Corporate Lending

Corporates often needs to borrow money to meet their funding requirements typically to invest in infrastructure, expand business operations at various location, upgrade to the latest plant and machinery or acquire other assets, maintain inventory, or to increase working capital. Most of corporates consider borrowing a business loan from the financial institutions is a convenient option because of its flexibility and affordability.

OBDX provides a platform by which banks can offer their corporate customers an enriching online banking experience in servicing their existing loans accounts. Corporate Loan Servicing module of OBDX is integrated with Oracle Banking Corporate Lending (OBCL).

Corporates can manage their banking requirements efficiently and effectively through the OBDX self-service channels. Corporate lending module offers a consolidated and easy to understand view of customer’s business loans position with an option to check the detailed view pf each loan account. Customer also can view the information of upcoming and overdue loan installments and the detailed loan account activity.

Quick & hassle-free online loan repayment option allows the corporate to initiate payment using Digital Banking Platform.

Note: Corporate Lending module support is currently not available on mobile device.

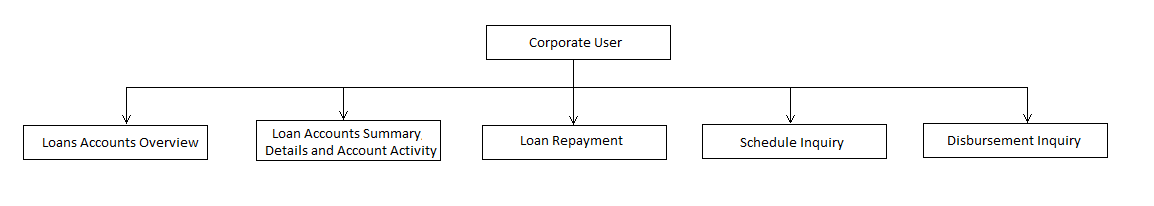

Features Supported In Application

- Loans Accounts Overview

- Loan Accounts Summary, Details and Account Activity

- Loan Repayment

- Schedule Inquiry

- Disbursement Inquiry

Features at a glance

Pre-Requisites

- Party preference is maintained.

- Corporate users are created.

- Transaction access is provided to the user

- Approval rule set up for corporate user to perform the actions

- Transaction working window is maintained

- Transaction limits are assigned to user to perform the transaction Party Preferences for Corporate

Note: This module has been added as part of 18.3.0.1.0 patch release, and is not available in 18.3 release.