Stored Value Card Authorization Reversal

Overview: When you process a cancellation associated with a stored value card payment or deactivate a stored value card payment, the system reimburses the original authorization amount to the stored value card.

In addition, if the Perform Authorization Reversal during Deposit Processing (J20) system control value is selected, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference; see Authorization Reversal Process During Deposits.

Stored value cards authorized through the external payment service: You can use a periodic function to submit stored value card reversal requests for stored value card pay types associated with the External Payment Service. See Stored Value Card Reversal Function for details.

In this chapter:

• Stored Value Card Authorization Reversal Process

- What Happens When the Authorization Reversal is Approved?

- What Happens When the Authorization Reversal is Declined?

• Authorization Reversal Process During Deposits

• Stored Value Card Reversal with the External Payment Service

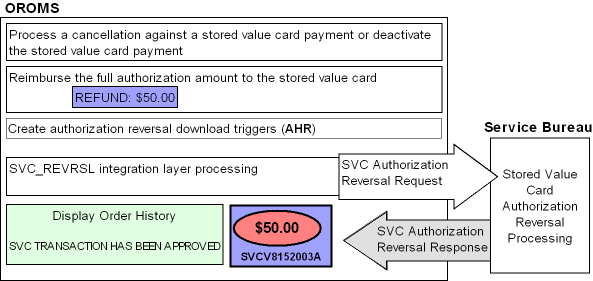

Stored Value Card Authorization Reversal Process

Purpose: The system reimburses a stored value card the original authorization amount associated with the card when you process a cancellation associated with a stored value card payment or deactivate the stored value card.

Note: If the Perform Authorization Reversal during Deposit Processing (J20) system control value is selected, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference; see Authorization Reversal Process During Deposits.

Stored Value Card Authorization Reversal Process:

1. |

You process a cancellation associated with a stored value card payment or deactivate the stored value card. You can process a cancellation by: • Selecting Cancel for an order line or selecting Cancel to cancel the entire order in order maintenance. • Selecting Void All/Cancel Order to void the pick slip and cancel the order at the Reprint/Void Pick Slips by Order Screen. • Selecting Cancel Group to cancel a group of order lines based on the cancellation date or item in the Working with Backorders Pending Cancellation (WBPC) menu option. • Processing soldout cancellations by submitting the job using the Processing Auto Soldout Cancellations (MASO) menu option or by selecting Sell Out for an order line in order maintenance. • Submitting a job to cancel orders flagged for cancellation due to credit card decline using the Working with Credit Card Cancellations (WCCC) menu option. • Submitting a job to cancel order lines for a given item and adding a substitute item to each order using the Processing Item Substitutions (PSUB) menu option. • Cancelling an order line or order on the web storefront using the Maintenance E-Commerce Process. You can deactivate a stored value card payment by selecting Deactivate for a stored value card payment at the Enter Payment Method Screen. PayPal reversals: The PayPal Direct Connection Integration supports processing a reversal only for the entire authorization amount, such as when the entire order is canceled or the only item on the order is sold out, or the payment method is deactivated before there has been any activity. Processing a reversal for individual lines or partial lines is not supported. |

2. |

The system determines if the order is eligible for stored value card authorization reversal. For an order to be eligible for stored value card authorization reversal, the order must: • contain a stored value card payment method that is associated with a cancellation or deactivation. Stored value card payments have a Pay category of Credit Card and a Card type of Stored Value. • have an open, unused authorization remaining for the stored value card. An open, unused authorization is an authorization that is: • in an A (authorized) or O (authorized, but not used) status • not associated with an outstanding pick slip for the order • not partially confirmed or deposited. Also, a reversal is not submitted when any lines on the order are submitted to Order Broker for fulfillment. Multiple payment methods: If the order contains one or more stored value card and/or credit card payments, the system performs authorization reversal for each eligible payment method. Authorizations in sent status: When you process a cancellation or deactivate a stored value card payment and the authorization is in an S (sent, but not received) status, the system does NOT create a SVC authorization reversal for the payment even if you later receive an approved authorization response. Expired authorizations: If the original authorization for an order is expired and the order received a new authorization during pick slip generation, the system will create an authorization reversal against the expired authorization when you process deposits. However, the service bureau will reject this authorization reversal since they have already expired the authorization and reimbursed the stored value card. Note: When the Send reversal flag is not selected for the authorization service, the system does not create an authorization reversal trigger record, described below, unless the reversal is created because the stored value card payment method is deactivated. PayPal reversals: Since the PayPal Direct Connection Integration supports processing a reversal only for the entire authorization amount, the following examples do not apply to PayPal. |

Example 1: The following transactions are applied against a stored value card payment on an order.

Order Activity |

Result |

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 46.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 36.31. |

You cancel the order in order maintenance. |

The system creates a stored value card authorization reversal for $10.00. Once the authorization reversal is processed, the balance on the stored value card is updated to 46.31. |

Example 2: The following transactions are applied against a stored value card payment on an order.

Order Activity |

Result |

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 46.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 36.31. |

You cancel an order line in order maintenance for 4.00. |

The system creates a stored value card authorization reversal for $10.00. Once the authorization reversal is processed, the balance on the stored value card is updated to 46.31. The remaining items on the order will be resent to the service bureau for authorization during pick slip generation. Note: The PayPal Direct Connection Integration does not support sending a reversal for cancellation of an individual order line if there are additional items on the order. |

Example 3: The following transactions are applied against a stored value card payment on an order.

Order Activity |

Result |

You enter an order and pay for the order with a stored value card payment. The balance on the stored value card is 40.31. The order amount is 10.00. You send the stored value card for authorization using online authorization. |

The system authorizes the stored value card for $10.00. The balance on the stored value card is 30.31. |

You generate a pick slip for an order line on the order for 6.00. |

The balance on the stored value card remains at 30.31. |

You cancel the remaining order line in order maintenance for 4.00. |

The system does not create an authorization reversal. The balance on the stored value card remains at 30.31. |

You ship and bill the order line for 6.00. |

The system updates the deposit amount for the authorization on the Authorization History Details screen to 6.00. The balance on the stored value card remains at 30.31. |

You deposit the order line for 6.00. |

The system creates a deposit record for 6.00 and updates the status of the authorization to voided. The balance on the stored value card is updated to 34.31. |

3. |

The system creates an authorization reversal for the original authorization amount, not the actual amount of the reversal. |

4. |

The system creates a record in the Auth History SVC Reversal table for the authorization amount to reimburse. |

Auth History SVC Reversal table:

Field |

Description |

Company |

The company where you processed the stored value card authorization reversal. |

Order # |

The order number associated with the stored value card authorization reversal. |

OPM Seq # |

The order payment method sequence number associated with the stored value card payment. |

AUH Seq # |

The authorization history sequence number associated with the stored value card payment. |

Seq# |

The Auth History SVC Reversal sequence number. |

Creation date |

The date, in CYYMMDD format, the stored value card authorization reversal was created. |

Creation time |

The time, in HHMMSS format, the stored value card authorization reversal was created. |

Approval date |

The date, in CYYMMDD format, the stored value card authorization reversal was approved by the service bureau. |

Approval time |

The time, in HHMMSS format, the stored value card authorization reversal was approved by the service bureau. |

Reversal amount |

The amount to reimburse to the stored value card. In the case of PayPal, this is the original authorization amount. |

Response |

The response received from the service bureau, indicating if the authorization reversal was approved or declined. |

5. |

The system creates an authorization reversal download trigger for the stored value card authorization reversal. You can view all download triggers in the IL Outbound Trigger table at the Work with Outbound Interface Transactions screen. Each authorization reversal download trigger in the IL Outbound Trigger table contains a: • File code: indicating the type of information to download and which IL process job processes the trigger. For authorization reversal download triggers, the File code is AHR. • Key: indicating the specific record to download. For AHR download triggers, the Key identifies the specific company, order number, order payment method sequence number, authorization sequence number, and authorization reversal sequence number in the SVC Authorization Reversal table. For example, the Key 55500006794001001001 indicates the authorization reversal information is located in company 555 for order number 6794, order payment method sequence number 001, authorization sequence number 001, and authorization reversal sequence number 001. • Capture type: indicating the type of activity performed against the record. AHR download triggers are always capture type A indicating the authorization reversal was created. |

6. |

Looks at the Authorization service field defined for the stored value card payment to determine the service bureau used to process the authorization reversal. Note: When the Send reversal flag is not selected for the authorization service, the system does not create an authorization reversal trigger record unless the reversal is created because the stored value card payment method is deactivated. |

7. |

The system looks for unprocessed AHR download triggers to process, based on the setting of the Use Activation / Reversal Batch Processing (I50) system control value. • If this system control value is selected, the system does not process the stored value card trigger records until you submit the batch process using the Transmitting Activation and Reversal Transactions (SSVC) menu option or the SVCREV periodic function (program name PFR0077). • If this system control value is unselected, the SVC Activation and SVC Reversal integration layer jobs monitor for stored value card download trigger records to process at defined intervals, based on the Outbound delay time. The system: • looks for AHR download triggers with the File code AHR and a status of ready (R). • determines which stored value card authorization reversal to download, based on the Key field for the authorization reversal download trigger. |

8. |

For each authorization reversal download trigger, the system generates a Stored Value Card Authorization Reversal Request. |

9. |

The system looks at the Communication type field for the service bureau to determine how transactions are processed between Order Management System and the service bureau. • Integration Layer = The system sends authorization reversal transactions to the service bureau using the queues defined for the authorization reversal integration layer job. • Payment Link = Point-to-point integration. The system sends authorization reversal transactions to the service bureau using a point-to-point integration. You must define communication settings in Working with Customer Properties (PROP). The system does not use an integration layer job to communicate with the service bureau; however, the system uses the job to process authorization reversal triggers. Note: This option is available for the Customer Engagement Stored Value Card Integration. See Processing Authorization Reversals Using Payment Link Communication. |

|

Processing Authorization Reversals Using Payment Link Communication If the Communication type field for the service bureau is Payment Link: • Order Management System sends the authorization reversal request in the format of the other system. If you are using the Customer Engagement Stored Value Card Integration, the system sends the Customer Engagement Release Auth Request to the Oracle Retail Customer Engagement system. • The service bureau receives the Authorization Reversal Request, processes the authorization reversal, and sends a response back to Order Management System. If you are using the Customer Engagement Stored Value Card Integration, the system receives the authorization reversal response from Oracle Retail Customer Engagement in the Customer Engagement Release Auth Response message. |

10. |

Order Management System processes the authorization reversal response accordingly. See: • What Happens When the Authorization Reversal is Approved? • What Happens When the Authorization Reversal is Declined? • When Communication Failures Occur Also, see Stored Value Card Reversal Function for information on processing reversals through the External Payment Service. Note: Stored value card authorization reversal responses contain a Response code and Response date, but may not contain an Authorization code. In this case, if the Response code is 100, the system updates the Authorization code with a dummy authorization number so that the authorization reversal is approved. |

What Happens When the Authorization Reversal is Approved?

An authorization reversal is approved if the Authorization Reversal Response message contains an authorization number. In this case, the system:

• updates the associated record in the Integration Process Control table to CMP complete (if the Communication type field for the service bureau is Integration Layer).

• updates the associated record in the SVC Authorization Reversal table with the approval date, approval time, and reversal response.

• creates an order transaction history message indicating the authorization reversal was approved: Reversal Has Been Approved.

• voids the authorization history record.

Note: If the stored value card authorization reversal response contains an amount, the system ignores the amount sent back and continues to use the amount from the Auth History SVC Reversal table.

You can review the stored value card authorization reversal at the Display Authorization Reversals Screen. The approved reversal will have a Response and an Approval date and time.

What Happens When the Authorization Reversal is Declined?

An authorization reversal receives a declined reversal if the Authorization Reversal Response Message does not contain an authorization number. In this case, the system creates an order transaction history message indicating the authorization reversal was declined: Reversal Has Been Rejected.

You can review the declined stored value card authorization reversal at the Display Authorization Reversals Screen. The declined reversal will have a blank Response, Approval date and time. You cannot resend a SVC authorization reversal request to the service bureau.

Note:

• Except for the order transaction history message, there is no other indication that the stored value card authorization reversal request was declined.

• Because the cancellation or deactivation amount was not reimbursed to the stored value card, the customer will not be able to use that amount on future purchases paid for against the stored value card.

• The response received from the service bureau does not display in the Response field on the Display Authorization Reversals Screen unless it is set up as a vendor response for the service bureau in Work with Authorization Services (WASV).

When Communication Failures Occur

Communication failures can occur if the SVC_REVRSL job is inactive, the connection between Order Management System and the service bureau is down, or the system times out before a response is received. If communication failures occur and you do not receive a response from the service bureau, the system:

• updates the associated record in the Integration Process Control table to FLD error (if the Communication type field for the service bureau is Integration Layer).

• does not update the associated record in the SVC Authorization Reversal table.

• does not create an order transaction history message.

You cannot resend a stored value card authorization reversal request to the service bureau.

Authorization Reversal Process During Deposits

Purpose: If the Perform Authorization Reversal during Deposit Processing (J20) system control value is selected, when you process deposits and the deposit amount is less than the original authorization amount, the system reimburses the stored value card the difference.

1. |

You process a deposit for an amount that is less than the original authorization amount. |

2. |

The system looks at the Communication type field for the service bureau to determine how transactions are processed between Order Management System and the service bureau. • Integration Layer = The system sends authorization reversal transactions during deposits to the service bureau using the queues defined for an integration layer job. • Payment Link = Point-to-point integration. The system sends authorization reversal transactions during deposits to the service bureau using a point-to-point integration. You must define communication settings in Working with Customer Properties (PROP). The system does not use the integration layer job to communicate with the service bureau; however, the system uses the job to process authorization reversal triggers. Note: This option is available for the Customer Engagement Stored Value Card Integration and this integration does not allow authorization reversals during deposits. See Process Authorization Reversals During Deposits using Payment Link Communication. |

|

Process Authorization Reversals During Deposits using Payment Link Communication If the Communication type field for the service bureau is Payment Link: • Order Management System uses the settings in Working with Customer Properties (PROP) to send the deposit request directly to the service bureau in the format of the other system. • The service bureau receives the deposit request, processes the deposit, and sends a response back to Order Management System. |

3. |

When a deposit response is received, Order Management System: • compares the merchantReference value in the deposit response against the Alpha order # field in the CC Deposit Transaction table to match a received deposit with a sent deposit record. When a match is found, the system updates the Credit Card Deposit Transaction table with the values in the deposit response message. • updates the status of the Integration Layer Process Control record to CMP complete (if the Communication type field for the service bureau is Integration Layer). • updates the Credit Card Deposit History table. • completes auto deposit processing. |

Examples:

Original authorization amount is equal to deposit amount |

||

Stored Value Card Activity |

SCV J20 selected |

SCV J20 unselected |

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

53.49 |

53.49 |

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

41.99 |

41.99 |

You ship the order and bill the order. The invoice amount is 11.50. You process deposits. The deposit amount (11.50) equals the original authorization amount (11.50). Deposit amount: |

11.50 |

11.50 |

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

41.99 |

41.99 |

Note: The following example does not apply to PayPal reversals.

Original authorization amount is greater than deposit amount |

||

Stored Value Card Activity |

SCV J20 selected |

SCV J20 unselected |

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

88.49 |

88.49 |

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

76.99 |

76.99 |

You void one of the items from the pick slip. You partial ship the remaining items on the pick slip and bill the order for the shipment amount. The invoice amount is 6.25. You process deposits. The original authorization amount is greater than the deposit amount. Deposit amount: Reversal amount: |

6.25 5.25 |

6.25 blank |

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

82.24 |

76.99 |

Note: The following example does not apply to PayPal reversals.

Original authorization amount is less than deposit amount |

||

Stored Value Card Activity |

SCV J20 selected |

SCV J20 unselected |

Before placing an order, you inquire on the remaining balance for a stored value card. Stored value card balance: |

82.24 |

82.24 |

You pay for the order using the stored value card as payment. The order total is 11.50. You authorize the stored value card and generate a pick slip for the order. Authorization amount: |

11.50 |

11.50 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

70.74 |

70.74 |

You add an item to the order for 5.25. You authorize the stored value card and generate a pick slip for the added item. Authorization amount: |

5.25 |

5.25 |

After the stored value card is authorized, you inquire on the remaining balance for the stored value card. Stored value card balance: |

65.49 |

65.49 |

You ship the entire order and bill the order for the shipment amount. The invoice amount is 16.75. You process deposits. Deposit amount: |

16.75 |

16.75 |

Once the deposit is processed, you inquire on the remaining balance on the stored value card. Stored value card balance: |

65.49 |

65.49 |

Stored Value Card Reversal with the External Payment Service

When you use the External Payment Service for stored value cards, you can use a periodic function, described below, to submit stored value card reversal requests for closed or canceled orders.

REVXAHP (Program name = PFREVXAHP): Reverse Partial Auth for External Payment Service: Generates SVC reversal request messages for the external payment service within the specified company, provided that:

• A company is specified.

• The parameter specified for the function is a valid stored value card pay type code for the company.

• The pay type is assigned to an authorization service configured as the external payment service.

Selecting authorization history records for reversal: The function generates the reversal request for an order if:

• The payment method matches the parameter specified for the periodic process.

• The pay type on the authorization history record does not match the Default Auth Code for CC Netting (M25) system control value.

• The order header status is closed or canceled.

• There is an authorization record in open (O) or authorized (A) status.

• The deposit amount on the order is less than the authorization amount. Also:

- Invoice payment method records? There are no invoice payment method records for the specified pay type, or

- Pending deposits? If there are any invoice payment method records, there are no outstanding deposits for the invoice payment method for the pay type. The function determines that there are no outstanding deposits if there is an actual deposit created date (as opposed to a deposit created date of 9999999), or the Suppress Deposit flag is set to Y.

Processing and updates: For stored value card payment methods that meet the criteria, the function:

• Determines the reversal amount to submit in the request by subtracting the deposit amount from the authorization amount.

• Sends the authorization reversal request. The request includes the stored value card number, PIN, transaction ID, and reversal amount.

• Sets the Authorization History record to void (V) status.

• Creates a Stored Value Card Authorization Reversal record. You can review this record at the Display Authorization Reversals Screen.

• Performs all additional existing processes and updates related to authorization reversal based on whether the request is successful or fails. See Stored Value Card Authorization Reversal for an overview of the authorization reversal process.

Note: The above process takes place regardless of whether the Send Reversal flag for the authorization service is selected.

Possible errors: The function may write the following errors in the APP.log if it cannot run:

"Error in parameters for Periodic Function REVXAHP. Pay Type must be associated with an External Authorization Service.");

"Error in parameters for Periodic Function REVXAHP. Pay Type must have card type S.");

"Error in parameters for Periodic Function REVXAHP. Pay Type must be a credit card.");

"Error in setup for Periodic Function REVXAHP. PayType is invalid. Please correct and retry.");

"Error in parameters for Periodic Function REVXAHP. Parameter Format: 2 digit Pay Type. Please correct and retry.");

"Error in parameters to Periodic Function REVXAHP. The parameter was not numeric.");

"Error in parameters for Periodic Function REVXAHP No parameters were passed - job ended without performing any updates.");