This chpater describes the details of Embedded Options Valuation.

OFSAA includes the ability to calculate the market value of certain interest rate options, namely caps and floors, and their variations. These options may be embedded in another instrument or maybe stand-alone (i.e. bare) options.

These embedded options are given a market value based on the Black-76 option market value model, where the value of a call option (or interest rate floor) c, is given by:

Description of the value of a call option formula follows

Conversely, the value of a put option (or an interest rate cap) p, is given by:

Description of the value of a put option formula follows

where:

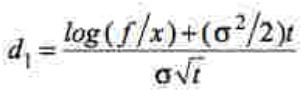

Description of d1 formula used in call option and put option follows

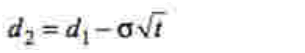

Description of d2 formula used in call option and put option follows

Log denotes the natural logarithmDescription of d1 formula used in call option and put option follows

f = the current underlying forward price

x = the strike price

r = the continuously compounded risk-free interest rate

t = the time in years until the expiration of the option

= the implied

volatility for the underlying forward price

= the implied

volatility for the underlying forward price

=

the standard normal cumulative distribution function

=

the standard normal cumulative distribution function

The market valuation for embedded options using the Black-76 model supports all interest rate caps (such as period caps, life caps), interest rate floors, cap, and floor combinations (e.g. collars), interest rate call and put options (European and Bermudan only).

Supports Adjustable Type 250 – Other Adjustable only.

Supported Amortization Types:

· 100 Conventional Fixed

· 500 Conventional Adjustable

· 600 Adjustable Negative Amortization

· 700 Non-Amortizing

· 710 Rule of 78s

· 820 Level Principal Payments

· 800 Conventional Schedule

· 801 Level Principal Schedule

· 802 Simple Interest Schedule

· 400 Balloon Payment

Supported instrument types and FSI_D tables are mentioned in the followin table.

Table 61: List of Supported instrument types and FSI_D tables

|

Variable Rate Instruments |

|

Instrument Table |

Caps/Caplets |

Floors/Floorlets |

FSI_D_INVESTMENTS |

X |

X |

FSI_D_BORROWINGS |

X |

X |

FSI_D_MORTGAGES |

X |

X |

FSI_D_CAPFLOORS |

X |

X |

When an instrument has an embedded option, the market value of that option may have a positive or negative market value depending on both the balance sheet category of the holding instrument and the type of embedded option.

Example: Suppose a bank owns a variable rate mortgage (an asset) with an embedded rate life cap. The cap is a benefit to the issuer of the debt, that is, the bank has sold this option to the borrower, thus they are short the option. Hence, while the market value of the mortgage is positive, the embedded option is reported as a negative value.

Table 62: Market Value details of Embedded Option Market Value Signage

Market Values |

|

Option-Free Mortgage |

100 |

Embedded Cap Value |

-1 |

Capped Mortgage |

99 |

This relationship would be reversed if the bank was the borrower of a variable rate mortgage.

Table 63: Examples of Options Market Value Signage

Balance Sheet Class |

Examples |

Embedded Option |

Signage |

Assets |

INVESTMENTS |

Calls |

- |

|

|

Puts |

+ |

|

MORTGAGES |

Caps |

- |

|

|

Floors |

+ |

|

|

Embedded Option |

|

Liabilities |

BORROWINGS |

Calls |

+ |

|

|

Puts |

- |

|

|

Caps |

+ |

|

|

Floors |

- |

Off Balance Sheet |

|

Bare Options |

* Follows same sign as buy +, Sell - indicator |

|

CAPSFLOORS |

Calls |

+/- |

|

|

Puts |

+/- |

|

|

Caps |

+/- |

|

|

Floors |

+/- |

|

|

Swaptions |

+/- |

Instruments desired to have a Black76 embedded option market value must meet all data validation requirements before this can be completed.

For all qualified variable rate instruments, there must be at least one embedded rate option specified (for example cap or floor).

Table 64: FSI_D details of Caps and Floors Variable Rate Instruments

FSI_D Field |

Description |

RATE_INCR_CYCLE |

The incremental period cap amount |

RATE_DECR_CYCLE |

Incremental period floor amount |

RATE_CAP_LIFE |

Life Cap Strike |

RATE_FLOOR_LIFE |

Life Floor Strike |

FIRST_RESET_CAP |

First Reset Cap (Mortgage Only) |

FIRST_RESET_FLOOR |

First Reset Floor (Mortgage Only) |

In addition to specifying the cap and floors, users must also specify a pre-configured ALM volatility surface and risk-free interest rate curve both of the same effective date and currency.

Table 65: FSI_D details of ALM Volatility Surface and Risk-free Interest Rate Curve

FSI_D Field |

Description |

OPTION_RFR_IRC_CD |

Risk-Free Interest Rate Curve |

OPTION_VOL_IRC_CD |

Volatility Surface |

EMBEDDED_OPT_MV |

Enable Embedded MV Evaluation |

To qualify for processing under the embedded option valuation methodology, certain pre-processing requirements must be satisfied.

To qualify for Black-76 embedded option evaluation, certain data-level requirements must be met:

1. Data must be a qualified instrument with valid embedded option parameters (if an embedded option instrument) in a supported table.

2. Data must include the additional data-level specifications for risk-free interest rate curves and option volatility matrix specifications.

Instruments intended to be evaluated under the Black-76 methodology must have valid, pre-defined risk-free and ALM volatility matrices interest rate curves defined and specified at the data level with matching currency type.

Embedded option valuation is only supported under Static-Deterministic processing. Once all data-level and IRC requirements are satisfied, a user can specify the output by selecting “Calculate Option Market Value” in the Calculation Elements processing screen. If desired, the options market value may be written back to the data level by selecting “Options Market Value” in Output Preferences (base scenario; net values only.)