This chapter describes how new business instruments are generated as part of an Oracle Asset Liability Management (ALM) forecast to replace balances that have run off for a particular product.

Topics:

· Introduction to Distributed Originations

· Current Target Average Approach

· Procedures for Implementation

New business instruments must be generated as part of an Oracle ALM forecast, to replace balances that have run off for a particular product. New business impacts the total amount of income and market value in future periods. Without new business, both values will be understated in future periods because, over time, existing balances runoff. The income and market value associated with a new business is a function of the balance booked, the rate booked, and the timing of the booking. The balance and rate are determined by the assumptions input by the user. The timing of the bookings is a function of the modeling methodology.

The booking of a new business can be viewed as coming from three sources:

· Internal roll-over of existing accounts (hereafter referred to as roll-over)

· Rolling of existing accounts into other accounts (hereafter referred to as roll-into)

· New money unrelated to existing business (hereafter referred to as new originations)

In modeling the timing of new business, the modeling goal is to come as close as possible in reflecting reality while adding minimal processing time.

New bookings generated from run-off (roll-over and roll-into) would realistically occur on the date the run-off occurred. On the run-off date, the source of funds becomes available. For a practical example, consider the rollover of a Term Deposit. When a customer opts to rollover a Term Deposit, the funds are rolled into a new Term Deposit on the maturity date of the previous Term Deposit.

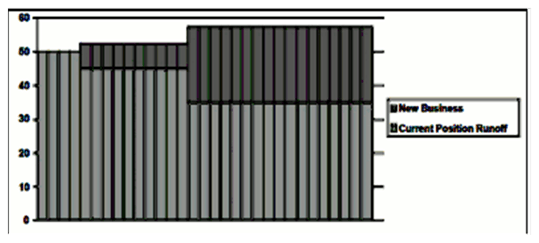

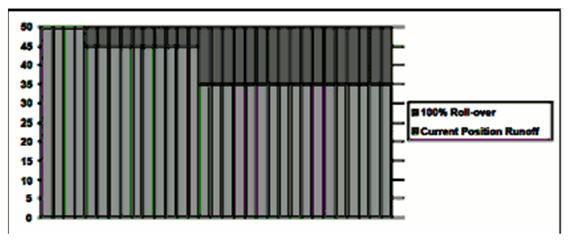

To model new business generated from rollover, the new business should be booked on the date the principal run-off occurs. A new record would be created on each date principal run-off occurs during the modeling period, as shown in the following figure:

Figure 4: Roll-over (150% of Principal Runoff)

Ending Balance = $57.50

Average Balance= ($50*4 days + $52.50*10 days + $57.50*17 days)/31 days

= $54.9193

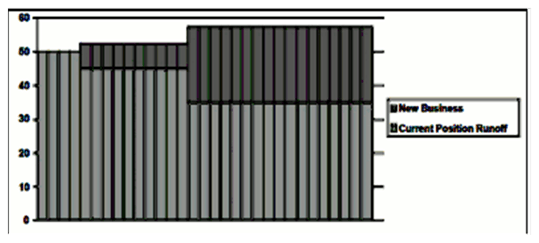

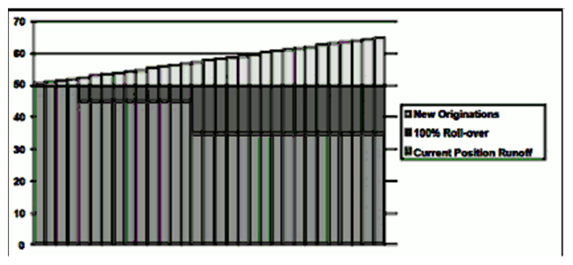

For new originations, users could make several assumptions about the timing. For instance, they could assume that it occurs at a single date within the bucket, that it occurs evenly over the bucket, or that it accelerates over the bucket. For our purposes, we are assuming that new originations are booked evenly over the modeling bucket; the balance will grow gradually over the modeling period.

For new originations, the booking of new accounts is done in a manner that best approximates the user's assumptions about the timing of new business over the bucket. In the case of even bookings over the bucket, the balance in the account appears graphically as a straight, positively sloped line. To match this assumption in the model, a new business record must be generated for each day in the bucket, as shown in the following figure:

Figure 5: New Originations (30% Growth)

Figure 6: Average Date Roll-over Method

Ending Balance = $65

Average Balance = ($50 + $65)/ 2 = $57.50

The problem with both of these approaches is performance. The more new business instruments generated per bucket, the longer the processing time will be. For processing efficiency, it is necessary to minimize the number of dates during the bucket when a new business is added.

To create the most accurate results, the new business should come as close as possible to matching the area between the new business curve and the current position curve. By matching the area under the curve, we generate the same ending balance and average balance as would be generated if new bookings were made every day.

For rollover accounts, the area under the curve is a function of the timing of runoff and the amount of principal runoff. By calculating an average day of run-off, the area under the new business curve can be matched by generating new bookings on the average date, as shown in the following figure:

Figure 7: Flat Balance Sheet

Average day of runoff = ($5 * 5 days + $10 * 15 days)/$15 = 11 2/3 days

Balance Plug: 1/3 * $15* 1.5 = $7.50 on the 11th

2/3 * $15* 1.5 = $15 on the 12th

Ending Balance = $57.50

Average Balance=($50 * 4 days + $45 * 6 days + $52.50 * 1 day + $67.50 * 3 days + $57.50 * 17 days)/ 31 = 54.9193

When comparing the average and ending balance with the numbers generated from the above figure, note that the values are the same. This is because we have changed the shape of the new business curve, but matched the area under the curve.

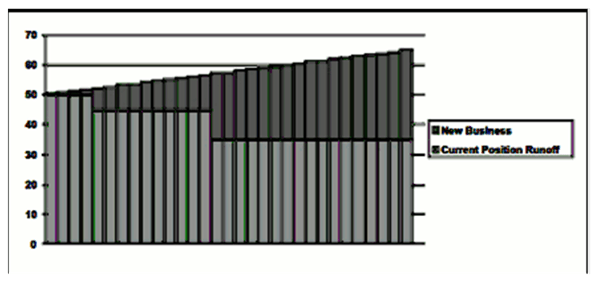

For new originations, the area under the curve is a function of the targeted change in the balance over the bucket, the timing of the runoff of the current position at the start of the bucket, and the amount of principal runoff.

This can be broken into two components:

A component of a new business that assumes a flat balance sheet. This is equal to 100% roll-over, as shown in the above figure.

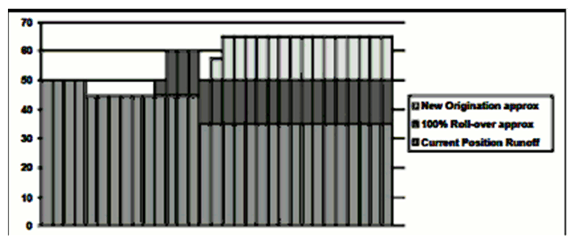

The new origination component, which can be viewed as a gradually increasing balance over the flat balance sheet, as shown in the following figure.

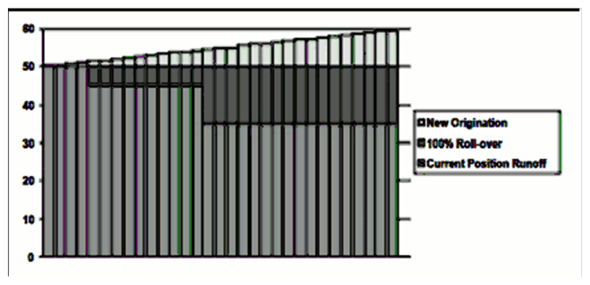

Figure 8: New Originations Separated by Components

New Business is approximated by splitting the new business into the two components: the average day roll-over method displayed in example 3 to account for the 100% roll-over component of new business plus an additional method to account for the new originations.

That is because, the shape of the new originations curve is a triangle, the area of this shape can be calculated as

1/2 days in the bucket * new origination balance.

The same area can be achieved by booking the entire balance at the mid-point of the bucket. Because, in this case, the mid-point of the bucket falls between two days, the balance should be spread evenly over those two days: $7.50 on the 15th and $7.50 on the 16th, as shown in following figure.

Figure 9: New Origination Average Date Method

Ending Balance = $65

Average Balance = $50 * 4 days + $45 * 6 days + $50 * 1 day + $60 * 3 days + $50.00 *1 day + 57.50 * 1 day + 65 * 15 days = $57.50

These approaches assume that, after new business has been added, no payments will not occur within the same bucket. To avoid this issue, any payments that occur within the bucket must trigger a secondary set of new originations.

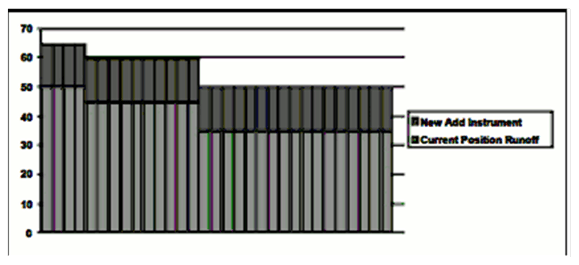

In the current target average approach, a new business instrument is booked on the first day of the bucket so that the average of this instrument plus the average of the current position will equal the targeted average balance.

The problem with this approach is that the results are not always logical to an end-user because they do not follow the business logic of new business generated throughout the bucket. In the case represented in the following figure, the user has targeted an average balance of $55 from a starting balance of $50. The logical assumption would be that the balance grows over the bucket from $50 to a final value greater than the average. However, in this case, the ending balance is $49.84, lower than the beginning balance. Although the average balance is correct, the ending balance makes no sense.

Figure 10: Current Average Balance Method

A more appropriate method would be to assume a gradual booking over the month to generate the average balance. In this case, an approach similar to the target end method could be used, where both average date and mid-bucket methods are used as shown in the following figure.

Figure 11: Targeting an Average Balance

This example is the same as the example in Figure New Originations Separated by Components with slightly different ending balance values. The method used to solve this case can be the same one that is demonstrated in Figure New Origination Average Date Method, using a combination of the average date method and the mid-bucket method.

Inter-account rolling can be achieved with no difficulty if the new instruments do not pay during the modeling bucket in which they are originated. In this simple case, the current position runoff that occurs in bucket 1 will define the new business generated in bucket 1. The new business run-off generated in bucket 2 plus the current position run-off in bucket 2 will impact the business generated in bucket 2, and so on.

If the instruments do pay during the bucket in which they are originated, then, ideally, a new business instrument should be created on the day of run-off for the new instrument for the account that it is rolling into.

All of the methods described earlier employ one of two techniques: Average Day of Runoff and Mid-Bucket. The implementation of these techniques is described per method as follows:

Forecast Balance Method |

Previous Approach |

New Approach |

|---|---|---|

Target End |

New instrument added at end of bucket equal to target balance minus the current position ending balance. |

The average day of runoff with 100% roll-over plus mid-bucket on new add balance. |

Target Average |

A new instrument added at beginning of bucket so that the current position average balance plus the average balance of the new instrument equals the target average balance. |

The average day of runoff with 100% roll-over plus mid-bucket on new add balance. |

New Add End |

A new instrument is added at the end of the bucket equal to the new add balance. |

Mid-bucket on new add balance. |

Roll-over |

On non-amortizing accounts, the new business produced from maturing balances is booked on the day of run-off. All other run-offs from non-amortizing instruments (prepayments, payments, total) are booked at the end of the bucket. New business generated from all run-off on amortizing accounts is booked at the end of the bucket. |

The average day of runoff with roll-over percentages specified by the user. |

Roll-into |

New business is generated at the end of the bucket |

The average day of runoff with roll-over specified. |

Target Growth |

It did not exist. |

The average day of runoff with 100% roll-over plus mid-bucket on new add balance. |

In each case where mid-bucket logic is used, the new add balance will be calculated differently. Following are the different methods for new add balance calculation:

Target End - Target End Balance - Beginning Balance of bucket

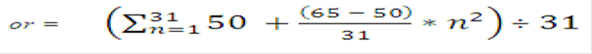

Target Average - 2*(Target Average Balance - Bucket Beginning Balance) + Total Runoff - Transaction Strategies Originations - Current Position Originations

Here, Bucket Beginning Balance and Total Runoff include both current and dynamic output (rsult_type_cd of 0 and 1).

NOTE:

Average formula is a general use statement that helps users to understand how Target Average Balance calculations are made and to validate output. Given the complexities of formula inputs, external detail calculation results may vary.

When you are using Target Average, it is recommended that only Target Average Balance is reported as other financial elements may fluctuate widely to achieve average targets from period to period.

New Add - New Add Balance

Target Growth - Beginning Balance of bucket * growth percent

Determine the mid-point of the bucket by taking the total number of days in the bucket and dividing it by two.

1. If the mid-point is not a fractional date, add all new add balance on the mid-point date.

2. If the mid-point is a fractional date, add half of the new add balance on each day.

Calculate and output the average day of runoff for each type of runoff: maturity, prepayments, and payment. Calculate as the balance times the difference between the date of runoff minus the beginning bucket date. Independently store values for positive and negative runoff of each runoff category.

1. For each bucket and each type of runoff, calculate the amount of balance to roll-over by multiplying the run-off amount by the percent roll-over specified by the user.

2. Add new business on the average date of run-off for each instrument using the proper balance roll-over.

3. If the new records make payments during the bucket, roll the instruments over at the time of payment.

When combined to produce a balanced forecast for a particular product member, it could result in a large number of new originations on different dates, because of all these methods. The logic finds the earliest date and the latest date of all the different possible originations and adds only new business on these two dates within the bucket.

The first and last plug dates are determined by finding the minimum and maximum date overall average date values. For example, given an average runoff date for payments of 13.4 and an average plug date for maturing balances of 15.6, four plug dates will be derived: 13, 14, 15, and 16. The first plug date will be the minimum date, the 13th. The second plug date will be the maximum plug date, the 16th.

When determining how much of the run-off balance to plug on each date, the calculation will be done as follows:

· Plug Balance(first plug ) = Run-off * (first plug date - average run-off date) / (second plug date - first plug date)

· Plug Balance (second plug ) = Run-off * (second plug date - average run-off date) / (second plug date - first plug date)

NOTE:

When New Business origination method is Distributed, engine solves to derive Origination Date. This logic uses inputs from all scenario(s) in a process, and derives Origination date for future modeled records. These future modeled records are consistent for all scenario(s) in a process. Origination balance then get calculated for these records for each specific scenario.

When forecast rate scenario(s) of Process A, has different forecast rates in comparison to another Process B (although a specific scenario of Process A and B can be same and have same forecast rates), New Business future modeled records for Process A would have different origination date and origination balance when compared to Process B.

The dynamic market value and dynamic gap values will be sensitive to the booking date if the dynamic valuation date is in the middle of a modeling bucket. To prevent this type of sensitivity, you should limit dynamic valuation dates to the start date for a bucket.

Oracle ALM assumes that all events occur at the end of the day on which they occur.