5. Pricings

5.1 Introduction

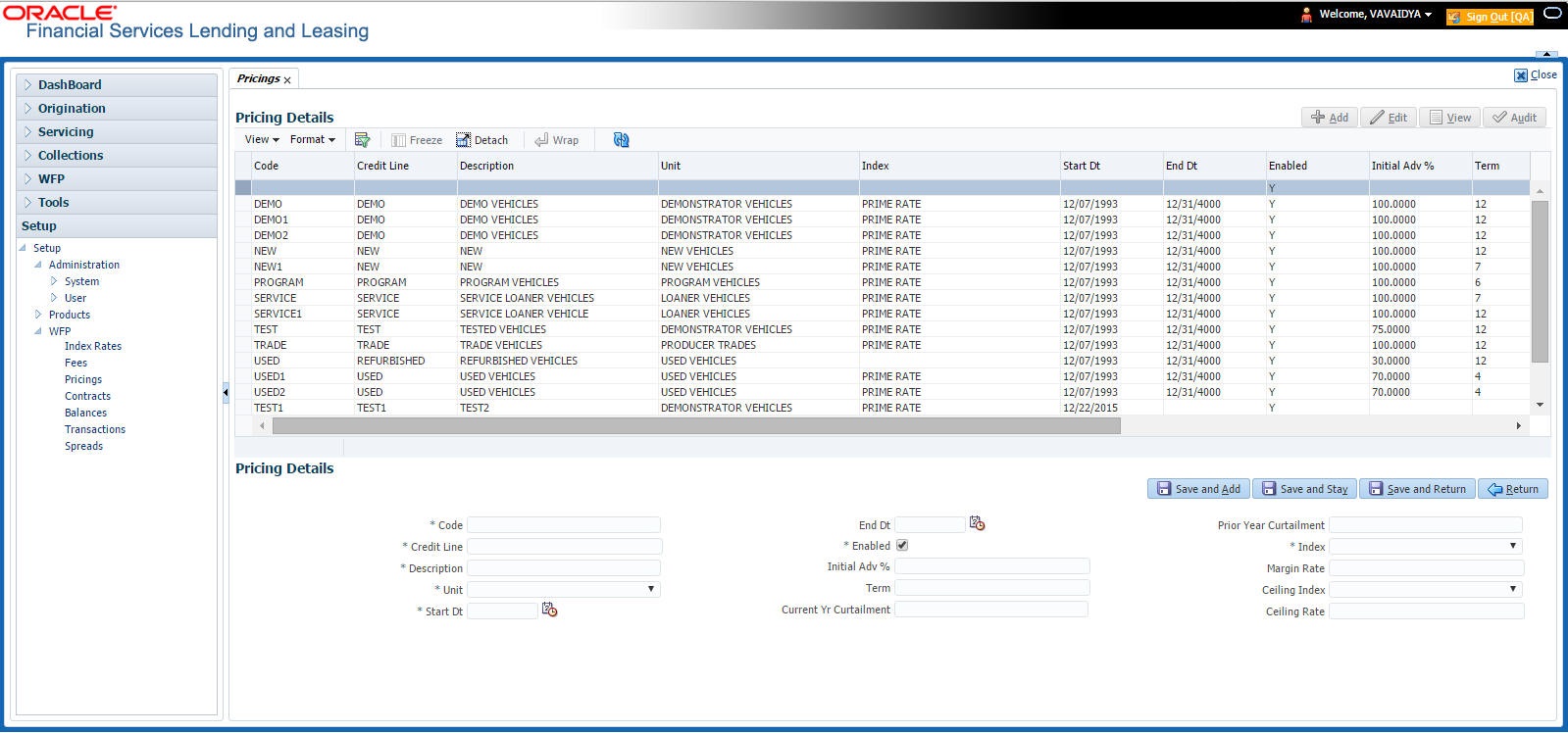

The Pricing link records the various pricing plans the financial institution offers to its producers. By default, sample pricing plans are available while setting up WFP. You can then modify and add plans to this screen. At least one pricing plan should be enabled.

5.2 Pricing Link

Oracle Financial Services Lending and Leasing takes the index rate from the Index Rates screen for the code in the Margin Index field and adds the value of the Margin Rate to calculate the credit line’s interest rate.

You cannot define different pricing policies for different producers (since producer is not a part of Policies setup). However, it is possible to overcome this by having two different credit lines on the Pricing screen, New-Producer A and New-Producer B, with the same unit type NEW.

To use the Pricing link

On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > WFP > Pricings

In the Pricing Details section, select the record you want to work with and click Show in the Details column.

- If you choose, use Search Criteria to limit the display of records.

- If you are entering a new record, click Add.

- If you are changing an existing record, click Edit.

- In the Pricing Details section, enter, view, or edit the following information:

In this field:

Do this:

Code

Enter the pricing code (required).

Credit Line

Enter the credit line. Each entry in the list should be unique (required).

Description

Enter a description of the credit line (required).

Unit

Select the unit type. This describes the type of unit to which the pricing applies (required).

Start Date

Enter the start date. This is the date after which the pricing plan would be in use and available in maintenance. Note: The start date of a pricing plan cannot be less than the current date (required).

End Date

Enter the end date. This is the date after which the pricing plan would not be available. Note: The end date cannot be less than the current date or start date (optional).

Enabled

Select to enable the pricing policy.

Initial Adv%

Enter the initial advance percent. This indicates what percent of the value of the unit is given to the producer as an advance (loan). For example, if the value of a new vehicle is $10,000 and the loan given to the producer is $8,000 then the initial advance percent is 80 percent (optional).

Term

Enter the total term in months. This indicates the maximum term (in months) of the credit line (optional).

Current Yr Curtailment

Enter the percent of outstanding principal which need tobe recovered from the producer each month in the current year.

Prior Year Curtailment

Enter the prior year curtailment percent (optional).

Margin Rate

Enter the margin rate. The interest rate equals the index rate plus margin rate. Index rate is the applicable interest rate for the selected index type (optional).

Ceiling Index

Select the ceiling index code. This indicates the index on which the interest rate ceiling would be based (optional).

Ceiling Rate

Enter the ceiling margin rate. This defines the ceiling for interest. The ceiling rate equals the ceiling index rate plus the ceiling margin rate. For example, if the index rate is three percent, the margin rate is one and a half percent, and the ceiling rate is five percent, then the interest rate is four and a half percent. If the index rate increases to four percent, the interest rate will be five percent and not five and a half percent (optional).

- Click Save in the Pricing Details section.