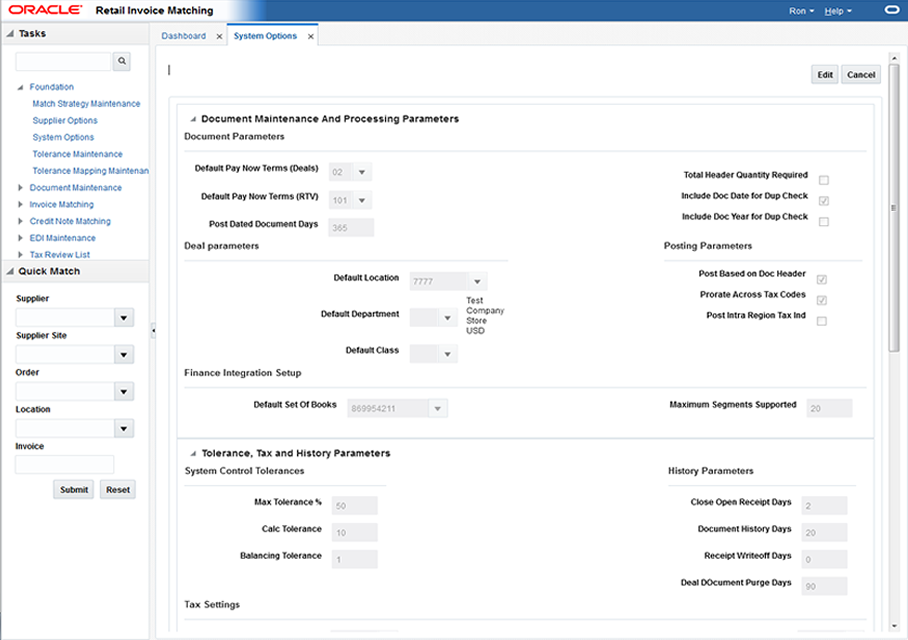

1 Manage System Options

In the System Options window, you can define system-wide parameters that affect the functions of Oracle Retail Invoice Matching. You indicate how long the system maintains various documents, and you can enter the unique codes that ReIM uses to identify document types.

Updated settings are available for all users who log on after the changes are made. To see the changes reflected in Oracle Retail Invoice Matching, you must log out and log in again.

This section includes the following system options instructions:

Navigate: From the Tasks menu, select Foundation > System Options. The System Options window opens.

Perform the following procedure to make changes to the ReIM system parameters

-

On the upper part of the screen, click Edit to enable the editable fields.

-

Once you have completed your system options updates, click Save and Close. If you want to save changes but continue to make additional changes, click Save.

Note:

Changes are available to users who log in after you have completed the changes. To see the changes reflected, you must log out and log in again.

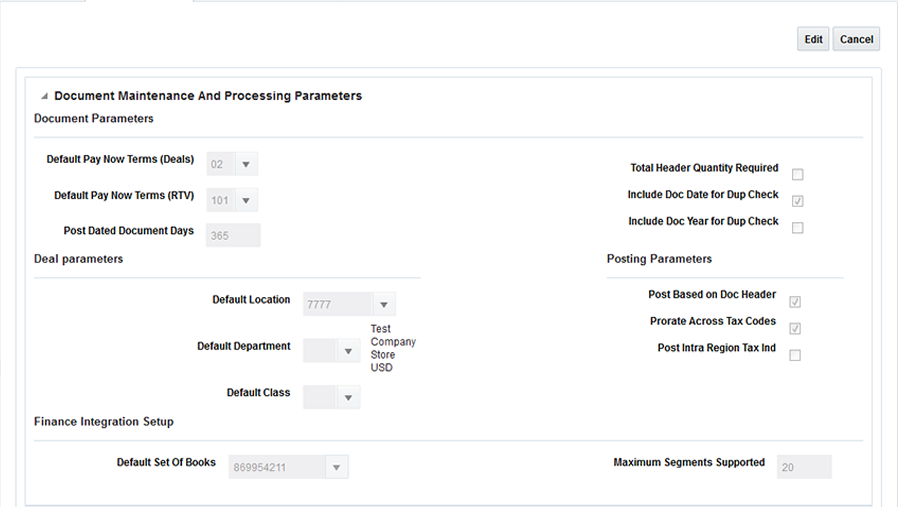

Document Maintenance and Processing Parameters

Table 1-1 Document Maintenance And Processing Parameters System Options

| Field | Description |

|---|---|

|

Default Pay Now Terms (Deals) |

This column holds the term id that is defaulted on deal documents. In the document creation dialog, this term, its discount percentage, and due days are defaulted onto new deal documents. |

|

Default Pay Now Terms (RTV) |

This column holds the term id that is defaulted on RTVs and resulting documents. In the document creation dialog, this term, and its discount percentage and due days are defaulted onto RTVs and resolution documents. |

|

Post Dated Document Days |

How many days old a document can be when entered into the system. For example, if set to 180 then a document older than six months cannot be entered via EDI or online entry. |

|

Total Header Quantity Required |

Is header quantity required when creating a merchandise invoice. |

|

Include Doc Date for Dup Check |

Indicates whether the document date should be included in the uniqueness check. If this setting is checked, 'Include Doc Year for Dup Check' must be unchecked. |

|

Include Doc Year for Dup Check |

Indicates whether the document year should be included in the uniqueness check. If this setting is checked, 'Include Doc Date for Dup Check' must be unchecked |

|

Default Location |

Default system location, used by non merch document injection. |

|

Default Department |

Default system department, used by deal processing. |

|

Default Class |

Default system class, used by deal processing. |

|

Post Based on Doc Header |

Should posting be done based on the document header rather a than the accumulated total of the details. |

|

Prorate Across Tax Codes |

Should tax posting entries be prorated across tax codes. |

|

Post Intra Region Tax Ind |

This Indicator is applicable on documents where supplier's and location's vat region are different. When set to ON, posting will post the taxes applicable on the item on location's VAT region as it would if supplier's and locations VAT region were the same. When set to OFF, posting would post the Zero taxes on the document (as is functionality). |

|

Default Set Of Books |

Default set of books. |

|

Maximum Segments Supported |

Maximum number of supported G/L accounting segments. |

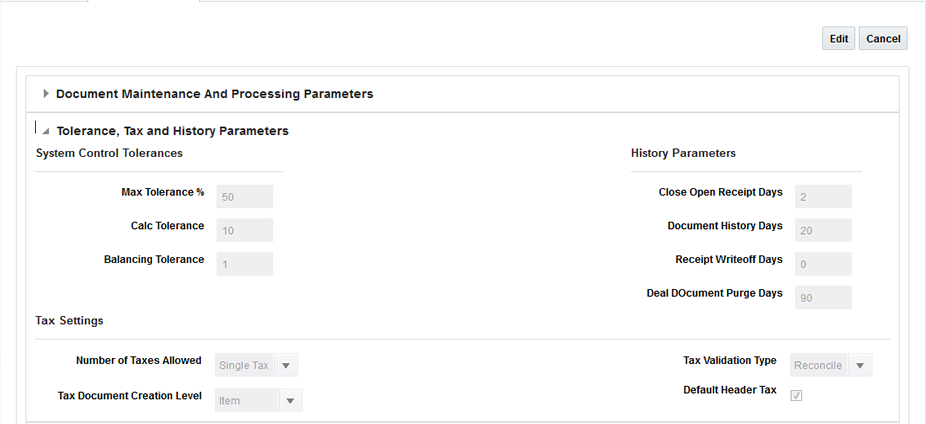

Tolerance, Tax, and History Parameters

Table 1-2 Tolerance, Tax and History Parameters System Options

| Field | Description |

|---|---|

|

Max Tolerance % |

Defines the largest percent tolerance that can be used within the system |

|

Calc Tolerance |

Calculation tolerance value. This is used to allow documents to be loaded to the system even if they have small rounding differences between the accumulated details and the document header. It is also used to allow for small rounding differences for taxes. |

|

Balancing Tolerance |

Tolerance setting for adjusting detail lines to align vat amount for balancing posting entries. |

|

Close Open Receipt Days |

This column holds the number of days that a shipment can remain in ready formatch status before it is automatically closed by ReIM. |

|

Document History Days |

Defines the number of days document history will be held before purging (for documents that have been fully processed) |

|

Receipt Writeoff Days |

Number of days to keep receipts before purging. |

|

Deal Document Purge Days |

Number of days to keep posted deals |

|

Number of Taxes Allowed |

Number of supported taxes per item. Valid values include 'Single Tax', or 'No Tax'. |

|

Tax Document Creation Level |

Tax document creation level; used to define of level at which rejection due to incorrect tax. Valid values include 'Item' or 'Full Invoice'. |

|

Tax Validation Type |

Type of tax validation. Valid values include 'Reconcile', 'Retailer', or 'Vendor'. |

|

Default Header Tax |

Should header taxes be defaulted from detail taxes |

|

Delay Line Matching |

Checking this indicator means Detail (or line level) matching will not occur until after the routing date is passed. If left unchecked, line matching will be attempted each time automatch is run (assuming the match strategy calls for it) but discrepancies are not generated (or auto resolved) until after the routing date has passed. |

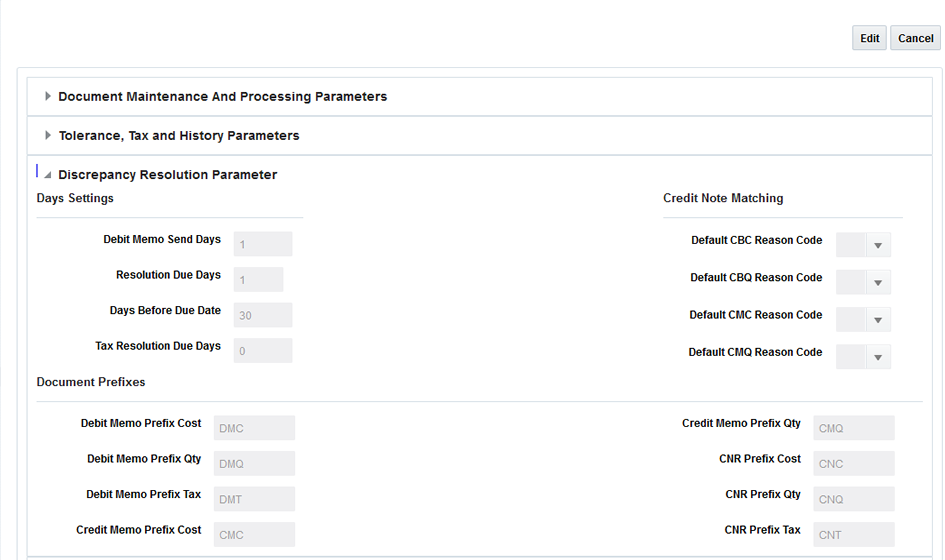

Discrepancy Resolution Parameters

Table 1-3 Discrepancy Resolution Parameter System Options

| Field | Description |

|---|---|

|

Debit Memo Send Days |

Describes number of days prior to the due date of an invoice that a debit memo should be sent if the credit note is late. |

|

Resolution Due Days |

Cost and Quantity discrepancy resolution due days. Used in calculation of resolve by date. This column holds the number of days that a cost resolution can stay outstanding from when it was routed for review to when it should be resolved. |

|

Days Before Due Date |

This parameter will indicate the maximum number of days before the invoice due date that any discrepancies for that invoice should be routed. |

|

Tax Resolution Due Days |

Tax discrepancy resolution due days. Used in calculation of tax discrepancy resolve by date. This column holds the number of days that a tax resolution can stay outstanding from when it was routed for review to when it should be resolved. |

|

Default Overbill Reason Code |

Default reason code for overbill cost. |

|

Default Overbill Reason Code |

Default reason code for overbill quantity. |

|

Default Underbill Reason Code |

Default reason code for underbill cost. |

|

Default Underbill Reason Code |

Default reason code for underbill quantity. |

|

Debit Memo Prefix Cost |

Document prefix for generated Debit memo cost |

|

Debit Memo Prefix Qty |

Document prefix for generated Debit memo qty |

|

Debit Memo Prefix Tax |

Document prefix for generated Debit memo tax |

|

Credit Memo Prefix Cost |

Document prefix for generated Credit memo cost |

|

Credit Memo Prefix Qty |

Document prefix for generated Credit memo qty |

|

CNR Prefix Cost |

Document prefix for generated Credit note cost |

|

CNR Prefix Qty |

Document prefix for generated Credit note qty |

|

CNR Prefix Tax |

Document prefix for generated Credit note tax |

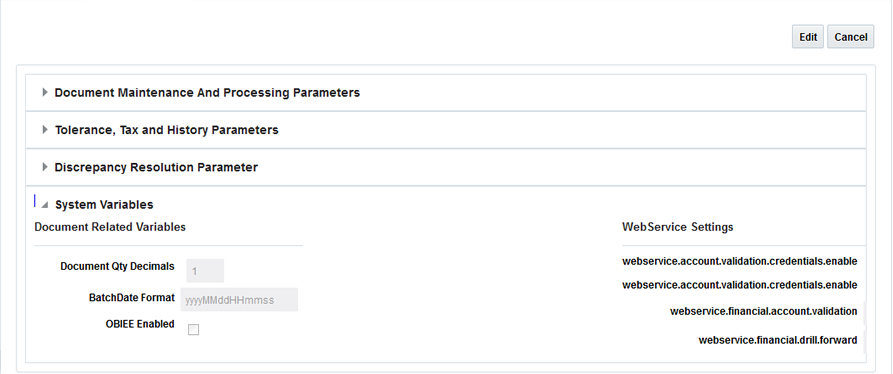

System Variables

Table 1-4 System Variables System Options

| Field | Description |

|---|---|

|

Document Qty Decimals |

Max number of digits allowed for quantity. Both display as well as accepting data |

|

BatchDate Format |

Expected data format for Injector batch |

|

OBIEE Enabled |

|

|

webservice.account.validation.credentials.enable |

provider URL for account validation |

|

webservice.account.validation.credentials.enable |

Enable validation of webservice account credentials. Should be secure |

|

webservice.financial.account.validation |

provider URL for drill forward |

|

webservice.financial.drill.forward |

Enable validation of webservice account credentials. Should be secure |

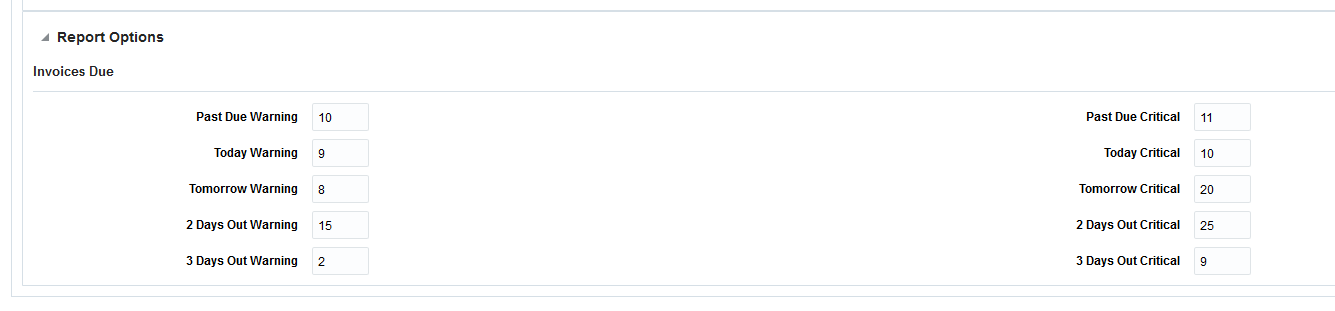

Report Options

Report Options indicate the number of unmatched invoices considered to display either a warning or a critical error in the Invoices Due tiles.

Table 1-5 System Variables Report Options

| Field | Description |

|---|---|

|

Past Due Warning |

The Past Due Warning option defines the number of past due invoices necessary for the Past Due tile to appear yellow (indicating a warning) on the dashboard. This value must be less than or equal to the Invoices Due - Past Due Critical System parameter. |

|

Past Due Critical |

The Past Due Critical option defines the number of past due invoices necessary for the Past Due tile to appear red (indicating a critical level of invoices are past due) on the dashboard. This value must be greater than or equal to the Invoices Due - Past Due Warning System parameter. |

|

Today Warning |

The Today Warning option defines the number of invoices due necessary for the Today tile to appear yellow (indicating a warning) on the dashboard. This value must be less than or equal to the Invoices Due - Today Critical System parameter. |

|

Today Critical |

The Today Critical option defines the number of invoices due necessary for the Today tile to appear red (indicating a critical level of invoices are due today) on the dash board. This value must be greater than or equal to the Invoices Due - Today Warning System parameter. |

|

Tomorrow Warning |

The Tomorrow Warning option defines the number of invoices due necessary for the Tomorrow tile to appear yellow (indicating a warning) on the dashboard. This value must be less than or equal to the Invoices Due - Tomorrow Critical System parameter. |

|

Tomorrow Critical |

The Tomorrow Critical option defines the number of invoices due necessary for the Tomorrow tile to appear red (indicating a critical level of invoices are due today). This value must be greater than or equal to the Invoices Due - Tomorrow Warning System parameter. |

|

2 Days Out Warning |

The 2 Days Out Warning option defines the number of invoices due necessary for the 2 Days Out tile to appear yellow (indicating a warning) on the dashboard. This value must be less than or equal to the Invoices Due - 2 Days Out Critical System parameter. |

|

2 Days Out Critical |

The 2 Days Out Critical option defines the number of invoices due necessary for the 2 Days Out tile to appear red (indicating a critical level of invoices are due today). This value must be greater than or equal to the Invoices Due - 2 Days Out Warning System parameter. |

|

3 Days Out Warning |

The 3 Days Out Warning option defines the number of invoices due necessary for the 3 Days Out tile to appear yellow (indicating a warning) on the dashboard. This value must be less than or equal to the Invoices Due - 3 Days Out Critical System parameter. |

|

3 Days Out Critical |

The 3 Days Out Critical option defines the number of invoices due necessary for the 3 Days Out tile to appear red (indicating a critical level of invoices are due today). This value must be greater than or equal to the Invoices Due - 3 Days Out Warning System parameter. |