AUTO LOAN APPLICATION

TRANSACTION HOST INTEGRATION MATRIX

Legends

|

NH |

No Host Interface Required. |

|

a |

Pre integrated Host interface available. |

|

Ñ |

Pre integrated Host interface not available. |

|

SR No |

Transaction / Function Name |

Oracle FLEXCUBE Core Banking 11.7.0.0.0 |

Oracle FLEXCUBE Universal Banking 12.4.0.0.0 |

Oracle Financial Services Lending and Leasing 14.3 |

|---|---|---|---|---|

|

1 |

Auto Loans Application |

Ñ |

Ñ |

a |

Introduction

An auto or vehicle loan is a secured personal loan taken to purchase a new or used vehicle. In an auto loan, the vehicle being purchased is considered as the collateral on the loans.

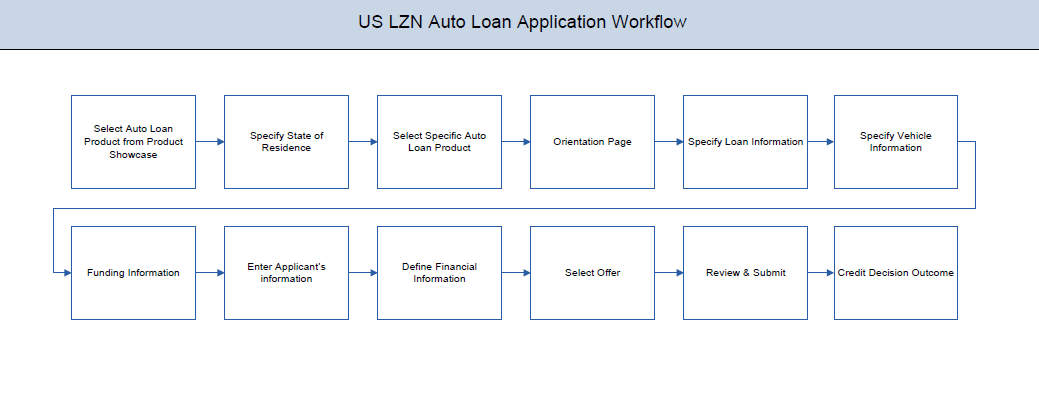

Auto Loans Application Workflow

Following are the steps involved in the loan account opening application:

- State Selection: Once you select the auto loans product from the product showcase, select the state of residence, after which you can proceed to the loan application.

- Loan Requirements: You can specify the amount to be borrowed, purpose of the loan, tenure, and also mention if a co-applicant is involved in the loan.

- Vehicle Information: You can provide vehicle information such as, whether the vehicle is used or new, the make and model of the vehicle, the estimated price of the vehicle, intended owner, and other details. Additionally, if the vehicle being purchased is a used vehicle, you can opt to lookup the vehicle information by specifying the vehicle identification number.

- Funding Information: This section displays the vehicle price, requested loan amount, application fees and the amount to be contributed by the applicant towards the loan.

- Applicant Information: The applicant information sections capture details such as, basic personal information, identity, contact, and employment information of the applicant.

- Financial Information: These sections capture financial details encompassing income, expense, asset, and liability details of the applicant.

- Offer Selection: This section displays multiple loan offers with an option to select any offer of choice.

- Review and Submit: This section comprises of two sub sections. The first displays the summary of the loan application. You can verify details submitted as part of the application and can modify any if required. The second sub section displays the disclosures and notices applicable on the loan application. You can view details of these disclosures and notices and if required, give consent to them before submitting the application to the bank.

- Credit Decision Outcome: Once you submit the application, a confirmation page will be displayed containing the current status of the application as well as the application reference number. This page will also contain details of any additional steps that might be required to be taken by either you or the bank. The options to either navigate to the application tracker or the product showcase are provided on this page.

![]() How to reach here:

How to reach here:

Dashboard > Auto Loan

To apply for an auto loan:

- Select Auto Loans on the product showcase screen.

- The state of residence screen appears.

State of Residence

|

Field Name |

Description |

|---|---|

|

Please select your state of residence |

|

|

Select State |

You are required to select the state in which you reside. |

- From the drop-down list, select the state of residence, and click . The product list screen is displayed.

OR

Click if you do not wish to proceed with the loan application.

- Once the appropriate product is selected, click Proceed. The Vehicle Loans Orientation screen is displayed containing details informing the applicant about the steps involved in the loan application, details required for application and eligibility criteria. Additionally, the orientation screen also displays text defining the USA Patriot Act, by which you are informed about the bank’s need to comply with the specific act and the requirement to capture certain information of all applicants.

- Click , if you are a new/ unregistered user.

OR

Click if you are a registered (existing) user. For more information on the application of an existing user, view the Existing User section.

OR

Click to abort the auto loan application process. For more information on cancelling an application, view the Cancel Application section. - The loan requirement screen is displayed. Enter loan requirement details such as loan amount i.e. the amount to be borrowed, the purpose of the loan, loan tenure, and if a co-applicant is to be added to the application.

Loan Requirement

|

Field Name |

Description |

|---|---|

|

Help us understand your loan requirements |

|

|

Loan Purpose |

The reason for which the loan application is being made. |

|

Loan Amount |

The loan amount (in US dollars) that you would like to borrow. |

|

Loan Term |

The tenure of loan in terms of years and months. |

|

Would you like to add a co-applicant |

You can identify whether a co-applicant is to be added to the application or not. |

|

Is Co-applicant an existing user |

Indicates whether the co-applicant is an existing user. This field is displayed, if you have selected Yes, in the Would you like to add a co-applicant ? field. |

|

Co-applicant Customer ID |

You are required to enter the co-applicant’s customer ID, if the co-applicant is an existing user. This field is displayed, if you have selected Yes, in the Is co-applicant an existing user ? field. |

|

Send Verification Code via |

Indicates the channel on which the verification code is to be sent. The options are:

This field is displayed, if you have selected Yes, in the Is co-applicant an existing user ? field. |

- Enter the relevant loan requirement details such as, loan purpose, loan tenure, amount, and other details.

- If you want to add a co-applicant, select option in the Would you like to add a co-applicant ? field.

OR

Click if the loan is for a single applicant. - If the co-applicant is an existing user click in the field.

OR

Click if the co-applicant is not an existing user. - If you have selected in the field, enter the co-applicant's customer ID in the Co-applicant Customer ID field.

- Once the co-applicants customer ID is entered, it needs to be verified. From the Send Verification Code via field, select the desired option through which the verification code is to be sent.

- Click .The Verification screen is displayed.

- In the Verification Code field, enter the verification code and click .

- A message stating that the code has been verified is displayed. Click .

- The sections comprising of the application form are displayed. If a co-applicant has been added, the respective sections in which the co-applicant’s information is to be captured are enabled.

- The sections of the application form are displayed on this page. You can start entering information in each section starting with the first section i.e. Applicant Information.

Applicant Information

In the applicant Information section enter the first name, middle name, last name, and suffix of the applicant.

|

Field Name |

Description |

|---|---|

|

First Name |

Enter the first name of the applicant. |

|

Middle Name (Optional) |

Enter the middle name of the applicant. This is an optional field. |

|

Last Name |

Enter the last name of the applicant. |

|

Suffix |

Select the applicable suffix here. This field is optional. E.g. Junior, Senior, ii, iii. |

- Click Continue to confirm the applicant’s information. If a co-applicant has been added, the screen on which co-applicant’s name is to be defined will be displayed, after which the Vehicle Information section will be displayed.

Vehicle Information

In the vehicle information section, enter vehicle details such as vehicle type, year of manufacture, make, model, estimated value, etc.

|

Field Name |

Description |

|---|---|

|

Vehicle Ownership |

You are required to identify if the vehicle is to be owned jointly or not. This field will be displayed only if you have added a co-applicant in the Loan Requirements page. The options available for selection are:

|

|

Owner |

Depending on the option selected in the Vehicle Ownership field, this field will either be a drop-down or a read only field. If you have selected option Single in the Vehicle Ownership field, this field will be a drop-down which will list down the names of the applicants. You can select either your name or the co-applicant’s name to indicate the owner of the vehicle. If you have selected the option Joint in the Vehicle Ownership field, this field will be read only which will display the names of both you and your co-applicant, indicating that the vehicle is going to be owned by both. |

|

New or Used |

Whether you are planing to purchase a new or used vehicle. |

|

Vehicle Type |

Type of vehicle you are planing on purchasing. |

|

Vehicle Identification Number |

A 17 character identifier unique to each vehicle. The Vehicle Identification Number (VIN) can be found on the lower-left corner of the vehicle dashboard or on the instrument panel. This field is optional if the vehicle being purchased is a new vehicle. |

|

Year |

The year in which the vehicle was manufactured. If the vehicle being purchased is a used vehicle, there will be an additional validation to ensure that the vehicle is not older than a certain age as defined by the bank. This age in years will be displayed against the field name. |

|

Make |

Vehicle manufacturer company name. |

|

Model |

Vehicle model name. The values in this field will be displayed based on the make selected. The option Others is provided so that you can enter the name of the model you want to purchase if the same is not listed. |

|

Estimated Value |

The approximate value of the vehicle. Once you select the make and model of the vehicle you wish to purchase, the estimated value will be fetched and displayed. You can change this value as seen fit. |

|

Mileage |

Enter the total distance covered by the vehicle in terms of miles. This field is displayed only if you have selected Used option in the New or Used field. The maximum mileage for which a loan can be provided will be defined by the bank and will be displayed against the field name. |

- Click Lookup Vehicle option displayed against the Vehicle Identification Number field after you have entered a value to have the system pre-populate the vehicle information.

This option is available only if you have selected option Used in the New or Used field. - Vehicle information (year, make, model, estimated value and mileage) is fetched and displayed in each respective field.

- Modify any information if you wish.

OR

Click Continue .

- The Funding Information section is displayed.

Funding Information

This section displays the total fees that are applicable on the loan application, the total cost which is the sum of the estimated value of the vehicle and the fees, as well as any amount that needs to be contributed by you which is the difference between the amount of loan you have requested and the total cost.

You can click  or the option to edit either the estimated value of the vehicle or the amount of loan you are requesting if the contribution amount is not suitable to you. Once the values displayed are suitable click on and to proceed to the next step in the application.

or the option to edit either the estimated value of the vehicle or the amount of loan you are requesting if the contribution amount is not suitable to you. Once the values displayed are suitable click on and to proceed to the next step in the application.

|

Field Name |

Description |

|---|---|

|

Estimated Value of Vehicle |

The purchase price of the vehicle as defined by you in the previous section. |

|

Requested Loan Amount |

Loan amount requested by you to purchase the vehicle. |

|

Total Fees |

Total fees applicable on the loan. You can click on the provided link in order to view the breakdown of the fees. |

|

Total Cost |

Total cost of the loan i.e. the sum of the value of the vehicle and the fees applicable. |

|

Your Contribution |

The amount to be contributed by you towards the purchase of the vehicle. This amount is the difference between the total cost of the vehicle and the requested loan amount. |

- Click Accept to agree with the contribution amount.

OR

Click Modify to edit and update the requested loan amount and/or estimated value of the vehicle. - Click

to save the modified loan details.

to save the modified loan details.

- Click Continue. The Primary Information section is displayed.

Primary Information

|

Field Name |

Description |

|---|---|

|

Salutation |

Identify your salutation. Examples of salutation are:

|

|

First Name |

Your first name as entered in the Applicant |

|

Middle Name |

Enter your middle name here. If you have already entered your middle name in the Applicant Information section, it will be displayed here. You can update this value if you wish to. |

|

Last Name |

Your last name as entered in the Applicant Information section is displayed. You can update this value if you wish to. |

|

Suffix |

Your suffix. If you have defined your suffix in the Application Information section, it will be displayed here. This field is optional. E.g. Junior, Senior, ii, iii. |

|

Date of Birth |

Your date of birth in format MM/DD The system validates your date of birth against your state of residence so as to identify whether you have attained age of majority as per your state specifications. |

|

Citizenship |

The country of which you are a citizen. By default, United States will be selected. You can change this value to reflect the country of which you are a citizen. |

|

Permanent Resident |

You are required to identify whether you are a permanent resident of the United States or not. If your citizenship is any other than United States and if you are also not a permanent resident of the United States, you will not be able to proceed with the application as, currently, only US citizens or resident aliens are allowed to submit applications online. |

|

Country of Residence |

This field is enabled only if you have identified that you are not a permanent resident of the United States by selecting No in the Permanent Resident field. In this case, you are required to indentify the country in which you reside. |

- Click Continue . The Proof of Identity section is displayed.

Proof of Identity

Enter your Social Security Number and identity details in this section.

|

Field Name |

Description |

|---|---|

|

Social Security Number |

Enter your Social Security Number. Your Social Security Number is a 9 digit number issued by the U.S. government to U.S. citizens, permanent residents and temporary residents for taxation and other purposes. |

|

Type of Identification |

Select the identification that you want to provide as proof of identity. The identification type could be.

|

|

State of Issue |

Enter the name of the state in which your identification document has been issued. This field is displayed if you have selected State ID or Driving License in Type of Identification list. |

|

ID Number |

Enter your Identification number corresponding to the identification type. |

|

Expiration Date |

Enter the date on which your identification document will expire. This date can be found printed on your identification document. The system will validate if the expiration date has passed or if it is a valid date i.e. not one that is too ahead in the future (the number of years will be defined by the bank) and will display an appropriate error message. In this case, you can either modify the expiration date or select a different ID to submit as proof of identity, one that has a valid expiration date. |

- Click Continue to save the identification information.

- The Contact Information section is displayed.

Contact Information

In the contact information section enter contact details including your email address, phone numbers, and current residential address.

You will be required to enter details of your previous residence if you have stayed at your current residence for less than the amount of time required. This amount of time is defined by the bank in terms of years.

|

Field Name |

Description |

|---|---|

|

|

|

|

|

Enter your email address. |

|

Confirm Email |

Re-enter your email address in order to confirm the same. |

|

Phone Number |

|

|

Phone Type |

Select the phone number type that you want to define as primary contact number. The options are:

|

|

Primary Phone Number |

Enter your phone number corresponding to the selected phone type. |

|

Alternate phone number |

You can select Yes if you want to add an alternate phone number. It is not mandatory to add an alternate phone number. |

|

Phone Type |

Type of phone number that is being added as an alternate number. The options are the same as those available for the phone type of primary phone number. The type selected as primary phone type will not be part of the list. Hence you cannot enter two phone numbers of the same type. This field is displayed if you select Yes in the Add an alternate phone number field. |

|

Phone Number |

Phone number corresponding to the selected alternate phone type. This field is displayed if you select Yes in the Add an alternate phone number field. |

|

Residential Address |

|

|

Default as that of Primary Applicant |

This field will be enabled only when the contact information of a co-applicant is being entered. By selecting this check box, the primary applicant’s address will be defaulted in the fields capturing address of the co-applicant. |

|

Accommodation Type |

The type of accommodation in which you reside. The accommodation types are:

|

|

Address 1-2 |

Enter your address details. |

|

City |

Enter the name of the city in which you reside. |

|

State |

The state in which you reside. The state that you selected upfront will be displayed in this field. You will not be able to change the state here. |

|

Zip Code |

The zip code of your residence. You can enter the zip code in format zip+4 in addition to regular format. |

|

Staying Since |

Date since which you have been residing at the current address. If you identify a date that is less than the minimum amount of time required for you to have resided in the current residence, the system will display fields in which you can specify you previous residence address. |

|

Previous Residential Address This sub section will be enabled and displayed only if you have identified a date in the Staying Since field that falls short of the minimum amount of time required for you to have resided in the current residence |

|

|

Accommodation Type |

The type of residence in which you resided previously. The accommodation types are:

|

|

Address line 1-2 |

Enter address details of your previous residence. |

|

City |

Enter the name of the city in which you resided previously. |

|

State |

The state in which you resided previously. The state that you selected upfront will be displayed here by default and can be changed. |

|

Zip Code |

The zip code of your previous residence. You can enter the zip code in format zip+4 in addition to regular format. |

- Click Continue to save the contact information. The Employment Information section is displayed.

Employment Information

In this section enter details of your employment over a defined period starting with your current primary employment. The details required are type of employment, subsequent status, date on which specific employment was started and if you are salaried or self employed, the company or employer name. If the amount of time at which you have been employed in your current employment is less than the required amount, the system will display fields in which you can enter details of previous employment.

|

Field Name |

Description |

|---|---|

|

Primary Employment |

|

|

Employment Type |

The type of your current primary employment. The types are:

|

|

Employment Status |

The status of your employment. The options in this field will depend on your selection as employment type. If you have selected the option Salaried or Self Employed the options will be:

If you have selected the option Others, the options will be:

|

|

Company Name or Employer |

Name of the company or firm at which you are employed. |

|

Start Date |

The date on which you started current employment. |

|

Additional Employment |

|

|

Employment Type |

The type employment. The types are:

|

|

Employment Status |

The status of your employment. The options in this field will depend on your selection as employment type. If you have selected the option Salaried or Self Employed the options will be:

If you have selected the option Others, the options will be:

|

|

Company Name or Employer |

Name of the company or firm at which you are/were employed. |

|

Start Date |

The date on which you started employment at the specific company or organization. |

|

Start Date |

The date on which your employment at the specific company or organization ended. |

- Click Add to update the employment information.

OR

You can lick to edit the employment information.

to edit the employment information. - Click

to add more than one employment information.

to add more than one employment information.

- Click Continue to proceed with the application process.

Financial Profile

This page comprises of multiple sections in which you can enter your financial details in the form of incomes, expenses, assets and liabilities.

- Select a section in which to enter appropriate financial information.

Income

In this section enter details of all income that you want to be considered. Hence, any income earned as alimony or child support need not be identified here if you do not wish for it to be considered. You can add multiple records of income up to a defined limit. Click the  to add additional income records and the

to add additional income records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Income |

|

|

Source of Income |

The source of your primary income. Examples of source of income can be rental income, salary, etc. |

|

Gross Income |

Gross amount of income earned. |

|

Net Income |

Net amount of income. The net income field will be defaulted with the gross income amount entered and can be changed. |

|

Frequency |

The frequency at which you earn the particular income. Examples of income frequency can be Monthly, Yearly, etc. By default Yearly will be selected in this field. You can change this value as required. |

- Click Save to update the income details.

- Click Continue to proceed with the expense details section.

OR

Click to add more than one employment information.

to add more than one employment information.

Expenses

In this section enter details of all expenses you incur on a regular basis. You can add multiple expense records up to a defined limit. Click the  to add additional expense records and the

to add additional expense records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Expense |

|

|

Type of Expense |

The type of expense. Example - household, school fees, etc. |

|

Total Expense Value |

The total value of expenditure against the specific type identified. |

|

Frequency of Expense |

The frequency at which you incur the specific expense. By default the value Monthly will be selected and can be changed. |

- Click Save to update the expense details.

- Click Continue to proceed with the asset details section.

- Click

to add another expense record.

to add another expense record.

Asset

In this section enter details of all assets owned by you. You can add multiple asset records up to a defined limit. Click the  to add additional asset records and the

to add additional asset records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Assets |

|

|

Type of Asset |

Select the type of asset you own. The examples of asset are Home, Savings Account with Bank etc. |

|

Value |

The market value of the asset. |

- Click Save.

- Click Continue to proceed with the liability details section.

OR

Click to add another asset record.

to add another asset record.

Liabilities

In this section enter details of all your liabilities. You can add multiple records up to a defined limit. Click the  to add additional records and the

to add additional records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Liability |

|

|

Type of Liability |

Select the type of liability you want to define. The liability type could be, home loan, personal loan, credit card, and others. |

|

Original Value |

Identify the original value of the liability. |

|

Outstanding Value |

Enter the current outstanding value of the liability. |

- Click .

- Click Continue to proceed with the loan application process.

OR

Click to add another liability record.

to add another liability record. - Once the asset, liability, income, and expense details are entered click .

- The Offers screen is displayed.

Offers

This section displays all the product offers applicable to you. You can select any one offer that best suits your needs.

- Select a suitable offer.

- Click .

- Click Review and Submit. The review screen is displayed.

Review and Submit

The review and submit page consists of the following two sub sections:

- Application Verification – This section will display all the information you have entered in the application. You can verify that all the information provided by you is correct and make any changes if required.

- Disclosures and Consents – This section displays all the various disclosures and notices impacting you and the bank. The facility to provide your consent to a disclosure is provided against each disclosure.

The following are the different sections of Application Verification sub section.

against any section if you wish to edit any information that is part of that section.

against any section if you wish to edit any information that is part of that section. Disclosures and Consents

|

Field Name |

Description |

|---|---|

|

ESIGN Disclosure |

|

|

I have reviewed and consent to the ESIGN Disclosure |

Select this check box to provide consent to the ESIGN Disclosure. |

|

Additional Disclosure |

|

|

I acknowledge that I have reviewed and agree to the Product Legal Documents and Privacy Policy Notice |

Select this check box to acknowledge that you have reviewed the product legal documents and the privacy policy of the bank. |

- You can view each disclosure by clicking on the respective link provided.

- Once you have verified all the information and have provided consent to all the disclosures click . The screen confirming application submission will be displayed which will contain the application reference number, decision outcome and any additional steps that might need to be undertaken by you or the bank.

Submitted Application Confirmation

The confirmation page is displayed once you have submitted your application. This page displays the current status of the application along with details of any further steps that might be required to be taken. The application reference number, by which you can track the status of your application, is also displayed on this page. Additionally, the options to register (if you are a new customer and have not yet registered with the bank) and to track the application are also provided on this page.

- If you are not a registered channel user, you will have an option to register for channel access. Click Register.

OR

Click to navigate to the product showcase. - Click . to track your submitted application. For more information on track application view the Application Tracker section.

Register User

Only those applicants who do not have a prior relationship with the bank might be required to register. When an existing customer is making an application, the option to register is disabled.

Registration might be mandatory or optional. In case registration is mandatory and you have not yet registered at the time of submitting the application, you will be required to mandatorily register before the application can be submitted. In this case, when you select the option to Submit the application on the Review & Submit page, the registration page will be opened. Once you have registered, you will be able to proceed with application submission.

In case registration is not mandatory and you have not yet registered at the time of submission, the option to register yourself for channel access will be provided on the confirm screen. Clicking on the link will open the Registration page.

Register Applicant

|

Field Name |

Description |

|---|---|

|

Define Login Credentials |

|

|

|

Enter the email ID with which you would like to register. |

|

Confirm Email |

To confirm the email ID re-enter the email ID entered in the Email field. |

|

Verify |

Click on this link to verify the email ID entered. A unique security code will be sent to the email address defined and a pop up window will be opened in which you can verify the email ID by entering the security code in the specified field. |

|

Password |

Enter a password to be used for the purpose of registration. You will be required to enter this password when you log-in to the system in the future. |

|

Confirm Password |

To confirm the password re-enter the password entered in the Password field. |

|

Set Security Questions |

|

|

Skip set up of security questions? |

Through this option, you can opt to skip setting up security questions at the time or registration. The options are:

By default the option No will be selected and the security question and answer fields will be displayed. If you select the option Yes, identifying that you wish to skip set up of security questions, the security question and answer fields will be disabled and hidden. |

|

Security Question |

Select a question to be assigned as a security question. The security questions will be numbered, e.g. Security Question 1, Security Question 2 and so on. The number of security questions and answers available will be dependent on the number configured by the bank administrator. |

|

Answer |

Specify an answer for the selected security question. The fields in which you can specify answers to selected security questions will be displayed below each security question and will be numbered, e.g. Answer 1, Answer 2 and so on. |

|

Terms and Conditions |

|

|

I have read, fully understood and agreed with the terms and conditions |

Select this checkbox to acknowledge agreement to the terms and conditions of registration for online banking access. |

|

Terms and Conditions Link |

Click this link to view the terms and conditions. |

To register:

- In the Email field, enter the email address.

- To confirm enter the email ID in the Confirm Email field.

- Click link to verify the entered email address.

- In the Verification Code field, enter the verification code sent on the defined email ID.

- Click , if the code is not received.

- Click . The successful email verification message is displayed.

- In the Password field, enter the password required for log-in.

- To confirm enter the password in the Confirm Password field.

- From the security question list, select a question to be added in your security question set.

- In the answer field, enter an answer for the selected security question.

- If you do not want to set security questions currently, select the option Yes against the Skip set up of security questions field.

- Click the Terms and Conditions link to view the terms and conditions.

- Select the Terms and Conditions check box to acknowledge agreement to the terms and conditions.

- Click Register/Submit Application to register. The button to register will be termed Register if registration is non mandatory and the user has navigated to the registration screen from the confirm screen. If registration is mandatory, this screen will be displayed once the user has filled out the application form and is proceeding to submit it, hence the button will be Submit Application.

OR

Click Cancel Application to cancel the application.

OR

Click Return to Application.

|

Field Name |

Description |

|---|---|

|

Verification Code |

Enter the security code sent to the email ID you have defined in the registration screen. |

- Click Submit to submit the verification code. On successful verification, a message stating that verification has been completed successfully will be displayed.

OR

Click Resend Code if you wish for the system to send you a different security code.

OR

Click Cancel to close the screen and return to the registration screen.

|

Field Name |

Description |

|---|---|

|

|

Specify the email ID of the co-applicant to register the co-applicant. This field will be displayed only if the co-applicant involved in the application is not registered with the bank. |

- Click Send Link to send the registration link to the co-applicant’s email ID specified.

OR

Click Track Application to navigate to application tracker to view the applications status.

OR

Click Go to Homepage to navigate to the product showcase.

Cancel Application

The option to cancel the application is provided throughout the application and you can opt to cancel the application at any step.

To cancel an application:

- Click Cancel. The cancel application screen is displayed. You will be able to select a reason for which you are cancelling the application.

- Click Cancel and Exit. The application is cancelled

|

Field Name |

Description |

|---|---|

|

Reason for Cancelling |

Indicate the reason for which you are cancelling the application. This is an optional step. The cancellation reason could be:

|

|

Please Specify |

This field is displayed if you have selected the option Others as Reason for Cancelling Enter the reason for which you are cancelling the application in this field. |

- Select the appropriate reason for cancelling the application.

- Click to cancel and exit the application. A message confirming that the application has been cancelled is displayed.

OR

Click to return to the loan application.

- Click to navigate to the product showcase.

Save for Later

There are two scenarios in this case

- If the applicant is a registered user and he/she is already logged in then the applicant will be displayed a confirmation page indicating that the application has been saved successfully.

- If the applicant is a new user i.e. who is not registered for channel access, then he/she will be required to register while saving the application. The following steps are involved in the process of saving an application in this scenario.

All saved applications will be available in the application tracker under the In Draft tab. You can select any application to resume the application submission process.

To save an application:

- Click . The Save and Complete Later screen is displayed.

|

Field Name |

Description |

|---|---|

|

|

Enter the email ID with which you would like to register. |

|

Confirm Email |

To confirm the email ID re-enter the email ID entered in the Email field. |

|

Verify |

Click on this link to verify the email ID entered. A unique security code will be sent to the email address defined and a pop up window will be opened in which you can verify the email ID by entering the security code in the specified field. Refer the Verify sub section under section Register User for further information on verification. |

|

Password |

Enter a password to be used for the purpose of registration. You will be required to enter this password when you login to the system in the future. |

|

Confirm Password |

To confirm the password re-enter the password entered in the Password field. |

|

Set Security Questions |

|

|

Skip set up of security questions? |

Through this option, you can opt to skip setting up security questions at the time or registration. The options are:

By default the option No will be selected and the security question and answer fields will be displayed. If you select the option Yes, identifying that you wish to skip set up of security questions, the security question and answer fields will be disabled and hidden. |

|

Security Question |

Select a question to be assigned as a security question. The security questions will be numbered, e.g. Security Question 1, Security Question 2 and so on. The number of security questions and answers available will be dependent on the number configured by the bank administrator. |

|

Answer |

Specify an answer for the selected security question. The fields in which you can specify answers to selected security questions will be displayed below each security question and will be numbered, e.g. Answer 1, Answer 2 and so on. |

|

Terms and Conditions |

|

|

I have read, fully understood and agreed with the terms and conditions |

Select this checkbox to acknowledge agreement to the terms and conditions of registration for online banking access. |

|

Terms and Conditions Link |

Click this link to view the terms and conditions. |

The following steps are applicable for cases wherein the applicant is not a registered user.

- In the Email field, enter the email address.

- To confirm enter the email ID in the Confirm Email field.

- Click link to verify the entered email address.

- In the Verification Code field, enter the verification code sent on the registered email ID.

- Click , if the code is not received.

- Click . A message stating that the email ID has been verified successfully is displayed.

- In the Password field, enter the password required for log-in.

- To confirm enter the password in the Confirm Password field.

- From the Security Question list, select a question to be added in your security question set.

- In the answer field, enter an answer for the selected security question.

- If you do not want to set security questions currently, select the option Yes against the Skip set up of security questions field.

- Click the Terms and Conditions link to view the terms and conditions.

- Select the Terms and Conditions check box to acknowledge agreement to the terms and conditions.

- Click .

OR

Click to close the save and complete later screen.

OR

Click to navigate to the application screen.

|

Field Name |

Description |

|---|---|

|

|

Specify the email ID of the co-applicant for registration. This field will be displayed only if the co-applicant involved in the application is not registered with the bank. |

- Click Send Link to send registration link to the co-applicant.

OR

Click Track your Application to view the application status.

OR

Click Go to Homepage to navigate to the product showcase.

Existing User

An application form being initiated by an existing user will differ from that of one being initiated by a new/unregistered user. If you are applying for an auto loan as an existing user, once you login to the banking system after having entered your login credentials, the application form will be displayed with all your personal details pre-populated in the respective fields and sections. You will, hence, be required to only specify details pertaining to the loan and vehicle including vehicle funding information. The sections that will be pre-populated with your information are Applicant Information, Primary Information, Proof of Identity, Contact Information, Employment Information and Financial Information including Income, Expenses, Assets and Liabilities.

Application Tracker

The Application Tracker enables you to view the progress of submitted applications and also to retrieve and complete applications that have been saved. Through the application tracker you can perform the following actions:

- View submitted applications: The application tracker enables you to view details of submitted applications which includes viewing status history, application summary and uploaded documents as well as performing any pending tasks required for the processing of the application.

- View applications in draft: While filling out an application form, if you opt to save the application instead of submitting it, the application is saved in the application tracker as an ‘In Draft application’. You can select any of the applications available under this tab in order to complete and submit that application.

To track an application:

- Click Track Application on the dashboard. The Login screen is displayed.

- Enter the registered email ID and password, click .

- The Application Tracker screen is displayed. By default the submitted application view is displayed.

Submitted Application-Auto Loan

|

Field Name |

Description |

|---|---|

|

Loan Offer Name |

The name of the offer for which the application has been made. |

|

Application ID |

The application reference number as generated by the bank at the time the application was submitted. |

|

Progress Bar |

The current status of the application is displayed graphically with the help of a progress bar. |

|

Loan Amount |

The requested loan amount. |

|

Applicant Name |

The names of both the primary and co-applicant will be displayed here. If no co-applicant has been added, only the primary applicant’s name will be displayed. |

|

Submitted On |

The date on which the application was submitted. |

|

Status |

The current status of the application. |

- Select the application card.

- The Application Details screen is displayed with options to view additional details of the application and pending tasks, if any.

|

Field Name |

Description |

|---|---|

|

Loan Offer Name |

The name of the offer for which the application has been made. |

|

Application ID |

The application reference number as generated by the bank at the time the application was submitted. |

|

Progress Bar |

The current status of the application is displayed graphically with the help of a progress bar. |

|

Loan Amount |

The requested loan amount. |

|

Applicant Name |

The names of both the primary and co-applicant will be displayed here. If no co-applicant has been added, only the primary applicant’s name will be displayed. |

|

Submitted On |

The date on which the application was submitted. |

|

Tenure |

The term of the loan. |

- Click any section heading to view details or to take required action on the application.

Account Configuration

This section allows you to view and configure the features of the loan account.

|

Field Name |

Description |

|---|---|

|

Pay only interest for the initial period |

You can identify if you wish to pay only interest during the initial period of the loan by selecting the option Yes in this field. This option will be provided only if this feature is supported by the loan offer selected. |

|

Interest Only Term |

If you have identified that you want to pay only interest during the initial period of the loan, you will then have to identify the period for which you would like to only pay interest. You can identify this period in terms of years and months. This field is displayed if you select the option Yes in the Pay only interest for the initial period field. |

|

Principal and Interest Repayment Frequency |

You can specify the frequency at which you would like to repay the principal and interest to the bank. The frequency could be:

|

|

Fixed rate for the initial period |

You can identify whether or not you would like to be charged a fixed rate of interest on the loan for the initial period. This option will be provided only if this feature is supported by the loan offer selected. |

|

Fixed Rate Term |

If you have identified that you would like to be charged a fixed rate of interest for the initial period, you will then be required to identify the period for which you would wish to be charged the fixed rate. You can identify this period in terms of years and months. This field appears if you select Yes option in the Fixed rate for the initial period field. |

|

Avail Redraw Facility |

You can identify whether or not you would like to avail of a redraw facility on the loan. This option will be provided only if this feature is supported by the loan offer selected. |

|

Statement Required |

You can identify whether you want to receive the loan statement. |

|

Statement Frequency |

If you have stated that you wish to receive the loan statement, you will be required to specify the frequency at which to receive the statement. This field is displayed if you select option Yes in the Statement Required field. |

- Enter the appropriate values in the relevant fields.

- Click . The updates made on the screen are saved.

Account Summary

The Account Summary section enables you to view basic details of the loan account.

|

Field Name |

Description |

|---|---|

|

Account Summary |

|

|

Rate Type |

Indicates the rate type of the loan, it could be fixed or variable or both. |

|

Frequency |

The principal and interest repayment frequency. The frequency could be:

|

|

Term |

The Loan term. |

|

Approximate Repayment Amount |

The approximate amount that has to be repaid towards the loan. |

Application Summary

|

Field Name |

Description |

|---|---|

|

Application Summary |

|

|

Applicant Name |

The names of the applicants will be displayed here. |

|

Purpose |

The purpose for which the loan was applied. |

|

Requested Amount |

The amount for which the loan is applied. |

|

Approved Amount |

Loan amount approved by the bank including the fees, and other costs. |

|

Tenure |

Loan repayment tenure. |

|

Loan Date |

Loan application date. |

- Click View Complete Application to view the complete application in PDF format.

Application Fees

This section lists down all the fees that are applicable on the loan.

|

Field Name |

Description |

|---|---|

|

Application Fees |

|

|

Fees |

All the fees applicable are listed down with the amount charged displayed against each fee type. |

|

Total Fees |

The total amount of all the fees charged is displayed. |

Status History

This section displays the status history of the loan application i.e. the various stages through which the loan application has passed along with the current status.

|

Field Name |

Description |

|---|---|

|

Status History |

|

|

State |

The status of the application. |

|

Remarks |

Displays the remarks if any. |

|

Acted By |

The User ID of the person that updated the status of the application. |

|

Updated On |

The date on which the specific status was updated. |

Document Upload

Document upload enables you to upload the documents which are required for the processing of the application. You can upload multiple documents against a document type. You can also delete any document that has been uploaded previously.

To upload / remove a document:

- Click the Documents link.

- Click .

- The option to browse the computer's folder is displayed.

- Select the appropriate file to be uploaded and click .

- Click . The file is uploaded.

Note: Click  to remove the uploaded document.

to remove the uploaded document.

|

Field Name |

Description |

|---|---|

|

Choose File |

On selecting this link, the browse option is opened, by which you can select the required document to upload. |

- Click on the link displayed against a specific document type in order to view the document.

Once the account is configured and required documents are uploaded, the offer is generated and made available in the tracker for you to view, download, and provide approval / rejection.

|

Field Name |

Description |

|---|---|

|

Letter of Offer |

Displays the generated offer letter. You can select the link provided in order to view the details of the offer made by the bank |

|

Offer Letter Acceptance |

In order to accept the loan offer, you will be required to accept the terms and conditions of the loan. Select the check boxes to accept the specific terms and conditions defined. |

|

Accept/Reject Offer |

Select the appropriate option in order to accept or reject the offer. In order to accept the offer, select the Yes button. In order to reject the offer, select the No button. |

- Click

to download the offer letter and other document.

to download the offer letter and other document. - Select the terms and conditions check box and click Yes to select the offer. The offer acceptance message is displayed.

OR

Click No to reject the offer.

Cancel Application

The option to cancel the application once submitted is provided in the application tracker and is available only if the application has not yet been processed to completion.

In order to cancel an application from the application tracker, select the Cancel option available on the application tracker details page and follow on with confirming the cancellation.

FAQs

![]() Can I apply for an auto loan if I am not a citizen of the United States?

Can I apply for an auto loan if I am not a citizen of the United States?

![]() Are there any types of vehicles that the bank will not finance?

Are there any types of vehicles that the bank will not finance?

![]() Why do I have to provide my Social Security Number (SSN

Why do I have to provide my Social Security Number (SSN![]() Social Security Number) in the application? How does the bank ensure that my information is safe?

Social Security Number) in the application? How does the bank ensure that my information is safe?

![]() Why do you require the expiry date of my identity proof?

Why do you require the expiry date of my identity proof?

![]() Can I provide my post office box number as residential address?

Can I provide my post office box number as residential address?

![]() I have my entire zip code i.e. in zip+4 format. Can I provide my entire zip code?

I have my entire zip code i.e. in zip+4 format. Can I provide my entire zip code?

![]() Do I need to include the income I get as alimony in the income section of the application?

Do I need to include the income I get as alimony in the income section of the application?

![]() Why do I have to give my consent to all the disclosures displayed under the Review & Submit section?

Why do I have to give my consent to all the disclosures displayed under the Review & Submit section?

![]() I am an existing customer of the bank but do not have channel access, how can I proceed?

I am an existing customer of the bank but do not have channel access, how can I proceed?

![]() Can I proceed with the application if I am not an existing channel user?

Can I proceed with the application if I am not an existing channel user?

![]() Why am I asked to capture previous residential address details?

Why am I asked to capture previous residential address details?

![]() Is it mandatory to change the default configuration for an account as part of application tracker?

Is it mandatory to change the default configuration for an account as part of application tracker?

![]() Can the co-applicant perform all the pending tasks in the application tracker?

Can the co-applicant perform all the pending tasks in the application tracker?

![]() Why am I being asked to capture previous employment details?

Why am I being asked to capture previous employment details?

![]() Can I change the contribution amount as part of funding information?

Can I change the contribution amount as part of funding information?