ACCOUNT NICKNAME

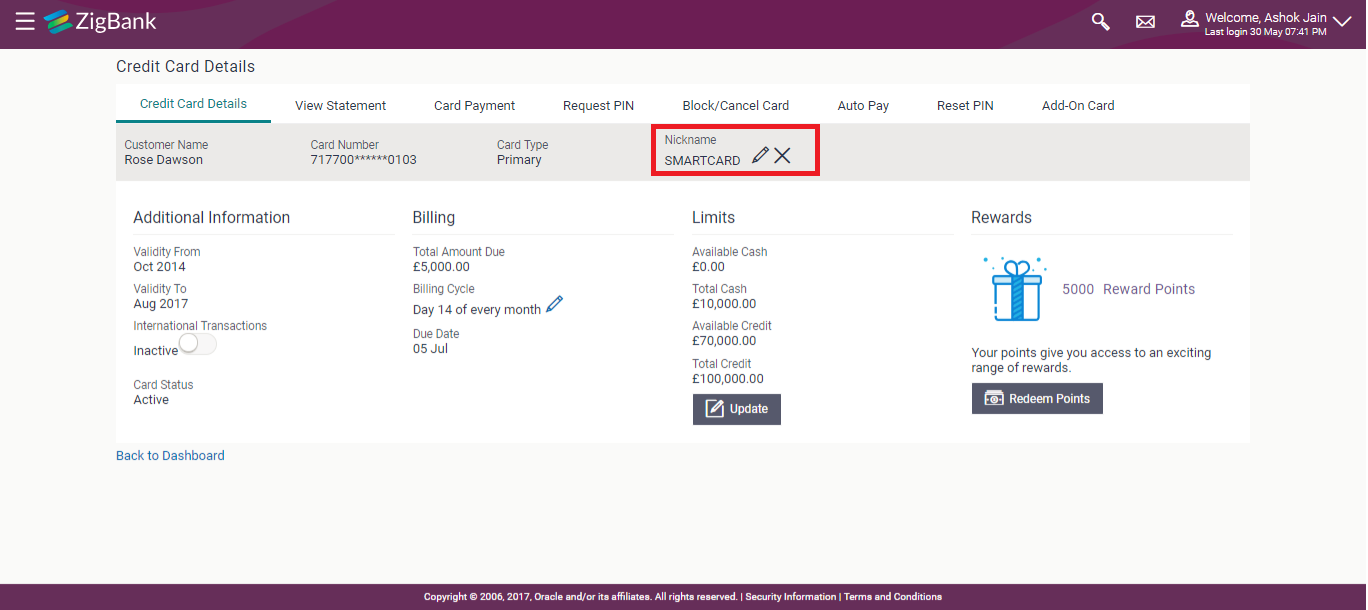

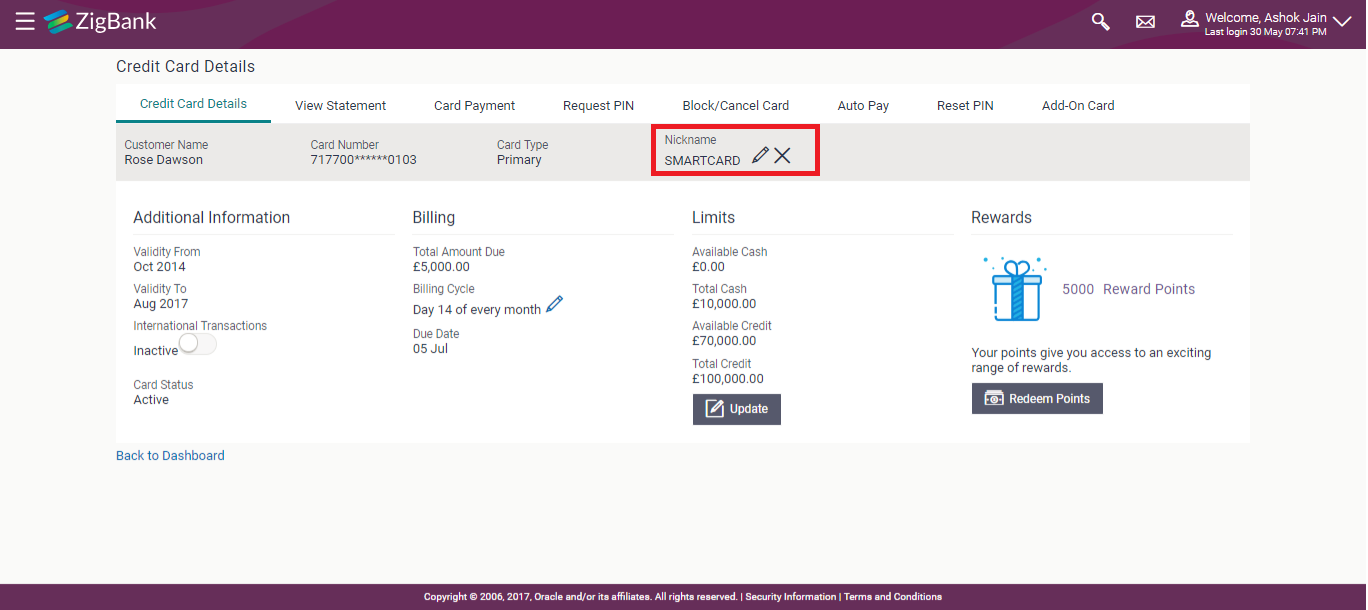

Users can assign their own description or name to all of their credit cards. User’s nickname is the unique ID. Nicknames will be displayed on various transactions instead of the standard account description. This option also allows user to modify or delete the nickname whenever required.

To add nickname to account:

- Click

, to add nickname to an account.

, to add nickname to an account.

- In the ADD Nickname field , enter the nickname you want to use.

Field Description

Field Description

|

Field Name

|

Description

|

|

Add Nickname

|

On clicking on the Add Nickname link, a field is displayed in which the user can specify a nickname to be assigned to the account.

|

- Click

to save your changes.

to save your changes.

The specified nickname will be displayed on various transaction screens.

To edit / delete nickname to account:

- Click

link displayed against the nickname in order to modify the nickname.

Modify the nickname as required and save your updates.

link displayed against the nickname in order to modify the nickname.

Modify the nickname as required and save your updates.

OR

Click  to delete nickname.

to delete nickname.

FAQs

What is the advantage of adding a nickname to an account?

What is the advantage of adding a nickname to an account?

You can personalize your account by giving it a nickname. This way you will be able to easily identify it when viewing card summary.

How can I check my credit card account balance?

How can I check my credit card account balance?

The credit card details page displays a summary of your current account status, including outstanding balance, available credit limit and information as to when your next payment is due.

The bill / Statement indicate 'Minimum Amount Due' and 'Total Amount Due'. What is the amount required to be paid by me?

The bill / Statement indicate 'Minimum Amount Due' and 'Total Amount Due'. What is the amount required to be paid by me?

The amount indicated as ‘Total Amount Due’ is required to be paid by the ‘payment due’ date. In case this is not done, interest will be charged on the outstanding balance and on any new transaction undertaken from the date of the transaction till such time that the past dues are paid in full.

In case the ‘Minimum Amount Due’ is paid, no late payment fee will be charged. However, interest will be charged on the balance outstanding amount due after the due date for payment. Interest will also be levied on all cash advances from the date of the transaction until the date of payment

.

What is a Credit Limit?

What is a Credit Limit?

The 'Credit limit' is the maximum amount that a user can spend/borrow on a single credit card. This limit is defined by the bank/financial institution based on the user’s credit rating and history.

What is a Cash Limit?

What is a Cash Limit?

The cash limit of a credit card is the maximum amount of money that can be withdrawn using the credit card.

Can I update the limits applicable on an Add-On credit card?

Can I update the limits applicable on an Add-On credit card?

Yes, you can update both the cash and credit limits of an Add-On card. However, the limits of an Add-On card cannot exceed the respective limits of the primary card to which it is linked.

What is the impact on the billing cycle of an Add-On card when the billing cycle of the primary card, to which it is linked, is changed?

What is the impact on the billing cycle of an Add-On card when the billing cycle of the primary card, to which it is linked, is changed?

When the billing cycle of a primary card is changed, the same billing cycle will be applicable on all linked Add-On cards as well.

Is the bank required to manually accept a request for change in billing cycle or does it get automatically approved?

Is the bank required to manually accept a request for change in billing cycle or does it get automatically approved?

Depending on the bank’s configuration, manual acceptance by the bank might be required or it could be a straight through process where in the billing cycle gets changed automatically when a request to change is initiated by the user.

If I suspect someone has stolen my credit card or used it to make a fraudulent purchase, what should I do?

If I suspect someone has stolen my credit card or used it to make a fraudulent purchase, what should I do?

You should block the card immediately from your online banking portal. If you do not have access to the online application you should call up at the bank's call centre and inform the bank to block the card immediately.

What happens to Add-On cards linked to a primary card if the primary card is blocked??

What happens to Add-On cards linked to a primary card if the primary card is blocked??

The status of the Add-On cards, linked to a primary card that is blocked, remains active. The card holders can continue to transact using the Add-On cards.

Will the bank cancel a credit card if the card holder requests bank to do so??

Will the bank cancel a credit card if the card holder requests bank to do so??

Yes. The bank cancels the credit card on request, provided that the outstanding amount, if any, is settled/ paid.

Where can I view details of all cancelled, blocked and deactivated credit cards?

Where can I view details of all cancelled, blocked and deactivated credit cards?

You can view the details of all cards that have been cancelled, blocked or deactivate in the Inactive Cards page by selecting the View All option available in the Inactive Cards widget on the Credit Cards dashboard.

What is Auto Pay’ and what is the difference between auto pay and scheduled payments??

What is Auto Pay’ and what is the difference between auto pay and scheduled payments??

Auto Pay or automatic payment is a request initiated by a user instructing the bank to make regular credit card bill payments via automatic direct debit from a specified savings or checking account. The difference between auto pay and scheduled payments is that once a user sets up an auto pay instruction with the bank, he need not manually make payments towards credit card bill payment. The bank will automatically debit the selected account for the credit card bill amount (depending on instruction which could be to pay the minimum due or the total amount due) subject to availability of funds in the account. If an auto pay instruction is not made, the user will be required to make scheduled manual payments towards credit card bill payment.

I made a mistake while setting the auto pay instruction for my credit card. Can I update the same??

I made a mistake while setting the auto pay instruction for my credit card. Can I update the same??

You can update the auto pay instruction of a credit card if it has been accepted by the bank. If the request is still in process, you cannot update the instruction.

How do I view the transactions undertaken by the Add-On card holder??

How do I view the transactions undertaken by the Add-On card holder??

The description of each transaction record displays details of the transaction as well as the card name and number using which the transaction was performed. Based on the name and number, you can identify which transaction was initiated by the primary card and which was initiated by the Add-On card.

How does the bank keep the card holder informed of the transactions initiated using the credit card issued?

How does the bank keep the card holder informed of the transactions initiated using the credit card issued?

Banks sends a monthly statement to all card holders giving details of the transactions made using the card and the amount required to be paid to settle any dues.

, to add nickname to an account.

, to add nickname to an account. to save your changes.

to save your changes.

link displayed against the nickname in order to modify the nickname.

Modify the nickname as required and save your updates.

link displayed against the nickname in order to modify the nickname.

Modify the nickname as required and save your updates.

to delete nickname.

to delete nickname.![]() What is the advantage of adding a nickname to an account?

What is the advantage of adding a nickname to an account?

![]() How can I check my credit card account balance?

How can I check my credit card account balance?

![]() Can I update the limits applicable on an Add-On credit card?

Can I update the limits applicable on an Add-On credit card?

![]() What happens to Add-On cards linked to a primary card if the primary card is blocked??

What happens to Add-On cards linked to a primary card if the primary card is blocked??

![]() Will the bank cancel a credit card if the card holder requests bank to do so??

Will the bank cancel a credit card if the card holder requests bank to do so??

![]() Where can I view details of all cancelled, blocked and deactivated credit cards?

Where can I view details of all cancelled, blocked and deactivated credit cards?

![]() What is Auto Pay’ and what is the difference between auto pay and scheduled payments??

What is Auto Pay’ and what is the difference between auto pay and scheduled payments??

![]() I made a mistake while setting the auto pay instruction for my credit card. Can I update the same??

I made a mistake while setting the auto pay instruction for my credit card. Can I update the same??

![]() How do I view the transactions undertaken by the Add-On card holder??

How do I view the transactions undertaken by the Add-On card holder??