2. Collaterals

The functions and actions provided by the Oracle Banking Enterprise Collateral Management are explained below. All functions explained come under Collaterals in the Menu Browser.

This chapter contains the following sections:

- Section 2.1, "Collateral Types Maintenance"

- Section 2.2, "Collateral Category Maintenance"

- Section 2.3, "Maintaining Charge Type"

- Section 2.4, "Issuer Maintenance "

- Section 2.5, "Securities Maintenance"

- Section 2.6, "Maintaining Insurance Company Details"

- Section 2.7, "Maintaining Insurance Types"

- Section 2.8, "Collaterals Maintenance"

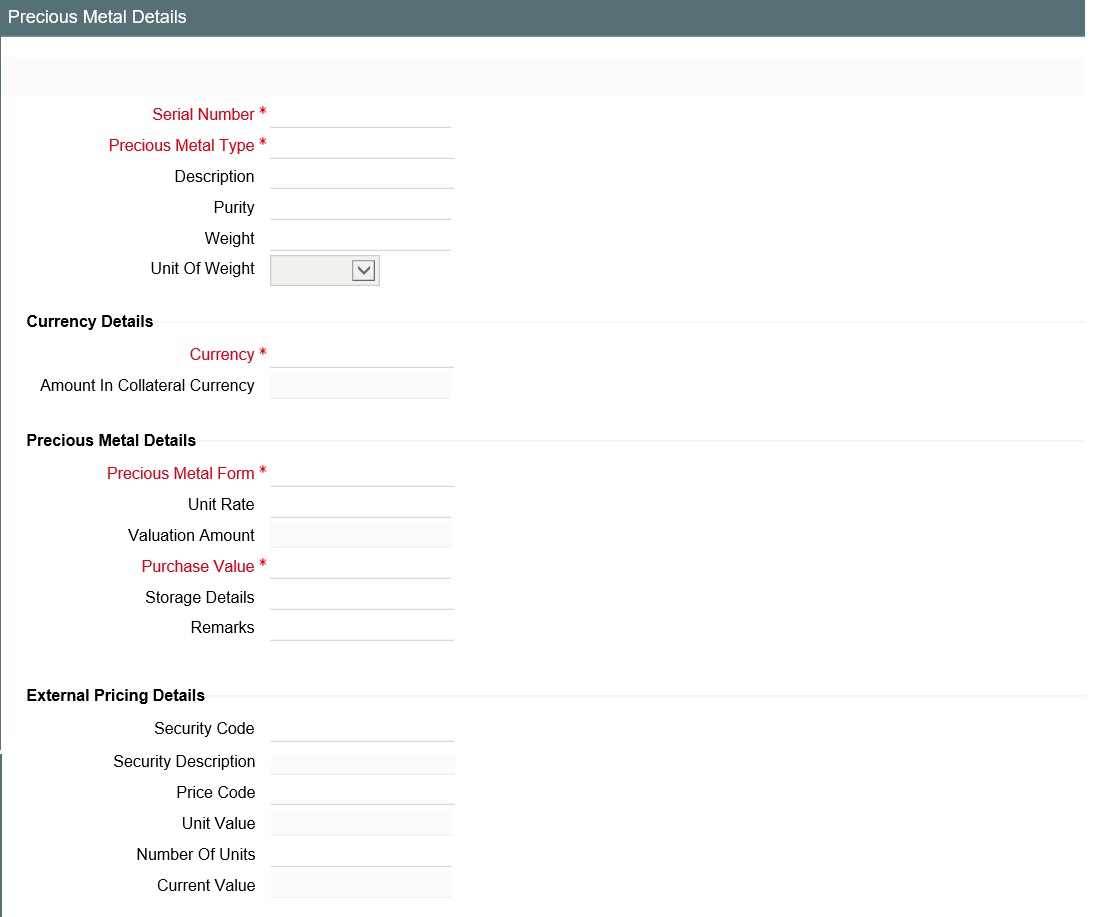

- Section 2.9, "Maintaining Specific Collateral Input Details"

2.1 Collateral Types Maintenance

Collateral Types maintenance is used to capture all types of Collateral which your bank accepts. Collateral Types information would be required when creating a new collateral in the system.

You can maintain Collateral Types in the ‘Collateral Types Maintenance’ screen. You can invoke the ‘Collateral Types Maintenance’ screen by typing ‘’GCDCOLTY’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

This maintenance is at done at the bank level and all branches would be able to access this information. The list of collateral types supported is supplied which is used in the application. For more information on list of collateral types, refer to ‘Collateral Category Maintenance’ section.

Collateral Type

Specify the Collateral Type. A maximum of 20 characters are allowed in this field.

Description

Give a brief description of Collateral Type. A maximum of 50 characters are allowed in this field.

Interest Rate

Specify the interest rate to be applied on the customer account when customer uses the overdraft facility against the collateral type.

This can later be linked to 'Collateral Category Maintenance' screen (GCDCOLCA), 'Issuer Maintenance' screen (GCDISSUR) and 'Securities' screen (GCDSECTY) while choosing the collateral type.

2.2 Collateral Category Maintenance

You can define the category to which collateral belongs to using the ‘Collateral Category Maintenance’ screen.

You can invoke the ‘Collateral Category Maintenance’ screen by typing ‘GCDCOLCA’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Category Name and Category Description

Specify the Category name and a brief category description of the category.

Collateral Type and Collateral Description

Specify the collateral type. Collateral description defaults from the ‘Collateral Types Maintenance’ screen based on Collateral type chosen.

Revision Date

Specify the date on which the Collateral Category has to be revised

Collateral Exposure Type

Indicate the Collateral Exposure Type from the following:

- Secured

- Unsecured

- Liquid Type

Asset Type

Specify the asset type here - Tangible or intangible

Charge Registration Required

Select this check box for recording registration details for the charge on collateral.

As part of charge registration, notice with required details can be sent to the appropriate registration authority. Filing statement has to be sent to registrar for charge creation.

Charge Renewal Frequency

A charge can be renewed as per the charge renewal frequency and units. For every charge type, a ‘Charge Renewal Frequency’ can be configured. You can select ‘Yearly’, ‘Half Yearly’, ‘Quarterly’, ‘Monthly’, ‘Weekly’, and ‘Daily’

Units

Specify the units.

For example, if 'Frequency' is selected as 'Monthly' and 'Unit' is selected as '2', then the system updates the charge end date considering perfection date + 2 months.

Filing Lead Days

Specify the lead days. The days before charge expiry date. You can renew the charge registration during these days

Revaluation Details

Revaluation details can be configured at collateral category level based on revaluation type and revaluation method as applicable to the collateral type.

Revaluation Type

You can select ‘Automatic’ or ‘Manual’ from the drop-down list. If you select ‘Manual’ all the fields in ‘Revaluation Details’ and ‘Holiday Processing’ are disabled.

Manual Revaluation

For the ‘Manual’ revaluation type, the following collateral types are applicable.

Sl No |

Collateral types - Only manual |

Function Id |

1 |

Corporate Deposits |

GCDCOLCD |

2 |

Inventory |

GCDCOLIY |

3 |

Account receivable |

GCDCOLAR |

4 |

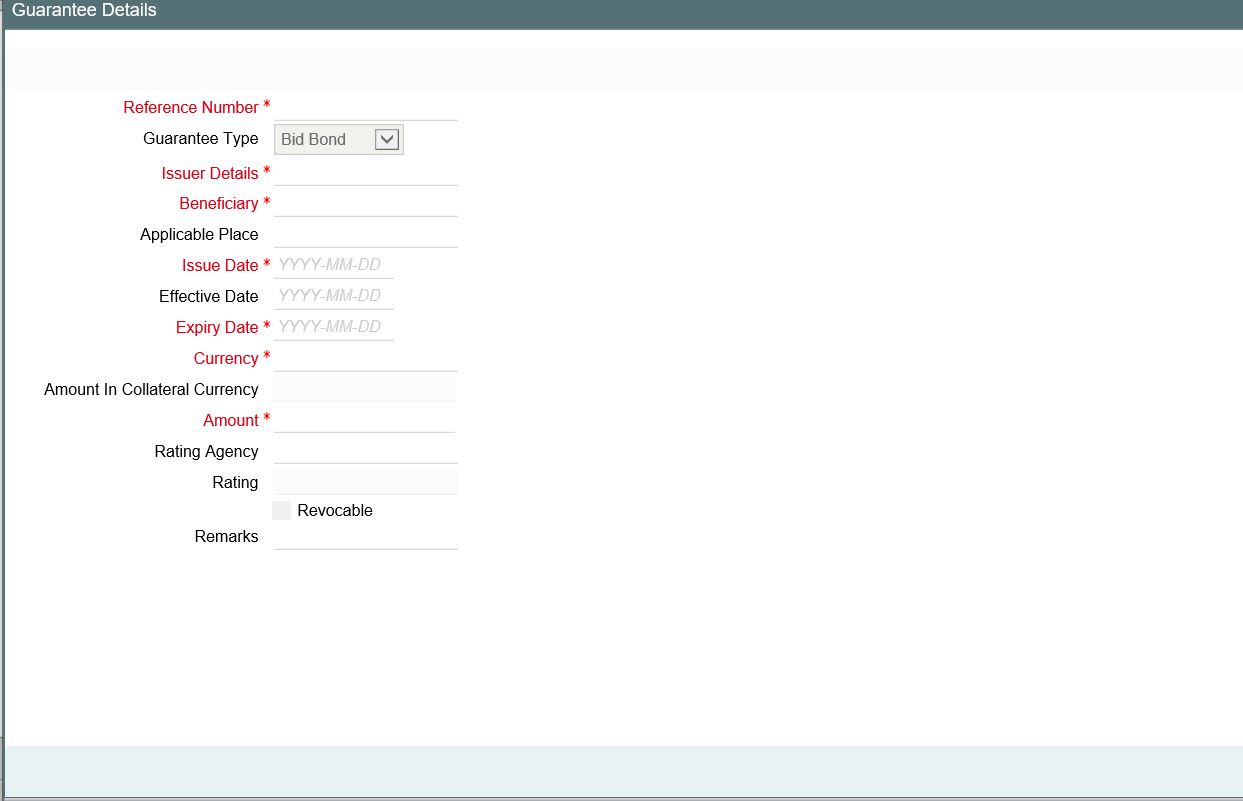

Guarantee |

GCDCOLLG |

5 |

Other bank deposits |

GCDCOLOD |

6 |

Accounts & Contracts |

GCDCOLAC |

7 |

Main Screen |

GCDCOLLT |

8 |

Obligation |

GCDCOLLO |

9 |

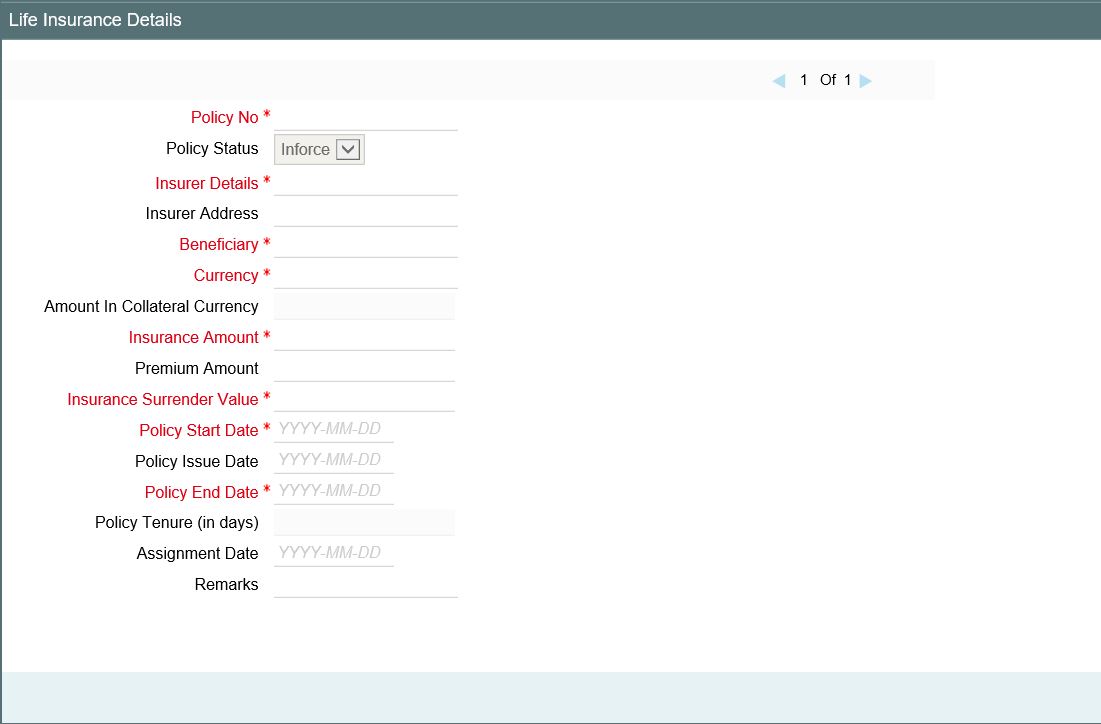

Insurance |

GCDCOLLI |

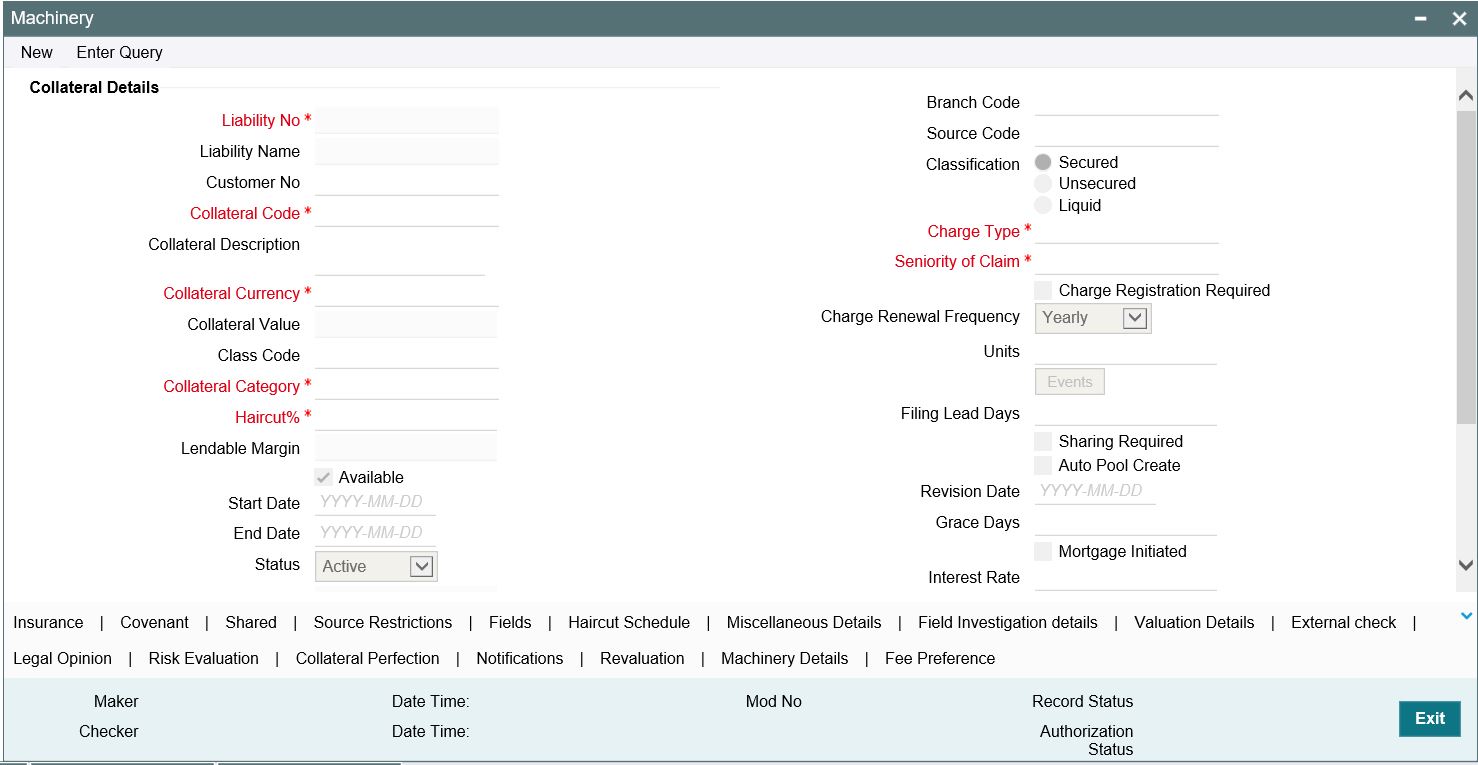

Auto and Manual Revaluation

Revaluation is based on configured depreciation method and percentage or external price change The following collateral types are applicable for both ‘Auto’ and ‘Manual ‘revaluation type.

Sl No |

Collateral types with revaluation type Manual & Auto External/Depreciation |

Function ID |

1 |

Vehicles |

GCDCOLLV |

2 |

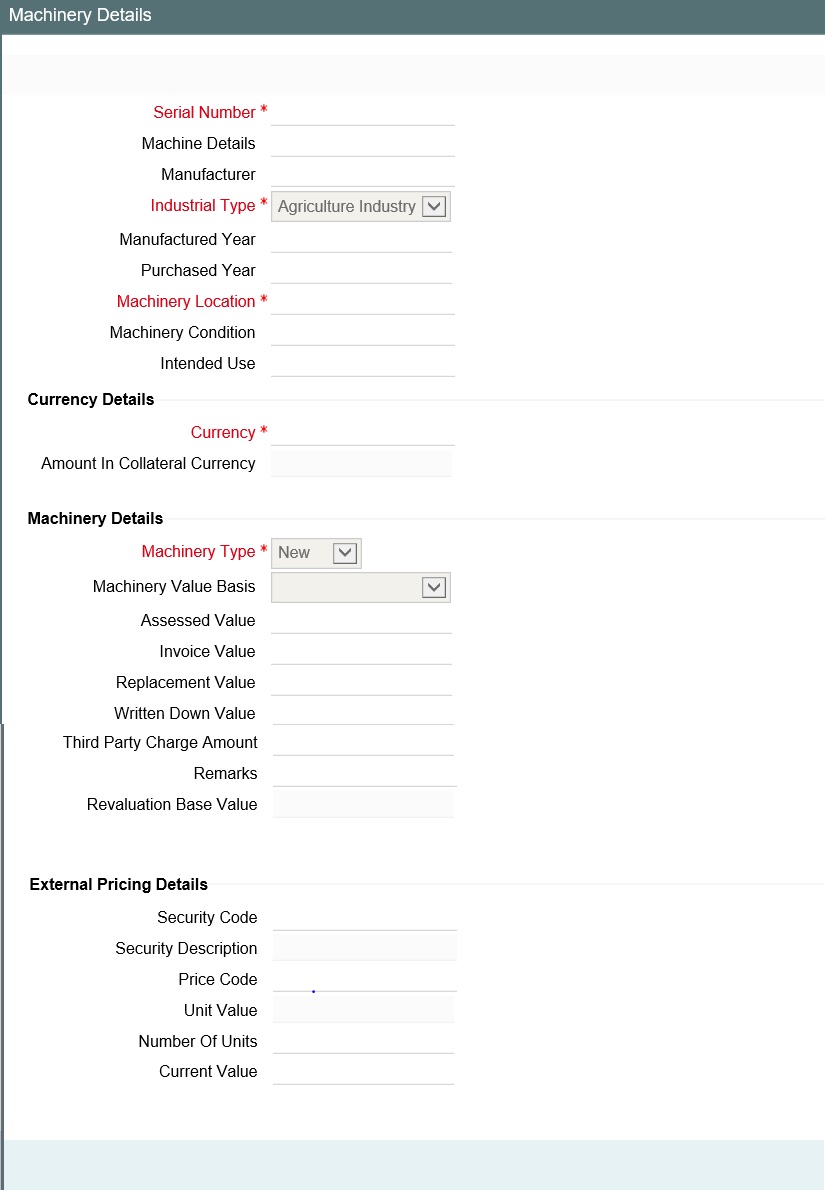

Machinery |

GCDCOLLY |

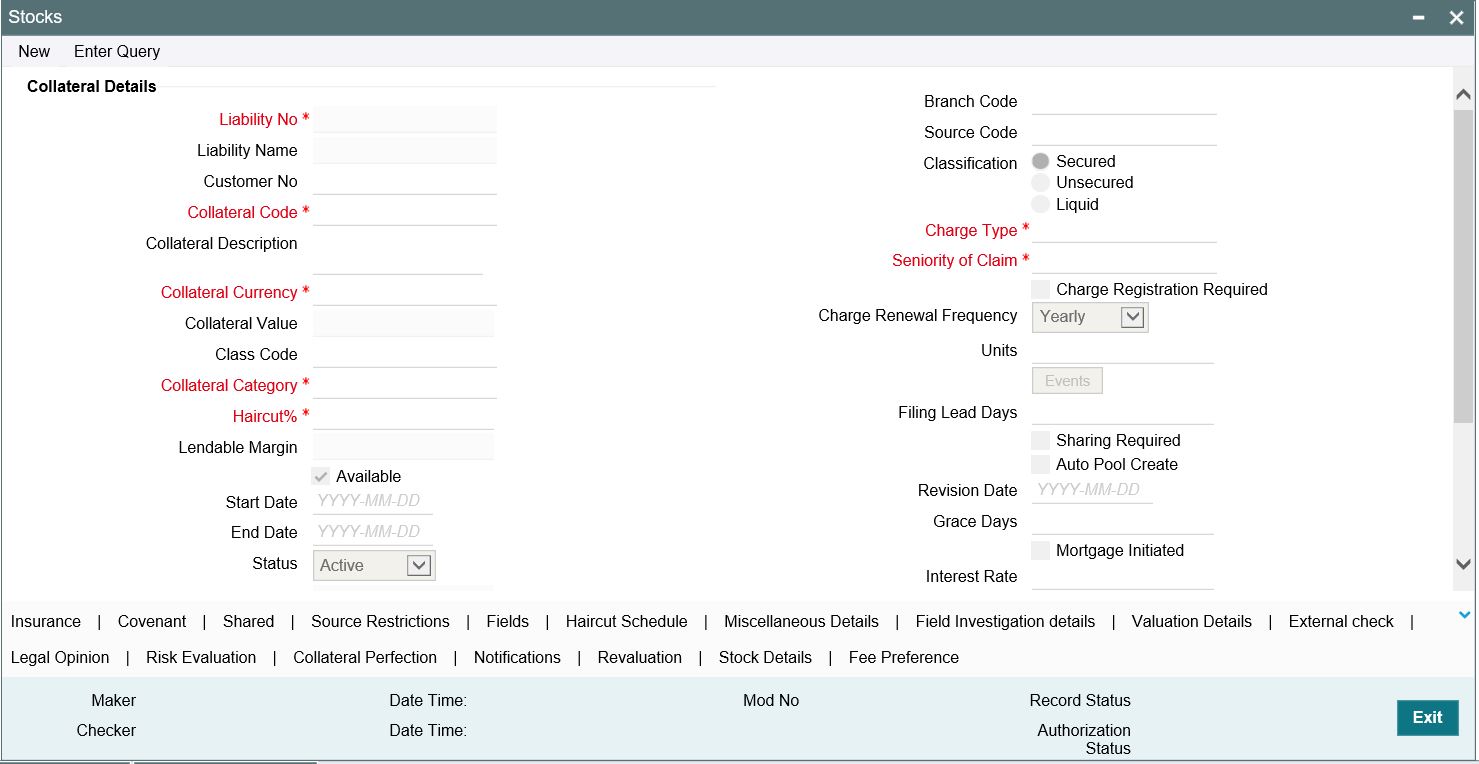

Auto Revaluation

The following collateral types are applicable only for ‘Auto’ revaluation type.

Sl No |

Collateral types with only Auto-external |

Function ID |

1 |

Funds |

GCDCOLFU |

2 |

Bonds |

GCDCOLBO |

3 |

Stocks |

GCDCOLLS |

Following are the methods of revaluation when revaluation type is automatic.

- Straight line method

- Written down value method

- Sum of years digit method

- External

- Custom

Following collateral types are considered for manual type of revaluation as well as automatic revaluation with external revaluation method.

Sl No |

Collateral types with Manual and Auto-External revaluation |

Function ID |

1 |

Commercial papers |

GCDCOLCP |

2 |

Crops |

GCDCOLCR |

3 |

Perishables |

GCDCOLPC |

4 |

Commodities |

GCDCOLCO |

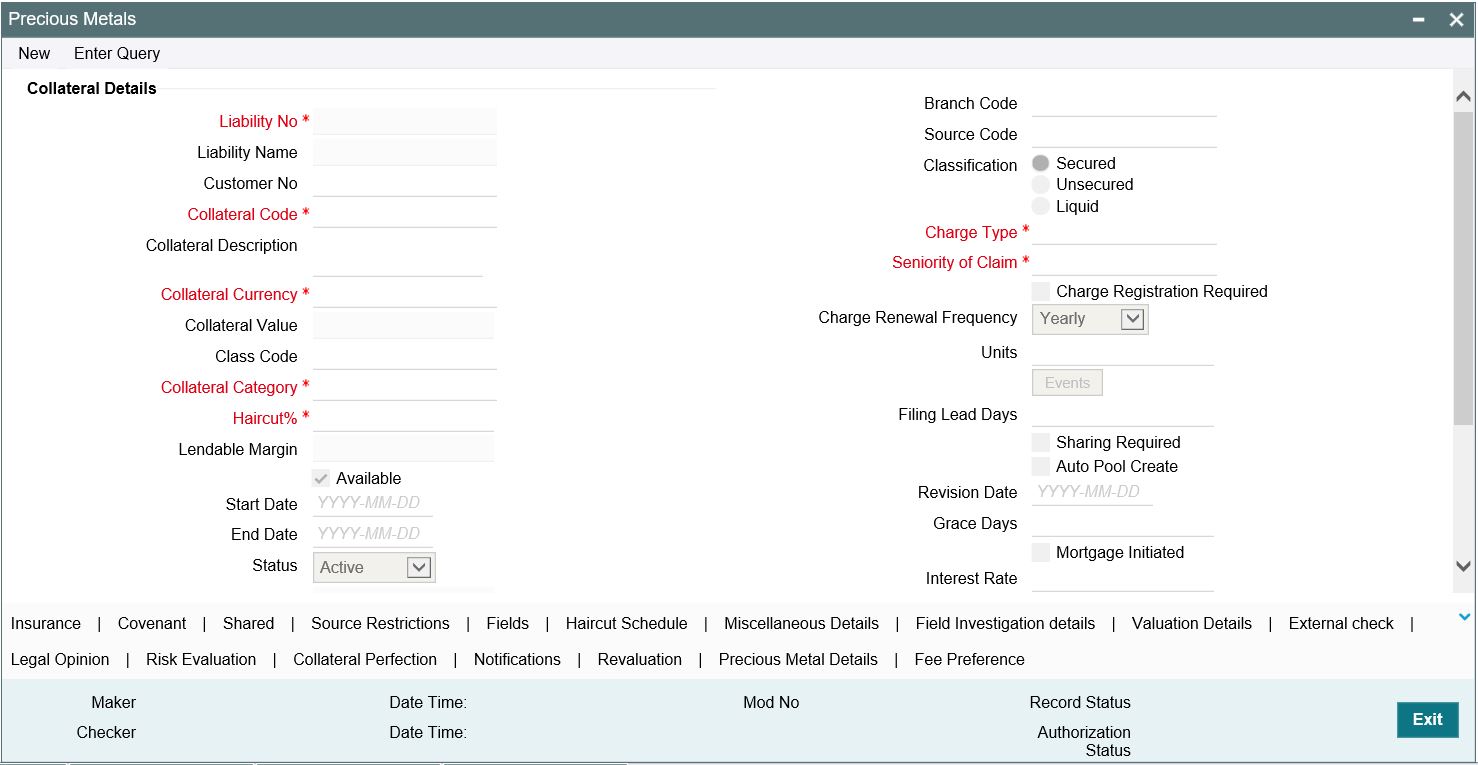

5 |

Metals |

GCDCOLLL |

6 |

Property |

GCDCOLLP |

For more information on collateral revaluation, refer to ‘Collateral Revaluation’ section in this User Manual.

Revaluation Method

You can select the following revaluation method from the drop-down list.

- Straight line method

- Written down value method

- Sum of years digit method

- External

- Custom

Rate of Depreciation

Specify the percentage. Rate of depreciation is applicable only when the revaluation method is straight line method or written down value method.

Revaluation Frequency

This field is applicable only when revaluation type is automatic. Revaluation frequency can be of yearly only for sum of years digit method.

Holiday Processing

The holiday processing settings are applicable only when revaluation type is automatic.

Ignore Holidays/Move Across Month/Cascade Schedules

By default ‘Ignore Holidays’ check box is selected. If this check box is selected, then ‘Move Across Month’ and ‘Cascade Schedules’ check boxes are disabled.

Holiday Check

You can either select ‘Currency’, ‘Local’ or ‘Both’. The collateral currency holiday is considered if holiday check is currency/both.

Schedule Movement

You can either select ‘ Move forward’ or ‘Move backward’.

Collateral Haircut Category

You can select a 'Haircut Name' created in 'Haircut Maintenance' screen and assign a 'Haircut Percentage' under 'Collateral Haircut Category' section.

Here you can maintain several collateral haircut categories for use as part of credit risk mitigation process. Multiple haircut records for same collateral category can be maintained.

Specify the following haircut details for each record:

- Haircut Name and Description

- Haircut Percentage - Specify the final Haircut (offset margin)

- Primary - Select a haircut as the primary haircut value for the Collateral Category

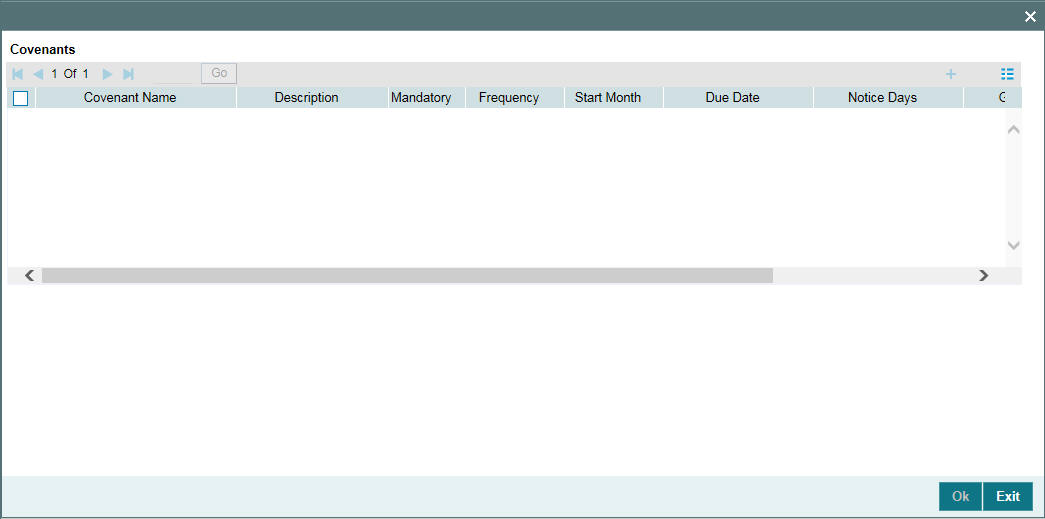

2.2.1 Maintaining Covenant Details for Collateral Category

To maintain the Covenant details for the Collateral Category, use the covenant screen by invoking ‘Covenant’ sub-system.

The Revision Date for the covenant is generated based on the Frequency and Due date.

For example, if the collateral category covenant for a particular covenant name the frequency is monthly and the due date is 15. Based on the date of creation of the collateral covenant category (say 20 JAN 2008) the revision date is 15-Feb-2008.

Covenant Name

Specify a covenant name which is maintained in the ‘Covenant Maintenance’ screen.

Description

The description for the covenant, as maintained in the 'Covenant Maintenance' screen gets defaulted here based on the 'Covenant Name' chosen.

Mandatory

The mandatory field for the covenant, as maintained in the 'Covenant Maintenance' screen gets defaulted here based on the 'Covenant Name' chosen.

Grace Days

The grace days for the covenant, as maintained in the 'Covenant Maintenance' screen gets defaulted here based on the 'Covenant Name' chosen.

This can later be linked to 'Collaterals Maintenance' screen (GCDCOLLT) for choosing the collateral category while maintaining the collateral.

Notice Days

Specify the notice days, that is, the number of days prior to revision date of the covenant. Notice days are mandatory when frequency is weekly and above. Covenant is available for tracking in its notice days.

Frequency

Select the frequency with which the collateral has to be revaluated. You can select one of the following:

- Yearly

- Half Yearly

- Quarterly

- Monthly

- Weekly

- Daily

Due Date

Due date of the covenant can be specified here. Covenant is available for tracking on the Due date. Covenant can be marked as complied on the Due date. Due date is mandatory when frequency is monthly and above.

Start Month

If the Frequency select is Yearly, Half Yearly, Quarterly or Monthly, then specify the start month here.

Remarks

Specify the remarks about the covenant details for collateral category maintenance.

For more information about ‘Covenant Maintenance’, refer to Enterprise Limits and Collaterals Common User Manual.

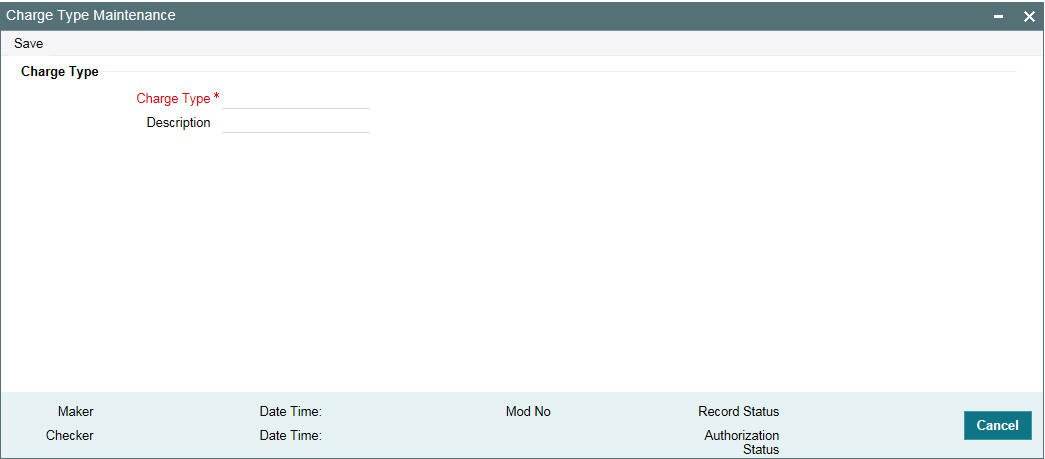

2.3 Maintaining Charge Type

In ‘Charge Type Maintenance’ screen, you can configure different charge type like mortgage, hypothecation, lien, and so on.

If you want to register charge for the collateral created under this category, then you need to configure charge registration details.

You can invoke the ‘Charge Type Maintenance’ screen by typing ‘GCDCHGTY ‘ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Charge Type

Specify the charge type like mortgage, hypothecation, lien and so on

Description

Specify brief description of charge type.

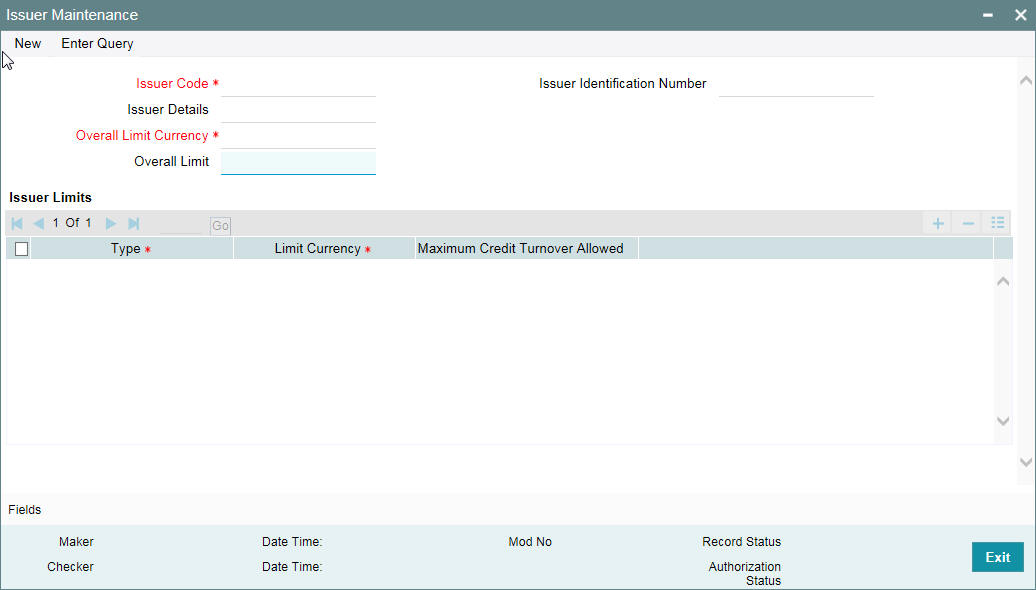

2.4 Issuer Maintenance

A customer is granted credit on the basis of his/her credit worthiness. The credit worthiness of a customer depends on the assets constituting the customer’s portfolio. The type of collateral that a customer offers can be in the form of marketable or non-marketable securities.

Marketable collaterals, driven by market forces, tend to fluctuate unpredictably. You may hence need to monitor your bank’s exposure to issuers of such collateral. The details of the issuer and limit for his securities can be defined using the ‘Issuer Maintenance’ screen.

You can invoke the ‘Issuer Maintenance’ screen by typing ‘GCDISSUR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Limits for the issuers of Collateral can be setup at the following two levels:

- Overall limit for each Issuer

- Limit for the Securities issued by an Issuer

Issuer Code

Each Issuer whose securities the bank accepts should be assigned a unique code. The Issuer is identified by this code. This code can also be used to retrieve information about the issuer. Specify the Issuer Code here.

Overall Limit

Specify an Overall Limit for the issuer here. This limit indicates the maximum limit beyond which your bank would not like to expose itself to the Issuer.

An issuer can issue different types of market based securities; these could be debentures, shares, bonds, and so on. By defining an overall limit for an Issuer, the bank can limit its exposure to the issuer.

When the total of all the collateral given by the customer in the form of market- based securities exceeds the overall limit specified for the Issuer, the system shows an appropriate message indicating that the limit has been exceeded.

Overall Limit Currency

Specify the currency in which the Overall Limit is specified.

Issuer Identification Number

Select the Issuer Identification Number if any, from the adjoining option list.

Issuer Details

Specify in brief any additional details of the issuer.

Issuer Limits for Collateral Types

An Issuer of Securities may issue different types of securities. These can be used by a customer as collateral for credit availed from the bank. The securities used as collateral can be debentures, shares, bonds, commercial papers, and so on. These securities can therefore be classified under different Collateral Types too.

For each security type that your bank accepts as collateral from the issuer, you can specify a limit indicating the maximum exposure amount (in value) to the issuer for this security type.

When the total of the collateral given by the customer in the form of a particular collateral type exceeds the limit set for the Issuer, the system will show you a notification.

You can define Issuer Limits for different collateral types under Issuer Limits. You can maintain several collateral types here, with their respective Limit Currencies and Limit Amounts.

Collateral Type

Select the collateral type for which issuer limits are being specified.

Limit Currency

Select the limit currency from the adjoining option list.

2.5 Securities Maintenance

The credit facilities granted to the customers of the bank under a credit line can be backed by the securities that the customer offers as collateral. You can maintain the details of all such securities in the Oracle Banking ELCM system. These details can then be used for determining the:

- Limit granted under a particular security

- Credit worthiness of a security when it’s used as collateral

Since market based securities (Marketable Securities) are driven by market forces, the price of such securities tends to rise or fall in value. These fluctuations have a direct effect on the collateral value of the security. You can update the value of the collateral if the value of the security that backs it fluctuates beyond the increase and decrease sensitivity that has been specified.

You can capture details of marketable securities in the ‘Securities’ screen as shown below. You can invoke the ‘Securities Maintenance’ screen by typing ‘ GCDSECTY’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Details of the marketable security that your bank accepts as collateral can specified in the above screen.

Security maintenance is used for creating securities which are considered for external revaluation including market based securities.

Security Code

Assign a unique ID to identify the security. This ID is called the Security Code. This ID is used while maintaining Collateral for a market value based Security.

Description

Describe in brief the security maintained.

Collateral Type

Select the collateral type to which the security belongs.

Currency

Specify the currency to be associated with the Security using the list available here. Once authorized this entry cannot be changed.

Equity Base

Here you can specify the equity base for the security, that is, the total amount raised by the issue of this security. This entry is for information purposes only.

For example, Gem granites have come out with Debentures 98 and have raised US $1 Million through this issue. This US $1M that Gem Granites has raised constitutes the equity base for Debentures 98.

Face Value

Specify the face value of the security. A maximum of 50 numeric characters are allowed here.

Note

Face value and Nominal value based is applicable only for collateral types – Funds, Stocks, and Bonds.

Price Increase Sensitivity and Price Decrease Sensitivity

If the value of collateral is backed by a marketable security (whose value is driven by market forces) you may want to revalue the collateral, so that its value reflects the current market price of the security, which backs it. To do so, you should specify your sensitivity to the security.

The price sensitivity of a security is expressed as a percentage. You should specify the percentage increase or decrease (the upper and lower limits) above or below the current market price, which should trigger the revaluation process. The revaluation process revaluates the collateral if the price of the securities that backs it fluctuates above or below the sensitivity you have defined.

Price Increase Sensitivity

Denotes the percentage increase in the market price that should trigger a revaluation of the Collateral. This means, if the current market price of the security rises above the old market price by the percentage you have defined as the increase sensitivity for the security, then the revaluation process happens.

For example, Consider a case wherein you have specified the price increase sensitivity for Debentures 98 to be 15%. If the market price of the security has increased from $100 to $125. At this rise in the market price of the security (which is 25% above the old market value), the revaluation process is triggered off, so that the Collateral value of the security reflects its current market value.

Price Decrease Sensitivity

Denotes the percentage decrease in the market price of the security that should trigger a revaluation of the Collateral. This means, if the current market price of the security falls below the old market price by the percentage you have defined as the decrease sensitivity for the security, the revaluation process happens.

For example, Consider a case wherein you had specified the price decrease sensitivity of Debentures 98 to be 15%. If the market price of the security has decreased from US $100 to US $75. At this fall in the market price of the security (which is 33.33% below the old market value of the security), the revaluation process is triggered off, so that the Collateral value of the security reflects it s current market price.

Note

Expired securities are not available for attaching to collateral at the time of collateral maintenance

Start Date and Expiry Date

Specify Start date and Expiry Date of the security in these fields.

Note

Only securities which are active (after start date and before expiry date) are available at collateral maintenance level for considering the security for creating collateral. Expired securities are not available for attaching to collateral at the time of collateral maintenance.

Limit Amount

Specify the limit amount for the particular security. Limit amount is applicable for funds, bonds, stocks and commercial papers. This is validated against the limit specified for the issuer in GCDISSUR for the collateral type under which security is created.Nominal Value Based

Select this check box if the collateral value is to be calculated on the nominal value based for a particular security.

Issuer Code

Specify the issuer code for the customer for whom the securities are collected. The list of issuers is available here.

Issuer code is mandatory for securities of collateral type funds, bonds, stocks and commercial papers.

Price Details

If the security is quoted in different markets, its value would differ in different markets. You can maintain the various market prices of the security under the Price table.

You can specify the following details here:

● Price Code - Indicates the market place for which the price is quoted. This is a unique code for the security to signify the price, like market place/exchange where the price is quoted for the security.

Note

Price code modification for a new price with a new effective date is not allowed on an expired security.

● Market Price - Price of the security in that market

● Last Price Change - Date on which the price was last changed. This gets updated with the date on which new price is signified for the price code.

This can later be linked to 'Collaterals Maintenance' screen (GCDCOLLT) for maintaining market value based collaterals.

Security created can be used in 'Collaterals Maintenance' screen of collateral types which are enabled for external revaluation.

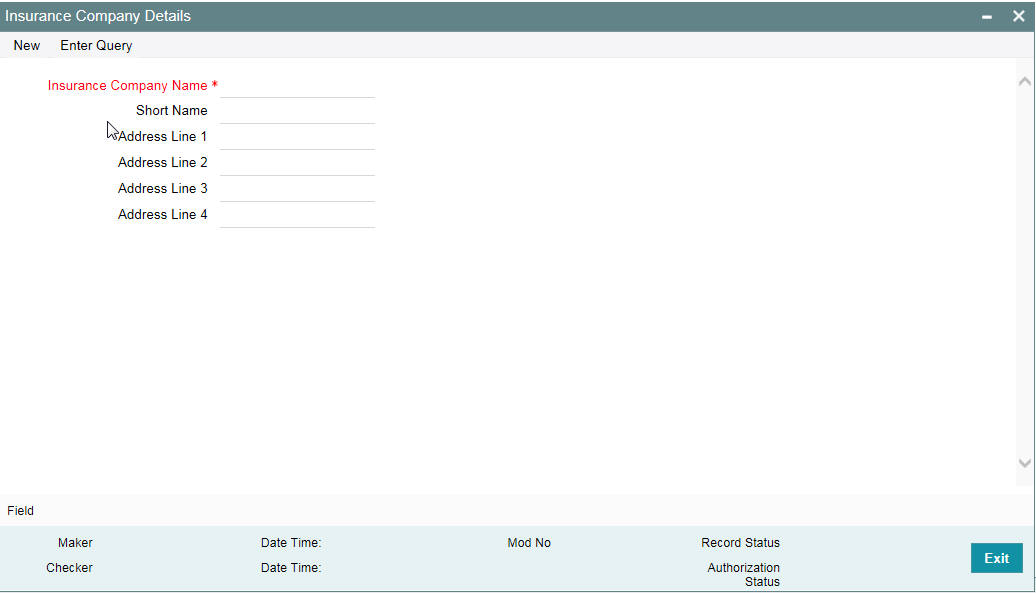

2.6 Maintaining Insurance Company Details

You can maintain the details of insurance companies using ‘Insurance Company Details’ screen. You can later use this information while maintaining details of collaterals offered by customers.

To invoke this screen, type ‘GCDINSCO’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Insurance Company Name

Specify the name of the insurance company. This must be a unique name, using which you can identify the insurance company later.

Short Name

Specify a short name to identify the insurance company.

Address Line 1 to 4

Specify the address of the insurance company in the fields provided. Once you have specified the above details, save the maintenance.

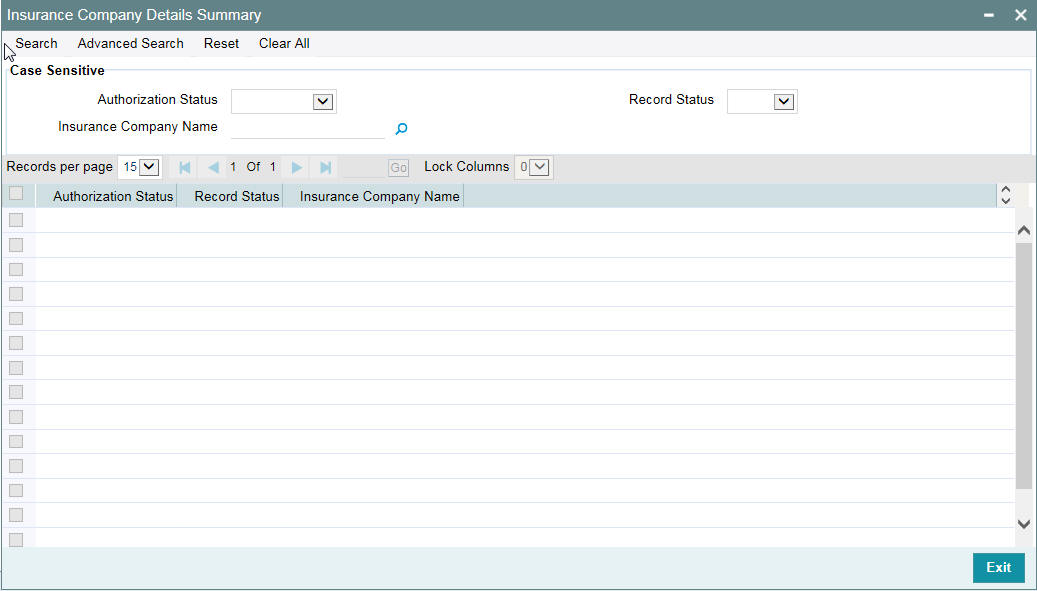

2.6.1 Viewing Insurance Company Summary

You can view the summary of all insurance company details maintained in the system using ‘Insurance Company Details Summary’ screen. To invoke this screen, type ‘GCSINSCO’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization status

- Record status

- Insurance company name

Once you have specified the search criteria, click ‘Search’ button. The system displays the following details of the insurance companies that match the filter criteria.

- Authorization status

- Record status

- Insurance company name

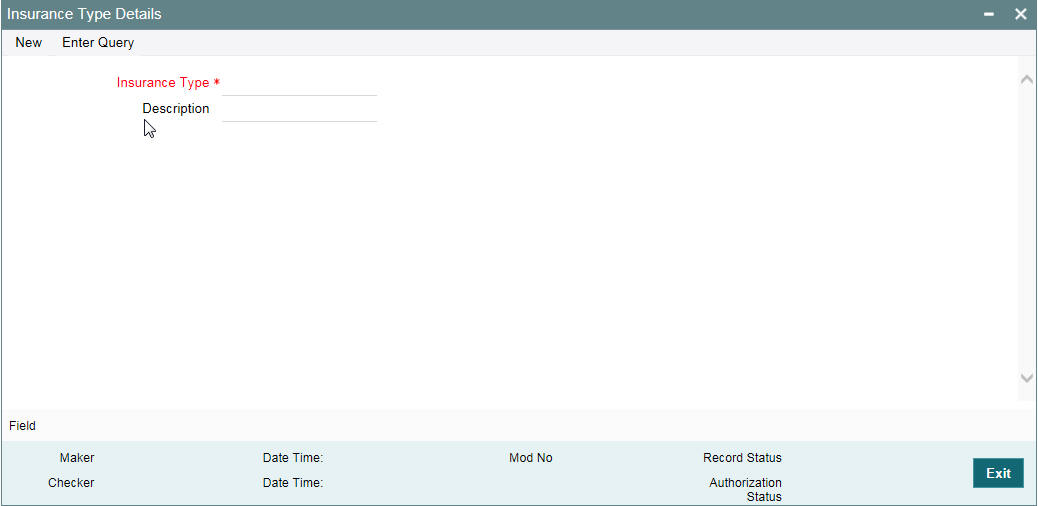

2.7 Maintaining Insurance Types

You can maintain insurance types using ‘Insurance Type Details’ screen. You can later use this information while maintaining details of collaterals offered by customers.

To invoke this screen, type ‘GCDINSTY’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Specify the following details:

Insurance Type

Specify the insurance type. This must be a unique value, using which you can identify the insurance type later.

Description

Specify a brief description of the insurance type.

Once you have specified the above details, save the maintenance.

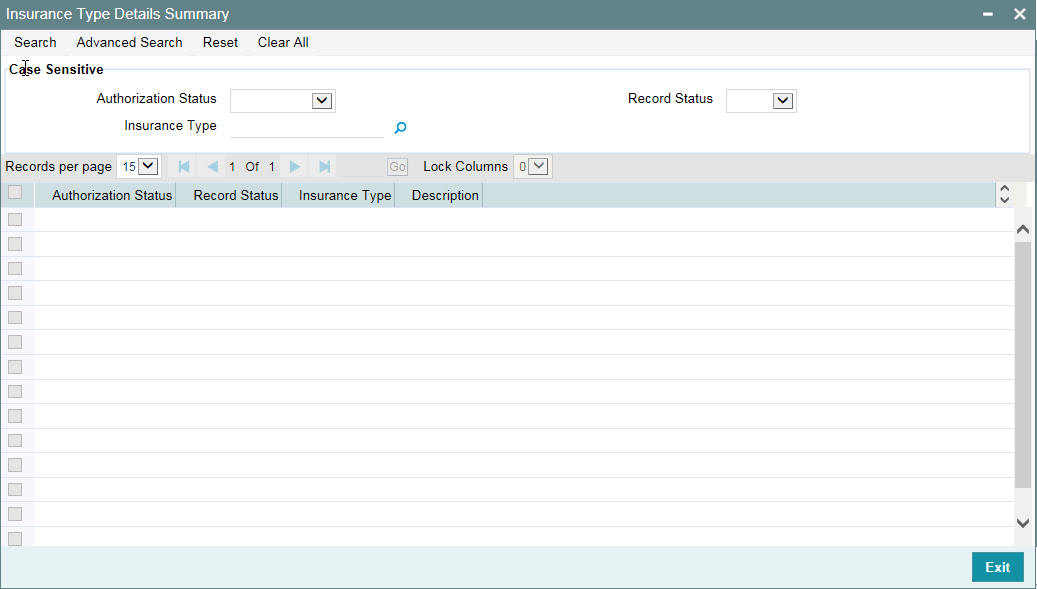

2.7.1 Viewing Insurance Type Summary

You can view the summary of all insurance types maintained in the system using ‘Insurance Type Details Summary’ screen. To invoke this screen, type ‘GCSINSTY’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

You can search for the records based on one or more of the following parameters:

- Authorization status

- Record status

- Insurance type

Once you have specified the search criteria, click ‘Search’ button. The system displays the following details of the insurance companies that match the filter criteria.

- Authorization status

- Record status

- Insurance type

- Description of the insurance type

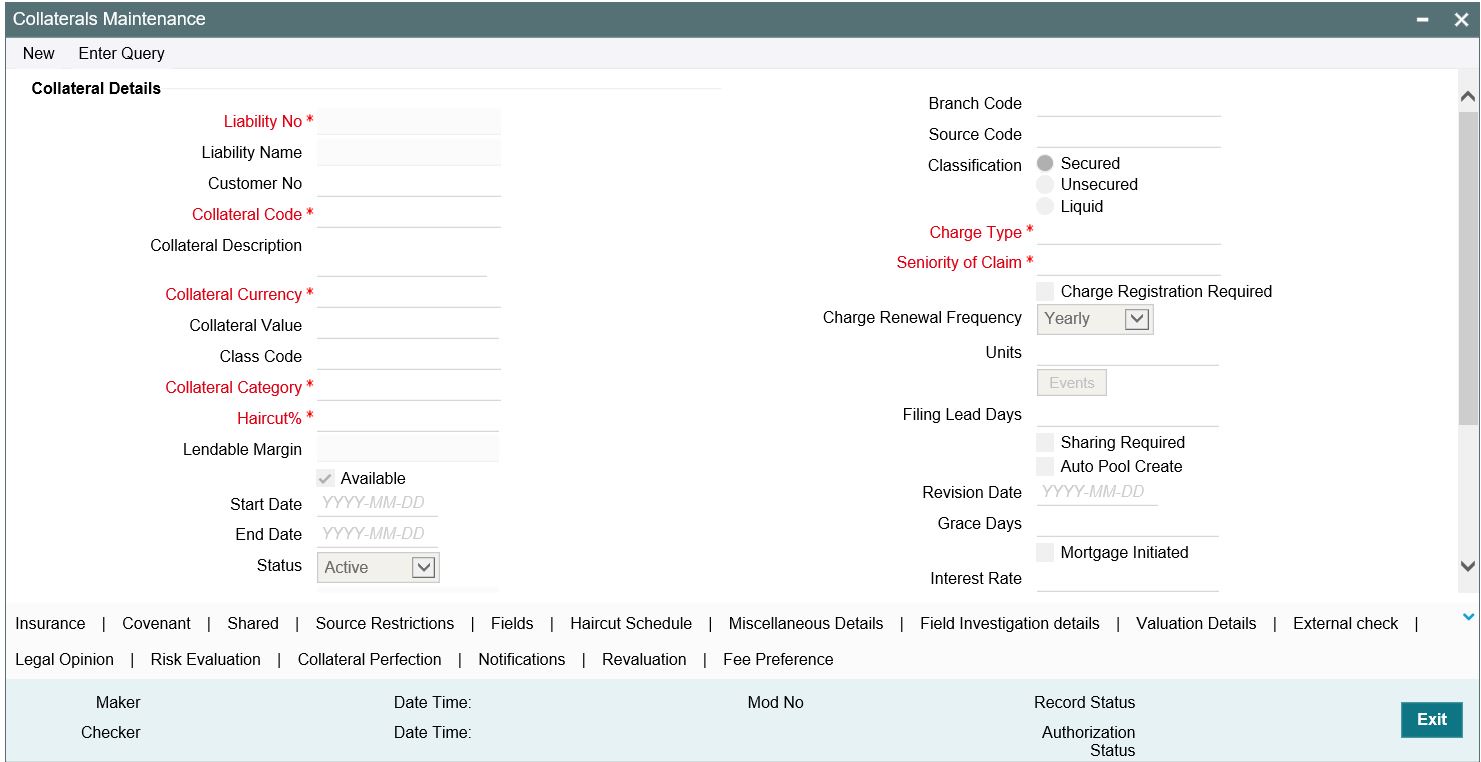

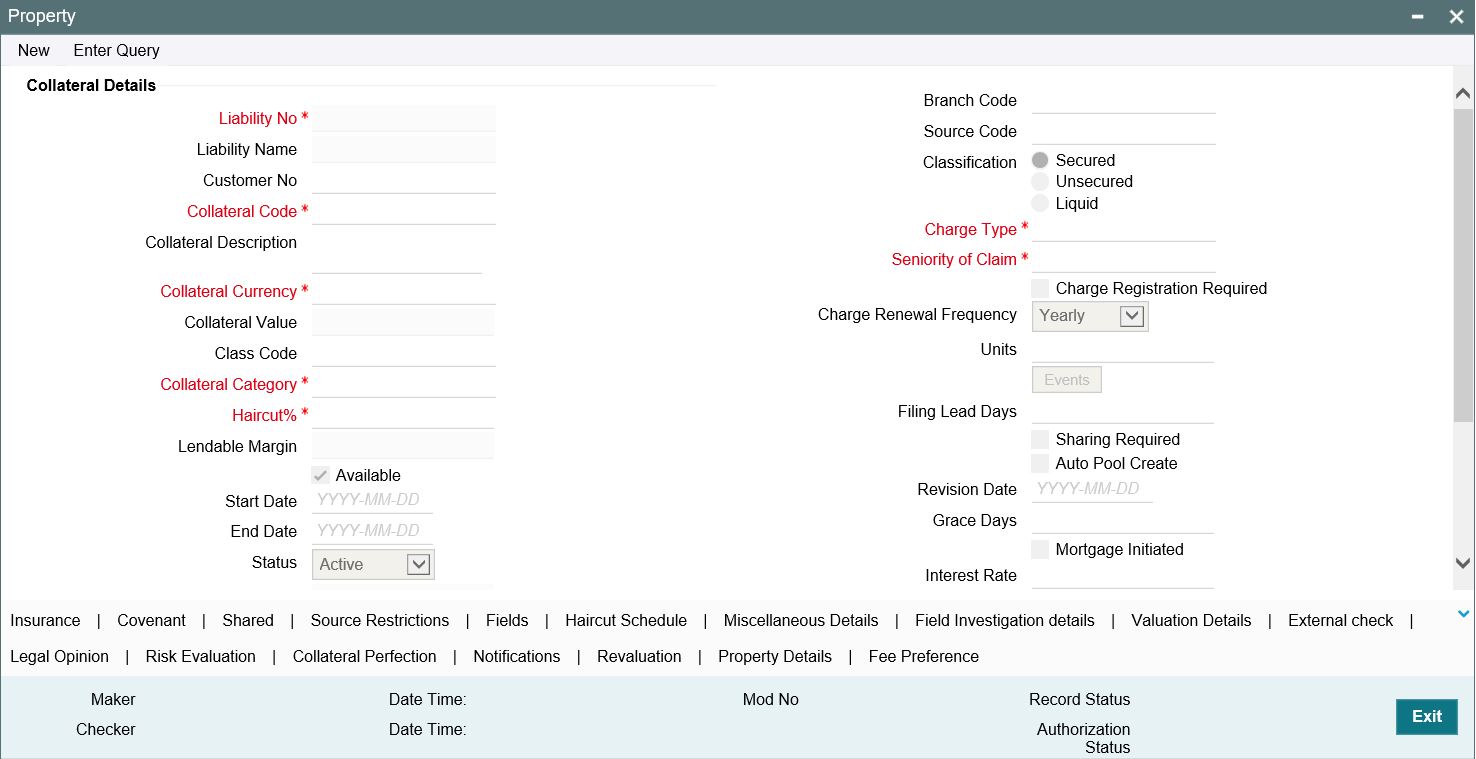

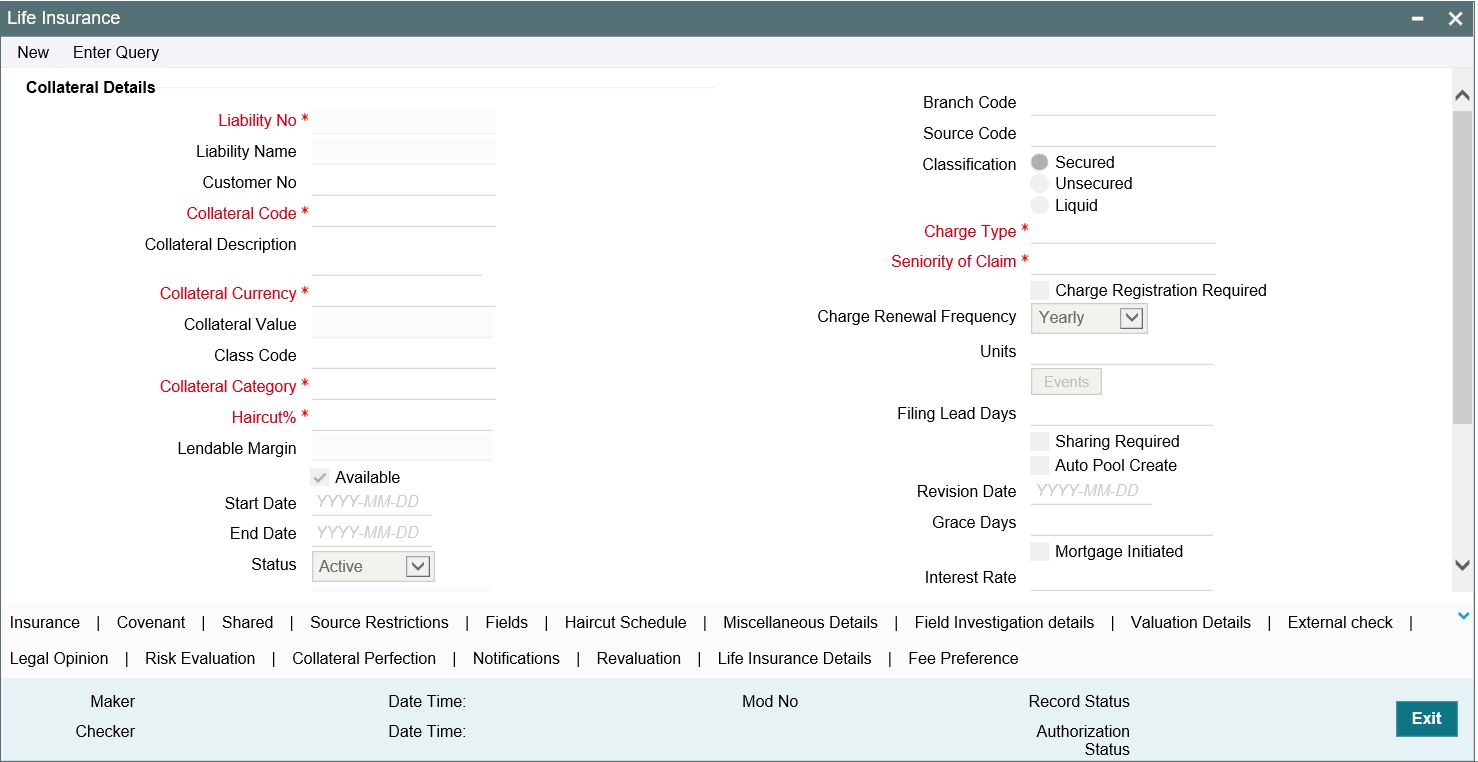

2.8 Collaterals Maintenance

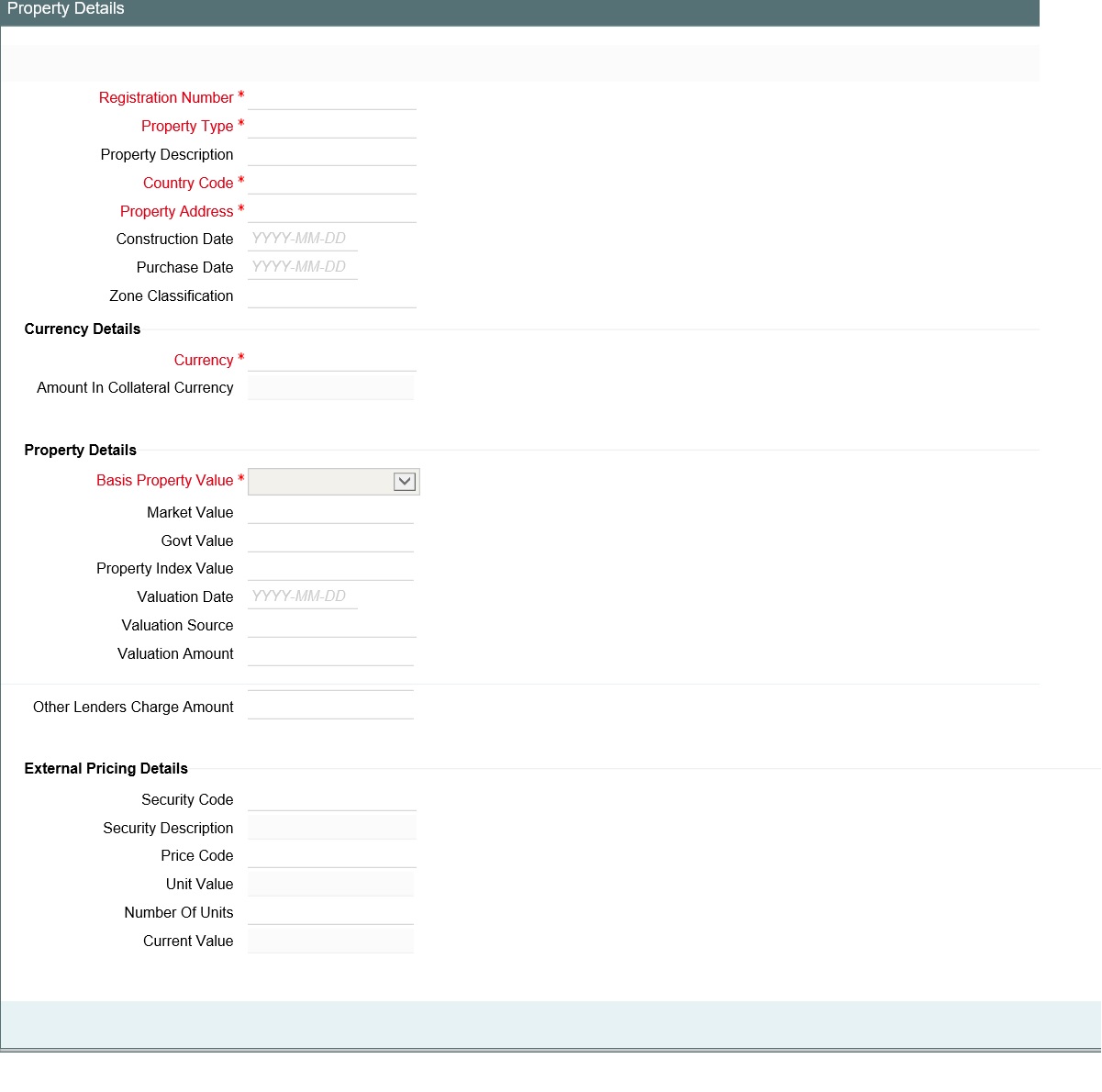

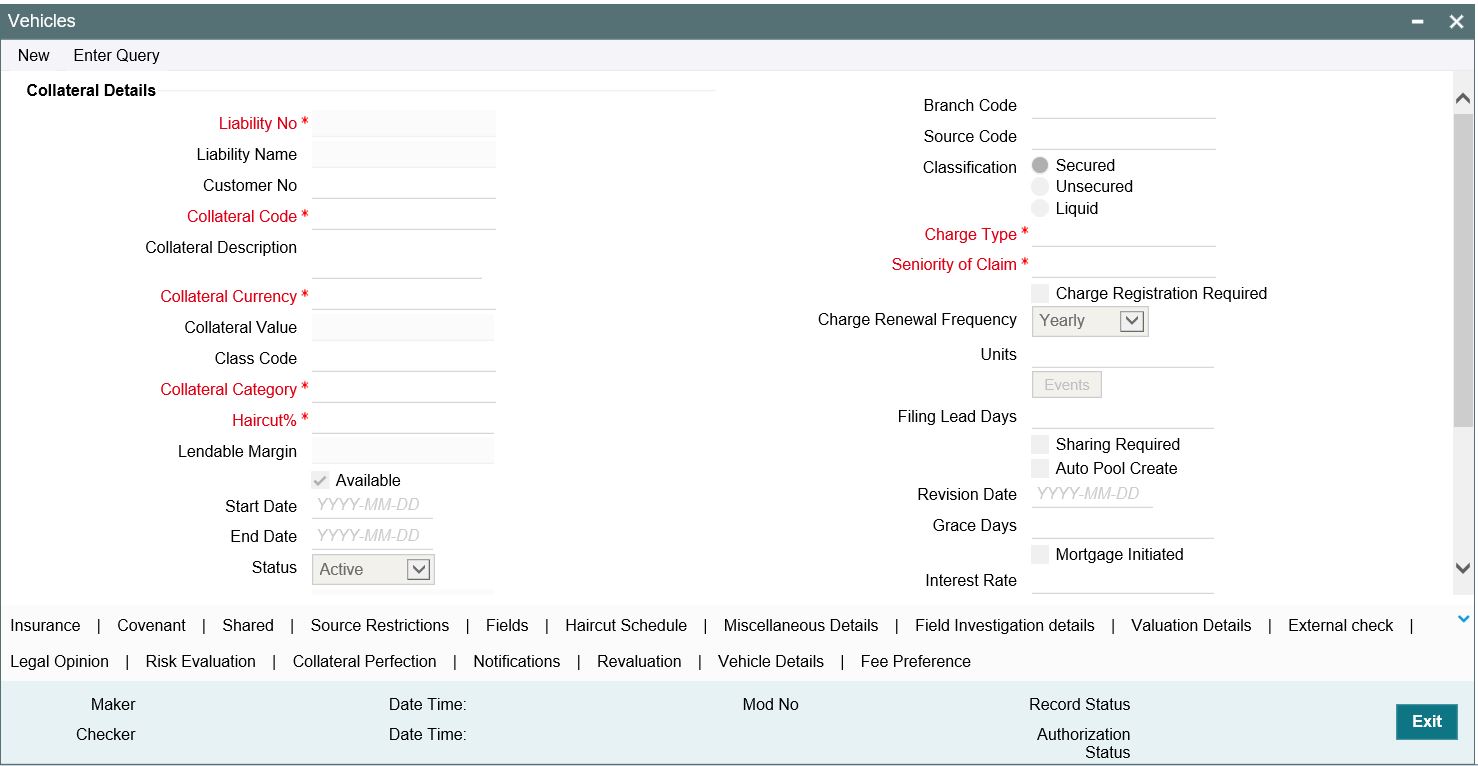

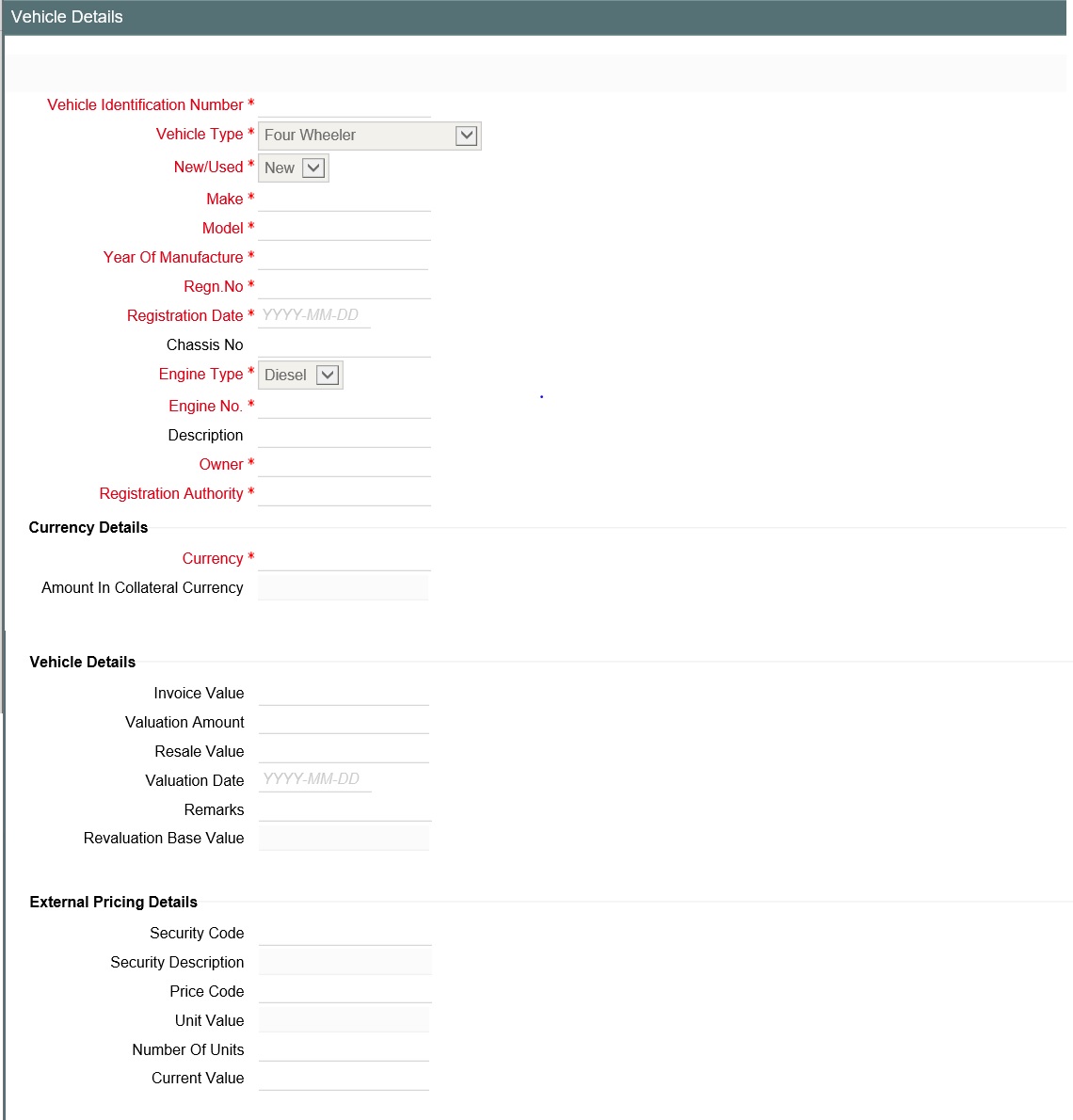

In the ‘Collaterals Maintenance’ screen, you can maintain the details of collateral offered by customers for the credit that the bank grants under a credit line. The collateral can either be market value based or non market value based.

You can invoke the ‘Collaterals Maintenance’ screen by typing ‘GCDCOLLT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In the above screen you can specify the contribution that the collateral should make to the limit assigned to a customer under a credit line.

Liability Number

Collaterals issued have to be linked to a liability. Specify the liability Number for which the collateral is linked.

Customer Number

Specify the customer number to which the collateral is linked.

You must select the liability number before specifying the customer number. Once the liability number is specified, the system enables the option list for customer number. This option list displays all valid customer number that are linked to the liability number selected above. You can select the appropriate one.

The selection of collateral customer linkage is optional.

Collateral Code

Specify the Collateral Code here. A maximum of 20 alphanumeric characters are allowed in this field. Each Collateral code should be unique.

Collateral Description

Give a brief description of the collateral here.

Remarks

Specify remarks, if any.

Collateral Currency

Specify the currency in which the Collateral has to be maintained. Once authorized you cannot change this entry.

Collateral Value

Collateral value is derived based on child records in all of the collateral type maintenance screens except in case of Collaterals Maintenance. Collateral value is directly entered in the main screen.

The collateral value depends on whether the security is Market Value based or Non-Market Value based.

If it is market value based then the collateral value is calculated as shown in the following examples.

Example

Input in case of a nominal quoted security:

Nominal Amount |

Price Code |

Market Price |

Collateral Value [(Market price/100) * Nominal Amount] |

10,00,000 |

BOM1 |

65 |

(65/100) *10,00,000=650000 |

5,00,000 |

BOM2 |

70 |

(70/100) * 5,00,000= 350000 |

7,00,000 |

BOM3 |

80 |

(80/100) * 7,00,000= 560000 |

Input in case of a unit quoted security:

Number of Units |

Price Code |

Market Price |

Collateral Value (Number of Units x Market Price Market price) |

65 |

BOM1 |

120 |

7800 |

70 |

BOM2 |

130 |

9100 |

40 |

CAL1 |

95 |

3800 |

If it is Non-Market Value based then the user has to enter the collateral value manually.

Note

In case 'Collateral Value' is increased, then in the 'Collateral Pool Maintenance' screen, the 'Linked Amount' is modified only if the 'Amount Basis' is 'Percentage'. If the 'Amount Basis' is 'Amount', then the 'Linked Amount' is retained as is. However based on the changed 'Collateral Value', the 'Linked Percent Number' is re-calculated considering the retained amount.

Reduction of collateral value

When collateral is only linked to pool

Linkage basis is percentage – reduction in collateral value results in recalculating collateral pool contribution to the pool and accordingly block amount on collateral changes

Linkage basis is amount – reduction in collateral value is permitted only to the extent of allocation already done, so that block amount on collateral continues to be same

When pool is linked to facility and no utilization has taken place

Scenario 1 - Collateral to pool linkage is percentage and Pool to facility linkage is

amount

- Collateral value – 20000

- Linkage to pool – 50% - 10000

- Pool to facility – 6000

- Post modification of collateral value to 10000

- Linkage to pool – 50% - 5000

- Pool to Facility-6000

Modification is not allowed since the modified pool value is going below the linked amount at Facility level

Scenario 2 - Collateral to pool linkage is Percentage and Pool to facility linkage is

Percentage

- Collateral value – 20000

- Linkage to pool – 50% - 10000

- Pool to facility –50%-5000

- Post modification of collateral value to15000

- Linkage to pool – 50% - 7500

- Pool to Facility-50%-3750

Modification is allowed since the reduced Collateral value is recalculating pool and facility contribution based on percentage

Scenario 3 - Collateral to pool linkage is Amount and Pool to facility linkage is Amount

- Collateral value – 20000

- Linkage to pool –10000

- Pool to facility – 5000

- Post modification of collateral value to 8000

- Linkage to pool – 10000

- Pool to Facility-5000

Modification is not allowed since the modified Collateral value is going below the Linked amount

Scenario 4 - Collateral to pool linkage is Amount and Pool to facility linkage is Percent

age

- Collateral value – 20000

- Linkage to pool –10000

- Pool to facility –50%-5000

- Post modification of collateral value to 8000

- Linkage to pool –10000

- Pool to Facility-50%-5000

Modification is not allowed since the modified Collateral value is going below the Linked amount

When pool is linked to facility and utilization has taken place

Scenario 1 – Collateral linked to pool with pool level utilization existing

- Collateral value – 20000

- Linkage to pool – 50% - 10000

- Utilization amount at Collateral Pool level-4000

- Post modification of collateral value to 7000

- Linkage to pool – 50% - 3500

Modification is not allowed since the modified Collateral value which in turn modifies the Limit Contribution is going below the Utilized amount at Pool level.

Scenario 2 – Collateral linked to pool which in turn is linked to facility and utilization

has taken place at facility level.

- Collateral value – 20000

- Linkage to pool – 50% –10000

- Pool to facility – amount - 10000

- Utilization amount at facility level – 10000

- Post modification of Collateral value to 16000

- Linkage to pool – 50% – 8000

- Pool to facility – amount – 10000

- Existing utilization at facility level – 10000

Modification is not allowed since the modified Collateral value resulting in pool contribution to facility to go below existing utilizationClass Code

You are required to enter/select the collateral fee class code in ‘Class’ field in main screen and then tab out/move to another field. The system validates and throw an exception if class code is entered and related details are not maintained in 'Fee Preference' sub-system.

Branch Code

This branch code on main screen is where the collateral record gets created and is defaulted by the system.

Limit Contribution

On save of the collateral, system calculates the amount contribution that will be applicable for the collateral after applying the hair cut percentage on the collateral value.

Example

Collateral is valued at $1000, and you want to offer the customer credit only worth $980. This amount is 98% of the collateral contribution.

(1000 - 980) / 1000 *100 = 2% is the Hair cut percentage

This means you want to have a lendable margin of 98%.

For instance, if you enter the lendable margin percentage, then based on the value you enter, the hair cut is calculated as described above and the limit contribution is calculated.

Start Date and End Date

Specify the tenor of the collateral using the Start Date and End Date fields. The collateral is considered effective only during this period.

If start date is not entered, current application date is considered as start date.

The start date indicates the date from which the collateral becomes effective.

End date is updated based on farthest maturity date/end date when multiple child records are linked to a collateral.

In case of few collaterals End date is updated directly on the main screen. For example, Inventory, Miscellaneous, Funds, Stocks, Commodities, Metals, Property, Vehicles and Machinery, and so on.

Revision Date

Specify the date on which this collateral has to be revisited for review.

Grace Days

Specify the grace days past the next due/revision date allowed for collateral.

Source Code

Indicates the product processor name from where the transaction has been originated. Collateral Category

Select the name of the category from the adjoining option list.

Utilization Amount

The system computes and displays the utilization amount to the Collateral, if a collateral is directly linked to a contract or account and not through a pool.

Available Amount

The system defaults the available amount for the collateral, on save of the collateral record.

Liability Name

Specify the liability name that needs to be linked with the collateral.

Pool Contribution

When the collateral is linked to the collateral pool, the system computes and displays the amount to be blocked. The blocked amount is computed based on the linked percentage or linked amount specified when a collateral is linked to a Collateral Pool.

For example, Collateral ‘Collat1’ is created with collateral value of 10000 USD. And 60% of Collat1 is linked to a Collateral Pool, then the blocked amount of the collateral is updated as 6000 (that is, 60% of 10000). The available amount of collateral is updated as 4000(10000-6000). The available amount of the collateral is arrived by using the below mentioned calculation

Available amount = Collateral value – utilization – blocked amount.

The available amount of pool is increased to the extent of linked amount in the pool currency. Any utilization to the pool will only impact the available amount and the utilization of the pool and not the collateral.

Lendable Margin

On save of the collateral, system calculates the lendable margin for the collateral. This value will be:

100 – Haircut (%).

Seniority of Claim

Specify the seniority of bank’s claim on the property.

Charge Type

Charge type is mandatory and available as LOV which comes from 'Charge Type Maintenance' screen.

User Reference

Specify the User Reference Number for the collateral.

Classification

Indicate the Collateral Exposure Type here. A particular collateral category can be of a Secured or Unsecured or Liquid Type.

Available

This check box is selected by default, indicating that the collateral is available for linking to the collateral pool. You can deselect this so as to manually freeze this collateral.

If the ‘Available’ check box is deselected then the collateral is frozen, that is, it is not available for subsequent linkages to new collateral pools. The collateral’s current links to collateral pools is not affected.

Note

- As a part of Collateral Pool creation for a Liability, only those collaterals which are checked as ‘Available’ is displayed in the list for collateral pool linkage.

Collateral which was ‘Available’ and which has been linked to pool/pools can be modified as unavailable later on. Unavailable collateral is not available for subsequent new collateral pool linkages, but the old linkages is not affected.

Sharing Required

Select this check box to indicate that the collateral can be shared among other liabilities. If you choose this option, you can specify the details of such liabilities in the ‘Shared Details’ screen.

If this option is chosen then in collateral maintenance for a collateral pool, the list of collaterals will include shared collaterals too. Revaluation of shared collaterals impacts the pools to which the same has been linked.

Auto Pool Create

Select this check box if you want to automatically create a collateral pool as and when you create collateral. To facilitate this, it is essential that the ‘Available’ option is selected for the collateral. The system then creates a collateral pool with the following characteristics when you save the record:

- The Pool Code, Pool Description, and Pool Currency are the Collateral Code, Collateral Description and Collateral Currency respectively.

- The Collateral Linked Percentage is set at 100%.

- Collateral linked to the pool which is auto created will have order number as 1 by default.

Note

You cannot modify this option after you authorize the collateral.

Haircut (%)

Specify the bank’s margin (Haircut) to be assigned for Collateral. Haircut% applied by the system as per the Haircut schedule would be displayed here.

Mortgage Initiated

Indicates if mortgage has been initiated for the collateral.

For more information about the 'Mortgage Initiated' field, refer to the ‘Linkages Tab’ section of the ‘Mortgages’ user manual.

Interest Rate

The interest rate defaults from the collateral type during selection of collateral category.

Taken Over

Indicates if the collateral has been taken over.

Tanked Utilization

Utilization transactions sent to the collateral during the EOD process are tanked and the utilizations are updated to the 'Tanked Utilizations' field instead of 'Utilization' field .

During BOD process the tanked utilizations are moved to 'Utilization' field and 'Tanked Utilizations' field is cleared

Charge Registration Required

Select this check box for recording registration details for the charge on collateral.

As part of charge registration, notice with required details can be sent to the appropriate registration authority. Filing statement has can be sent to registrar for charge creation.

Note

Based on the collateral category selected, charge registration details are defaulted during customer collateral maintenance which can be modified.

Charge Renewal Frequency

A charge can be renewed as per the charge renewal frequency and units. For every charge type, a ‘Charge Renewal Frequency’ can be configured. You can select ‘Yearly’, ‘Half Yearly’, ‘Quarterly’, ‘Monthly’, ‘Weekly’.

Units

Specify the units.

For example, if 'Frequency' is selected as 'Monthly' and 'Unit' is selected as '2', then the system updates the charge end date considering perfection date + 2 months.

Filing Lead Days

The filing lead days is number of days prior to charge expiry date during this period charge can be renewed.

The collateral details which are associated with a collateral code can be picked up during collateral pool maintenance.

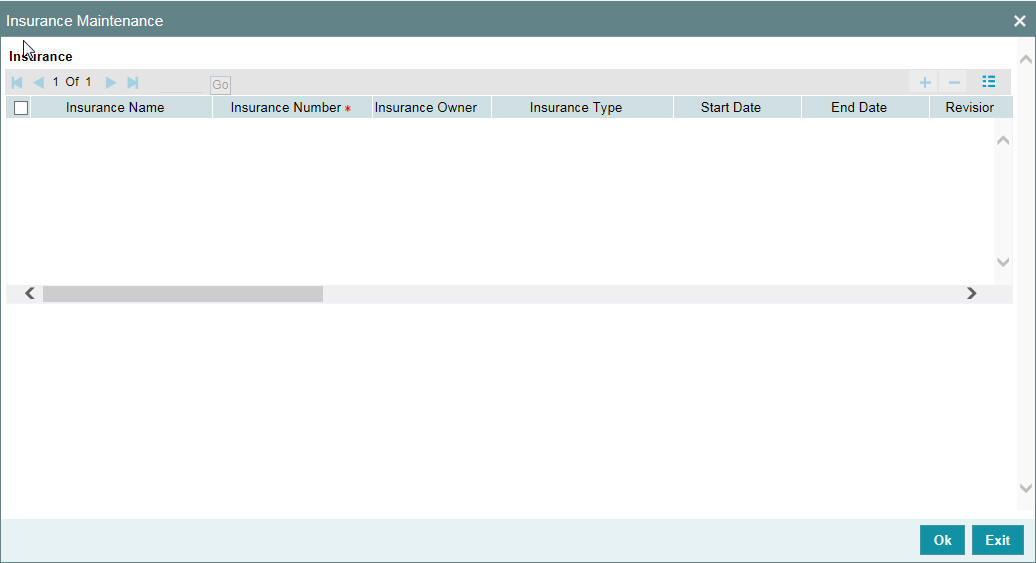

2.8.1 Specifying the Insurance Details

You may enter the Insurance details for a Collateral through the ‘Insurance Maintenance’ screen. Click ‘Insurance’ button to invoke this screen.

You can specify the following details:

Insurance Name

Specify the name of the Insurance/Insurance Company associated with the collateral. The option list displays all valid insurance company names maintained in the system. Select the appropriate one.

Insurance No

Specify the insurance number under which that insurance has been issued.

Insurance Owner

Select the owner of the insurance policy from the adjoining drop-down list. This list displays the following values:

- Bank

- Customer

Insurance Type

Specify the type of the insurance that is associated with that collateral. The option list displays all valid insurance types maintained in the system. Select the appropriate one.

Start Date

Specify the start date for that insurance.

End Date

Specify the end date for that insurance.

Revision Date

Specify the date of revision of the insurance.

Notice Days

Indicates the number of days prior to next revision date of insurance. You can modify this value. The period during the notice days is the notice period.

Insurance Premium Periodicity

Select the premium periodicity of the insurance. The list displays the following values:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Premium Status

Specify the insurance premium payment status.You can select one of the following premium payment statuses from the drop-down list.

- Paid

- Unpaid

Premium End Date

Specify the end date of the premium payment.

Insurance Amount

Specify the insured amount of the policy.

Insurance Currency

Specify the insurance currency of the policy.

Cover Date

Specify the date from which the insurance policy is valid. The insurance cover date cannot be greater than the collateral expiry date.

Insurance Code

Specify the insurance code of the policy for which you want to capture insurance details.

Premium Currency

Specify the currency of the premium to be paid.

Premium Amount

Specify the amount of the premium to be paid.

Remarks

Specify the remarks about the insurance details.

Policy Assigned to Bank

Specify whether the insurance policy has been assigned to the bank or not. You can select one of the following options.

- Yes

- No

Coverage

Specify the coverage details of the insurance.

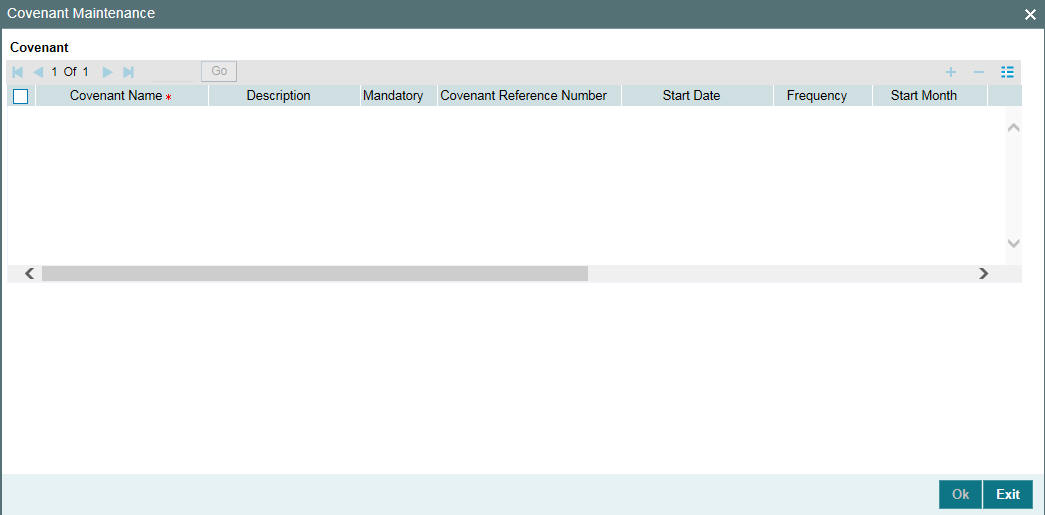

2.8.2 Specifying Covenant Details

The covenant details can be captured for a collateral in the ‘Covenant Maintenance’ screen. Click ‘Covenant’ button to invoke this screen.

Multiple covenants can be entered in the screen shown below. You can customize the details of each covenant recorded here.

Covenant Name

Select the covenant name from the list available here. The list displays the covenant names maintained in Covenant Maintenance screen. Based on the covenant selected, all other details of the covenant maintenance are brought here.

Mandatory

Mandatory/Non mandatory details are shown on choosing a covenant name. You may change this.

Covenant Reference Number

Specify the covenant reference no for the covenant being maintained.

Start Date

Start date is defaulted to current business date when covenant is linked to a collateral and you cannot modify it.

Frequency

Frequency of the specified covenant is defaulted here based on the details maintained at ‘Covenant Maintenance’ screen. You may change the frequency shown here on choosing a covenant name.

Start Month

Start month of the specified covenant is defaulted here based on the details maintained at ‘Covenant Maintenance’ screen. You may change the 'Start Month' shown here on choosing a covenant name. Start month is mandatory when frequency is monthly and above.

Due date

Due date of the specified covenant is defaulted here based on the details maintained at ‘Covenant Maintenance’ screen. You may change the Due Date shown here on choosing a covenant name. Due date is mandatory when frequency is monthly and above.

Revision Date

Indicates the date on which covenant has to be revisited for review. Revision date is derived by system and updated when covenant is saved – based on combination of start date + (combination of frequency and due date and start month).

Examples for the revision date calculation of different frequencies.

System date -5th April 2019

1. Daily-6th April 2019

2. Weekly-12th April 2019

3. Monthly-10th May 2019 (Due date provided-10)

4. Quarterly-2nd June 2019 (Due date provided-2, Start month- June)

5. Half yearly-1st Feb 2020 (Due date provided-1, Start month-Feb)

6. Yearly- 10th July 2020 (Due date provided-10,Start month-July)

Notice Days

Specify the notice days, that is, the number of days prior to revision date of the covenant. The period during the notice days are the notice period. Notice days are mandatory when frequency is weekly and above. You can change the Notice Days details which are displayed here on choosing a covenant name.

Grace Days

Specify the grace days, that is, the number of days after the revision date of the covenant that the covenant will be available for tracking. You can change the Grace Days details which are displayed here on choosing a covenant name.

Remarks

Remarks if any specified for the covenant at the ‘Covenant Maintenance’ screen are defaulted here. It can also be changed here.

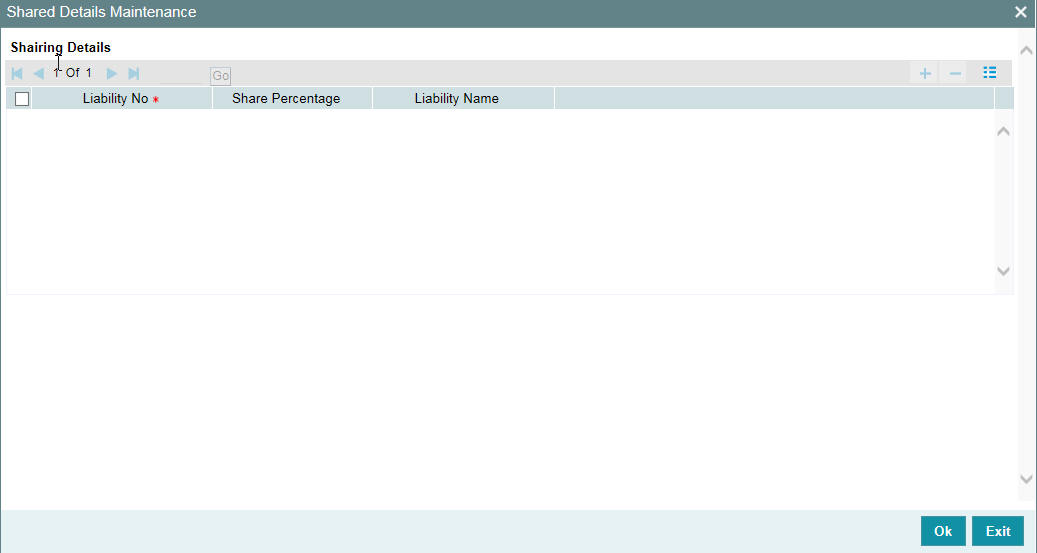

2.8.3 Specifying Shared Details

The details of the liabilities sharing the collateral can be captured for a collateral in the ‘Shared Details Maintenance’ screen. Click ‘Shared’ button to invoke this screen.

Liability Number

Specify the liability number of the liability that is sharing the collateral. Sharing with liability/liabilities cannot be exceed 100% of collateral value.Shared Percentage

Specify the percentage share of the liability in the collateral.

You can modify the above retails post authorization. However, the modification must be authorized.

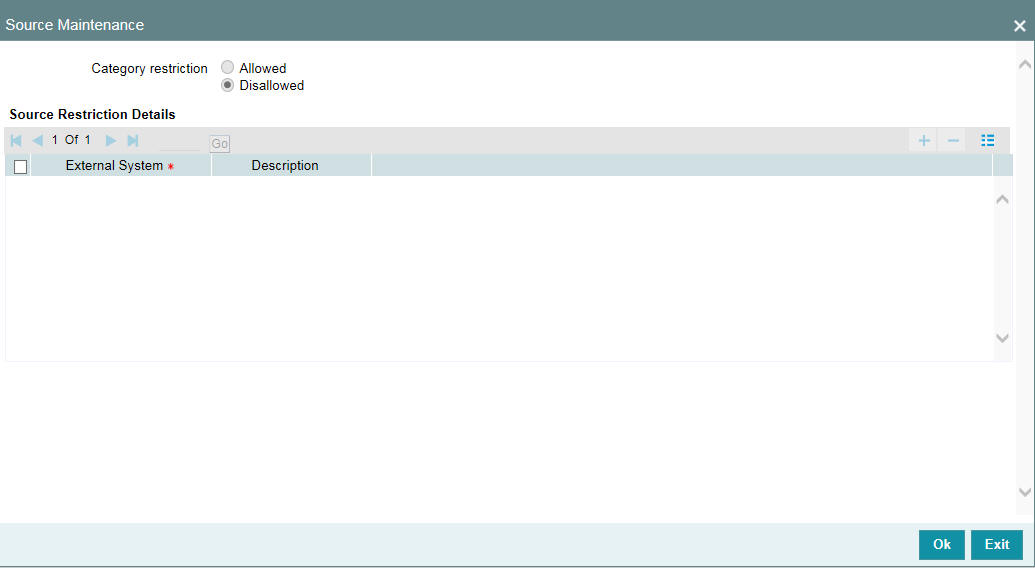

2.8.4 Maintaining Source Restrictions

You can specify which sources are allowed or restricted to access the collateral in ‘Source Maintenance’ screen. Click ‘Source Restrictions’ button to invoke this screen.

Restriction Type

Choose the ‘Allowed’ option to maintain an allowed list of external systems. Choose the ‘Disallowed’ option to maintain a disallowed list of external systems.

Default value of this field is’ Disallowed’. If you select restriction type as ‘allowed’, then you need to input at least one record.

Source

Specify the external system by selecting from adjoining LOV and enter description.

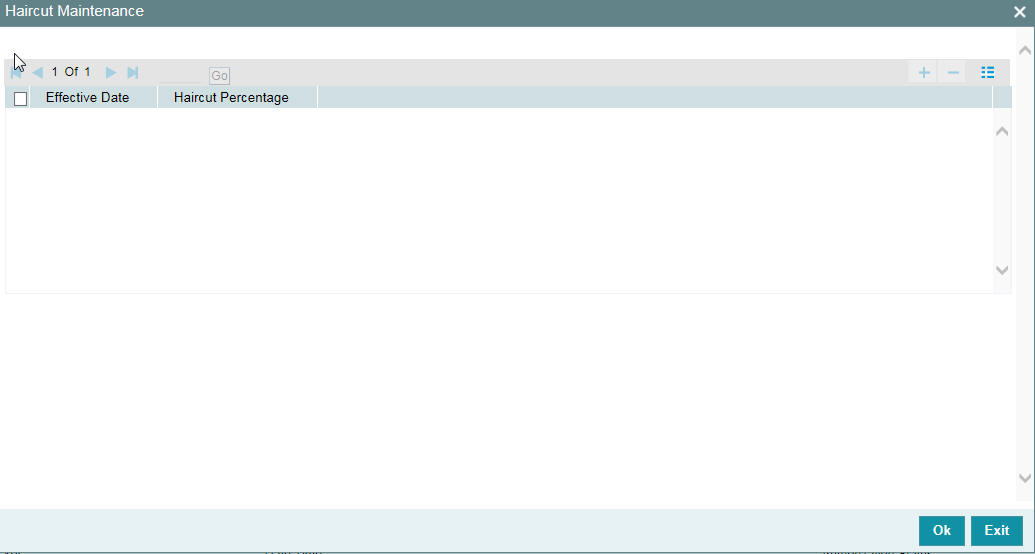

2.8.5 Maintaining Haircut Schedules

You can specify the hair-cut revisions for the collateral in ‘Haircut Maintenance’ screen. Click ‘Haircut Schedule’ button to invoke this screen.

Effective Date

Specify the date on which the Haircut % becomes effective from the adjoining option list.

Haircut %

Specify the Hair cut% of the Collateral. You can enter values between 1 to 100.

Note

System applies the haircut% to the collateral on the schedule effective date during the BOD process of the collateral batch (GCBCOLAT).

The following validations are performed during save, For New operation,

- Effective date should be greater than the application date and start date of the collateral

- Multiple Haircuts for the same effective date is not allowed.

- Haircut% chosen at the main screen gets defaulted as the first schedule with collateral start date as the effective date, in the Haircut schedules sub-screen.

- For modify operation,

- Effective date should be greater than the application date and start date of the collateral

- Effective date should be less than the end date of the collateral.

- Deletion or Modification of existing Haircuts whose effective date are less than application date would not be allowed.

- Haircut schedules maintained in this sub screen would be applied on the effective date in the existing collateral batch process.

- Existing field Haircut% would show the latest haircut of the collateral.

2.8.6 Maintaining Miscellaneous Details

Collateral maintenance is a generic option to create collateral of miscellaneous type (which does not fit into any of the collateral types provided).

The details of collateral can be captured against collateral notes 1, 2, 3,and so on,

Miscellaneous sub-system is also available in other collateral types maintenance screens, which can be made use of for capturing miscellaneous details about the collateral.

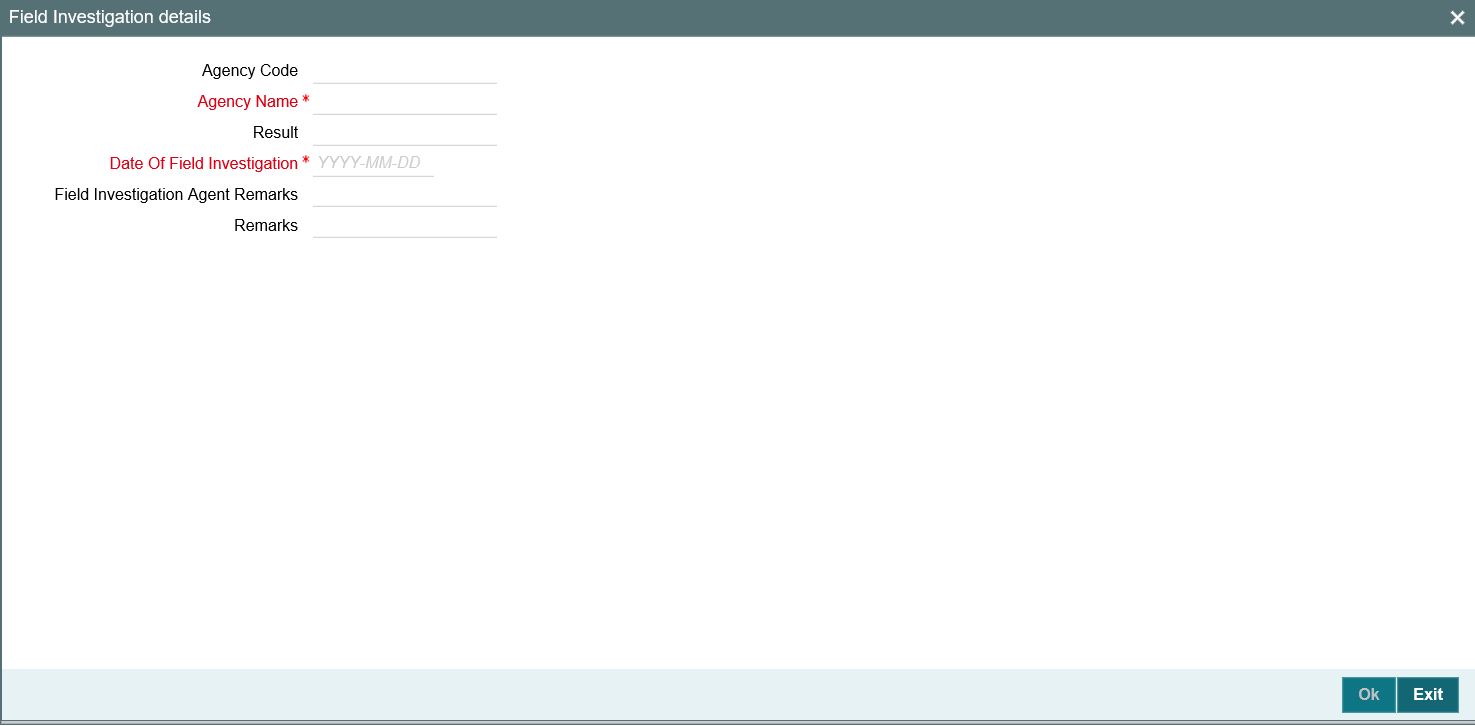

2.8.7 Maintaining Field Investigation Details

You can maintain field investigation details in the Field Investigation Details screen. To invoke this screen click ‘Field Investigation Details’ button in Collateral Maintenance screen.

Agency Code

Specify the agency code of field investigation agency.

Agency Name

The system displays the field investigation agency name.

Result

Specify the result of the field investigation.

Date of Field Investigation

Enter the date of field investigation.

Field Investigation Agent Remarks

Specify the remarks by the field investigation agent.

Credit Remarks

Specify the remarks by credit team.

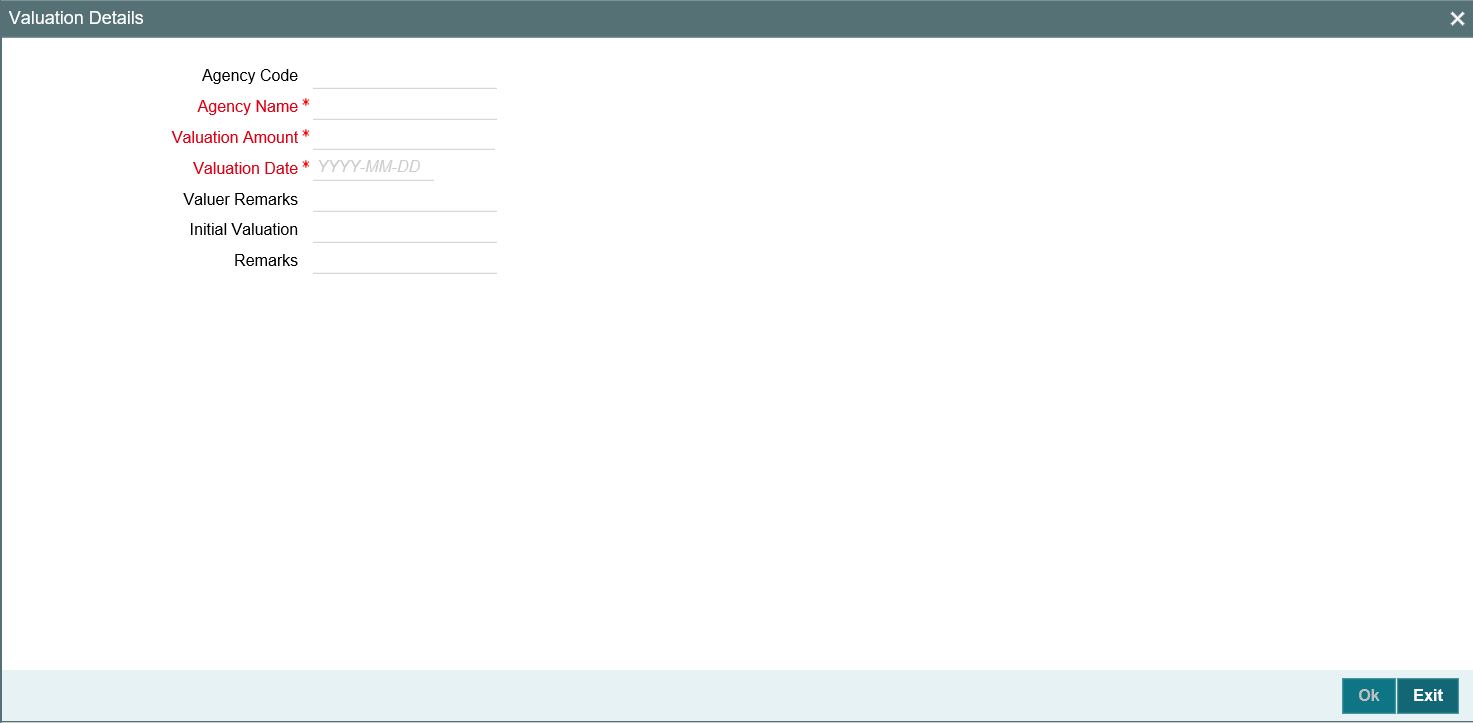

2.8.8 Maintaining Valuation Details

You can maintain valuation details of a collateral in Valuation Detail screen. Click ‘Valuation Details’ button in ‘Collateral Maintenance’ screen to invoke this screen.

Agency Code

Specify the valuation agency code.

Agency Name

The system displays the valuation agency name.

Valuation Amount

Specify the valuation amount.

Valuation Date

Enter the date of valuation.

Initial Valuation

The system displays the initial valuation as ‘Yes’ if the valuation is done during collateral creation process.

Remarks

Specify the remarks by credit team.

Valuer Remarks

Specify the remarks by valuation agent.

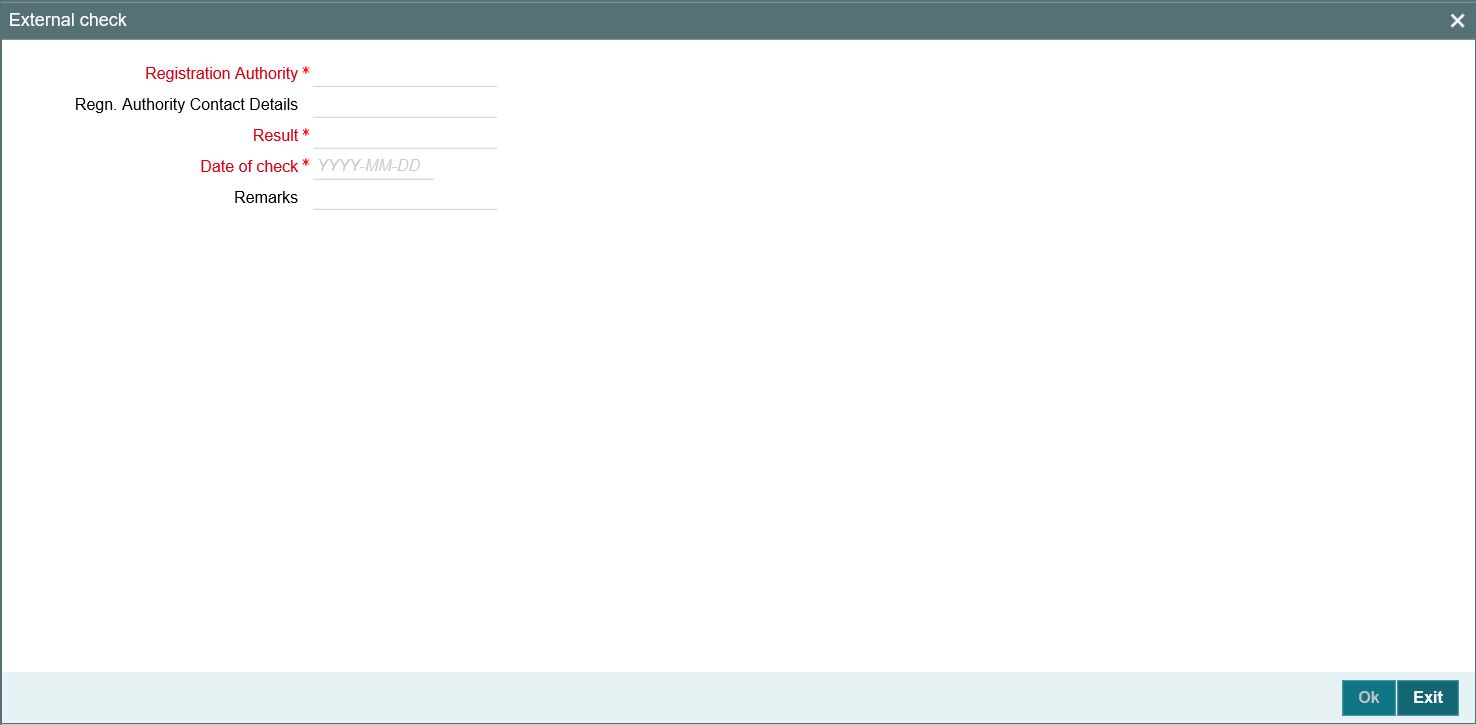

2.8.9 Maintaining External Check Details

You can maintain the details of external check in ‘External Check’ screen. Click ‘External Check’ button in Collateral Maintenance screen to invoke the following screen:

Registration Authority

Specify the registration authority details.

Registration Authority Contact Details

Specify he registration authority contract details.

Result

Specify the result of the external check.

Date of Check

Specify the date when the external check was started.

Remarks

Specify credit remarks, if any.

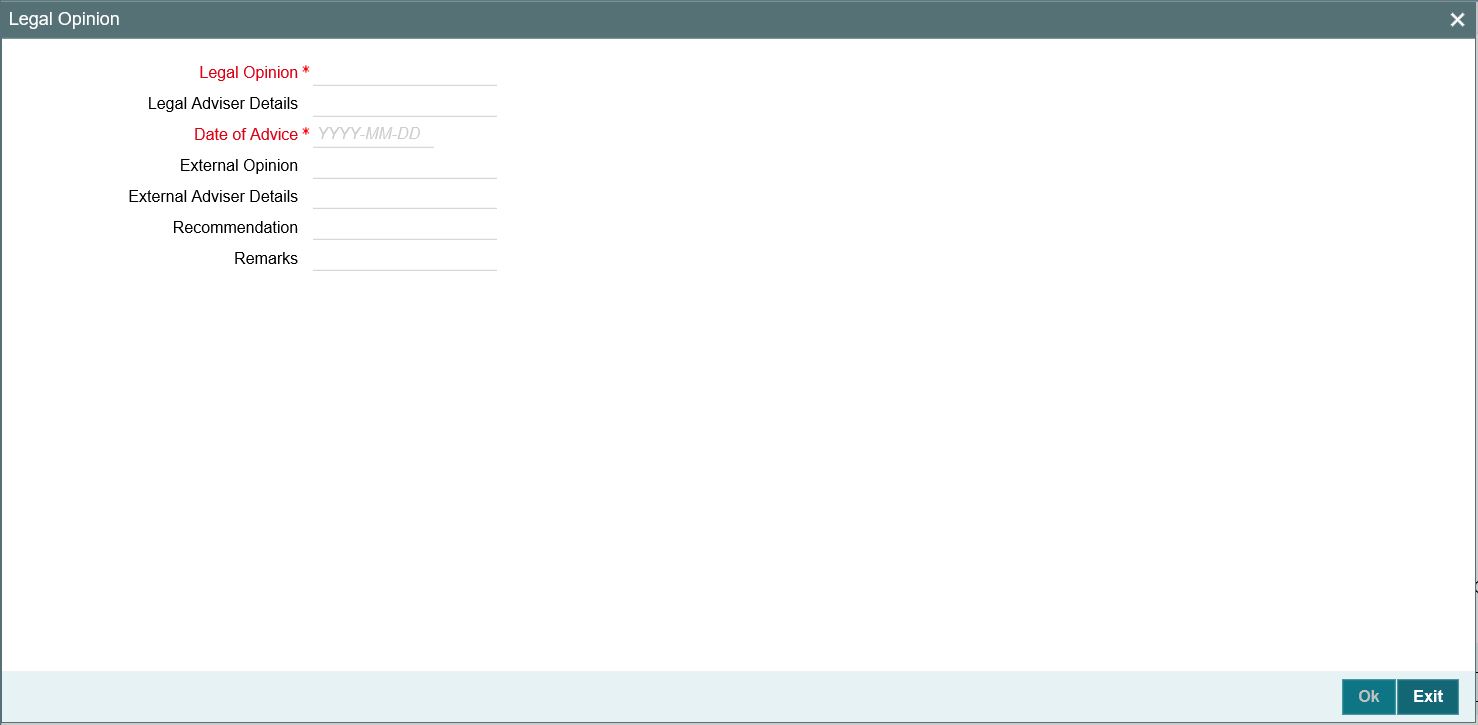

2.8.10 Maintaining Legal Opinion

Click ‘Legal Opinion’ button in Collateral Maintenance screen to maintain legal opinion details.

.

Legal Opinion

Specify the legal opinion on the acceptability of the proposed collateral.

Legal Adviser Details

Specify the legal adviser details.

Date of Advice

Specify the date when the advice was received from legal team.

External Opinion

Specify the external legal opinion.

External Adviser Details

Specify the external legal adviser details.

Remarks

Specify remarks of the credit team, if any.

Recommendation

Specify the final opinion based on the internal and external legal opinion.

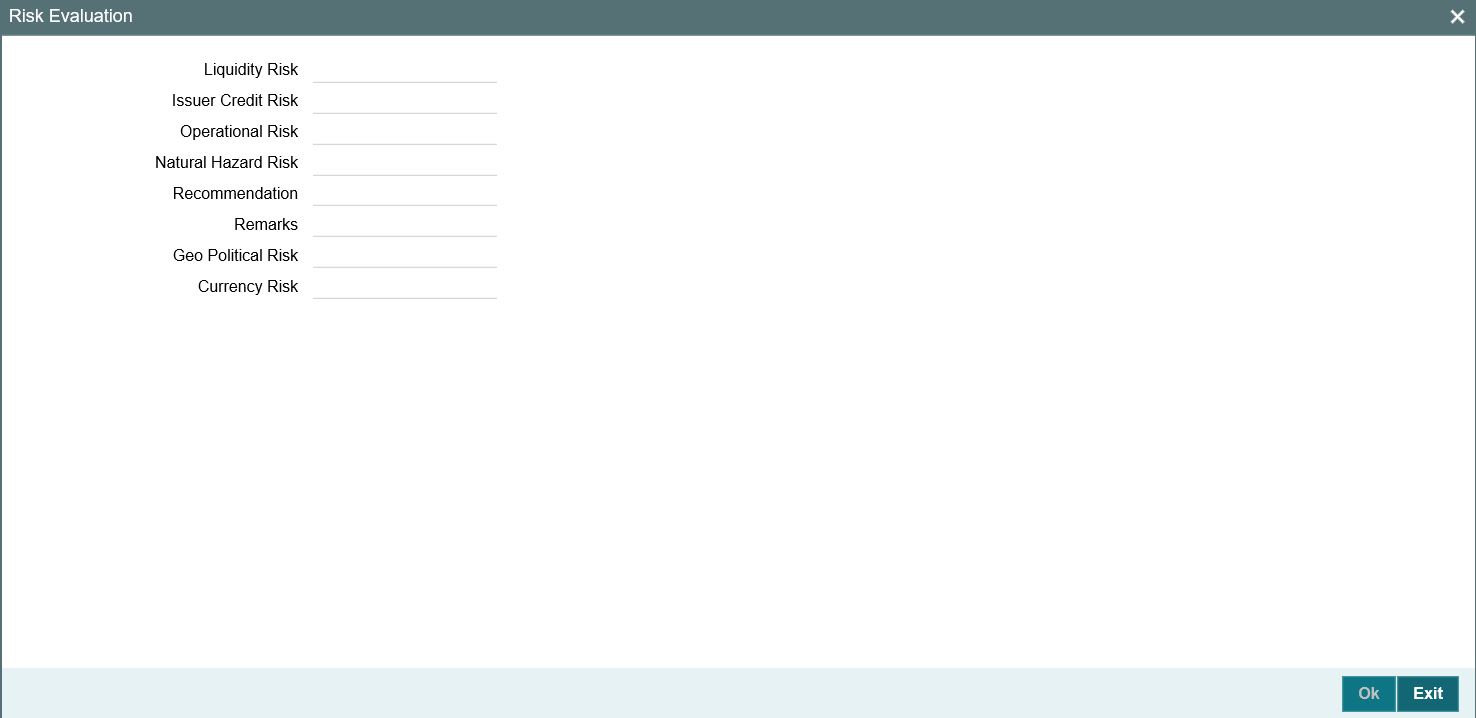

2.8.11 Risk Evaluation Details

You can maintain risk evaluation details in the Risk Evaluation screen. Click ‘Risk Evaluation’ button in Collateral Maintenance screen to invoke the following screen.

Liquidity Risk

Specify the liquidity risk of the collateral.

Issuer Credit Risk

Specify the credit risk of the collateral issuer.

Operational Risk

Specify the operational risk involved in managing the collaterals like ship, aeroplane or a warehouse with goods.

Natural Hazard Risk

Specify if the location of the collateral is prone to natural hazards like floods, earthquake, and so on.

Recommendation

Specify the final recommendation after risk evaluation.

Remarks

Specify credit remarks, if any.

Geo Political Risk

Specify geographical political risk involved in the collateral. For example: Oil assets situated in certain countries like Iraq.

Currency Risk

Specify if the collateral currency possess any currency risk.

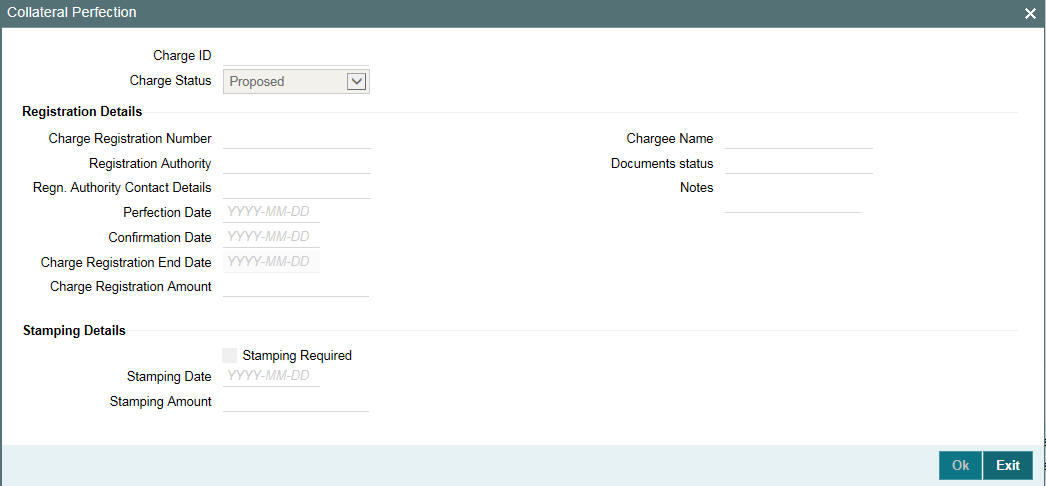

2.8.12 Collateral Perfection Details

Banks have a right over the collateral in case of default by the customer so charges are recorded on customer collaterals.These charges need to be registered as part of charge perfection with relevant authorities.

Collateral perfection can be done as part of customer collateral creation and as also part of amendment.

Based on the charge status, data is generated for sending a notice to an external registration authority at the time of charge registration, charge renewal and charge termination.

Charge ID

Charge ID is generated by system. This ID is generated only if charge status is ‘Registered’ and charge perfection details are entered and saved, wherever ‘Charge registration required’ check box is enabled.

Charge Status

The charge status is used to track the status of the charge registration process. The charge status can be ‘Proposed’, ‘Registered’, ‘Expired’, ‘Discharged’ or ‘Renewal’.

- Proposed - The initial charge status

- Registered - When charge perfection details are entered and saved, charge status gets updated as ‘Registered’ and the data required for sending notice to the charge registration authority is generated.

- Renewal - Registered charge can be renewed upfront during lead days before charge end date by opting renewal. Charge can be renewed for a further period as per renewal frequency and unit configured. Charge status gets updated as 'Registered' once renewal is complete. Subsequent to renewal, charge renewal notice can be generated with the required data available.

- Expired - Charge status is updated as ‘Expired’ by the system in case charge is not renewed during lead days period. The system updates the status as ‘Expired’ during BOD date equal to charge registration end date + 1. An expired charge can be renewed by entering the registration details and charge status is updated as ‘Registered’ with a new charge end date.

- Discharged - When a loan provided for the collateral is repaid in full, charge noted for the collateral can be discharged.

Note

Once charge is discharged on a customer collateral, no further updates can be performed on the same.

Charge status is updated as 'Discharged', then the system generates a discharge notice that needs to be sent to the registration authority.

Registration Details

Charge Registration Number

Specify the unique charge registration number.

Registration Authority

Specify the registration authority with which collateral is perfected.

Regn. Authority Contact Details

Specify the contact details of registration authority.

Perfection Date

Specify the date on which bank’s charge has been registered.

Confirmation Date

Specify the date on which you received confirmation of perfection. That is, confirmation received from the registered authority. This date cannot be prior to perfection date.

Charge Registration End Date

Once charge perfection details are entered and saved, based on ‘Charge Perfection Date’ and ‘Charge Renewal Frequency’ multiplied with ‘Unit’, charge registration end date is calculated by the system.

For example, if 'Frequency' is selected as 'Monthly' and 'Unit' is selected as '2', then the system updates the charge end date considering perfection date + 2 months.

Charge Registration Amount

Specify the charge registration amount.

Chargee Name

Specify the chargee name

Documents Status

Specify if the perfection documents are received from registration authority.

Notes

Specify notes, if any.

Stamping Details

Stamping Required

Select this check box if stamping is required with relevant authority.

Stamping Date

Specify the stamping date.

Stamping Amount

Specify the stamping amount.

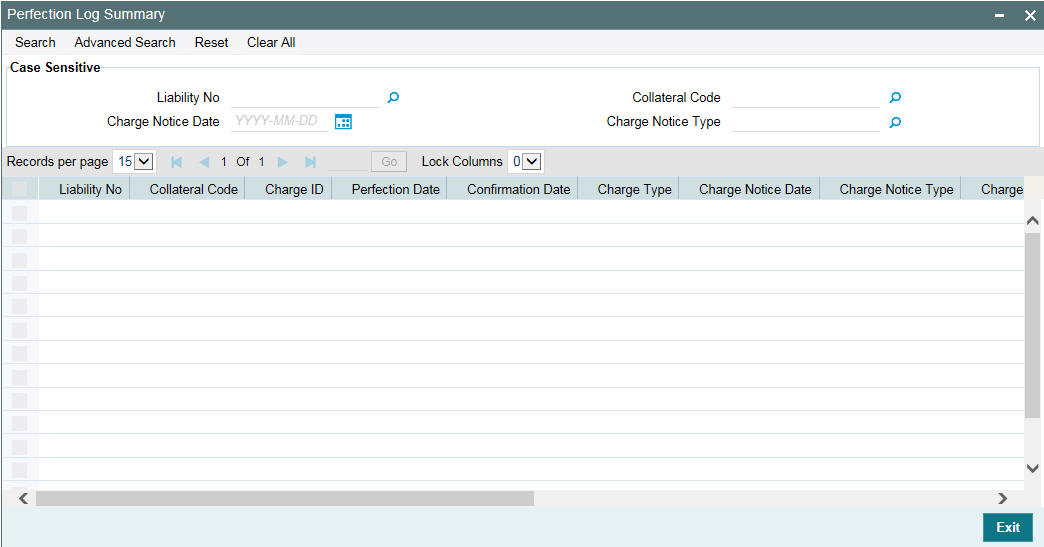

2.8.13 Collateral Perfection Log Summary

You can view the summary of all collateral perfection details maintained in the system using ‘Perfection Log Summary’.

To invoke this screen, type ‘GCSPFLOG’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

2.8.14 Notifications

As part of notification framework with JSON, selected fields are provided out of the box at collateral level for maintenance. When one more fields are checked for notification and values against these fields are modified, notification is generated containing old and new values of such fields along with other details of collateral in the main screen. These notification messages are generated either on direct modification of the fields or after EOD.

Notification messages are logged in a table with unique reference number. A new quartz job is required to read notification messages and publish it on configured queue/topic.

To configure the fields for notification message, click ‘Notification’ subsystem.

Field name |

Screen |

Modification |

Old value relevance |

Notification triggered when |

Collateral value |

Main screen |

Direct/Batch |

Yes |

Collateral value changes |

Lendable margin |

Main screen |

Direct/Batch |

Yes |

Lendable margin changes because of revaluation on account of change in haircut or on changing the Haircut % directly |

Revision date |

Covenants screen |

Batch |

No |

Revision date is crossed and covenant expires |

Valuation amount |

Valuation screen |

Direct |

Yes |

Valuation amount changes |

Haircut % |

Main screen |

Direct/Batch |

Yes |

Haircut % changed directly or based on haircut schedule or linked haircut code rate is modified resulting in haircut% in turn lendable margin |

Charge status |

Perfection screen |

Batch |

No |

Charge status is expired |

End date |

Insurance screen |

Batch |

No |

Whenever collateral is modified as part of EOD or manual screen update and Insurance end date is less than or equal to current date |

Available amount |

Main screen |

Direct/Batch |

Yes |

Available amount changes. |

2.8.15 Collateral Revaluation

You can maintain revaluation details in the ‘Collateral Revaluation Details’ screen. Click ‘Revaluation’ button in the ‘Collaterals Maintenance’ screen to invoke the following screen.

The collateral revaluation related settings are defaulted from category level at the time of collateral creation. Either the same settings can be retained or modified at the time of collateral creation.

Revaluation Type

Revaluation type can be selected as applicable to the collateral type.

You can select ‘Automatic’ or ‘Manual’ from the drop-down list. If you select ‘Manual’ all the fields in ‘Revaluation Details’ and ‘Holiday Processing’ are disabled.

Revaluation Method

Revaluation method can be selected as applicable to the collateral type.

You can select the following revaluation method from the drop-down list.

- Straight line method

- Written down value method

- Sum of years digit method

- External

- Custom

Rate of Depreciation

Specify the percentage. Rate of depreciation is applicable only when the revaluation method is straight line method or written down value method.

Revaluation Frequency

This field is applicable only when revaluation type is automatic. Revaluation frequency can be of yearly only for sum of years digit method.

Revaluation Start Month

Revaluation start month and day get defaulted to the month/day on which collateral is created. If not modified, next revaluation date is arrived based considering the revaluation frequency from this defaulted date.

However, you can specify the next revaluation date by modifying the revaluation start month/day.

Reval Day

This is defaulted as date on which collateral is created and is modifiable. If modified, this reval day and revaluation start month settings defines the next revaluation date.

Useful Life

Useful life of the asset entered is considered for revaluation of the asset. If the useful life of the asset is less than collateral end date, then useful life end date is updated as collateral end date. If the useful life end date is after collateral end date, collateral end date entered is retained.

Note

Whenever collateral value becomes zero even before useful life end date because of rate of depreciation, appropriate override message appears at the time of saving the record.

Likewise, if residual value of collateral remains at the end of useful life period after depreciation as per rate signified, appropriate override message is displayed at the time of saving the record.

Rate of depreciation

Rate of depreciation is per annum rate. However, revaluation amount will be appropriately arrived at per frequency when the revaluation is done.

Next Revaluation Date

At the time of creation of collateral, next revaluation date is arrived duly considering the date of creation + frequency (considering revaluation start month/day is not modified) or signified start month/days as next revaluation date duly considering holiday settings as applicable.

Next revaluation date is populated and shown to user at the time of saving the record.

Note

Wherever holiday setting is applicable at the time of creation, and the next revaluation date arrived at based on frequency falls on holiday, the system considers the holiday setting and appropriately arrive at next revaluation date at the time of saving the collateral.

Note

Even in case of collateral created with start date as back date, revaluation is considered from the date of creation of collateral.

Last Revaluation Date

The date on which last revaluation was done. At the time of creation this is blank.

Ignore Holidays/Move Across Month/Cascade Schedules

By default ‘Ignore Holidays’ check box is selected. If this check box is selected, then ‘Move Across Month’ and ‘Cascade Schedules’ check boxes are disabled.

Holiday processing settings can be enabled for revaluation only when ignore holidays is not selected.

Holiday Check

You can either select ‘Currency’, ‘Local’ or ‘Both’. The collateral currency holiday is considered if holiday check is currency/both.

Schedule Movement

You can either ‘Move forward’ or ‘Move backward’.

2.8.15.1 Modification of Revaluation Related Settings

Modification of Revaluation type

For collateral which are enabled for revaluation, revaluation type can be modified post creation. If a collateral is created with manual revaluation type, then it can be modified to auto revaluation type with one of the applicable revaluation methods. Likewise, if a collateral is created with auto revaluation type, it can be modified to manual revaluation type wherever the same is applicable.

When revaluation type is modified from Manual to Auto with one of the applicable revaluation methods, then the system considers the revaluation settings signified and appropriately stamp next revaluation date.

Likewise when revaluation type is modified from auto (with one of the applicable revaluation methods) to manual revaluation related settings are blanked out and collateral is eligible for manual revaluation.

Modification of revaluation method

Modification of only revaluation method is not applicable.

Modification of rate of depreciation

Based on new rate, revaluation is done on the next revaluation date already stamped.

Modification of revaluation frequency

- Override message appears that modified frequency is applicable after the next revaluation.

- On the next revaluation date, modified frequency is considered and further revaluation date is arrived.

Modification of revaluation start month

Next revaluation date is stamped based on modified revaluation start month.

Modification of due date

• Based on new value, next revaluation date is to be updated. The system considers the new value and compares with current business date/last revaluation date to stamp the next revaluation date.

Modification of holiday processing – from ignore to one of the settings

- Appropriate override message is shown during modification that modified holiday processing settings are applicable after next revaluation date.

- New holiday processing setting is applicable from next revaluation date.

Modification of holiday processing – from one of the settings to ignore

- Appropriate override message is shown during modification that modified holiday processing settings are applicable after next revaluation date.

- New setting is applicable from next revaluation date onwards.

For more information on collateral revaluation, refer to ‘Collateral Revaluation’ section in this User Manual.

2.8.16 Fee Preferences

Fee Preferences sub-system defaults all the attributes from ‘Fee & Accounting Class’ screen including the ‘Holiday Treatment’ along with the ' Fee Rule Maintenance' screen attributes.

Holiday Treatment

You can view the defaulted holiday preference parameters and make changes.

Fee Rule Preferences

'Fee Rule Preferences' section contains all the fee rules associated with a fee class and their respective attributes.

Start Date and End Date

- You can enter fee start date and fee calculation starts from that day.

- You can enter fee end date and fee is calculated till this date.

- Fee start date if not entered, then it is defaulted from the collateral start date.

- Fee start date cannot be before collateral start date. The system validates and displays an error if fee start date is before collateral start date.

- Fee end date if not entered, then it is defaulted from the collateral expiry date.

- Fee end date cannot be after collateral expiry date. The system validates and displays an error if fee end date is after collateral expiry date.

- For all fee calculations, fee start date and end dates takes precedence over collateral start date and expiry date.

- If both collateral start date and collateral expiry dates and fee start date and fee end dates are provided respectively, then system considers the fee start and fee end dates for the calculation.

- Since, both collateral end date and fee end date are not mandatory, if none of them are provided, the system validates and displays an error to enter the dates.

User Input Fee Amount

The ‘User Input Fee Amount’ is used for the fee of type USER INPUT.

You need to specify the fee amount in terms of absolute amount and it is considered for the whole liquidation cycle (frequency) and accrued accordingly based on the day basis and other parameters.

The system validates if fee type is of ‘User Input’ and this field is left blank.

Branch

The ‘Branch’ where the customer account exists and it is used for debiting the collateral fee.

Account No

The ‘Account No’ which needs to be debited for collateral fee.This is based on the branch selection in ‘Branch’ field. You can specify the individual accounts for respective fees.

If you have multiple accounts in a bank or in a branch, you can specify the individually for each fees the accounts that needs to be debited.

Waived

Out of multiple fee rules attached to a fee class which are populated during collateral creation, one or more fee rules can be waived by selecting check box under waived column.

Effective Dates

‘Effective Dates’ is used to specify the dates from which fee rate details are applicable. A fee rule can be configured having multiple effective dates. As the effective dates are reached, the corresponding rate details becomes applicable for each fee.

The system validates and displays an exception if fee type is 'Rate/Amount' and effective date details are not maintained.

For create event fee, effective date has to be always collateral creation date. In addition, only one effective date is allowed for create event fee as create event is always one time.

Fee Rate Details

‘Fee Rate Details’ is used to specify the values as opted in ‘Fee Rule Maintenance’ screen.

Basis Amount

Specify the multiple basis amounts. The system validates and displays an exception if fee type is 'Rate/Amount' and rate details are not maintained.

Rate

Specify the rate for the defined basis amount if fee is configured as 'Rate'.

The system validates and displays an error if fee type is of rate and user inputs amount or leave the rate details as blank.

Rate details are applicable based on the effective dates applied.

Amount

Specify amount for the defined basis amount if fee is configured as 'Amount'.

The fee value as amount is considered for the whole liquidation cycle (frequency) and accrued accordingly based on the day basis and other parameters. The system validates if fee type is of amount and user inputs rate or leave the rate details as blank.

2.8.17 Collateral Fee Processing

Collateral fee supports below types of fee processing.

- Recurring Fees

- Event Based Fees

You can perform the following for collateral fee

- Configure multiple fees for a collateral.

- Waive fees selected out of one or more number of fees at collateral level during creation.

- Define collateral fees as a fixed amount, percentage or user input fees.

- Define the collateral fee structure as 'Slab' or 'Tier'.

- Fee liquidation related accounting entries are passed on fee collection as configured – FLIQ event.

- Fee accrual/amortization is done based on the configuration opted – FACR event

- Collect the fee automatically on cycle end date (Arrears) for recurring fees (and then based on the frequency) and on happening of an event (Event based fee).

- Fee Type ‘USERINPUT’ and ‘AMOUNT’, the value specified as fee is considered for the whole liquidation cycle (frequency) and accrued accordingly based on the day basis and other parameters.

- For example

- Fee amount specified 2400,

- Accrual frequency is daily,

- Liquidation frequency is Monthly and Days in month 30,

- Day basis is Actual/Actual,

- Fee accrued per day is 2400/30 = 80

- Liquidation method ‘Advance’ is not applicable for collateral fees.

- Any upfront fee can be collected through an event based fee

- Day basis is applicable and is used for fee calculation and accrual/amortization of both amount and percentage based fees.

- RULE_INC, RULE_REC, and so on accounting roles are generated on Fee rule creation.

- Fee currency is same as the collateral currency.

Recurring Fee

- Recurring fees can be of following types:

- Collateral maintenance fees

- Collateral inspection fees

- Collateral custody fees and so on

- Recurring fees is collected based on liquidation frequency configured.

- Recurring fees is calculated and accrued based on underlying collateral value as on the date and as per accrual frequency configured.

- It is possible to stop a recurring fee from collection based on effective end date given.

- You can collect recurring fees only using auto collection methods.

- Holiday processing for fees is applicable only to recurring fees if opted and is handled as below.

1 |

|

Holiday |

|

|

|

|

||

Liquidation Freq |

Ignore Holidays |

Holiday Level |

Movement |

Collateral Creation Date |

Next Liquidation Date |

Holiday |

Actual Liquidation Date* |

|

Monthly |

Yes |

NA |

NA |

02-Aug |

02-Sep |

Yes |

02-Sep |

|

Monthly |

No |

Local/Currency/Both |

Forward |

02-Aug |

02-Sep |

Yes |

03-Sep |

|

Monthly |

No |

Local/Currency/Both |

Backward |

02-Aug |

02-Sep |

Yes |

01-Sep |

|

2 |

|

Holiday |

|

|

|

|

|

||

Liquidation Freq |

Ignore Holidays |

Holiday Level |

Movement |

Collateral Creation Date |

Next Liquidation Date |

Holiday |

Actual Liquidation Date* |

Cascade Schedules |

|

Monthly |

No |

Local/Currency/Both |

Forward |

02-Aug |

02-Sep |

Yes |

03-Sep |

Yes |

|

Monthly |

No |

Local/Currency/Both |

Backward |

02-Aug |

02-Sep |

Yes |

01-Sep |

No |

|

3 |

|

Holiday |

|

|

|

|

|||

Liquidation Freq |

Ignore Holidays |

Holiday Level |

Movement |

Across Month |

Collateral Creation Date |

Next Liquidation Date |

Holiday |

Actual Liquidation Date* |

|

Monthly |

No |

Local/Currency/Both |

Forward |

Yes |

30-Aug |

30-Sep |

Yes |

01-Oct |

|

Monthly |

No |

Local/Currency/Both |

Forward |

No |

30-Aug |

30-Sep |

Yes |

29-Oct |

|

4 |

|

Holiday |

|

|

|

|

|||

Liquidation Freq |

Ignore Holidays |

Holiday Level |

Movement |

Across Month |

Collateral Creation Date |

Next Liquidation Date |

Holiday |

Actual Liquidation Date* |

|

Monthly |

No |

Local/Currency/Both |

Backward |

Yes |

01-Aug |

01-Sep |

Yes |

31-Aug |

|

Monthly |

No |

Local/Currency/Both |

Backward |

No |

01-Aug |

01-Sep |

Yes |

02-Sep |

|

* Assuming not a holiday. If holiday then again the holiday processing as configured is applicable.

Event Based Fee

Event based fees is usually of the following type:

- Collateral creation fees

- Collateral extension fee (when collateral end date is modified and extended further)

- Collateral expiry fee (when end date is crossed and collateral value becomes zero)

- Collateral reactivation fee (when collateral is reactivated post suspension)

- Collateral suspension (when collateral is suspended)

- Event based fee are collected when collateral status gets updated, like active (on creation), extended (when collateral end date is modified and extended further), expired (when end date is crossed and collateral value becomes zero), reactivated (when collateral is reactivated post suspension), suspended (when collateral is suspended).

- Event based fees is linked to collateral at the time of creation itself, but gets triggered on happening of status update.

- Event based fee becomes applicable as many number of times as the collateral achieves a particular status.

- For example - collateral suspension fee gets triggered as and when multiple suspension takes place.

- Collateral fees of type ‘Event Based Fee’ is always be a one-time fee but recurring multiple times as and when a lifecycle event is triggered for a collateral.

- Collateral Fees of type ’Event Based Fee’ can have liquidation frequency as only ‘One-Time’.

- It is possible to collect ’Event Based Fee’ only automatically.

- For collateral fees of type ‘Event Based Fee’, the calculation and accrual are based on the underlying basis amounts - ‘Collateral Value’ (Limit Contribution’ and ‘Available Amount’ are not applicable)

- Collateral fees of type ‘event based fee’ can have accrual frequency as one-time and liquidation frequency as one-time.

Since an ‘Event Based Fee’ gets triggered on happening of a certain collateral lifecycle event, in that case holiday processing is not applicable. In other way it is based on holiday parameter maintained at GEDPARAM level.

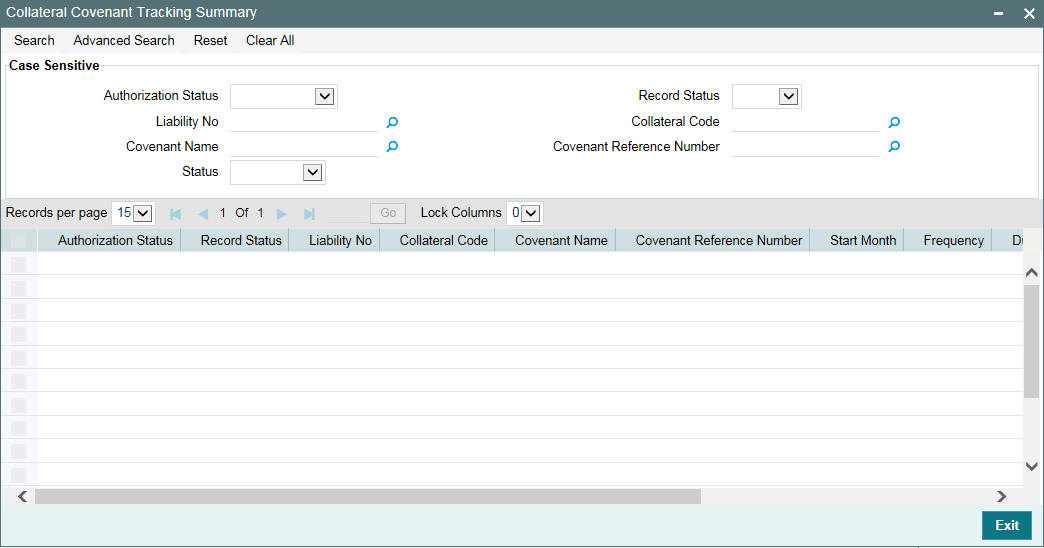

2.8.18 Viewing Collateral Covenant Tracking Summary

You can view summary of covenants attached to collateral for tracking using the ‘Collateral Covenant Tracking Summary’ screen. You can open detailed screen using this screen. You can query the records based on the search criteria.

You can invoke this screen by typing ‘GCSCOVTR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

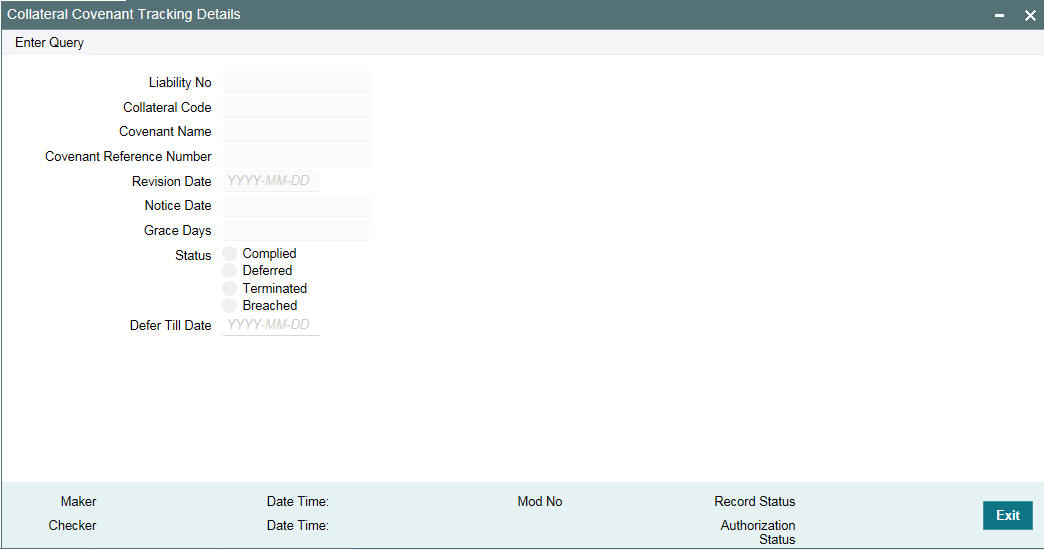

2.8.19 Tracking Collateral Covenant Details

The captured covenants as part of collaterals can be tracked using 'Collateral Covenant Tracking Details' screen.

You can invoke the ‘Collateral Covenant Tracking Details’ screen by typing ‘GCSCOVTR’ (Collateral Covenant Tracking Summary) and on clicking the queried record ‘GCDCOVTR’ (‘Collateral Covenant Tracking Details’) is opened with the details of the covenant.

You can unlock and update the status of the covenant here.

Liability Number

Indicates the liability Number for which the collateral is linked.

Collateral Code

Indicates the collateral code here. Each collateral code should be unique.

Covenant Name

Indicates the covenant name.

Covenant Reference Number

Indicates the covenant reference no for the collateral being maintained.

Revision Date

Indicates the date on which covenant has to be revisited for review.

Revision date is derived by system and updated when covenant is saved – based on combination of start date + (combination of frequency and due date and start month).

Notice Date

Indicates the date on which covenants can be tracked for compliance before revision date in advance based on notice days configured.

Grace Days

Indicates the grace days for the next due/revision date allowed for facility covenant.

Status

You can select the covenant status as the following:

- Complied

- If the status of the covenant is not compiled on or before revision date, then the status is updated as breached by batch process immediately after revision date.

- If the covenant has the grace days configured, compliance can be marked till the grace period end date. The status gets updated as breached only after grace period end date if compliance is not marked by then.

- Compliance on the breached covenant can be marked after which the covenant for next frequency is enabled with the next revision date duly considering the original revision date + frequency.