IN PRINCIPLE APPROVAL APPLICATION

TRANSACTION HOST INTEGRATION MATRIX

Legends

|

NH |

No Host Interface Required. |

|

a |

Pre integrated Host interface available. |

|

Ñ |

Pre integrated Host interface not available. |

|

SR No |

Transaction / Function Name |

Oracle FLEXCUBE Core Banking 11.7.0.0.0 |

Oracle FLEXCUBE Universal Banking 12.4.0.0.0 |

Oracle Banking Platform 2.5.0.2.0 |

|---|---|---|---|---|

|

1 |

Mortgage Loans - In Principle Approval Application Submission |

Ñ |

Ñ |

a |

Introduction

An in principle approval loan indicates whether bank can potentially lend the amount to the borrower.

In principle approval is availed in the following scenarios:

- If you are planing to buy a new home

- If you have found a property and need an indication that we may be able to lend you the amount you need

- If you are ready to apply for a mortgage

Important information pertaining to in principle approval:

- An Approval in Principle letter is not an offer of a loan

- Requesting an Approval in Principle does not mean that you are committing to apply for a mortgage with the bank

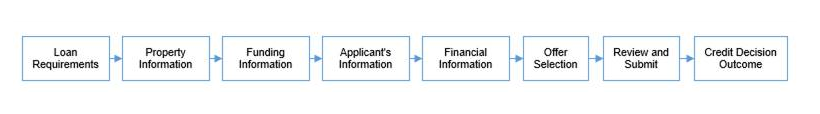

In Principle Approval Workflow

Following are the steps involved as part of application submission:

- Loan Requirements: You can specify the amount to be borrowed, purpose of the loan, tenure, and co-applicant if there is any.

- Property Information: You can provide property information like, purchase price, ownership details, intended owners of the property, address of property etc.

- Funding Information: This section displays the purchase price of the property, requested loan amount, application fees, lenders mortgage insurance, (if applicable), and contribution amount by the applicant towards the loan.

- Applicant Information: The applicant information section consists of details like, basic personal information, identity, contact, and employment information of the applicant.

- Financial Information: This section consists of income, expense, asset, and liability details of the applicant.

- Offer Selection: It displays multiple loan offers with an option to select any offer of choice.

- Review and Submit: It displays the summary of the loan application with details submitted as part of the application and modify any details if required.

- Credit Decision Outcome: It displays the credit decision, once the loan application is submitted successfully.

![]() How to reach here:

How to reach here:

Dashboard > In Principle Approval

To apply for in principle approval loan

- Select In Principle Approval on the product showcase.

- The product selection screen is displayed.

- Click the Proceed option available on the desired product card. The Mortgage Loans Orientation screen is displayed containing details informing the applicant about the steps involved in the loan application, details required for application and eligibility criteria.

- Click , if you are a new/unregistered user.

OR

Click if you are a registered user. For more information on the application of a registered (existing user) view the Existing User section.

OR

Click to abort the loan application process. For more information on cancelling an application, view the Cancel Application section. - The loan requirement screen is displayed. Enter the loan requirement details such as loan amount that is amount to be borrowed, loan tenure, and if a co-applicant is to be added to the application.

Loan Requirement

|

Field Name |

Description |

|---|---|

|

Help us understand your loan requirements |

|

|

What is your purpose for this loan ? |

The reason for which the loan application is being made. |

|

How much would you like to borrow |

The loan amount that you would like to borrow. |

|

Tenure |

The tenure of the loan in terms of years and months to repay the loan amount. |

|

Is this the first time you are purchasing a house? |

Indicates if the borrower is buying a house for the first time. |

|

Is there a co-applicant |

You can identify whether a co-applicant is to be added to the application or not. |

|

Is Co-applicant an existing user |

Indicates whether the co-applicant is an existing user. This field is displayed, if you have selected Yes, in the Would you like to add a co-applicant? field. |

|

Co-applicant Customer ID |

You are required to enter the co-applicant’s customer ID, if the co-applicant is an existing user. This field is displayed, if you have selected Yes, in the Is co-applicant an existing user? field. |

|

Send Verification Code via |

Indicates the channel on which the verification code is to be sent. The options are:

This field is displayed, if you have selected Yes, in the Is co-applicant an existing user? field. |

- Enter the relevant loan requirement details such as loan purpose, loan tenure, amount and other details.

- If a co-applicant is to be part of the application select option Yes in the Would you like to add a co-applicant? field.

OR

Click if the loan is required for a single applicant. - If co-applicant is an existing user click Yes in the Is co-applicant an existing user? field.

OR

Click No if the co-applicant is not an existing user. - If you have clicked Yes in the Is co-applicant an existing user? field, enter the co-applicant customer ID in the Co-applicant Customer ID field.

- Once the co-applicants customer ID is entered, it needs to be verified. From the Send Verification Code via field, select the desired option through which the verification code is to be sent.

- Click Verify. The Verification screen is displayed.

- In the Verification Code field, enter the verification code and click .

- A message stating that the code has been verified is displayed. Click . The sections comprising of the application form are displayed. If a co-applicant has been added, the respective sections in which the co-applicant’s information is to be captured are enabled.

- The applicant information section will open to enter basic information about the applicant.

Applicant Information

In this section enter the information like, salutation, first name, middle name, and last name.

|

Field Name |

Description |

|---|---|

|

Salutation |

Identify your salutation of applicant. The options are:

|

|

First Name |

Enter your first name. |

|

Middle Name |

Enter your middle name. This is an optional field. |

|

Last Name |

Enter your last name. |

- Click Continue to confirm the applicant’s information. If a co-applicant has been added, the screen on which co-applicant’s name is to be defined will be displayed, after which the Property Information section will be displayed.

Property Information

In the property Information screen enter the information like property type, subtype, ownership and address of the property.

Property Information

|

Field Name |

Description |

|---|---|

|

Property Details |

|

|

Ownership Type |

You are required to identify if the property is to be owned jointly or not. This field will be displayed only if you have added a co-applicant in the Loan Requirements page. The options available for selection are:

|

|

Owners of the Property |

Depending on the option selected in the Ownership Type field, this field will either be a drop-down or a read only field. If you have selected option Single in the Ownership Type field, this field will be a drop-down which will list down the names of the applicants. You can select either your name or the co-applicant’s name to indicate the owner of the property. If you have selected the option Joint in the Ownership Type field, this field will be read only which will display the names of both you and your co-applicant, indicating that the property is going to be owned by both. |

|

Type of Property |

The type of the property that you are planning to purchase i.e. residential property, commercial property, etc. |

|

Sub-Type |

The sub type of the property within the type of property i.e. Property under construction etc. |

|

Purchase Price |

Specify the purchase price of the property. |

|

Address of the Property |

|

|

Country |

Specify the country in which the property is located. |

|

Address Line 1 -2 |

Specify Address details of the property. |

|

City |

Specify the city name in which the property is located. |

|

State |

Select the state where the property is located. |

|

Zip Code |

Specify the zip code of the property. |

|

Is this your primary place of residence ? |

Indicates whether the specified property is the primary place of residence. |

- Click Continue to update the property information. The Funding Information section is displayed.

Funding Information

This section displays the total fees that are applicable on the loan application, the total cost which is the sum of the property purchase price and the fees, as well as any amount that needs to be contributed by you which is the difference between the amount of loan you have requested and the total cost.

You can click on  or the Modify option to edit either the property purchase price or the amount of loan you are requesting if the contribution amount is not suitable to you. Once the values displayed are suitable, click on Accept and Continue to proceed to the next step in the application.

or the Modify option to edit either the property purchase price or the amount of loan you are requesting if the contribution amount is not suitable to you. Once the values displayed are suitable, click on Accept and Continue to proceed to the next step in the application.

Funding Information

|

Field Name |

Description |

|---|---|

|

Property Purchase Price |

The purchase price of the property as defined by you in the previous section. |

|

Requested Loan Amount |

Loan amount requested by you to purchase the property in the requirements section. |

|

Total Fees |

It is the total fees to be paid for loan processing. |

|

Lenders Mortgage Insurance |

It is the insurance amount applicable against the mortgage loan. |

|

Total Cost |

Total cost of the loan that is property purchase price + total fees + lenders mortgage insurance. |

|

Your Contribution |

The amount to be contributed by you towards the purchase of the property. This amount is the difference between the total costs to purchase the property and the requested loan amount. |

- Click Accept to agree with the contribution amount displayed.

OR

Click Modify if you wish to get the contribution amount modified. You will need to modify the requested loan amount and/or property purchase price for the contribution amount to change. - Click

to save the modified loan details.

to save the modified loan details.

- Click Continue. The Primary Information section is displayed.

Primary Information

In the primary Information screen enter the appropriate information like, salutation, first name, last name, date of birth, citizenship, etc.

Primary Information

|

Field Name |

Description |

|---|---|

|

Salutation |

Your salutation as captured in the applicant information section. The options are:

|

|

First Name |

Your first name as entered in the Applicant Information section is displayed. You can update this value if you wish to. |

|

Middle Name |

Enter your middle name here. If you have already entered your middle name in the Applicant Information section, it will be displayed here. You can update this value if you wish to. |

|

Last Name |

Your last name as entered in the Applicant Information section is displayed. You can update this value if you wish to. |

|

Date of Birth |

Enter your date of birth. |

|

Gender |

Specify your gender. |

|

Marital Status |

Select your marital status from the list. The options are:

|

|

Number of Dependents |

Specify number of people dependent on you. |

|

Country of Citizenship |

Select the country of which you are a citizen. |

|

Permanent Resident |

You are required to identify whether you are a permanent resident. |

|

Country of Residence |

This field is enabled only if you have identified that you are not a permanent resident by selecting No in the Permanent Resident field. In this case, you are required to identify the country in which you reside. |

- Click Continue . The Proof of Identity section is displayed.

Proof of Identity

In the proof of identity section enter the identity details such as, identity type, ID number, and expiry date.

Proof of Identity

|

Field Name |

Description |

|---|---|

|

Identity |

|

|

Type of Identification |

The identification amount that you want to provide as proof of identity. The identification type could be:

|

|

ID Number |

Enter Identification number corresponding to the identification type. |

|

Expiration Date |

Enter the date on which your identification document will expire. This date can be found printed on your identification document. The system will validate if the expiration date has passed or if it is a valid date i.e. not one that is too ahead in the future (the number of years will be defined by the bank) and will display an appropriate error message. In this case, you can either modify the expiration date or select a different ID to submit as proof of identity, one that has a valid expiration date. |

- Click Continue to save the identification information. The Contact Information section is displayed.

Contact Information

In the contact information section enter the contact details including your email address, phone number and current residential address.

You will be required to enter details of your previous residence if you have stayed at your current residence for less than the amount of time required. This amount of time is defined by the bank in terms of years.

Contact Information (Current and Previous Residential Address)

|

Field Name |

Description |

|---|---|

|

Residential Address |

|

|

Country |

Enter the country name in which you reside. |

|

Address 1-2 |

Enter your Address details. |

|

City |

Enter the name of the city in which you reside. |

|

State |

Select the state from the list. |

|

Zip Code |

Enter your Zip code. |

|

Staying Since |

Date since which you have been residing at the current address. If you identify a date that is less than the minimum amount of time required for you to have resided in the current residence, the system will display fields in which you can specify you previous residence address. |

|

Accommodation Type |

The type of accommodation in which you reside. The accommodation types are:

|

|

Previous Residential Address |

|

|

Country |

Select the country where you resided previously. |

|

Address Line 1-2 |

Enter address details of your previous residence. |

|

City |

The city in which you resided previously. |

|

State |

The state in which you resided previously. |

|

Zip Code |

Enter the zip code where you resided previously. |

|

Accommodation Type |

The type of accommodation in which you resided previously. The accommodation types are:

|

|

|

|

|

|

Enter your email address. |

|

Please confirm your email ID |

Re-enter your email ID to confirm the same. |

|

Phone Number |

|

|

Phone Type |

Select the phone number type that you want to define as primary contact number. The options are:

|

|

Primary Phone Number |

Enter your phone number corresponding to the selected phone type. |

|

Add an alternate phone number |

You can select Yes if you want to add an alternate phone number. It is not mandatory to add an alternate phone number. |

|

Phone Type |

Type of phone number that is being added as an alternate number. The options are:

This field is displayed if you select Yes in the Add an alternate phone number field. |

|

Alternate Phone Number |

Alternate phone other than primary phone number. Phone number corresponding to the selected alternate phone type. |

|

Default as that of Primary Applicant (Co-Applicant) |

Indicates whether address details of co-applicant is same as primary applicant. This field appears if you Yes in the Is there a co-applicant field in the loan requirement screen. |

Landlord Information

The section appears if you select Rented or Leased option in the Accommodation Type list.

Contact Information (Landlord Details)

|

Field Name |

Description |

|---|---|

|

Landlord's Full Name |

Specify full name of the landlord. |

|

Country |

Select the country name where the landlord resides. |

|

Address Line 1-2 |

Specify address details of the landlord. |

|

City |

Specify the city name where the landlord resides. |

|

State |

Select the state name where the landlord resides. |

|

Zip Code |

Specify the zip code where the landlord resides. |

|

Mobile Number |

Specify the mobile number of the landlord. |

- Click Continue to save the contact information. The Employment Information section is displayed.

Employment Information

In this section enter details of your employment over a defined period starting with your current primary employment. The details required are type of employment, employment status, date on which specific employment was started and if you are salaried or self-employed, the company or employer name. If the amount of time at which you have been employed in your current employment is less than the required amount, the system will display fields in which you can enter details of previous employment.

Employment Information

|

Field Name |

Description |

|---|---|

|

Employment Type |

The type of your current primary employment. The types are:

|

|

Employment Status |

The status of your employment. The options in this field will depend on your selection as employment type. The options are:

|

|

Employer Name |

The name of the company or firm in which you are employed. |

|

Start Date |

Enter the date on which you started at current employment. |

|

Designation |

Enter your designation with the current employer. |

|

Gross Annual Salary |

Enter your gross annual salary with the current employer. |

|

Country |

Select the country in which you are currently employed. |

|

Address Line 1-2 |

Enter your employer’s address. |

|

City |

Enter the city in which you are currently employed. |

|

State |

Select the state name where you are currently employed. |

|

Zip Code |

Specify the zip code of the location where you are currently employed. |

- Click Add to update the employment information.

OR

You can lick to edit the employment information.

to edit the employment information. - Click

to add more than one employment information.

to add more than one employment information.

OR

Click Continue to proceed with the application process.

- The Financial Profile screen appears with Income, Expense, Asset, and Liability sections.

Financial Profile

- Enter the appropriate details in the relevant sections.

Income Information

In this section enter details of all income that you want to be considered to be the basis on which you will repay the loan. You can add multiple records of income up to a defined limit. Click the  icon to add additional income records and the

icon to add additional income records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Income |

|

|

Income Type |

The source of your primary income. Examples of source of income can be rental income, salary, etc. |

|

Gross Income |

Gross amount of income earned. |

|

Net Income |

Net amount of income. The net income field will be defaulted with the gross income amount entered and can be changed. |

|

Frequency |

The frequency at which you earn the particular income. Examples of income frequency can be Monthly, Yearly, etc. |

- Click Save to update the income details.

- Click Continue to proceed with the expense details section.

OR

Click to add another income record.

to add another income record.

Expense Information

In this section enter details of all expenses you incur on a regular basis. You can add multiple expense records up to a defined limit. Click the  icon to add additional expense records and the

icon to add additional expense records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Expense |

|

|

Type of Expense |

The type of expense. Example - household, school fees, etc. |

|

Total Expense Value |

The total value of expenditure against the specific type identified. |

|

Frequency of Expense |

The frequency at which you incur the specific expense. By default the value Monthly will be selected and can be changed. |

- Click Save to update the expense details.

- Click Continue to proceed with the asset details section.

OR

Click to add another expense record.

to add another expense record.

Asset Information

In this section enter details of all assets owned by you. You can add multiple asset records up to a defined limit. Click the  icon to add additional asset records and the

icon to add additional asset records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Assets |

|

|

Type of Asset |

Type of asset owned by you. Examples of assets are – Home, Savings account with bank, etc. |

|

Value |

The market value of the asset. |

- Click Save .

- Click Continue to proceed with the liability details section.

OR

Click to add another asset record.

to add another asset record.

Liability Information

In this section enter details of all your liabilities. You can add multiple records up to a defined limit. Click the  icon to add additional records and the

icon to add additional records and the ![]() icon against a specific record to delete it.

icon against a specific record to delete it.

|

Field Name |

Description |

|---|---|

|

Primary Liability |

|

|

Type of Liability |

Select the type of liability you want to define. The liability type could be, home loan, personal loan, credit card, and others. |

|

Original Value |

Identify the original value of the liability. |

|

Outstanding Value ($) |

Enter the current outstanding value of the liability. |

- Click Save.

OR

Click to add another liability record.

to add another liability record. - Once the asset, liability, income, and expense details are entered click Continue.

- Click Continue to proceed with the application process.

This section displays all the product offers applicable to you. You can select any one offer that best suits your needs.

- Select a suitable offer.

- Click .

- Click Review and Submit. The review screen is displayed.

It will display all the information you have entered in the application. You can verify that all the information provided by you is correct and make any changes if required.

- Click

against any section if you wish to edit any information that is part of that section.

against any section if you wish to edit any information that is part of that section. - Once the details are edited click Continue.

- The review and submit screen appears. Click Submit.

- The screen confirming application submission will be displayed which will contain the application reference number, decision outcome and any additional steps that might need to be undertaken by you or the bank.

The confirmation page is displayed once you have submitted your application. This page displays the current status of the application along with details of any further steps that might be required to be taken. The application reference number, by which you can track the status of your application, is also displayed on this page. Additionally, the options to register (if you are a new customer and have not yet registered with the bank) and to track the application are also provided on this page.

- If you are not a registered channel user, you will have an option to register yourself for channel access. Click Register.

OR

Click Go to Homepage to navigate to the product showcase. - Click Track your Application to track your submitted application. For more information on the application tracker view the Application Tracker section.

Register Applicant

|

Field Name |

Description |

|---|---|

|

Define Login Credentials |

Enter the email ID with which you would like to register. |

|

|

Enter the email ID with which you would like to register. |

|

Confirm Email |

To confirm the email ID re-enter the email ID entered in the Email field. |

|

Verify |

Click on this link to verify the email ID entered. A unique security code will be sent to the email address defined and a pop up window will be opened in which you can verify the email ID by entering the security code in the specified field. |

|

Password |

Enter a password to be used for the purpose of registration. You will be required to enter this password when you log-in to the system in the future. |

|

Confirm Password |

To confirm the password re-enter the password entered in the Password field. |

|

Set Security Questions |

|

|

Skip set up of security questions? |

Through this option, you can opt to skip setting up security questions at the time or registration. The options are:

By default the option No will be selected and the security question and answer fields will be displayed. If you select the option Yes, identifying that you wish to skip set up of security questions, the security question and answer fields will be disabled and hidden. |

|

Security Question |

Select a question to be assigned as a security question. The security questions will be numbered, e.g. Security Question 1, Security Question 2 and so on. The number of security questions and answers available will be dependent on the number configured by the bank administrator. |

|

Answer |

Specify an answer for the selected security question. The fields in which you can specify answers to selected security questions will be displayed below each security question and will be numbered, e.g. Answer 1, Answer 2 and so on. |

|

Terms and Conditions |

|

|

I have read, fully understood and agreed with the terms and conditions |

Select this checkbox to acknowledge agreement to the terms and conditions of registration for online banking access. |

|

Terms and Conditions Link |

Click this link to view the terms and conditions. |

To register

- In the Email field, enter the email address.

- To confirm enter the email ID in the Confirm Email field.

- Click link to verify the entered email address.

- In the Verification Code field, enter the verification code sent on the defined email ID.

- Click , if the code is not received.

- Click . The successful email verification message is displayed.

- In the Password field, enter the password required for log-in.

- To confirm enter the password in the Confirm Password field.

- From the security question list, select a question to be added in your security question set.

- In the answer field, enter an answer for the selected security question.

- If you do not want to set security questions currently, select the option Yes against the Skip set up of security questions field.

- Click the Terms and Conditions link to view the terms and conditions.

- Select the Terms and Conditions check box to acknowledge agreement to the terms and conditions.

- Click Register/Submit Application to register. The button to register will be termed Register if registration is non mandatory and the user has navigated to the registration screen from the confirm screen. If registration is mandatory, this screen will be displayed once the user has filled out the application form and is proceeding to submit it, hence the button will be Submit Application.

OR

Click Cancel Application to cancel the application.

OR

Click Return to Application

|

Field Name |

Description |

|---|---|

|

Verification Code |

Enter the security code sent to the email ID you have defined in the registration screen. |

- Click Submit to submit the verification code. On successful verification, a message stating that verification has been completed successfully will be displayed.

OR

Click Resend Code if you wish for the system to send you a different security code.

OR

Click Cancel to cancel the close the screen and return to the registration screen.

Register Applicant Confirmation

|

Field Name |

Description |

|---|---|

|

|

Specify the email ID of the co-applicant for registration. This field will be displayed only if the co-applicant involved in the application is not registered with the bank. |

- Click Send Link to send the registration link to the co-applicant.

OR

Click Track Application to navigate to the application tracker and view the application status.

OR

Click Go to Homepage to navigate to the product showcase.

The option to cancel is provided throughout the application and you can opt to cancel the application at any step.

To cancel an application

- Click Cancel. The cancel application screen is displayed. You will be able to select a reason for which you are cancelling the application.

- Click Cancel and Exit. The application is cancelled.

Cancel Application

|

Field Name |

Description |

|---|---|

|

Reason for Cancelling |

Indicate the reason for which you are cancelling the application. This is an optional step. The cancellation reason could be:

|

|

Please Specify |

This field is displayed if you have selected the option Others as Reason for Cancelling. Specify the reason for which you are cancelling the application. |

- Select the appropriate reason for which you are cancelling the application.

- Click to cancel and exit the application. Application has been cancelled message is displayed.

OR

Click to view the loan application.

- Click to navigate to the product showcase screen.

There are two scenarios in this case:

- If the applicant is a registered user and he/she is already logged in then the applicant will get a confirmation page indicating submission saved successfully.

- If the applicant is a new user i.e. who is not registered for channel access, then he/she will be required to register while saving the application. The following steps are involved in the process of saving an application in this scenario.

All saved applications will be available in the app tracker under the In Draft tab. You can select any application to resume the application submission process.

To save an application

- Click . The Save and Complete Later screen is displayed.

Save and Complete Later

|

Field Name |

Description |

|---|---|

|

|

Enter the email ID with which you would like to register. |

|

Confirm Email |

To confirm the email ID re-enter the email ID entered in the Email field. |

|

Verify |

Click on this link to verify the email ID entered. A unique security code will be sent to the email address defined and a pop up window will be opened in which you can verify the email ID by entering the security code in the specified field. Refer the Verify sub section under section Register User for further information on verification. |

|

Password |

Enter a password to be used for the purpose of registration. You will be required to enter this password when you login to the system in the future. |

|

Confirm Password |

To confirm the password re-enter the password entered in the Password field. |

|

Set Security Questions |

|

|

Skip set up of security questions? |

Through this option, you can opt to skip setting up security questions at the time or registration. The options are:

By default the option No will be selected and the security question and answer fields will be displayed. If you select the option Yes, identifying that you wish to skip set up of security questions, the security question and answer fields will be disabled and hidden. |

|

Security Question |

Select a question to be assigned as a security question. The security questions will be numbered, e.g. Security Question 1, Security Question 2 and so on. The number of security questions and answers available will be dependent on the number configured by the bank administrator. |

|

Answer |

Specify an answer for the selected security question. The fields in which you can specify answers to selected security questions will be displayed below each security question and will be numbered, e.g. Answer 1, Answer 2 and so on. |

|

Terms and Conditions |

|

|

I have read, fully understood and agreed with the terms and conditions |

Select this checkbox to acknowledge agreement to the terms and conditions of registration for online banking access. |

|

Terms and Conditions Link |

Click this link to view the terms and conditions. |

The following steps are applicable for cases wherein the applicant is not a registered user.

- In the Email field, enter the email address.

- To confirm enter the email ID in the Confirm Email field.

- Click link to verify the entered email address.

- In the Verification Code field, enter the verification code sent on the registered email ID.

- Click , if the code is not received.

- Click . A message stating that the email ID has been verified successfully is displayed.

- In the Password field, enter the password required for log-in.

- To confirm enter the password in the Confirm Password field.

- From the Security Question list, select a question to be added in your security question set.

- In the answer field, enter an answer for the selected security question.

- If you do not want to set security questions currently, select the option Yes against the Skip set up of security questions field.

- Click the Terms and Conditions link to view the terms and conditions.

- Select the Terms and Conditions check box to acknowledge agreement to the terms and conditions.

- Click .

OR

Click to close the save and complete later screen.

OR

Click to navigate to the application screen.

|

Field Name |

Description |

|---|---|

|

|

Specify the email ID of the co-applicant for registration. This field will be displayed only if the co-applicant involved in the application is not registered with the bank. |

- Click Send Link to send registration link to the co-applicant.

OR

Click Track Application to navigate to application tracker to view the applications status.

OR

Click Go To Homepage to navigate to the product showcase.

Existing User

An application form for an existing user will differ from that of one being initiated by a new/unregistered user. If you are applying for a In principle approval loan as an existing user, once you login to the system after having entered your login credentials, the application form will be displayed with all your personal details pre-populated in the respective fields and sections. You will, hence, be required to only specify details pertaining to the loan. The sections that will be pre-populated with your information are Primary Information, Proof of Identity, Contact Information, Employment Information and Financial Information including Income, Expenses, Assets and Liabilities.

The Application Tracker enables you to view the progress of submitted applications and also to retrieve and complete applications that have been saved. Through the application tracker you can perform the following actions:

- View submitted application: The application tracker enables you to view details of submitted applications which includes viewing status history, application summary and term sheet document.

- View application in draft: While filling out an application form, if you opt to save the application instead of submitting it, the application is saved in the application tracker as an ‘In Draft application’. You can select any of the applications available under this tab in order to complete and submit that application.

To track an application

- Click Track Application on the dashboard. The Login screen is displayed.

- Enter the registered email ID and password, click .

- The Application Tracker screen is displayed. By default the submitted application view is displayed.

Submitted Application

|

Field Name |

Description |

|---|---|

|

Loan Offer Name |

The name of the offer for which the application has been made. |

|

Application ID |

The application reference number as generated by the bank at the time the application was submitted. |

|

Progress Bar |

The current status of the application will be displayed graphically with the help of a progress bar. |

|

Loan Amount |

The requested loan amount. |

|

Applicant Name |

The names of both the primary and co-applicant will be displayed here. If no co-applicant has been added, only the primary applicant’s name will be displayed. |

|

Submitted On |

The date on which the application was submitted. |

|

Status |

The current status of the application. |

- Select the application card.

- The Application Details screen is displayed with options to view additional details of the application and pending tasks, if any.

|

Field Name |

Description |

|---|---|

|

Loan Offer Name |

The name of the offer for which the application has been made. |

|

Application ID |

The application reference number as generated by the bank at the time the application was submitted. |

|

Progress Bar |

The current status of the application will be displayed graphically with the help of a progress bar. |

|

Loan Amount |

The requested loan amount. |

|

Applicant Name |

The names of both the primary and co-applicant will be displayed here. If no co-applicant has been added, only the primary applicant’s name will be displayed. |

|

Submitted On |

The date on which the application was submitted. |

|

Tenure |

The term of the loan. |

- Click any section heading to view details or to take required action on the application.

Application Summary

|

Field Name |

Description |

|---|---|

|

Application Summary |

|

|

Applicant Name |

The names of the applicants will be displayed here. |

|

Purpose |

The purpose for which the loan was applied. |

|

Requested Amount |

The amount for which the loan is applied. |

|

Approved Amount |

Loan amount approved by the bank including the fees, and other costs. |

|

Tenure |

Loan repayment tenure. |

|

Loan Date |

Loan application date. |

Status History

This section displays the status history of the loan application i.e. the various stages through which the loan application has gone along with the current status.

|

Field Name |

Description |

|---|---|

|

Status History |

|

|

State |

The status of the application. |

|

Remarks |

Displays the remarks, if any. |

|

Acted By |

The User ID of the person that updated the status of the application. |

|

Updated On |

The date on which the specific status was updated. |

Offer / Term Sheet

As part of this section, there will be term sheet available for the applicant to view and download.

|

Field Name |

Description |

|---|---|

|

Term Sheet |

Displays the generated term sheet for In Principle Approval application. |

- Click

to download the term sheet document.

to download the term sheet document.

FAQs

![]() I am an existing customer of the bank but do not have channel access, how can I proceed?

I am an existing customer of the bank but do not have channel access, how can I proceed?

![]() Can I proceed with the application if I am not an existing channel user?

Can I proceed with the application if I am not an existing channel user?

![]() Why am I required to specify whether I am a first time home buyer or not, in the application?

Why am I required to specify whether I am a first time home buyer or not, in the application?

![]() Why am I asked to capture previous residential address details?

Why am I asked to capture previous residential address details?

![]() Why am I being asked to capture previous employment details?

Why am I being asked to capture previous employment details?

![]() Can the co-applicant perform all the pending tasks in the application tracker?

Can the co-applicant perform all the pending tasks in the application tracker?