Appendix B :Variable and Fixed Interest Rate

B.1 Variable Interest Rate Loans

A variable interest rate loan is one in which the interest component of the payable loan can fluctuate over time. This fluctuation can be either due to periodic changes in index rate or varying interest rates in the market. Accordingly, the loan payment amount may increase or decrease depending on the variable interest rate.

For Variable rate loans, the interest rate basically consists of two components:

- Index rate - The index rate component is based on the financial market and may fluctuate accordingly.

- Margin rate - The margin rate component is the fixed rate, which normally does not change during life of the loan.

Note

Interest rate = Index rate + Margin rate.

During loan origination and up to the funding process, the interest rate is computed based on the prevailing index rate at the time of approval. However, once the loan is funded, the interest rate on the loan may change when the index rate changes. This interest rate change may causes changes in the loan’s repayment amount, if specified in the terms of the contract.

Oracle Financial Services Lending and Leasing supports the variable rate functionality for closed-end loans during the originating, funding, and servicing of new products and loans with interest rates based on various industry-standard interest rate indices.

Variable rate calculation for Lease is supported for ‘Interest Rate’ calculation method only. During product setup, on selecting the lease calculation method as ‘Interest Rate’, the following fields are enabled and also the ‘Rate Adjustments’ sub tab is available to specify the details:

- Flexible Repayment

- Index Rounding

- Reschedule Method

- Reschedule Value

Note the following for lease variable rate calculation:

- The index rate changes are bound by ‘Rate Cap & Adjustments’ and ‘Payment Caps’ which are defined at Setup > Contract level.

- If the change payment is greater than ‘Max Pmt Inc/ Life’, system does not post ‘Rate Change’ and ‘Term Change’ transactions and displays an error indicating ‘Rate Change not allowed, as new payment amount exceeds max increase life’ to avoid impact on residual value usage.

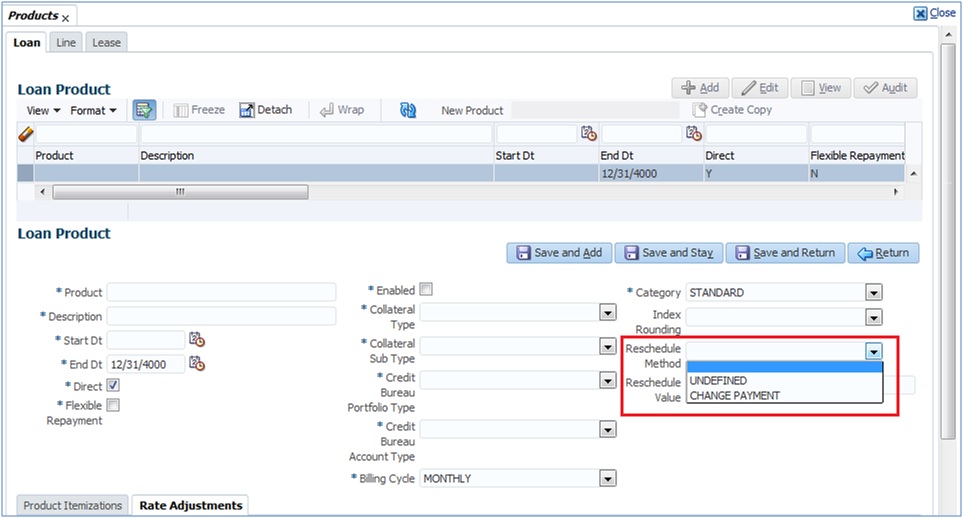

During the Product setup, you can define and control the changes in loan payment amount using 'Reschedule Method' and 'Reschedule Value' fields.

- When Reschedule Method is selected as 'UNDEFINED', no payment changes are allowed.

- When Reschedule Method is selected as 'CHANGE PAYMENT', and Reschedule Value is specified as '0', loan payment amount changes every time depending on the variable rate.

- When Reschedule Method is selected as 'CHANGE PAYMENT', and Reschedule Value is specified in percentage (i.e. 5%, 10%) loan payment amount changes only when the variable rate increases upto the defined percentage. (For example, if change percentage is specified as 10%, loan payment amount changes only if the variable rate increases by 10%. Else, no change is allowed.)

Hence the impact of variable rates on loan payment amount can be controlled to stop negative amortization.

B.1.1 'Rate Adjustments' for Variable Rate Loans

Every loan contract can have different limits on interest rate change as indicated below:

- Allowed amount for each minimum and maximum interest rate change

- Number of minimum and maximum interest rate changes allowed within a year and life of the account

Note

These limits are enforced when processing the interest rate change on the loan.

OFSLL supports such Adjustable-Rate Mortgages (ARM) by defining them accordingly in the 'Rate Adjustment' tab of Product setup screen.

In the 'Rate Adjustment' tab (Setup > Products screen > 'Rate Adjustment' tab), multiple records can be created depending on the limits defined for each ARM's.

For example:

- For a particular ARM if interest rate change is allowed only once in a year, then a corresponding record in Rate Adjustments tab can created with following field details:

- Adjustment Frequency 'RATE CHANGE OCCURS EVERY X YEARS', Period '1', and # of Adjustment '1'.

- For a particular ARM if interest rate change is allowed only once in 5 years during life of a loan, then a corresponding record in Rate Adjustments tab can created with following field details:

- Adjustment Frequency 'RATE CHANGE OCCURS EVERY X YEARS', Period '5', and # of Adjustment '1'.

- Similarly, for an ARM if desired number of interest rate changes are to be allowed during first 10 years of a loan, the record in Rate Adjustments tab can have the following field details:

- Adjustment Frequency 'RATE CHANGE OCCURS EVERY X YEARS', Period '10', and # of Adjustment 'any value upto 999'.

B.2 Fixed Interest Rate Loans

Fixed interest rate loan is one in which the rate of interest remains fixed from funding till the loan’s entire term. Hence, the loan payment amount does not change with fluctuations in index rate or market rates.

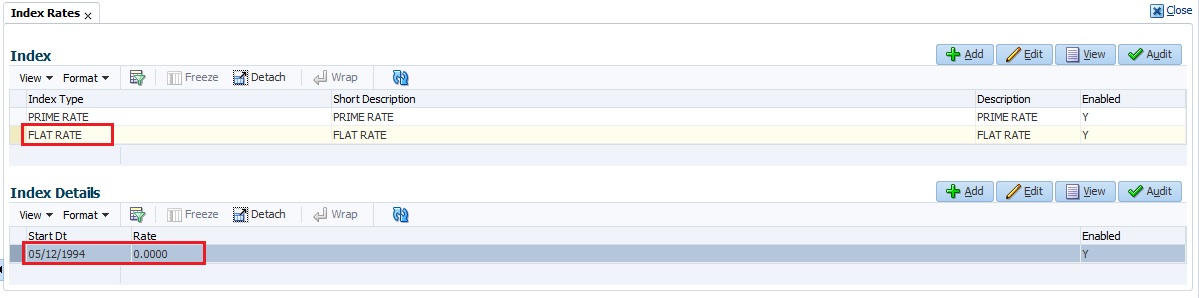

In Oracle Financial Services Lending and Leasing, fixed interest rate loans can be defined in the following way:

- Create a 'FLAT RATE' Index Type record in Index Rates screen (Setup > Products > Index Rates) with Rate=0.00

- Select this Index Type record during Origination/Servicing for Fixed Rate loans.

Since the index rate is always zero for this Index Type, the loan interest rate will always be the Margin rate (i.e. contract rate) which does not change during life of the loan.