This chapter provides an overview of the Oracle Financial Services Compliance Regulatory Reporting goAML Suspicious Transaction Reporting Express Edition (OFS CRR goAML STR XE) application.

As a part of regulations and compliances, a Financial Services Organization must perform appropriate analyses and report any suspicious activity, which lead to fraud and money laundering to the regulatory authorities. These regulatory bodies are responsible for safeguarding financial institutions and consumers from abuse, providing transparency in the country's financial system, enhancing that country's security, and deterring and detecting criminal activity in the financial system.

Financial institutions are required to provide data regarding suspicious activities to their geographic region's regulatory authority. This data is delivered to the regulatory bodies through regulatory reports. These reports, depending on the regulatory geographic region, can be delivered in either paper or electronic formats.

The United Nations Office on Drugs and Crime (UNODC) standard software system is available for Financial Intelligence Units to counter Terrorist Financing and Money Laundering.

In today's global economy, terrorist financing and money-laundering have assumed heightened importance. Money-laundering and the financing of terrorism are global problems that threaten the security and stability of financial institutions and also lead to undermining economic prosperity. A lot is being done in order to combat money laundering at the global level.

goAML is a UNODC response to combat money-laundering. It is an intelligence analysis system intended to be used by the FIU (Financial Intelligence Unit). FIUs have a big role to play as they have access to financially related information that provides a base for financial investigations. An FIU is responsible for receiving, analyzing and processing reports required from financial institutions or persons referred to in national anti-money-laundering legislation.

Financial Intelligence Units play a leading role in any anti-money laundering regime as they are generally responsible for receiving, processing, and analyzing reports made by financial institutions or other entities according to the requirements of domestic anti-money laundering laws and regulations. Such reports and other information gathered by FIUs often provide the basis for investigations into money laundering, terrorist financing, and other serious offenses. This template allows the banks to generate the final Suspicious Transaction XML Report that is submitted to their regulator via the goAML application.

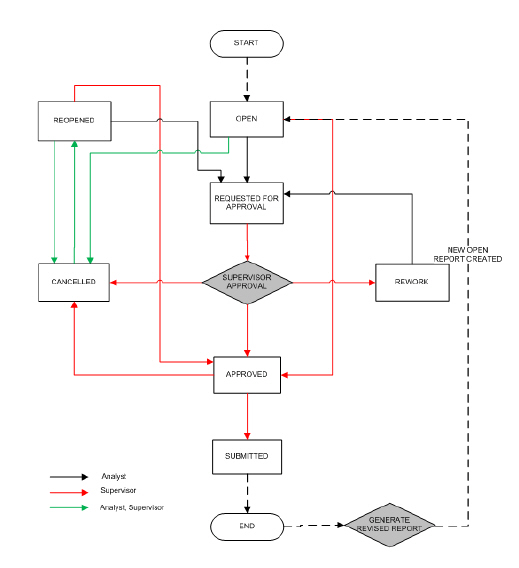

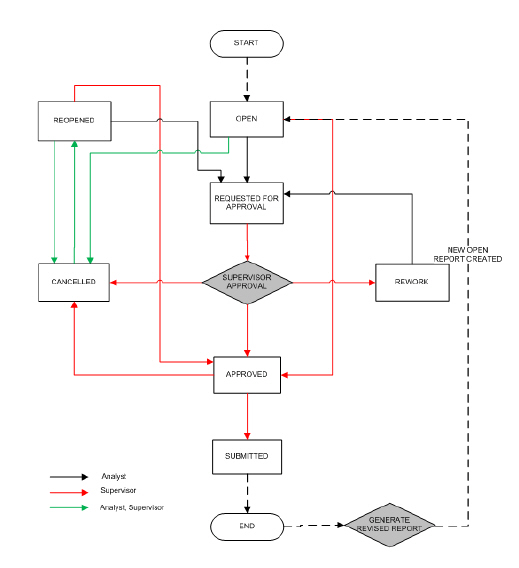

This section explains the workflow of OFS CRR goAML STR XE for users mapped to the role of Analyst and Supervisor.

An Suspicious Transaction Reporting (STR) is created in the Compliance Regulatory Reporting Express Edition application as a result of taking Generate goSTR action from the Oracle Financial Services Anti-Money Laundering Express Edition (OFS AML XE) or manually creating a report from OFS CRR goAML STR XE. When an STR is created in the Regulatory Reporting application through OFS AML XE, the report details are auto-populated with information from the case which triggered the action to generate the STR. Users mapped to the role of Analyst can update a report, which is in Open status and request the report’s details for approval. During the edit and review process, the STR is available to be viewed as a draft report.

A Supervisor can approve, rework, and cancel the filing of reports after an Analyst requests for approval. Supervisors can also edit report details and approve reports directly if needed.

If the STR is approved by the Supervisor, the Regulatory Reporting application generates the STR in the final XML format after all necessary validations. The STR is then manually submitted to the Regulator. The submission to the Regulator occurs outside of the OFS CRR goAML STR XE application. The STR status can then be marked as Submitted in the Regulatory Reporting application.

The Supervisor can cancel submitted reports for approval. The STR status then changes to Canceled.

If required, the Supervisor can send the reports for rework when the report is in Request for Approval status. The analyst must then rework and re-submit the report for approval. This process continues until the report is approved or canceled.

Authorized users can reopen canceled reports. The Report status then changes to Reopened.

For the complete list of actions an Analyst, Auditor, or Supervisor can perform on various report statuses, see Table 2 . For more information on user roles, see Table 4 .

A Report has a life cycle that begins with the Open status and ends when it is in the Submitted status.

To view the report details, click the report name in the OFS CRR goAML STR XE Search and List page.

If the report is already opened by another user, then that report is locked. You can only view such a report.

Table 3 explains the statuses in which an Analyst, Auditor, and Supervisor can edit the report details.