5. Simple Application Entry

5.1 Introduction

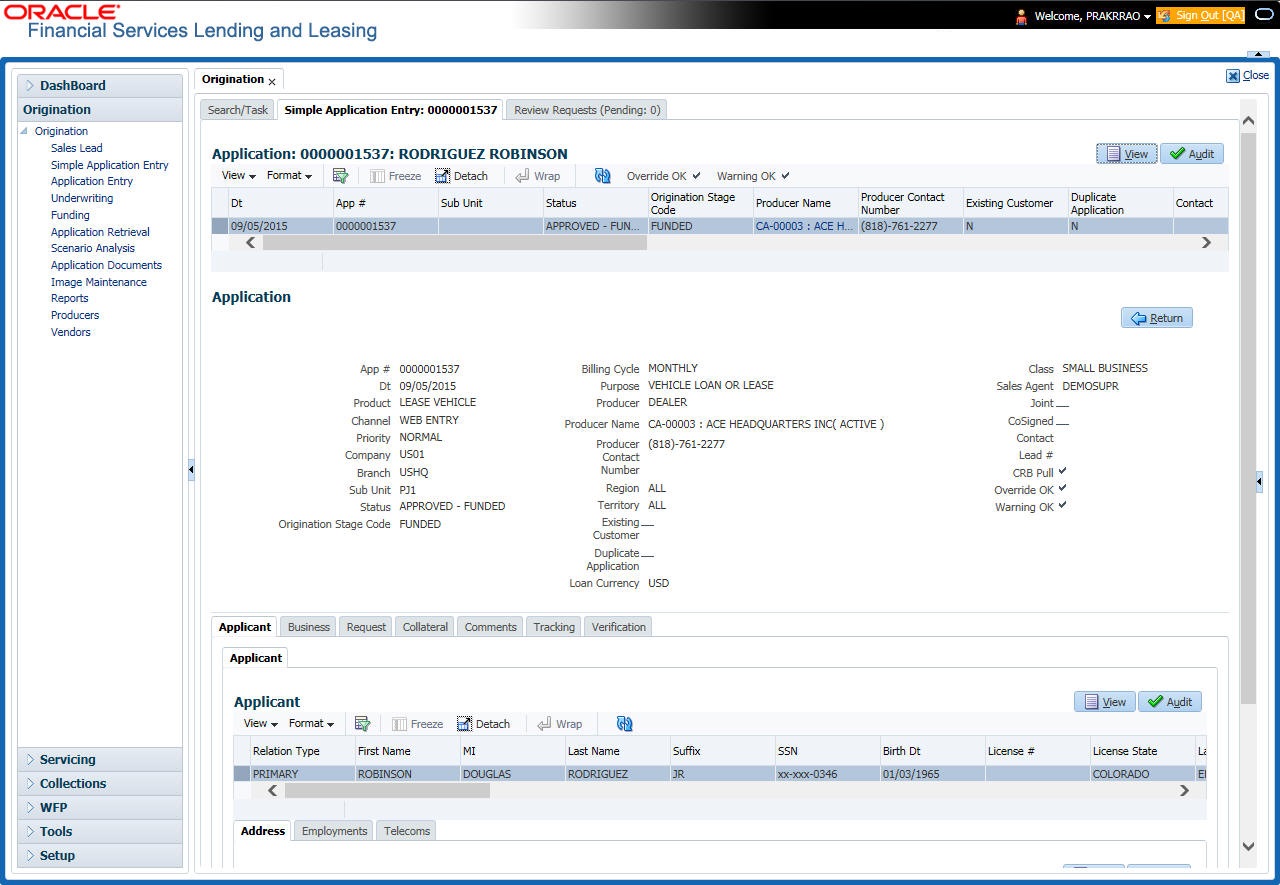

The first step in the Lease origination process is entering credit application data into Oracle Financial Services Lending and Leasing Application. The Simple Application Entry screen enables you to specify information from the credit application into the system and request a credit bureau report.

This chapter explains how to use the Applications screen to specify and validate a credit application.

5.2 Entering a Credit Application

There are four main steps in entering an application

- Select product type and producer at the top of the Application screen in the Applications section. The product defines the type of credit application: Lease as well as any collateral, such as vehicles or homes, associated with the Lease. When you save the application, system activates the links on Applications screen that are associated with the product, streamlining the application process. The producer is the dealer supplying the application. When selected, the status of the Producer is displayed along with Producer Name.

- Enter information regarding the primary applicant, such as name, social security number, address, place of employment and financial assets and liabilities. Enter this same information for any other applicants, such as co-signers or joint applicants, if they exist. System displays the error message as “The Application does not exist” if the provided details does not match with any application details.

- Enter information about the requested credit for the Lease such as Lease amount and number of terms.

- Enter information about the collateral.

You can also enter credit application data into Oracle Financial Services Lending and Leasing Application using the Fax-In container. For more details, refer to ‘Application Entry using Fax-In’ section.

Once the basic details are entered, the user has to check whether the application pre qualifies or not. Once the pre-qualified edits are satisfied, click Submit in the Application screen.

When finished, Oracle Financial Services Lending and Leasing checks the application for completeness using a predefined set of edits. These edits search for errors and warnings based on your system setup. Status change of the application can be determined by the credit bureau and scoring model of the application. The prescreening checks ensure that automatic credit bureau reports are pulled only for applications which meet set criteria, thus saving cost.

After an application clears the edits check, click Process Application in the Applications section. The system begins the processes of prescreening the application and pulling a credit bureau while you can begin entering the next application in your queue.

To enter a new application

- Click Origination > Origination > Simple Application Entry.

- The Simple Application Entry screen appears, opened at the Search link’s Results screen.

The Recreate Instance button appears only when the BPEL parameter is YES.

- In the Results tab’s Quick Search section, click New Application. The Search link’s Applications Entry screen opens at the Simple Application Entry tab.

For field description refer Applications of the Underwriting chapter:

Pre-fill applicant information from Sales Lead

You can pre-fill the applicant information if the same applicant details are already captured as a prospect in the Sales Lead screen. To do so, select the sales lead number in the drop-down of ‘Lead #’ field and save the Application details. The ‘Copy Lead Details’ button is enabled in the Applicant section below. Click on it to auto populate the Applicant details.

5.2.1 Pre-qualifying an Application

After entering the basic details of the applicant like identification and demographic details along with the address, employment, assets, liabilities and other income information and requested details, the user has to check whether the application pre-qualifies or not by clicking Pre-qualify Application button. This is governed by a set of Pre-qualification edits.

If pre-qualified edits are satisfied, the status is changed to NEW-PREQUALIFY APPROVED and user can modify or update any further details in the Application Entry screen.

If the edits are not satisfied, application will be pushed to REJECTED APPLICATIONS queue with a status update to REJECTED-PREQUALIFY REJECTED. You can also view rejected pre-qualification in the Underwriting screen.

When specific services listed in Dashboard -> System Monitor -> Services tab are 'stopped', the application status will display 'NEW PRE-SCREEN APPROVED' and user will not be able to change the status manually to move it to Underwriting queue. In such cases, services should be started post which the application is processed automatically by the system and falls in the appropriate queue as per work flow.

5.3 Applicants Tab

Using the information supplied on application, complete Applicants tab details and the following sub tab details:

- Address

- Employments

- Telecoms

- Financials

- Liabilities

- Other Incomes

- Summary

- Credit Scores

- Duplicate Applicant

- Existing Accounts.

The system uses information on Financial and Liabilities sub tabs to determine the applicant’s net worth. The system uses information on Employments tab and Other Incomes sub tab to calculate applicant’s debt-to-income ratio.

Note the following while completing frequency fields:

- Biweekly in the system means ‘once every two weeks’ and not ‘twice a week’.

- Bimonthly in the system means ‘once every two months’ and not ‘twice a month’.

For more information, refer appendix Payment Amount Conversion.

To complete the Applicants Details screen

- On the Simple Application Entry tab, click Applicant > Applicant.

- For details on this screen refer Applicant Tab of the Underwriting chapter.

5.4 Business Tab

Oracle Financial Services Lending and Leasing can record SME business related financial information and business partners on the Business screen to assist in approving Lease application during underwriting. The Business Applicant screen is available for Lease and contains the following sub screens:

- Address

- Telecoms

- Financials

- Liabilities

- Partners

- Affiliates

- Other details

To complete the Business tab

- If SME business information is included on the application, select small business in the Class field on the Applications section and click Save.

The Business tab appears on Application Entry screen.

- On the Application Entry screen, click Business.

For details on this screen, refer Business Tab of Underwriting chapter.

5.5 Request Tab

Depending on the type of product you select, the following screen will be available from Requested tab

To complete Request tab:

- On the Application Entry tab, click Request tab.

For details on this screen refer Request Tab of the Underwriting chapter:

5.6 Collateral Tab

Depending on the type of product or producer you select, the Collateral tab opens one of the three following collateral screens: a vehicle information screen, a home information screen or an other information screen. Complete the screen that is available on your Applications screen. After that, complete the Valuation and Tracking sub screen, which the Collateral screens share. If you are entering an unsecured Lease, the Collateral tab is present but inactive; in which case, skip this step.

To enter vehicle information from the Collateral tab

- On the Application Entry link bar, click Collateral.

To enter home information from the Collateral tab

- On the Application Entry tab, click Collateral sub tab.

If collateral is any other, the Collateral link displays information about that collateral.

For details on this screen, refer Collateral Tab of the Underwriting chapter.

5.7 Comments Tab

When using the Simple Application Entry screen, you can add comments to an application at any time in the application entry process by clicking Comments tab.

To complete the Comments tab

- On the Application Entry tab, click comments.

For details on this screen, refer Comments Tab of the Underwriting chapter.

5.8 Tracking Tab

The Tracking tab enables you to record further information associated with the application. What items you choose to track are setup during implementation.

To track attributes

- On the application entry screen, click the Tracking tab.

For details on this screen, refer Tracking Tab of the Underwriting chapter

5.9 Verification Tab

Oracle Financial Services Lending and Leasing can be configured to automatically validate portions of an application when you attempt to change its status. The results of this data check appear on the Verification link’s Edit screen as an Error, a Warning or an Override.

If it is an Error, the system will not allow you to change application’s status and approve Lease until you fix all the errors.

If it is a Warning, the system enables you to change an application’s status without correcting the matter. While you should still investigate the problem, Warning messages are of a lesser importance than Error messages.

If it is an Override, the system displays a dialog box informing you that an override is needed; your responsibility level does not have the authority required to process this step. (Choose Yes on the dialog box to move the application to the queue of the user with the required authority.)

To validate a credit application

- Enter all the information associated with the application on the Application Entry screen.

- When you are finished entering data, on the Application Entry tab, click Verification sub tab, then click the Edits sub tab.

For details on this screen, refer Verification Tab of the Underwriting chapter.

5.9.1 Application Entry using Fax-In

You can enter credit application data into Oracle Financial Services Lending and Leasing Application using the Fax-In image functionality using the Fax-In container. Once the all the images are loaded into the system using the steps mentioned in ‘Entering a Credit Application’ section, you can view those images in the Fax-In container and perform data entry concurrently.

The Fax-In container option is a simple image holder which is available to the user on clicking the ‘New Application’ button. The option is available only if has been enabled in the system settings by the administrator.

If you are the administrator, you can enable/disable this feature to the users in the access screen. However, you can view the availability of this feature by navigating to Main Menu > Setup > Administration > User > Access screen. Select Screen tab and in the Security Access Definition section, the status of “ACCESS TO MENU IMAGE MAINTAINENCE” flag defines the availability of this feature. If the flag is set to ‘Y’ then the Fax-In container is available in Application Entry screen.

The image container displays the image with the header information stored in the tables loaded as a part of the loading process. You can navigate through the pictures using the navigation buttons (First, Previous, Next and Last) available on the top right.

After entering the Application details, you need to select the Image check box placed on the top of Fax Image container. By doing so the system will automatically associate the current image with the application and save it along with the other application details. Also the image will no longer be available in the container since the container only holds those images which are not associated with any application.

5.10 Review Request

The Review Request tab facilitates to flag an Application for the attention of another Oracle Financial Services Lending and Leasing user and ask for review / feedback. It allows the system users to send and receive requests (including e-mail) commenting on a specific account or application. The Review Request tab supports iterative review of selected Application and also to process the review with multiple reviewers.

For detailed information on using this feature, refer to ‘Review Request’ section in Underwriting chapter of the document.