2. Maintaining Customer Information Files

In the ‘Customer Maintenance’ screen, you maintain various personal and business details of the customers of your bank.

The CIF details are maintained at the branch level by the sign-on branch. These details can be accessed by all branches and therefore a duplicate customer record for a customer in two different branches need not be maintained.

This chapter includes the following sections:

l Section 2.1, "Customer Maintenance"

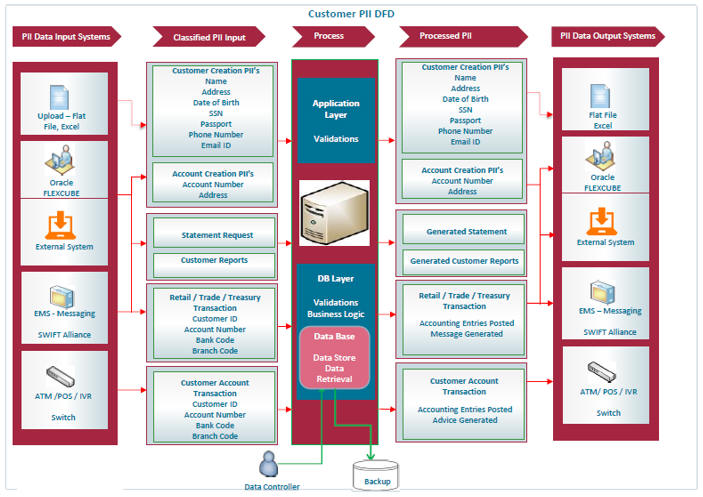

l Section 2.2, "Personally Identifiable Information"

l Section 2.3, "Customer Category Maintenance"

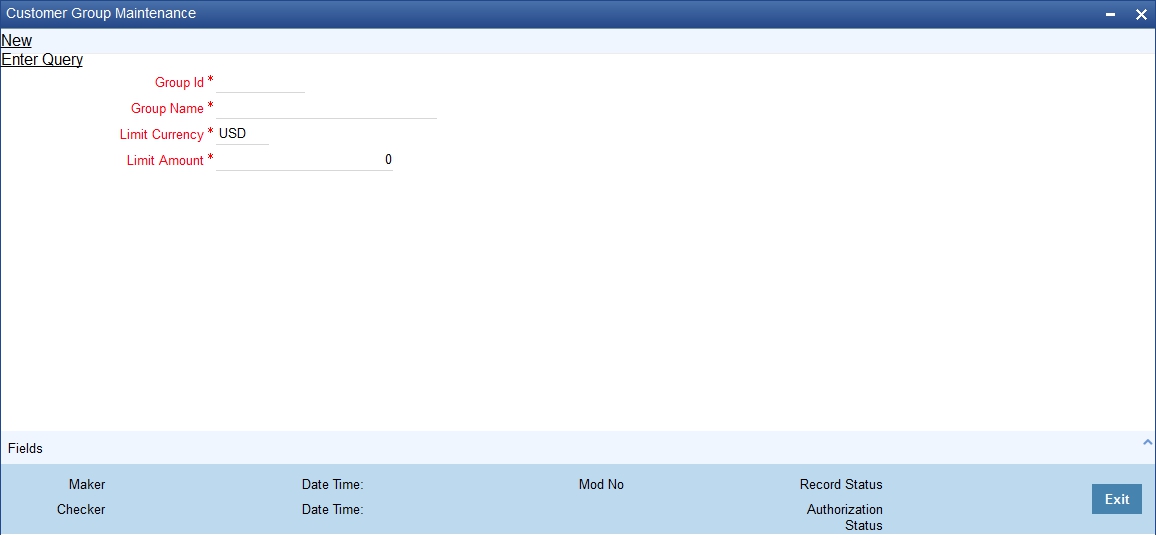

l Section 2.4, "Customer Group Maintenance"

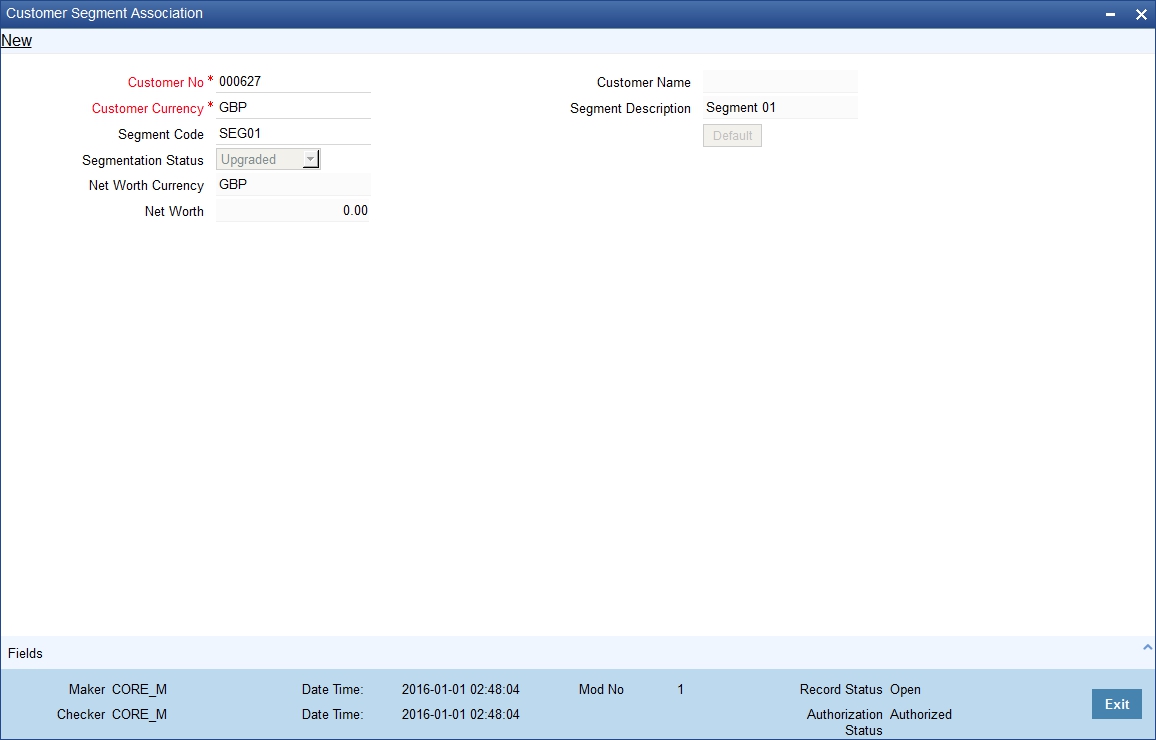

l Section 2.5, "Customer Segment Maintenance"

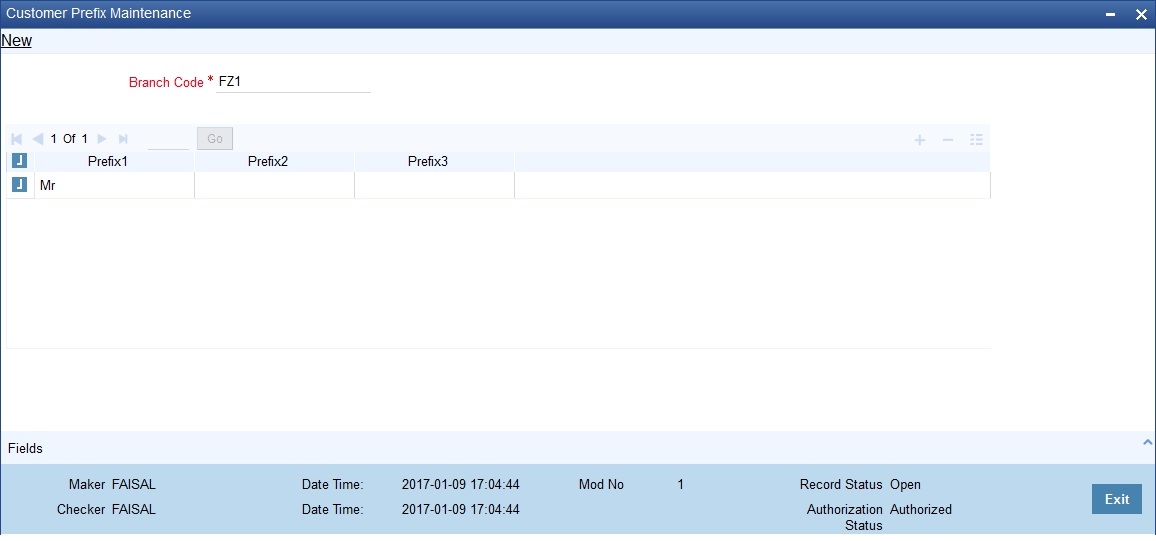

l Section 2.6, "Capturing Customer Prefixes"

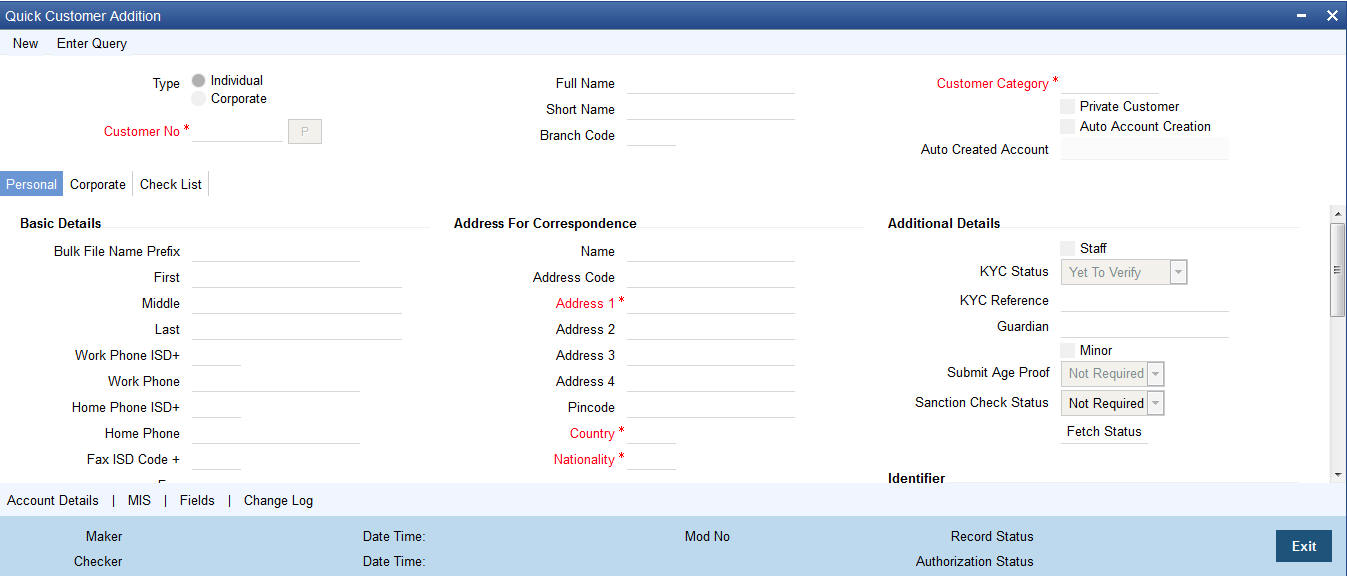

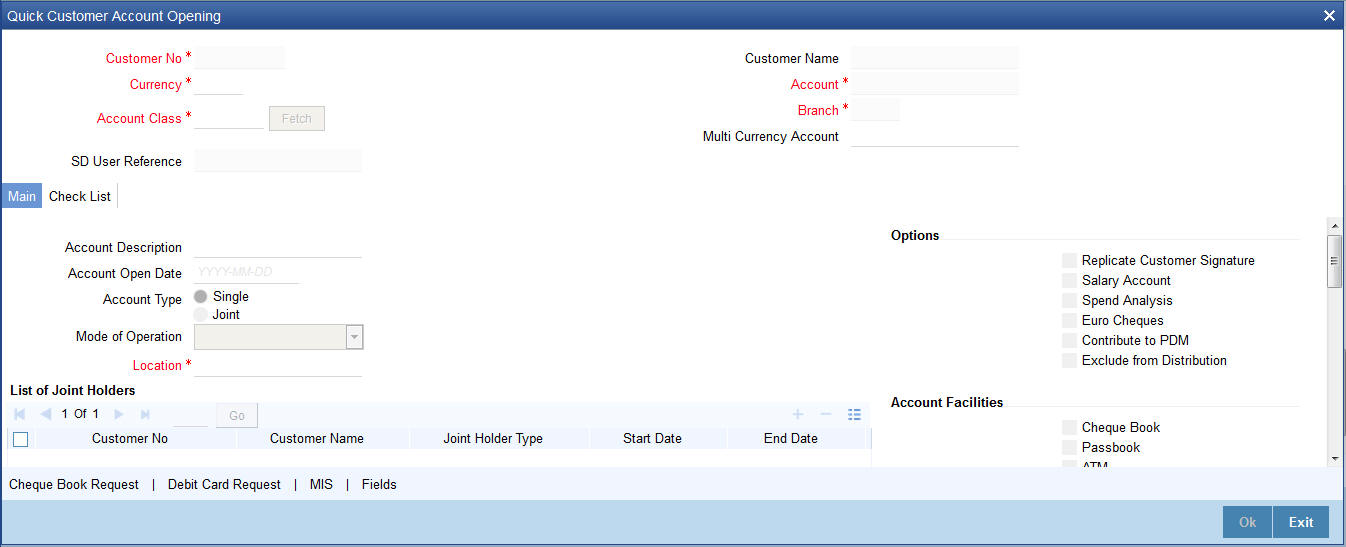

l Section 2.7, "Quick Customer Addition"

l Section 2.8, "Employer Maintenance"

l Section 2.9, "Tax Waiver Maintenance"

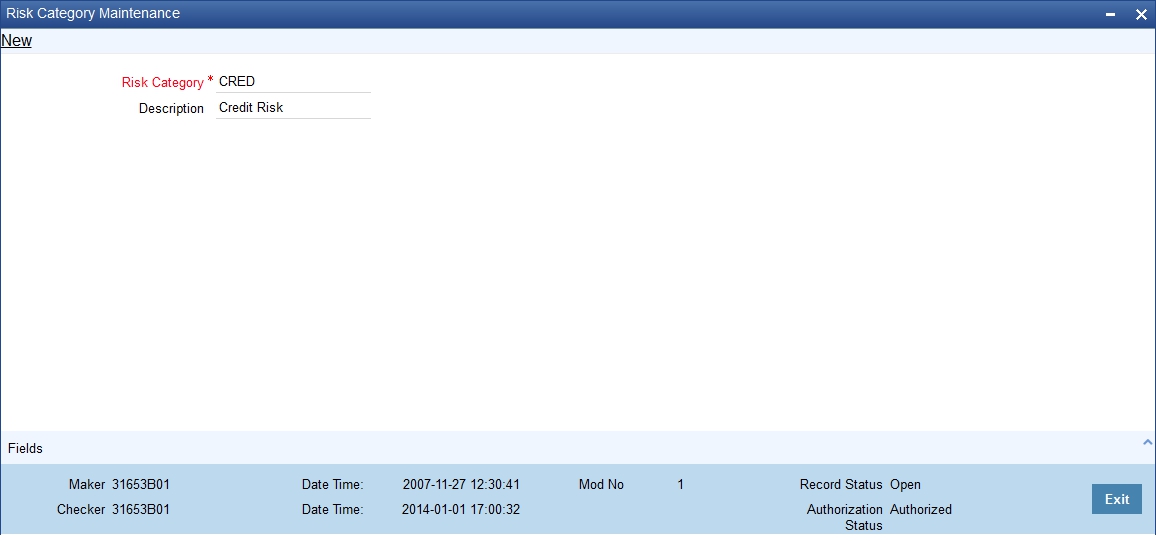

l Section 2.10, "Maintaining Risk Category for Customers"

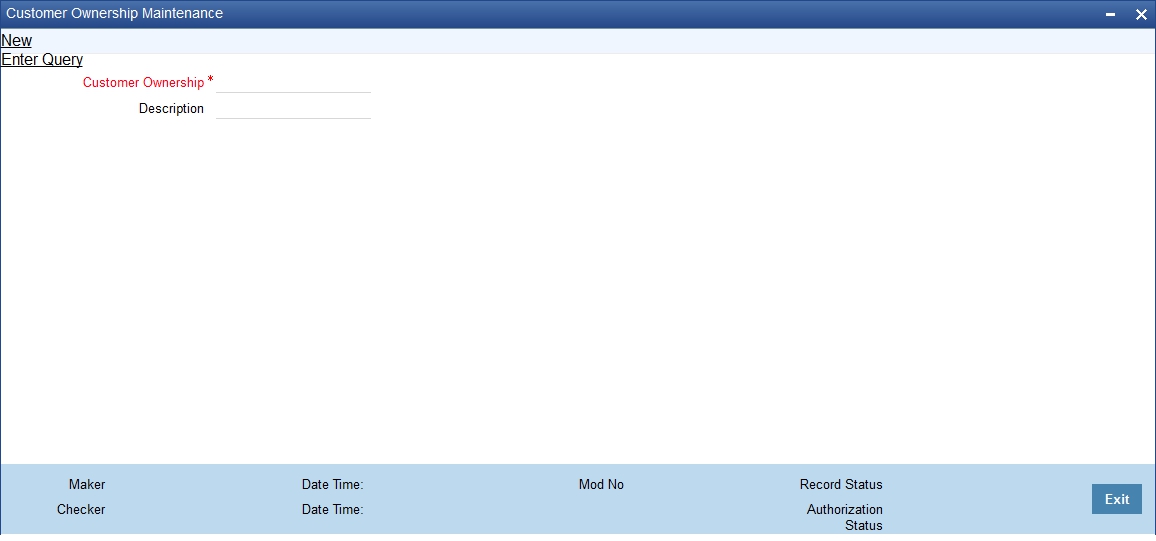

l Section 2.11, "Maintaining Customer Ownership"

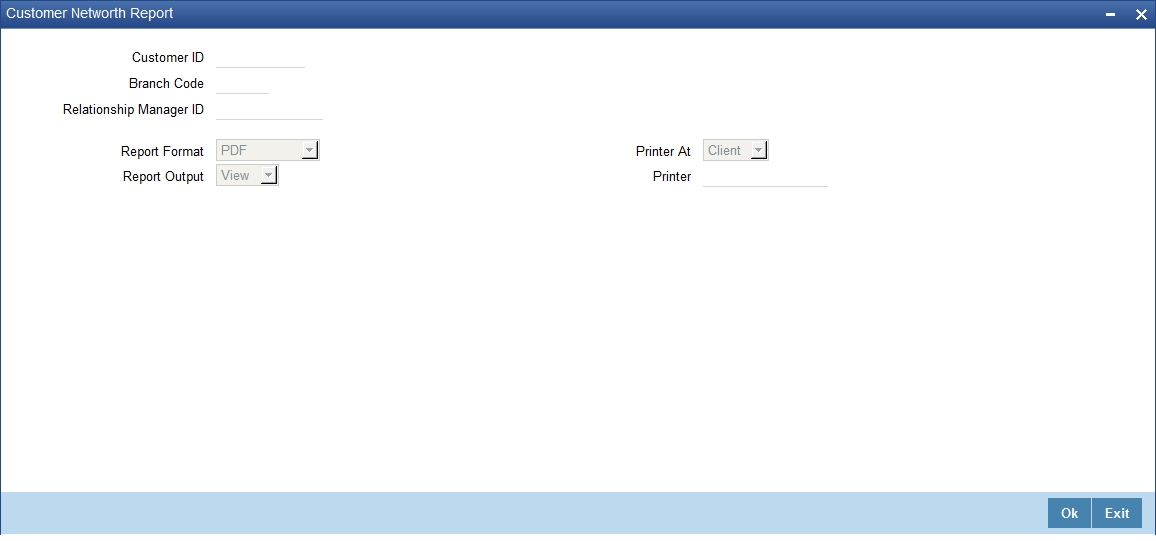

l Section 2.12, "Viewing Customer Net Worth Report"

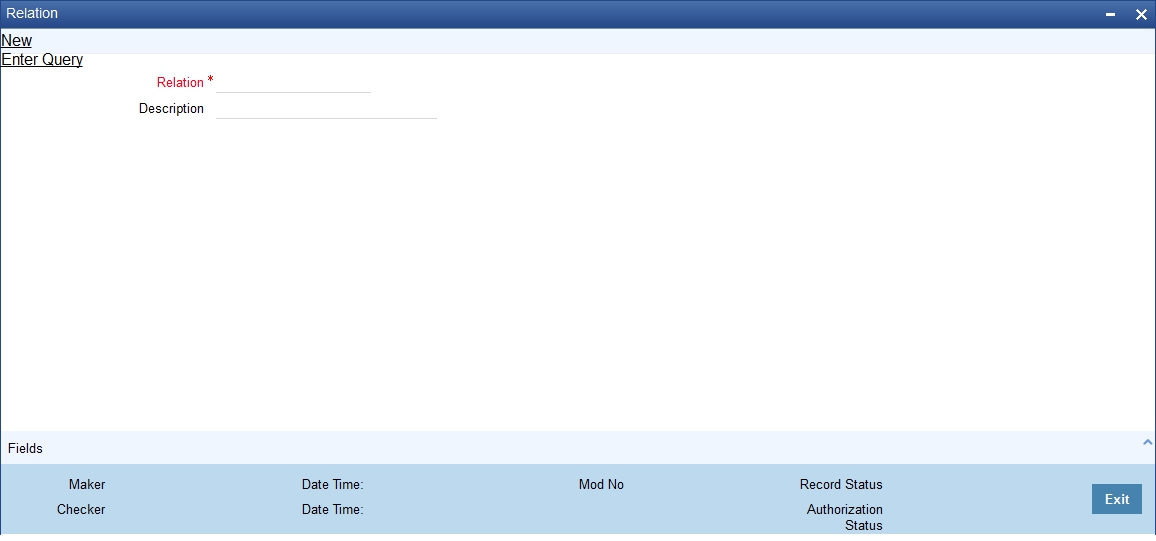

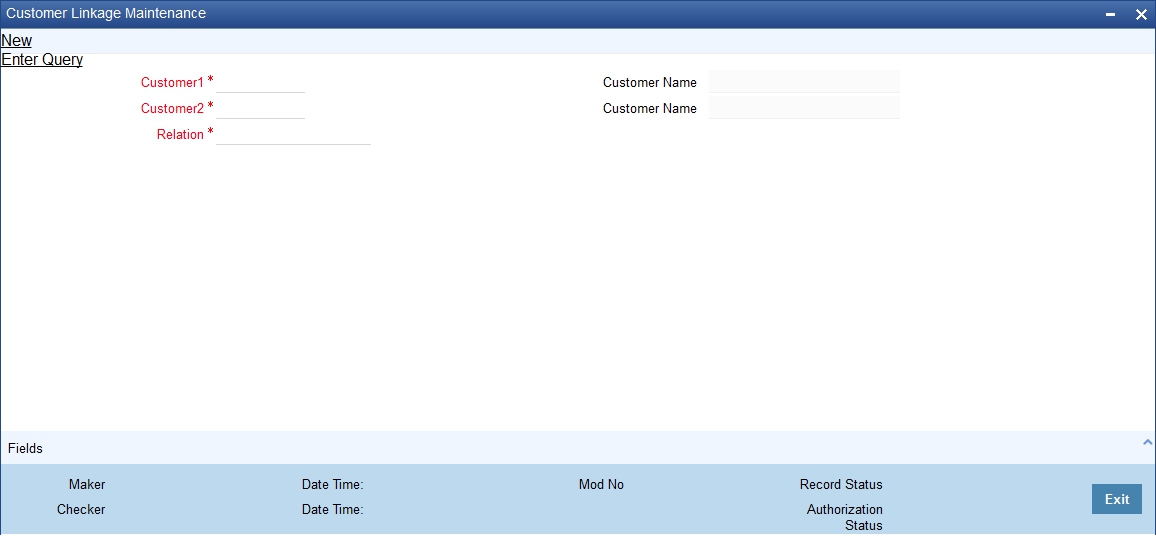

l Section 2.13, "Customer Relationship Maintenance"

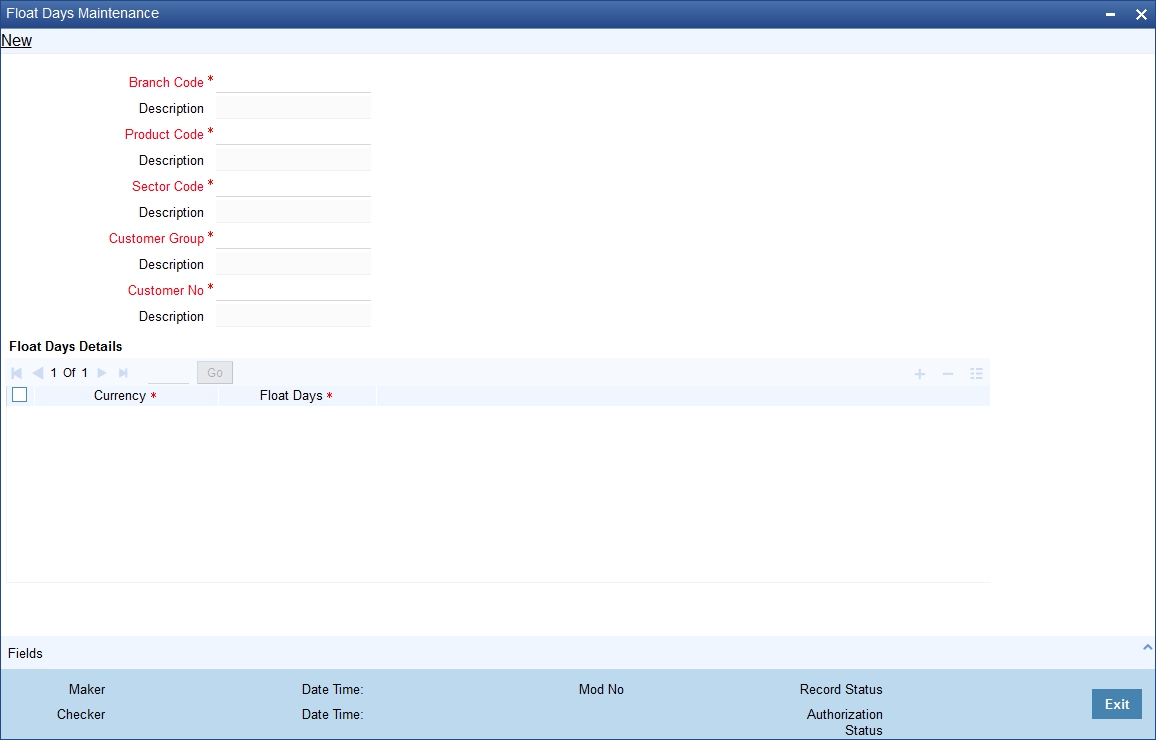

l Section 2.14, "Float Days Maintenance"

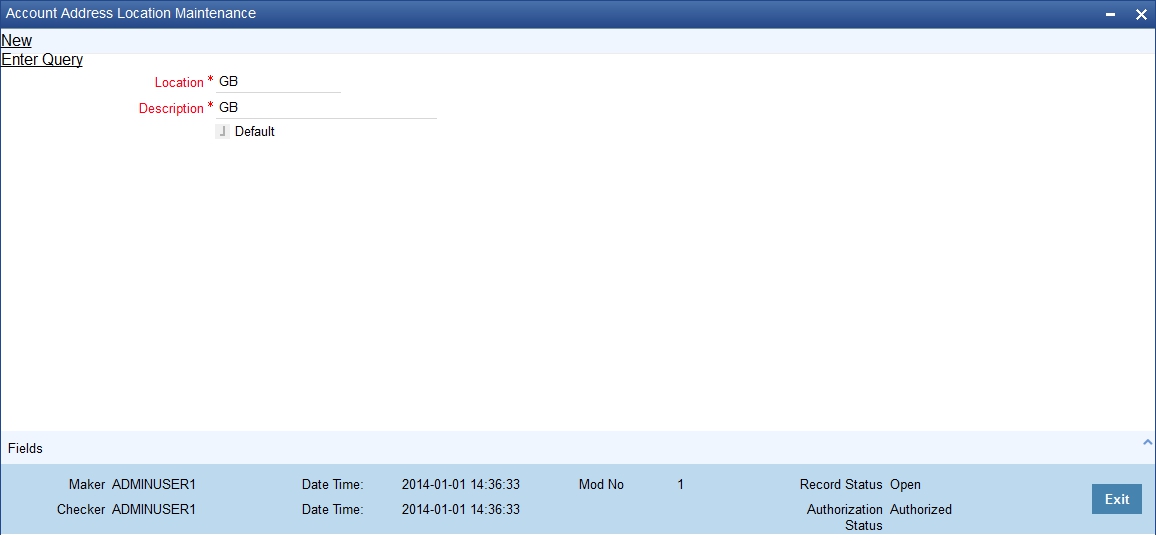

l Section 2.15, "Account Address Location Maintenance"

l Section 2.16, "KYC Maintenance"

l Section 2.17, "Alphabet Equivalent Maintenance"

l Section 2.18, "Creating a Message Advice Format"

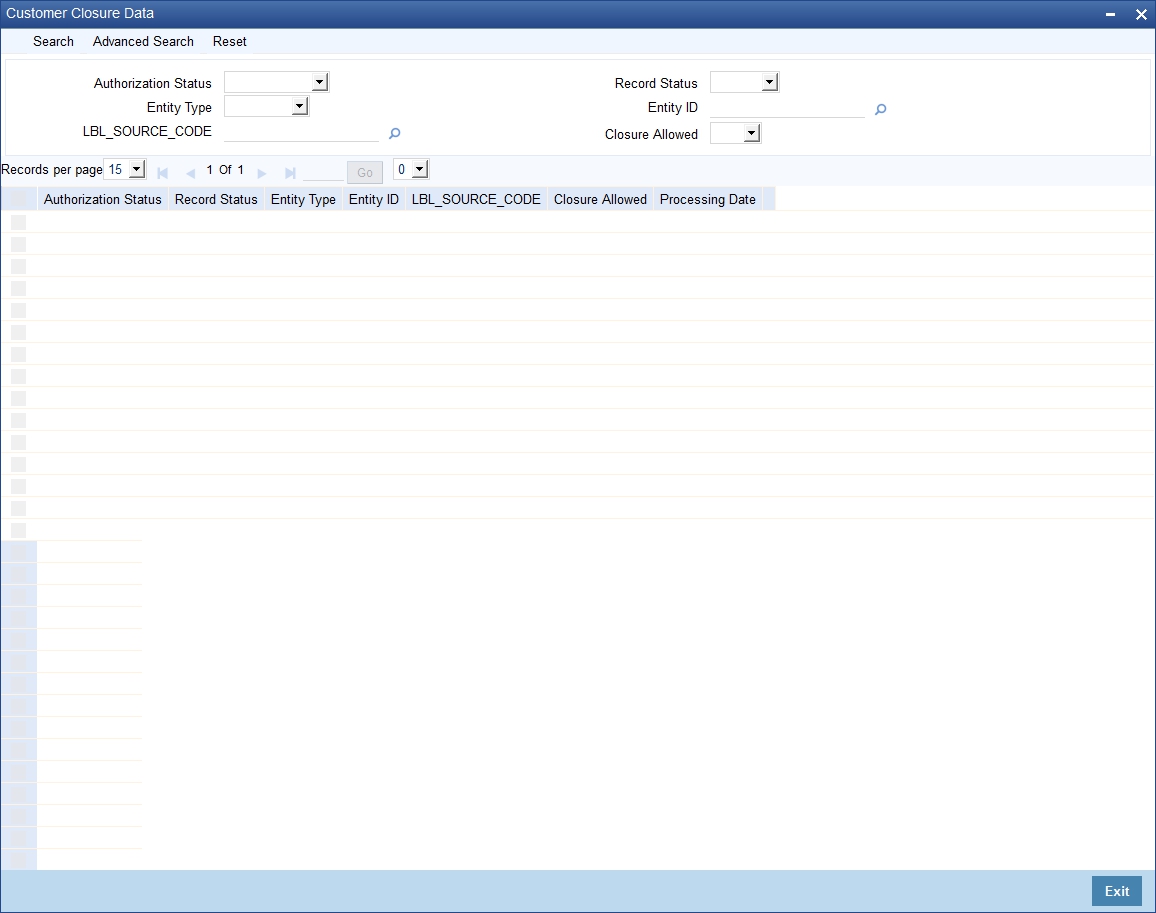

l Section 2.19, "Customer Closure Data from Channels"

l Section 2.20, "Searching for Customers"

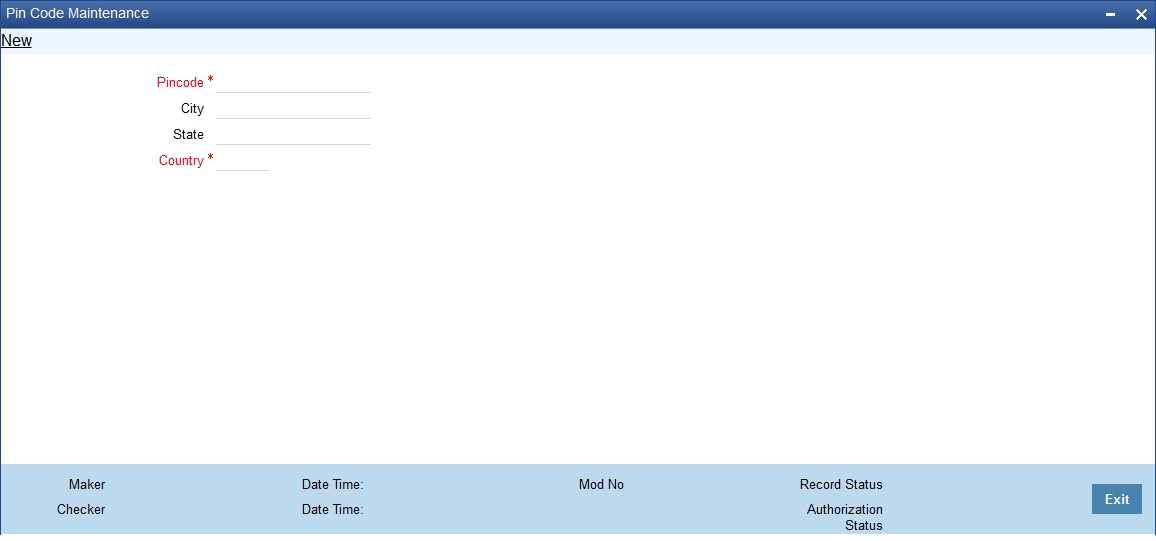

l Section 2.21, "Pin Code Maintenance"

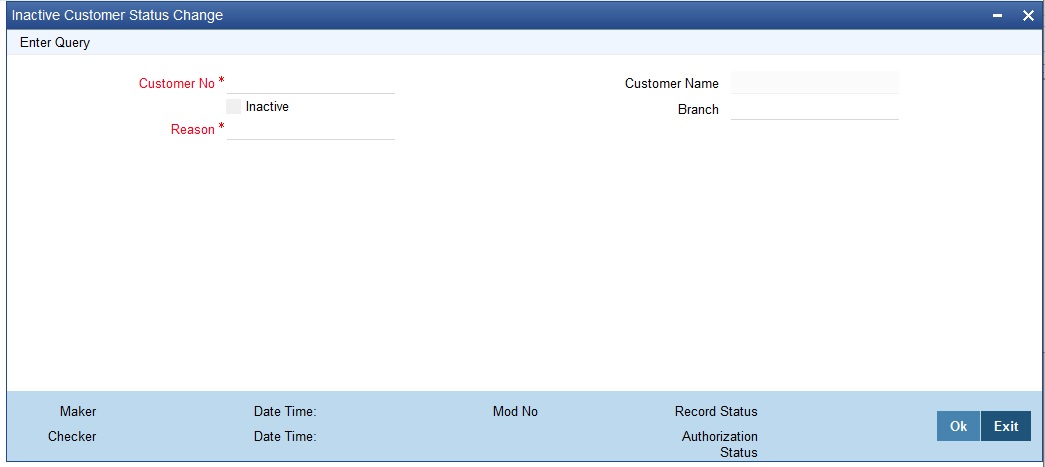

l Section 2.22, "Inactive Customer Status Change"

This section contains the following topics:

l Section 2.1.1, "Invoking Customer Maintenance Screen"

l Section 2.1.2, "Personal Tab"

l Section 2.1.3, "Corporate Tab"

l Section 2.1.4, "Additional Tab"

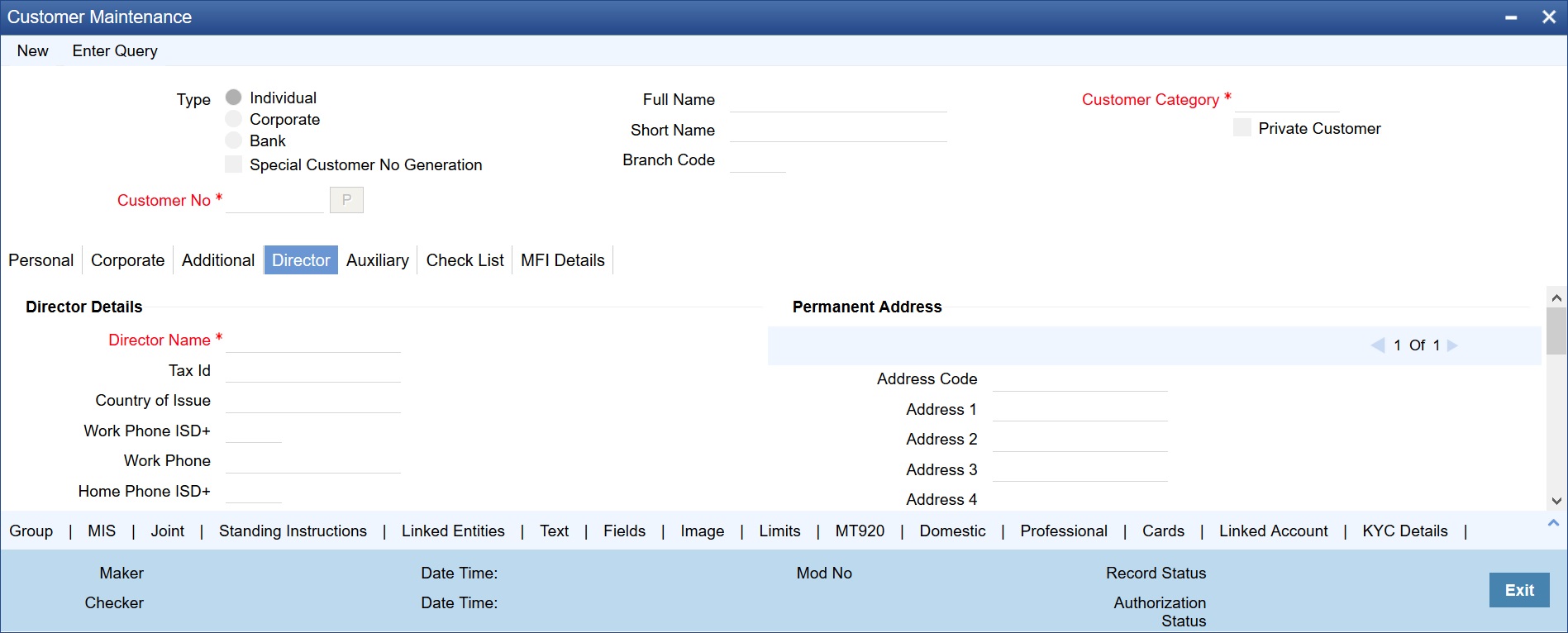

l Section 2.1.5, "Director Tab"

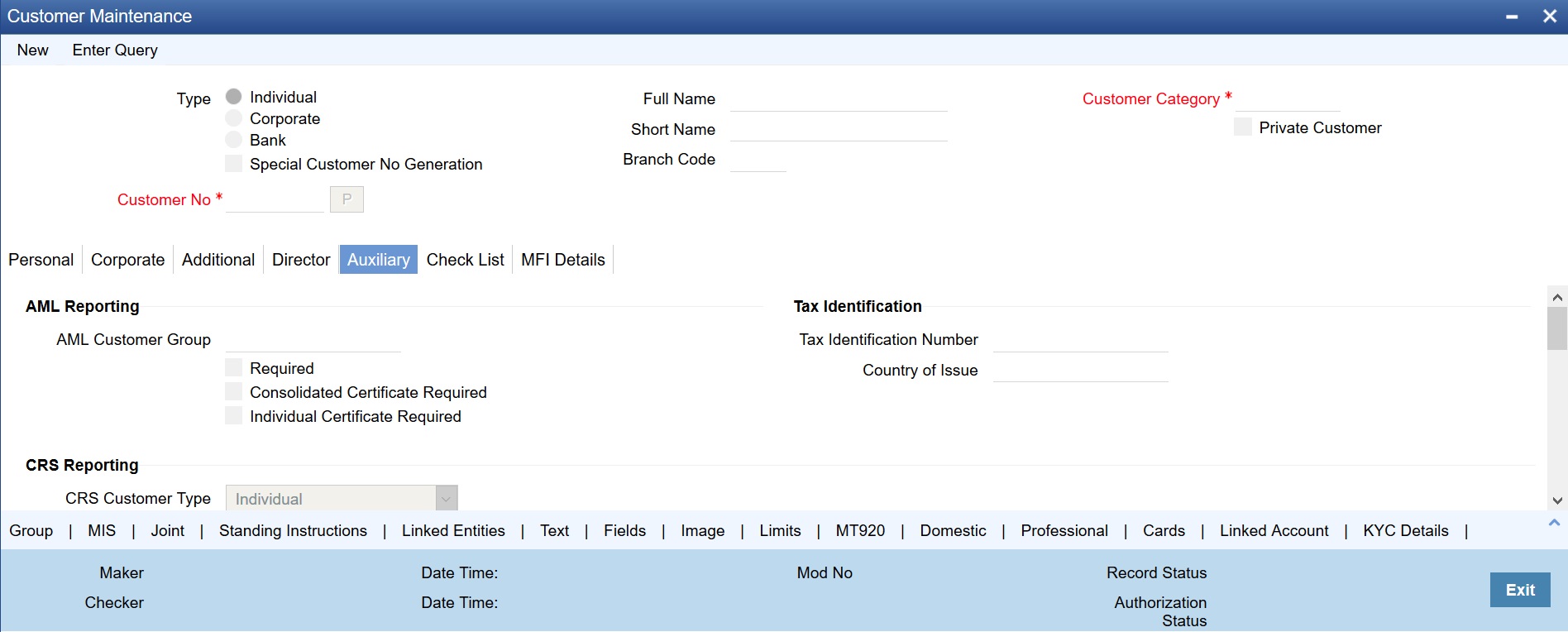

l Section 2.1.6, "Auxiliary Tab"

l Section 2.1.7, "Checklist Tab"

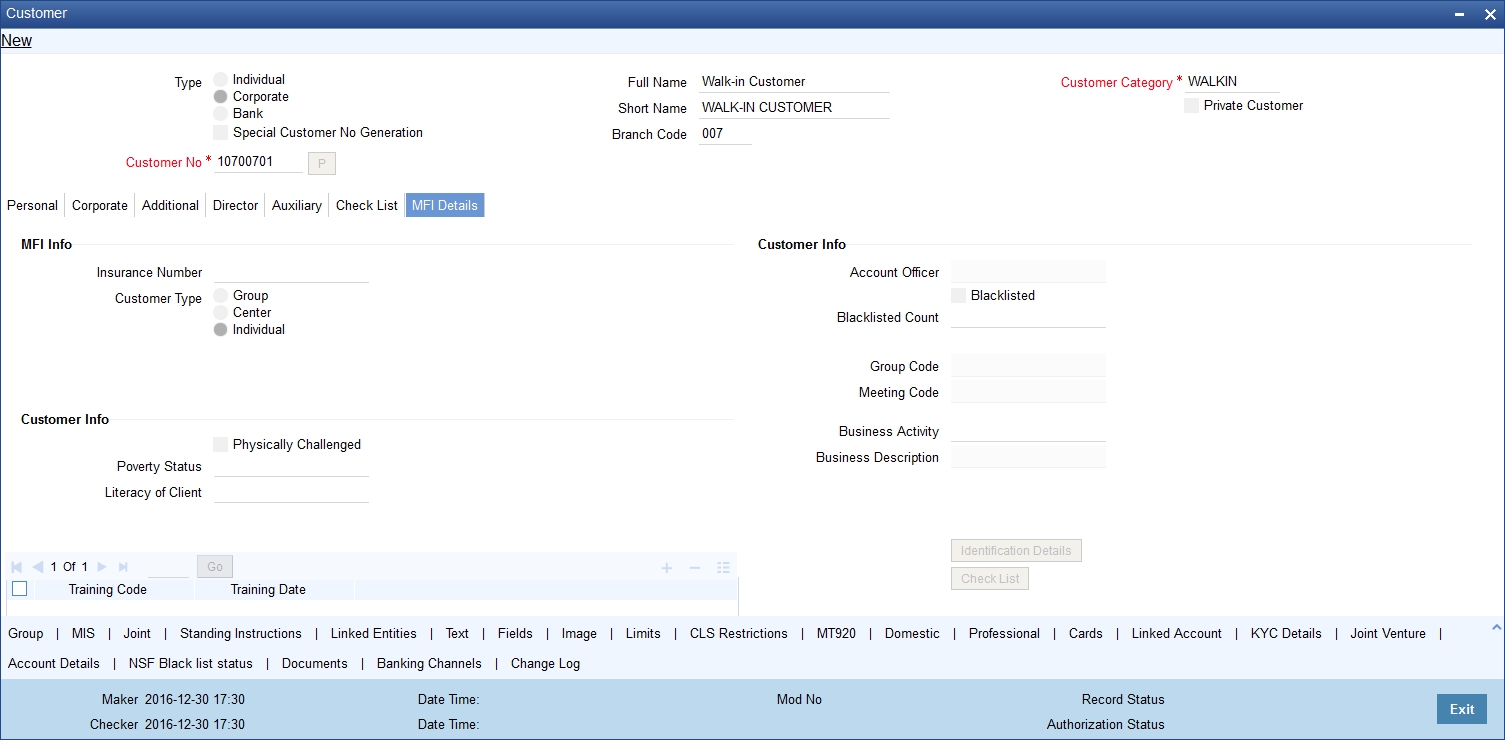

l Section 2.1.8, "MFI Details Tab"

l Section 2.1.9, "Fields Button"

l Section 2.1.10, "Other Basic Customer Information"

l Section 2.1.11, "Cards Button"

l Section 2.1.12, "OFAC Check Button"

l Section 2.1.13, "KYC Details Button"

l Section 2.1.14, "Joint Venture Button"

l Section 2.1.15, "NSF Blacklist Status Button"

l Section 2.1.16, "Documents Button"

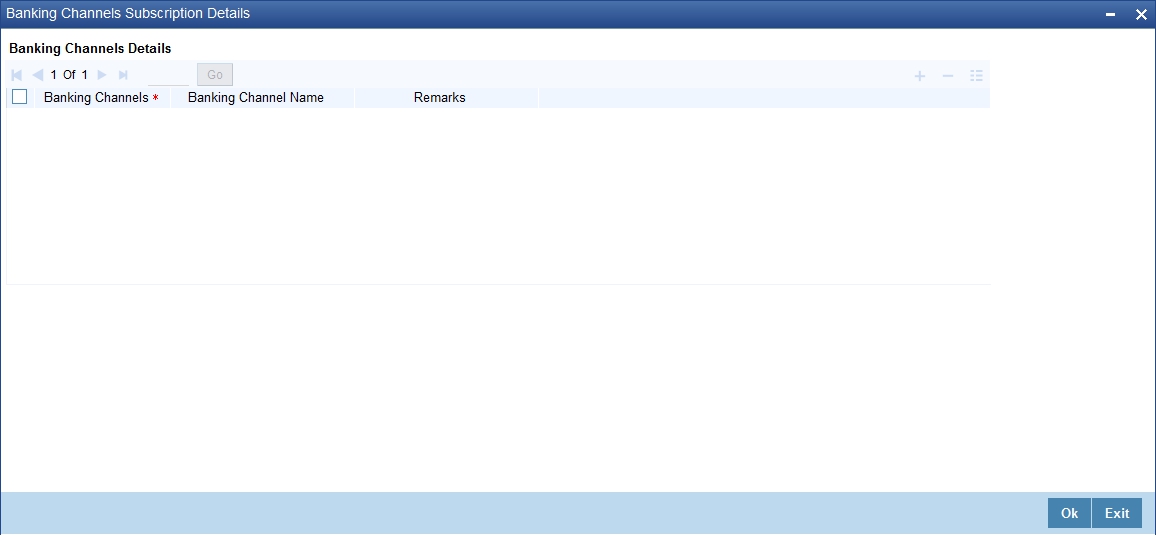

l Section 2.1.17, "Banking Channels Button"

l Section 2.1.18, "Account Details Button"

l Section 2.1.19, "MT920 Button"

l Section 2.1.20, "Group Button"

l Section 2.1.21, "Linked Entities Button"

l Section 2.1.22, "Viewing Customer Information"

2.1.1 Invoking Customer Maintenance Screen

You can invoke the ‘Customer Maintenance’ screen by typing ‘STDCIF’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You need to specify the following basic details of the customer:

Type

Indicate the Type of customer that your are maintaining. You can select one of the following options:

l Individual

l Corporate

l Bank

To recall, if a customer record is created from an external Siebel CRM application after a successful upload into Oracle FLEXCUBE, the ‘CRM Customer’ flag gets checked after the upload. You can however, uncheck the same when you unlock such a record and make changes. When you unlock such a record, system throws up an override stating that the customer is a CRM customer and asks whether you want to continue modifying the record. If you confirm the same, Oracle FLEXCUBE allows you to make changes. If you choose to ignore, the original record is saved.

Special Customer No Generation

Check this box to generate a special customer number in the ‘Customer Number’ field.

Note

– If the customer creation is manual, you should enter the desired customer number complying with the mask having the special number in the ‘Customer Number’ field. On click of ‘Populate’ button, the system validates whether the special number entered is an unused and a valid number.

– This field is disabled after generating customer number in the ‘Customer Number’ field.

– For normal customers, if the customer number generation is manual, you cannot use the special numbers maintained for customer number generation. If the customer number generation is automatic, the system skips the special numbers maintained for the branch.

– You cannot generate Special Customer Number from ‘Quick Customer Creation’ screen. A customer created using ‘Quick Customer Creation’ screen is treated as normal customer.

You can maintain branch wise CIF and CASA range for specific customers. A range can also be maintained for special number generation. For more information, refer to the section ‘Special Range/Number Maintenance’ in the chapter 'Customer Accounts' in CASA User Manual.

Customer No

Specify a customer code for the customer. Thee customer code is assigned to identify a customer. It is also referred to as the customer CIF Number. This code should be unique across branches. It can be 9-characters long.

For example, Assign a code using a maximum of 9 characters, alphanumeric. For example, assume your customer is DOW Corporation, US. You can assign him a code, which could either, be a number representing the customer’s serial number or an alphabetic code like DowCorp or an alphanumeric code like Dow1000US or DowUS1000 / 1000DowUS, if he is the 1000th customer to approach your bank.

Full Name

Specify the complete name of the customer in this field.

Short Name

Specify the customer’s unique abbreviated name or a short name. It helps in conducting a quick alpha-search or generating queries regarding the customer. This is an optional field.

While processing a transaction which involves customer identification, this uniquely abbreviated short name of the customer will be available in the option list for selection of the customer.

Branch Code

Specify the code of the corresponding branch.

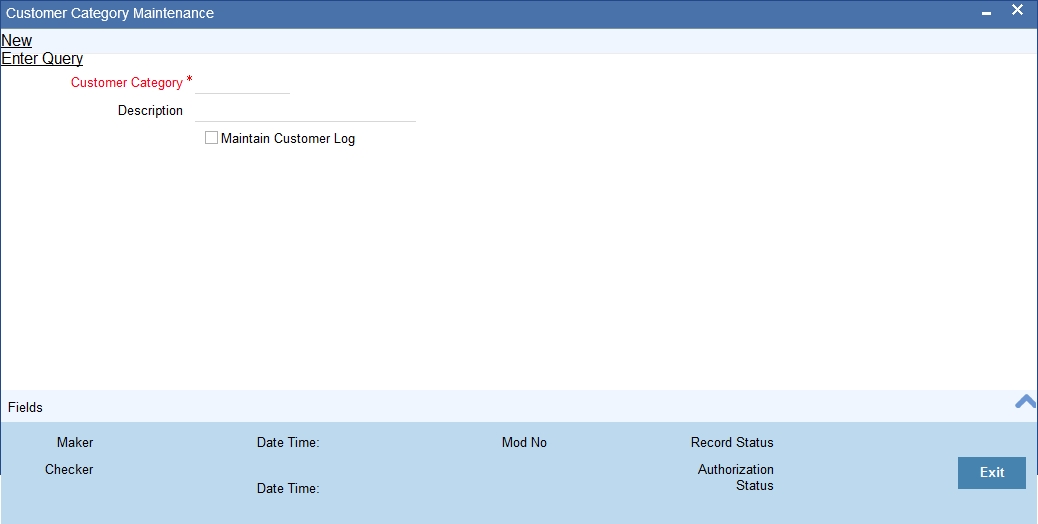

Customer Category

Select the category under which a particular customer has to be categorized.Each customer that you maintain can be categorized under any one of the categories that you have maintained in the Customer Category Maintenance screen.

Note

You need to capture the basic details for each customer, regardless of the type of customer you are maintaining.

Private Customer

Check this box to indicate that the customer type is private.

The Customer Maintenance screen has the following tabs:

|

Tab |

Remarks |

|

Personal |

Maintains the attributes for individual customers |

|

Corporate |

Maintains the attributes for all corporate customers |

|

Additional |

Contains additional information of the individual, corporate and bank customers. |

|

Director |

Contains the director’s basic information. |

|

Auxiliary |

Contains the information about the auxiliary department. |

|

Check List |

Contains the information about documents and its remarks, if any. |

|

MFI Details |

Contains information about the MFI. |

To define the basic details of the customer click on the tab titled ‘Main’. The details that you can specify for a customer depend on the type of customer whose details you are capturing.

If a particular field is disabled, it means that the field is not relevant to the type of customer that you are creating.

Note

The system performs the action level access rights validation only on ‘Save’ operation.

If your customer, for whom you have defined parameters in the ‘CIF-basic’ screen, is an ‘individual, you also have to maintain the personal details in order to determine the credit line. You can maintain these details in the ‘Personal’ tab of the ‘CIF Maintenance’ screen.

In the ‘Personal’ tab, you can maintain generic personal details of a customer. In addition, you can also maintain the domestic and professional details of the ‘individual’ type customer. You can do this by invoking the relevant screens by clicking on the respective buttons.

The information that you capture in these screens forms more a part of a credit line questionnaire. Whenever you are deciding on a credit limit for an individual customer, you can use these details for verification.

You have to maintain the following parameters for every individual type of customer:

Prefix 1, 2 and 3

Specify the title prefixed to the name of the customer whose code is input against Customer Code in the Main section. The title could be Mr. /Mrs./ Ms./ Dr. /Prof. etc.

The academic titles (like Prof., Dr., etc) of the customer along with the salutations (like Consulate, Senator, Chancellor, etc.). You can either select the prefixes from the option list key-in a prefix of your choice.

First Name

Specify the First name of the customer.

Middle Name

Specify the Middle name of the customer.

Last Name

Specify the Last name of the customer.

Work Phone ISD+

Specify a valid international dialling code for the work telephone number of the customer. The adjoining option list displays all valid ISD codes maintained in the system. Select the appropriate one.

Work Phone

Specify the work telephone number of the customer.

Home Phone ISD+

Specify a valid international dialling code for the home telephone number of the customer. The adjoining option list displays all valid ISD codes maintained in the system. Select the appropriate one.

Home Phone

Specify the home telephone number of the customer.

Mobile ISD Code+

Specify the international dialling code for the mobile number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Mobile Number

Specify the mobile number of the customer.

Fax ISD Code +

Specify the international dialling code for the fax number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Fax Number

Specify the Fax number of the customer.

Email Id

Specify the email address of the customer.

Gender

Select the gender of the customer. The following options are available for selection:

l Male

l Female

l Other

l Prefer Not to Disclose

Communication Mode

Indicate the mode of communication to be used to intimate the customer about the beneficiary account credit. You can select one of the following options:

l Mobile

l Email ID

The above field is enabled only for the product that uses the NEFT clearing network, i.e., Network Qualifier of the Clearing network should be NEFT.

National ID

Specify the national identification number or national social security number of the customer.

Birth Place

Specify the birth place of the customer.

Birth Country

Specify the birth country of the customer.

Date of Birth

Specify the date of birth of the customer.

Mother’s maiden name

Specify the maiden name of the customer’s mother.

Language

Specify the language in which your customer wants the statements and advices to be generated while sending periodic updates. Alternatively, you can also choose the language from the adjoining option list. English is defaulted as the language of correspondence; you have the option to change the default. The list displays all the language codes maintained in the SMS module. You can select the appropriate.

Address for Correspondence

‘Address for Correspondence’ contains the physical address of the customer. You need to specify the following address details:

Name

Specify the name of the customer. The customer will be addressed by this name in all correspondences sent from the bank. These characters should conform to SWIFT standards.

Note

The number of characters that you can specify in this field is determined by the preference that you have specified in the Bank Parameters screen. However, in the advices and statements that are sent to the customer only the first 35 characters of the name will be displayed.

Address Code

Select the address code from the adjoining address code value list. On selection, it defaults to below address 1-4 and pincode.

Address 1–4

Specify the mailing address of the customer in the four rows that are provided. In each line, you can enter a maximum of 35 alphanumeric characters. All characters should conform to SWIFT standards.

Country

Specify the country as given in the address of correspondence of the customer. Alternatively, you can also choose the country from the adjoining option list. The list displays all the country codes maintained in the Country Codes screen. You can select the appropriate.

Nationality

Specify the nationality of the customer. The list of country codes maintained in the Country Codes Maintenance screen are available in the option-list positioned next to this field. You can select the appropriate.

Permanent Address

‘Permanent Address’ contains the permanent address of the customer. You need to specify the following information:

Same as Correspondence Address

Select the check box if the ‘Address For Correspondence’ is same as “Permanent Address’. If the permanent is same as the address for correspondence, you need not provide the details of the permanent address. If not, you need to specify the permanent address.

Address Code

Select the address code from the adjoining address code value list.

Address 1–4

Specify the permanent address of the customer. Four lines have been provided for this purpose. You can capture a maximum of 35 characters, alphanumeric in each line. Only characters specified in SWIFT standards are permissible.

Pincode

Specify pincode of the address specified.

Country

Along with the permanent address, specify the country of permanent residence of the customer.

Resident Status

Choose the resident status of the customer. This indicates whether the customer is a recognized resident of the country in which the particular branch of your bank operates or not. Choose one of the following options:

l Resident

l Non Resident

Permanent US Resident Status

Check this box to indicate that the customer of some other nationality has a Us resident permit.

Visited US in last 3 years?

Check this box to indicate that the customer has visited US in the last three years.

MFI Info

MFI Customer

Check this box to indicate that the user is a Microfinance user. By default, the system leaves this box unchecked to indicate that all users would be normal users. This box should be checked for Individual Customers and not for Corporate Customers or other Banks.

The MFI Details tab is enabled only when this box is checked.

Passport Details

You need to specify the passport details of this customer, which include the passport number, the date on which the passport was issued, and the date on which the passport is due to expire.

Passport Number

Specify the passport number of the customer.

Issue Date

Specify the passport issue date. The following validations are applicable to passport issue date:

l This date should not be later than the passport expiry date

l This should not be the same as the passport issue date

l This should not be the same as the current system date

l This should not be later than the current system date

If any of the above conditions is not met, the system will display a configurable override message. The system will validate the issue date against the system date and passport expiry date when you create or modify a record.

Expiry Date

Specify the passport expiry date. The following validations are applicable to the passport expiry date:

l This date should not be the same as the current system date

l This date should not be later than the current system date

If the above conditions are not met, the system will display a configurable override message. The system will validate the passport expiry date against the system date when you create or modify a record.

Additional Details

Additional Details contains the details to Know Your Customer (KYC). KYC refers to Know Your Customer. KYC details for customers are maintained using KYC Details screen. The system generates a KYC Reference Number during this maintenance. You need to specify the following KYC information:

Staff

Check this box whenever a customer record is created for a staff. By default this box is left unchecked.

KYC Status

Select the KYC status of the customer.

KYC Reference

Specify the KYC Reference Number. The option list displays all valid KYC reference numbers generated. Choose the appropriate one. The system will link the KYC details of the selected reference number to the customer CIF.

Guardian

Specify the customer’s guardian’s name.

Minor

Check this box to indicate that the customer is minor.

Submit Age Proof

Indicate the age proof submission status of the minor to major from the drop-down list. The available options are:

l Not required

l Pending

l Verified

Note

– Any out flow or debit transaction is posted on a particular customer’s account/s and the ‘Submit Age Proof’ chosen is ‘Pending’, then the system displays an error message as “Necessary documents are not submitted for Major.”

– Once the documents are submitted, the user has to manually set ‘Submit Age Proof’ as ‘Verified’.

After the field ‘Submit Age Proof’ is changed to ‘Verified’, then all the accounts created for the customer would be allowed for withdrawals.

Preferred Date of Contact

Specify the preferred date for contacting the customer. You can also select the date from the adjoining calendar icon.

The system does not allow Back dated values.

Preferred Time of Contact

Select the preferred time for contacting the customer on the preferred date of contact, from the adjoining drop-down list. This list displays the following time slots in 24hrs format:

l Any time

l 1 hour combination of timings starting from 12am – 1am to 23pm – 12am.

Power of Attorney

Note

If the FATCA is enabled at the bank and the check box 'Power of Attorney' is checked here, then it is mandatory to specify the Power of Attorney information.

Power of Attorney

Check this box to indicate that the customer account is to be operated by the power of attorney holder.

Holder Name

The person who has been given the power of attorney.

Nationality

Specify the nationality of the power of attorney holder.

Address

Specify the address of the power of attorney holder.

Country

Specify the country of the power of attorney holder.

Telephone ISD Code +

Specify the international dialling code for the telephone number of the power of attorney holder. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Telephone Number

Specify the telephone number of the power of attorney holder.

Click the ‘Corporate Details’ tab from the ‘Customer Maintenance’ screen to define the details of a Corporate or a Bank type of customer. The tab is enabled only for a corporate or a bank customer. You need to specify the following details:

In this screen, you can maintain generic personal details of a corporate or a bank customer. In addition, you can also maintain the corporation and registration details of the ‘Corporate’ or ‘Bank’ type customers. You can do this by invoking the relevant screens by clicking on the respective buttons.

The information that you capture in these screens forms more a part of a credit line questionnaire. Whenever you are deciding on a credit limit for an individual customer, you can use these details for verification.

You have to maintain the following parameters for every individual type of customer:

Address for Correspondence

In this section, you can maintain the address for correspondence.

Name

In the lines that are provided you can enter the name of the customer. The customer will be addressed by this name in all correspondence sent from the bank. These characters should conform to SWIFT standards.

Note

The number of characters that you can enter in this field is determined by the preference that you specified in the Bank Parameters screen. However, in the advices and statements that are sent to the customer only the first 35 characters of the name will be displayed.

Address Code

Select the address code from the adjoining address code value list.

Address 1–4

You can specify the mailing address of the customer in the four rows that are provided. In each line, you can enter a maximum of 35 alphanumeric characters. All characters should conform to SWIFT standards.

Pincode

Specify pincode of the address specified.

Country

This is the country as given in the address of correspondence of this customer. Click on the option list positioned next to this field, a list of countries maintained in the Country Codes screen is displayed. You can select the appropriate.

Telephone ISD Code

Specify a valid international dialling code for the telephone number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Telephone

Specify the telephone number of the customer.

Mobile ISD Code +

Specify the international dialling code for the mobile number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Mobile Number

Specify the mobile number of the customer.

Fax ISD Code +

Specify the international dialling code for the fax number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Fax

Specify the fax number of the customer.

Email Id

Specify the email address of the customer.

Language

As part of maintaining customer accounts and transacting on behalf of your customer, you will need to send periodic updates to your customers in the form of advices, statement of accounts and so on.

You have to indicate the language in which your customer wants the statements and advices to be generated. English is defaulted as the language of correspondence; you have the option to change the default. The list positioned next to the language field contains all the language codes maintained in the SMS module. You can select the appropriate.

Communication Mode

Indicate the mode of the communication to the customer to intimate about the beneficiary account credit. You can select one of the following options:

l Mobile

l Email ID

The above field is enabled only for the product that uses the NEFT clearing network, i.e., Network Qualifier of the Clearing network should be NEFT.

Registration Address

‘Registration Address’ contains the registration address of the customer. You need to specify the following information:

Same as Correspondence Address

Select the check box if the ‘Address For Correspondence’ is same as “Permanent Address’. If the permanent is same as the address for correspondence, you need not provide the details of the permanent address. If not, you need to specify the permanent address.

Address Code

Select the address code from the adjoining address code value list.

Name

Specify the company name as an Registered address of the organization.

Address 1–4

Specify the registration address of the customer. Four lines have been provided for this purpose. You can capture a maximum of 35 characters, alphanumeric in each line. Only characters specified in SWIFT standards are permissible.

Pincode

Specify pincode of the address specified.

Country

Along with the permanent address, specify the country of permanent residence of the customer.

Incorporation

‘Incorporation’ consists of the corporate details of the corresponding organization. You need to specify the following details:

Date

Specify the date on which the customer’s company was registered as an organization.

Capital

Specify the initial investment in the company.

Net Worth

Specify the net worth of the company.

Country

Specify the Country of registration of the office of the corporate.

Currency of Amounts

Specify the Currency in which you specify the particular customer’s various financial details like the Net worth of the customer organization, the total Paid Up capital etc.

Additional Details

Additional Details contains the details to Know Your Customer (KYC). KYC refers to Know Your Customer. KYC details for customers are maintained using KYC Details screen. The system generates a KYC Reference Number during this maintenance. You need to specify the following KYC information:

KYC Status

Select the KYC status of the customer.

KYC Reference

Specify the KYC Reference Number. The option list displays all valid KYC reference numbers generated. Choose the appropriate one. The system will link the KYC details of the selected reference number to the customer CIF.

National ID

It displays the company details. On selection it defaults National Id, Registration Address details and Incorporation Date and Country.

Type of Ownership

Specify the ownership type of the customer business. The adjoining option list displays a list of ownership types maintained in the system. Select the appropriate one.

Preferred Date of Contact

Specify the preferred date for contacting the customer. You can also select the date from the adjoining calendar icon.

Preferred Time of Contact

Select the preferred time for contacting the customer on the preferred date of contact, from the adjoining drop-down list. This list displays the following time slots in 24hrs format:

l Any time

l 1 hour combination of timings starting from 12am – 1am to 23pm – 12am

Joint Venture

Select the check box if you have a joint venture.

Description of Business

Specify the additional details of the business, if any.

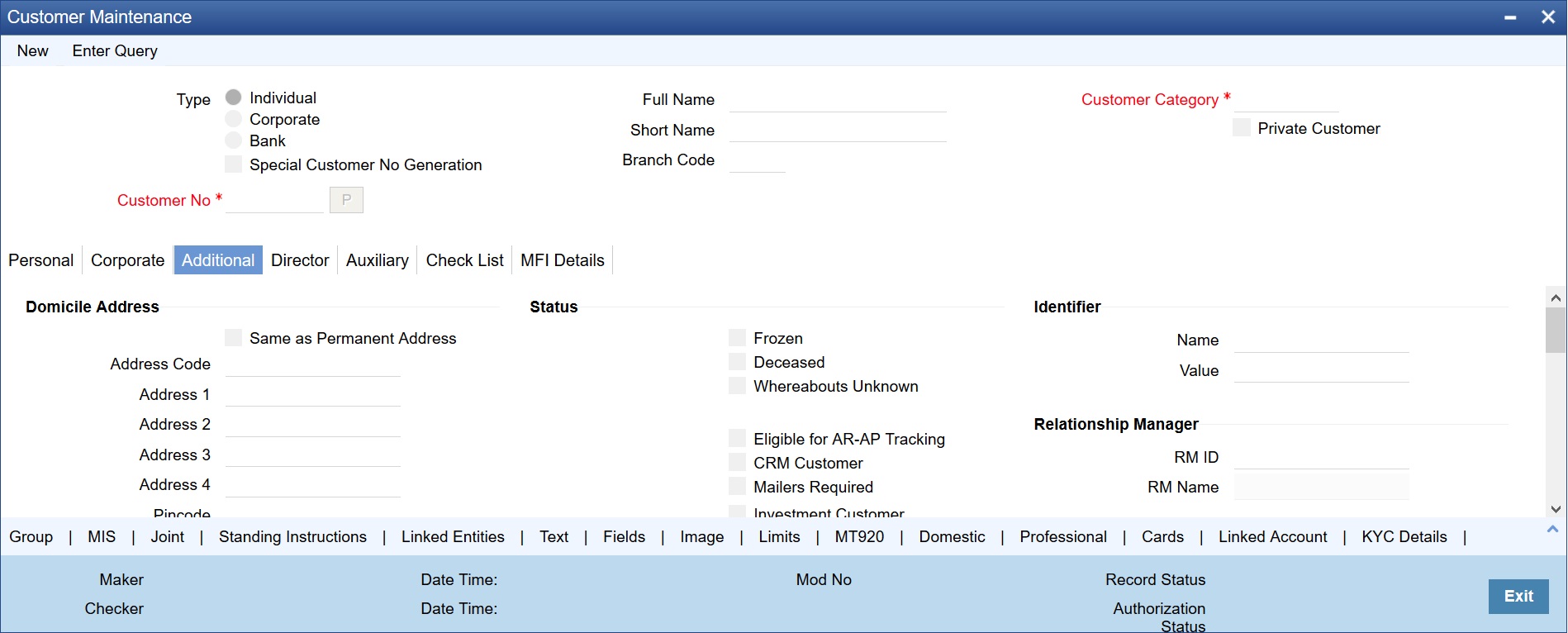

‘Additional tab contains additional information of the individual, corporate and bank customers.

You need to specify the following details:

Domicile Address

Domicile Address contains the address of domicile of the customer. You need to specify the following details:

Same as Permanent Address

Check this if the domicile address is same as the permanent address.

Address Code

Specify the address code from the adjoining option list.

Address 1–4

Specify the address of domicile of the customer. Four lines have been provided for this. Each line can have a maximum of 35 characters, alphanumeric. Only characters specified as per SWIFT standards are permissible.

Pincode

Specify pincode of the address specified.

Country

Specify the country of domicile of the customer. A list of all country codes maintained in the ‘Country Codes Maintenance’ screen is available in the option list. You can select the appropriate code.

Misc Details

‘Misc Details’ contains the miscellaneous details of the customer. In this tab, you need to specify the following information:

Swift Code

You can choose to associate a SWIFT Code with the customer whose CIF details you are maintaining. This code will be used to send all SWIFT related messages to the customer. This is pertinent while creating CIF record for banks as customers.

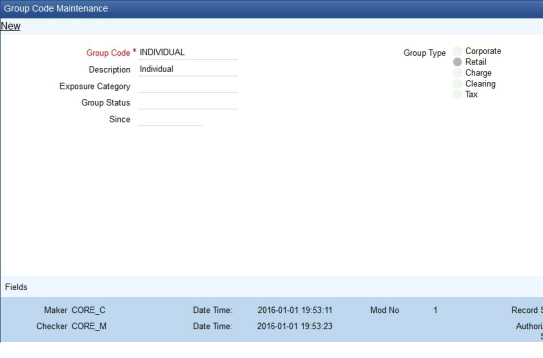

Group Code

Specify the group code. Alternatively, you can select the group code from the option list. The list displays all valid group codes maintained in the system. The group code selected here is used only for status change at batch level.

Access Group

Specify the access group. Alternatively, you can select the access group from the option list. The list displays all valid access groups allowed to the user based on the maintenance at Access Group Restriction screen.

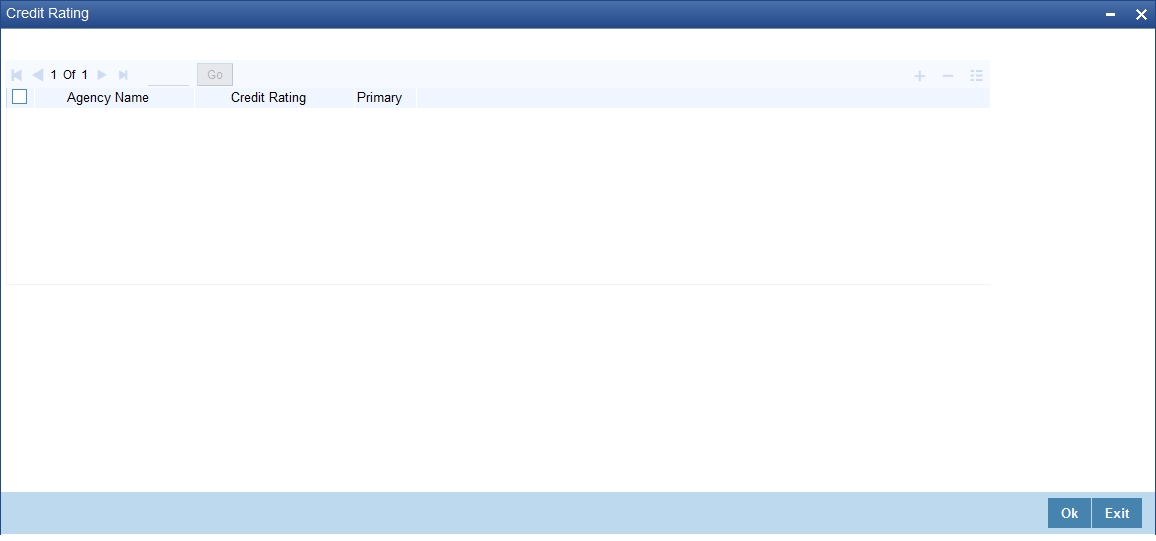

Credit Rating

Specify valid credit rating for a Customer number from the option list. You can modify the credit rating of a customer.

Credit rating basically indicates the credit worthiness of the customers linked to a particular credit line. It is used primarily for information only. The Limits Services Module also uses it in generation of reports.

Charge Group

Specify the charge group of the customer from the option list provided. Only the Group codes maintained with type Charge will appear for selection.

Clearing Group

Categorize the customer for levying charges at a customer group level.

Tax Group

You need to specify the tax group of the customer from the option list provided. Only the Group Codes maintained with type Tax will appear for selection.

Customer classification

Specify the customer classification.

External Ref No

To recall, if a customer record is created from an external Siebel CRM application after a successful upload into Oracle FLEXCUBE, the external reference number is defaulted in the ‘External Ref No’ field. You can amend the same when you unlock a record and make changes.

Location

Specify the relevant location code. This pertains to a particular area in a country. It cannot be more than 15 characters.

Status

Status contains the customer’s account information.

Note

When the customer status is modified to "Frozen", "Deceased" or "Whereabouts Unknown" from the customer screen (STDCIF), the system will check if there is an active amount block on any of the customer accounts. If there is an amount block system will display a configurable override message: "There are some active amount block on the customer accounts”.

You need to specify the following information:

Frozen

Check this box if the account needs to be frozen. A customer’s account is frozen when an order is passed by law, the customer has deceased, or the customer’s whereabouts are unknown.

Deceased

Check this box if the customer has deceased.

Whereabouts Unknown

Check this box if the whereabouts of the customer are unknown.

Eligible for AR-AP Tracking

Check this box if the Customer is eligible for AR-AP Tracking.

CRM Customer

Check this box if the customer is a CRM customer.

Mailers Required

Check this box if you require mailers for the customer.

Issuer Customer

If the customer, for whom you are maintaining the CIF, is an issuer of securities, then check this box.

Investment Customer

Check this box if you wish to classify the customer as an investment customer. This selection indicates that the customer can have unit holder relationship with the FCIS system. When a CIF ID is created or modified in the system, then a notification is sent to the external channel with the CIF details.

Joint Customer

Check this box if the customer is a Joint Customer.

MT920

Check this option to indicate that the customer is eligible to request for MT920 messages.

MT920 - Account Update Request - A request for an up-to-date statement from the bank where the referenced Account is held. The request may be for an Intra Day Update (MT942) or an End of Day Update (MT940) and is subject to the service agreed with that bank.

Relationship Pricing

Select this checkbox to indicate that the customer is eligible for relationship pricing. This checkbox will be unselected by default.

For more details on relationship pricing, refer Relationship Pricing user manual.

Withholding Tax Applicable

Check this box to apply withholding tax for the customer during the payment and rollover operations of a loan.

ELCM Customer

Check this box to replicate the customer details to ELCM system. By default, system checks this box whenever the new customer is created. You can uncheck this box if required so that customer data will not get replicated to ELCM system.

Note

Once you select the option ‘ELCM customer’, system will not allow you to unselect it.

ELCM Customer Number

You need to specify the ELCM customer number if the option ‘Generate Customer Number’ is not selected in ‘ELCM Parameter Maintenance’ screen. If the option ‘Generate Customer Number’ is selected in ‘ELCM Parameter Maintenance’ screen, then the system will replicate the customer number from ELCM system.

For each customer you will be allowed to mark one or more statuses. For example, if the customer has deceased then the customer account will be declared frozen. Therefore, for the particular customer both the statuses ‘Deceased’ and ‘Frozen’ will be applicable.

If none of the statuses is marked, it suggests that this customer’s status is normal.

CIF Status

If status processing for your branch is being done at Group/CIF level (as specified in the Branch Parameters), the current status assigned to all loans issued to the CIF as well as all overdraft accounts belonging to the CIF, is displayed in the CIF Status field in the Customer Maintenance screen. This status is the worst status of all loans contracts and overdraft accounts for a Group/CIF and is displayed both at the account as well as the loan level for all the accounts and loans a customer has in the current branch. The update applies only to the accounts and loans in the current branch not across branches.

Sanction Check Status

The system displays the sanction check status. The status can be any of the following:

l Not required

l Pending

l Approved

l Rejected

Click the ‘Fetch’ button to retrieve the latest status of the sanction check.

By default the ‘Sanction Check Status’ is updated as ‘Not Required’. When the request for sanction check is send, then the status is updated as ‘Pending’. If the sanction check status of the record is ‘Pending’, then the records cannot be reopened, modified or authorized.

Based on the final status received from the external system, the status is updated as 'Approved' or 'Rejected'.

A sanction check request is send if a customer is created/modified/reopened using Customer Maintenance screen (STDCIF), Quick Customer Addition screen (STDCIFAD), Financial Inclusion Customer Account Maintenance screen (STDFIACC), web-services or upload.

For more information on sanction check maintenance and processing refer ‘Sanction Check Maintenance’ chapter in Core Service user manual.

Segment Details

Identifier

Each customer is required to provide certain identification details to your bank for establishing the customer’s identity. For instance, the passport number or ration card of the customer may serve as the criteria to establish the customer’s identity. In Oracle FLEXCUBE, this is known as Unique Identifier Name.

Name

Enter the identifier name in not more than 20 characters.

Value

You have to capture the serial number or any number of significance that is to be associated with the document, which can help in identifying the document. You can use a maximum of 30 alphanumeric characters, to capture the identifier value.

Relationship Manager

Every customer in Oracle FLEXCUBE can be designated to a relationship manager. You need to specify the following details of the relationship manager:

RM Id

Specify the user ID of the relationship manager of this customer. The option list displays all valid user IDs with their roles defined as relationship manager. Choose the appropriate one.

Relationship managers are responsible for helping the customers designated to them in need.

RM Name

Based on the RM ID, the system displays the name of the relationship manager.

Combined Statement Plan

Auto Generated Statement Plan

Check this box to automatically generate the combined statement plan.

Frequency

Select the frequency at which the combined statement should be generated from the adjoining drop-down list. The options available are:

l Annual

l Semi Annual

l Quarterly

l Monthly

l Fortnightly

l Weekly

l Daily

Statement Day

Select the day on which combined statement should be generated from the adjoining drop-down list. If value for Statement Day is not selected, then the system defaults the values based on the frequency cycle selected. The statement gets generated on the month end of the defaulted values.

The maker and checker ID of the combined statement plan generated from the customer account screen should be ‘System’.

Modifications done on the frequency cycle and statement day in the combined statement screen will not be reflected in the combined statement plan of the customer maintenance screen.

Sanction Check

Sanction Check Required At Transaction Level

Check this box if sanction check is required at the transaction level.

Director tab consists of the director’s basic information.

You need to specify the following information:

Director Details

Director Details consists of the details of the corresponding branch’s director. You need to specify the following information:

Director Name

Specify the corresponding director’s name.

Tax Id

Specify the Tax Id of the corresponding director.

Country of Issue

Specify the country which has issued the tax ID for the customer. Alternatively, you can select the country from the option list.

Work Phone ISD+

Specify a valid international dialling code for the work telephone number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Work Phone

Specify the work telephone number of the director.

Home Phone ISD+

Specify a valid international dialling code for the home telephone number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Home Phone

Specify the home telephone number of the director.

Mobile ISD Code+

Specify the international dialling code for the mobile number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Mobile Number

Specify the mobile number of the corresponding director.

Email id

Specify a valid email address of the corresponding director.

Mailing Address

‘Mailing Address’ contains the mailing address of the corresponding director. You need to specify the following information:

Address Code

Select the address code from the adjoining address code value list.

Address 1–4

Specify the mailing address of the director. Four lines have been provided for this purpose. You can capture a maximum of 35 characters, alphanumeric in each line.

Pincode

Specify pincode of the mailing address specified.

Country

Specify the country of the Mailing Address of the corresponding director.

Permanent Address

‘Permanent Address’ contains the permanent address of the corresponding director. You need to specify the following information:

Address Code

Specify the address code from the adjoining option list.

Address 1–4

Specify the permanent address of the director. Three lines have been provided for this purpose. You can capture a maximum of 35 characters, alphanumeric in each line. Only characters specified in SWIFT standards are permissible.

Pincode

Specify pincode of the permanent address specified.

Country

Specify the country of the permanent Address of the corresponding director.

Other Details

Nationality

Specify the nationality of the corresponding director.

Permanent US Resident Status

Check this box to indicate that the corresponding director is a permanent US resident.

Shareholding %

Specify the shareholding percentage of the director in the company.

Type of Ownership

Specify the type of ownership. Alternatively, you can select the ownership type from the option list. The list displays all valid options.

This field is mandatory if CRS customer type is Passive Non-Financial Entity.

Birth Place

Specify the birth place of the director.

Birth Country

Specify the birth country of director.

Date of Birth

Specify the date of birth of the director.

Additional Tax ID Details

Tax ID

Specify the tax identification number (TIN) of the customer.

Country of Issue

Select the country which has issued the TIN for the customer.

Click the Auxiliary tab to provide the auxiliary details pertaining to the customer.

You need to specify the following details:

Tax Identification

Tax Identification Number

Specify the Tax Identification Number (TIN).

Country of Issue

Specify the country which has issued the TIN for the customer. Alternatively. you can select the country from the option list.

Consolidated Certificate Required

Check this box to indicate whether a consolidated tax certificate is required for all transactions done for a given tax cycle. This option would work in conjunction with a similar option in the Tax Category screen and the Tax Details screen accessed from the Branch Parameters Detail screen.

Generating Consolidated Tax Certificate

Depending on the frequency maintained at the branch level, the system will generate the Consolidated Tax Certificate for a customer, provided the consolidated tax certificate generation is required at the customer level and the option is maintained at the Tax Category level. The Tax Certificate will be in a pre-shipped advice format and printed on a Year to Date basis

Maintaining Elements for Advice Generation

The following elements will be available for advice generation for consolidated tax certificates.

|

Element Name |

Description |

Data Type |

|

CUSTOMERNO |

The customer number for which the tax summary certificate is printed |

Alphanumeric |

|

CUSTOMERNAME |

The customer name |

Alphanumeric |

|

FROMDATE |

The from date for which the certificate is generated |

Date |

|

TODATE |

The to date for which the certificate is generated |

Date |

|

TXNNUMBER |

The contract reference number |

Alphanumeric 16 characters |

|

CALCDATE |

The tax calculation date |

Date |

|

TAXCCY |

The tax currency |

Alphanumeric 3 characters |

|

TAXAMTINTAXCCY |

The tax amount in tax currency |

Number |

|

INTERESTAMT |

The interest amount (basis amount on which the tax has been calculated |

Number |

Individual Certificate Required

Check this box to indicate whether an individual tax certificate is required for each transaction. An individual tax certificate is a certificate (advice) which is generated for each individual event (in a transaction) resulting in computation/deduction of tax from the customer’s account. The advice is linked to the product and is generated at the time of authorization of the contract/event.

Generating Individual Tax Certificate

For contracts that have tax defined on interest liquidation, an individual tax certificate will be generated by the system, provided the tax certificate is linked as an advice for the event and the individual transaction tax certificate is required to be generated for the customer.

For income other than through interest on customer accounts, the advice format for the tax certificate can be maintained depending on the requirement. This advice format can be linked to the products.

For income through interest on customer accounts, the advice format for the tax certificate is pre-shipped. The format of the advice can be modified except for the name of the advice format which is pre-shipped.

Maintaining Tags for Advice Generation

The following tags will be available for advice generation for individual transaction.

|

Tag Name |

Description |

Data Type |

|

TXNNUMBER |

The contract reference number |

Alphanumeric 16 characters |

|

CALCDATE |

The tax calculation date |

Date |

|

COMPCCY |

The interest component currency |

Alphanumeric 3 characters |

|

TAXCCY |

The tax currency |

Alphanumeric 3 characters |

|

TAXAMTINTAXCCY |

The tax amount in tax currency |

Number |

|

INTERESTAMT |

The interest amount (basis amount on which the tax has been calculated) |

Number |

CRS Reporting

CRS Customer Type

Select the type of CRS customer from the drop-down list. The list displays the following values:

l Individual

l Financial Entity

l Active Non-Financial Entity

l Passive Non-Financial Entity

The system defaults ‘Individual’ as the CRS Customer Type if the customer type is selected as ‘Individual’. If the customer type is Corporate, then the system defaults Active Non-Financial Entity as CRS Customer Type. If Bank is selected as the customer type then ‘Financial Entity’ is defaulted as the CRS Customer Type.

Utility Provider

Utility Providers are the recipients of the bill payment. Typical entities involved in a bill payment transaction are the consumer, your bank and the institutions (utility providers).

Utility Provider

Check this box if the customer whose details you are maintaining happens to be a Utility Provider

Utility Provider Id

Assign a unique ID to identify the utility provider.

Check Digit Validation Required

Check this box to indicate whether the check digit validation should be performed for the consumer number that is captured while making bill payment for the utility provider.

Algorithm ID

If the check digit validation should be performed you must also identify the Algorithm ID, which is used to perform the check digit validation on the consumer number.

Utility Provider Type

Indicate the type of utility provider. The option list adjoining ‘Utility Provider Type’ displays all valid utility provider types maintained in the system. You can select the appropriate one.

Head Office

Account Number

The Head Office Account Number is the customer’s account number with the Head Office of your bank. You need to capture this value only if the Customer Type is a ‘Bank’. It is used only for reference purposes.

Debtor Category

Specify the category of the Debtor from the adjoining option list.

Risk Profile

Specify the risk profile from the adjoining option list.

Additional Fields Labels

You can specify the additional details, if any.

Tax Identification

Tax Identification Number

Specify the Tax Identification Number (TIN).

Country of Issue

Specify the country which has issued the TIN for the customer. Alternatively, you can select the country from the option list.

Additional Tax ID Details

Tax ID

Specify the tax identification number (TIN) of the customer.

Country of Issue

Select the country which has issued the TIN for the customer.

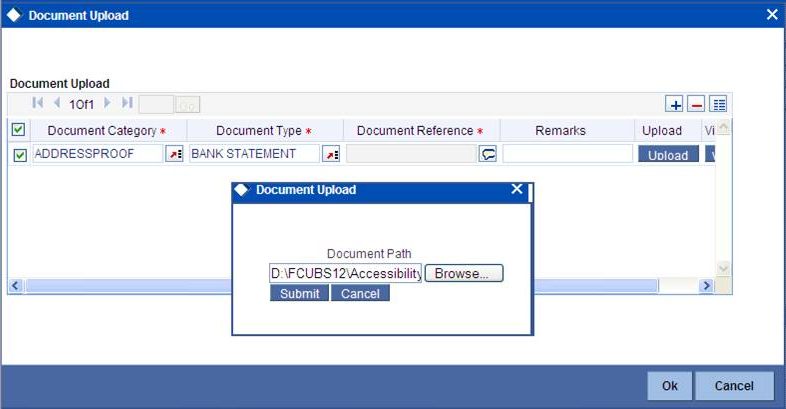

Click the ‘Checklist’ tab from the ‘Customer Maintenance’ screen to capture the details of document types that are to be maintained. Checklist is an optional tab based on the workflow of the bank. In this tab, you need to provide the following information:

Specify the following details:

Document List

Document Category

Specify the category of the document.

Document Type

Specify the document type. The adjoining option list displays all the document types that are maintained in the system. You can select the appropriate one.

Document Name

Specify the name of the document. For example, Address Proof, Identity Proof etc. This is an optional field.

Document Reference

Specify the reference number for the document. For example, if the document submitted is a passport, then you can maintain the passport number here. This is an optional field.

Date Requested

Specify the date on which the document was requested.

Expected Date

Specify the date by which the document has to be submitted.

Note

If you do not specify the expected submission date, then on save, the system calculates and defaults the expected date in this field. The system calculates this date based on the requested date + the verification time limit (in days) maintained in 'Customer Type-Wise FATCA Parameters' screen.

Actual Date

Specify the date on which the document was actually submitted.

Expiry Date

Specify the date till which the document is valid.

Note

If you do not specify the expiry date, then it will be considered to be valid till perpetuity.

Checked

Check this box to indicate that the received documents are acknowledged.

Remarks

Specify the additional information, if required.

Note

For an investment customer, at least one record needs to be mandatorily maintained.

Oracle FLEXCUBE facilitates linkage of required documents automatically during due diligence. When a customer is classified for ‘PENDING CLASSIFICATION’ in the Maintaining Customer Type-wise FATCA Parameters (STDFATCA) screen, the system automatically populates the check list for FATCA due diligence.

For more information on automatic population of check list for due diligence, refer to the section ‘Automatic Population of Check List for Due Diligence’ in this User Manual.

As part of maintaining financial details of customers, you can maintain micro-finance details of individual customers like the customer’s insurance number, poverty status, education level, whether blacklisted or not. This tab is enabled only if MFI Customer field is checked in the Personal tab.

Click the ‘MFI Details’ tab from the CIF Maintenance screen to maintain these details.

In this screen, you can capture the following details for each individual type of customer:

MFI Info

Insurance Number

Specify the insurance number of the individual customer.

Customer Type

Indicate the type of customer that you are maintaining. You can select one of the following options:

l Group

l Centre

l Individual

Group Code

The system displays the group code assigned to the customer.

Meeting Code

The system displays the meeting code maintained for the corresponding Group Code.

Account Officer

Specify a valid account officer assigned to the customer. The adjoining option list displays all valid account officers maintained in the system. You can select the appropriate one.

Note that this is an optional field. If no Account Officer is specified, the system picks up the same from the next microfinance level (Group or Center).

Blacklisted

Check this box to indicate that the customer is blacklisted. By default the system leaves it unchecked to indicate that the customer is not blacklisted.

Number of Times Blacklisted

The system displays how many times the customer has been blacklisted, if any.

Customer Info

Physically Challenged

Check this box to indicate that the customer has some physical limitations.

Poverty Status

Specify a valid financial status of the customer. The adjoining option list displays all valid poverty statuses maintained in the system. You can select the appropriate one.

Literacy of Client

Specify a valid literacy level of the client. The adjoining option list displays all valid literacy levels maintained in the system. You can select the appropriate one.

Business Activity

Specify a valid nature of work that the customer does for a living. The adjoining option list displays all valid business activities maintained in the system. You can select the appropriate one.

Business Description

The system displays a relevant description of the business corresponding to the selected Business Activity.

Training Code

The system displays the assigned training code of the customer.

Trained On

The system displays the date on which the customer is trained.

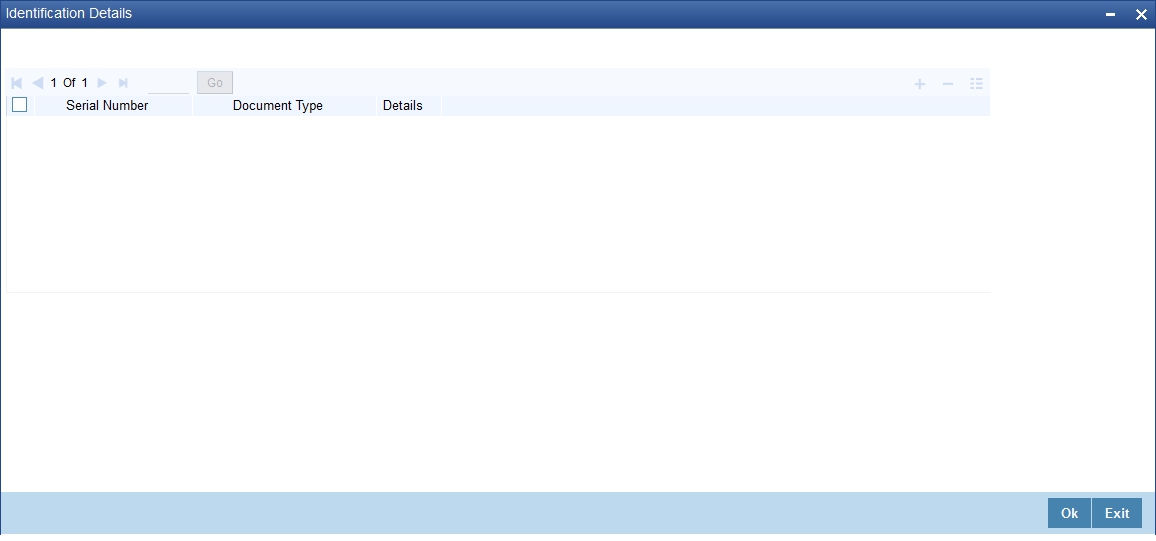

2.1.8.1 Identification Details Button

You can maintain what documents are received from the customer as part of collecting identification details using the ‘Identification Details’ screen. Click on ‘Identification Details’ button. The ‘Identification Details’ screen will be displayed.

You can capture the following details here:

l Sl No: The system displays the serial number.

l Document Type: The type of document made available by the customer for identification.

l Details

Click on ‘Details’ button. The ‘Document Type Details’ screen will be displayed.

You can specify the following details here:

Document Type

The system displays the document type based on the information you specified in ‘Customer Identification Details’ screen.

Name As Per Document

Specify the name of the customer as mentioned on the document.

Series

Specify the series of the document.

Doc Id

Specify the document ID number.

Date of Issue

Specify the date on which the document was issued to the customer.

Date of Expiry

Specify the date on which the validity of the document expires.

Issuing Authority

Specify the name of the person or agency that issued the document.

Place of Issue

Specify the place in which the document was issued.

2.1.8.2 Checklist Button

You can maintain a list of what documents have been checked using the ‘Checklist Details’ screen. Click on ‘Checklist’ button. The ‘Checklist Details’ screen will be displayed.

This screen contains a list of documents maintained using the ‘MFI Action Checklist Maintenance’ screen. If you have checked a particular document appearing under ‘Description’, check the corresponding box under ‘Checked’ to indicate that the document has been checked.

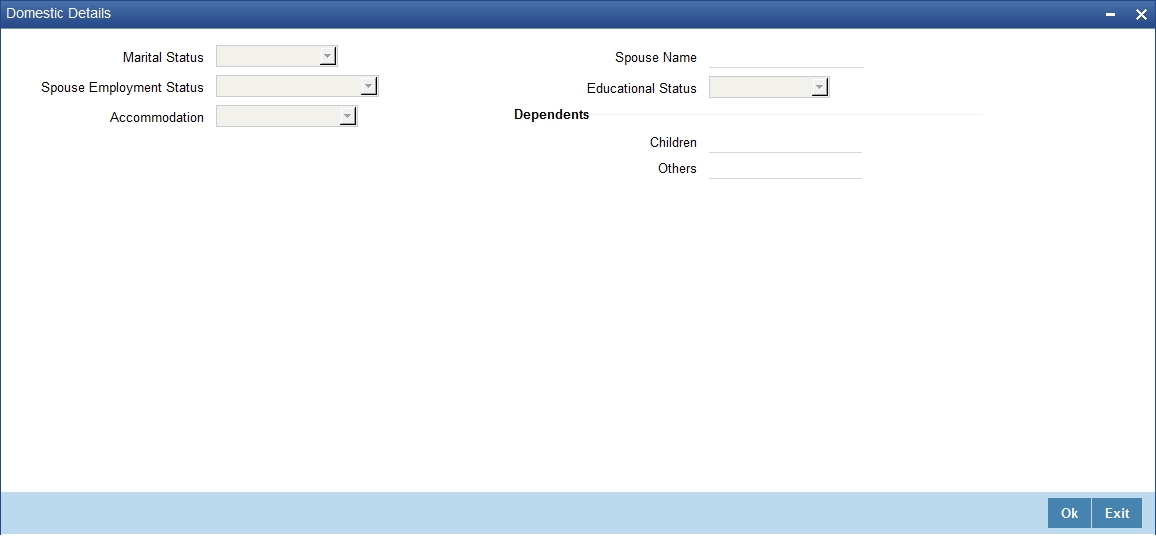

2.1.8.3 Domestic Button

As part of maintaining personal details of the customer, you can capture Domestic details about the customer like the customer’s educational status, marital status, number of dependants, etc. Click on ‘Domestic’ button. The Customer - Domestic Details screen will be displayed.

In this screen, you can capture the following details for each individual type of customer:

l The Marital status of the customer: A customer could be married, single, re-married, divorced, separated, widowed etc. You have to indicate the appropriate

l The name and employment status of the customer’s spouse

l The educational status of a customer (Under Graduate, Graduate, Post Graduate and Non-student). If the customer has received no formal education, select Non-student

l The family members (children and others) who are dependent on the customer financially. You can indicate any number between 0 and 99

l The type of accommodation this customer is availing of. The types could be classified into - own accommodation, company provided and others. Others include all types other than self-owned and company provided. You can select the appropriate option.

2.1.8.4 Professional Button

After having captured the Domestic details of the individual customer you can capture the professional details about the customer.

These details include the customer’s employment status, employer details or the annual expenses that the customer incurs and so on. Click on ‘Professional’ button. The Customer – Professional Details screen will be displayed.

You can capture the following professional details of the individual type of customer through this screen:

Employment Details

l The employment status of the customer (full time permanent, full time temporary, part-time, self-employed, retired pensioned, retired non-pensioned, unemployed.)

l The number of years the customer has been in his/her current job

l The age at which the customer is due to retire from his/her current job or business

l The designation this customer held in his/her previous job or employment

l The name of the previous employer of this customer

l The designation held by this customer in his present job

l The name, address, country, telephone, telex, fax and E-mail address of the customer’s current employer. The name, address and country of the employer should conform to SWIFT standards

Note

The ‘Current Employer’ field is used by the system to map the user to his current employer. Click the adjoining option list to display all the authorised and open employer codes maintained in the system.

Income details

l The annual returns that your customer earns through salary and other sources of employment if any. If your customer earns revenue through other source apart from a monthly, salary you have to capture the customer’s combined income from all other sources.

l The annual expenses that your customer incurs from sources other than the annual salary

l The currency in which the customer’s financial details like, annual salary, annual rent expenses, annual loan repayment, etc is expressed

Expenditure Pattern

l The customer’s annual expenditure on rent, premium on insurance

l The customer’s current annual expenditure incurred on re-payment of loans availed

l The customer’s current annual expenditure incurred on payment of expenses other than rent, insurance premium or loans

l The number of credit cards the customer has subscribed to

l The value in terms of money, of this customer’s house (in case he owns one)

The Other Details Include

l The name of your customer’s previous employer and the designation that the customer held in the previous job.

l The customer’s current designation and the full name of the customer’s employer

l The complete mailing address of your customer’s employer

l The telephone, telex, fax numbers and E-mail address of your customer’s current employer or business partner

After having captured all the relevant details, you can save the record. You will be returned to the Personal Details section of the CIF Maintenance screen.

In order to know your customer better, you may need to capture certain additional information specific to a customer. This is in addition to the regular information that you would capture in the Customer Maintenance screen. To capture more details of the customer, you can define a set of UDFs and associate them with the function id ‘STDCIF’ (for Customer Maintenance screen). After you associate the UDFs, they will appear in the Customer Maintenance screen. You can then capture the values for these UDFs.

The UDFs that are displayed in the Customer Maintenance screen depend on your selections in the ‘UDF in Base Table’ screen. A maximum of five UDFs can be made to appear in Customer Maintenance screen.

Refer the manual on ‘User Defined Fields’ for details on defining a user-defined field and associating the UDF with the function id ‘STDCIF’.

The values that you enter for the UDFs will be validated against the rules maintained for them. If the entries fail the validations, the system will display a suitable message to inform you that the entries made do not adhere to the rules maintained.

The UDFs will be displayed in the Customer Maintenance Summary screen as well. You will also be allowed to perform queries based on these fields.

2.1.9.1 Special Customer Grouping UDF

While maintaining the customer information, you can place a customer under a special customer group for different rating purposes. Through the Special_Status user defined field (UDF) you can link the customer to a group and specify the rating for the group.

Whenever a contract is booked for such a customer, the system will display an alert message specifying the status of the customer thereby you can apply the new rates specified for such customers.

The steps involved for including the SPECIAL_STATUS UDF in customer maintenance are as follows:

1. Create a new user defined field SPECIAL_STATUS

2. Link it to the Function ID STDCIF

3. Specify the value of the user defined field at the time of creating a customer

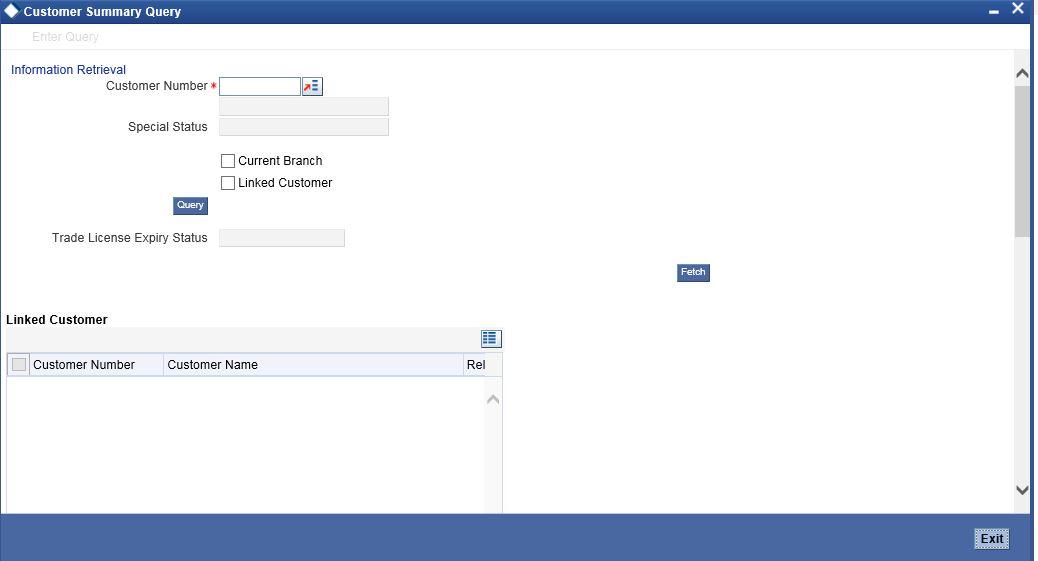

The special status is also displayed in the information retrieval screen when you do a query for such a customer. You can do the query using the ‘Customer Summary Query’ screen.

You can invoke this screen by typing ‘ACDCBIR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Note

After having captured all the required details save the CIF record. It becomes valid only after a user other than you authorizes it.

Check the ‘Linked Customer’ check box and provide the Customer Number and click ‘Query’ button to view all linked customers in Linked Customer Details. Select a customer from the details and click ‘Fetch’ button to perform a query operation on the selected customer. The displayed values are based on the query parameters provided.

2.1.10 Other Basic Customer Information

You will notice the following buttons in the Customer Maintenance screen:

|

Tab |

Description |

|---|---|

|

Group |

Through this screen you can associate the customer code with a group |

|

MIS |

Through this you can define the MIS details of a customer (for future use) |

|

Joint |

Through this you can capture details of joint customers. |

|

Standing Instructions |

Through this screen, you can view the details of all standing instructions associated with respective the customer code. |

|

Linked Entities |

Through this screen, you can link different customers to the specific customer whose details you are capturing and specify the relation shared by the two customers. For details about linked entities, refer to the section Maintaining Customer Accounts under the heading ‘Relationships for Customer’ in this user manual. |

|

Text |

Through this screen, you can store free format text, scanned images etc about the customer whose details you are capturing. You can store this information either as text documents or as plain text. |

|

Fields |

Through this you can capture user defined fields. |

|

Image |

Through this screen, you can capture the photograph of the customer whose details you are maintaining. You will be allowed to access this screen, only if you have the requisite access rights i.e., you may have rights to access the CIF screen but not view the photograph of the customer. |

|

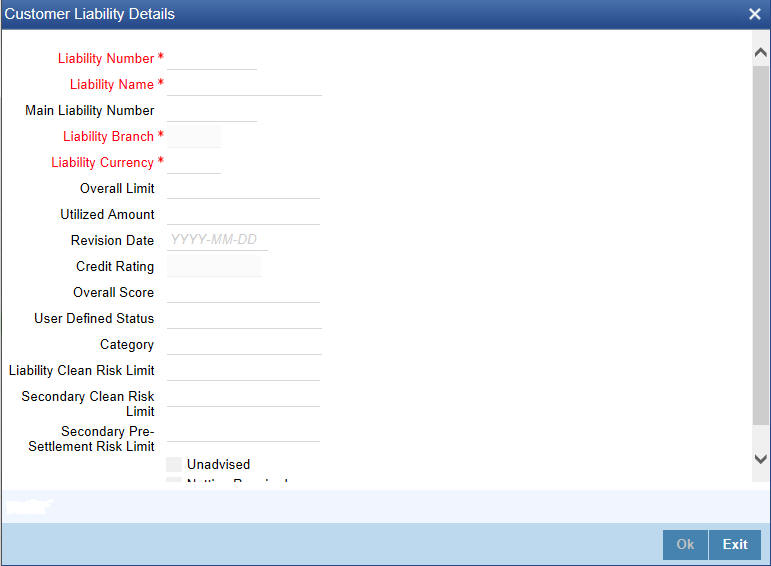

Limits |

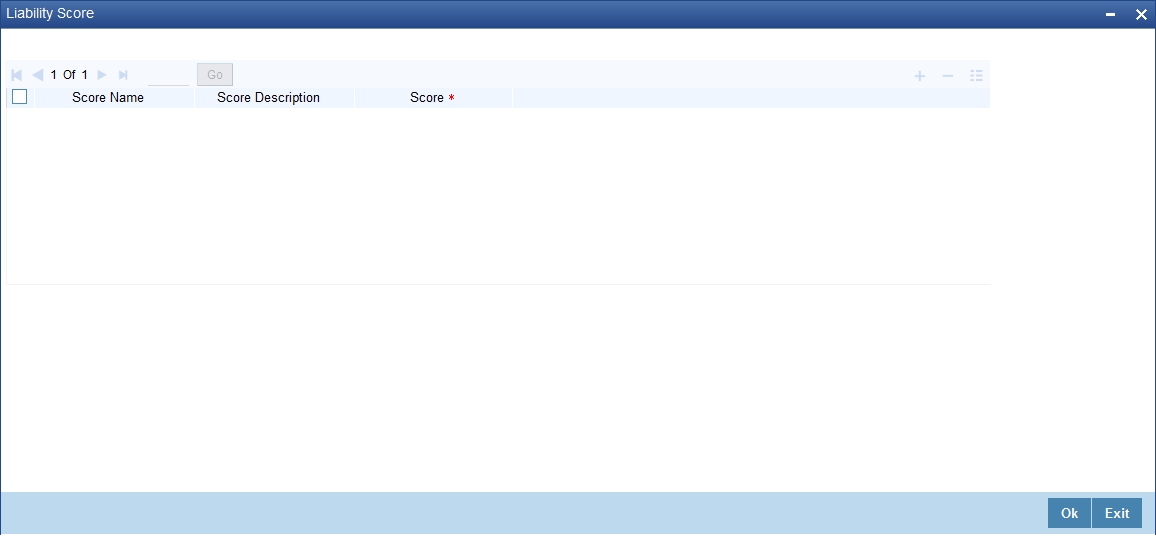

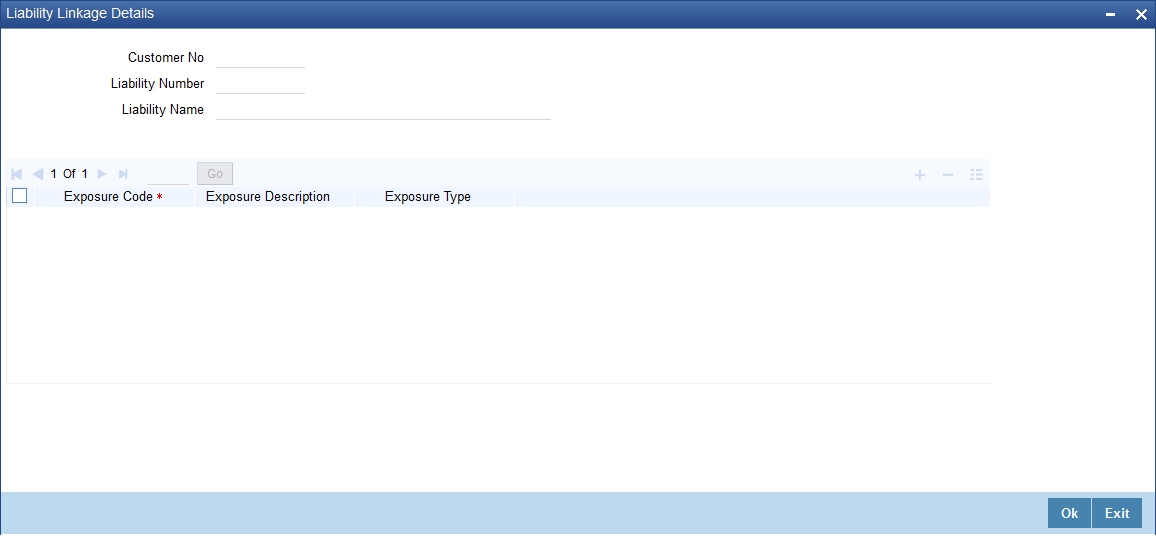

Through this button you can view/modify/add (define) the liability details of a customer, provided you have been assigned the necessary rights. This button appears enabled only if ‘Track Limits’ check box is checked in the Additional tab of Customer Maintenance (STDCIF) screen. |

|

MT920 |

Through this screen, you can specify MT920 preferences. |

|

Domestic |

Through this screen, you can capture domestic details of the customer. |

|

Professional |

Through this screen, you can capture professional details of the customer. |

|

Issuer |

In case of an issuer customer, you can capture issuer details. |

|

Cards |

Through this screen, you can view cards details of the customer. |

|

Linked Account |

This button invokes the Linked Account screen where you can view the details of linked accounts. |

|

KYC Details |

This button invokes the KYC Details screen where you can view the KYC details of the customer. |

|

Joint Venture |

Through this screen, you can maintain the joint venture details. |

|

Account Details |

This button invokes ‘The Account Details’ screen where you can maintain the account details. |

|

NSF Black list status |

You can view the NSF rejection details and customer blacklisted details in this screen. |

|

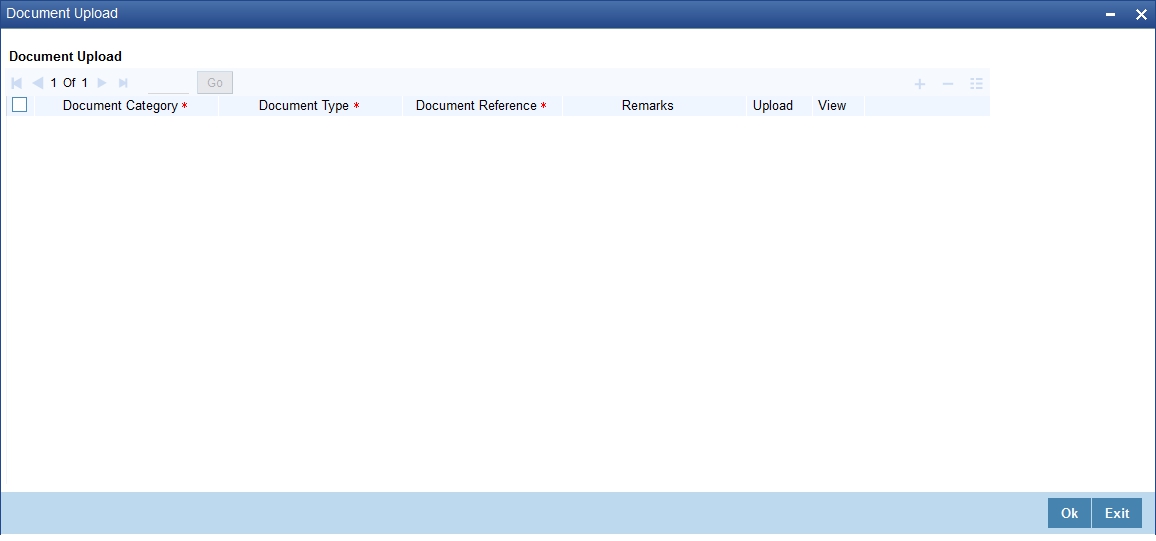

Documents |

This button invokes the Document upload screen where you can capture the customer related documents in central content management repository. |

|

Change Log |

This button invokes the Change Log screen where you can capture the audit history details for the operations performed on that customer and the account. |

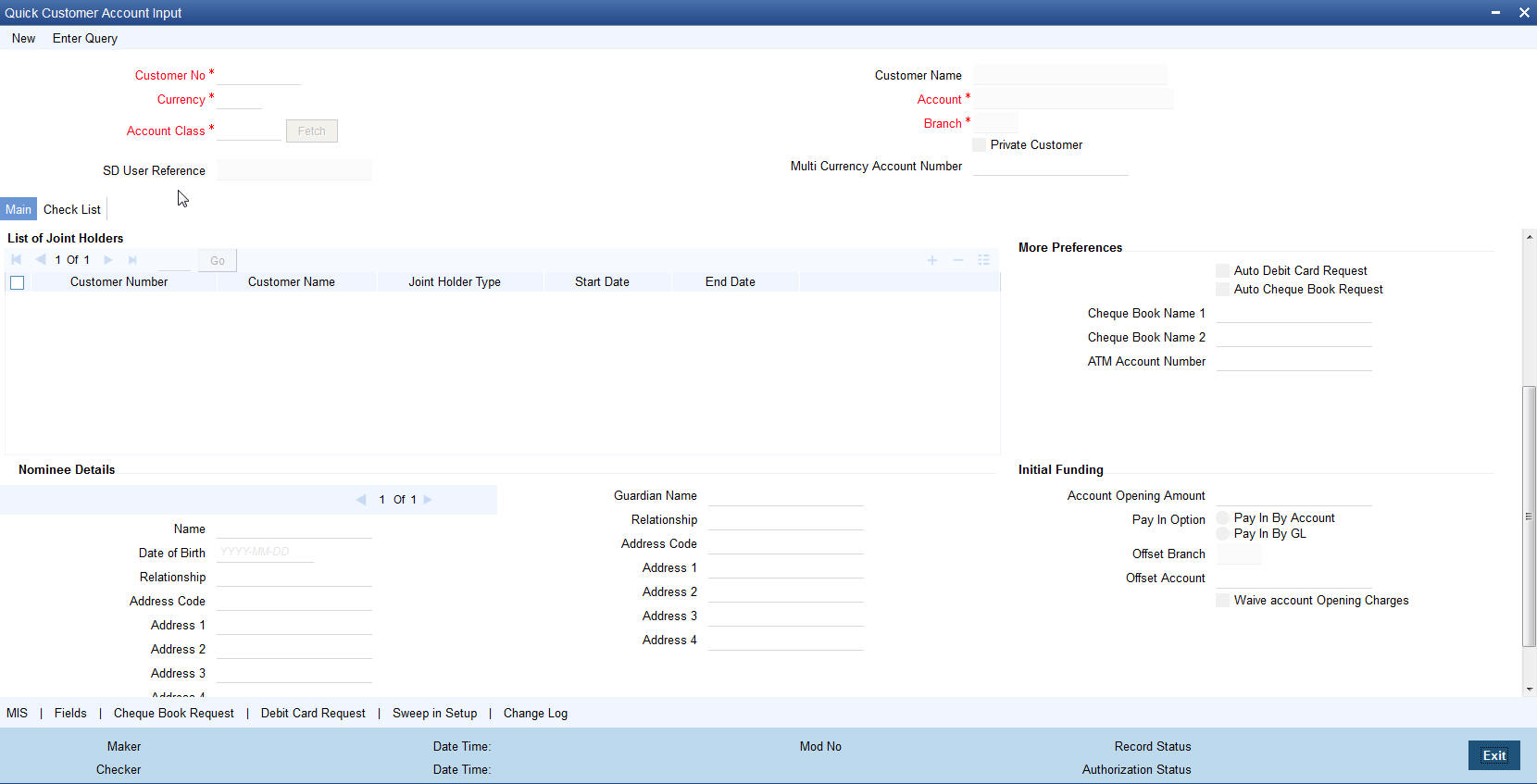

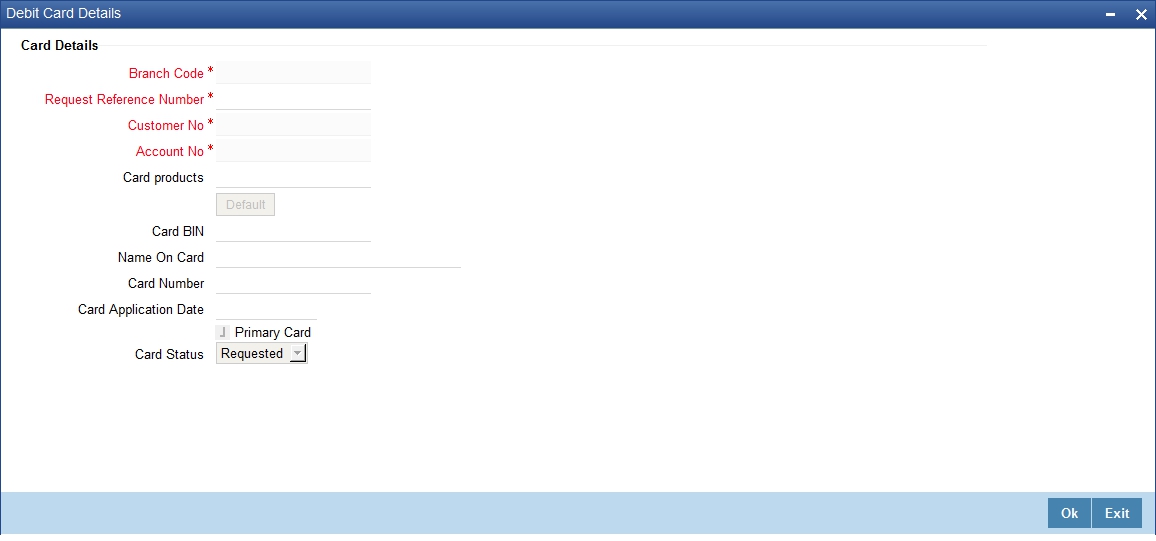

Click ‘Cards’ button to view details about debit cards issued to a customer.

Here, you can view the following details.

Branch Code

The branch code is displayed from the main ‘Customer Information Maintenance’ screen.

Customer No

The customer identification code (CIF) is displayed from the main ‘Customer Information Maintenance’ screen.

Account No

The system displays the account number against which you have maintained debit card details.

Authorisation Status

Indicate the authorisation status of the debit card by selecting one of the following values:

l Authorised

l Unauthorised

Record Status

Indicate the record status of the debit card by selecting one of the following values:

l Open

l Closed

Branch Code

The system displays the branch code where the debit card has been issued.

Request Reference Number

The system displays the request reference number of the card issuance record.

Card Number

The system displays the debit card number of the card holder.

Multiple cards can be issued to a customer.

OFAC check enables the application to call an external web service to perform black list check for customer and customer accounts and give warnings appropriately while transacting with black listed customers. You can also capture your remarks before overriding the black list warning.

Click ‘OFAC Check’ button in ‘Customer Account Creation’ screen to view the OFAC check response in the ‘External System Detail’ screen On clicking ‘OFAC Check’ button, system will build the request XML and call the web service. The ‘External System details’ screen displays the response is received from the external system; and you will be also allowed to enter your remarks in this screen. The response received will also be sent to Oracle FLEXCUBE Database layer for any further interpretations of the same.

This button can be made visible while carrying out the actual customization. Request building response interpretation in the database layer needs to be done as part of customization to enable this.

Here, you can view /capture the following details:

External System Response

The response from the external system regarding the black listed customer is displayed here.

User Remarks

Specify your remarks regarding the black listed customer here.

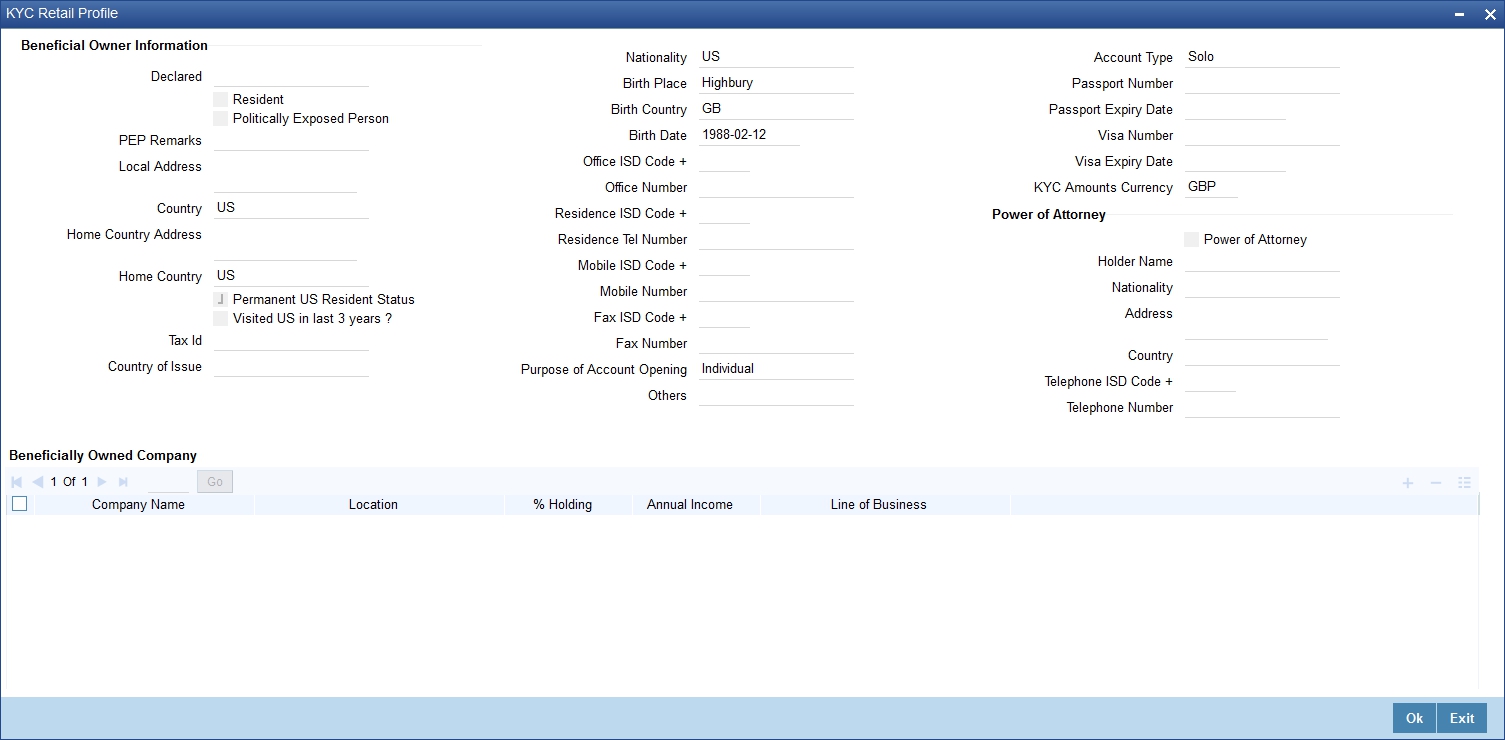

KYC refers to know your customer. You can view the KYC details maintained for a customer on ‘KYC Maintenance’ screen. Click ‘KYC Details’ button to invoke the screen

Alternatively, you can invoke this screen by typing 'STDKYCMN' in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The system displays the following details:

l KYC reference number

l Full name of the customer

l Type of customer

l Risk level of the customer

l Type of CRS customer (Individual, Financial Entity, Active Non-Financial Entity, and Passive Non-Financial Entity)

The system defaults ‘Individual’ as the CRS Customer Type if the customer type is selected as ‘Individual’. If the customer type is Corporate, then the system defaults Active Non-Financial Entity as CRS Customer Type. If Bank is selected as the customer type then ‘Financial Entity’ is defaulted as the CRS Customer Type.

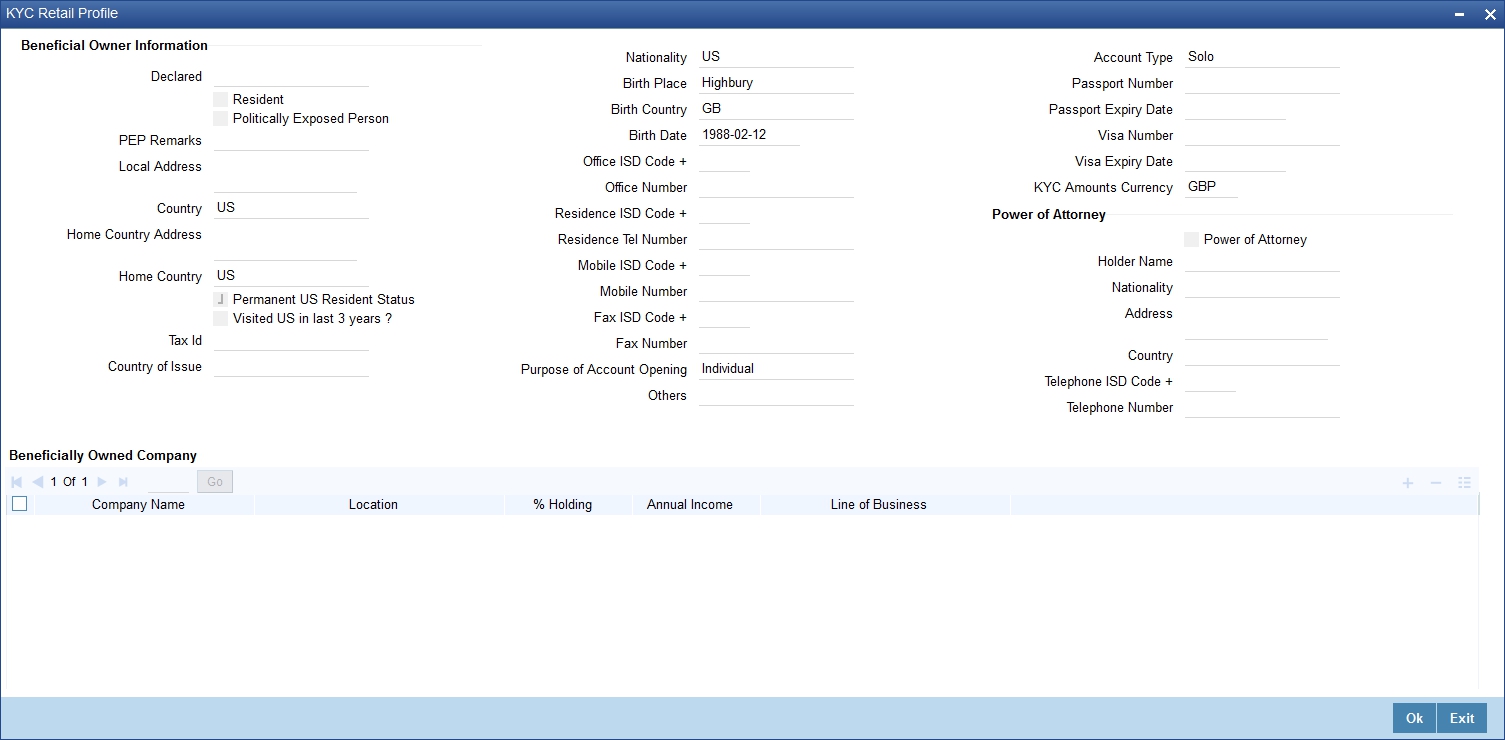

2.1.13.1 Retail Customer Tab

You can view the KYC profile details for retail customers on ‘KYC Retail Profile’ screen. Click ‘Retail Customer’ tab in the ‘KYC Maintenance’ screen.

The system displays the following details of the retail customer:

Beneficial Owner Information

l Whether the beneficial owner is declared as a resident

l Whether the beneficial owner is declared as politically exposed person

l Remarks on the politically exposed person

l Local address of the beneficial owner

l Country code of the beneficial owner

l Home country address of the beneficial owner

l Home country of the beneficial owner

l Whether the beneficial owner has a valid US residence status

l Whether the beneficial owner has visited US in the last three years

l Tax identification number (TIN) of the beneficial owner

l Country which has issued TIN for the beneficial owner

l Nationality of the beneficial owner

l Place of birth of the beneficial owner

l Birth country of the beneficial owner. It is mandatory to maintain birth country if the FATCA is enabled for the bank.

l Birth date of the beneficial owner

l International dialling code for the office telephone number

l Telephone number of the beneficial owner’s office

l International dialling code for the residential telephone number

l Residential telephone number of the beneficial owner

l International dialling code for the mobile number

l Mobile phone number of the beneficial owner

l International dialling code for the fax number

l Fax number of the beneficial owner

Note

If the FATCA is enabled for the bank, and any of the Office number, Residential telephone number, Mobile number or Fax number is maintained, then it is mandatory to maintain the corresponding ISD code as well.

l Purpose of opening the account

l Other details

l Type of account

l Whether power of attorney is given to beneficial owner

l Passport number of beneficial owner

l Expiry date of the passport

l Visa number of the beneficial owner

l Expiry date of visa

l Currency in which KYC amount is maintained

Power of Attorney

l Whether the customer account is to be operated by the power of attorney holder

l The person who has been given the power of attorney

l Nationality of the power of attorney holder

l Address of the power of attorney holder

l Country of the power of attorney holder

l International dialling code for the telephone number

l Telephone number of the power of attorney holder

Note

If the FATCA is enabled at the bank and the check box 'Power of Attorney' is checked here, then it is mandatory to specify the Power of Attorney information.

Beneficially Owned Company Details

l Name of the company

l Location of the company

l Percentage of the holding

l Annual income of the company

l Line of business of the company

Source of Income

l Whether salary is a source of income

l Whether rental is a source of income

l Whether investment is a source of income

l Whether business concern is a source of income

l Whether professional business is a source of income

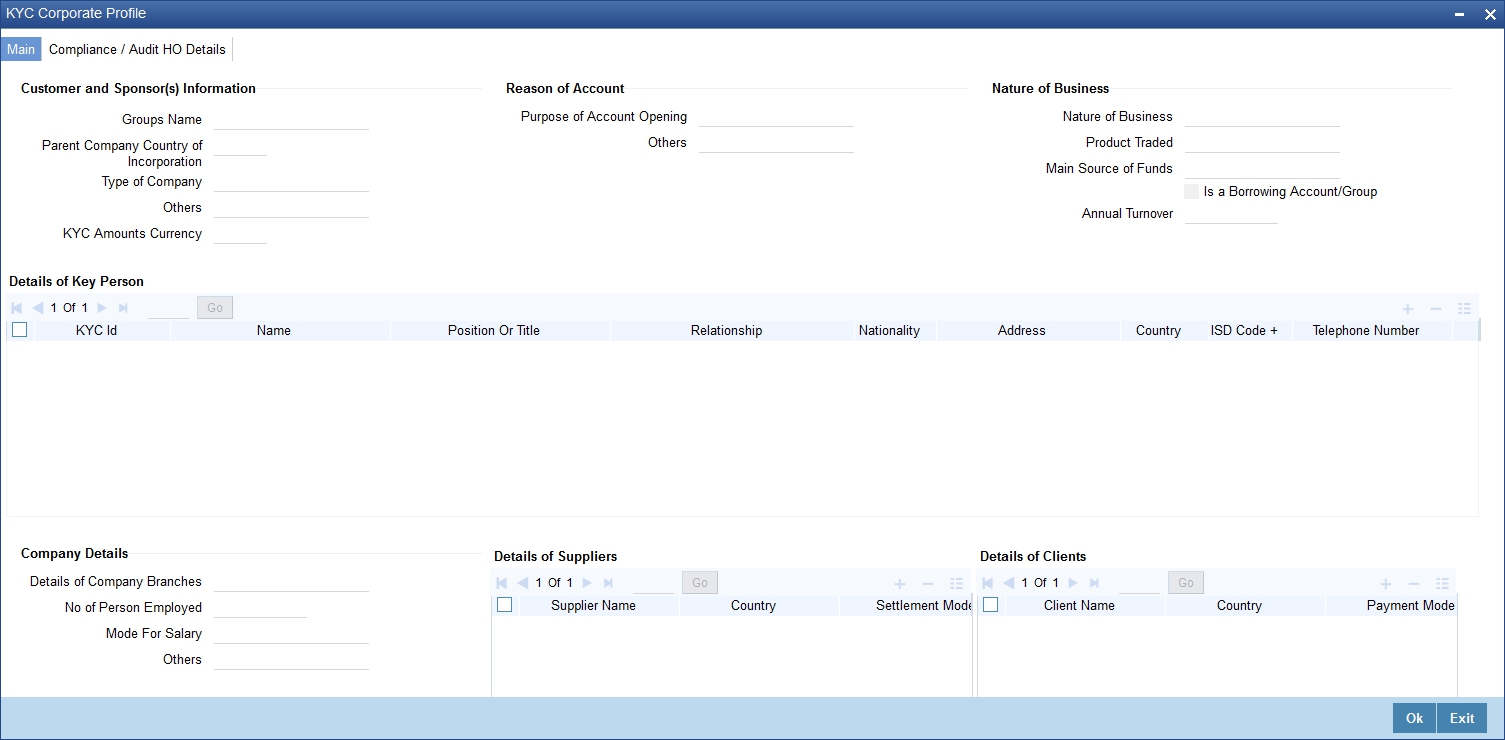

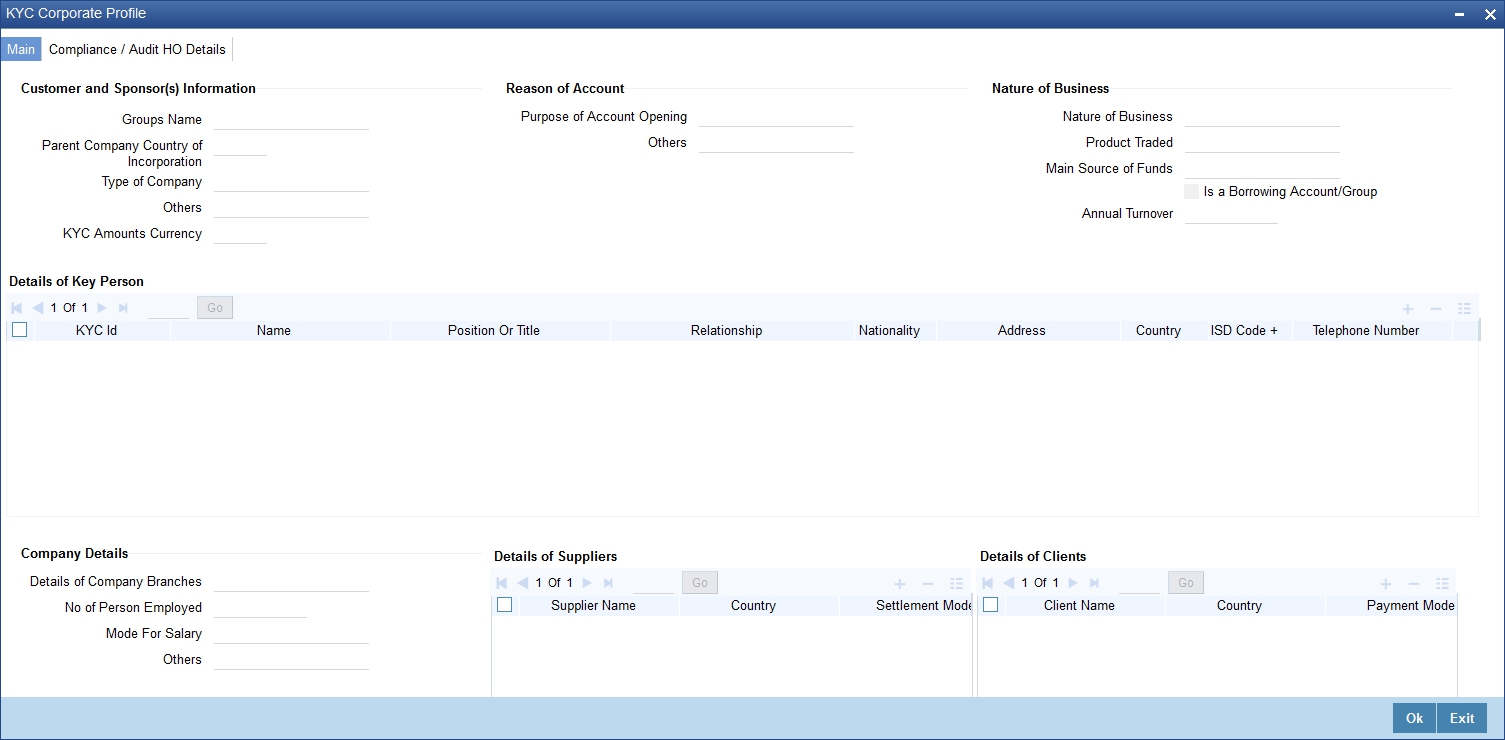

2.1.13.2 Corporate Customer Tab

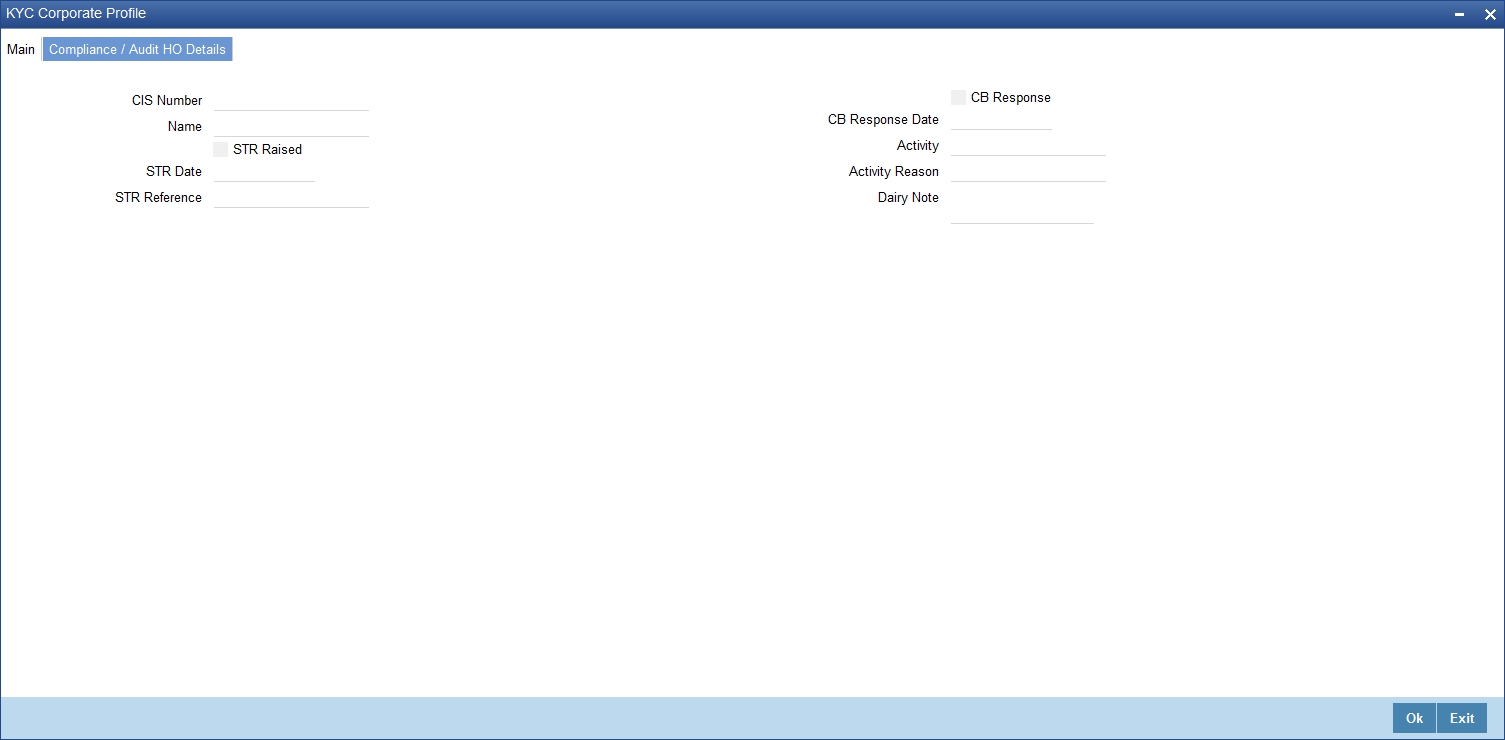

‘KYC Corporate Profile’ screen gives an account of the KYC profile details for corporate customers. Click ‘Corporate Customer’ tab in the ‘KYC Maintenance’ screen. The system displays ‘KYC Corporate Profile’ screen.

The screen is as shown below:

The system displays the following details:

Customer and Sponsors Information

l Name of the group

l Country of Parents Company

l Type of the company

l Other details

l Currency in which KYC amount is maintained

Reason of Account

l Reason for opening an account

l Other details

Specifying Nature of Business

l Nature of business

l Name and details of the product traded in the business

l Main source of funds

l Borrowing account group

l Annual turnover of the company

Details of Key Person

l Unique identification for the KYC

l Name of the key person

l Position or title of the key person

l Relation ship of the key person with the corporate customer

l Nationality of the key person

l Address of the key person

l Country of the key person

l International dialling code of the key person

l Telephone number of the key person

l Birth place of the key person

l Birth country of the key person

l Date of birth of the key person

l Ownership type of the key person

l Tax Identification Number (TIN) of the key person

l Country which has issued the TIN for the key person

l Percentage of share for the key person

Specifying Company Details

l Details of the company branches

l Number of person employed in the company

l Mode of salary in the company

l Other details

Specifying Details of Suppliers

l Name of the supplier

l Country of the supplier

l Mode of settlement

Specifying Details of Clients

l Name of the client

l Name of the country of the client

l Mode of payment

Specifying Transaction Types

l Type of transaction

l Count of the transaction

l Total amount of the transaction

l Maximum single amount for the transaction

l Purpose of the transaction

l Country of the transaction

l Purpose of fund transfer within a country

l Audit date

l Whether account should be solicited

l Date on which the account is solicited

l Details of the introducer

l Date of compliance clearance

l Date of business approval

l Trade licence number

l Next date of KYC review

Specifying Comments

l KYC comment about the corporate customer

l Comments on the corporate customer by the sales and service officers

l Name and comments of the approvers on the corporate customers

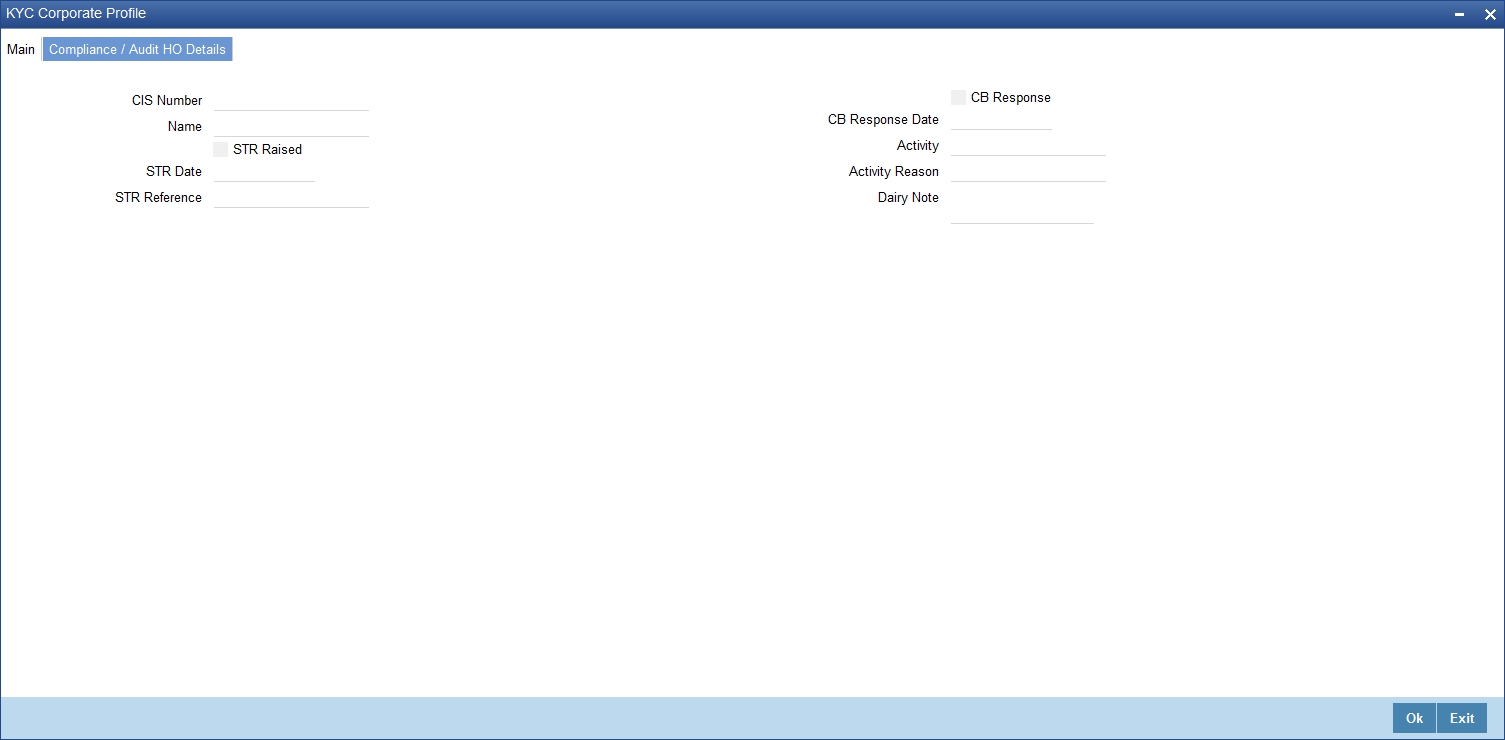

2.1.13.3 Corporate/Audit HO Details Tab

Click ‘Corporate/ Audit HO Details’ tab in the ‘KYC Corporate Profile’ screen.

The system displays the following details:

l Number of the corporate customer

l Name of the corporate customer

l Whether STR should be raised

l Date of STR using adjoining calendar

l Reference number of the STR

l Whether the CB should be responded

l Date of the CB Response

l Details of the activity

l Reason for the activity

l Dairy note

2.1.13.4 Corporate Customer Tab

‘KYC Financial Profile’ screen displays KYC profile details for financial customer. Click ‘Corporate Customer’ tab in the ‘KYC Maintenance’ screen.

The system displays the following details:

l Address of the bank

l Country of the financial customer

l Currency of the KYC amounts

Transaction Products

l Name of the transaction product

l Rating of the product

l Number of monthly transactions

l Monthly amount

Management Details

l Name of the manager

l Designation

Share Holders Details

l Name of the share holder

l Holding of the share holder

l Address of the share holder

l City of the share holder

l Country of the share holder

2.1.13.5 Fields Button

‘User Defined Fields’ screen displays the all UDFs defined using KYC Maintenance screen. You can invoke this screen by clicking ‘Fields’ button in the ‘KYC Maintenance’ screen.

The system displays the following details:

l Name of the user defined field

l Value of the user defined field

You can maintain the joint venture details for a customer on ‘Joint Venture Details’ screen. Click ‘Joint Venture’ button to invoke the screen.

The screen is as shown below:

Party ID

Specify the party ID.

Party Name

The system displays the party name.

Ratio

Specify the ratio between the participants on share.

2.1.15 NSF Blacklist Status Button

Click Blacklist Status to invoke this screen. Blacklist status of the customer is displayed in this screen.

Internal Bank – NSF Details

NSF Level

The system displays the NSF level of the customer. (SP1, SP2, SP3 or SP3A)

Effective Date

The system displays the effective date on which the NSF level is set based on the Expiry period NSF (month) defined at STDNSMNT-NSF level maintenance.

Expiry Date

The system displays the expiry date of the NSF Level based on the Expiry period NSF (month) defined at STDNSMNT-NSF level maintenance.

IB Blacklisted Status

The system displays the active blacklist status of the customer. This is displayed only when Customer cheque is rejected in Internal Bank and is black listed through inward clearing due to NSF (Non Sufficient Fund).

Description

Description for the active blacklist status is defaulted here.

Effective Date

The system displays the effective date on which the Customer is Internal Bank black listed due to NSF based on the Expiry period NSF(month) defined at STDNSMNT-NSF level maintenance.

Expiry Date

The system displays the expiry date from which the Customer is internal Bank black listed due to NSF based on the Expiry period NSF(month) defined at STDNSMNT-NSF level maintenance.

Central Bank – NSF Details

CB Blacklisted Status

The system defaults the blacklisted status of customer which has been shared by Central bank.

Description

Description for the blacklist status is defaulted here.

Effective Date

The system displays the effective date on which Central bank has sent the File and processed for the marking CB black listed for Customer.

Expiry Date

The system displays the expiry date of the NSF CB status which is available in CB File.

Web Branch NSF Details

Counter Cheque Status

The system displays the active blacklist status of the customer whose cheque is rejected over the counter.

Description

Description for the blacklist status is defaulted here.