This chapter describes the details of FX Swap Contracts.

An FX swap is a bilateral contract where different currencies are exchanged by combining FX spot and forward contracts. As assets in one currency serve as collateral for securing obligations in the other, FX swaps are effectively collateralized transactions, although the collateral does not necessarily cover the entire counterparty risk.

Financial institutions can use FX swaps to raise foreign currencies from other funding currencies. More specifically, financial institutions with a need for foreign currency funds face a choice between borrowing directly in the uncollateralized cash market for the foreign currency, or borrowing in another (typically the domestic) currency’s uncollateralized cash market, and then converting the proceeds into a foreign currency obligation through an FX swap. For instance, when a financial institution raises dollars via an FX swap using the euro as the funding currency, it exchanges euros for dollars at the FX spot rate, while contracting to exchange in the reverse direction at maturity at the FX forward rate.

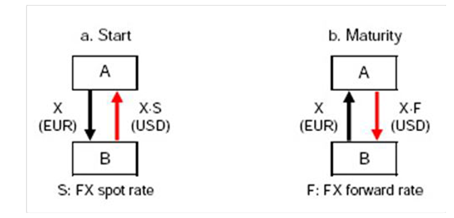

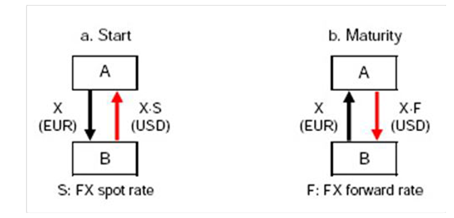

The following figure shows an example, where the fund flows involved in a Euro / US dollar swap. At the start of the contract, A borrows X·S USD from and lends X EUR to, B, where S is the FX spot rate. When the contract expires, A returns X·F USD to B, and B returns X EUR to A, where F is the FX forward rate as of the start.

Description of Overview FX Swap as follows

In the above example, the Euro is the funding currency and the US dollar is borrowed currency.

In FX swap, following two exchange contracts packed into one:

· a spot foreign exchange transaction

· a forward foreign exchange transaction

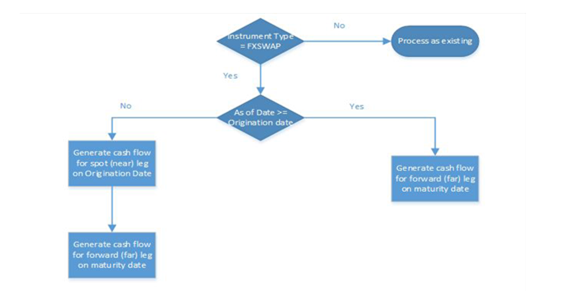

Description of FX Swap Process Flow as follows

· A new instrument type code (983) has been introduced in table FSI_INSTRUMENT_TYPE_CD/MLS to support the FX Swap instrument type.

· Processing table FSI_D_FX_SWAPS has both inflow and outflow for each leg (spot and forward).

· T2T moves the data of FX swap from STG_SWAPS_CONTRACTS to FSI_D_FX_SWAPS

Below T2Ts are used to move data from STG_SWAPS_CONTRACT to FSI_D_FX_SWAPS.

Table 78: List of T2Ts to move data from STG_SWAPS_CONTRACT to FSI_D_FX_SWAPS

Contract Type |

T2T Name |

Spot Pay |

T2T_FX_SWAPS_CONTRACTS_SPOT_PAY |

Spot Receive |

T2T_FX_SWAPS_CONTRACTS_SPOT_RCV |

Forward Pay |

T2T_FX_SWAPS_CONTRACTS_FWD_PAY |

Forward Receive |

T2T_FX_SWAPS_CONTRACTS_FWD_RCV |

With this approach, table Stg_Swaps_Contract would contain records for both interest rate SWAP and FX Swap types. Hence, a filter has been introduced on the “Instrument Type” field to filter the respective required from the table.

NOTE |

Results of FX Swap in process cash flow table are written with Cash Flow Code as 3. |

· Liquidity Gap

Below process flow shows the cash flow generation for the liquidity gap:

Description of Liquidity Gap Process Flow as follows

All cash flows will be tagged in FE 190 and 210 and aggregated to corresponding LR Gap FE’s (1667, 1661, 1660, 1491, etc. as per the current behavior of CFE).

· Repricing Gap

The cash flows for IRR will be the same as LR. They will be aggregated in relevant buckets and repricing FE’s like 660, 661, and 662.

Below is the list of FEs which are considered for Cashflow Generation:

FE 190, 210, 490, 491, 492, 493, 494, 710, 715, 716, 720, 721, 725.

· Income Simulation Analysis

There is no impact of FX Swap on NII.

The following outputs are updated to processing table FSI_D_FX_SWAPS:

1. Macaulay Duration (DURATION_C)

2. Macaulay Duration (DURATION_C)

3. Modified Duration (MODIFIED_DURATION_C)

4. Convexity (CONVEXITY_C), Current Yield (CUR_YIELD), DV01 (DV01_C), and average Life (AVERAGE_LIFE_C) are not calculated. CONVEXITY_C, CUR_YIELD is updated to ‘0’.