PAYMENTS USING VIRTUAL ACCOUNTS

Virtual Accounts Management payments feature enables the business users to perform corporate payments using 'Virtual Accounts'.

VAM Payments involves ‘Virtual Accounts’ as the source account, where the users can select a virtual account as “Pay From” account while doing payment transaction.

Virtual account payments supports following types of transactions.

- Payment from a virtual account to a real account & vice versa

- Payments between two virtual accounts mapped to two different real accounts

- Payment between two virtual accounts mapped to the same real account

Note:

1) This module has been added as part of 19.1.0.0.1 patch release, and is not available in 19.1.0.0.0 release.

2) The users can perform the transactions using only those virtual accounts, to which they have access.

3) While selecting “Pay From” account during a payment, there is no separate grouping of virtual accounts; they appear along with regular CASA![]() Current Account or Savings Accounts are operative accounts through which account holders perform day to day operations such as deposits and withdrawal of money..

Current Account or Savings Accounts are operative accounts through which account holders perform day to day operations such as deposits and withdrawal of money..

4) Currently, ‘Internal’ and ‘International’ payments using virtual accounts is supported. ‘Domestic’ payments using virtual account is not yet supported.

- Manage Payee – Add Internal Payee

- Manage Payee – Add International Payee (Swift code, NCC, Bank details)

- Transfer Money - Existing Internal Payee - Pay Now/ Pay Later

- Transfer Money - Existing International Payee using ( Swift code, NCC , Bank details ) - Pay Now/ Pay Later

- Transfer Money – My Accounts– Pay Now/ Pay Later

- Adhoc Payment – Internal Payee – Pay Now/ Pay Later

- Adhoc Payment - International Payee – (Swift code, NCC, Bank details) Pay Now/ Pay Later

- Multiple Transfers

Following is an example of Virtual Account Management in 'Payments' transaction.

Add Payee - Bank Account

A ‘Payee’ is the final recipient of payment transactions. The online banking application enables users to register a payees towards whom payments are to be made frequently with a virtual account on a regular basis. Payee maintenance is beneficial to users as, it spares the user the effort and time spent to fill out the payee information every time a payment is to be initiated towards the payee’s account.

While adding a payee, the user is provided with the option to assign an account number to the payee.

This section documents the addition of a payee with transfer type as bank account.

- Internal

- International

![]() How to reach here:

How to reach here:

Dashboard > Payments Widget > Manage Payees & Billers > Add New Payee > Bank Account

OR

Dashboard > Toggle Menu > Payments > Setups > Manage Payees & Billers > Add New Payee > Bank Account

OR

Dashboard > Payments Menu > Transfer Money > Manage Payees & Billers > Add New Payee > Bank Account

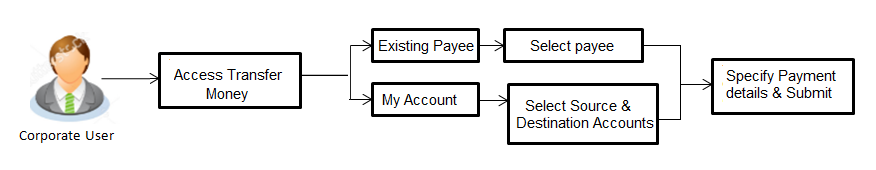

Transfer Money

Through this feature, the user is provided with an option to either transfer funds within his own accounts using virtual accounts as source of funds held in the same bank by selecting the ‘My Accounts’ option or to transfer funds to other accounts even to accounts held beyond geographical boundaries) by selecting the ‘Existing Payee’ option.

Note: Option to add and transfer money to ‘Domestic payee’ is not supported.

The user can transfer funds to the existing Internal, and International payee on the same business day (Pay Now) or at a later date (Pay Later), with the virtual accounts to which he have access to as source of funds.

Prerequisites:

- Transaction and account access is provided to corporate user

- Approval rule set up for corporate user to perform the actions

- Payees are maintained

- Purposes of Payments are maintained which are mandatory for Internal Payment

- Transaction limits are assigned to user to perform the transaction

Features supported in the application

The ‘Transfer Money’ feature enables users to make payments towards:

- Existing Payee – Internal, and International transfers are supported and are triggered based on the payee and specific payee account selection.

- My Accounts – Users are able to transfer funds within their own accounts held in the bank.

Workflow

![]() How to reach here:

How to reach here:

Dashboard > Toggle menu > Payments > Payments and Transfers > Transfer Money

OR

Maker Dashboard > Quick Links > Funds Transfer

OR

Maker Dashboard > Quick Links > Own Account Transfer

Make Payment - Existing Payee

The existing payee option of the ‘Transfer Money’ feature enables the user to initiate payments using a virtual account that he has access to, towards existing registered payees. All account payees created by the logged in user and shared by other users of the Party![]() A party is any individual or business entity having a banking relationship with the bank. are listed for selection. Once a payee has been selected, the details are auto populated on the transaction screen. The user is then required to fill in payment details to initiate the funds transfer. Payment details will vary based on the transfer type associated with the payee’s account. The user can also view the payee and transaction limits by selecting the ‘View Limits’ link provided on the screen.

A party is any individual or business entity having a banking relationship with the bank. are listed for selection. Once a payee has been selected, the details are auto populated on the transaction screen. The user is then required to fill in payment details to initiate the funds transfer. Payment details will vary based on the transfer type associated with the payee’s account. The user can also view the payee and transaction limits by selecting the ‘View Limits’ link provided on the screen.

![]() How to reach here:

How to reach here:

Dashboard > Toggle Menu > Payments > Payments and Transfers > Transfer Money > Make Pavement > Existing Payee

OR

Maker Dashboard > Quick Links > Fund Transfer > Existing Payee

Make Payment - My Accounts

By selecting the ‘My Accounts’ option as transfer type, the user is able to initiate funds transfers towards his own mapped accounts held with the bank.

An E-Receipt gets generated on successful completion of the transaction in the Core Banking Application. The E-Receipt can also be accessed from Activity Log detailed view.

![]() How to reach here:

How to reach here:

Dashboard > Toggle Menu > Payments > Payments and Transfers > Transfer Money > Make Pavement > Existing Payee > My Accounts

OR

Maker Dashboard > Quick Links > Fund Transfer > Existing Payee > My Accounts

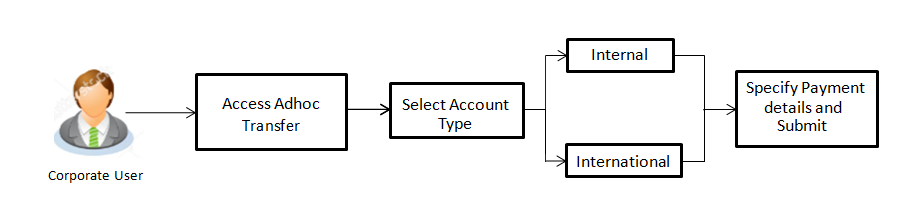

Adhoc Transfer

An adhoc transfer is one which is used to transfer funds from the user’s virtual account that he has access to as source of funds to a beneficiary/ payee account which is not registered with the bank. Since the transfer is towards an unregistered beneficiary, customers are required to specify the beneficiary details manually along with the transfer details while initiating an adhoc transfer.

The adhoc transfer can be initiated on the same business day (Pay Now) or any future date (Pay Later).

Pre-Requisites

- Transaction and account access is provided to retail user.

- Transaction limits are assigned to user to perform the transaction.

Workflow

Features Supported In Application

Following type of transactions are supported under Adhoc Transfers

- Internal Transfer

- International Transfer

![]() How to reach here:

How to reach here:

Dashboard > Toggle menu > Payments > Payments and Transfers > Adhoc Payment > Adhoc Transfer

OR

Dashboard > Quick Links > Adhoc Transfer

Adhoc Payment - Internal Fund Transfer

An Internal Bank Account transfer is a transfer initiated from a virtual account to an account, which is maintained within the Bank.

Basic payee details i.e. the name of the payee and payee account number are captured. In addition to the payee details, the user is also required to specify transfer specific details while initiating an adhoc internal transfer. The user can also view the transaction limits associated with a current transaction.

Adhoc Payment - International Fund Transfer

An international fund transfer involves the transfer of funds from a virtual account to an account that is maintained outside the country and beyond geographical boundaries. While initiating an adhoc international fund transfer, the customer is required to specify payee details which include the payee account number, clearing code of the bank in which the payee’s account is held along with the network through which the transfer is to be processed. Details specific to the transfer type must also be defined which include identifying the party who is to bear correspondence charges and defining payment details.

Note: Adhoc Payment to ‘Domestic payee’ is not supported.

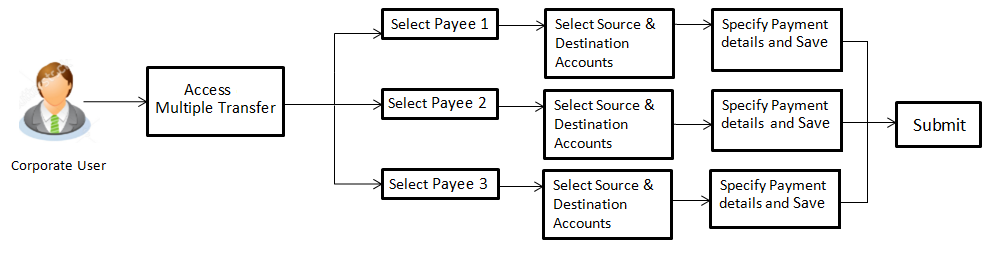

Multiple Transfers

The Multiple Transfers feature enables users to initiate transfers from a virtual account that he has access to as source of funds towards a group of people as part of a single transaction. Through this feature, users can initiate transfers towards registered payees of different transfer types i.e. internal, and international transfers, with different transfer dates, all at once from a single screen.

Prerequisites:

- Transaction and account access is provided to the retail user

- Registered payees are maintained

- Purpose of Payments are maintained

- Transaction limits are assigned to the user to perform the transaction

- Payee limits and cooling period limits are maintained

Workflow

![]() How to reach here:

How to reach here:

Dashboard > Toggle Menu > Payments > Payments and Transfers > Multiple Transfers

OR

Dashboard > Payments Menu > Multiple Transfers