1 Feature Summary

The enhancements below are included in this release.

-

Feature: Provides a description of feature being delivered.

-

SR Number: Identifies the SR number associated with the feature, if any.

-

Delivered: Identifies whether the feature is Enabled or Disabled upon initial delivery.

-

Scale: Identifies the size of the feature. Options are:

-

Small: These UI or process-based features are typically comprised of minor field, validation, or program changes. Therefore, the potential impact to users is minimal.

-

Large: These UI or process-based features have more complex designs. Therefore, the potential impact to users is higher.

-

-

Customer Action Required – You must take action before these features can be used. These features are delivered disabled and you choose if and when to enable them.

| Feature | Module Impacted | Delivered | Scale | Customer Action Required? |

|---|---|---|---|---|

|

Merchandising |

Disabled |

Large |

Yes |

|

|

Merchandising |

Disabled |

Large |

Yes |

|

|

Sales Audit |

Disabled |

Small |

Yes |

|

|

Merchandising |

Enabled |

Small |

No |

|

|

Merchandising |

Enabled |

Large |

Yes |

|

|

Merchandising |

Enabled |

Large |

No |

|

|

Merchandising |

Enabled |

Small |

No |

|

|

Merchandising |

Enabled |

Small |

Yes |

|

|

Merchandising |

Enabled |

Small |

No |

|

|

Merchandising |

Disabled |

Small |

Yes |

|

|

Merchandising |

Enabled |

Small |

Yes |

|

|

Merchandising |

Disabled |

Small |

Yes |

|

|

Merchandising |

Disabled |

Small |

Yes |

|

|

Merchandising |

Enabled |

Small |

No |

|

|

Sales Audit |

Disabled |

Small |

Yes |

|

|

Sales Audit |

Enabled |

Small |

No |

|

|

Sales Audit |

Enabled |

Small |

No |

|

|

Sales Audit |

Enabled |

Small |

No |

|

|

Merchandising |

Enabled |

Small |

No |

|

|

Merchandising |

Disabled |

Small |

Yes |

|

|

Merchandising, Sales Audit |

Disabled |

Small |

No |

|

|

Merchandising |

Disabled |

Small |

Yes |

|

|

Sales Audit |

Disabled |

Small |

Yes |

|

|

Merchandising |

Enabled |

Small |

No |

|

|

Merchandising |

Enabled |

Small |

No |

|

|

Invocation of external services moved to the Application layer |

Merchandising |

Disabled |

Small |

Yes |

|

Merchandising |

Disabled |

Small |

No |

Enhanced Support for Global Tax

In order to support the more complex taxes that are required in countries and regions around the world, a new tax option has been added to Merchandising. When this new option is enabled, you will be able to use a new rule-based tax configuration, rather than configuring tax information at the item/region level.

The tax rules approach facilitates the support of more complex tax setup and maintenance, as well as provides a better way to see how taxes are set in the system. Tax rules can be created at higher levels and address multiple regions, making the tax maintenance simpler. With this new feature, it is possible to support:

-

Countries with multiple tax regions

-

Multiple taxes applied to the same item and transaction

-

Taxes with complex calculations, such as tax over tax scenarios or per unit taxes,

-

Taxes on non-merchandise costs

-

Taxes calculated based on flexible attributes (CFAS)

A new batch process is then responsible for turning the tax rules setup into merchandise hierarchy and item level tax data. This data will be used in tax calculations in Merchandising, Sales Audit, Pricing, and Invoice Matching.

A new option for Default Tax Type, Global Tax, has been added to enable this new feature. This joins the already supported US Sales Tax and Simple VAT options, which continue to be available.

Note:

This new option is not applicable for US-based sales taxes.System Options Updates

| Attribute Name | New/Updated? | Description | Patch Default |

|---|---|---|---|

|

Closed Tax Rules Days |

New |

This system option is used to identify how many days to retain Global Tax rules that have been closed. |

365 |

|

Default Tax Type |

Updated |

A new valid value, Global Tax Solution (GTS), was added to the existing system option, which determines what type of taxation is being used. No change will be made to your existing setting on application of the patch. |

Code Updates

| Code Type | Code Type Description | Code | Code Description | New/Updated | Delivered |

|---|---|---|---|---|---|

|

DTAX |

Default Tax Types |

GTAX |

Localized Tax Solution |

Updated |

Enabled |

|

DTAX |

Default Tax Types |

GTS |

Global Tax Solution |

New |

Enabled |

|

VRCT |

VAT Region Calc Type |

G |

Global |

New |

Enabled |

|

GTST |

Tax Rule Config Status |

W |

Worksheet |

New |

Enabled |

|

GTST |

Tax Rule Config Status |

S |

Submitted |

New |

Enabled |

|

GTST |

Tax Rule Config Status |

AP |

Approved |

New |

Enabled |

|

GTST |

Tax Rule Config Status |

AC |

Active |

New |

Enabled |

|

GTST |

Tax Rule Config Status |

U |

Updated |

New |

Enabled |

|

GTST |

Tax Rule Config Status |

O |

Closed |

New |

Enabled |

|

GTTB |

Global Tax Basis Type |

B |

Both |

New |

Enabled |

|

GTTB |

Global Tax Basis Type |

C |

Cost |

New |

Enabled |

|

GTTB |

Global Tax Basis Type |

R |

Retail |

New |

Enabled |

|

GTTB |

Global Tax Basis Type |

N |

Non-Merchandise |

New |

Enabled |

|

GTTT |

Global Tax Calculation Type |

P |

Percentage |

New |

Enabled |

|

GTTT |

Global Tax Calculation Type |

U |

Unit |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

1 |

All Departments |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

2 |

Department |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

3 |

Class |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

4 |

Subclass |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

5 |

Item |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

6 |

Parent/Diff |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

7 |

Item List |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

8 |

Upload List |

New |

Enabled |

|

GTCT |

Global Tax Rule Condition Type |

0 |

Region |

New |

Enabled |

|

GTRL |

Global Tax Rule Restriction Level |

M |

Merchandise Hierarchy |

New |

Enabled |

|

GTRL |

Global Tax Rule Restriction Level |

S |

Source Region |

New |

Enabled |

|

GTRL |

Global Tax Rule Restriction Level |

D |

Destination Region |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

ITMTAX |

Item Tax Information |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

PO |

Purchase Order Information |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

TSF |

Transfer Information |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

DEAL |

Deal Information |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

RTV |

Return to Vendor Information |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

POSSAL |

B2C sales via POS |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

SALES |

Sales Information |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

TAXINF |

Tax rules information (no calculation) |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

FO |

Franchise orders information |

New |

Enabled |

|

GTRT |

Global Tax Rule Transaction Type |

FR |

Franchise returns information |

New |

Enabled |

|

GTET |

GTS Region explode type |

A |

Explode all |

New |

Enabled |

|

GTET |

GTS Region explode type |

S |

Explode to levels with the same source and destination tax regions only |

New |

Enabled |

|

GTET |

GTS Region explode type |

D |

Explode to levels with different source and destination tax regions only |

New |

Enabled |

Other Merchandising Impacts for Tax Enhancements

In addition to the new tax rules configuration, other changes were also required in Merchandising based on the new tax rule setup. These changes are only applicable if you have configured your environment to run using the default tax type of Global Tax.

When configured for Global Tax, the tax region setup has been changed to optionally support a hierarchy of regions. Additionally, the department and item level VAT screens are disabled in this configuration because taxes are based on rules versus a set rate. But, a new Item Tax screen has been added under this configuration. In this screen, users are able to see all taxes applicable to the item and have the ability to create tax rules for a particular item.

Induction processes for VAT regions, tax codes, and non-merchandise codes were also adjusted to support the Global Tax configuration to avoid these being deleted if they are used in tax rules. Additionally, if a CFAS attribute for item, location, or supplier is associated with a tax rule it also cannot be deleted.

Additionally, for stores, warehouses, and suppliers, a new Tax ID attribute has been added and the existing field for partners has been made available for all partner types. This field is optional for these entities and is used in invoicing processes.

Transaction Tax Calculations and Postings

A new tax calculation process will be used for Merchandising transactions when the Global Tax is configured as the default tax type, including support for multiple taxes. This includes the following transaction types: purchase orders, intercompany transfers, deal income, RTVs, and franchise sales and returns. The results of these calculations are stored as a record of tax related details related to each transaction.

All taxes for the same item/transaction are posted to the transaction level stock ledger separate from the transaction itself as part of the Global Tax configuration, which allows the tax information to be posted separately to the General Ledger.

Additionally, reverse tax calculations or self-assessment tax calculations are also supported in the Global Tax configuration, similar to what is supported with Simple VAT. This type of tax calculation is applied during purchase order receipts, but will have different postings for the Global Tax configuration, making it possible for you to have separate accounting for regular taxes versus those calculated in a self-assessment format.

Note:

Self-assessed tax calculations are not supported for inter-company transfers in this release.Tax information shown on the purchase order header was enhanced to display multiple taxes, when applicable on a purchase order. Also in Order Details, an additional Tax Details tab was added in the Item Details contextual report for visibility to item level taxes on the order.

The invoice creation process in Merchandising has also been modified to ensure that multiple tax lines can be added for items being invoiced. The format for the EDI file, which gets integrated to Invoice Matching, is also changed to allow for multiple tax lines.

Steps to Enable

To enable Global Tax as the default tax type in your environment, see the details in the Enhanced Support for Global Tax requirement. In addition to setting up tax rules, if you enable Global Tax, then you will need to modify any custom Item Induction templates to remove the VAT_ITEM tab, as it are not used with this configuration.

Code Updates

| Code Type | Code Type Description | Code | Code Description | New/Updated | Delivered |

|---|---|---|---|---|---|

|

GLST |

General Ledger Single Transactions |

89C |

GL Intf – Reverse Tax In (Cost) |

Updated |

Y |

|

GLST |

General Ledger Single Transactions |

90R |

GL Intf - Reverse Tax Out (Retail) |

Updated |

Y |

|

GLMT |

General Ledger Monthly Transactions |

89C |

GL Interface - Reverse Tax In (Cost) |

Updated |

Y |

|

GLMT |

General Ledger Monthly Transactions |

90R |

GL Intf - Reverse Tax Out (Retail) |

Updated |

Y |

|

GLRT |

General Ledger Rolled Transactions |

89C |

GL Interface - Reverse Tax In (Cost) |

Updated |

Y |

|

GLRT |

General Ledger Rolled Transactions |

90R |

GL Interface - Reverse Tax Out (Retail) |

Updated |

Y |

Data Access Schema (DAS) Updates

| Table Name | View Name | New/Updated? | Change Notes |

|---|---|---|---|

|

GTS_TAX_DTL_TSF |

DAS_WV_GTS_TAX_DTL_TSF |

New |

New table is being added to hold the multi tax line in case of 88/87 or 89/90 posting for Inter-company Transfers. |

|

GTS_TAX_DTL_DEAL |

DAS_WV_GTS_TAX_DTL_DEAL |

New |

New table is being added to hold the multi tax line in case of 88/87 or 89/90 posting for Deals |

|

GTS_TAX_DTL_PO |

DAS_WV_GTS_TAX_DTL_PO |

New |

New table is being added to hold the multi tax line in case of 88/87 or 89/90 posting for Purchase Orders |

|

GTS_TAX_DTL_RTV |

DAS_WV_GTS_TAX_DTL_RTV |

New |

New table is being added to hold the multi tax line in case of 88/87 or 89/90 posting for RTV. |

|

GTS_TAX_DTL_WFORDRTN |

DAS_WV_GTS_TAX_DTL_WFORDRTN |

New |

New table is being added to hold the multi tax line in case of 88/87 or 89/90 posting for Inter-company Transfers. |

|

DAILY_DATA |

DAS_WV_DAILY_DATA |

Updated |

New Column added REVERSE_TAX_IN_COST and REVERSE_TAX_OUT_RETAIL |

|

WEEK_DATA |

DAS_WV_WEEK_DATA |

Updated |

New Column added REVERSE_TAX_IN_COST and REVERSE_TAX_OUT_RETAIL |

|

MONTH_DATA |

DAS_WV_MONTH_DATA |

Updated |

New Column added REVERSE_TAX_IN_COST and REVERSE_TAX_OUT_RETAIL |

|

STORE |

DAS_WV_STORE |

Updated |

New column TAX_ID added |

|

SUPS |

DAS_WV_SUPS |

Updated |

New column TAX_ID added |

|

WH |

DAS_WV_WH |

Updated |

New column TAX_ID added |

|

VAT_REGION |

DAS_WV_VAT_REGION |

Updated |

New column PARENT_REGION added |

Integration Impacts

| API Name | New/Updated? | Integration Type | Field Name | Change Notes |

|---|---|---|---|---|

|

Vendor Subscription |

Updated |

RIB |

TAX_ID |

Optional field TAX_ID added in the VendorHdrDesc. This field holds the Tax Identification Number for the Supplier. |

|

Supplier Service |

Updated |

Web Service |

TAX_ID |

Optional field TAX_ID added in the SupAttr. This field holds the Tax Identification Number for the Supplier. |

|

Store Subscription |

Updated |

RIB |

TAX_ID |

Optional field TAX_ID added in the XStoreDesc. This field holds the Tax Identification Number for the Store |

|

Partner Subscription |

Updated |

RIB |

TAX_ID |

Field length changed from varchar2(18) to varchar2(20) |

|

VAT Publication |

Updated |

BDI |

PARENT_REGION |

PARENT_REGION added in this BDI outbound Interface - Vat_Fnd_BdiInterfaceModule. This field contains the parent VAT region for the corresponding VAT_REGION column value. |

|

Item Induction Upload |

Updated |

Batch |

The templates for the item induction spreadsheet and batch will no longer contain the VAT_ITEM sheet in a Global Tax configuration. If you have custom templates using these, they must be removed. |

Sales Audit Impacts for Tax Enhancements

Several minor impacts to Sales Audit were made to support the new Global Tax configuration in Merchandising. Sales Audit previously supported receiving and managing multiple taxes for an item on transactions, but with this release enhancements were made to support per-unit taxes, as well as Merchandising integration changes related to taxes. A new field has also been added in the RTLOG and Sales Audit to differentiate whether the tax is a percent-based tax or a per-unit tax. This is shown as the Tax Calc Type. Some changes have also been made related to how tax data is passed to Merchandising. For any per-unit taxes that are received in Sales Audit at an item level in a transaction, a rate will be calculated for inclusion on tax transaction data records. Also, when taxes are received at a transaction level rather than item level, they will be apportioned to all items in the transaction that are determined to be taxable. These changes are only applicable if the default tax type in Merchandising is Global Tax.

Steps to Enable

If you are running with a Default Tax Type in Merchandising as Simple VAT (SVAT) or US Sales Tax (SALES), then no change is required to the RTLOG format. If you have enabled Global Tax as your Default Tax Type in Merchandising, then you will need to modify the IGTAX file format to include the basis for the tax calculation. See the Integration Impact section for more details.

Integration Impacts

| API Name | New/Updated? | Integration Type | Field Name | Change Notes |

|---|---|---|---|---|

|

SAIMPTLOG/SAIMPTLOGI |

Updated |

Flat File |

TAX_CALC_TYPE |

Added a new field to the IGTAX line. This field contains the tax calculation type for the item tax line if you are running in a Global Tax configuration. Valid values are P - Percent-based or U - Per-Unit. No change is required if configured with Simple VAT or US Sales Tax. |

Tax Dashboard

As part of the global tax enhancements, a dashboard was created as a new option in the Reports menu. The intent of this dashboard is to highlight to financial managers the areas where tax setup is incomplete. Three reports will be available on this dashboard by default:

-

Rules with Upcoming End Dates

-

Rules Pending Approval

-

Missing Tax Setup

System Options Updates

| Attribute Name | New/Updated? | Description | Patch Default |

|---|---|---|---|

|

Number of Weeks for Expiring Rules |

New |

This report option is used to define the number of weeks to consider for the Rules with Upcoming End Dates report. |

4 |

|

Number of Weeks for Pending Approval Rules |

New |

This report option is used to define the number of weeks to consider for the Rules Pending Approval report. |

4 |

Merchandising Exchange Rate Enhancements

Previously, Merchandising employed an approach of holding all exchange rates between the primary currency and another currency. So, when a conversion was required between two currencies that are different from the primary currency, it would first convert the source currency into the primary and then from the primary to the target currency. This two-stage conversion sometimes resulted in calculation or rounding errors. In this update, changes have been made to store currency conversions between all currencies held in Merchandising, not just the exchange rates with primary. If a direct rate is not available for conversion between two currencies, then a conversion via the primary currency is used.

The Currency Exchange Rate subscription used by Merchandising to subscribe to exchange rates from Financials via Oracle Retail Financial Integration (RFI) has been enhanced to subscribe to exchange rates not just against the primary currency but between any two currencies that exist in Merchandising.

The table holding currency exchange rates in Merchandising has been modified to add a new column for the from currency. When the patch is applied, it will be updated with the primary currency for pre-existing exchange rate records to maintain previous functionality. The from currency field was also added on the template-based uploads and downloads of exchange rate information.

Because it is expected that the number of historical exchange rates in Merchandising will increase based on this change, a new background process has also been introduced to cleanup non-active exchange rate records that are older than the value specified by the new Currency Rate Purge Months system option.

The Exchange Rates publisher from Merchandising has been deprecated, as it was not actually sending exchange rates for the last several releases. The assumption is that any other solutions that require currency rates would subscribe to the same source (usually Financials) as Merchandising and Merchandising would not be a pass through for this information. Lastly, the Euro triangulation functionality, which was added when the Euro was first introduced, has been removed as it is no longer required with the above defined changes.

Steps to Enable

There are several steps needed to enable this new functionality:

-

Determine the number of months that you wish to retain historical currency exchange rates in Merchandising and set the new system option accordingly.

-

In the Merchandising task list, select Application Administration > System Options.

-

Navigate to the Data Retention section and locate the new Currency Rates Retention Months option.

-

Update the value to the number of months you wish to retain rates.

-

Click Save and Close to save your changes and exit the system options screen.

-

-

Log an SR to enable the background process for purging older exchange rates. See also the Batch Schedule section below.

-

Recommended: Remove currencies that are not relevant for your business from Merchandising so as to avoid importing unnecessary To and From exchange rates for your business. To remove unused currencies, do the following:

-

From the Merchandising task list, select Foundation Data > Download Foundation Data.

-

In the Download Data screen, select the template type Finance Administration and template Currencies.

-

Then, click Download and when prompted, select to open the data in the spreadsheet application of your choosing.

-

In the Currencies tab, navigate to the first non-used currency and select Delete in the Action column.

-

In the Currency Translations tab, navigate to each instance of the currency marked for Delete in step d and select Delete in the Action column. Using the filtering option in your spreadsheet application may be helpful with this step.

-

In the Currency Exchange Rates tab, navigate to each instance of the currency marked for Delete in step d and select Delete in the Action column. Using the filtering option in your spreadsheet application may be helpful with this step.

-

Repeat steps d-f until all unused currencies have been flagged for delete.

-

Save your updated spreadsheet to a local directory (retaining the .ods extension) and close the document.

-

In the Merchandising task list, select Foundation Data > Upload Foundation Data.

-

In the Upload Data screen, select the template type Finance Administration and template Currencies. Then, using the Browse button, select the file that you saved in step h. The Process Description will default for you. Then click Upload.

-

Lastly, validate that there were no errors with your updates. From the Merchandising task list, select Foundation Data > Review Status.

-

In the Data Loading Status screen, navigate to the row containing the process description that defaulted in step j. If the status is Processed Successfully, the currencies were successfully deleted. If there are errors, use the View Issues button to get more information on the errors and correct your updates. Once the data is corrected, repeat steps i and j.

-

Batch Schedule Impacts

| Process Name | Process Type | New/Updated? | Delivered |

|---|---|---|---|

|

CURRENCY_RATES_CHANGE_PURGE_JOB |

Background Process |

New |

Disabled |

Log an SR to enable this background process. As part of the SR, you will need to indicate how many times per day that you wish this background process to execute.

Data Access Schema (DAS) Updates

| Table Name | View Name | New/Updated? | Change Notes |

|---|---|---|---|

|

PURGE_CONFIG_OPTIONS |

DAS_WV_PURGE_CFG_OPTNS |

Updated |

New column added - CURRENCY_RATES_PURGE_MONTHS.This field indicates the number of months after which an exchange rate can be purged from the system once it is no longer active. All inactive currency rates records older than this number of months will be purged. |

|

SYSTEM_OPTIONS |

DAS_WV_SYSTEM_OPTNS |

Updated |

New column added - CURRENCY_RATES_PURGE_MONTHS.This field indicates the number of months after which an exchange rate can be purged from the system once it is no longer active. All inactive currency rates records older than this number of Months will be purged. |

|

ORDHEAD |

DAS_WV_ORDHEAD |

Updated |

New column added - EXCHANGE_RATE_IND.This field Indicates the currency against which the exchange rate has been captured on the entity. Valid values are: P (Primary) or L (Local) currency. |

|

ORDLOC_EXP |

DAS_WV_ORDLOC_EXP |

Updated |

New column added - EXCHANGE_RATE_IND.This field Indicates the currency against which the exchange rate has been captured on the entity. Valid values are: P (Primary) or L (Local) currency. |

|

CURRENCY_RATES |

DAS_WV_CURRENCY_RATES |

Updated |

New column added - FROM_CURRENCY_CODE. This field holds the currency code for which direct exchange rate is defined |

Exchange Rate Changes for Merchandising Transactions

The below documents in Merchandising previously captured and displayed the exchange rate against primary currency:

-

Purchase Orders

-

Order Expenses

-

Transportation

-

Custom Entries

-

Obligations

-

Franchise Orders

Given that the stock ledger is maintained in local currency, the previous posting process for most of these documents included a second conversion from the primary currency to the local currency. For example, the exchange rate on a PO is between the supplier's currency and the primary currency. But, on receipt, the exchange rate was converted from supplier to primary to local for posting in the stock ledger.

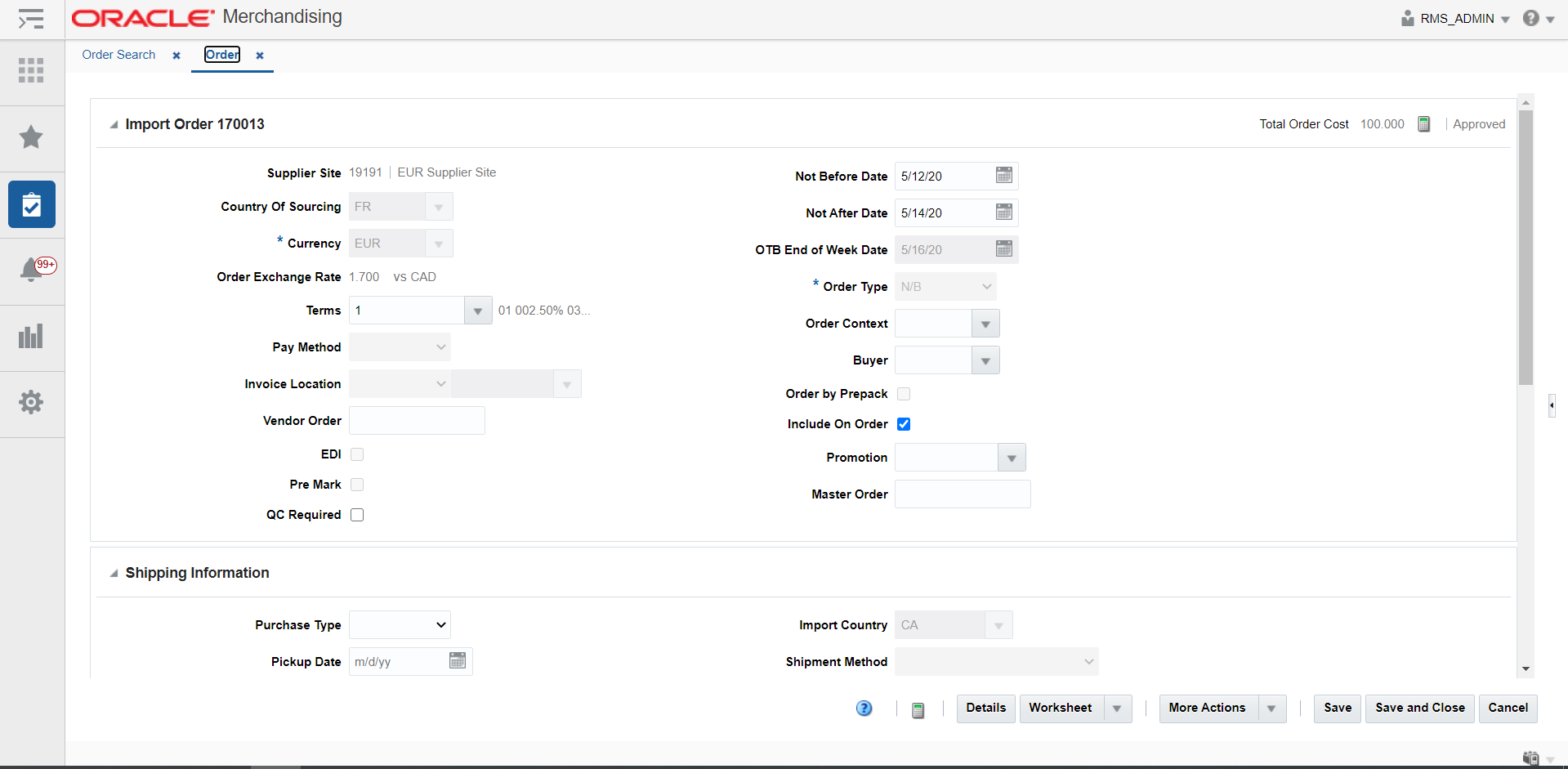

With this update, the rate captured and displayed on each of these documents will be the rate against the currency of the location on the document, so that a single conversion step will suffice for stock ledger posting. Since the local currency could differ based on the locations on the document, any new documents created after this update will have a suffix added to the exchange rate displayed in the user interface to provide users visibility to which currency the exchange rate corresponds to. Documents created prior to the upgrade shall not display this suffix. The rate on previously created documents will continue to be the rate against the primary currency. The local currency suffix can thus be used to distinguish documents with rates captured against the location currency from those wherein the rate was against the primary currency. The image below shows how the prefix is displayed for a purchase order exchange rate.

The posting process for any of the above listed documents created post the upgrade will leverage direct exchange rates for conversions between the two currencies, if it exists. If direct rates do not exist then the previous process of conversion via the primary currency will be attempted. If this too is not possible then an error will be flagged indicating that exchange rates don't exist. Documents created prior to the upgrade will use the pre-existing process of conversion via the primary currency. In cases wherein the currency rate on the document is optional and a rate has not been captured on the document, the conversion process will proceed to use exchange rate values received from finance as an alternative for conversion.

Exchange Rate Changes for ALC Finalization

Previously, the process of Actual Landed Cost (ALC) Finalization was managed in primary currency and any variances identified required a further leg of conversion to enable posting in local currency. From this release onward, the ALC Finalization screens shall display the estimated, actual values and variances directly in local currency thereby ensuring that the variance displayed on screen is the exact value posted. Purchase orders for which the ALC finalization process was initiated prior to this update will use the pre-existing approach wherein the computation and display is done in primary currency and subsequently converted to local currency for posting purposes. All purchase orders for which finalization is initiated post this update will carry out the finalization directly in local currency.

Addition of Import Tables to Order Subscription API

Previously, the Order Subscription API that is used to feed purchase orders to Merchandising from an external system did not support import order attributes, such as harmonized tariff schedules (HTS), letter of credit, expenses, or the master order number. To better facilitate integrating import orders using this API, enhancements have been made in order to accept these details. The new set of fields have been added in the API in such a way that they are not mandatory, so if you are using this API, changes do not need to be made to your integration, unless you choose to start using these components.

Note:

There is a known issue with these changes that key attributes at the order header level needed for the Letter of Credit payment method are not available with these two integration methods (purchase type, payment method, FOB title pass and FOB title pass description). These will be addressed in a patch post release.Integration Impacts

| API Name | New/Updated? | Integration Type | Field Name | Change Notes |

|---|---|---|---|---|

|

PO Subscription API (Create and Modify) |

Updated |

RIB |

XOrderDesc

|

The new fields are optional at the header level. Additionally, the following new nodes were added to this RIB message:

|

|

XOrderLC

|

||||

|

XOrdLocExp

|

||||

|

XOrderSkuHTS

|

||||

|

XOrdSkuHTSAssess

|

||||

|

PO Subscription API (Delete) |

Updated |

RIB |

XOrderLocExpRef

XOrderSkuHTSRef

XOrderSkuHTSAssessRef

|

The following new optional nodes each representing an Import table have been added to the XOrderRef message to support delete of the associated PO import information.

|

|

Order Management Service (Create and Update) |

Updated |

SOAP Service |

XOrderDesc

|

New optional attributes have been added at the header level for import details. Also, the following optional attributes have been added to the XOrderDesc node

Operations Impacted:

|

|

XOrderLC

|

||||

|

XOrdLocExp

|

||||

|

XOrderSkuHTS

|

||||

|

XOrdSkuHTSAssess

|

||||

|

Order Management Service (Delete) |

Updated |

SOAP Service |

XOrderLocExpRef

XOrderSkuHTSRef

XOrderSkuHTSAssessRef

|

The following new optional nodes each representing an Import table have been added to the XOrderRef message to support delete of the associated PO import information.

Operations Impacted:

|

Custom Validation Rules

To provide retailers with flexibility to supplement built-in validations while submitting and approving key foundation entities, like items, or transaction entities like purchase orders, a new custom validation rule configuration functionality will be introduced in Merchandising. Each supported entity can have one or more rules which are executed in addition to base validations. For example, you could build a rule that supports validating that a PO type has been associated with all purchase orders prior to approval. This functionality will use a rule builder similar to that used by Sales Audit for building custom rules. With this release, custom validations will be supported for the following:

-

Item Submission/Approval

-

Purchase Order Submission/Approval

-

Supplier Activation/Deactivation

-

Partner Activation/Deactivation

Steps to Enable

To enable this feature and start creating rules, you must follow the security configuration instructions for this release to add this duty to the roles that you wish to allow access to this feature.

Code Updates

| Code Type | Code Type Description | Code | Code Description | New/Updated | Delivered |

|---|---|---|---|---|---|

|

CVLO |

Custom Validation Logical Operators |

AND |

and |

New |

Enabled |

|

CVLO |

Custom Validation Logical Operators |

OR |

or |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

= |

= |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

!= |

!= |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

< |

< |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

> |

> |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

>= |

>= |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

<= |

<= |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

B |

BETWEEN |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

NB |

NOT BETWEEN |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

IN |

IN |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

NOT IN |

NOT IN |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

NULL |

IS NULL |

New |

Enabled |

|

CVAO |

Custom Validation Rules Restriction Arithmetic Operation |

!NULL |

IS NOT NULL |

New |

Enabled |

|

CVRS |

Custom Validation Rules Status |

W |

WORKSHEET |

New |

Enabled |

|

CVRS |

Custom Validation Rules Status |

S |

SUBMITTED |

New |

Enabled |

|

CVRS |

Custom Validation Rules Status |

A |

APPROVED |

New |

Enabled |

|

CVRS |

Custom Validation Rules Status |

C |

CLOSED |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

1 |

1 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

2 |

2 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

3 |

3 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

4 |

4 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

5 |

5 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

6 |

6 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

7 |

7 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

8 |

8 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

9 |

9 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

10 |

10 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

11 |

11 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

12 |

12 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

13 |

13 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

14 |

14 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

15 |

15 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

16 |

16 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

17 |

17 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

18 |

18 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

19 |

19 |

New |

Enabled |

|

CVRE |

Custom Validation Rules Execution Order |

20 |

20 |

New |

Enabled |

|

CVCP |

Custom Validation Rules Complex Parameter Arithmetic Operation |

+ |

+ |

New |

Enabled |

|

CVCP |

Custom Validation Rules Complex Parameter Arithmetic Operation |

- |

- |

New |

Enabled |

|

CVCP |

Custom Validation Rules Complex Parameter Arithmetic Operation |

* |

* |

New |

Enabled |

|

CVCP |

Custom Validation Rules Complex Parameter Arithmetic Operation |

/ |

/ |

New |

Enabled |

|

CVCP |

Custom Validation Rules Complex Parameter Arithmetic Operation |

( |

( |

New |

Enabled |

|

CVCP |

Custom Validation Rules Complex Parameter Arithmetic Operation |

) |

) |

New |

Enabled |

|

CVPA |

Presence Absence Indicator |

P |

Presence |

New |

Enabled |

|

CVPA |

Presence Absence Indicator |

A |

Absence |

New |

Enabled |

|

TLLT |

Translation code for default UI label to be used for base system of record RMS table for the entity. |

CVRN |

Validation Rule |

New |

Enabled |

|

TLLC |

Translation code for default UI label to be used for the field if the label is not available in the UI layer. |

CVRN |

Rule Description |

New |

Enabled |

Shipment Reconciliation Enhancements

Two enhancements have been introduced in the shipment reconciliation functionality for improved usability and mass maintenance capabilities.

First, the restriction in the Stock Order Reconciliation screen that only allowed shipments without a receipt to be reconciled using Forced Receipt has been removed. Going forward, any of the four available reconciliation methods (Freight Claim, Forced Receipt, Shipping Location, or Receiving Location) can be selected to reconcile shipments without receipt.

Additionally, enhancements have been made in Stock Orders Pending Close dashboard report for a smoother workflow and mass resolution of discrepancies. There will now be an option to reconcile one or multiple shipments directly from this report by specifying an adjustment type, similar to Stock Order Reconciliation screen. To facilitate this action, this report has been modified to show information at the stock order/shipment level. Several new columns such as Shipment Status, Shipment Date, and Days Since Shipment have been added to provide more information about the shipment and thereby assist in taking appropriate action.

Approve Deals on Upload

Deals that get uploaded through batch were previously always created in Worksheet status and were required to be manually approved. To avoid this manual intervention, enhancements have been made to leverage a new supplier attribute to determine whether to attempt to approve a deal when uploading or leave it in the worksheet status. This new attribute, which is at the supplier level (not supplier site) will be available for update in the Supplier page, as well as in the Supplier Subscription API. If the deal does not pass the validations required for submitting and approving a deal, then the deal will still be created on upload, but it will remain in Worksheet status.

After this update is applied, the new attribute will be set to Worksheet for all suppliers to mimic previous application behavior.

Steps to Enable

-

In the Merchandising task list, select Foundation Data > Supplier and Partner Foundation. Then, select Manage Suppliers.

-

Enter criteria to search for all suppliers that you would like to have deals set to submitted or approved status on upload and click Search.

-

For each supplier that requires an update, click on the hyperlink for the supplier ID to open the Supplier page.

-

Navigate to the Deal Status for Uploads attribute and update the value to either Submit or Approve.

Repeat for each supplier where you want to change the default upload status. The Supplier Subscription API could also be used to update this attribute for suppliers, if desired.

Integration Impacts

| API Name | New/Updated? | Integration Type | Field Name | Change Notes |

|---|---|---|---|---|

|

Supplier Subscription API |

Updated |

RIB |

Deal_upload_status |

Indicates whether deals uploaded from this supplier should be automatically approved. Only applies for suppliers, not supplier sites. Valid values are worksheet (W), submit (S), or approve (A). |

Consignment Rate for Clearance and Promotional Items

Two new billing types, Promotional Consignment Rate and Clearance Consignment Rate, have been introduced in order to support a special purchase rate that can be used for consignment items that are part of a promotional offer or are on clearance. This would only apply to consignment items that use a purchase rate as the calculation basis for cost, as that rate is based on the selling unit retail. These deal types will be able to be created in the Deals page in Merchandising, or using the Deal Upload process. These deal types will also be present in Deal Search. Concession items are not eligible for these types of deals.

When a Clearance Consignment Rate deal is active, and when a consignment item that is on clearance is sold, the rate that will apply on the related purchase order will use the special rate defined in the deal, rather than the regular purchase rate. When a Promotion Consignment Rate deal is active, then if an item is sold with discounts applied based on a promotional offer linked to a Promotion Consignment Rate deal, the special rate defined in the deal will be used rather than the regular purchase rate.

Steps to Enable

To enable one or both of the new deal types to be visible to users, the following steps should be followed:

-

From the Merchandising task list, select Foundation Data > Download Foundation Data.

-

Select template type Administration and template Codes and Descriptions and click Download. You may want to filter the download to only export the details on code type DLBT.

-

Open the .ods file that is downloaded in your preferred spreadsheet application and navigate to the row in the spreadsheet that contains PCR and/or CCR.

-

In the Action column, select Update and then in the Used column, change the value to Y to indicate it should be enabled.

-

Save the .ods file with your changes and close the document.

-

Return to Merchandising and from the task list, select Foundation Data > Upload Foundation Data.

-

Select template type Administration and template Codes and Descriptions. Then, click the Browse... button to select the file where you made your changes. Click Upload.

If you choose to create this type of deal via the Deal Upload API and are currently using this API for uploading other types of deals, then there is an impact to the format of the file. See Integration Impacts for details.

Integration Impacts

| API Name | New/Updated? | Integration Type | Field Name | Change Notes |

|---|---|---|---|---|

|

DEALUPLD_JOB |

Updated |

Flat File |

CONSIGNMENT_RATE |

For the new types of deals introduced in this release, this new field is required in the flat file input. No change is required to the file format if not using the Clearance Consignment Rate or Promotion Consignment Rate deal types. |

Retention Days for Cost Changes

Previously, when a cost change was executed, it was immediately purged from the system. This is a bit different than the standard followed by other transactions in Merchandising, where there are a certain number of days that an event is retained after it is executed. To align with the solution standard, a new system option Extracted Cost Changes Days has been added that will allow executed cost changes within the system to be retained for the specified number of days before they are finally purged. Also as part of this change, the existing system option Cost Event History days was moved to the system options table containing other purge configurations. The DAS views for the purge configuration table has also been updated for both of these parameters.

Steps to Enable

Initially the value for the new system option will be 0, which will mimic current functionality. To update the value based on your business requirements, do the following:

-

In Merchandising, select Application Administration and then System Options from the task list.

-

Navigate to the Data Retention section on the System Options page.

-

Update the number of days for the Extracted Cost Changes parameter under Cost to the value that is appropriate for your business, between 0-999 days.

System Options Updates

| Attribute Name | New/Updated? | Description | Patch Default |

|---|---|---|---|

|

Extracted Cost Changes |

New |

Indicates the number of days after a cost change goes into effect that it will be retained by the system. After this number of days have elapsed, the cost change will be removed. |

0 |

|

Cost Event History Days |

Updated |

Moved column COST_EVENT_HIST_DAYS from FOUNDATION_UNIT_OPTIONS to PURGE_CONFIG_OPTIONS. |

N/A |

Data Access Schema (DAS) Updates

| Table Name | View Name | New/Updated? | Change Notes |

|---|---|---|---|

|

PURGE_CONFIG_OPTIONS |

DAS_WV_PURGE_CFG_OPTNS |

Updated |

New columns RETN_EXTRACTED_COST_CHG and COST_EVENT_HIST_DAYS |

|

FOUNDATION_UNIT_OPTIONS |

DAS_WV_FOUNDATION_UNIT_OPTNS |

Updated |

Column COST_EVENT_HIST_DAYS is obsoleted as this is moved to PURGE_CONFIG_OPTIONS |

|

SYSTEM_OPTIONS |

DAS_WV_SYSTEM_OPTNS |

Updated |

New column RETN_EXTRACTED_COST_CHG |

Automated Item List Rebuild

Previously in Merchandising there was no process to automatically rebuild item lists that are created as dynamic; they could only be rebuilt manually prior to usage. With this enhancement, a batch process has been added to rebuild dynamic item lists automatically, similar to location lists. All item lists that are flagged for batch rebuilding will be automatically rebuilt during the nightly batch process. Dynamic item lists that are flagged for batch rebuilding can also be manually rebuilt, as needed, when applying to events.

Steps to Enable

In order to flag certain item lists for batch rebuilding, you will need to follow these steps:

-

From the Merchandising task list, select Items and then Manage Item Lists.

-

Using the search criteria, find the first list that you wish to update and click on the hyperlinked ID or select Edit from the Actions menu.

-

Set Batch Rebuild Indicator as Yes. Then, selected Save and Close to save your change.

-

Repeat for all item lists you want to enable for this function.

Additionally, you will need to enable the batch process that does the rebuilding in your batch schedule. See the details below for which job to enable.

Batch Schedule Impacts

| Process Name | Process Type | New/Updated? | Delivered |

|---|---|---|---|

|

ITMLRBLD_CYCLE_JOB (in LCLRBLD_SITMAIN_CYCLE_PROCESS) |

cyclic |

New |

Disabled |

|

ITMLRBLD_JOB (in LCLRBLD_SITMAIN_PROCESS) |

nightly |

New |

Disabled |

|

ITMLRBLD_ADHOC_JOB (in LCLRBLD_SITMAIN_PROCESS_ADHOC) |

ad-hoc |

New |

Disabled |

To enable the above jobs as part of your nightly batch cycle, follow the instructions below.

-

Log into the Process Orchestration and Monitoring (POM) application with the Administrator role

-

In the task list, select Schedules > MERCH > Administration > Batch Administration. This will bring up the MERCH: Batch Administration screen which has the following panels:

-

Batch Applications and Modules

-

Batch Cycle Management

-

Batch Jobs

-

-

Under Batch Jobs, scroll (or filter) to locate the jobs to be enabled and click the Enabled check box to enable or disable the job. Repeat until all jobs have been updated.

-

Click Save and Close to save your changes and update the schedule.

Note:

After saving, the changes will take effect once the new scheduler day is created. The changes will not take effect for the current day.Mobile Merchandising Re-introduction

The Merchandising mobile workflows are being re-introduced with this release to better support SaaS implementations and to provide increased usability. The mobile workflows that are available for Merchandising are Recent Orders and Recent Transfers. Additionally, for Sales Audit, there is a mobile dashboard workflow.

Modifications to Promotion Validation

For customers using Oracle Retail Customer Engagement (ORCE), rather that Oracle Retail Pricing Cloud Service, to create and manage promotions and offers, there previously was not an option to have the promotional information audited in Sales Audit. With this release, Sales Audit will have the ability to read promotions and offers from ORCE as well, so that this can now be part of the audited details.

Steps to Enable

In order to enable Sales Audit to audit the promotions and offers from ORCE, you will need to

-

Follow the steps below in the Batch Schedule Impacts section to enable the new batch used to import the promotion details from ORCE and also configure the ORCE promotion consumer service in Merchandising.

-

Ensure that your sales files sent to Sales Audit use 9999 as the promotion type (RMS_PROMO_TYPE) in the RTLOG file.

Batch Schedule Impacts

| Process Name | Process Type | New/Updated? | Delivered |

|---|---|---|---|

|

RESA_PROMO_JOB |

Nightly |

New |

Disabled |

|

RESA_PROMO_ADHOC_JOB |

Adhoc |

New |

Disabled |

|

RESA_PROMO_CYCLE_JOB |

Cyclic |

New |

Disabled |

To enable the above jobs as part of your nightly batch cycle, follow the instructions below.

-

Log into the Process Orchestration and Monitoring (POM) application with the Administrator role

-

In the task list, select Schedules > MERCH > Administration > Batch Administration. This will bring up the MERCH: Batch Administration screen which has the following panels:

-

Batch Applications and Modules

-

Batch Cycle Management

-

Batch Jobs

-

-

Under Batch Jobs, scroll (or filter) to locate the jobs to be enabled and click the Enabled check box to enable or disable the job. Repeat until all jobs have been updated.

-

Click Save and Close to save your changes and update the schedule.

Note:

After saving, the changes will take effect once the new scheduler day is created. The changes will not take effect for the current day.Code Updates

| Code Type | Code Type Description | Code | Code Description | New/Updated | Delivered |

|---|---|---|---|---|---|

|

AATC |

Admin API Template Category |

RMST |

Merchandising |

Updated |

Enabled |

|

IISL |

Item Induction - List of sources |

RMS |

Merchandising Tables |

Updated |

Enabled |

|

PRMT |

Promotion Sales Types |

2000 |

External Promotion |

Updated |

Enabled |

|

PRMT |

Promotion Sales Types |

9999 |

Internal Promotion |

Updated |

Enabled |

|

SYSE |

Sales Audit System Export Interfaces |

RMS |

Merchandising Export |

Updated |

Enabled |

Integration Impacts

| API Name | New/Updated? | Integration Type | Field Name | Change Notes |

|---|---|---|---|---|

|

CE Promotion Service (Consumer) |

New |

Web Service |

The RESA_PROMO_JOB process invokes the ORCE Promotion web service to pull promotion information into Sales Audit to be used in the auditing process. |

|

|

SAIMPTLOG/SAIMPTLOG |

Updated |

Flat File |

RMS_PROMO_TYPE (Merchandising Promotion Number) |

If you are importing promotion details from ORCE from POS or OMS, then this field should be changed from 2000 to 9999. |

Updated Handling for Base and Custom Errors

In certain cases where errors occur during the import or auditing process, in order to correct the errors, the solution is not an update to the transaction itself, but an addition or modification of other data, such as the addition of a missing code or an update to a custom audit rule. When this is done however, there isn't an easy way to trigger Sales Audit to reprocess those transactions that would have failed due to the error that the data correction was meant to fix. This enhancement will provide two solutions to help address this issue.

-

Re-validate Errors: In the Error List tab on the Store Day Summary screen, a new option has been added under the Actions menu, titled Revalidate Error. This will re-run the validation against the selected error for a selected set of transactions provided as options in a popup message. These options will be provided for the auditor to choose for which set of transactions the re-validation needs to be performed.

-

Rule Maintenance Options: A new set of options has replaced the existing message in the Rule Maintenance wizard when the Save and Close button is clicked. These options will allow the auditor to reset the audit status of a desired set of store days based on the rule changes made. In addition to these, a new option to reset the audit status of open store days with the error or errors linked to the rule that has been modified. Depending on the option chosen, the audit status for the store day combination would then be updated to Re-total/Re-audit Required. Then, the auditor can choose to either manually re-total/re-audit the store days individually or let the batch pickup the respective store days in its next run.

All custom rules, as well as select base rules, will be set to allow this re-validation process to occur on patching.

Updated Transaction Rule Validation

A modification has been made to the Sales Audit Transaction Maintenance screen to validate the data differently when a new transaction is being entered, versus an existing transaction being modified. For a new transaction, the validation of the transaction for both system and the custom rules will be done when the 'Save and Close' button on Transaction Maintenance is clicked, but if any errors are found, the data will not be saved until the auditor corrects all errors in the transaction. For an existing transaction being updated, the same validations will be done as for a new transaction, but in this case the auditor does not have to resolve all errors in order to save their changes. The assumption here is that an auditor entering a new transaction manually should have all the information that they need to do this task. But, if they are going in to correct an error with an existing transaction, this may be done in pieces, as the corrections are determined.

Added Customer Order Information for Totals and Rules

In order to allow customer order information to be used in building totals or rules in Sales Audit, the V_ORDCUST view has been added to the list of available realms. The view includes all columns on the customer order header, other than the customer details (name, address, and so on). It should be noted that in order to use this view in your totals or rules, you will need to also include the transaction item (SA_TRAN_ITEM) or transaction item revision (SA_TRAN_ITEM_REV) tables.

Added to Merchandising Screens for External Launch

The following additional screens have been enabled for launch through an external URL:

-

Order Details

-

Item Search

-

Shipment Search

-

Transfer Search

-

Create Transfer

-

RTV Search

-

Replenishment Attribute Maintenance

-

Item Location

-

Item Supplier Country

-

Inventory Adjustment by Item

-

Transfer Reconciliation

-

Receiver Unit Adjustment

-

Receiver Cost Adjustment

Details on the URLs to use for external launch will be available in the Merchandising Customization and Extension Guide on release.

Purge and Archive Expansion

Background purge processes, along with the option to archive were added for the following entity in Merchandising:

-

Future Cost

For the following entities, a background purge process previously existed, but with this release an option to archive was added:

-

Transaction-level Stock Ledger History

-

Daily Sales Discount

-

Price History

-

Ownership Change

-

Sales History

If you choose to archive any of these entities, then when the background purge process runs, it will also write the data to an inactive table, in addition to purging it from the active version of the table. The number of days it will be retained in the inactive tables before archiving to a file is determined by an input parameter for the Archive and Truncate Purge History Tables job. This is a previously existing job that may already be enabled in your environment.

Steps to Enable

If you would like to use the background purge processes and optionally take advantage of the archiving function, you should review the purge processes that you have running for the functional areas noted here. These are the steps to enable these processes:

-

Log an SR to have your batch schedule updated to enable the background purge jobs you wish to run and to disable the nightly version of the job, if applicable, including the new Future Cost process.

-

As part of enabling the background job, you will also need to indicate how many times per day you wish it to run.

-

-

If you wish to archive any of the above entities, you will also need to enable the Archive and Truncate Purge History Tables (BATCH_ARCHIVE_PURGE_HIST_JOB) process, if it is not already enabled in your environment. Note that as part of enabling this process, you will also need to indicate how long you want to retain the data in the inactive tables. The default is 6 months. To enable the process, follow these steps:

To enable the above job as part of your nightly batch cycle, follow the instructions below.

-

Log into the Process Orchestration and Monitoring (POM) application with the Administrator role

-

In the task list, select Schedules > MERCH > Administration > Batch Administration. This will bring up the MERCH: Batch Administration screen which has the following panels:

- Batch Applications and Modules

- Batch Cycle Management

- Batch Jobs

-

Under Batch Jobs, scroll (or filter) to locate the jobs to be enabled and click the Enabled check box to enable or disable the job. Repeat until all jobs have been updated.

-

Click Save and Close to save your changes and update the schedule.

Note:

After saving, the changes will take effect once the new scheduler day is created. The changes will not take effect for the current day. -

-

Additionally, for all programs where you want to archive the data, you will need to indicate this using the spreadsheet template Background Process Configuration and template type Administration.

-

From the Merchandising task list, select Foundation Data > Download Foundation Data

-

Select template type Administration and template Background Configuration and click Download.

-

Open the .ods file that is downloaded in your preferred spreadsheet application and navigate to the row in the spreadsheet that contain the job you wish to update in the Batch Name column and ARCHIVE_IND in the Param Key. Using a filter in the spreadsheet may be helpful for this step.

-

In the Action column, select Update and then in the Param Value column, change the value to Y to indicate it should be archived.

- Only programs that have ARCHIVE_JOB_IND = Y can have the ARCHIVE_IND set to Y

- Even if you are not archiving for the job, you can also set parameters for the following for each of these jobs: number of threads (NUM_THREADS), number of records to process per run (NUM_DATA_TO_PROCESS), and number of records to process before committing (COMMIT_MAX_COUNTER), using similar instructions.

-

Save the .ods file with your changes and close the document.

-

Return to Merchandising and from the task list, select Foundation Data > Upload Foundation Data

-

Select template type Administration and template Background Configuration. Then, click the Browse... button to select the file where you made your changes. Click Upload.

-

New / Updated DAS Tables

Several new tables were added and some updates were made to existing tables available for replication in DAS based on new features added in this update. The details on these changes can be found in the respective enhancement summaries. Below are listed tables that were added in 19.0.00x patches and also available in 19.1.

Additionally, configuration file were added or updated with this update:

-

dasimport_03.par - additional import file that holds the new tables for 19.1

-

Also modified in 19.0.00x patches, but included here for visibility:

-

rrms.prm (classic) - Modified to add error-handling on flashback data archive and ignore error to continue processing.

-

rrms.json (microservices) - Modified to add error-handling on flashback data archive and ignore error to continue processing.

-

Steps to Enable

For directions on how to add new tables, see the "Patching DAS and Oracle Retail Foundation Cloud Service" section of the white paper on My Oracle Support (support.oracle.com) under ID 2283998.1.

Data Access Schema (DAS) Updates

| Table Name | View Name | New/Updated? | Change Notes |

|---|---|---|---|

|

PRICE_HIST |

DAS_WV_PRICE_HIST |

Updated |

Added Added ID column and PRICE_HIST_ID_SEQ sequence (19.0.002) |

|

COND_TARIFF_TREATMENT |

DAS_WV_COND_TARIFF_TREATMENT |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

HTS_CHAPTER |

DAS_WV_HTS_CHAPTER |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

IM_SYSTEM_OPTIONS |

DAS_WV_IM_SYSTEM_OPTIONS |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

ITEM_APPROVAL_ERROR |

DAS_WV_ITEM_APPROVAL_ERROR |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

QUOTA_CATEGORY |

DAS_WV_QUOTA_CATEGORY |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

SA_BALANCE_GROUP |

DAS_WV_SA_BALANCE_GROUP |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

SA_CUST_ATTRIB |

DAS_WV_SA_CUST_ATTRIB |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

SA_TRAN_PAYMENT |

DAS_WV_SA_TRAN_PAYMENT |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

SA_TRAN_PAYMENT_REV |

DAS_WV_SA_TRAN_PAYMENT_REV |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

SEC_GROUP_LOC_MATRIX |

DAS_WV_SEC_GROUP_LOC_MATRIX |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

STORE_HOURS |

DAS_WV_STORE_HOURS |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

TRAN_DATA_HISTORY |

DAS_WV_TRAN_DATA_HISTORY |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

UDA_ITEM_DEFAULTS |

DAS_WV_UDA_ITEM_DEFAULTS |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

VAT_CODE_RATES |

DAS_WV_VAT_CODE_RATES |

Updated |

Changed from optional to required table for DAS Replication (19.0.003) |

|

CARTON |

DAS_WV_CARTON |

New |

New table added for DAS Replication (19.0.003) |

|

COMP_PRICE_HIST |

DAS_WV_COMP_PRICE_HIST |

New |

New table added for DAS Replication (19.0.003) |

|

COMP_STORE |

DAS_WV_COMP_STORE |

New |

New table added for DAS Replication (19.0.003) |

|

COMPETITOR |

DAS_WV_COMPETITOR |

New |

New table added for DAS Replication (19.0.003) |

|

COUNTRY_TL |

DAS_WV_COUNTRY_TL |

New |

New table added for DAS Replication (19.0.003) |

|

CURRENCIES_TL |

DAS_WV_CURRENCIES_TL |

New |

New table added for DAS Replication (19.0.003) |

|

DIFF_TYPE_TL |

DAS_WV_DIFF_TYPE_TL |

New |

New table added for DAS Replication (19.0.003) |

|

MERCH_HIER_DEFAULT |

DAS_WV_MERCH_HIER_DEFAULT |

New |

New table added for DAS Replication (19.0.003) |

|

RPM_ITEM_LOC |

DAS_WV_RPM_ITEM_LOC |

New |

New table added for DAS Replication (19.0.003) |

|

SEASONS_TL |

DAS_WV_SEASONS_TL |

New |

New table added for DAS Replication (19.0.003) |

|

UDA_ITEM_FF_TL |

DAS_WV_UDA_ITEM_FF_TL |

New |

New table added for DAS Replication (19.0.003) |

|

WH_TL |

DAS_WV_WH_TL |

New |

New table added for DAS Replication (19.0.003) |

|

SUB_ITEMS_HEAD |

DAS_WV_SUB_ITEMS_HEAD |

New |

New table added for DAS Replication (19.0.004) |

|

SUB_ITEMS_DETAIL |

DAS_WV_SUB_ITEMS_DETAIL |

New |

New table added for DAS Replication (19.0.004) |

|

ALLOC_DETAIL |

DAS_WV_ALLOC_DETAIL |

Updated |

Added UPDATED_BY_WMS_IND column (19.0.005) |

|

ITEM_LOC_SOH_EOD |

DAS_WV_ITEM_LOC_SOH_EOD |

Updated |

moved from merchtables to merchoptionaltables (19.0.005) |

|

DEPT_CHRG_DETAIL |

DAS_WV_DEPT_CHRG_DETAIL |

New |

New table added for DAS Replication (19.0.005) |

|

DEPT_CHRG_HEAD |

DAS_WV_DEPT_CHRG_HEAD |

New |

New table added for DAS Replication (19.0.005) |

|

ITEM_CHRG_DETAIL |

DAS_WV_ITEM_CHRG_DETAIL |

New |

New table added for DAS Replication (19.0.005) |

|

ITEM_CHRG_HEAD |

DAS_WV_ITEM_CHRG_HEAD |

New |

New table added for DAS Replication (19.0.005) |

|

SA_COMMENTS |

DAS_WV_SA_COMMENTS |

New |

New table added for DAS Replication (19.0.005) |

|

SA_STORE_DAY_USER |

DAS_WV_SA_STORE_DAY_USER |

New |

New table added for DAS Replication (19.0.005) |

|

SA_USER |

DAS_WV_SA_USER |

New |

New table added for DAS Replication (19.0.005) |

|

DAILY_SALES_DISCOUNT |

DAS_WV_DAILY_SALES_DISCOUNT |

New |

New table added for DAS Replication (19.0.007) |

|

SA_RULE_COMP_RESTRICTIONS |

DAS_WV_SA_RULE_COMP_REST |

New |

New table added for DAS Replication (19.0.007) |

|

SA_RULE_HEAD |

DAS_WV_SA_RULE_HEAD |

New |

New table added for DAS Replication (19.0.007) |

|

SA_VR_HEAD |

DAS_WV_SA_VR_HEAD |

New |

New table added for DAS Replication (19.0.007) |

|

TRANSIT_TIMES |

DAS_WV_TRANSIT_TIMES |

New |

New table added for DAS Replication (19.0.007) |

Merchandising Security Updates

Below is an outline of new and updated privileges and duties added in the solution since the last update. Review the details of the duties and privileges and then follow the instructions outlined below to enable them in your implementation and add them to your user roles, as appropriate.

New/Updated Duties

| Title | Base Role | Child Duties | New/Update? | Duty Description |

|---|---|---|---|---|

|

TAX_RULE_DASHBOARD_INQUIRY_DUTY |

RMS_APPLICATION_ADMINISTRATOR_JOB |

New |

A duty for viewing the Tax Rules Dashboard. This duty will contain the VIEW_TAX_RULE_DASHBOARD_PRIV. |

|

|

RMS_TAX_RULES_DASHBOARD_INQUIRY_DUTY |

RMS_APPLICATION_ADMINISTRATOR_JOB, RMS_DATA_STEWARD_JOB, BUYER_JOB, SOURCING_ANALYST_JOB, SUPPLY_CHAIN_ANALYST_JOB, FINANCIAL_ANALYST_JOB, FINANCIAL_MANAGER_JOB |

New |

A duty for viewing the Tax Rules Dashboard. |

|

|

RMS_OWNERSHIP_DUTY |

This duty should be removed from all roles and then completely removed from the system. |

Removed |

This duty is being replaced with the RMS_OWNERSHIP_CHANGE_INQUIRY_DUTY, RMS_OWNERSHIP_CHANGE_MGMT_DUTY, and RMS_OWNERSHIP_CHANGE_APPROVAL_DUTY. Previously all ownership change privileges were incorrectly put into this single RMS_OWNERSHIP_DUTY. |

|

|

RMS_OWNERSHIP_CHANGE_MGMT_DUTY |

INVENTORY_ANALYST_JOB and INVENTORY_MANAGER_JOB |

RMS_OWNERSHIP_CHANGE_INQUIRY_DUTY |

New |

A duty for maintaining consignment/concession ownership changes. This duty is an extension of the Ownership Change Inquiry Duty. This duty will contain the RMS_OWNERSHIP_CHANGE_INQUIRY_DUTY, the MAINTAIN_OWNERSHIP_CHANGES_PRIV, and the SUBMIT_OWNERSHIP_CHANGES_PRIV |

|

RMS_OWNERSHIP_CHANGE_INQUIRY_DUTY |

This duty will not be directly mapped to any base roles. |

New |

A duty for searching for and viewing consignment/concession ownership changes. The contents of this duty will be the SEARCH_OWNERSHIP_CHANGES_PRIV and the VIEW_OWNERSHIP_CHANGES_PRIV |

|

|

RMS_OWNERSHIP_CHANGE_APPROVAL_DUTY |

RMS_APPLICATION_ADMINISTRATOR_JOB, RMS_DATA_STEWARD_JOB, BUYER_JOB |

RMS_OWNERSHIP_CHANGE_MGMT_DUTY |

New |

A duty for approving consignment/concession ownership changes This duty is an extension of the Ownership Change Management Duty. This duty will contain the RMS_OWNERSHIP_CHANGE_MGMT_DUTY and the APPROVE_OWNERSHIP_CHANGES_PRIV |

|

RMS_MRT_MGMT_DUTY |

RMS_OBLIGATION_APPROVAL_DUTY |

Update |

The RMS_OBLIGATION_APPROVAL_DUTY has been mapped to the RMS_MRT_MGMT_DUTY |

|

|

RMS_CUSTOM_VALIDATION_RULE_INQUIRY_DUTY |

In the default security configuration, none of the base roles have inquiry level access. Higher level access has been granted to other roles in our default security configuration via the Custom Validation Rule Management or Approval duties in which this duty is nested. |

New |

A duty for searching for and viewing custom validation rules. |

|

|

RMS_TAX_RULE_MGMT_DUTY |

RMS_APPLICATION_ADMINISTRATOR_JOB and FINANCIAL_ANALYST_JOB |

RMS_TAX_RULE_INQUIRY_DUTY |

New |

A duty for maintaining and submitting tax rules via the Tax Rule workflow and via spreadsheet upload. This duty is an extension of the Tax Rule Inquiry Duty. |

|

RMS_TAX_RULE_INQUIRY_DUTY |

RMS_APPLICATION_ADMINISTRATOR_JOB, BUYER_JOB, SOURCING_ANALYST_JOB, SUPPLY_CHAIN_ANALYST_JOB |

New |

A duty for searching for and viewing tax rules via the Tax Rule workflow and via spreadsheet download. |

|

|

RMS_TAX_RULE_APPROVAL_DUTY |

RMS_APPLICATION_ADMINISTRATOR_JOB, FINANCIAL_MANAGER_JOB |

RMS_TAX_RULE_MGMT_DUTY |

New |

A duty for approving tax rules via the Tax Rule workflow and via spreadsheet upload. This duty is an extension of the Tax Rule Management Duty. |

|

RMS_CUSTOM_VALIDATION_RULE_MGMT_DUTY |

RMS_DATA_STEWARD_JOB |

RMS_CUSTOM_VALIDATION_RULE_INQUIRY_DUTY |

New |

A duty for maintaining custom validation rules. This duty is an extension of the Custom Validation Rule Inquiry Duty. |

|

RMS_CUSTOM_VALIDATION_RULE_APPROVAL_DUTY |

RMS_APPLICATION_ADMINISTRATOR_JOB |

RMS_CUSTOM_VALIDATION_RULE_MGMT_DUTY |

New |

A duty for approving and closing custom validation rules This duty is an extension of the Custom Validation Rule Management Duty. |

New/Updated Privileges

| Title | New/Update? | Parent Duty | Privilege Description |

|---|---|---|---|

|

RAAC_NOTIFICATION_MANAGE_PRIVILEGE - Merchandising |

The Role Type of the RAAC_NOTIFICATION_MANAGE_PRIVILEGE was created as a 'Job'. This job should be completely removed. It should have been created with a Role Type of 'Privilege'. This will be replaced with a new privilege, RAAC_NOTIFICATION_MANAGE_PRIV. |

||

|

RAAC_NOTIFICATION_MANAGE_PRIV - Merchandising |

ADMIN_CONSOLE_DUTY |

This privilege is to be mapped to the ADMIN_CONSOLE_DUTY. |

|

|

VIEW_TAX_RULE_DASHBOARD_PRIV |

RMS_TAX_RULE_DASHBOARD_INQUIRY_DUTY |

This privilege gives the user access to the Tax Rules Dashboard. If the user has the View Tax Rule Dashboard Priv, the Tax Rule Dashboard link in the Reports list will display, otherwise it will be hidden. |

|

|

VIEW_OWNERSHIP_CHANGES_PRIV |

RMS_OWNERSHIP_CHANGE_INQUIRY_DUTY |

The mapping of this privilege directly to the RMS_APPLICATION_ADMINISTRATOR_JOB is being removed. The mapping of this privilege to the RMS_OWNERSHIP_DUTY is also being removed. |

|

|

VIEW_ITEMS_PRIV |