounts. However, you would not have maintained such a mapping for CUSTOMER since this is a role whose value gets defined at the contract level based on the counterparty involved in the contract.

While processing a contract you can modify the following information pertaining to Settlements:

- Account details (details about the accounts involved in the contract or deal; that have to be either debited or credited in your branch)

- Message details (payment details -- whether settled by an instrument or a messaging service such as SWIFT)

- Party details (details about the various parties/banks involved in the transfer of funds to the Ultimate Beneficiary).

- Other Details, (the default values for fields in MT 103 messages for the contract)

2.7.2 Account Details Tab

In the Settlement Instructions screen you would have maintained the settlement accounts for an entity, module, currency and branch combination.

While processing a contract, these details will be defaulted to the Settlement sub-screen of the contract main screen. You have the option of changing any or all of the settlement accounts while processing a contract.

2.7.2.1 Account Details

The account details that get defaulted include the following:

- Component and its Currency

- Payment Account and its Currency

- Branch of your bank to which the account belongs

Note

- If settlement instruction is not defined for the customer, than system will always default the Nostro accounts based on settlement instruction set.

- Change the settlement account branch and settlement account for charge component in case change or waiver at contract level.

Account Description

The system displays a brief description on account.

Netting Indicator

In addition to maintaining a netting agreement for each counterparty, you have to specify whether or not the contract is under the netting agreement for each contract involving the counterparty.

Check this box to indicate that you would like to enable the Netting option for the various components (Amount Tags) involved in the transaction. These components could be commission, interest, tax, charges etc.

Rate Code

Specify rate code by selecting appropriate rate code frx‘om selection list. Following values are available:

- Buy

- Sell

- Mid

Note

In case of charges, if charge currency and settlement currency are different, system applies mid rate.

Spread Definition

Select the spread definition from the adjoining drop-down list. The options available are:

- Point

- Percentage

Customer Spread

This defaults from your specification of tenor-wise spread for the relevant Currency Pair in the Customer Spread Maintenance screen. You can change this for a specific contract.

Original Exchange Rate

If the component currency is different from the account currency, the system requires an exchange rate for the conversion. The components of the final exchange rate used for conversion are:

- The Base Rate – this is defaulted from the exchange rate that you have maintained for the currency pair involved. It is computed as Mid Rate +/- Spread (depending on whether it is the Buy Spread or the Sell Spread).

- The Customer Spread - the spread that you have maintained for the specified Counterparty, Currency Pair and Tenor combination in the Customer Spread Maintenance screen is picked up and applied for the customer involved in the deal.

The final exchange rate = Base Rate +/- Customer Spread (depending on whether it is a Buy or a Sell deal).

Note

If Customer Spread details for a specific counterparty (for the currency pair) are unavailable, the System looks for the customer spread maintained for the wildcard ALL entry. If even that is not available, then the Customer Spread defaults to zero.

The method of spread definition, whether percentage or points is also displayed.

Note

If you have specified an account that uses an account class that is restricted for the product, an override is sought when you attempt to save the contract.

Exchange Rate

For transactions involving any relationship pricing benefit scheme, the customer specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme, gets displayed here.

If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

For more details on customer specific exchange rates, refer the section titled ‘Specifying Pricing Benefit Details’ in Relationship Pricing user manual.

Negotiated Cost Rate

The system defaults the negotiated cost rate.

Negotiation Reference

The system displays the negotiation reference here.

Generate Message

Enable this option if a payment messages has to be generated for the settlement instruction.

IBAN Account Number

The system displays the IBAN Account Number.Euro Currency and Euro Amount

SWIFT messages (MT103/MT202) generated towards settlement can furnish the value of the settlement amount in both the settlement account currency, and a Euro Related Information (ERI) currency of your choice. If you opt to furnish the ERI value of the amount, you have to enter the following in this screen:

- The ERI currency

- The ERI Amount

The system defaults to the ERI currency specified for the customer and currency combination. You can change the default ERI currency. The ERI amount that you specify will be validated against the Tolerance Limit specified for the ERI currency (in the Currency Maintenance screen).

Cross-currency Settlements of FX deals

Oracle FLEXCUBE allows cross currency settlements of foreign exchange deals that involve an ‘In’ currency. You can settle the ‘In’ currency leg in another ‘In’ currency or in ‘Euro’.

For example,

Assume you enter into the following foreign exchange deal. You sell 100,000 FRF against USD.

The scenario:

- You specify the exchange rate: 1 USD = 5.2 FRF

- The bought amount is therefore: 19230.769 USD

- The settlement account is in EUR

- The exchange rate between EUR/FRF: 1 EUR = 6.475 FRF

Since FRF is an ‘In’ currency, you can settle the sell leg of the deal through EUR (in this example). The settlement amount would be EUR 15444.015.

Suppressing Settlement Messages

Settlement messages, defined for components that fall due, will be generated automatically when the settlement actually happens for the respective component. You can suppress the generation of the settlement message, defined for a component, by clearing the check box in the ‘Gen Message’ field.

Note

If a component is to be paid the credit account chosen becomes the pay account. Similarly, if a component is to be received the debit account chosen becomes the receive account in the settlement maintenance.

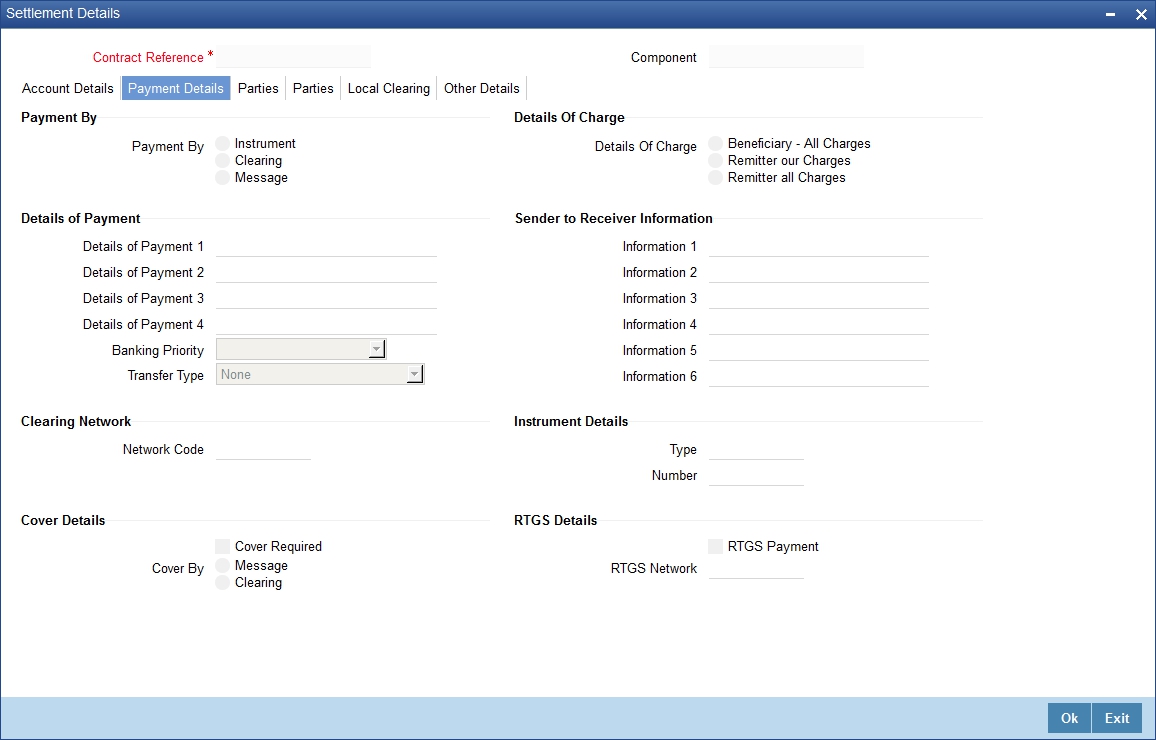

2.7.3 Payment Details Tab

The details of the payment have to be specified in the ‘Payment Details’ screen..

Payment By

Payment By

Indicate the method of payment for both Outgoing as well as Incoming Payments, for a Branch, Account and Currency combination. The following options are available:

- Instrument (settlement is done through a Check, MCK etc.)

- Message (payment is made by means of a SWIFT Message)

- Clearing (the transaction is a local payment transaction and the settlement is routed through the Clearing House of the bank)

Note

You can indicate the payment method as ‘Clearing’ only,

- If the payment currency is the local currency of the branch

- If it is one of the clearing currencies defined for the branch

- If you have selected ‘ALL’ in the currency field

No payment message will be generated for settlements routed through a Clearing House.

Depending on the method in which you want to settle the contract, you should specify either Instrument or Message details.

Details of Charge

Details of Charge

In this section you can maintain details of the party who will bear the charges incurred in processing the transaction. It could be either:

- Remitter – All Charges

- Beneficiary – All Charges

- Remitter – Our Charges

Note

In FT Module, ‘Details of Charges’ is selected on the basis of value selected in ‘Charge Bearer’ field in the ‘Other Details’ tab.

Note

- Remitter – All Charges - Corresponds to ‘OURS’ in Field 71 A of SWIFT MT 103 / 103+.

- Beneficiary – All Charges - Corresponds to ‘BEN’ in Field 71 A of SWIFT MT 103 / 103+.

- Remitter – Our Charges - Corresponds to ‘SHA’ in Field 71 A of SWIFT MT 103 / 103+.

Details of Payment

Here you can specify information, from the Ordering Party to the Beneficiary Customer, about the reason for the payment.

This field can contain reference numbers, invoice numbers or any other details, which will enable the Beneficiary to identify the transaction. This information is to be passed through the payment chain to the Beneficiary.

This field corresponds to field 70 of S.W.I.F.T. Refer to the S.W.I.F.T. manual for details on the code words and the format of the message you can input.

Banking Priority

Select the priority of the payment messages from the drop down list. The options available are:

- Highly Urgent

- Urgent

- Normal

The default value is Normal.

Sender to Receiver Information

Information 1,2,3,4,5 and 6

This could be instructions or additional information for the Receiver, Intermediary, Account With Institution or Beneficiary Institution.

This field corresponds to field 72 of the S.W.I.F.T. message. The format of the message depends on the type of S.W.I.F.T. message that is generated. Refer to the S.W.I.F.T. manual for details on the format of the message and the code words to be used.

Clearing Network

Cover details for local clearing will capture Clearing Network. This clearing network will be defaulted during Contract Input and be used subsequently during further payments processing through external payment system.

Instrument Details

If you opt to settle a contract with an instrument, you should specify the type of instrument that you would use. For example, you could settle a contract using a Manager’s Check, a Check or a Demand Draft. You should also specify the number that identifies the instrument. This number will be printed on the instrument.

If the settlement is through an instrument, you cannot specify party details.

Note

Settlement through instruments is a feature applicable only for the Funds Transfer module of Oracle FLEXCUBE.

Cover Details

Cover By

Select the cover by as Message or Clearing.

Cover Required

Check this box if cover is required.

RTGS Details

RTGS Payments

If the settlement chosen is one of the RTGS Nostro that is, RTGS outgoing Nostro account in case of Outgoing customer and Bank transfer and RTGS incoming Nostro in case of outgoing Direct Debit transfer then the system will check this check box as per the validations done in RTGS Network. The user cannot change this value.

RTGS Network

If in a RTGS Network the accounts are maintained as ‘Pay account’ or ‘Receiver Account’ during the save of settlement instruction, then a set of validations will be performed as mentioned below:

For Pay message, it will validate the intermediary (if intermediary is not present, the Account with Institution (AWI) will be validated and if the AWI is also not present then receiver will be validated) is a RTGS participant.

For Pay+ Cover message, it will validate that a receiver correspondent is a RTGS network participant.

If the above conditions are satisfied, the RTGS Network will be updated and the system will check RTGS Payments check box.

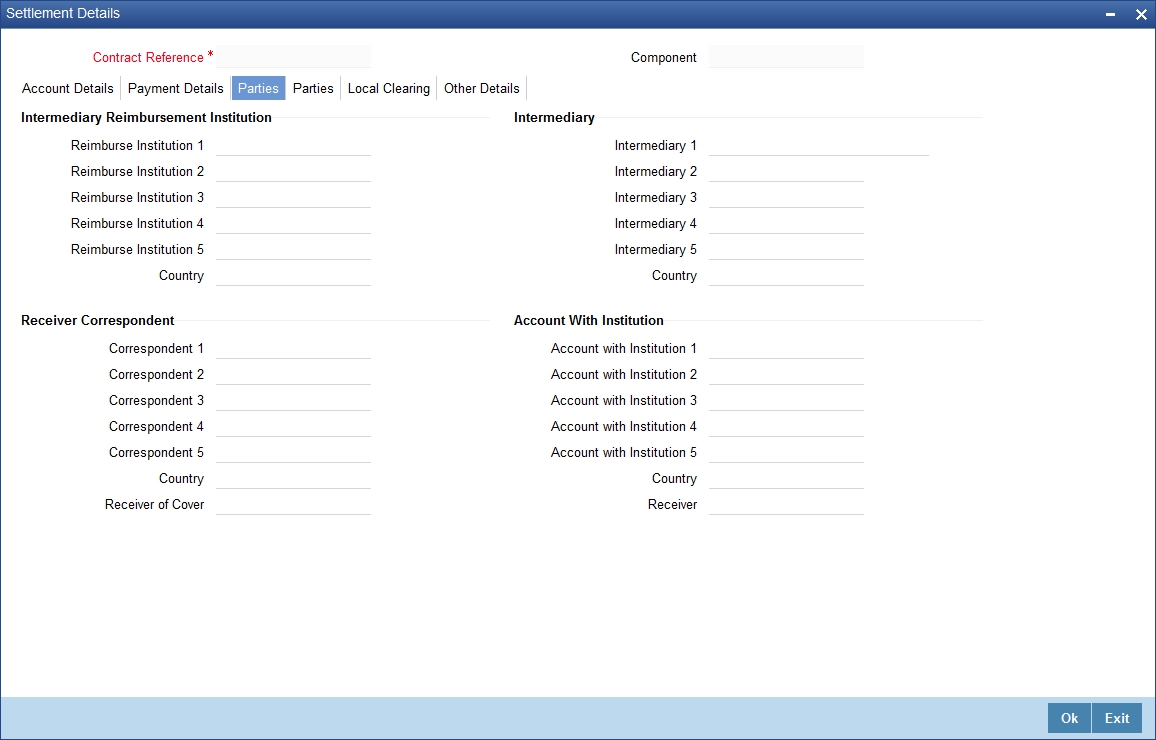

2.7.4 Party Details Tab

When you settle a contract, funds may have to pass through a series of banks before it actually reaches the Ultimate Beneficiary. In the Parties screen, you can capture details of all parties involved in a contract.

2.7.4.1 Parties

These screens contain fields that can capture details of all the possible parties through whom the funds involved in a contract can pass. Depending on the type of contract you are processing, and the number of banks involved, you should enter details in these screens.

Intermediary Reimbursement Institution

An Intermediary Reimbursement Institution is the financial institution between the Sender’s Correspondent and the Receiver’s Correspondent, through which the reimbursement of the funds will take place.

Country

Specify the country of the intermediary reimbursement institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Intermediary

The Intermediary in a contract refers to the financial institution, between the Receiver and the ‘Account with Institution’, through which the funds must pass.

The Intermediary may be a branch or affiliate of the Receiver or the ‘Account With Institution’, or an entirely different financial institution. This field corresponds to field 56a of SWIFT

Here you can enter either the:

- ISO Bank Identifier Code of the bank

- Name and address of the Bank

Country

Specify the country of the intermediary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Receiver’s Correspondent

The Receiver’s Correspondent is the branch of the Receiver or another financial institution at which the funds will be made available to the Receiver. This field corresponds to field 54a of SWIFT. You can enter one of the following:

- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

Country

Specify the country of the receiver’s correspondent. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Account with Institution

An Account with Institution refers to the financial institution, at which the ordering party requests the Beneficiary to be paid. The ‘Account with Institution’ may be a branch or affiliate of the Receiver, or of the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution. This field corresponds to field 57a of SWIFT. You can enter one of the following:

- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)

If no selection is made for Account with Institution, all beneficiaries will appear for selection in the option list for Ultimate Beneficiaries in the Parties tab 2 screens. If a particular Ultimate Beneficiary is selected in Parties tab 2, then the Account with Institution for the selected ultimate beneficiary will appear by default in the AWI field in the Parties tab 1 screen.

Country

Specify the country of the account with institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Note

The country information is captured to enable Mantas to analyse the transactions for possible money laundering activities.

For more details on Mantas, refer 'Mantas' interface document.

Receiver of Cover

Specify the details of the Receiver of the cover message, which can be any one of the following:

- ISO Bank Identifier Code of the bank

- Branch of the Receiver

- Name and address of the Receiver

- Other identification codes (for example, account number)

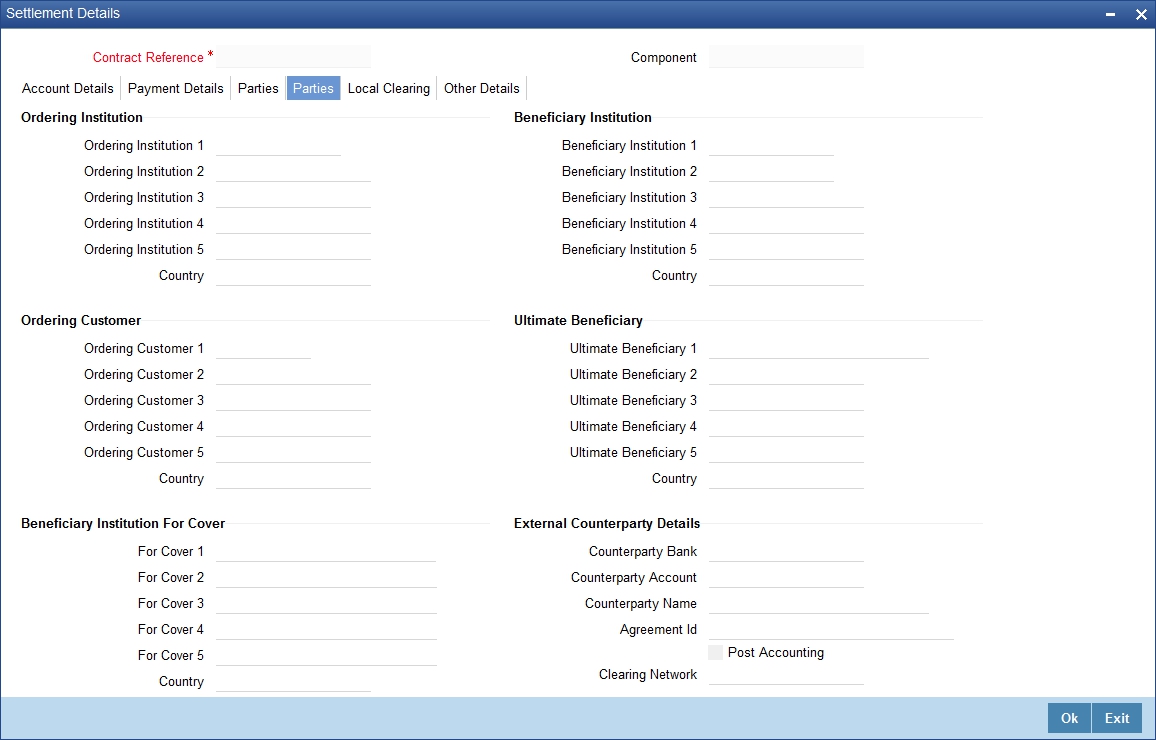

2.7.4.2 Parties

Ordering Institution

The Ordering Institution is the financial Institution, which is acting on behalf of itself, or a customer, to initiate the transaction. This field corresponds to 52a of SWIFT. In this field, you can enter one of the following:

- The ISO Bank Identifier Code of the Ordering Institution

- The branch or city of the Ordering Institution

- The Name and address of the Bank

Country

Specify the country of the ordering institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Ordering Customer

The Ordering Customer refers to the customer ordering the transfer. Here, you can enter the name and address or the account number of the Customer, ordering the transaction. This field corresponds to field 50 of SWIFT. You will be allowed to enter details in this field only if you have initiated a customer transfer (MT 103 and MT 102). In case of an MT 910, a credit confirmation message, the first line should contain number ‘1’ in option F of field 50.

Country

Specify the country of the ordering customer. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Beneficiary Institution

Here, you can enter details of the institution in favor of which the payment is made. It is in reality the bank, which services the account of the Ultimate Beneficiary. This is applicable only in the case of bank transfers and not for customer transfers. This field corresponds to field 58a of SWIFT

You will be allowed to make entries into this field only for Bank Transfers (when the remitter and beneficiary of the transfer are financial institutions –MT 202). Here you can enter either:

- The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

Country

Specify the country of the beneficiary institution. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Ultimate Beneficiary

The Ultimate Beneficiary refers to the Customer to whom the amount of the component is to be paid. This field refers to field 59 (is this now 59A) of SWIFT. You can make entries into this field only for a customer transfer (MT 103 or MT 100). This would not be applicable for Bank Transfers, only for Customer Transfers.

You can also select an ultimate beneficiary account from the option list provided. Upon selection of the account, the Account with Institution of the selected ultimate beneficiary will appear by default in the AWI field in the Parties 1 tab. If no selection is made for AWI in the Parties tab 1 screen, then all accounts of ultimate beneficiaries existing in the system will be appear for selection.

Country

Specify the country of the ultimate beneficiary. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

Note

The country information is captured to enable Mantas to analyse the transactions for possible money laundering activities.

For more details on Mantas, refer 'Mantas' interface document.

When the SWIFT message is captured in the ‘Settlement Message Details – Parties’ screen, the system will display the parties involved in the transaction based on the values that come in the fields 52, 54, 55, 56, 57 58 etc. However, you can change the parties by choosing the appropriate value from the respective option lists. In case of the messages MT 103, MT202 and MT210, the option lists will display only those BICs for which the option ‘BEI Indicator’ is unchecked in the ‘BIC Code Maintenance’ screen. However you can manually enter a BIC for which the option ‘BEI Indicator’ is checked. During message generation, the system will replace the BIC with the corresponding name and address of the party.

The number of banks/intermediaries involved in the transfer would, in practice depend on the:

- Relationships and arrangements between the sending and receiving banks

- Customer instructions

- Location of parties

- The banking regulations of a country

Note

During the life-cycle of a contract you will be allowed to amend the details of a Settlement Instruction only for those components which are yet to be settled.

Beneficiary Institution for Cover

This field corresponds to field 58a of S.W.I.F.T. Enter details of the institution in favor of which the payment is made. It is in reality the bank, which services the account of the ultimate beneficiary.

You will be allowed to make entries into this field only for Bank transfers (MT 200 or MT 202). In this field you can enter either the:

- The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

Country

Specify the country of the beneficiary institution for cover. This adjoining option list displays all valid country codes maintained in the system. You can choose the appropriate one.

The country information is captured to enable Mantas to analyse the transactions for possible money laundering activities.

External Counterparty Details

Select the Counterparty Bank from the option list provided. All the Counterparty Accounts pertaining to this Bank will appear for selection. On selecting the Counterparty Account, the system will default the Counterparty Name as maintained for that account. If at the time of selecting Counterparty Account, Counterparty Bank is Null, then the Counterparty Bank will also appear by default.

For processing direct debits you will also need to capture the Agreement ID of the counterparty in order to facilitate a cross-referencing between the Payment and the Direct Debit instruction when a reversal of payment is carried out due to rejection of the outbound DD.

Clearing Network

During Contract Input, Clearing Network in settlement screen will be defaulted with 'Clearing Network' maintained in local clearing section in settlement instruction.

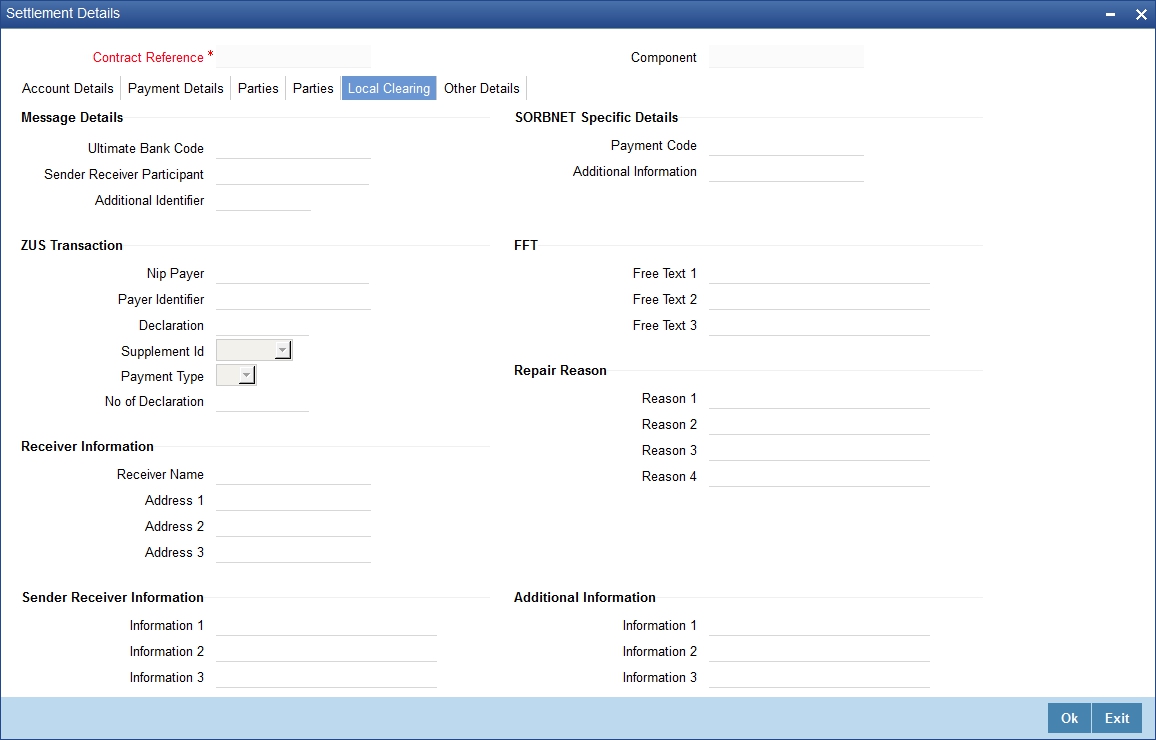

2.7.4.3 Local Clearing Details

You can maintain the local clearing details here.

Message Details

Ultimate Bank Code

Select the ultimate bank code from the adjoining option list.

Sender Receiver Participant

Specify the sender receiver participant.

Additional Identifier

Specify the additional identifier.

SORBNET Specific Details

Payment Code

Specify the payment code.

Additional Information

Specify additional information, if any.

ZUS Transaction

Nip Payer

Specify the nip payer.

Payer Identifier

Specify the payer identifier.

Declaration

Specify the declaration.

Supplement Id

Select the supplement Id from the adjoining drop-down list.

Payment Type

Select the payment type from the adjoining drop-down list.

No of Declaration

Specify the number of declaration.

FFT

Free text 1, 2 and 3

Specify free text, if any.

Repair Reason

Reason 1, 2, 3 and 4

Specify the reason for repair.

Receiver Information

Receiver Name

Specify the receiver name.

Address 1,2 and 3

Specify the address here.

Sender Receiver Information

Information 1, 2, 3, 4, 5 and 6

Specify the sender receiver information here.

Additional Information

Information 1, 2, 3 and 4

Specify additional information, if any.

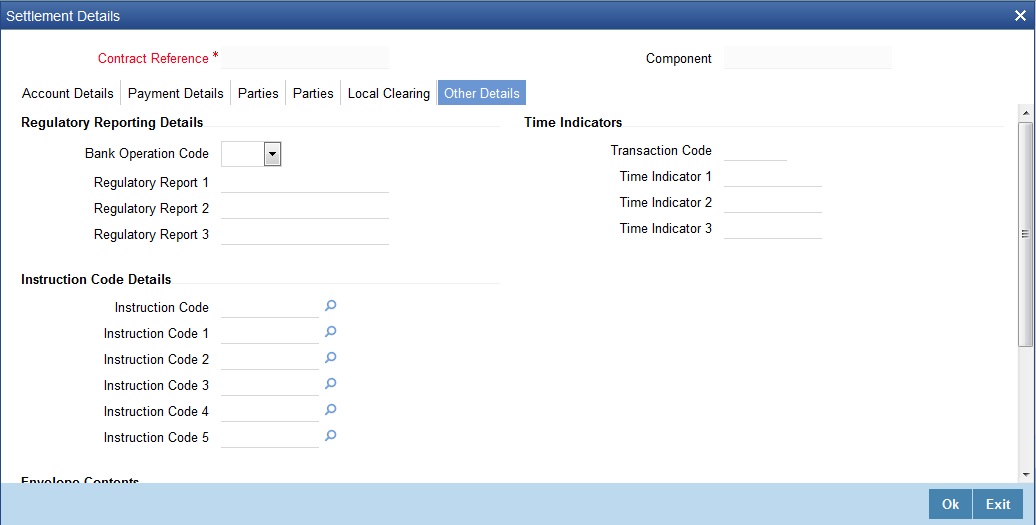

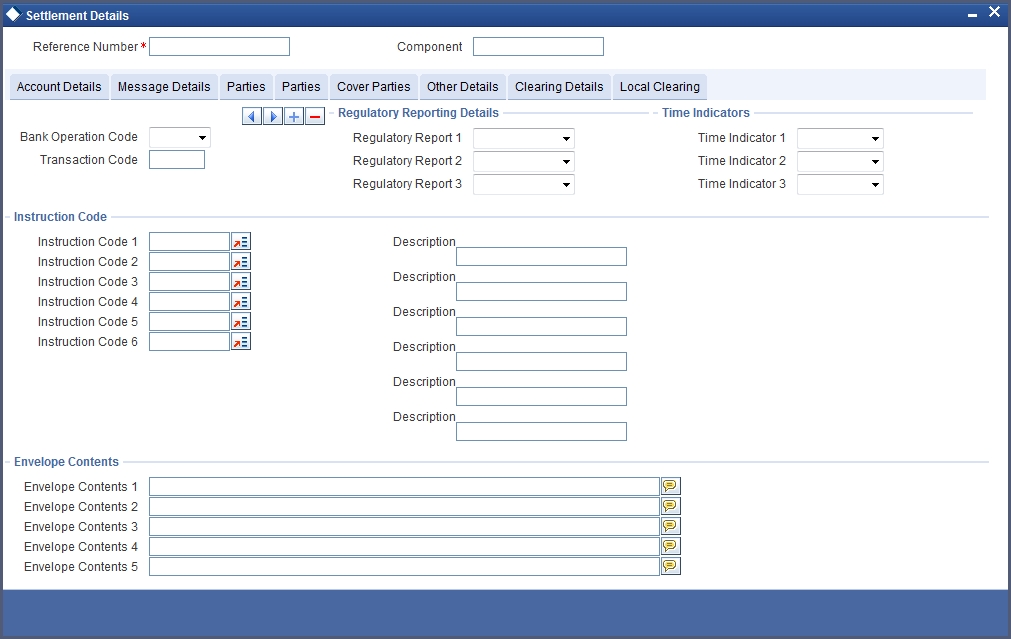

2.7.5 Other Details Tab

You can maintain the other details here.

Regulatory Reporting Details

Bank Operation Code

You can indicate the bank operation code that will be inserted in Field 23B of the MT 103 message. The options available are SPRI, SSTD, SPAY and CRED.

Time Indicators

Transaction Code

This is the code for the transaction type. This field corresponds to field 26T of the MT103 message.

Instruction Code Details

Instruction Code 1, 2, 3, 4 and 5

You can indicate the Instruction code that will be inserted in Field 23E of the MT103 message. You can specify a maximum of six instructions codes here. However, you cannot repeat any code that has already been specified. The options available are:

- CHBQ

- TELE

- PHON

- PHOI

- REPA

- INTC

- TELI

- SDVA

- PHOB

- TELB

- HOLD

- CORT

Instruction Code Description

You can specify the additional information, if any, which would be inserted to qualify multiple Instruction Codes in Field 23E of the MT103 message. The instruction code description can only be maintained for the following instruction codes

- PHON

- PHOB

- PHOI

- TELE

- TELB

- TELI

- HOLD

- REPA

For instance, if the Instruction Code is REPA and the description is ‘Repayment’ then the text ‘REPA/Repayment’ is inserted in Field 23E.

Regulatory Reporting Details

Specify the Regulatory Reporting Details. The entered value will be inserted in Field 77B of the MT103 message.

Time Indicators

Time Indication, specifies one or several time indication(s) related to the processing of the payment instruction. Select the time indication code from the following values available in the option list:

- /CLSTIME/ - Time by which funding payment must be credited, with confirmation, to the CLS Bank's account at the central bank, expressed in CET.

- /RNCTIME/ - Time at which a TARGET payment has been credited at the receiving central bank, expressed in CET

- /SNDTIME/ - Time at which a TARGET payment has been debited at the sending central bank, expressed in CET

2.7.6 Default MT 103 Details

In the Settlement Instructions screen you would have maintained the default values for fields in MT 103 messages that are generated in respect of contracts involving an entity, module, currency and branch combination.

When a contract is entered for the customer in any module, the values that you maintain here will be defaulted for MT 103 generation in respect of the contract, and you can view them in the Settlement sub-screen of the contract main screen.

2.7.7 Amending Settlement Details

While amending a contract, you can modify the settlement information on the following tabs:

- Message Details

- Parties

- Cover Parties

- Clearing Details

Save the contract once you have made the required changes. The system validates the modified information as in case of a new settlements operation.

2.7.8 Processing Settlements for Track Receivable or Payable Amount Tags

While processing a settlement, the system validates marking of an Amount Tag to Track Receivable or Track Payable Process.

If Amount Tag is marked to ‘Track Receivable’ or ‘Track Payable’ and ‘Eligible for AR-AP Tracking’ check box is checked for the CIF linked to the Settlement Account, then the system replaces the Settlement Account with the ‘GL for ARAP’ or ‘Payable GL for ARAP’, respectively. The GL is defaulted based on the derivation logic maintained at ‘ARAP Code maintenance’.

If the Customer is not marked for AR-AP Tracking at the Customer Level, then the system validates for the mapping of the selected GL to the Product & Component combination. If it is not mapped, then the system displays an override message.

If an ICCF Amount Tag is marked for ‘Track Receivable’ or ‘Track Payable’ and the Settlement Account is a GL then a record would be created in LQ Module. The AR/AP Code and GL are defaulted based on the details maintained at AR-AP Code Maintenance level.

The MIS Information of the contract is defaulted as MIS Information of the record created in LQ Module.

The following steps are involved for updating the records in LQ module, for LC, BC, FT, PC and CL contracts:

- When a contract is saved, a record will be posted in LQ module with an ‘Unauthorized’ status and ‘Outstanding’ collection status.

- System authorizes the LQ record automatically after a contract is authorized.

- If a contract is deleted, then system deletes the corresponding LQ outstanding.

- If a contract is reversed, then the system reverses the corresponding LQ outstanding record.

- If the contract is ‘Unauthorized’, then the system does not allow liquidation of LQ record.

2.8 Generation of MT920 Messages

This section contains the following topics:

2.8.1 Generating MT920 Message

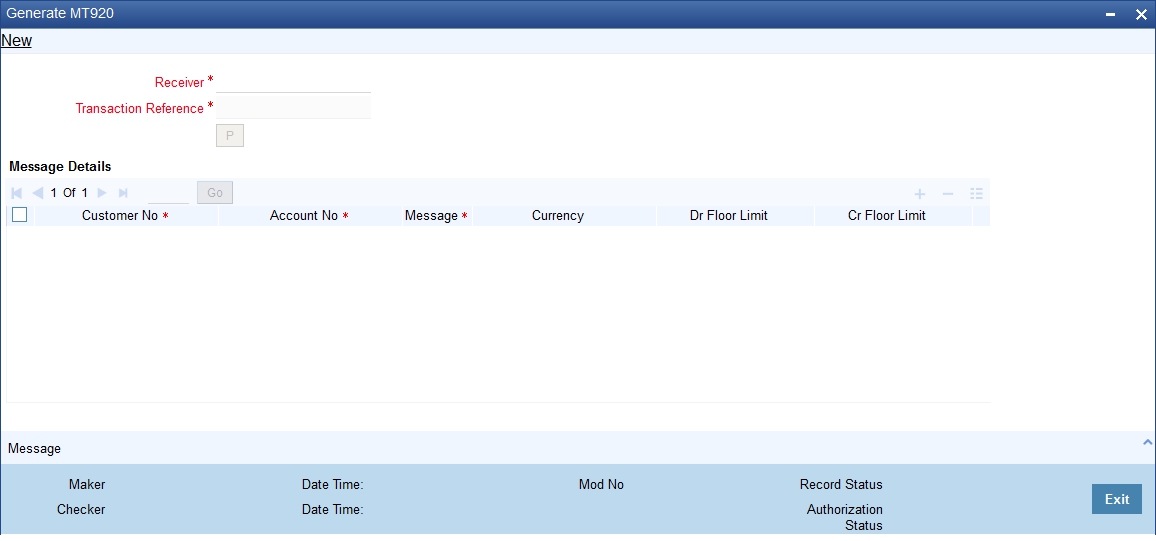

Oracle FLEXCUBE allows you to generate SWIFT Messages for transactions. MT920 is a transaction message requesting latest information available for the particular account. The request will be to transmit account customer statement message (MT940) or Balance report (MT941) or Interim statement (MT942) or a customer summary statement (MT950).

You need to generate the MT920 message. You can do this in the ‘Generate MT920’ screen. To invoke this screen, type ‘MSDGT920’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Receiver

In the Generate MT920 screen, you can select the receiver of the message. The system shows only those receivers whose details you have maintained in the customer maintenance with MT920 as Y.

Reference No.

After providing the receiver details, click ‘P’ button. Based on this the system generates the new reference number

Details

Under Details in the Generate MT920 screen, provide the following details about the chosen receiver:

Customer No

Under Details, select the required ‘Customer No’ from the options listed. In the list you can find only those customer numbers maintained for the receiver in customer BIC maintenance with MT920 flag as Y

Account No.

Select the relevant account number of the customer from the available options. In the list, you will find only those Account numbers maintained for the receiver (BIC) and the Account in customer BIC maintenance.

Message

Select the message requested by the customer here.

Currency

Indicate the preferred currency of the customer.

Dr/(Dr and Cr) Floor Limit

Specify the debit floor limit of the customer. If the credit floor limit is not separately specified, this will indicate both the debit and the credit floor limits.

The system will pick the debit/credit transactions above this limit for customer account statement report.

This is mandatory for MT942 message type.

Cr Floor Limit

Specify the credit floor limit of the customer. The system will pick the credit transactions above this limit for customer account statement report.

If you specify the credit floor limit, you must also specify the debit floor limit. However, if you do not specify the credit floor limit, the system will consider the limit specified in the field ‘Dr/(Dr and Cr) Floor Limit’ for both credit and debit floor limits.

On save and authorization of the Maintenance, system generates the outgoing SWIFT message namely MT920.

If you click ‘Message’ button, the system will display the outgoing MT920 message separately.

2.8.2 Processing of Incoming 920

When the incoming message is MT920 and the requested message is 940 (customer account statement) message, the system sends back the SWIFT Message, MT940 with response.

When the incoming message is MT920 and the requested message is MT941, the system sends back the SWIFT Message, MT941 with response.

When the incoming message is MT920 and the requested message is MT942, the system sends back the SWIFT Message, MT942 with response.

When the incoming message is MT920 and the requested message is MT942, the system sends back the SWIFT Message, MT950 with response.

Thus, the system, which uploads an MT920 message, is also able to generate an outgoing MT940, MT941, or MT942 Swift Messages.