Oracle Financial Services Insurance Accounting Analyzer application includes pre-packaged reports, which cater to disclosure requirements under IFRS 17 It also includes reports, which are created to help management in strategic decisions All the disclosure reports can be exported to different formats like PDF, CSV, Excel, and so on All the reports are segregated into the following three Dashboards:

· Dedicated Disclosure Reports

· Projection of Contractual Service Margin

· Analytical Reports and Trend Reports

· List of Oracle Financial Services Insurance Accounting Analyzer Reports

· List of Long Duration Contracts Reports

The IFRS 17 guidelines lay specific emphasis on the disclosure of key financial data while keeping the scope open on what constitutes an appropriate disclosure The Application has a range of disclosure reports to track the Movement Analysis, Reconciliations, and Statement of Accounts.

The projection of Contractual Service Margin displays the projection as calculated based on the input variables and other parameters to extrapolate the output for the contract duration.

The Analytical and Trend Reports help in identifying the Onerous or Non Onerous contracts for the different legal entities within an organization and other parameters that allow the Management in strategic decision making.

The Dashboards have a set of filters, which allow the users to access the specific information for the reports viewed and reported The filters are Legal Entity, Reporting Date, Liability Calculation Run, and so on In addition to the filters, users can view the reports in a specific reporting currency.

Figure 50 The Dashboard Filters

The following are the reports available as part of the Oracle Insurance Accounting Analyzer Release version 8.1.1.0.0.

This section details the disclosure reports that are a part of the Oracle Financial Insurance Accounting Analyzer application.

This section details direct insurance reports Depending on the method that you select in the Method Name field, the reports specific to the method appears.

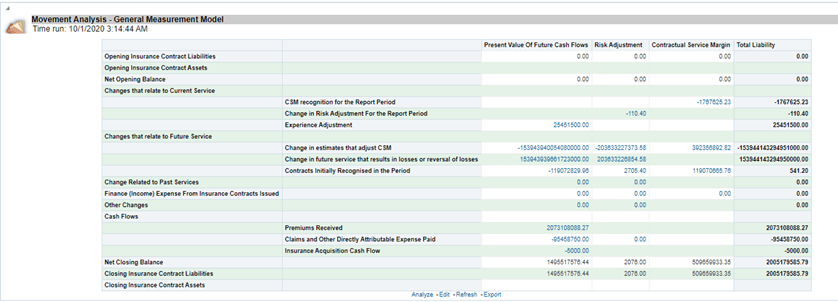

Depending on the run that you execute (Normal or Transition), this report provides a detailed analysis of changes or movements in insurance liabilities, during the coverage period of contracts under the General Measurement Model.

Figure 52 The Movement Analysis Report – General Measurement Model

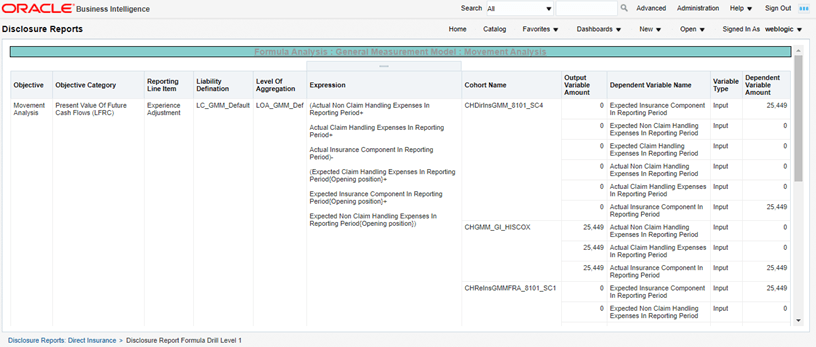

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

Figure 53 The Movement Analysis Report – General Measurement Model drill-down

Figure 54 The Movement Analysis Report – General Measurement Model drill-down continued

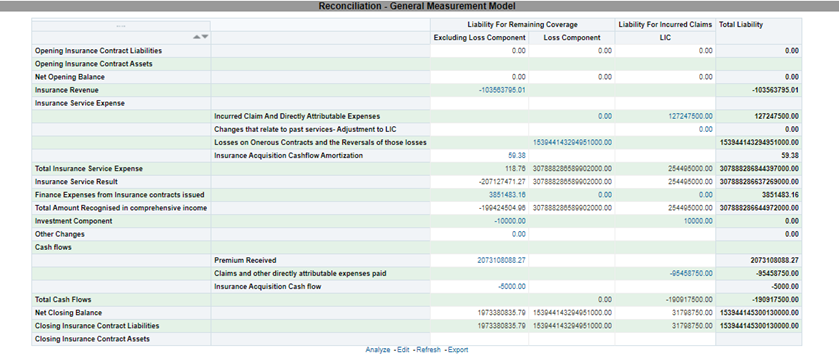

Depending on the run that you execute (Normal or Transition), this report helps in reconciling the data derived from the calculation of CSM or net liability under the General Measurement Model.

Figure 55 The Reconciliation – General Measurement Model Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

Figure 56 The Reconciliation – General Measurement Model Report drill-down

Figure 57 The Reconciliation – General Measurement Model Report drill-down continued

Figure 58 The Reconciliation – General Measurement Model Report drill-down continued

This report displays the profit and losses that are generated by insurance services and investments for a selected reporting period.

Figure 59 The Statement of Profit or Loss – General Measurement Model Report

Depending on the run that you execute (Normal or Transition), this report provides a detailed analysis of changes or movements in insurance liabilities, during the coverage period of contracts under the Variable Fee Model.

Figure 60 The Movement Analysis – Variable Fee Approach Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

Depending on the run that you execute (Normal or Transition), this report helps in reconciling the data derived from the calculation of liability under VFA.

Figure 61 The Reconciliation – Variable Fee Approach Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

This report displays the profit and losses that are generated by insurance services and investments for a selected reporting period.

Figure 62 The Statement of Profit or Loss – Variable Fee Approach Report

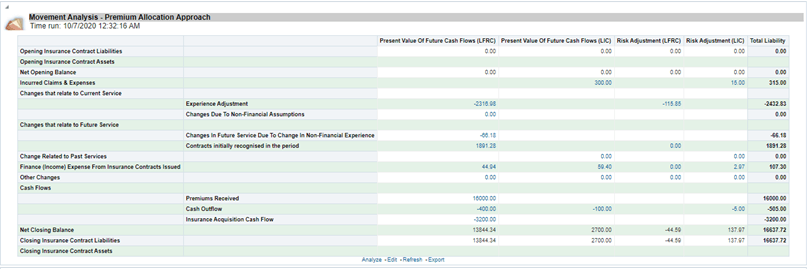

Depending on the run that you execute (Normal or Transition), this report provides a detailed analysis of changes or movements in insurance liabilities and transitionary balance, during the coverage period of contracts under the Premium Allocation Approach.

Figure 63 The Movement Analysis – Premium Allocation Approach Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

Figure 64 The Movement Analysis – Premium Allocation Approach Report drill-down

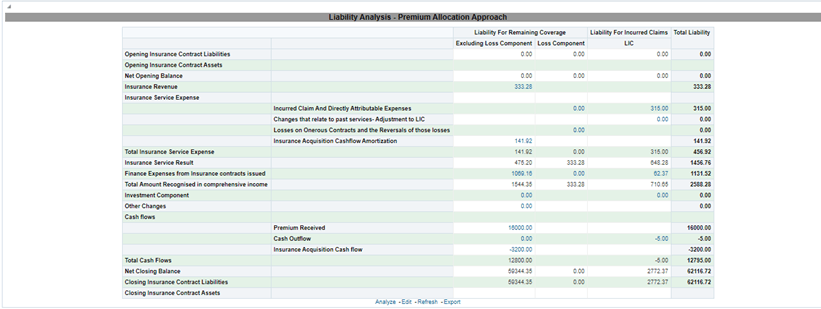

Depending on the run that you execute (Normal or Transition), this report provides a detailed analysis of changes or movements in insurance liabilities and transitionary balance during the coverage period of the contract, under the Premium Allocation approach.

Figure 65 The Liability Analysis – Premium Allocation Approach Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

Figure 66 The Liability Analysis – Premium Allocation Approach Report drill-down

This report displays the revenue and expenses which are generated by insurance services and investment in the reporting period This is taken forward to the Profit and Loss statement under the Premium Allocation approach.

Figure 67 The Statement of Profit or Loss – Premium Allocation Approach Report

This section details the reinsurance held reports.

This report provides a detailed analysis of changes or movements in insurance liabilities, during the coverage period of reinsurance held contracts under the General Measurement Model.

Figure 68 The Movement Analysis Report – General Measurement Model Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

Figure 69 The Movement Analysis Report – General Measurement Model Report drill-down

Figure 70 The Movement Analysis Report – General Measurement Model Report drill-down continued

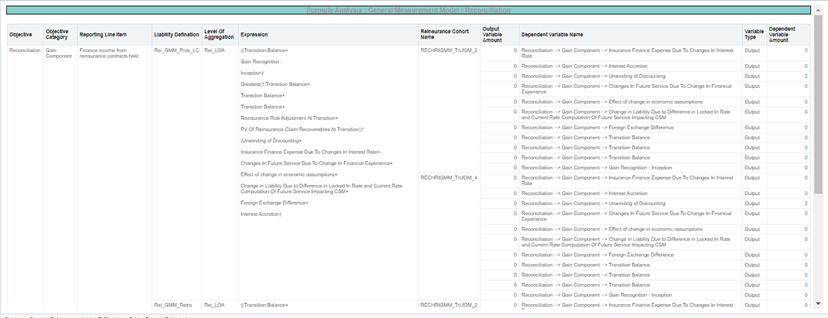

This report helps in reconciling the data derived from the calculation of CSM or net liability for reinsurance held under the General Measurement Model.

Figure 71 The Reconciliation – General Measurement Model Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the break-up of the formula and the inputs to calculate the final result.

Figure 72 The Reconciliation – General Measurement Model Report drill-down

Figure 73 The Reconciliation – General Measurement Model Report drill-down continued

This report displays the Reinsurance financial statement data for the GMM method.

Figure 74 The Reinsurance Financial Statement – General Measurement Model Report

This report provides a detailed analysis of changes or movements in insurance liabilities, during the coverage period of reinsurance held contracts under the PAA method.

Figure 75 The Movement Analysis Report – Premium Allocation Approach Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the drill-down data.

Figure 76 The Movement Analysis Report – Premium Allocation Approach Report drill-down

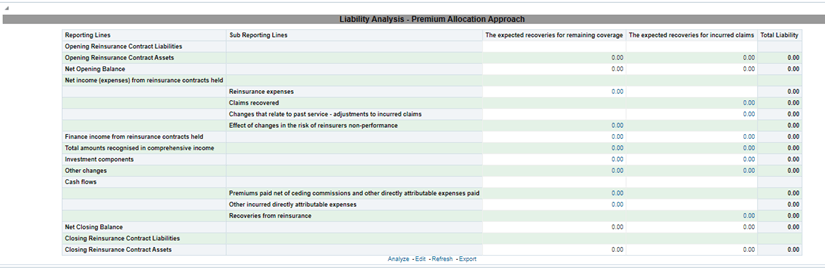

This report provides a detailed analysis of changes or movements in insurance liabilities and transitionary balance during the coverage period of the reinsurance held contract, under the Premium Allocation approach.

Figure 77 The Liability Analysis Report – Premium Allocation Approach Report

The drill-down feature in this report enables you to select the link to the required data in this report to view it in detail Click the required link to view the drill-down data.

Figure 78 The Liability Analysis Report – Premium Allocation Approach Report

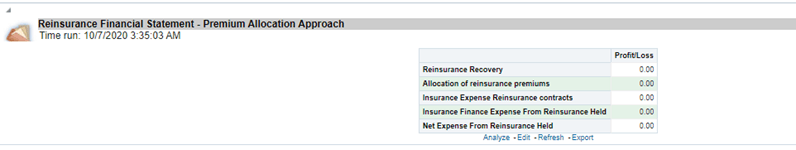

This report displays the reinsurance financial statement data for the PAA method.

Figure 79 The Reinsurance Financial Statement – Premium Allocation Approach Report

This section details the CSM Projection report.

This report displays the reports CSM or Loss Projection for the future period in tabular and graphical formats.

Figure 80 The CSM Projection Report

The reports in this tab compare the data in the GMM reports with the PAA reports.

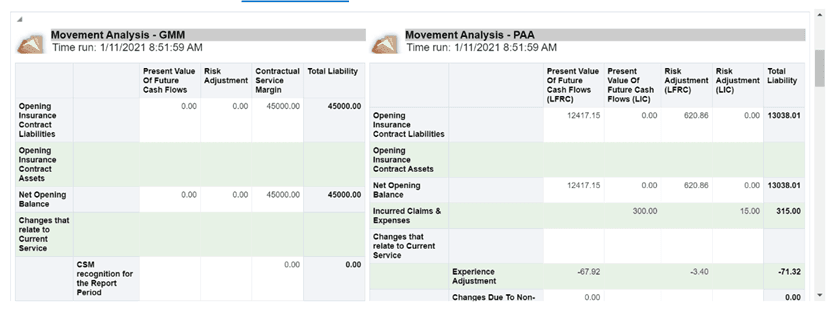

This report compares the data for the movement analysis between the GMM and PAA methods.

Figure 81 The Comparison of the Movement Analysis GMM and Movement Analysis PAA reports

This report compares the reconciliation data between two GMM method reports.

Figure 82 The Comparison of the Reconciliation for GMM reports

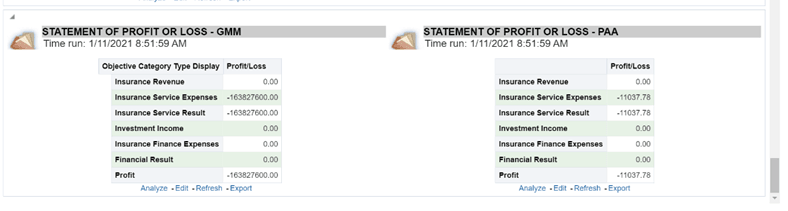

This report compares the statement of profit or loss data between the GMM and PAA methods.

Figure 83 The Comparison of the Statement of Profit or Loss GMM and Statement of Profit or Loss PAA reports

This report compares the direct insurance liability against the corresponding reinsurance held.

This report compares the movement analysis against the corresponding reinsurance held.

Figure 84 The Movement Analysis and Reinsurance Movement Analysis Consolidation Report

This report compares reconciliation against the corresponding reinsurance held.

Figure 85 The Reconciliation and Reinsurance Reconciliation Consolidation Report

This report displays the consolidated statement of profit or loss with the net of reinsurance held taken into account.

Figure 86 The Statement of Profit or Loss and Reinsurance Financial Statement Consolidation Report

This section details the Summary of Contract Groups report.

This report provides a detailed analysis of the LOB, legal entity, and accounts.

Figure 87 The New Account Category Report

This report provides a detailed analysis of the LOB, legal entity, and accounts.

This section details the list of Long Duration Contracts Reports.

This section details the Disclosure reports for the Long Duration Contracts.

This section details the Disclosure of Information about the Liability for Future Policy Benefits LFPB RF report.

This report provides a detailed analysis of the roll forward premium and benefit.

Figure 88 The Roll Forward Premium and Benefit Report

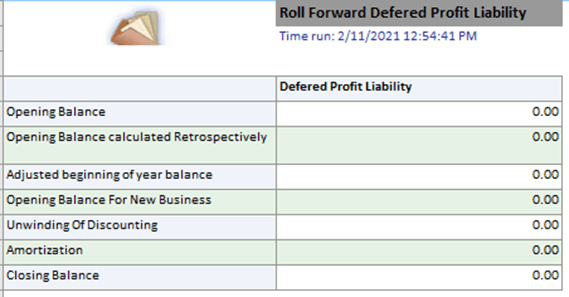

This section details the deferred profit liability reports.

This report provides a detailed analysis of the roll forward deferred profit liability.

Figure 89 The Roll Forward Deferred Profit Liability Report

This section details the Acquisition Cost reports.

This report provides a detailed analysis of the roll forward acquisition cost.

Figure 90 The Roll Forward Acquisition Cost Report

This report provides a detailed analysis of the roll forward acquisition cost expense.

Figure 91 The Roll Forward Acquisition Cost Expense Report

This section provides details on the market-linked balance reports.

This report provides a detailed analysis of the roll forward policyholder account balance.

Figure 92 The Roll Forward Policy Holder Account Balance Report

This report provides a detailed analysis of the roll forward market risk-benefit.

Figure 93 The Roll Forward Market Risk Benefit Report

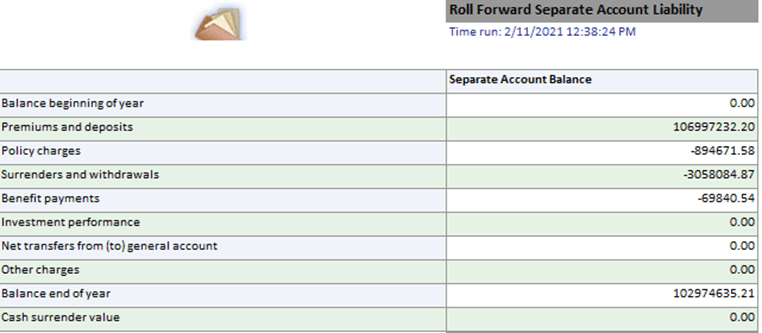

This report provides a detailed analysis of the roll forward separate account liability.

Figure 94 The Roll Forward Separate Account Liability Report

This report provides a detailed analysis of the roll forward additional account liability.

Figure 95 The Roll Forward Additional Account Liability Report

This section provides details on the market-linked balances.

This report displays balance information for the reconciliation of separate accounts.

Figure 96 Reconciliation Policy Holder Account Balance Report

This report displays balance information for the reconciliation of separate accounts.

Figure 97 Reconciliation Separate Account Balance Report

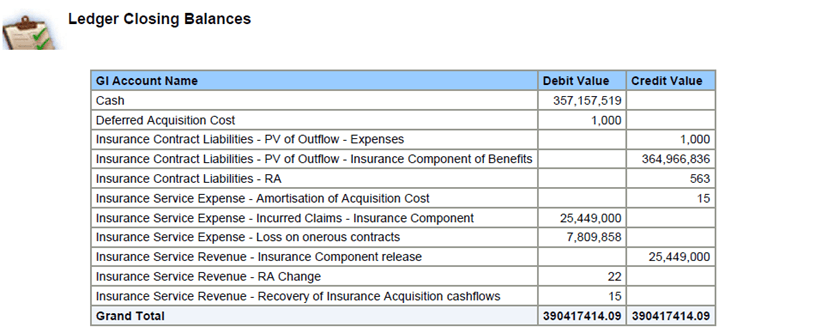

This section details the Subledger reports It includes reports from the Ledger Closing Balances and Comparison tabs.

This section details the reports that are present in the Ledger Closing Balances tab.

This report displays the Debit Value and Credit Value for the GL Accounts like Cash, Deferred Acquisition Cost, Insurance Contract Liabilities (BEL, CSM, and RA), and so on.

Figure 98 Ledger Closing Balances Report

Additionally, you select the link of the GL account to view its’ drill-down details.

This section details the Journals – Event View report.

Figure 99 The Journals Event View Report

This report displays the profit and losses that are generated by insurance services and investments for a selected reporting period.

Figure 100 The Statement of Profit or Loss Report

This section details the reports that are present in the Comparison tab

The reports in this tab compare the Ledger closing Balances between the two CSM runs.

Figure 101 The Ledger Closing Balances Comparison Report