Appendix G :Trading of Accounts

This chapter consists of following sections:

G.1 Introduction

Trading of Accounts refers to buying and selling of account holdings (also termed as equity). Trading of Accounts in vacation ownership industry refers to an exchange of ‘vacation plan’ also called as ‘Timeshare’. This is a flexibility offered to customer/member to trade their existing Timeshare or vacation plan with new Timeshare.

During the trade, if the existing Timeshare is fully paid then customer/member can use the full Equity/Ownership to exchange for new Timeshare. If partially paid, then only the customer paid equity can be used to exchange for new Timeshare.

Oracle Financial Services Lending and Leasing provides a complete framework for trading of accounts which involves account equity calculation, Timeshare trading (Inquiry, Processing), rescission of trade and account cancellation. Further, the details of trade equity transfer are captured and displayed in Customer Service > Trade Details screen with details of ‘From’ and ‘To’ Account(s) created as a result of Trade. This screen also records all the successful and failure equity transfers on the selected Account.

G.2 Prerequisites

To perform trade, Trade Equity calculation are to be setup using User Defined Configurable Calculation parameters. For more details, refer to ‘User Defined Parameters’ section in Setup Guide.

G.3 Trading of Accounts Workflow

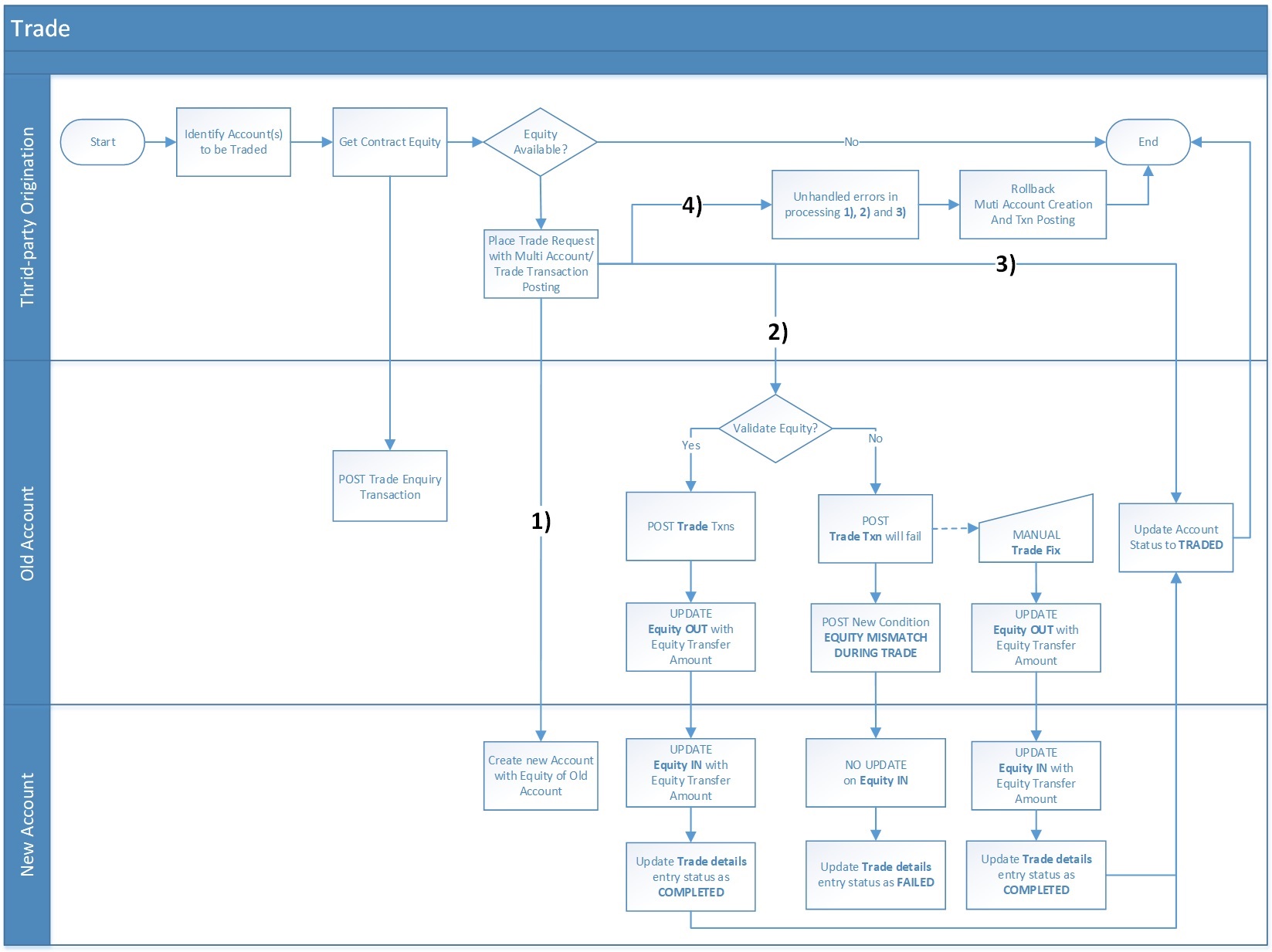

The workflow in Trading of accounts begins with a web service request generated from third-party origination system and is processed in OFSLL with transfer of customer/member’s Trade Equity from an existing (old) account to a new Account as indicated below.

Following are the high-level categorization of different processes involved in Accounts Trading workflow. These processes are handled with corresponding monetary and non-monetary transactions and they are either posted automatically or manually in OFSLL.

Click on each link to view the section details:

G.3.1 Equity Calculation

As per the above workflow, a particular account or set of customer accounts are identified for Trade and a request is generated from third party origination system to OFSLL to derive the contract equity of the trading account. This request in turn is configured to automatically post ‘Trade Enquiry’ transaction and Account details web service to calculate and validate if Account(s) can be traded. For more information, refer to ‘Trade Enquiry Transaction’ section.

G.3.2 Trading of Timeshare

Timeshare trading involves the following processes:

- Trade Enquiry

- Add/Update Trade Details

- Trade Transaction (Upgrade, Downgrade, Split, or Combine)

On deriving contract equity of the trading account(s), a ‘Trade Enquiry Transaction’ request is generated from third party origination system to OFSLL. Trade can happen on one-to-one account, or one to multi-account, and/or from multiple to single account. Based on this, a request is placed for new Account creation, and to populate Equity Transfer details from old to new account, and a Trade transaction on existing Account using ‘Multi Account On-boarding with Transaction Posting’ services. This service facilitates to create new account with equity of old account. For detailed information of this transaction, refer to ‘Trade Transaction’ section.

G.3.2.1 Equity Validation

Trade transaction is allowed ‘Only if’ Sum of Equity in itemization of new Accounts = Sum of Trade Equity of existing (old) Accounts = Sum of Equity Transfer Amount in Trade Details.

- If Equity Validation is successful, Trade transaction is processed with following changes on respective accounts:

Changes to Existing (old) Account

Changes to New Account

- Trade Details is populated with Equity Transfer details.

- TRADE EQUTY is recalculated and updated based on Transaction Date.

- TRADE Transaction is posted and Equity Transfer details status is updated to COMPLETED.

- Trade related EQUITY OUT TRANSFER transaction is posted with Equity Transfer Amount. For more information, refer to ‘Equity Out Transfer Transaction’ section.

- ACH processing is stopped.

- One last metro II reporting is generated with account status as PAID-OFF

- Future billing is stopped.

- Adjust minus transaction is posted.

- Account status is updated as TRADED. This status indicates that there is no more Trade Equity available on the account.

- Trade Details is populated with Equity Transfer details.

- EQUITY IN TRANSFER transaction is posted with traded transaction amount. For more information, refer to ‘Equity In Transfer Transaction’ section.

- Status of Trade Details is updated to COMPLETED.

- If Equity Validation fails, Trade transaction is not processed and following updates are posted on respective accounts. However, a failed Equity Validation can be manually corrected as explained in ‘Error Rectification’ section.

Changes to Existing (old) Account

Changes to New Account

- Status of Trade Details is updated to FAILED.

- TRADE MISMATCH transaction is posted along with a condition - EQUITY MISMATCH DURING TRADE.

Status of Trade Details is updated to FAILED.

G.3.2.2 Itemizations

To capture ‘Equity In’ and ‘Unpaid/Rollover Interest’ into the new account created as part of Trade transaction, a set of 5 Itemizations are provided for each as part of base product.

Itemizations to record ‘Equity In’ transfer details from existing (old) account:

- Txn Code - IEQ_1 to IEQ_5

- Itemizations - ITM INCOMMING EQUITY 1 to ITM INCOMMING EQUITY 5

- Itemization Group - ITM INCOMMING EQUITY

Itemizations to record ‘Unpaid/Rollover Interest’ from existing (old) account:

- Txn Code - IRI_1 to IRI_5

- Itemizations - ITM ROLLOVER INTEREST 1 to ROLLOVER INTEREST 5

- Itemization Group - ITM ROLLOVER INTEREST

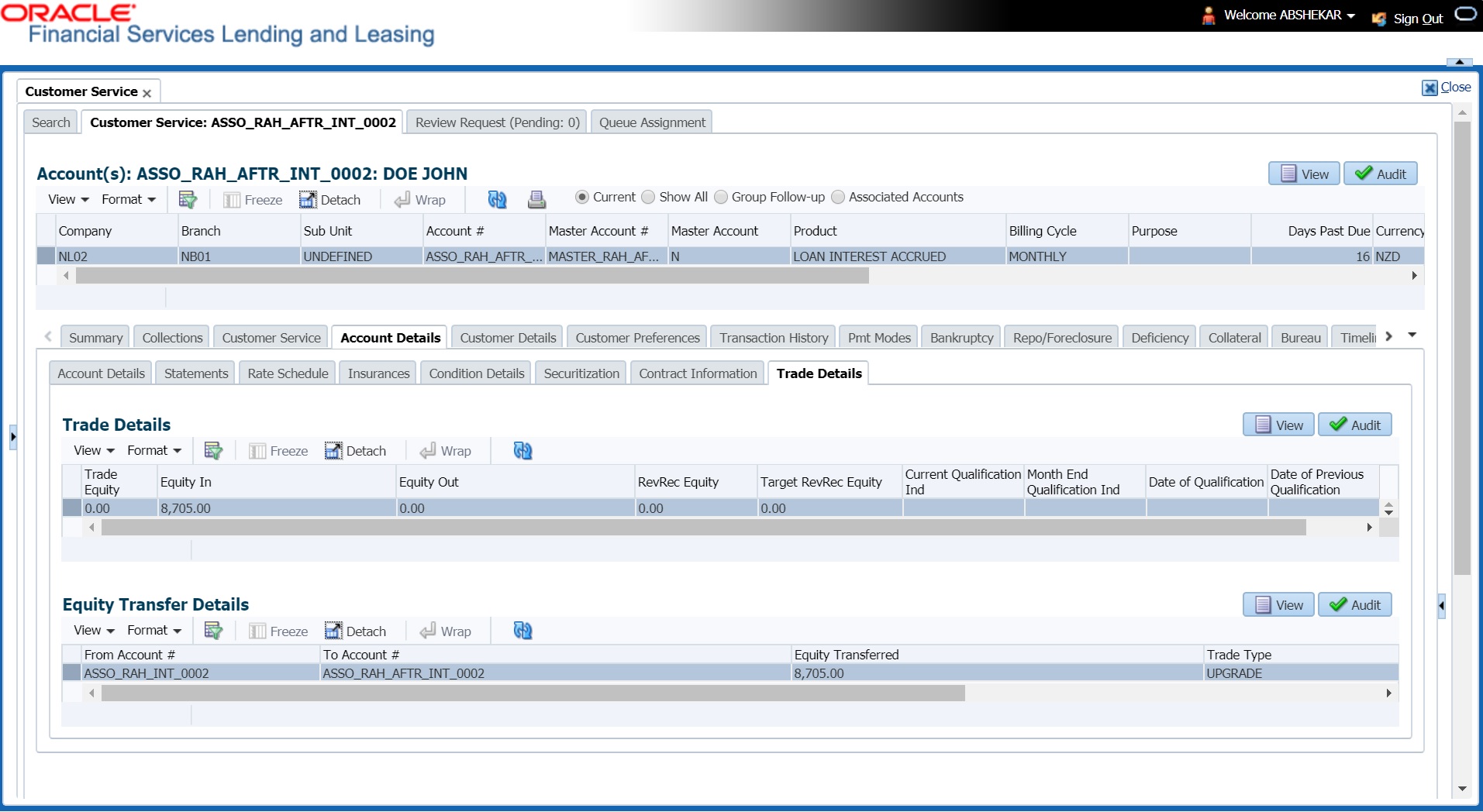

G.3.2.3 Capture Trade Details

The details of Trade transactions are captured in Customer Service > Account Details > Trade Details sub tab. This tab displays Equity Transfer Details from existing (old) account to new account involved in the Trade. For more information, refer Trade Details sub tab section.

G.3.3 Error Rectification

If a Trade transaction has failed during Equity Validation, the same can be manually corrected by adjusting the ‘Equity Transfer Amount’ in existing (old) account. This can be done by posting ‘ADD/UPDATE TRADE DETAILS’ non-monetary transaction in Customer Service > Maintenance > Transaction Batch Information section. For more details, refer to ‘Add / Update Trade Details Transaction’ section.

Also, you can override the ‘Equity In’ adjustments that are received to new account after Trade processing by posting ‘EQUITY IN MAINTENANCE’ monetary transaction. For more information, refer to ‘Equity in Maintenance Transaction’ section.

On resolving Equity Mismatch, Equity transfer can be processed by using TRADE FIX transaction. For more information, refer to ‘Trade Fix Transaction’ section. This in turn posts EQUITY OUT TRANSFER transaction on existing (old) account and EQUITY IN TRANSFER transaction on new account.

On resolving Equity Validation using Trade Fix transaction, the status of Trade Details is updated as COMPLETED and status of account is updated as TRADED. However, the condition EQUITY MISMATCH DURING TRADE posted on existing (old) account needs to be removed manually by posting a Call Activity.

G.3.4 Trade Reversal/Rescission and Charge-off of Account

After processing a Trade transaction, if there are unforeseen circumstances due to which the trade has to be reversed or cancelled, you can do so by posting the following non-monetary transactions in Customer Service > Maintenance > Transaction Batch Information section.

- TRADE REVERSAL - This transaction can be posted on existing (old) account to reverse the Equity Out transfer. This can be posted when the Trade Type is either ‘Upgrade’ (one-to-one) or ‘Split’ (one-to-many). For more information, refer to ‘Trade Reversal’ section.

- RESCISSION ACCOUNT - This transaction can be posted to void the new account created as part of the Trade transaction. This can be posted when the Trade Type is either ‘Upgrade’ (one-to-one) or ‘Combine’ (many-to-one). For more information, refer to ‘Rescission Transaction to Void Account’ section.

On processing Trade Reversal/Rescission transaction, the following changes are posted on respective accounts:

Existing (old) / Source Account |

New / Target Account |

- Reverses TRADE transaction and updates Equity Out value to zero. - If Trade transaction is posted on Linked and Master Account, the same is reversed and account status is reverted to earlier status. - Removes Equity Out value updated in Account Details > Traded Details screen. - ACH processing will be restarted. - Metro II reporting is restarted. - Future billing is restarted on next billing batch job run. - Adjust minus transaction is reverted. - Comment is posted in the format ACCOUNT TRADE REVERSED DUE TO RESCISSION ON <DATE> FOR THE <REASON> AND <COMMENT>. |

- Reverses all active transaction on the multiple new Accounts created from Split or One-to-One trade and Void the new Accounts. - RESCISSION non-monetary transaction is posted to convert account to VOID status. - Comment is posted on multiple new Accounts in the format RESCINDED ON <DATE> FOR THE <REASON> AND <COMMENT>. |

Charge off

If the new account created is not performing well or due to any other reason an account is to be cancelled in OFSLL, you can post CHARGED OFF monetary transaction. For more information, refer to ‘Account Charge Off’ section.

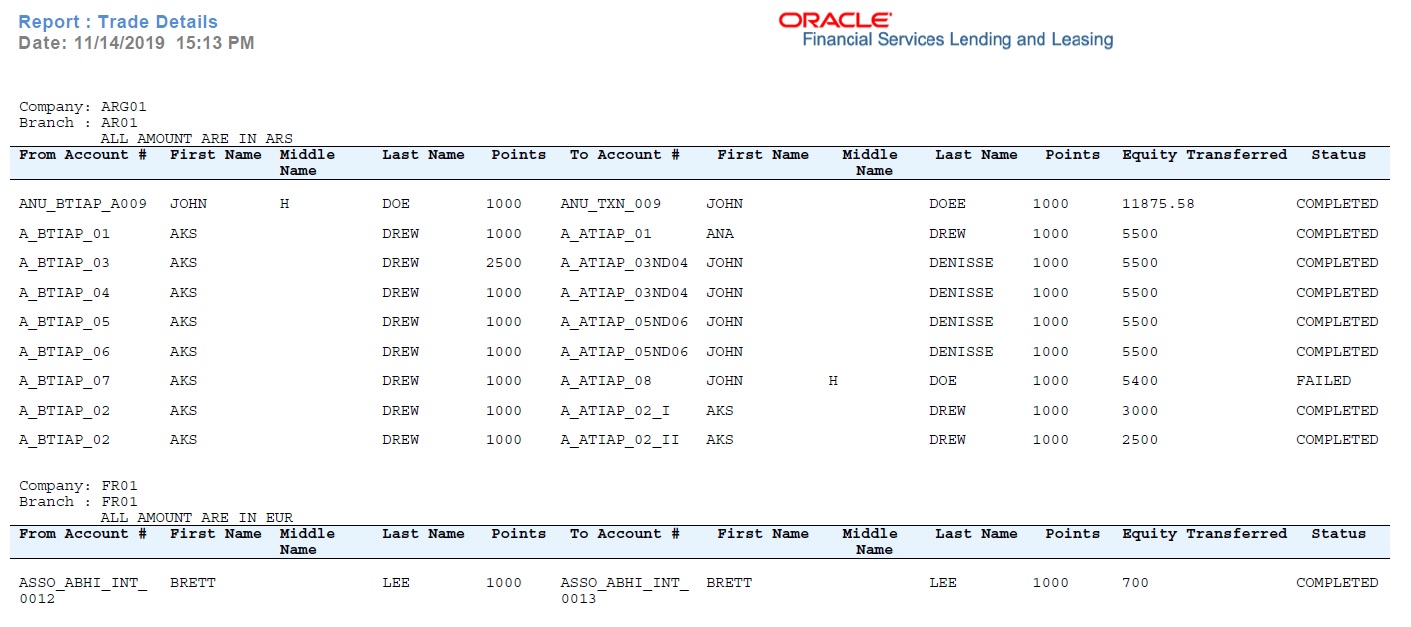

G.4 Trade Details Report

You can generated Trade Details report to view the traded accounts information within the specified date range provided in input parameters. These accounts consists of both existing (old) accounts which are traded along with new accounts which are created as part of the trade. For more information, refer to ‘Trade Details’ in Reports chapter.

G.5 Assumptions

Following are the assumptions while processing trade transactions in OFSLL:

- Trades, Splits and Combine transactions are permitted only within the same company.

- Single trade transaction is used to perform Trade, Discovery Upgrade, Downgrade, Split and Combine. Reason code or comment can be used to differentiate each process.

- Trade, Discovery Upgrade, Downgrade, Split and Combine transactions are updated with Status as TRADED.

- Downgrade should be performed by creating a new Account and posting trade transaction on existing Account.

- Reallocation of Asset after Rescission should be manually handled.

- Refund processing during Rescission/ Cancellation transaction are to be handled outside OFSLL.

- Fees, Expense and Sales Tax already applied on to be Traded, Rescinded or Cancelled Account are to be settled before transaction processing.

- ‘Adjustment transaction posting’ for new Trade account during equity mismatch is to be handled manually.

- Statutory Rescission day validation is not supported in OFSLL.