Topics:

· Rate Locks on Loan Commitments

· How to Transfer Price using Forward Rates and Calculate Rate Lock Option Costs

·

·

·

A Rate Lock is a lender's promise to hold a certain interest rate for the borrower, usually for a specified period of time and fee, while the loan application is being processed. Rate locks are commonly granted to borrowers when they apply for a mortgage loan and generally carry a term of 30, 60 or 90 days. In Oracle Funds Transfer Pricing these loan commitments (which are not yet on the balance sheet) are stored in the FSI_D_LOAN_COMMITMENTS table, separate from loans which are already funded. These loan commitments can be Transfer Priced using implied forward rates which correspond to the assumed loan start date (end of commitment period). This capability allows treasury to “lock-in” a loan funding rate at a point in time prior to the actual loan funding.

For more information on using the “Forward Rates” option, see Transfer Pricing Process.

Many times, lenders also offer a one time option to borrowers to take a lower rate if market rates drop during the commitment period. If on the settlement date, the advertised rate for the chosen fixed rate period falls below the 'locked rate', the borrower will benefit from the lower of the current advertised fixed rate and the 'locked rate'. The benefit granted to the user to receive the lower rate at time of settlement can be thought of as an option, specifically the bank sells the customer a European 'at the money spot' interest rate swap option. The cost of this option can be calculated and should be charged by treasury back to the line of business as an internal cost. Oracle FTP provides the capability to calculate the 'rate lock' option cost. The general approach assumes that loan commitment information will be available in sufficient detail from the source systems to support cash flow transfer pricing using forward FTP curves and all required information describing the terms of the rate lock.

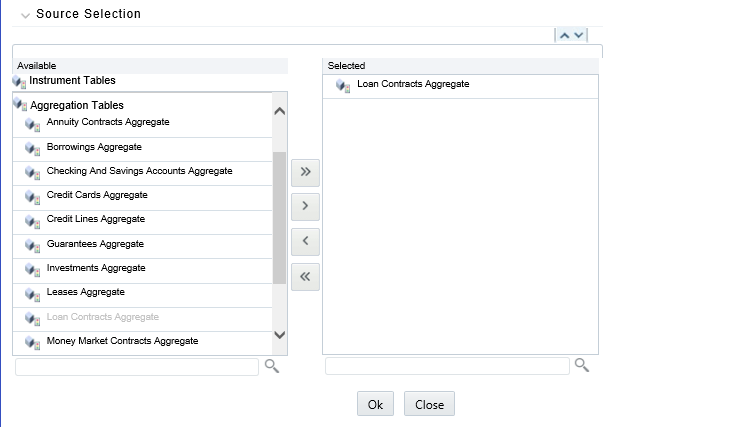

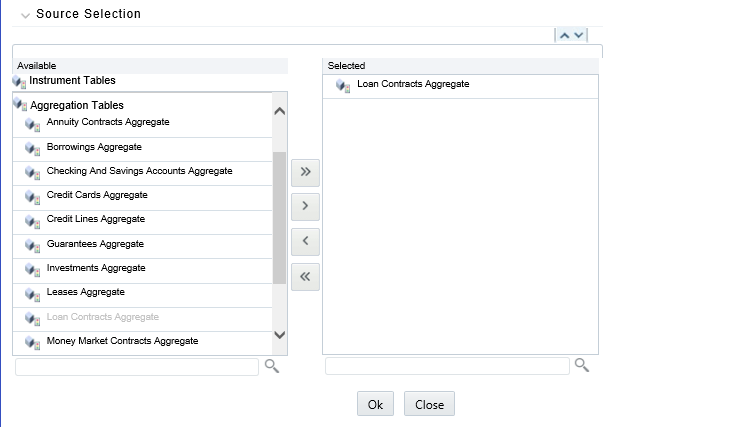

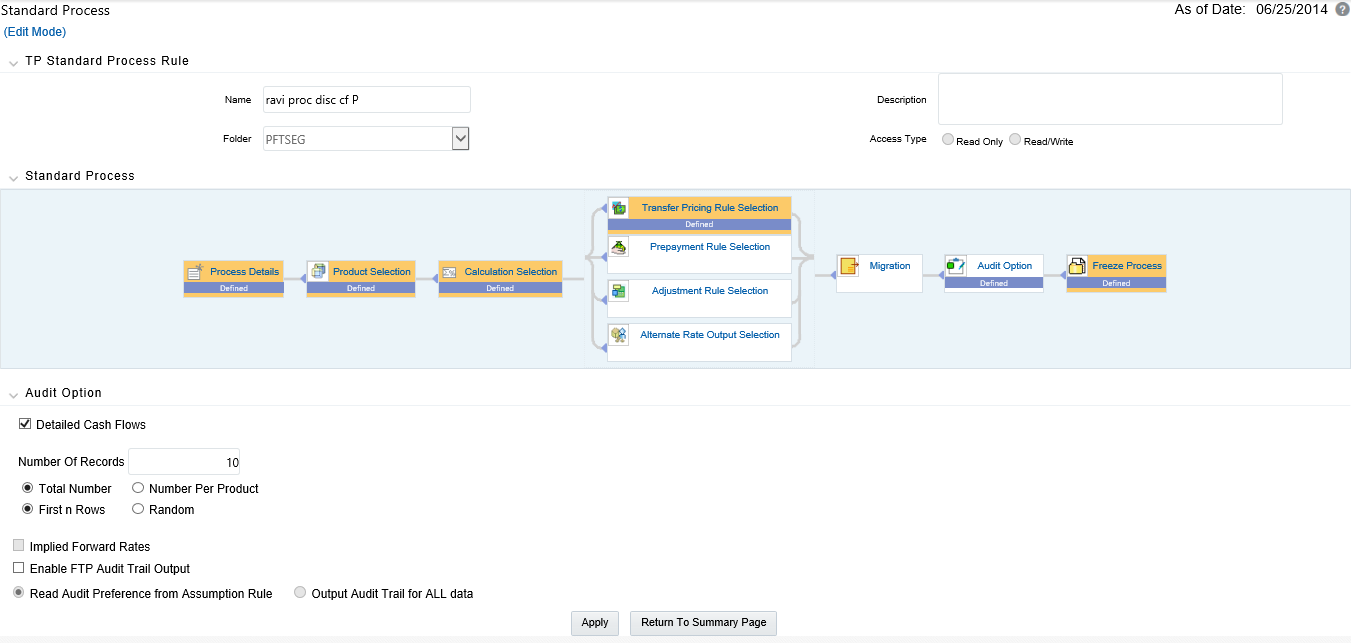

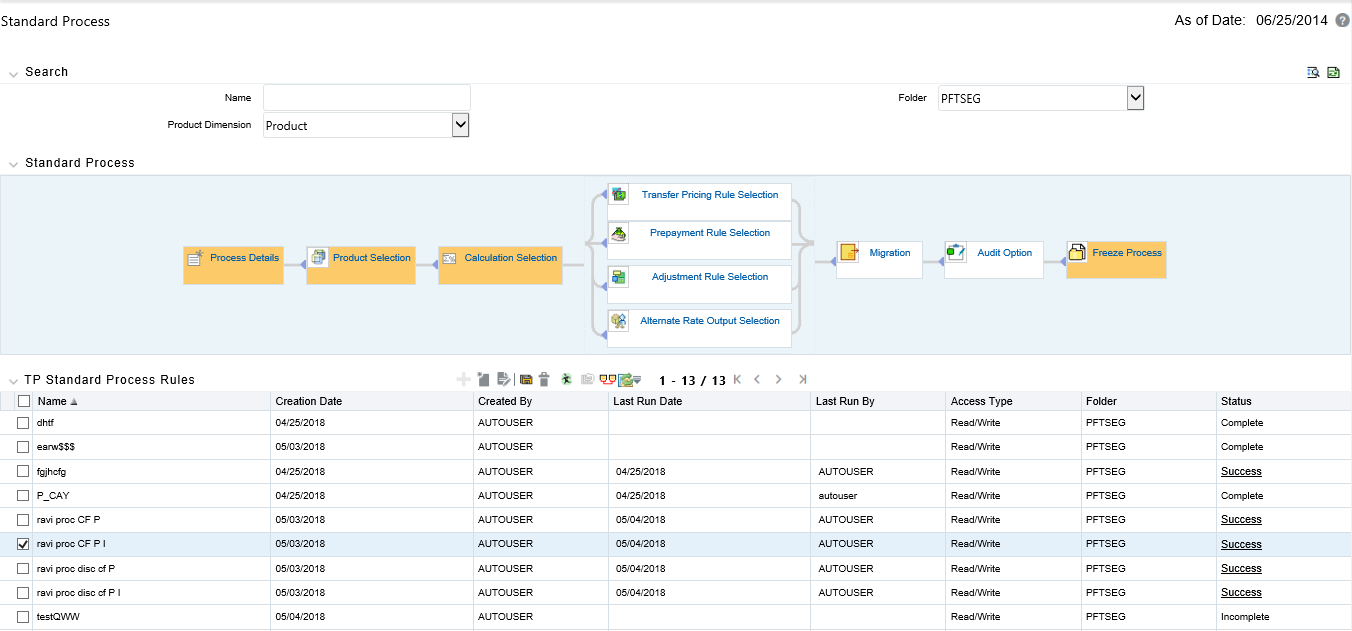

The Standard FTP Process provides setup options that allow you to Transfer Price data in the Loan Commitments table using forward rates and calculate the related rate lock option costs. To do this, please select the Loan Commitment table under Source Selection

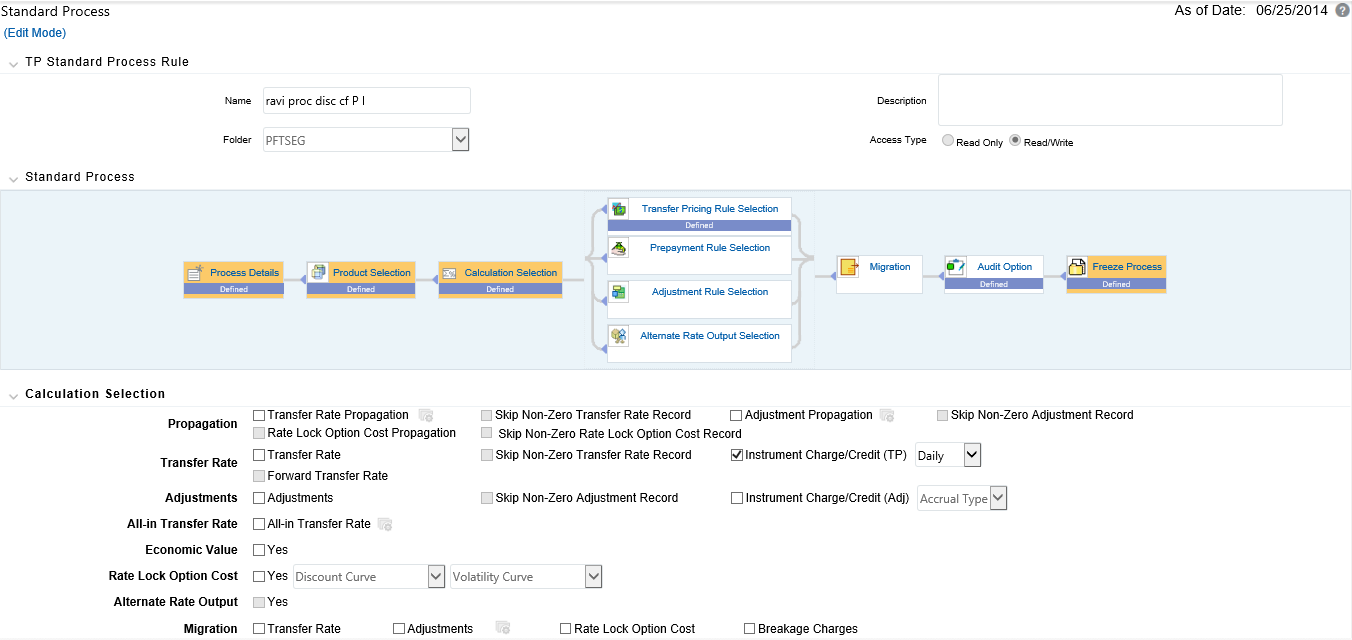

The following options are available on the Calculation Selection page.

Figure 1:

|

NOTE |

These calculation options assume the user has also selected the Loan Commitments table on the Product Selection page under “Source Selection”: · Forward Transfer Rate: The Forward Transfer Rate option is required when the user wants to use an Implied Forward Curve as the reference curve for Transfer Pricing a future dated instrument records. · Rate Lock Option Cost: The Rate Lock Option Cost selection option along with drop-down lists for selecting the Risk free curve and Discount curve are required for calculating the related Rate Lock Option Costs. · Migration of Rate Lock Option Costs to Ledger Stat: If the Rate Lock Option Cost to Ledger Stat migration is needed, users should additionally select this option. |

Figure 2:

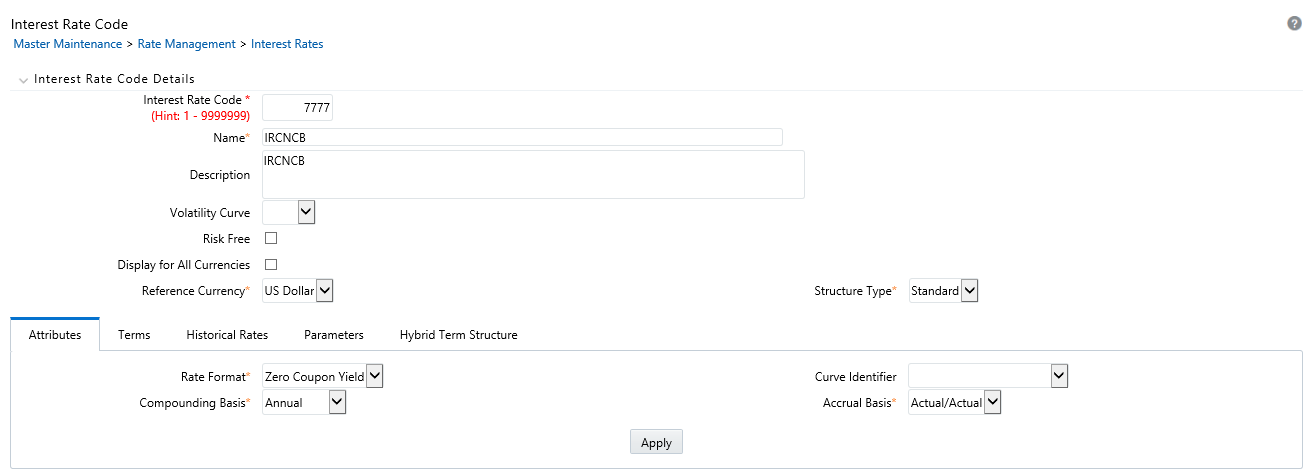

As shown in the TP Process screen shot above, the Rate Lock Option Cost calculation requires two inputs both of which come from the Rate Management > Interest Rates page.

· Discount Curve: This can be a standard interest rate curve

· Volatility Curve: This is a special form of interest rate curve, where the volatility curve option has been selected

To setup a volatility curve, while defining a new Interest Rate Curve, select the check box – 'Volatility Curve'. This check box selection signifies that the curve will hold volatility rates. Select the Reference Currency of the IRC being created.

When 'Volatility Curve' is checked, the following fields are disabled and are not applicable

· Compounding basis

· Accrual basis

· Rate Format

Figure 3:

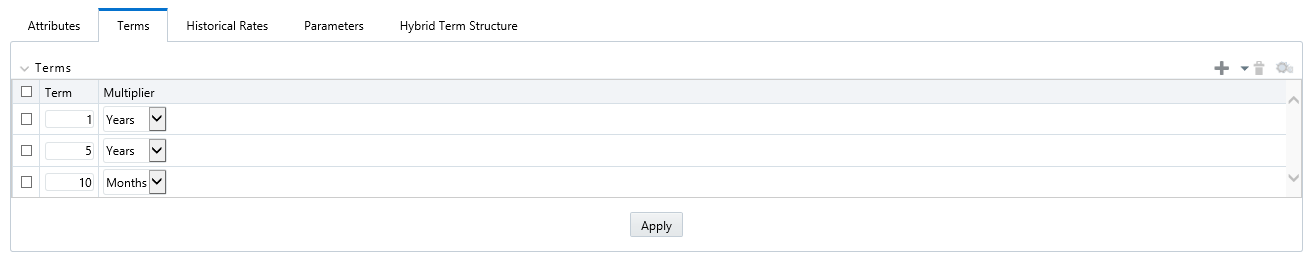

Terms tab: For a Volatility Curve, the Terms tab displays two types of Terms – The Contract term (Loan term) and the Expiration term (Rate Lock (option expiry) term). Users must provide the volatility inputs for all combinations of "Contract Term" and "Expiration Term".

|

NOTE |

In the moneyness dimension, typically associated with option volatility is not required, because Rate Lock Options are assumed to be granted “at the money”. |

The following steps are required to complete the setup of a volatility curve:

· Terms tab - Contract Term: Add rows and input terms for the number of required loan terms. These are the maturity term of the loan. Select APPY to save the data.

Figure 4:

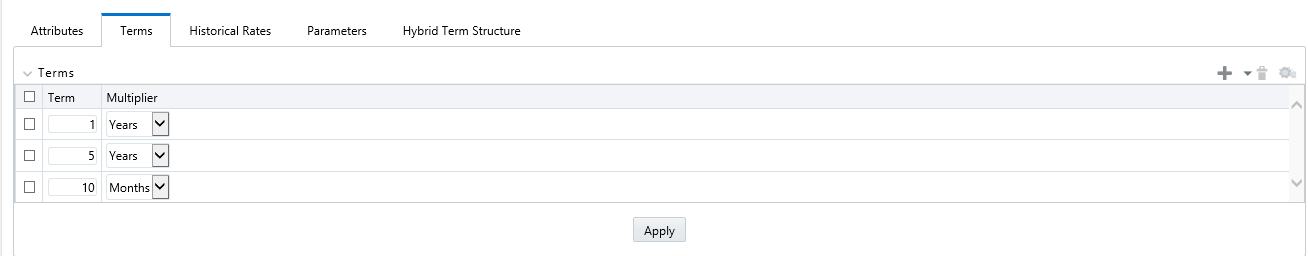

· Terms Tab – Expiration Term: Add rows and input terms for the number of required Expiration terms. These correspond to the number of rate lock terms being offered. Select APPLY to save the data.

Figure 5:

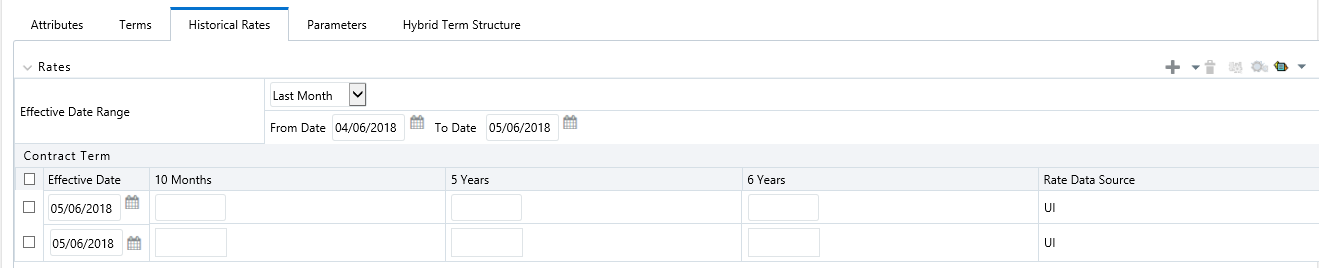

· Historical Rates Tab: After defining and applying the volatility curve dimensions, navigate to the Historical Rates tab and input the volatility rates for each combination of loan term and rate lock term and for each effective date that you wish to store historical volatility data.

Figure 6:

Select Apply when finished to save the data.

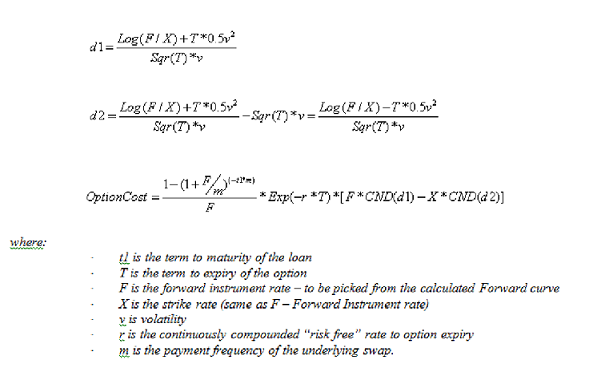

Users have the option to output the implied forward rates to an Audit Table if needed for validating the Transfer Rate result. To support the validation requirement, the FTP engine (optionally) writes the forward rates to an Audit table - FSI_O_FTP_IMP_FWD_RATES_AUDIT. The option to write implied forward rates is available in the Standard TP Process on the Audit block.

The Implied Forward Rates audit output is linked to the Detailed Cash Flows selection and Number of Records selection as a way to limit the amount of forward rate output. During processing, the FTP engine will output forward rates for any instrument records that also have detailed cash flows output, i.e. there one forward curve corresponding to each instrument record. Our assumption is that users will only need to output implied forward rates for a limited set of data records for the purpose of validating the forward curves and the related transfer rates generated by the TP engine.

The check box 'Implied Forward Rates' will be active only when

· The “Forward Transfer Rate” option has been selected on the Calculation Selection block

· The 'Detailed Cash Flows' check box is selected in the Audit block

Figure 7:

The base FTP rate quoted on the Commitment Start date is calculated using the current forward rates corresponding to the tenor of the Rate Lock period requested and the loan period/payment frequency based on the TP method selected. If an instrument record has a commit_start_date <= as_of_date and origination_date > as_of_date, then FTP will generate implied forward rates based on the commit_start_date spot IRC curve.

|

Effective Date |

Lookup Tenor |

|---|---|

|

COMMIT_END_DATE (for example, 30, 60, 90 days forward) |

Term of the loan (or) Related cash flow terms, depending on the TP method |

Once the record is identified as a Rate lock record, the Forward Curve is generated for the same term points as the Spot curve (selected in the Transfer Price Rule UI). Once this is done, the TP method that is selected follows its usual flow, except for using the Forward TP IRC instead of the Spot TP IRC. If required tenors are not found, interpolation is used.

Within the Loan Commitment table, prior day results can be propagated forward, so post processing, all open commitments will have a Transfer Rate and Rate Lock Option Cost assigned either through propagation or new calculation.

|

NOTE |

The FTP engine uses only Standard Term for forward rate based TP calculation and not Remaining Term. |

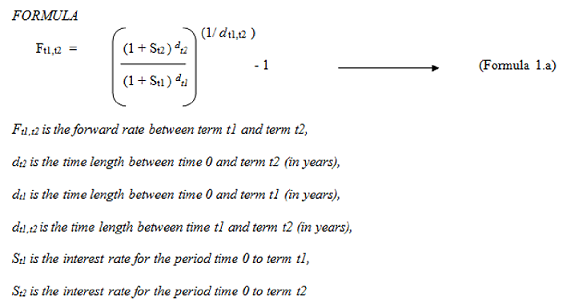

An Implied Forward is that rate of interest that is predicted to be the spot rate at some point in the future.

If 1 year TP Rate is 6.00% and 3 month TP Rate is 2.00% we can calculate the 3 month forward implied 9 month rate as follows:

Therefore, the market is implying that in 3 months time, 9 month TP Rate will be 7.36%.

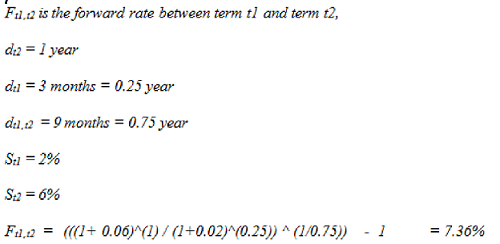

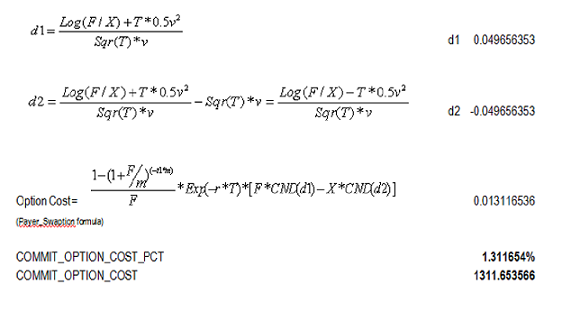

Rate Lock Option Cost Calculation: The Rate Lock Option Cost calculation uses a standard Black European swaption pricing formula. This calculation is triggered from a Standard FTP Process, and can be performed for both fixed rate and adjustable rate instruments. The following conditions must hold true for instrument records in the FSI_D_LOAN_COMMITMENTS table:

commit_start_date <= as_of_date

origination_date > as_of_date

Black Formula for calculating Rate Lock Option Cost

|

Calculate Rate Lock Option Cost for a Rate Lock arrangement with the following details |

||

|---|---|---|

|

Loan Face value - ORG_BOOK_BAL |

10,000,000 |

|

|

Tenor of Loan - ORG_TERM & ORG_TERM_MULT |

5 |

years |

|

Locked TP Rate - TRANSFER_RATE |

8.20% |

|

|

Rate Lock Commitment period - COMMIT_TERM & COMMIT_TERM_MULT |

90 |

days |

|

Loan Payment frequency - PMT_FREQ |

6 |

months |

|

Volatility |

20% |

|

|

Risk free rate to Option Expiry |

4% |

|

|

Term to maturity of the loan |

t1 |

5 |

years |

|

Term to expiry of the rate lock option |

T |

0.2465753 |

years |

|

Strike rate - Locked TP Rate (Forward TP Rate as on Loan Origination) |

X |

8.20% |

|

|

Volatility |

|

|

|

|

Details for Volatility - From the historical volatility curve that is loaded in Rate Management by the user, pick Volatility% with |

|

|

|

|

EFFECTIVE DATE = COMMIT_START_DATE and LOOKUP TENOR = Tenor of the Loan. In Release 6.0, 2 Dimensional Volatility curve was introduced with Contract term and Expiry term as the 2 dimensions. |

v |

20% |

|

|

Payment frequency of the loan |

m |

6 |

months |

|

Continuously Compounded TP rate to option expiry |

r |

4.08% |

(Refer calculation (1) below) |

|

Implied Forward TP rate |

F |

8.20% |

(Refer calculation (2) below) |

|

(1) Continuously Compounded TP rate to option expiry |

r |

4.08% |

|

(2) Implied Forward TP rate |

|

|

|

(FDD v1.1 - Implied Forward Rate Calculation - Section 6.1.2.1) |

|

|

|

Inputs required - (Terminology for these inputs is according to Section 6.1.2.1) |

F |

|

|

dt1 - Commitment term of Rate Lock |

0.246575 |

years |

|

dt1,t2 - Tenor of Instrument |

5 |

years |

|

dt2- Time length between Commitment Start Date and Loan maturity |

5.246575 |

years |

|

St1- Spot Interest Rate as on COMMIT_START_DATE for Commitment Term of the Rate Lock (COMMIT_MAT_DATE – COMMIT_START_DATE) |

4% |

|

|

St2- Spot Interest Rate as on COMMIT_START_DATE for Time length between Commitment Start Date and Loan maturity |

8% |

|

|

Implied Forward Rate, F (Formula given above in explanation) |

0.0820119 |

8.20% |

You can execute the TP Process to calculate Forward Rates and Rate Lock Option Costs by selecting the process in the Summary screen and then clicking on the Run button

Figure 8:

The following are the relevant output columns related to this feature:

· COMMIT_OPTION_COST_PCT: Rate Lock Option Cost in Percent terms

· COMMIT_OPTION_COST: Rate Lock Option Cost in Amount terms

· TRANSFER_RATE: Forward Transfer Rate

Users have the option to output the implied forward rates to an Audit Table if needed for validating the Transfer Rate result. To support the validation requirement, the FTP engine (optionally) writes the forward rates to an Audit table - FSI_O_FTP_IMP_FWD_RATES_AUDIT.

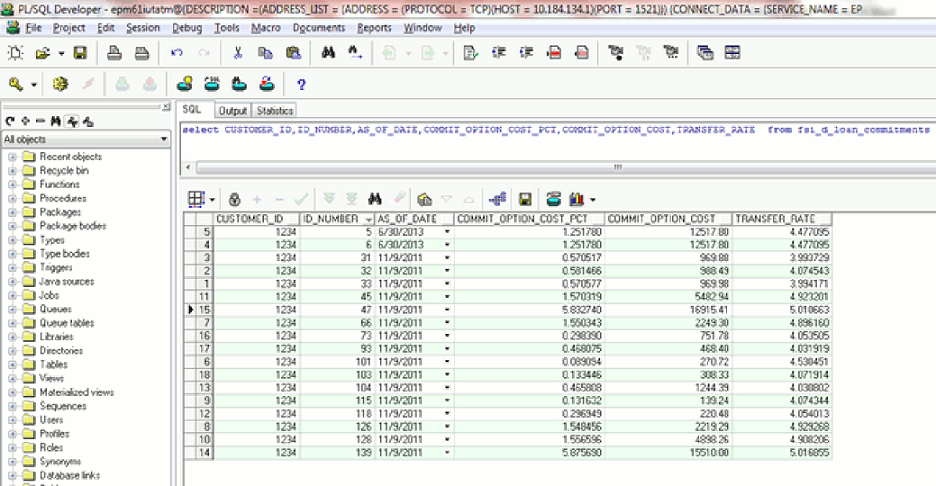

Sample results of SQL queries shown below:

Figure 9: