20. Maintain and Process Corporate Actions

In the Securities module of Oracle Banking Treasury Management, defining the corporate action is a part of the maintenance function. The processing of corporate action events is done as part of the End of Cycle process. The following are the corporate action events that can take place.

•Settlements (Money as well as Security settlements).

•Bonds

•Interest coupon payment

•Redemption (both series and quantity)

•Maturities

•Calls

•End of Trading

•Warrants (detachment, tradable)

•Equities

•Dividend payment (both cash and stock)

•Bonus

•Rights (Tear-Off, Exercise, Expiry)

This section contains following sub-topics:

1)Process Corporate Action Event Stages

5)Rights and Warrants Expiry Details

8)Process of Amendment on Redemption Schedules

11)Process Interest Rate Revision Details

12)Maintain Stock Dividend Details

14)Process Bonus to Cash Conversion Details

15)Process Bonus to Cash Conversions

16)Process Corporate Action Events

20.2 Process Corporate Action Event Stages

The three stages are

•Corporate action initiation

•Corporate action collection

•Corporate action liquidation

Table 20.1: Corporate Action Events

|

Term |

Definition |

|---|---|

|

Corporate action Initiation |

At the time of defining new security, you can indicate whether corporate actions have to be auto-initiated. A check box is available where you can make this specification. If you leave this box unchecked, then you will have to manually initiate the action. |

|

Corporate action Collection |

Corporate action collection can be manual or automatic. This specification is done for every security at the time of defining SK locations. When the corporate action collection, for a particular security, is indicated as automatic then, the Beginning of Day programs will pick up all the corporate actions due and trigger the event. You have to trigger the event manually if the automatic process is not indicated. It is important to note that the collection event is triggered only after the initiation event is complete. |

|

Corporate action Liquidation |

Securities can be liquidated automatically or manually. Deals specified, as having an automatic mode of liquidation, will be automatically liquidated on Event Date, during the Beginning of Day processing. Automatic or manual Liquidation of corporate actions is specified at the portfolio definition level. If you specify that corporate actions have to be liquidated automatically, then the appropriate liquidation event for the corporate action is triggered. In the case of manual liquidation of corporate actions, only those actions, which have undergone the tear-off event, will be eligible for liquidation. If more than one event is due for liquidation, for the same security, then you have to trigger each event one after the other. |

|

Please remember |

Liquidation for a corporate event is done automatically, only if you check the Auto liquidate Corporate Events field, in the Portfolio Definition screen. If for a portfolio you have unchecked the auto liquidate option, then the liquidation event is liquidated manually. If the automatic disbursement fails, then the event will be identified for processing in the next Event Selection program. The same program can, however, be forced liquidated through manual disbursement. |

This topic contains the following sub-topics:

2)Indicating Rights Ratio and Rounding Fractions

20.3.1 Process Rights and Warrants

This topic describes the systematic instructions to process rights and warrants.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

Context:

As part of the maintenance function in Oracle Banking Treasury Management, you need to maintain basic details of Rights and Warrants, as and when they are issued. Rights and warrants can be defined through the Securities Rights and Warrants Corporate Action maintenance screen. The details that you maintain here relate to the ratio at which rights and warrants are issued, the resultant security id, the resultant ratio, the exercise start, and end date, etc.

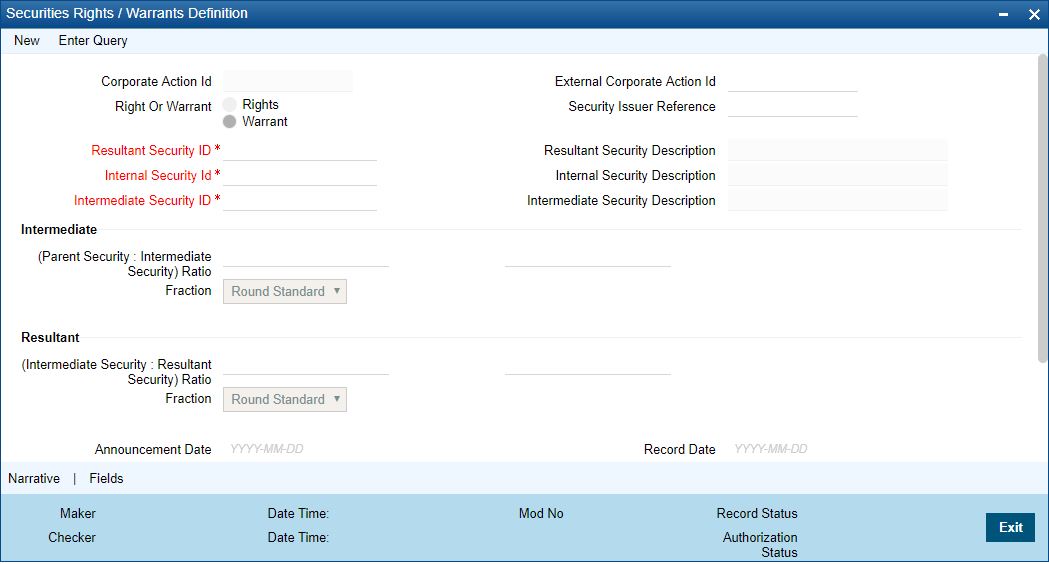

1.On Homescreen, specify SEDXRWDF in the text box, and click next arrow.

Step Result: Securities Rights/Warrants Definition screen is displayed.

Figure 20.1: Securities Rights/Warrants Definition

2.On Securities Rights/Warrants screen, specify the fields.

If you are defining details of a new right or warrant, click on a new icon from the toolbar. The Rights and Warrants Corporate Action maintenance detailed screen will be displayed without any details. If you are calling a record that has already been created, click on the Summary view. The details of existing records will be displayed in a tabular form. Highlight the record you wish to view and double click on it. You can specify whether you are maintaining details for Rights or Warrants by clicking on the appropriate button.

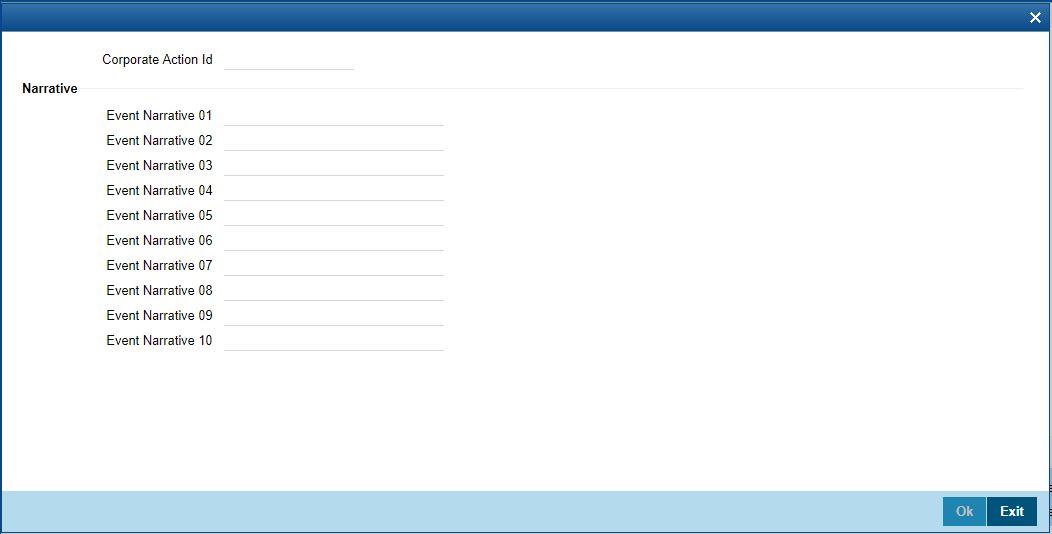

3.On Security Rights/Warranty Definition screen, click Narrative

Step Result: Security Rights/Narrative Definition screen is displayed.

Figure 20.2: Security Rights/Narrative Definition

You have the option of entering a free format narrative for the rights/warrants event or leaving this screen blank. If you choose to define a narrative, it will be associated with the security of rights/warrants type, for which you have defined the event. You can also choose to leave this field blank.

20.4 Indicating Rights Ratio and Rounding Fractions

Indicate the ratio at which rights are issued. Usually, rights are issued in proportion to the percentage of ownership. This is to ensure that current owners maintain their percentage of ownership if additional shares of the same class are issued. The simplest method to achieve this is to issue, one right per unit of security owned. For instance, an owner of 100 units of security will get 100 rights. This, however, might not be the case always; hence you need to specify the rounding fraction. The rounding fraction indicates how the fractional entitlements in the parent security is handled. The options that you can indicate are as follows:

Table 20.2: Options

|

Options |

Description |

|---|---|

|

Retain |

If you choose this option, then the fractional units will be retained. |

|

Round Up |

The entitlement will be rounded up, to the next full unit. |

|

Round Down |

The entitlement will be rounded down, to the previous full unit. |

|

Round standard |

The entitlement will be rounded up to the next full unit if the fraction is greater than 0.5, else it will be rounded down to the previous full unit. |

For example, rights are declared in the ratio of 10: 1 for the parent security. Parent security has 125 units. This means that for every ten units of intermediate security owned one intermediary security right will be issued. The entitlement is computed as follows:

Ratio: 10: 1

Rights Shares of Intermediate Security

125 x 1/10=12.5

If you choose

Table 20.3: Options

|

Options |

Description |

|---|---|

|

Round Up |

12.5 will be rounded up as 13 |

|

Round Down |

12.5 will be rounded down as 12 |

|

Round Standard |

In this case, since the fraction is greater than 0.5, the entitlement will be rounded up to 13. |

You can also choose to retain the fractional unit as 12.5. The ratio and rounding standard for the Resultant security is computed in the same manner as the Parent to Intermediate security ratio.

•note: The ratio and rounding fraction calculation basis is the same for rights as well as warrants. Click on the appropriate button, Rights or Warrants, before entering details to indicate whether you are maintaining details for rights or warrants.

•The Intermediate Security Id LOV fetches only those securities which are created with Security Type as ‘Right’/’Warrant’ and the Tear off / Issue date for such security is greater than the Current System.

•Exercise End Date must be less than the Expiry Date of Intermediate Security.

20.5 Save Rights/Warrants Record

After you have defined the mandatory attributes for a right/warrant, click Save in the toolbar or choose Save from the Actions menu to save the record. A message prompting you to confirm the saving of the record is displayed. The Event date defaults with the Issue/ Tear-off Date as maintained at the Instrument Definition of the respective Right/Warrant Security when you save the record.

Click ‘Exit’ to exit the Rights/Warrants Definition screen. You will be returned to the

Application Browser

note: Entry to certain fields in the Rights/Warrants definition screen is mandatory. If you try to save the record without inputs to all mandatory fields, the record will not be saved. You will be prompted to give all the mandatory inputs before attempting to save it again.

20.6 Process Rights and Warrants

Remember that only those securities marked with auto initiation will be picked up for processing. Both with Rights as well as with Warrants the initiation, collection and liquidation happen together. The quantity of rights/warrants due for a portfolio is determined by the opening position/ holdings as of the record date. The rights/warrants events table is populated on the record date and is available for maintenance, as well as for viewing details of existing events. You are allowed to insert after the record date, those deals that were settled earlier to this date. As and when you insert back dated deals, the opening balance of rights/warrants due as of the record date is altered. This change will be reflected every day at EOD.

The record date is picked up and defaulted as the processing date. If required, you can change the processing date. Although the processing date can be changed, no change can be done to an existing record, as of the event date.

Processing for rights takes place for three events:

•Rights Tear–off

•Rights Exercise

•Rights Expiry

Each of the above is processed in stages. Initiation, Collection, and Liquidation, depending on the stage that is applicable to the event being processed. For instance, there is no collection involved in the case of tear-off events. If the automatic processing of events fails due to some then the same events can be force run manually.

This topic contains following sub-topics:

The Events table is as of the record date and is updated when backdated deals are inserted. On the initiation processing date, a holding in the rights security is created for the portfolio. This process is automatically for all equities marked for auto initiation of corporate actions. For equities marked for manual corporate action the initiation event has to be invoked manually, for holdings to be created. Positions and holdings for Rights are updated to reflect the latest, once the event is completed.

If you associate security of rights type, with an exercise type of product in the deal input screen the exercise event is carried out for the security involving the product. You have to indicate the number of rights to be exercised along with the SK location and the SK account where the rights are lodged. You can view details of the quantity of the resultant security, along with other details such as the exercise price. In case there are charges, the charge details will also be displayed. Depending on the number of rights exercised, the holdings in the rights security will go down and the holdings in the resultant security will go up. For the event Rights Exercise Collection for a long position (RELC), only those events with the collection date less than or equal to today and for which collection has not already been made will be selected for processing.

Once the collection is complete the Rights Exercise Initiation for a long position (RELT), is triggered. The Rights Exercise event processes those events that have not yet been initiated, despite having the initiation date of today or less than today. After the rights initiation event is through the Rights Exercise Disbursement for long periods (RELL) event is triggered. In the case of auto liquidation, the system liquidates only those events which are yet to be disbursed with the disbursement date being less than or equal to today. Positions are updated once the disbursement event is complete.

On the initiation processing date, a holding in the warrant's security is created for the portfolio. This process is automatic for all equities, marked for auto initiation of corporate actions. In case of equities marked for manual corporate action, the initiation event has to be invoked manually, for the holdings to be created.

Security of warrants type is associated with an exercise type of product then at the time of deal input, the exercise event is carried out for the security, involving the product. You have to indicate the number of warrants to be exercised along with the SK location and the SK account where the warrants are held. The details of the quantity of the resultant security can be viewed along with other details such as the exercise price. In case there are charges, the charge details will also be displayed. Depending on the quantity of warrants exercised, the holdings in the warrants security will go down and the holdings in the resultant security will go up. The Warrants Exercise Collection for long position (WELC) will pick up those events for which the collection is not yet done. This is however, done only for events with collection date less than or equal to today's date. After the collection, the Events table is updated to indicate that the collection is complete, for the event. After WELC, the Warrants Exercise Disbursement for long positions (WELL) is triggered. Those events with the disbursement date, less than or equal to today will be picked up for liquidation. Once the disbursement is complete, the Events table is updated to indicate that liquidation is complete for the event.

20.8 Rights and Warrants Expiry Details

This topic contains following sub-topics:

1)Process Rights and Warrants Expiry Details

4)Rights and Warrants Expiry Details

Process Rights and Warrants Expiry Details

This topic provides the systematic instruction to process rights and warrants expiry details.

Context:

The Rights and Warrants Expiry definition screen, allows the capture of some additional details of an expiry event, for a security of rights / warrants type.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

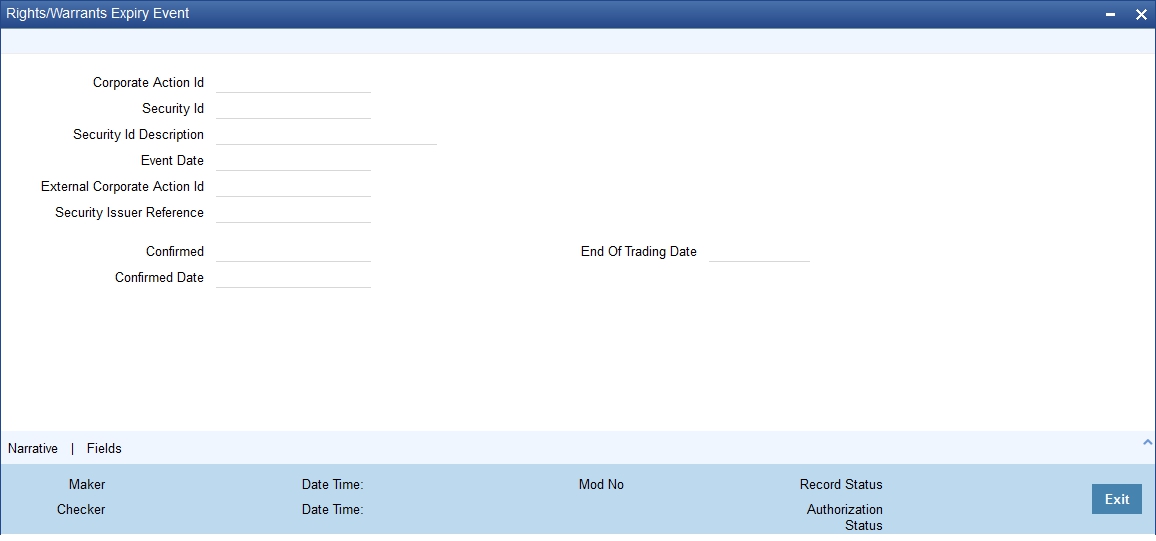

1.On Homescreen, specify SEDXEXPD in the text box, and click next arrow.

Step Result: Rights/Warrants Expiry Event screen is displayed.

Figure 20.3: Rights/Warrants Expiry Event

2.On Rights/Warrants Expiry Event screen, specify the fields.

If you are calling a record that has already been created, click on the Summary view. The details of existing records will be displayed in a tabular form. To open a record, double click on it.

You can amend the details of an existing rights/warrants type of security by clicking on the unlock icon in the toolbar or by choosing Unlock from the Actions Menu.

note: Please remember that you can change the details of an existing rights/warrants type of security only if it is not yet authorized. Once a record is authorized and confirmed it will be processed as of the event date.

Table 20.4: Rights/Warrants Expiry Event - Field Description

|

Field |

Description |

|---|---|

|

Specifying End of Trading Date |

The event date or the date on which holdings in the security would expire is picked up from the Security Definition screen. You are only allowed to indicate the date on which, the trading in the rights/warrants security, is to be suspended. You can indicate that trading is to be suspended on the security, on either the event date or a few days before the event date. For instance, if the Event date is 31 March 2000, you can specify the same end of the trading date or specify 28 March 2000 as the date on which, trading in the security is to be suspended. |

|

Event Narrative |

To define an event narrative, to be used while generating SWIFT messages, click the ‘Narrative’ button. The event narrative screen is displayed. To exit from the screen without saving the text, click the ‘Exit’ button. |

|

Processing a Rights Expiry Event |

For the rights expiry event, holdings in the rights security are depleted for the relevant portfolios, as of the event date. The event is triggered automatically if specified to do so. Otherwise, it will have to trigger manually. Only those events, with an expiry date less than or equal to today, are selected for processing. Rights expiry consists of two separate events: •Rights expiry initiation (selects the event to be processed) •Rights expiry disbursement (selects the event to be liquidated from The event, Rights Expiry Initiation for a long position (RXLT), is triggered for those events, which have an initiation date less than or equal to today but have not yet been initiated. After RXLT is through, the event Rights Expiry Disbursement for long position (RXLL) event is triggered. Only those events with the disbursement date less than or equal to today and for which liquidation has not already been done will be processed. Positions and holdings are updated for rights once the event is completed. |

|

Processing a Warrants Expiry Event |

n the event date, holdings in the warrant's security are depleted for the relevant portfolios. The event is triggered automatically if you have specified so otherwise, it will have to be triggered manually. The Events table is scanned when the Warrants Expiry Initiation for long position (WXLT) event is triggered. Only those events with initiation dates less than or equal to today’s date are picked up The Events table is updated after the completion of the event. After WXLT, the Warrants Expiry disbursement or liquidation for a long position (WXLL) is triggered for those events, which are not yet liquidated but have disbursement dates less than or equal to today. After liquidation, the events table is updated to indicate that disbursement for the event is complete. Positions and holdings for warrants are updated. |

20.9 Security Redemption Details

This topic contains the following sub-topic:

1)Process Security Redemption Details

20.10 Process Security Redemption Details

This topic describes the systematic instructions to process security redemption details

Context:

One of the methods of retiring a bond is to redeem it. The Securities Corporate Action Event Maintenance - Redemption screen, allows us to define, and maintain details of redeemable securities.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

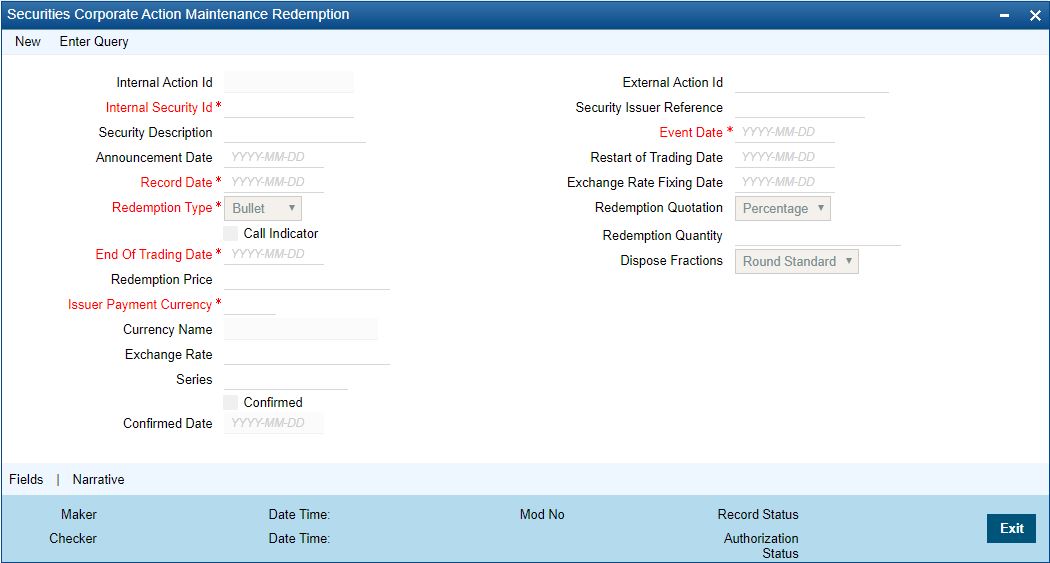

1.On Homescreen, specify SEDXREDF in the text box, and click next arrow.

Step Result: Securities Corporate Action Maintenance Redemption screen is displayed.

Figure 20.4: Securities Corporate Action Maintenance Redemption

2.On Securities Corporate Action Maintenance Redemption screen, specify the fields.

If you are defining details of new redeemable security, click new icon from the toolbar. The Corporate Action Maintenance Redemption detailed screen will be displayed, without any details. If you are calling a redeemable security record that has already been created, click on the Summary view. The details of existing records will be displayed in a tabular form. From the Summary, the screen chooses an existing record to open it.

Table 20.5: Securities Corporate Action Maintenance Redemption

|

Field |

Description |

|---|---|

|

Redemption Type |

The Redemption type for security will default as defined at the Security Instrument. While defining redeemable securities you can specify the method in which the security is to be redeemed. You can indicate whether the redemption type is to be Bullet, Quantity or Series. In a bullet type of redemption, all the holdings in the security will be redeemed on maturity. For quantity redemption, the nominal held in the security is redeemed by a specific percentage on a date different from the maturity date. While redeeming the security either the face value of the security or the number of units held in the security will be reduced by the percentage you specify. In a series type of redemption, the holdings in the specified security pertaining to the specified list will be redeemed on a date other than the maturity date. |

|

Specifying Redemption Schedules |

For securities that are redeemable on call and with redemption type Quantity, you can choose to redeem a specific amount of the face value by entering the requisite percentage/ factor or cash flow amount in the ‘Redemption Quantity’ field. In the case of quantity redemption, the nominal value held in security is redeemed by a specific percentage on a date different from the maturity date. The face value of the security is reduced by the percentage you specify. The total number of units held in the security remains unchanged. For example, if you are holding 10 units of security of face value 1000 USD, then, after a quantity redemption of 30%, your holdings will become 10 units at a face value of 700 USD each. When you insert a redemption schedule, the redemption price of the last schedule is adjusted. For example, you have initially set up security for 100% redemption on maturity at a price of 1,200 USD. The face value of the security is 1,000 USD. Now, you specify a 30% redemption schedule at 360 USD. The system changes the redemption schedule: FROM the original 100% at 1,200 USD TO 30% at 360 USD and 70% at 700 USD. You will have to unlock the Securities Corporate Action Maintenance – Redemption screen and amend the redemption price for the last schedule – in this case, to 840 USD, if you wish to maintain the same total redemption premium. You can, however, change the redemption price of the last schedule to any value that you desire. When a new redemption schedule is maintained, discount/premium accruals are completed up to the event date using the old yield. The YTM re-computation is done as of the event date. |

|

Specifying Back-dated Redemption Schedules |

You can insert backdated redemptions for security, provided the back-dated redemption does not go beyond the previous coupon payment date. For specifying backdated redemptions, the quantity quotation for the security has to be ‘Nominal’. Also, you should have maintained the security as a callable one is the Security Definition screen. However, the effective date cannot be before the last coupon date. Amendment is allowed only for unconfirmed schedules. Secondly, the back-dated amendment will not be allowed if the DSTL date falls on or after the event date of the redemption schedule. In the case of the back-dated amendment, corporate action for redemption is processed during End Of Day (EOD) processing. In the case of the insertion of the back-dated schedule, the redemption processing is done during the Beginning Of Day (BOD) processing of the next working day. A back-dated amendment or insertion of redemption schedules cannot be done beyond the last coupon date. For example, if the system date is January 18, 2003, and the last coupon payment happened on January 01, 2003, then a backdated redemption schedule can go only as far back as January 01, 2003. Also, an inserted redemption schedule date must correspond with a coupon payment date. If it does not, then a coupon schedule will automatically be inserted by the system. For example, suppose that a security has a coupon period from January 01, 2003, to July 01, 2003. The system date is June 15, 2003, and the redemption schedule was inserted on March 31, 2003. The system breaks the existing coupon period into two: •January 01, 2003 to March 31, 2003; and •March 31, 2003 to July 01, 2003 note: Any deals booked after the Record Date of the inserted redemption schedule will have to be manually reversed and then re-booked by you after authorizing the inserted redemption schedule. This is because the status of these deals will change from ‘Cum’ to ‘Ex’ due to the insertion of the coupon/redemption schedule. Following the insertion of the redemption schedule, the system will automatically adjust the ALPL and DPRP events of all deals and rebook them. |

|

End and Restart of trading period |

Indicate the date on which trading in the security will be suspended and the date on which the trading will be resumed. This is done by way of specifying the End of Trading Date and the Restart of Trading Date. |

|

Exchange Rate and the Exchange Rate Fixing Date |

If the issuer payment currency is different from the security currency then specify the exchange rate between the security currency and the issuer payment currency can be specified. In addition you can also indicate the date on which the exchange rate between the security currency and the issuer payment currency will be announced. |

|

Redemption Price |

For securities having ‘Factor’ or ‘Cash flow’ redemption quotation, the redemption price is calculated automatically. For securities having ‘Percentage’ as the redemption quotation, you need to specify the price at which they can be redeemed. |

|

Redemption Quotation |

The system displays the redemption quotation selected in the ‘Securities Instrument Definition’ screen. You will not be able to change it. |

|

Redemption Quantity |

If the redemption quotation is ‘Factor’, specify the redemption factor. If the redemption quotation is ‘Cash flow’, specify the actual cash flow. Whenever you modify this value, the system calculates the redemption price upon saving. In the case of factor quotation, whenever the redemption factor is modified for the existing redemption schedules, the redemption price is recalculated on saving. The redemption factor and the price for future schedules are also adjusted. However, the factor for the last redemption is not adjusted. It remains 0. Similarly, whenever a call redemption schedule is maintained with redemption quotation as ‘Factor’ or ‘Cash flow’, the system calculates the redemption price upon saving. For factor-based redemption schedules, the factor and redemption price is adjusted for future redemption schedules. The factor for the last redemption is not adjusted. |

This topic contains the following sub-topics:

1)Process Security Redemption Details

2)Redemption Processing based on Quotation Type

20.11.1 Process for Security Redemptions

Only those events that have not yet been initiated will be selected. However, this is done only for events with initiation date less than or equal to today. The Events table is updated to indicate that initiation is complete. Specification of redemption collection to be automatic or manual is done at the time of defining the security. Only those securities for which the auto collect option is checked will be picked up for redemption collection. Other events would have to be triggered manually. Those events with the collection date less than or equal to today and for which collection has not yet been done, are selected for processing. The Redemption Collection for short position (RDSC) or the Redemption Collection for a long position (RDLC), is triggered depending on whether the position is short or long respectively. The collection event collects the redemption amount from the safekeeping location and updates the Events table, to indicate that collection is complete for the event. After the updation of the Events table, the events for which liquidation is due and the liquidation date is less than or equal to today, are picked up for liquidation. The Redemption Disbursement or liquidation for short position (RDSL) and Redemption Disbursement or liquidation for a long position is triggered depending on whether the position is short or long respectively. The Events table gets updated after liquidation is complete. In the case of accruals is due, then the accrual of interest, premium, discount and redemption premium are consolidated by running the ACIN and ACPD events. The liquidation events (RDSL and RDLL) are run only after that. Once you run the accrual event the tax and ICCF details will also get updated.

note: The initiation collection and disbursement events are synonymous.

20.11.2 Redemption Processing based on Quotation Type

If the redemption quotation type is ‘Factor’, then the redemption amount due for the intermediate redemption schedules will be calculated as follows: Redemption Amt = Holdings * (Redemption factor of previous period – Redemption factor of the current period) If the redemption quotation type is ‘Cash flow’, then the redemption amount due for the intermediate redemption schedules will be calculated as follows: Redemption Amt = Holdings * (Redemption price/Initial FV) For final redemption, the remaining holdings are redeemed. On running the YTM recalculation batch, the system recalculates the price of the redemption schedules based on the current coupon rate in case of coupon rate revision.

note: Batch processing is applicable only for securities under ‘Cash flow’ type of redemption quotation. Recalculation is done only for the redemption schedules on or after the current coupon period.

20.11.3 End of Trading Processing

This topic describes about the end of trading process.

Securities, which are due to mature end of trading days before the maturity date, will be picked up for the End of Trading processing. Those securities with the end of trading date less than or equal to today, are picked up and the EOTR event is triggered.

20.11.4 Process of Amendment on Redemption Schedules

You can amend future-dated redemption schedules. In such a scenario, accruals linked to the DPRP event are completed based on the old yield an old cash flows till the application date. New cash flows are built on the application date. The YTM for all the existing deals is recalculated as of the application date based on new cash flows. Also, future accruals linked to the DPRP event are calculated based on the new YTM. During the amendment of back-dated redemption schedules, accruals linked to the DPRP event are completed based on the old yield an old cash flows till the event date of redemption. New cash flows are built as of the event date. The YTM for all the existing deals is recalculated as of event date based on the new cash flows. For re-computation of YTM, the following formula is used for NPV calculation: NPV = Face value – Un-accrued Discount + Un-accrued premium. Future accruals linked to the DPRP event are computed based on the new YTM. coupon accruals are also adjusted based on the new face value. Back-dated redemption processing on the amendment is done at EOD.

This topic contains the following sub-topics:

1)Process Interest Coupon Details

2)Link Interest Component to Tax Component

20.12.1 Process Interest Coupon Details

This topic contains the systematic instruction to process interest coupon Details.

Context:

The securities coupon definition screen allows capture of additional details of a coupon event, for the security of bond type. The details that are displayed in this field (such as the Internal action ID, the Internal Security ID and description, the event date, etc.) are picked up from the Security Definition screen. You are only allowed to amend existing details, like the currency in which the issuer would make the cash payments, the exchange rate between the security currency and the issuer payment currency and the date on which the exchange rate will be announced.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

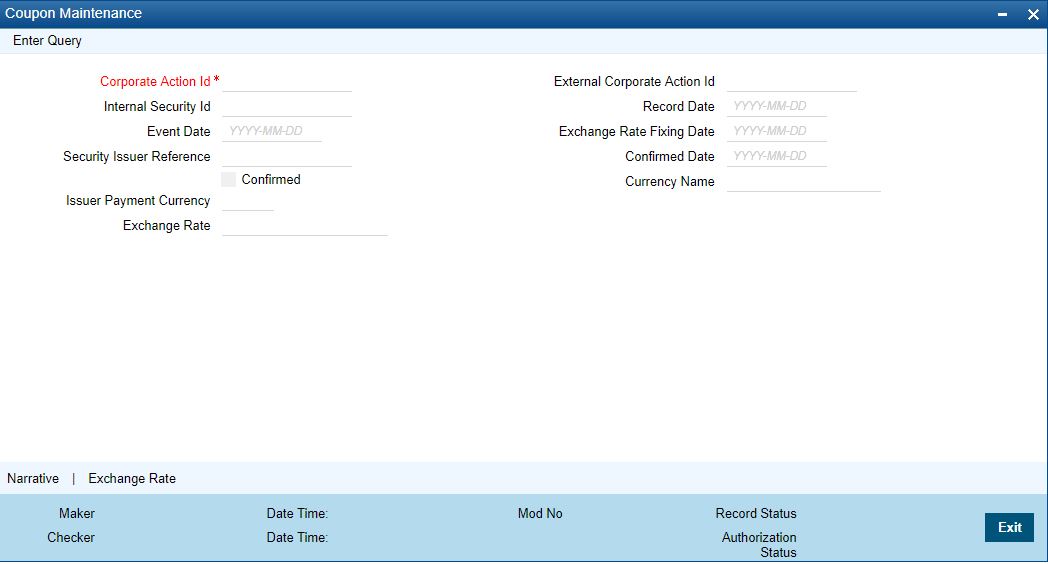

1.On Homescreen, specify SEDXCPND in the text box, and click next arrow.

Step Result: Coupon Maintenance screen is displayed.

Figure 20.5: Coupon Maintenance

2.On Coupon Maintenance screen, specify the fields.

If you are calling a coupon maintenance record that has already been created, click on Summary view. The details of existing records will be displayed in a tabular form. From the

Summary highlight the record you wish to view details of and double click to open it. To amend the details of an existing coupon, click on unlock icon in the toolbar or choose Unlock from the Actions Menu.

note: You are allowed only to amend the details of future dated records that are not yet confirmed. Once a record is authorized and confirmed it will be processed as of the event date. You will not be allowed to make any changes to a confirmed record.

Exchange Rate and the Exchange Rate Fixing Date

If the issuer payment currency is different from the security currency, then you can specify the exchange rate between the security currency and the issuer payment currency. In addition, you can also indicate the date on which the exchange rate between the security currency and the issuer payment currency will be announced. The exchange rate that you define in this screen will be used for conversion when the security is being processed. If no exchange rate has been maintained, then the mid-rate will be used for conversion.

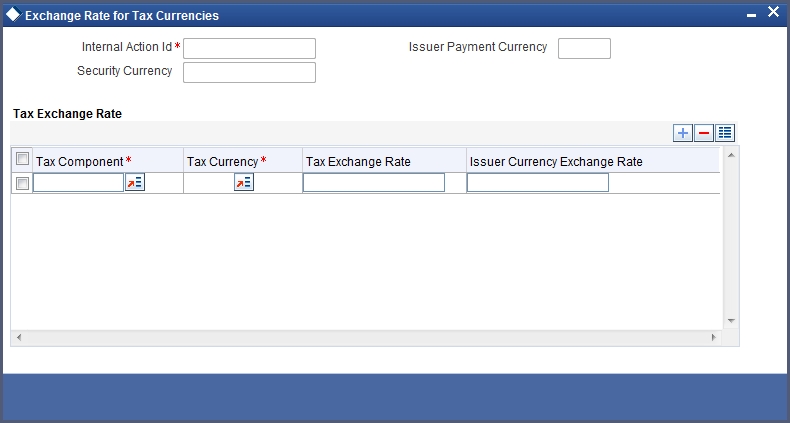

20.12.2 Link Interest Component to Tax Component

An interest component can be the basis amount tag of one or more tax components. Since each coupon that is maintained can have several interest components you need to link each of these components to the tax components. The interest components can also be in a currency other than the tax currency. Therefore, in addition to linking an interest component with the tax component, you need to specify the tax currency. If the currency of the interest component is different from the tax currency, then specify the tax exchange rate. To link an interest component with a tax component and to specify the tax currency for the exchange rate, click ‘Exchange Rate’ in the Coupon Maintenance screen. The Exchange Rate for Tax Currencies screen is displayed.

Figure 20.6: Exchange Rate for Tax Currencies

You also need to specify the exchange rate between the issuer payment currency and the tax currency. You can add or delete a tax component from the list of tax components maintained. To add a new component, click add icon and select the new component from the pick list. To delete an existing tax component, highlight it and click the delete icon.

20.12.3 Specify Event Narrative

You can maintain a free format message, of the coupon event. This narrative or message will be used while generating SWIFT messages. Click ‘Narrative’ button, the Event narrative screen is displayed. In this screen, you can either enter a free format narrative for the coupon event or leave this screen blank. If a narrative is defined, it will be associated with the security of the bond type for which the coupon event has been defined.

The Coupon Initiation event (CPIN) is triggered only for those interest coupons with initiation date less than or equal to today and for which initiation has not yet been done. After the initiation event is complete, the Events table is updated. The coupon collection event collects the coupon amount from the safekeeping location. The Coupon Collection event (CPCD) is triggered depending on whether the position is short or long. The Events table is scanned and those events with a collection date less than or equal to today and for which collection has not been done are picked up for processing. Once the processing is through the events table is updated to indicate that collection is complete for this event. The Coupon Disbursement event (CPLQ) is triggered depending on whether the position is short or long. This function picks the event from the Events table and liquidates it after executing doing the necessary validations.

note: Triggering the event AICN completes the accrual of interest if accruals are due. The AICN event is triggered before the events for liquidation (CPSL or CPLL) are triggered. All details relating to Tax and ICCF are updated.

Once the event is complete, the Events table is updated to indicate that liquidation is complete

for the event.

note: If the security currency is different from the issuer currency and you have maintained the

exchange rate and the exchange rate effective date, then this rate will be used for conversion.

Else the mid-rate will be used for conversion.

If the positions table has not been updated till the event date then positions and holdings are projected up to the event date. It is at depending on whether the interest calculation is position-based or holding based.

20.13.1 Process Interest Rate Revision Details

This topic describes the systematic instruction to process Interest Rate Revision Details.

Context:

You can capture the interest rate revision details for a security that has already been defined, through the Interest Revision screen. You can capture details like the date on which the interest rate was announced, the date on which the interest rate revision would be processed and the value date of rate revision.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

1.On Homescreen, specify SEDXRVND in the text box, and click next arrow.

Step Result: Interest Revision screen is displayed

Figure 20.7: Interest Revision

2.On Interest Revision screen, specify the fields.

To enter interest rate remission details, click new icon on the toolbar. If you are calling an interest revision record that has already been created, click on Summary view. From the summary screen you can choose to open an existing record. The details of the record that you have created will be displayed in a tabular form.

note: Interest revision screen for a security id and effective date will have two records one for positive and another for negative interest component

For a positive interest component corresponding to a corporate action id, the system to allow input of negative revision rate for a manual corporate action record.

All operations in revision screen such as new, open, close, unlock, copy, and reopen should be allowed only in the Positive Interest component record and the Negative interest component should be meant for query only.

The system supports the auto propagation of details and records the status of the positive component to negative components automatically.

Interest Revision screen does not support the manual rate revision, and hence the RFR Interest components are not fetched.

Table 20.6: Interest Revision -Field Description

|

Field |

Description |

|---|---|

|

Corporate Action Identification |

This is the system generated ID to uniquely identify the interest revision. |

|

External Corporate Identification |

This is the Id assigned to the event at the time of event declaration. Enter the Id associated with the event to uniquely identify it. |

|

Issuer Reference |

Indicate the issuer reference for the interest rate revision event. |

|

Announcement Date |

Enter the date on which the issuer would have declared the interest revision event. |

|

Event Date |

Each Rate Revision defined is having a event date from when it will be applicable. From this date the interest revision rate will be effective. |

|

MIS Rate |

For the Securities module you only have the option of maintaining a fixed rate for MIS refinancing. |

|

Confirmed |

Check this box to indicate if the occurrence of the event is confirmed. |

|

Confirmation Date |

When you select the check-box, and save the record the confirmation date will be defaulted with the current date. |

|

Parent Security Identification |

You have to indicate the code or ID of the bond type for which you are defining the interest revision rate. The Security ID or Code is picked up from the Security Definition screen. This short description of the security is for information purposes only and will not be printed on any customer correspondence. |

|

Interest Component |

Specify the component of the security for which you are defining the interest revision rate. At the time of defining a security, you can maintain different interest components for the security. The interest component(s) maintained will be reflected in the pick list available for this field. |

|

Effective Date |

Each rate that is defined for a Security ID and Interest Component combination should have an Effective Date associated with it. This is the date from which the interest revision rate will be effective. Once a rate comes into effect, it will be applicable till another Effective Date is defined for the same Security ID and interest component combination. When you save a record the effective date gets defaulted with the Event Date of Rate Revision. |

note: In Interest Revision screen, changes are done not to fetch RFR Interest components as no manual rate revision is supported.

20.13.2 Specify Auto or Manual Interest Revision

While specifying the interest revision rate, you can indicate whether the interest revision for the particular security is to be automatic or manual. If an automatic revision is specified, then revised rates will be applied and liquidations made as part of the Beginning of Day process. Otherwise, revisions will have to be made manually by you.

Revision Rate

The revision rate that you enter here will be effective as of the Value date defined.

20.13.2.1 Specify Event Narrative

You can also enter a free format narrative, of the interest rate revision event. This narrative or message will be used while generating SWIFT messages. Click the ‘Narrative’ button, the Event Narrative screen is displayed. The message entered will be associated with the interest revision event. This field can be left blank if necessary.

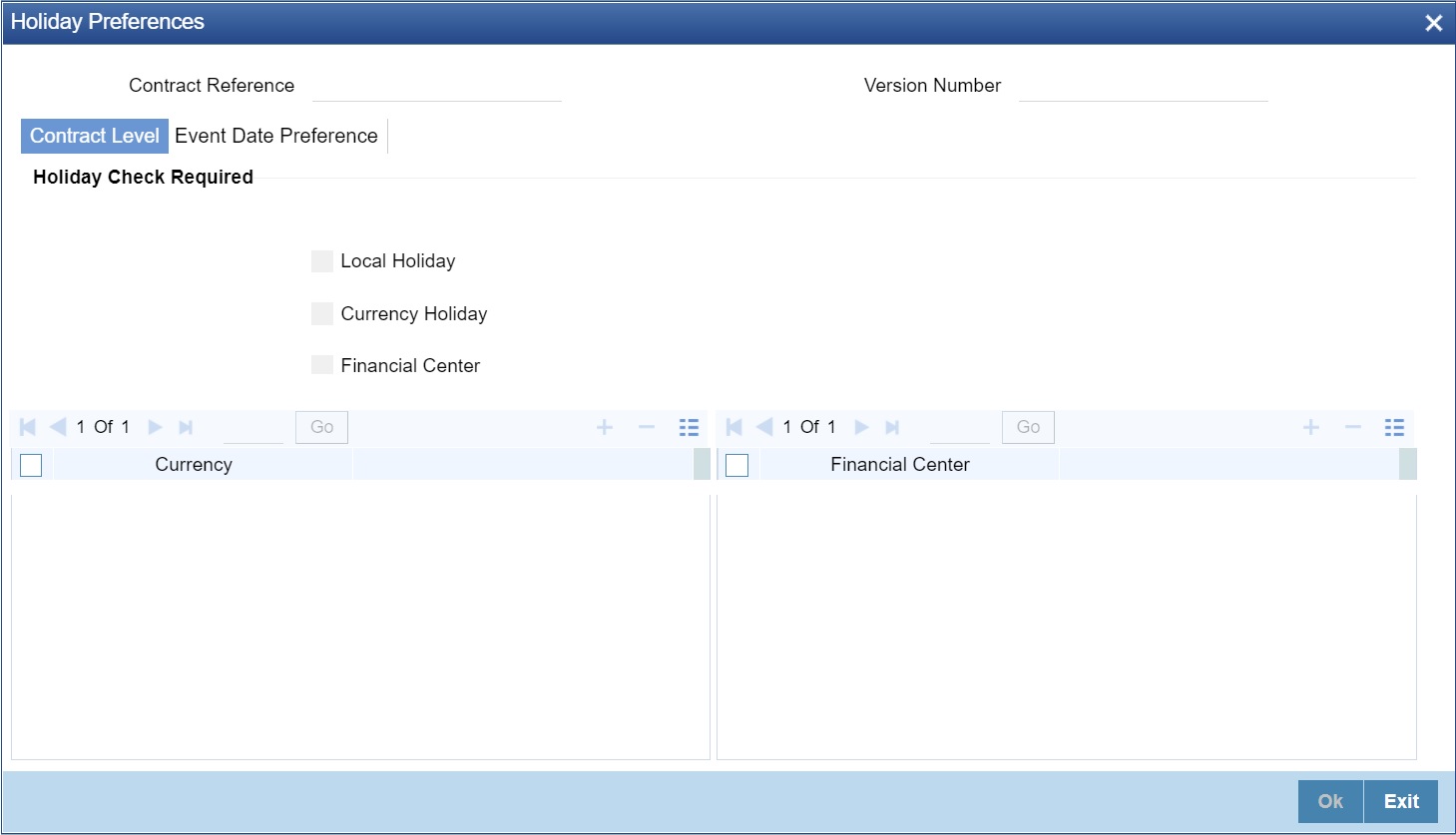

1.On the Interest Revision screen, click Holiday Preferences.

Step Result: Holiday Preference screen is displayed.

Figure 20.8: Holiday Preference

2.On the Holiday Preference screen, specify the details as required.

For more information on holiday preference, see the section 19.13 Holiday Preference

20.14 Auto Processing of Rate Fixing

If rate fixing event is not processed either manually from the Rate fixing screen or during BOD batch then during SE EOD batch processing system should check for effective date rate and if available, rate fixing should be processed based on the flag set for Proceed with previous available rate.

At Treasury branch parameter maintenance screen STDTRBRN, a preference check Proceed with previous available rate is introduced and is considered during both rate revision and rate fixing process during EOD. Default value of this field is checked.

In case when Proceed with previous available rate preference is enabled, during EOD processing system will check for rate availability for that particular effective date in the Floating rate table and if rates are not available for that date, then Rate fixing and revision event is applied on instruments with the previous latest rate available in the system.

Whereas when Proceed with previous available rate check box is not enabled, during EOD, processing system will skip the Rate fixing and revision event on respective instruments in case when the rate for that effective date is not available.

For every revision schedule, which applies a rate fixing during EOD processing, a new rate-fixing event RFIX triggers. In case of a forward movement on fixing days from the revision effective date, rate fix will happen after the revision effective date and interest catch up entries is posted during EOD processing.

note: For the Manual processing, refer to the Interest User Manual, Section 2.12 Treasury Manual Rate Fixing.

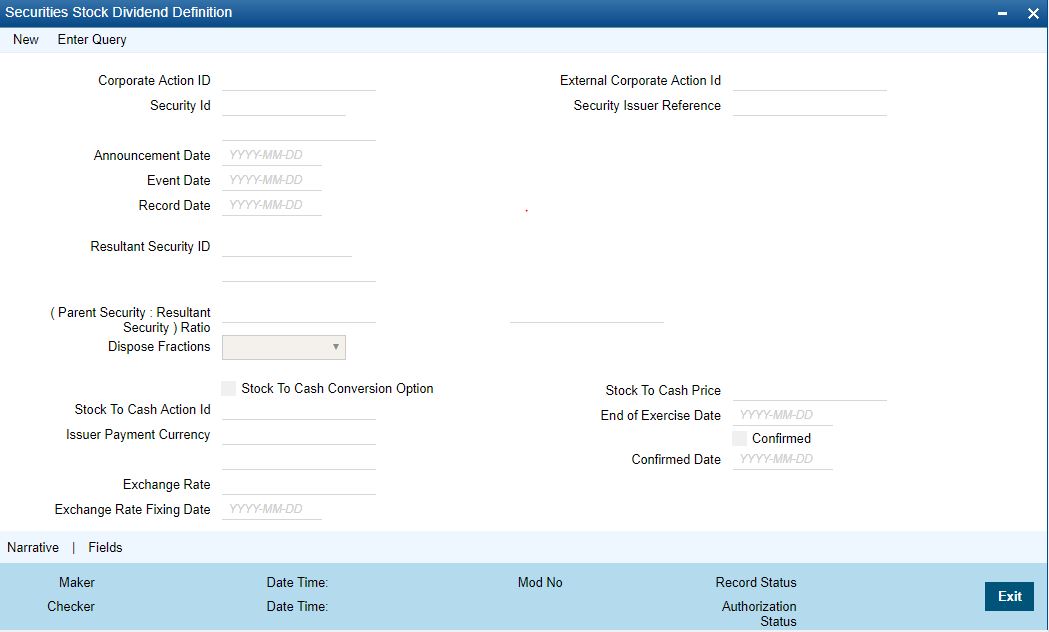

20.15 Maintain Stock Dividend Details

This topic describes the systematic instruction to maintain stock dividend details.

Context:

In the Stock Dividend or Bonus Definition screen, you can maintain details of the stock dividend declaration event, for security. The essential details that you need to capture for security include the resultant Security ID and the dispose fraction. Details like the stock to the cash price, the issuer pay currency and the end of exercise date can be captured only if you specify that stock is to be converted to cash.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

1.On Homescreen, specify SEDXDVDF in the text box, and click next arrow.

Step Result: Securities Stock Dividend Definition is displayed.

Figure 20.9: Securities Stock Dividend Definition

When you click on the new icon the system automatically assigns a unique internal action ID to the corporate event. The system date is defaulted as the date on which the dividend event was announced. However the Announcement Date or the date on which the event was declared can be changed to a previous date.

2.Click New on the tool bar to maintain deals of new declaration.

If you are calling an event record that has already been created, click on Summary view. The details of the existing event records will be displayed in a tabular form. Specify the fields.

Table 20.7: Cash Dividend Definition

|

Field |

Description |

|---|---|

|

Corporate Action Identification |

This is the system generated ID to uniquely identify the declaration of Stock Dividend. |

|

External Corporate Action Identification |

This is the Id assigned to the event at the time of event declaration. Enter the Id associated with the event to uniquely identify it. |

|

Security Identification |

Specify the code or ID of the equity-type security for which the dividend declaration is being defined. The codes displayed, in the pick list available for this field are picked up from the Security Definition screen. |

|

Security Issuer Reference |

Indicate the issuer reference number for the stock dividend event. |

|

Announcement Date |

This is the date on which the issuer would have declared the stock dividend event. Enter the announcement date of the event. |

|

Event Date |

Enter the date on which the cash payment will be made by the issuer. |

|

Record Date |

Enter the date on which the issuer determines the beneficiary eligible for the dividend based on the registered owner of the securities. The Record Date is computed from the ex days set up defined for the local market of issue. |

|

Resultant Security Identification |

Indicate the security of the equity type in which shares would be awarded. |

|

Resultant Ratio and Dispose Fractions |

Select the equity type of security in which shares should be awarded. After this, you are required to specify the ratio of, the quantity of the new security awarded to the number of current holdings, in the existing security. Also indicate how the fractional elements in the parent security should be handled. You can choose the following options: |

|

Stock to Cash Conversion |

Check this option to convert the stock dividend declared to cash. In such a case you are required to specify, the date by which the stock to cash conversion option, is to be exercised. Also, specify the price per unit. This is the price at which the stock dividend would be converted into cash. |

|

Stock to Cash Price |

Enter the price at which the stock dividend would be converted into cash. |

|

End of Exercise Date |

Enter the date before which the stock to cash conversion option is to be exercised. |

|

Stock to Cash Action Identification |

This is a unique event ID which is generated by the system on saving the Stock Dividend Definition record. |

|

Issuer Pay Currency |

In case of stock to cash conversion, you can indicate the currency in which the issuer should make the cash payments. From the pick list available select the payment currency. |

|

Confirmed |

Check this box to indicate that the occurrence of the event is confirmed. |

|

Confirmed Date |

When you select the check-box, and save the record the confirmed date will be defaulted with the current date. |

|

Exchange Rate |

When the issuer payment currency is different from the security currency, the exchange rate between the security currency and the payment currency has to be indicated. Specify the exchange rate. |

|

Exchange Rate Fixing Date |

This is the date on which the exchange rate will be announced. Indicate the exchange rate announcement date. note: You can enter a free format event narrative for the event being defined or leave this field blank. If you enter a free format text it will be associated with the event while generating SWIFT messages. After entering the relevant details click save icon in the toolbar or Save from the Actions Menu, to save the event record. |

Table 20.8: Options Table

|

Options |

Description |

|---|---|

|

Retain |

The fractional units would be retained |

|

Round Up |

Entitlements will be rounded up to the next full unit |

|

Round Down |

Entitlements will be rounded down to the previous full unit |

|

Round standard |

If the fractional unit is above 0.5, entitlements will be rounded up to the next full unit, otherwise the entitlements will be rounded down to the previous full unit. |

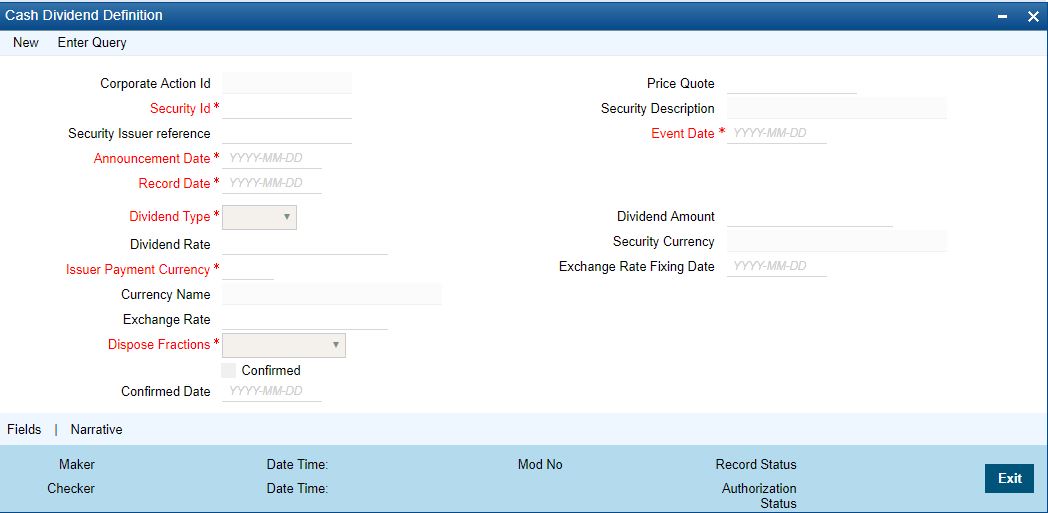

This topic describes the systematic instruction to process dividend.

Context:

The details of a cash dividend declaration can be captured through the Cash Dividend Definition screen. Through this screen, you can capture relevant details such as the dividend type (rate or amount), the issuer payment currency, the exchange rate, and the rate-fixing date.

Context:

The details of a cash dividend declaration can be captured through the Cash Dividend Definition screen. Through this screen, you can capture relevant details such as the dividend type (rate or amount), the issuer payment currency, the exchange rate, and the rate-fixing date.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

1.On Homescreen, specify SEDXCDVD in the text box, and click next arrow.

Click the new icon on the tool bar to create the icon.

Step Result: Cash Dividend Definition screen is displayed.

Figure 20.10: Cash Dividend Definition

2.On Cash Dividend screen, specify the fields.

The details of a cash dividend declaration can be captured through the Cash Dividend Definition screen. Through this screen, you can capture relevant details such as the dividend type (rate or amount), the issuer payment currency, the exchange rate, and the rate-fixing date.

Table 20.9: Cash Dividend Definition - Field Description

|

Field |

Description |

|---|---|

|

Corporate Action Identification |

This is the system generated ID to uniquely identify the declaration of Cash Dividend. |

|

External Corporate Action Identification |

This is the Id assigned to the event at the time of the event declaration. Enter the Id associated with the event to uniquely identify it. |

|

Security Identification |

Specify the security Id of the equity type for which the cash dividend event is to be defined. The description associated with the specified code will be displayed in the adjacent field. |

|

Security Issuer Reference |

Indicate the issuer reference for the cash dividend event. |

|

Announcement Date |

This is the date on which the issuer would have declared the cash dividend event. Enter the announcement date of the event. |

|

Event Date |

Enter the date on which the cash payment will be made by the issuer. |

|

Record Date |

Enter the date on which the issuer determines the beneficiary eligible for the dividend based on the registered owner of the securities. The Record Date is computed from the ex days set up defined for the local market of issue. |

|

Dividend Type |

Indicate the type in which the dividend amount should be declared. It could be a percentage of the face value of the security, or it could be the amount per unit of the security. |

|

Dividend Amount |

Indicates amount per unit. Specify the amount per unit to be used in calculating the cash dividend. |

|

Dividend Rate |

This field indicates the rate as a percentage of the face value. Enter a percentage of the face value to be used in calculating the cash dividend. |

|

Issuer Payment Currency |

Indicate the currency in which the issuer will make the cash payment. Click the adjoining option list for a list of valid currency codes. Select the appropriate. |

|

Dispose Fractions |

Indicate how fractions should be handled. Refer Dispose Fractions Available Options for available options. |

|

Confirmed |

Check this box to indicate that the occurrence of the event is confirmed. |

|

Confirmed Date |

Select the check-box, and save the record the confirmed date will default with the current date. |

|

Exchange Rate and Exchange Rate Fixing Date |

When the issuer payment currency is different from the security currency, the exchange rate between the security currency and the payment currency has to be indicated. Along with this, the date on which the exchange rate will be announced should also be entered. |

Table 20.10: Dispose Fractions Available Options

|

Term |

Definition |

|---|---|

|

Retain |

Fractions will be retained as they are |

|

Round Up |

Entitlement will be rounded up to the next full integer |

|

Round Down |

Entitlement will be rounded down to the previous full integer |

|

Round Standard |

Entitlement will be rounded up to the next full integer if the fraction is greater than 0.5. Else it will be rounded down to the previous full integer |

Only those records, which have been authorized and confirmed, will be picked up for processing. The Dividend Initiation or tear off for long position (DVIN) event is triggered for those dividends with initiation date less than or equal to today's date. Based on the initiation date only those events for which initiation has not been done are selected. The Events table is updated once the event is complete. After DVIN event, the cash and stock dividends with collection date less than or equal to today will be picked up. Thus, the Dividend Collection for a long position event (DVCD) is triggered. The collection event collects the stock/cash amount and the cash instead of stock (for those

securities with the stock to cash option on) from the SK location. Once the collection event is done the Events table is updated. The Dividend Disbursement for a long position (DVLQ) picks up those events with disbursement dates less than or equal to today. When the disbursement is through the Events table is updated.

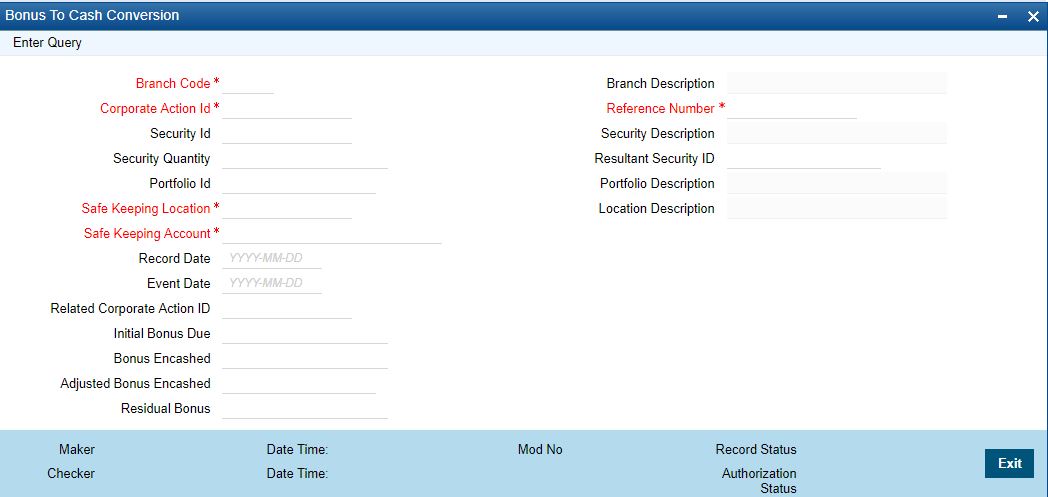

20.17.1 Process Bonus to Cash Conversion Details

This topic describes the systematic instructions to process bonus to conversion details.

Context:

When you specify that stock is to be converted to cash, in the Stock Dividend definition screen, details of that event will be picked up and stored as, a Bonus to Cash conversion record. You are only allowed to maintain some additional stock to cash conversion details, such as the bonus to be en cashed, the total bonus en cashed, the residue bonus due. This is maintained so on in the Bonus to Cash conversion screen. Invoke this screen by clicking on Bonus to Cash and then on the Detail option, under Securities CA Maintenance. This is invoked from the Application Browser. To view the details of a previously created record, go to the Summary View screen. The details of existing records are displayed in a tabular form. Highlight the record you want to view and double click it.

Prerequisite:

Specify User Id and Password, and login to Homescreen.

1.On Homescreen, specify SEDXBNCS in the text box, and click next arrow.

Step Result: Bonus to Cash Conversion screen is displayed.

Figure 20.11: Bonus to Cash Conversion

2.On Bonus to Conversion screen, specify the fields.

In the Bonus to Cash conversion, the main screen enters the security ID, the portfolio ID, and the SK location Id from where bonus due, is to be received.

Table 20.11: Bonus to Cash Conversion - Field Description

|

Field |

Description |

|---|---|

|

Branch Code |

Specify the Branch Code |

|

Corporate Action ID |

This is the system generated ID to uniquely identify the declaration of Stock Dividend. This value is defaulted. |

|

Reference Number |

This is the system generated ID to uniquely identify the Corporate action of Stock to cash conversion. |

|

Security Id |

This is the security Id of the equity for which the bonus to cash details are being maintained. The description associated with the specified code is displayed in the adjacent field. |

|

Security Quantity |

This is the quantity of security for which the bonus was declared. |

|

Resultant Security Id |

The resultant security Identification to which shares have been awarded is defaulted here. |

|

Portfolio Id |

This is the portfolio ID of the equity for which the bonus to cash conversion details are being defined. |

|

Stock Keeping Location |

This is the SK location where the security is lodged and for which cash payment is to be received. |

|

Stock Keeping Account |

This is the account number which is to be credited when the payment due is received. |

|

Record Date |

The record date is defaulted from the Stock Dividend definition screen. |

|

Event Date |

The event date is defaulted from the Stock Dividend definition screen. |

|

Stock to Cash Action Id |

The stock to cash action Id assigned in the Stock Dividend screen is defaulted in this screen. |

|

Initial Bonus Due |

This field indicates the bonus amount that is due to be paid. |

|

Bonus Encashed |

You can choose to convert either a part of or the entire bonus that is due. Specify the amount to be encashed, in the Bonus to be Encashed field. If you choose to encash only a part of the amount due, then the residue bonus will be automatically calculated and displayed, in the Residue Bonus Due field. Assume that you have a holding of 500 units in a particular security. Bonus is declared in the ratio of 2:1. Therefore, you are liable to get 250 units of shares free. If you indicate that bonus is to be encashed for 125 units only then the remaining 125 units, which need to be encashed, will be reflected in the Residual Bonus field. You can choose to encash them at a later date. |

|

Adjusted Bonus Encashed |

The adjusted bonus is calculated by the system and displayed in this field. The calculations are such that, the net bonus encashed minus the adjusted bonus will be equal to the initial bonus. |

|

Residual Bonus |

If the bonus is encashed in parts then the residual amount due is displayed here. |

20.18 Process Bonus to Cash Conversions

This topic describes the overview to process bonus to cash conversion.

The events table is scanned. Those events with an initiation date less than or equal to today and for which initiation has not been done will be picked up. The BOST (Bonus Initiation for short position) or BOLT (Bonus initiation for a long position) depending on whether the position in short or long. After the initiation event is complete, the Events table is updated. Positions and holdings are also updated. For disbursing the events due, only those events with the disbursement date less than or equal to today’s date will be picked up. The Bonus disbursement for short positions (BOSL) or Bonus Disbursement for long positions (BOLL) will be triggered depending on whether the position in short or long. After liquidation, the events table is updated to indicate that liquidation is complete for the event.

note: Please remember that automatic liquidation is carried out only if you have specified so at the portfolio definition level. Otherwise, events due will have to be liquidated manually.

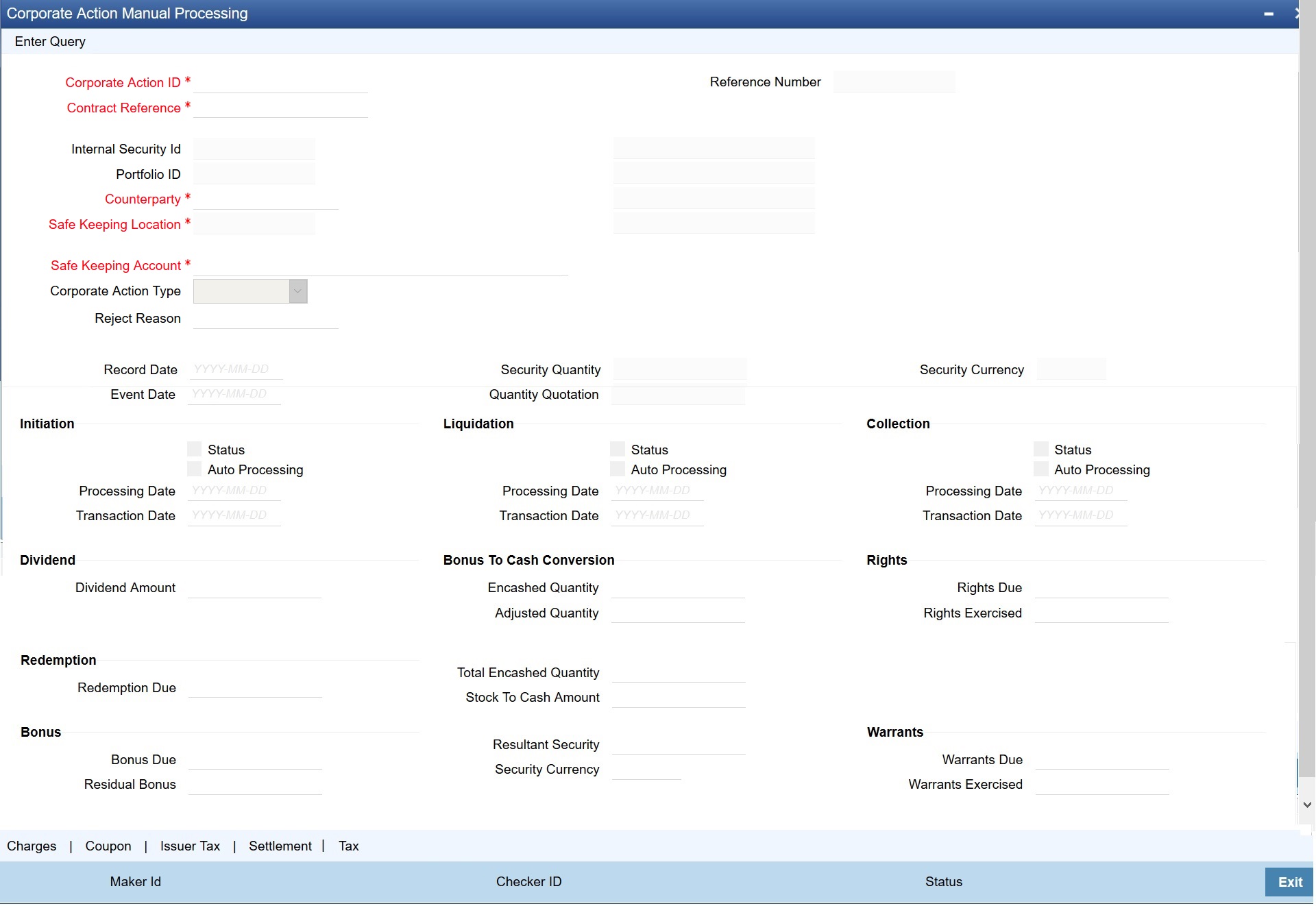

20.18.1 Process Corporate Action Events

Context:

You can manually process these events marked for manual processing, through the Corporate Actions Manual Processing screen. The details of all these events, which are to be manually initiated, collected and liquidated, are displayed in this screen. Also the details of those events which have already been processed (either automatically or manually) will be displayed. You can change the date on which a particular event is to be processed. You are also allowed to manually process an event which was earlier marked for auto processing.

1.On Homescreen, specify SEDXCAMN to the text box, and click next arrow.

Step Result: Corporate Action Manual Processing screen is displayed.

Figure 20.12: Corporate Action Manual Processing

2.On Corporate Action Manual Processing screen, specify the fields.

The Corporate Action Manual Processing screen, allows you to amend existing details such as the processing date. You can also change the processing from automatic to manual or vice versa. To amend the details of an existing event, click on unlock in the toolbar or Unlock from the Actions Menu.

Counterparty Id will fetch the coupon from Repo counterparty. The Counterparty for Collateral portfolio is for repo counterparty and for bank portfolio will be issuer/External SK CIF.

To the right of the Corporate Action Manual Processing, the screen are displayed a vertical array of six icons. By invoking these icons, you will be able to view and in case of charges and tax modify the attributes, of the event you are processing. To select a screen, click on an icon from the group of icons displayed at the right-hand side of the screen. A brief description of the functions icons represent, the given below:

Table 20.12: Icons

|

Icons |

Description |

|---|---|

|

Events |

Click on this button to view the leg events accounting entries and overrides. |

|

Settlement |

Click on this button to enter the settlement message details. You can specify the following details: The accounts to be debited for charges The method in which the event is to be settled whether it is an instrument (as in a check or a demand draft) or a message (as in SWIFT or mail message). Details about the parties involved in the event. |

|

Charge |

Click on this button to view the charge details associated with the product. You are allowed to amend the charge amount and if necessary waive the application. You are allowed to make these changes, only at the time of processing the event. |

|

Tax |

Click on this button to view the transaction tax details. In addition to changing the charge amount, you can also waive the application. You are allowed to make these changes, only at the time of processing the event. |

|

Issuer Tax |

Click on this button to view the issuer tax details. This is only a view screen, you are not allowed to modify the details displayed in this screen. You can view the issuer tax details only in case of coupon dividend or bonus to cash conversion events. |

|

Coupon |

Click on this icon to view the coupon details. This is a view-only screen, you are not allowed to modify any details displayed here. The coupon events are displayed only for a corporate action event coupon. |

|

Counterparty Coupon Details |

Click this icon to view the Counterparty Coupon Details. This screen displays the counterparty wise coupon details. Bank claims the coupon from Repo counterparty for the pledged security. The same details are shown in this screen to view Counterparty wise coupon details for a Corporate action ID |

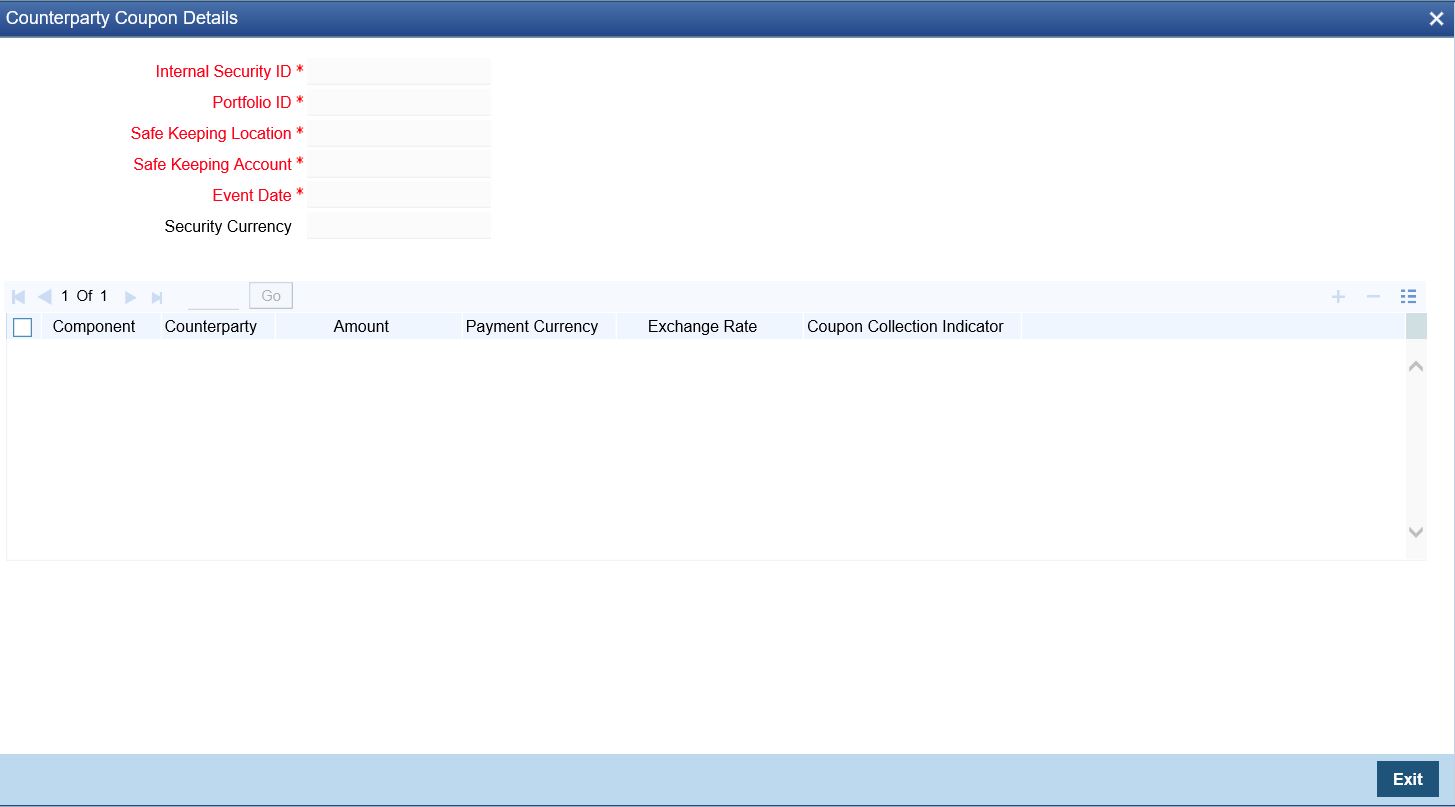

3.On the Corporate Action Manual Processing screen, click Counterparty Coupon Details.

Step Result: Counterparty Coupon Details screen is displayed.

Figure 20.13: Counterparty Coupon Details

4.On the Counterparty Coupon Details screen, specify the details as required.

For more information on fields, see the below table

Table 20.13: Counterparty Coupon Details

|

Field |

Description |

|---|---|

|

Component |

System will default the Interest Component for the coupon. |

|

Counterparty |

System defaults Repo Counterparty to whom security is pledged and bank will claim the coupon. |

|

Amount |

System shows the Coupon amount to be claimed from the Repo Counterparty. |

|

Payment currency |

Currency in which coupon is paid. |

|

Exchange rate |

System defaults Currency exchange rate. |

|

Coupon Collection Indicator |

Indicates whether bank has collected the coupon from the counterparty or not. system updates the field as processed after the coupon is collected |

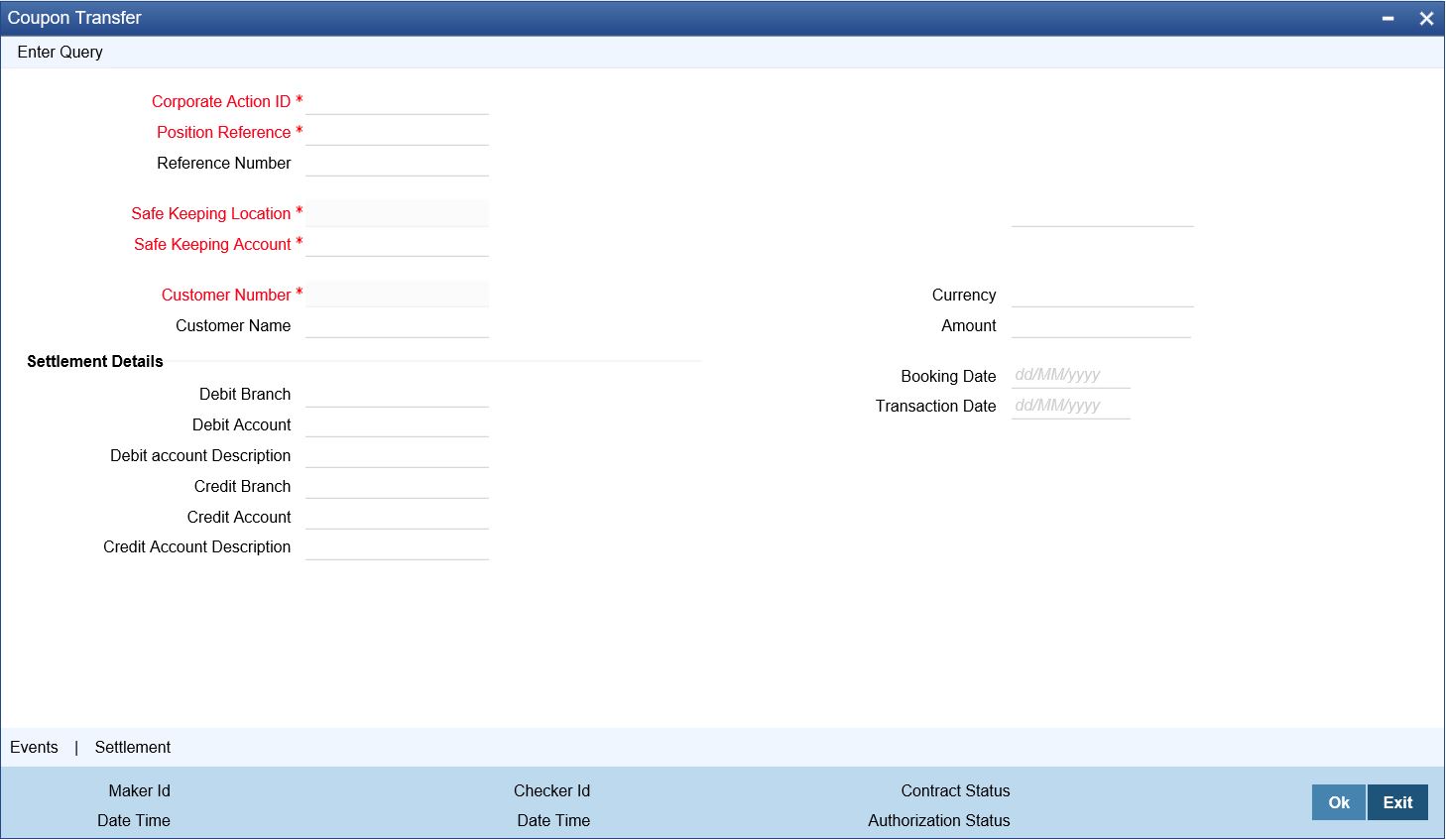

Context:

Coupon collected on the securities received as part of reverse repo deal is transferred back to the reverse repo counterparty. This screen allows the user to transfer coupon to the counterparty when claimed. On selecting Corporate action ID, Position Reference number and counterparty, the coupon amount collected in the collateral portfolio for the coupon schedule is defaulted in the amount field.

1.On the Homepage, type SEDXCTFR in the text box, and click the next arrow.

Step Result: Coupon Transfer screen is displayed.

Figure 20.14: Coupon Transfer

2.On the Coupon Transfer screen, refer to the details as required.

On selecting Corporate action ID, Position Reference number and Counterparty Coupon amount collected in collateral portfolio for the coupon schedule is default in amount field.

20.20 Coupon Transfer - Field Description

|

Field |

Description |

|---|---|

|

Corporate Action ID |

Corporate Action ID of the security code |

|

Position Reference |

Collateral portfolio Position reference number |

|

Reference Number |

Generated by system on a successful save of record |

|

Safe Keeping Location |

ID of the safekeeping location |

|

Safe Keeping Account |

Default Safekeeping Account that the holder of the collateral portfolio maintained. |

|

Customer Number |

Lists Reverse Repo Counterparty number |

|

Customer Name |

Defaults Reverse Repo Counterparty name |

|

Currency |

Defaults Coupon Currency |

|

Amount |

System defaults Coupon amount that bank transfers to the counterparty |

|

Settlement Details |

|

|

Debit Branch |

Defaults Debit account branch |

|

Debit Account |

Defaults Debit account from which coupon amount is paid |

|

Debit account Description |

Default account description |

|

Credit Branch |

Defaults Credit account branch |

|

Credit Account |

Defaults Counterparty account where coupon amount is transferred |

|

Credit Account Description |

Default Account Description is displayed in this field |

|

Booking Date |

Date when Coupon transfer is booked |

|

Transaction Date |

Date when the settlement happens |

List Of Glossaries - Maintain and Process Corporate Actions

SEDXRWDF

Securities Rights/ Warrants Definition - 20.3.1 Process Rights and Warrants (p. 220)

Rights/Warrants Expiry Event - Process Rights and Warrants Expiry Details (p. 226)

Securities Corporate Action - 20.10 Process Security Redemption Details (p. 228)

Coupon Maintenance - 20.12.1 Process Interest Coupon Details (p. 233)

Interest Revision - 20.13.1 Process Interest Rate Revision Details (p. 235)

Cash Dividend Definition - 20.16 Process Cash Dividend (p. 242)

Bonus To Cash Conversion - 20.17.1 Process Bonus to Cash Conversion Details (p. 244)

Corporate Action manual Processing - 20.18.1 Process Corporate Action Events (p. 246)

Coupon Transfer - 20.19 Coupon Transfer