10. Collateral Management

Centralized Asset Management or Collateral Management System (CMS) enables the user to record a new collateral, evaluate it, and re-evaluate the existing collateral.

A Collateral Management System is used to minimize the frauds which involve the same collateral being pledged for different Lease and re-evaluating existing collateral manually or connecting to the VIN Interface.

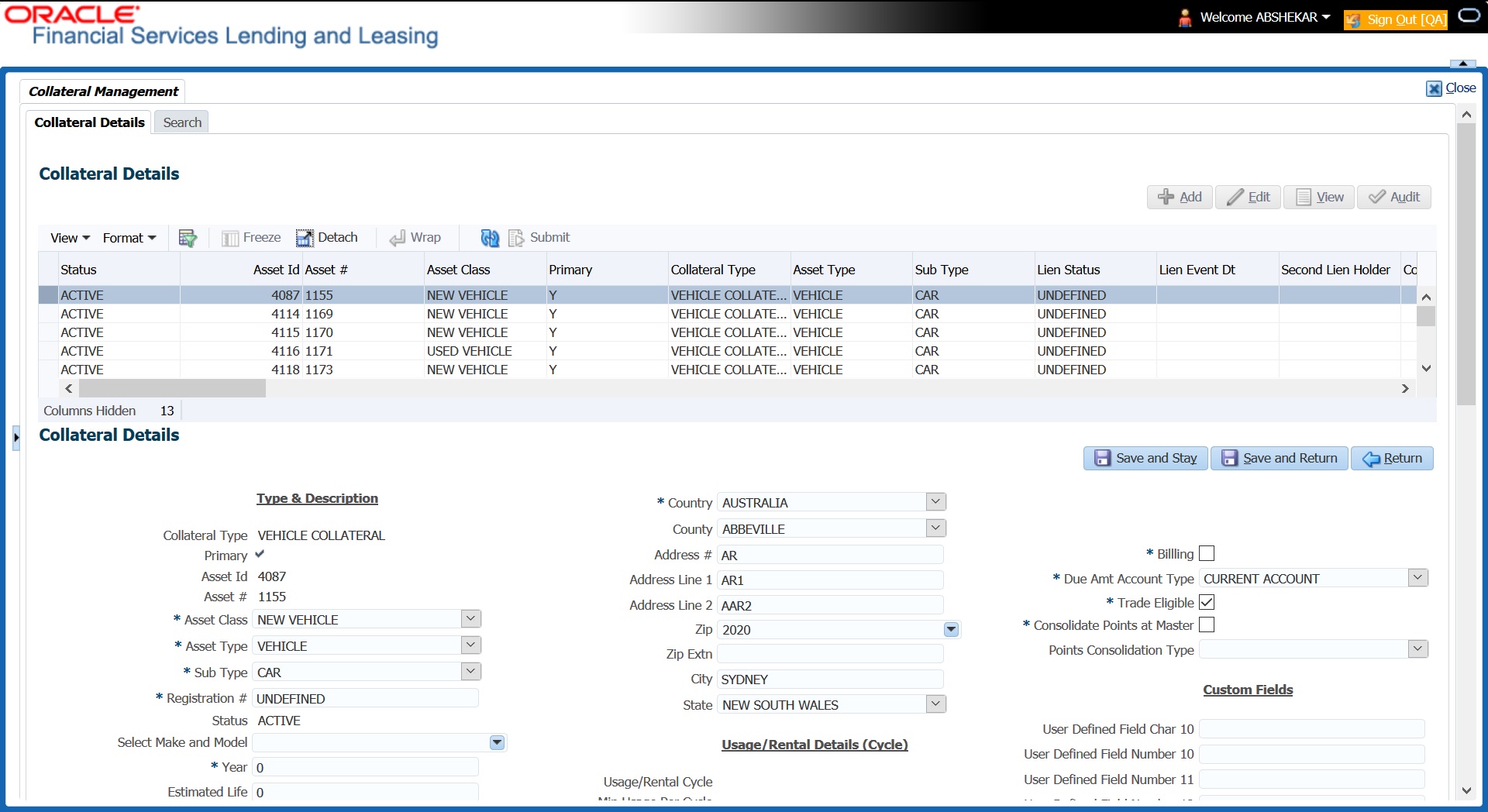

The Collateral Details screen is opened from the Servicing > Servicing > Collateral Management and contains the following tab:

- Collateral

- Search

10.1 Collateral Tab

Using the Collateral screen, you can record a new collateral, view the valuation of collateral, and re-evaluate the existing collateral.

The collateral details can also be defined in the collateral screen of Application Entry screen.

Note

If you are working on Usage or Rental based type of leased collaterals, then additional options are available in the Collateral Management screen to define the asset usage details and additional sub tabs such as Usage Summary and Usage/Rental Charge Matrix sub tabs are available. For detailed information on the same, refer to Customer Service screen’s Collateral tab section.

Collateral tab displays the usage / rental history of an asset which is linked to all accounts including the currently mapped account. This can be identified in Asset Relation tab, and usage of the asset can be viewed in Usage Summary tab.

The system assigns collateral statuses and the following are the statuses:

- Undefined- When the collateral is created for the first time.

- New- When an undefined collateral/ asset gets validated, its status is changed to New. This collateral can only be used for Substitution in Servicing.

- Inactive- When an asset/collateral from ‘Released, Sold or Inventory’ status is attached to application, it becomes Inactive.

- Active- When the application gets funded, inactive collateral gets associated with the account in Servicing and gets activated. The status of the collateral then becomes 'Active'.

- Released- The Lease collateral can move to "Released" when the collateral is no more attached to any account.

- Substituted- When collateral with the status active is replaced with different collateral, the active status is changed to substituted.

To enter the Collateral Details

- On the application master screen, click Servicing > Servicing > Collateral Management > Collateral Details.

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Type and Description section |

|

Collateral Type |

Select the collateral type. |

Primary |

Select the check box if this property is the primary collateral. |

Asset ID |

View the asset identification number. |

Asset # |

View the asset number which is automatically generated. |

Asset Class |

Select the asset Class. |

Asset Type |

Select the asset type. |

Sub Type |

Select the asset sub type. |

Registration # |

Enter the vehicle registration number. |

Status |

View the vehicle status. |

Select Make and Model |

Select the Make and Model number of asset from the drop down list. You can use the search option to select the details. |

Year |

Specify the year of the vehicle. |

Estimated Life |

Specify the estimated life of the asset. |

Make |

Specify the make of the vehicle. |

Model |

Specify the model of the vehicle. |

Identification # |

Specify the vehicle identification number. |

Body |

Specify the body of the vehicle. |

Description |

Specify the description of the asset. |

Condition |

Select the condition of the asset from drop-down list. |

Lien Details |

|

Lien Status |

Select the type of Lien action. |

Lien Event Dt |

Select the lien event date from the calendar. |

Second Lien Holder |

Specify the name of second lien holder. |

Comments |

Specify additional details if any. |

Lien Release Entity |

Select the lien release entity from the drop-down list. The list displays the following values: - Customer - Producer - Others - Business Note: If ‘Others’ is selected as the Lien Release Entity, ensure that the Entity Name and Address details are updated correctly since the same is not auto-validated with the data maintained in the system. |

Entity Name |

If you have selected the lien release entity as ‘Customer’ or ‘Producer’, system automatically filters entity name list with corresponding customer accounts or producer. Similarly, if the lien release entity is selected as ‘Business’ system displays the Business name if the asset is linked to Business account. Select the required entity name from the drop-down list. If you have selected the lien release entity as ‘Others’ specify the entity name. |

Address section |

|

Country |

Select the country. |

County |

Select the county. |

Address # |

Specify the address number. |

Address Line 1 |

Specify the first address line. |

Address Line 2 |

Specify the second address line. |

Zip |

Select the zip code. |

Zip Extn |

Specify the zip extension. |

City |

Specify the city. |

State |

Select the state. |

Usage / Rental Details (Cycle) The below Usage / Rental sections are displayed only if the current Collateral is either of type VEHICLE or HOUSEHOLD GOODS AND OTHER COLLATERAL and the billing is based on Lease Usage or Rental type. For more information on how OFSLL handles Usage based leasing, refer to Appendix - Usage Based Leasing chapter and for Rental based leasing, refer to ‘Rental Agreement’ section in Application Entry chapter. |

|

Usage / Rental Cycle |

Select the frequency of billing the asset from the drop-down list and click on ‘Load Details’ button. If details are maintained for the selected billing frequency in Setup > Products > Asset Types > Usage/Rental Details screen, the same is auto populated and can be modified in this screen. |

Min Usage per cycle |

View/specify the minimum usage value of the allowed range. |

Max Usage per cycle |

View/specify the maximum usage value of the allowed range. |

Base Rental Amount |

View the calculated Base Rental Amount populated from Rental Agreement tab. This field is applicable for Rental/Usage Rental agreement type. |

Security Deposit |

View the security deposit amount paid upfront for the term. This field is applicable for Rental/Usage Rental agreement type. |

Discount % |

View/specify the percentage of discount exempted from final billing. |

Discount Amount |

View the flat discount amount allowed upfront from the final billing. This field is applicable for Rental/Usage Rental agreement type. |

Usage Rollover/ Advance |

View/select the type of asset usage calculation as one of the following: - ROLLOVER (remaining usage balance is carried forward to next cycle) - NO-ROLLOVER (remaining usage balance is not carried forward) - ROLLOVER AND ADVANCE (remaining usage balance is carried forward to next cycle + total usage limit for current cycle can be utilized upfront) - ADVANCE (total usage limit for current cycle can be utilized upfront) Note: For Rental based lease agreement, only non rollover usage method is applicable. |

Reset Frequency |

View/specify the reset frequency of the billing cycle. This field is enabled only for ROLLOVER type of asset usage billing. |

Elastic Term Calc Method |

View the system predicted term remaining to reach the asset usage life which is calculated by one of the following methods as per current usage pattern. - ACTUAL - here the current details updated/received is treated as the final record for usage term calculation. - AVERAGE - here the average of usage details received in previous cycles are considered for usage term calculation. |

Excess Rent Collection Method |

If you have selected the Agreement Type as USAGE RENTAL, view the Charge Matrix selected as one of the following type to derive the Excess Rent Collection Method: - USING USAGE MATRIX - USING RENTAL MATRIX |

Usage / Rental Calculation |

|

Calc Method |

View/select the calculation method as one of the following from the drop-down list. - TIERED (billing is based on the defined Usage/Rental Charge Matrix). This is the default value for Rental/Usage Rental agreement type. - NON-TIERED (system automatically chooses the applicable slab based on the final usage value) |

Usage / Rental Receipt |

|

Usage / Rental Details |

View/select the Usage / Rental details as one of the following from the drop-down list. - INCREMENTAL (Details updated/received is considered as incremental record and is updated as new record in Servicing > Collateral > Usage History section without modifying existing record) - ACTUAL (Details updated/received is considered as latest record and is updated in Servicing > Collateral > Usage History section with Active/ current status as ‘Y’). This is the default value for Rental/Usage Rental agreement type. |

Usage Details The details maintained in this section is used to calculate ‘EXCESS USAGE FEE’ in payoff quote and termination transactions. |

|

Start |

View/specify the start unit of asset usage. |

Base |

View/specify the base units. |

Extra |

View/specify the extra usage units. |

Total |

View/specify the total usage units. |

Vacation Ownership Details |

|

Billling |

Check this box to indicate if the asset is considered for billing. |

Due Amt Account Type |

Select one of the following account type from the drop-down list to indicate on which account this asset is to be considered for billing. - Current Account - Linked Account - Master Account Note: If ‘Billing’ option is checked and the Due Amt Account Type is selected as Current/Linked/Master Account, then the billing batch job posts the transactions based on Asset Billing Rate setup in Current account / Linked Account of current Account / Master Account of current Account respectively. |

Trade Eligible |

This check box is selected by default and indicates that the asset is eligible for trade. If checked (Trade Eligible = Y) then Asset Status is marked as INACTIVE during Trade. If unchecked (Trade Eligible = N) Asset status is marked as ACTIVE. |

Consolidate Points at Master |

Check this box to indicate that point can be consolidated at master account level. Refer to ‘Consolidate Points at Master’ section for more details. |

Points Consolidation Type |

Select the type of points consolidation option from drop-down list. This field is used to identify the assets at Associated accounts to consolidate the points. |

Custom Fields - This section displays the custom User Defined Fields if enabled in Setup and if configured, populates specific business computation values. |

|

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Submit.

Consolidate Points at Master

If ‘Consolidate Points at Master’ option is checked, system consolidates the asset level points at Master Account of the associated account provided the following conditions are satisfied:

- The same ‘Points Consolidation Type’ is selected for associated account.

- The status of asset is ACTIVE.

- The status of account is available and enabled in ACC_STATUS_POINT_CONS_CD lookup type.

- The asset expiry date is greater than GL date (asset is not expired).

Points consolidation is done in following scenarios:

- When new account is added under a Master Account by UI, Funding process, API, Onboarding Multi Account onboarding, and/or Master Account Maintenance Transaction.

- Account Status Change

- During Current Account Level Asset Maintenance updates.

- Collateral POST/PUT/GET Web Services

- Collateral Create/Update File uploads

- Collateral Maintenance from UI

- Add New Asset Transaction

- Substitution of asset Transaction

To ‘Consolidate Points at Master’, following validations and update options are provided:

- Lookup code ‘Account Statuses for Points Consolidation’ determines which Accounts with which status are to be considered for point's consolidation.

- Batch job which updates the consolidated points at Master Account level only if the ‘Expiration Date of Asset’ of Actual Asset at associated account is less than the GL date. This batch job is scheduled to run before the billing batch job to update the actual points that needs to be considered for Billing.

- ‘Points’ are maintained at actual asset level and any changes done at Master account level asset points does not flow down to the Actual Asset.

- In case of an update at Master Account level Asset Point's and subsequently any change in actual asset at current account, system recalculates the points and overrides the points at master account.

10.1.1 Valuations Sub Tab

The Valuation sub section contains information about the value of the asset. The Values section enables you enter the value of the asset. The Addons sub tab records information about any add ons associated with the collateral.

To complete the Valuations section

- Click Valuations section.

- In this section, you can perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Valuations section |

|

Current |

Select if this is the current valuation. |

Valuation Dt |

Specify the valuation date. |

Source |

Select the valuation source. |

Edition |

Specify the valuation edition. |

Supplement |

Specify the valuation supplement. |

Total Value = |

View the total value. |

Wholesale Base |

Specify the wholesale value. |

Usage |

Specify the usage value; that is, the monetary effect that current mileage has on the value of vehicle. |

Retail Base |

Specify the retail value. |

Addons + |

View the add-ons value. |

Usage Value + |

Specify the usage. This pertains to Lease and usually is entered as the current mileage on vehicle. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Addons section, you can perform any of the Basic Operations mentioned in Navigation chapter. You need to specify all the field values for every asset’s add-ons and attributes on the application.

- A brief description of the fields is given below::

Field:

Do this:

Addons/Attributes

Select the add-on/attribute.

Value

Specify the value of the attribute.

Amt

Specify the add-on amount.

- Perform any of the Basic Actions mentioned in Navigation chapter.

10.1.2 Tracking Sub Tab

The Tracking sub screen enables you to record further information associated with the collateral. What items you choose to track are setup during implementation.

To track attributes for the collateral

- Click the Tracking sub tab.

- In the Tracking Items section, click Load Details.

- In the Tracking Items section, you can perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Tracking Item |

View the tracking type |

Disposition |

Select the disposition. |

Start Dt |

Specify the tracking start date. |

End Dt |

Specify the tracking end date. |

Followup Dt |

Specify the next follow-up date. |

Enabled |

Select to track the information from start date in the Start Dt field. |

Comment |

Specify any comments regarding the tracking item. |

- Complete the Tracking Item Details section by entering information about a parameter in the corresponding the Value field.

- Perform any of the Basic Actions mentioned in Navigation chapter.

10.1.3 Vacation Ownership sub tab

In the Vacation Ownership sub tab you can capture and maintain ‘Timeshare’ specific collateral details of an account. This tab is displayed only for ‘Home’ collateral and allows to maintain only one records for the selected account.

For detailed information of the fields in this sub tab, refer to ‘Vacation Ownership tab’ section in Customer Service > Collateral > Home tab.

10.1.4 Status History Sub Tab

The Status History sub tab enables you to view the asset history of association with accounts.

To view the Status History

- Click the Status History sub tab.

- In the Status History section, view the following information:

Field:

Do this:

Account #

View the account number.

Status

View the status of asset.

Lien Status

View lien status of the asset.

Line Event Date

View lien event date of the asset.

Data Change Status

View the data change status of the asset.

Data Change Date

View the data change date of the asset.

Comments

View comments of the asset if any.

10.1.5 Asset Relation Sub Tab

The Asset Relation sub tab enables you to view the asset relationship.

To view the Asset Relation

- Click the Asset Relation sub tab.

- In the Asset Relation section, view the following information:

Field:

Do this:

Account #

View the account number.

Asset #

View the asset number.

Account Status

View the Account status.

Current Ind

Indicates that this is the current asset.

Primary Ind

Indicates that this asset is the primary.

10.1.6 Audit Sub Tab

The Audit sub tab enables you to view the asset relationship.

To view the Audit

- Click the Audit sub tab

- In the Audit section, view the following information:

Field:

Do this:

Account Id

View the account identification number.

Asset Id

View the asset identification number.

Column Name

View the column name.

New Value

View the new value.

Old Value

View the old value.

Changed By

View the person name who changed the details.

Changed Date

View the date on when the details are changed.

10.1.7 Usage Summary

The Usage Summary sub tab gives you a summary of units charged for asset Usage/Rental which is derived based Usage/Rental Charge Matrix for Usage/Rental based lease account.

The incoming data of asset usage details are classified into the chargeable buckets of Base, Cycle, and Life and based on the defined amount, the total units are charged. Here each record indicates chargeable units for each billing cycle. For detailed information, refer to Usage Summary section.

10.1.8 Renting History

The Renting History sub tab gives you a summary of total charges levied/collected on an asset during its life when it has been rented/linked to different accounts.

The incoming data of asset usage/rental details are classified into the chargeable buckets of Base, Cycle, and Life and based on the defined amount and term, the total rental amount is calculated. Each record indicates total rental amount charged on individual account.

The calculated rental amount is only displayed and is posted on the account only after posting Account Close Monetary transaction on the account. For more information on how OFSLL handles Rental based leasing, refer to ‘Rental Agreement’ section in Lease Origination User Guide.

In the Renting History section, you can select ‘Show All’ check box to display all the rental calculation records for the selected collateral. A brief description of fields is given below:

In this field: |

View this: |

Account # |

View the lease rental account number to which the asset is linked. |

Agreement Dt |

View the account funded date. |

Agreement Terms |

View the actual contract term converted into days (i.e. Maturity Date minus Contract date). |

Termination Dt |

View the account closure date. |

Actual Terms |

View the number of days between account funded date and account close date. |

Usage Start |

View the starting units from when billing is done. |

Usage End |

View the ‘Current Usage’ value at the time of termination. |

Excess Usage |

View the difference of total usage from usage start value. |

Base Amount Charged |

View the minimum rental amount charged. |

Excess Amount Charged |

View the excess amount charged which is calculated based on the difference of final usage value from agreed usage. |

Total Amount Charged |

View the total of Paid / Terminated amount from all balances after lease rental account is closed. |

10.1.9 Usage Charge Matrix sub tab

The Usage Charge Matrix sub tab displays the different chargeable slabs defined based on the combination of Billing Cycle and Charge Type. The details maintained here are used for billing calculation based on a particular asset usage.

The information in this tab is auto-populated based on details maintained in Asset Type setup. For more information about field details, refer to ‘Usage Charge Matrix’ section in Setup guides.

10.1.10 Rental Charge Matrix sub tab

The Rental Charge Matrix sub tab displays the different chargeable slabs defined based on the combination of Billing Cycle, Rental Duration, Charge Per Cycle and Charge Type. The details maintained here are used for billing calculation based on a particular asset usage.

The information in this tab is auto-populated based on details maintained in Asset Type setup. For more information about field details, refer to ‘Rental Charge Matrix’ section in Setup guides.

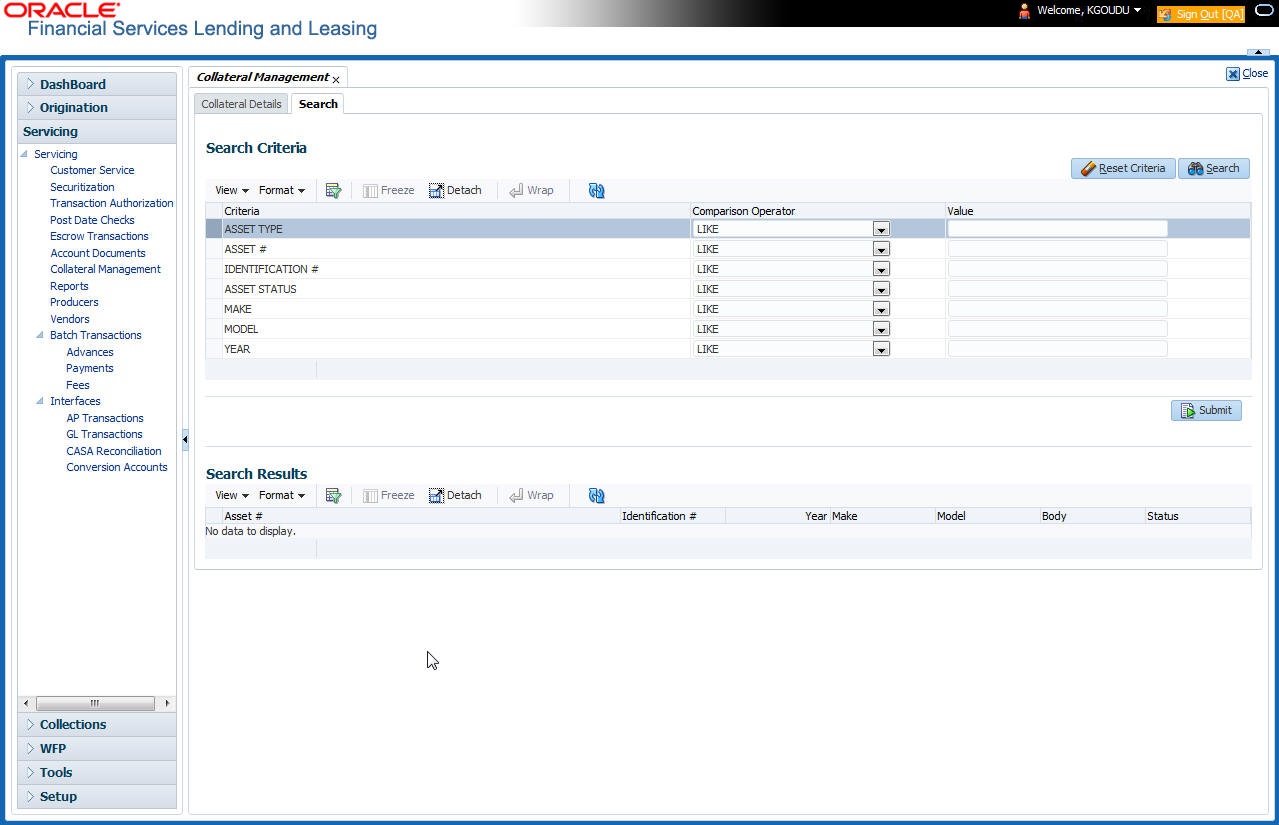

10.2 Search Tab

A Search screen is available on the Collateral Management System to help locate information such as an asset type, asset number, identification number, asset status, make, model, and year. This is the information that is used on the Collateral screen.

To search for a Collateral details

- On the Oracle Financial Services Lending and Leasing Application home screen, click Servicing > Servicing > Collateral Management > Search.

- The Collateral Management screen’s Search screen appears.

- In the Search Criteria section, use the Comparison Operator and Value columns to enter the search criteria you want to use to locate a collateral.

- Click Search. The system displays result of the search in Results screen.

- On the Results screen, select the collateral you want to load and click Submit. The system loads the collateral details on the Collateral Details screen.