3. Dashboard

3.1 Dashboard

OBCLPM dashboards provide various information to the Relationship Managers for their easy access and processing.

This chapter contains the following sections:

- Section 3.1.1, "Assets at Risk"

- Section 3.1.2, "Loans Maturing"

- Section 3.1.3, "Loans Application Status"

- Section 3.1.4, "Rate Quotation Status"

- Section 3.1.5, "Pending Loan Disbursements"

- Section 3.1.6, "Application Ageing Status"

- Section 3.1.7, "Scheduled Activity Widget"

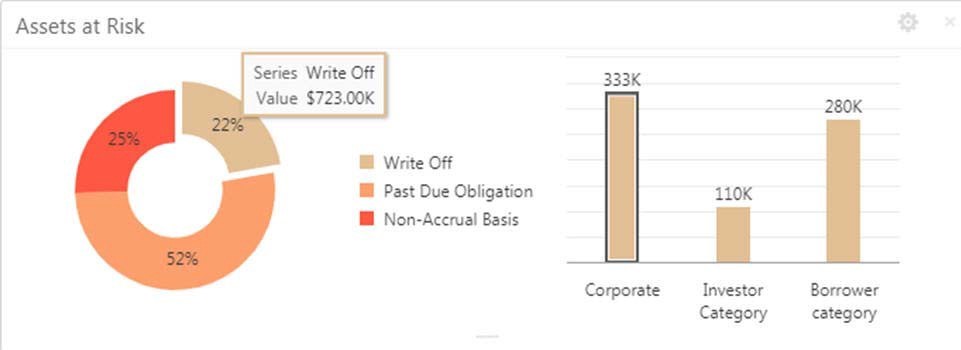

3.1.1 Assets at Risk

Display the performance of the asset as a pie-chart. The asset performance will be derived in the system based on the borrower's repayment. Data from the loan product processor is periodically refreshed for this widget. This widget will display the total value of the holding asset and percentage wise status. A sample of the asset performance is illustrated:

The following details are displayed in the widget:

- Total value of the asset in currency

- Percentage of status in each pie

The bank user can perform the following actions on the asset:

- On click of each pie, customer category wise total asset value will be displayed as bar chart.

- On click of each bar, summary view of the Corporate lending loan contracts will be shown for the

- Transaction Branch, Currency, Customer Category and Loan status combination.

- User can filter the details based on the Customer Name or Relationship Manager.

- User can sort the displayed results under various categories.

3.1.2 Loans Maturing

Display the total loan value that are getting matured in the subsequent no of weeks as a Graph matrix.

On click of dotted matrix, system will display the total Loan value that are getting matured for the week starting with date. For example, system will display the total value of say 10 M USD maturing for the week starting 16thApril 2018. This implies the total value of all the loans that are maturing from 16th April 2018 to June 2018.

Further bank user can click on it to get the summary view listing all the loans that are getting matured for the week. User will be allowed to click on a loan contract to view the entire loan details.

User will be able to filter the widget such that the user can view the loan maturing for a particular customer or loans maturing in a specific period or loans scheduled for auto or manual rollover. User can sort the displayed results under various categories. Upon clicking the line item user will be able to initiate the either rollover or payment of that particular loan.

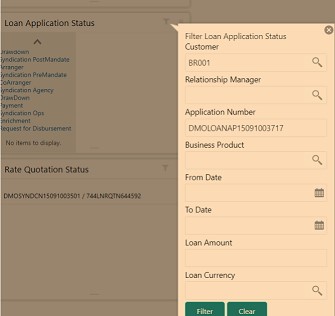

3.1.3 Loans Application Status

Displays the list of applications that are created by the RM and reportees. System displays the lifecycle application count that are created in the system. For every lifecycle process (Loan Origination, Restructuring, and Draft Proposal), system displays the application count under each application category created.

On click of count shown under each application category, a summary view of loan contracts is displayed with the Loan application reference no, Loan Amount, Currency and Customer Name.

- On click of Loan application reference, loan details are displayed in a detailed view.

- In addition, bank user can view the process flow diagram of the loan application showcasing the list of process/stages which the application will flow through and the current stage where the application is held with.

- User will be able to filter the widget such that the user can view

the loan applications based on the following search criteria.

- Customer Name

- Customer Number

- Relationship Manager

- Application Number

- Business Product

- From Date

- To Date

- Loan Amount

- Loan Currency

User should be able to apply one or multiple filters. Once the user logs in, all the local filter and global filter is set to reset.

- User can sort the displayed results under various categories

- Helps the bank user to identify the exact status of the application.

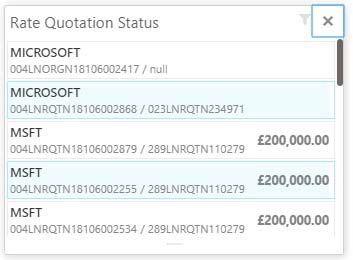

3.1.4 Rate Quotation Status

This widget displays the list of applications for which the Rate Quotation has agreed and pending revert from the Customer. The widget will display the details of rate Quotation passed the cut off time as well. This widget will help the user to monitor the application for which the COF is already agreed with the treasury and communicated to the Borrower to submit the Utilisation request. Since the action to be taken on same day before cut off time, this widget will alert the user to review such items and takes necessary action.

Upon clicking on the line item the user will be able to access the Rate Quotation Transaction and will be able to proceed with the Loan draw down upon receipt of utilization request from the Borrower or the cancellation of the treasury ticket if no utilization request received from the Borrower.

- User can filter the details based on the Customer Name or Relationship Manager or the Currency

- User can sort the displayed results under various categories.

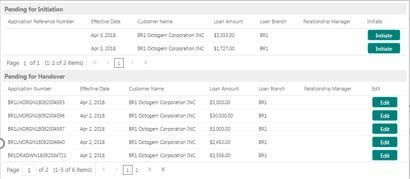

3.1.5 Pending Loan Disbursements

This new widget displays the details of the loan for which either the first disbursement is yet-to-be handed off or the first disbursement is processed and the subsequent disbursements are scheduled with a future value date. The user will be able to view the Pending Loan Disbursements and will be able to initiate the disbursement of the loan on the value date.

- Upon clicking on the dues, system displays the list of records pending for first manual handover and records that are pending for initiation of subsequent disbursements. Upon clicking them, the user will be able to access the Pending Loan Disbursement Transaction and will be able to proceed with the Loan disbursement on the value date.

- User can filter the details based on the Customer Name, Relationship Manager, or for a specific period.

- User can sort the displayed results under various categories.

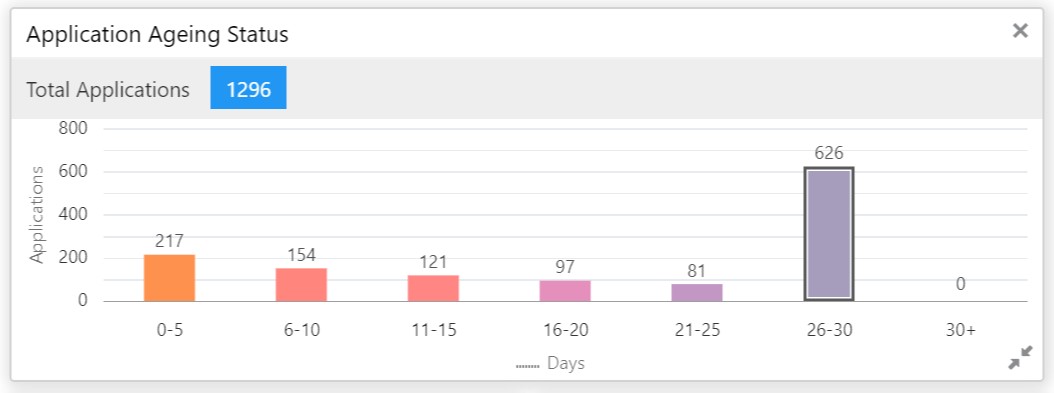

3.1.6 Application Ageing Status

This new widget helps the user to monitor the status of each application. User will be able to view all the pending application with its respective stages. Upon clicking the line item user will be able to view the details of the application and proceed with the respective action from that stage. User can filter this widget by the Customer Name or Relationship Manager Name. User can sort the widget results under each headers. In addition, the user will be able to export the results.

- On clicking on the bars, system displays the list of Application reference numbers ageing with their respective details.

- Upon clicking Application reference number, the user will be able to access the complete summary and process status of the application.

3.1.7 Scheduled Activity Widget

Syndication drawdowns and bilateral loan contracts, which have maturity due in the next configured number of days, will be pulled up from OBCL and will be listed in the Scheduled activity Widget. This widget will also list the Syndication and bilateral Scheduled payment related transaction, such as Principal Payment, Interest Payment and Principal plus Interest payment which are due in next configured number of days.

The details pulled up from OBCL will create automatic task in the corresponding Rollover or Payment process flow. This will enable the OBCLPM user to proceed with the auto created. Contracts with Rollover or Payment opted in manual mode alone will be created as scheduled task

3.2 Customer Dashboard

Customer Dashboard helps the user to filter all the applicable widgets for a particular customer and you can view the relevant information of that particular customer under each widget. Customer Dashboard contains all the widgets which are available in the main Dashboard.

This Dashboard helps you to view the loans specific widgets as part of Customer 360 degree view from Oracle Banking Party Management. When you access the loans information from Oracle Banking Party Management for a specific customer this Dashboard provides the filtered view of all the widgets for that customer.

How to reach here:

Corporate Lending > Customer Dashboard