4. Product

Under the Setup master tab’s drop-down link bar, the product Setup link opens screens that enable you to configure the basic business guidelines necessary to support one or more products in the system. This includes defining the types of collateral your company supports, creating lending instruments, and determining what is included in credit bureau reporting. Setting up the Products screens requires a thorough understanding of the current rules of your business and must be completed before you can use Oracle Financial Services Lending and Leasing. The Products drop-down link opens screens to record data of all the products supported by the system and contains the following links:

Navigating to Products

In the Setup > Setup > Products link enables you to setup the options related to following closed ended products your company offers:

- Asset Types

- Index Rates

- Currency Exchange

- Scoring Parameters

- Products

- Pricing

- Contract

- Edits

- Cycles

- Scoring Models

- Fees

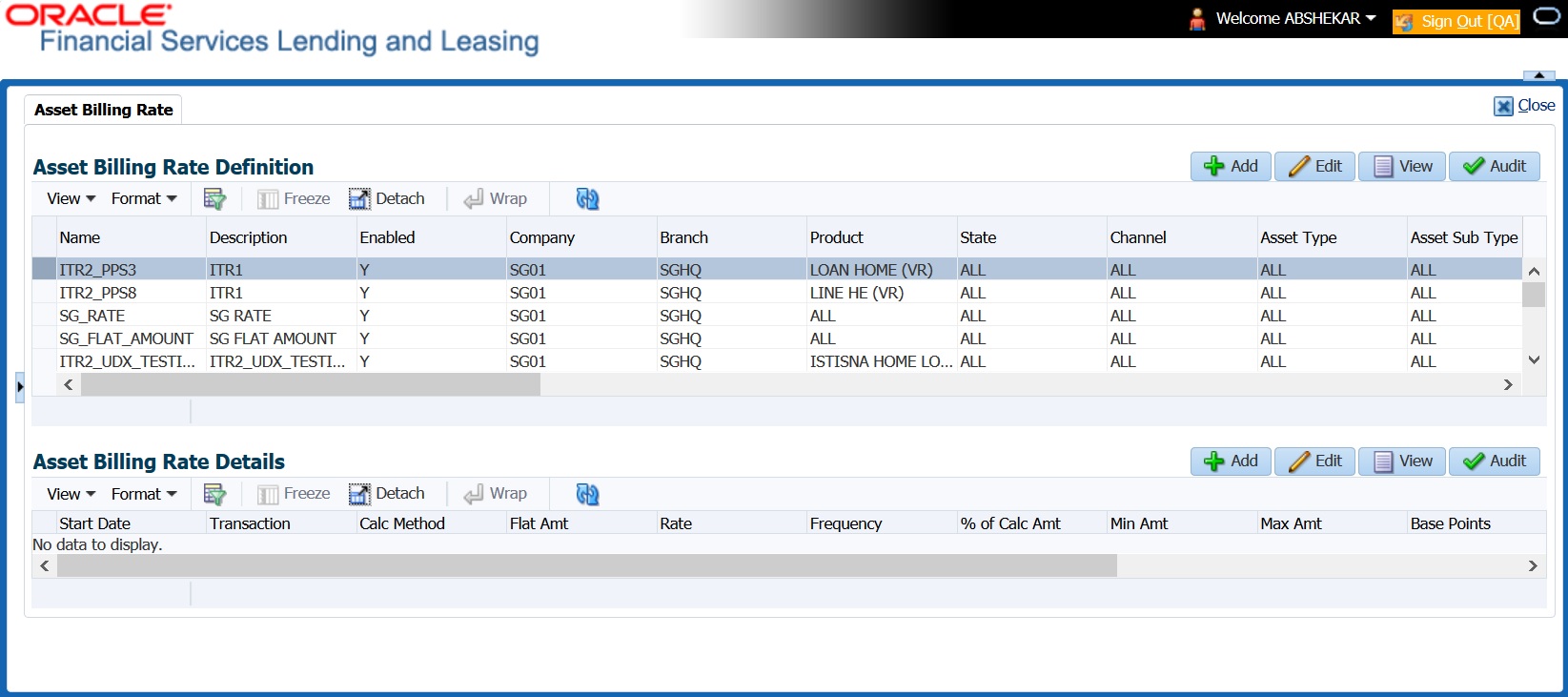

- Asset Billing Rate

- Origination Fees

- Insurances

- Checklists

- Stipulations

- Letters

- Promotions

This chapter explains how to setup the screens associated with each one.

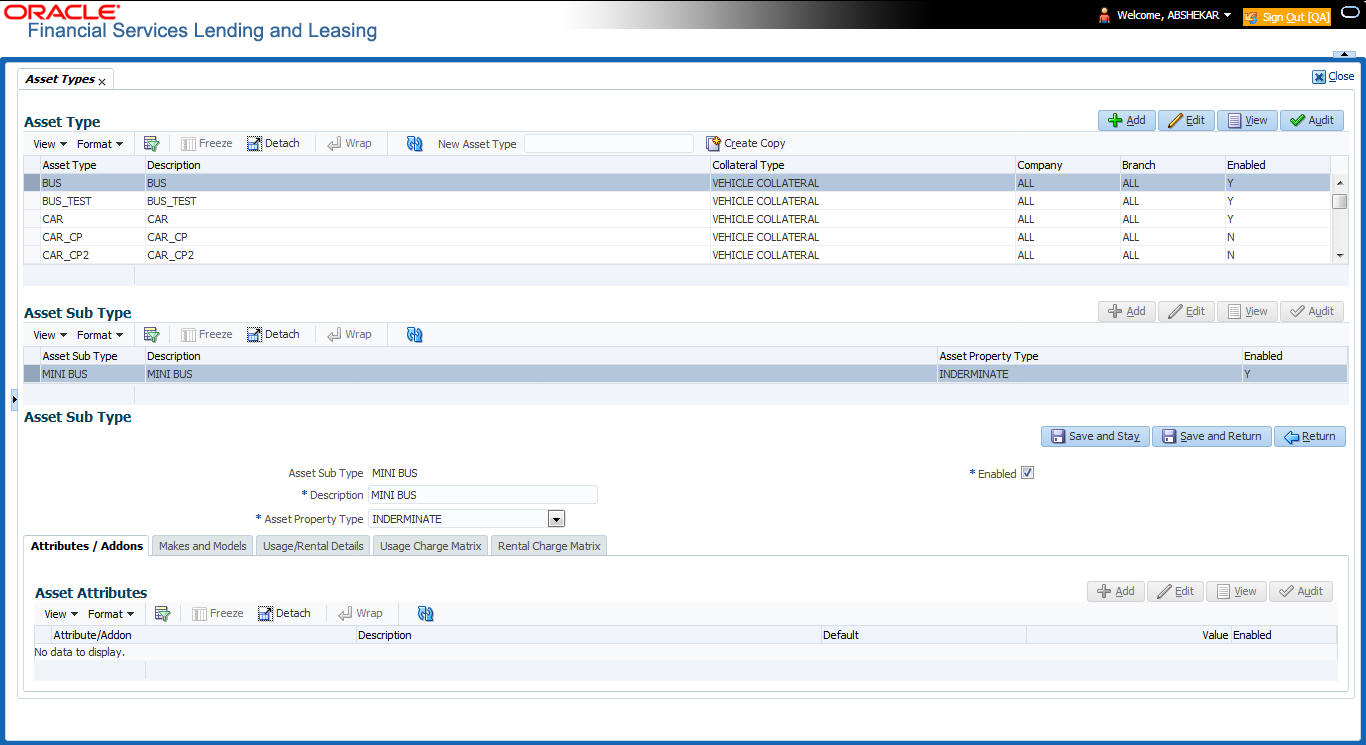

4.1 Asset Types

In Assets types you can setup the asset types that can serve as an application or account’s collateral.

The information on the Assets screen is used by the system to automatically display the appropriate collateral screen (Vehicle, Home, or Other) on the Application Entry screen.

The system recognizes the following four types of collateral:

Collateral Type |

Description |

Home collateral |

Homes, manufactured housing, or any real estate collateral. |

Vehicle collateral |

All vehicle types, such as cars, trucks, and motorcycles. |

Household goods and other collateral |

All other collateral types not defined as home, vehicle, or unsecured; for example, household items such as water heaters, televisions, and vacuums. |

Unsecured collateral |

All unsecured lending instruments. (This collateral type makes the collateral tabs on the system forms unavailable.) |

The Asset Sub Type section allows you to further categorize an asset; for example, the asset type vehicle might be categorized as car, truck, or van.

The Attributes/Addons and Makes and Models sub screens continue to further detail the asset both in description and value. For example, a vehicle asset might include addons such as leather seats and cruise control.

Note

Neither asset types nor asset sub types can be deleted. As they may have been used in the past, the display and processing of that data is still dependent on the existing setup.

To set up the Asset Types

You can either define new Asset Type or specify a new name in the New Asset Type field and click Create Copy to create a copy of selected asset with details.

- Click Setup > Setup > Products > Asset Types.

- In the Asset Type section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Asset Type |

Specify the asset type. |

Description |

Specify the description for the asset. (This is the asset type which will appear throughout the system). |

Collateral Type |

Select the collateral type (the general category that the asset type falls within) from the drop-down list. Note: There is no need to define an asset for UNSECURED COLLATERAL, as by definition there is no asset on such account. |

Company |

Select the portfolio company to which the asset type belongs, from the drop-down list. These are the companies within your organization that can make Lines using this asset type. This may be ALL or a specific company. |

Branch |

Select the portfolio branch to which the asset type belongs, from the drop-down list. This is the branch within the selected company that can make Lines using this asset type. This may be ALL or a specific branch. This must be ALL if in the Company field you selected ALL. IMPORTANT: By selecting which asset type to use, the system searches for a best match using the following attributes: 1 Company 2 Branch Hence, the system recommends creating one version of each asset type where ALL is the value in these fields. |

Enabled |

Check this box to enable the asset type and indicate that the asset type is currently in use. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Asset Sub Type section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Asset Sub Type |

Specify the asset sub type. |

Description |

Specify the description for the asset subtype |

Asset Property Type |

Select the type of property from the drop-down list. |

Enabled |

Check this box to enable the asset sub type. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Click Setup > Setup > Products > Assets > Attributes/Addons.

- In the Attributes/Addons section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Attribute/Addon |

Displays the asset attribute or addon name for the selected asset). |

Description |

Select the description for the asset attribute/addon from the drop-down list. |

Default |

Specify the default text to be copied or displayed when the asset attributes and addons fields are completed on an application for this asset. |

Value |

Specify the default monetary value to be copied or displayed when the asset attributes and addons fields are completed on an application for this asset. |

Enabled |

Check this box to enable the asset attribute/Addon and indicate that it is available for this type of asset. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- Click the Setup > Setup > Products > Assets > Makes and Models.

- In the Makes and Models section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Make |

Specify asset make. |

Model |

Specify asset model. |

Style |

Specify asset style type. |

Model Year |

Specify asset model year. |

Enabled |

Check this box to enable the asset make and model and indicate that it is included on fields for this asset type. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.1.1 Usage/Rental Details

The Usage / Rental Details sub tab allows you to define Usage/Rental definition details to categorize the incoming asset usage/rental data based on different parameters. The details maintained here are populated in Origination screen for billing calculation and can also be modified based on requirement.

For more information on how OFSLL handles Usage based leasing, refer to Appendix - Usage Based Leasing chapter and for Rental based leasing, refer to ‘Rental Agreement’ section in Lease Origination User Guide.

- In the ‘Usage/Rental Details’ section, perform any of the Basic Operations mentioned in Navigation chapter.

- A brief description of the fields is given below:

Field:

Do this:

Agreement Type

Select the agreement type as one of the following from the drop-down list. The selected Agreement Type defines the criteria for pricing selection during billing calculation.

- USAGE

- RENTAL

- USAGE RENTAL

Note: Based on the above selected option, the other fields are either enabled or disabled for selection as indicated below:

For Usage Agreement Type, the following fields are editable:

- Calc Method

- Usage Cycle

- Min Usage

- Max Usage

- Discount %

- Usage Rollover / Advance

- Usage Term Calc Method

For Rental Agreement Type, the following fields are editable:

- Discount %

- Discount Amount

- Security Deposit

For Usage Rental Agreement Type, the following fields are editable:

- Usage Cycle

- Max Usage

- Discount %

- Discount Amount

- Security Deposit

Calc Method

Select the calculation method as one of the following from the drop-down list.

- TIERED (billing is based on the defined Usage/Rental Charge Matrix)

- NON-TIERED (system automatically chooses the applicable slab based on the final usage value)

Usage Cycle

Select the frequency of billing the asset usage from the drop-down list. This field is disabled for RENTAL agreement type.

Min Usage

Specify the minimum usage value of the allowed range. This field is disabled for RENTAL agreement type.

Max Usage

Specify the maximum usage value of the allowed range. This field is disabled for RENTAL agreement type.

Discount %

Specify the percentage of discount exempted from final billing.

Usage Rollover / Advance

Select the type of asset usage calculation as one of the following:

- ROLLOVER (remaining usage balance is carried forward to next cycle)

- NO-ROLLOVER (remaining usage balance is not carried forward)

- ROLLOVER AND ADVANCE (remaining usage balance is carried forward to next cycle + total usage limit for current cycle can be utilized upfront)

- ADVANCE (total usage limit for current cycle can be utilized upfront)

Note: This field is disabled for RENTAL and USAGE RENTAL agreement type and ‘NO-ROLLOVER’ option is applicable by default.

Reset Frequency

Specify the reset frequency of the billing cycle. This field is disabled for RENTAL and USAGE RENTAL agreement types and is available for ROLLOVER, ADVANCE and ROLLOVER AND ADVANCE methods of asset usage billing.

Usage Term Calc Method

Select the type of asset usage term for billing calculation as one of the following from the drop-down list:

- ACTUAL - here the current details updated/received is treated as the final record for usage term calculation.

- AVERAGE - here system takes the average of usage details received in previous cycles for usage term calculation.

The calculation method selected here is populated to ‘Elastic Term Calc Method’ field in Origination/Servicing Collateral screen. This field is disabled for RENTAL and USAGE RENTAL agreement type.

Discount Amount

If you are defining Usage/Rental Details for RENTAL or USAGE RENTAL type of agreements, specify the discount amount allowed upfront from the final billing. This field is disabled for USAGE agreement type.

Security Deposit

If you are defining Usage/Rental Details for RENTAL or USAGE RENTAL type of agreements, specify the security deposit amount paid upfront for the term. This field is disabled for USAGE agreement type.

Excess Rent Collection Method

If you have selected the Agreement Type as USAGE RENTAL, select one of the following type of Charge Matrix to be used to derive the Excess Rent Collection Method from the drop-down list.

- USING USAGE MATRIX

- USING RENTAL MATRIX

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.1.2 Usage Charge Matrix

The Usage Charge Matrix sub tab allows you to define and maintain different chargeable slabs based on the combination of Billing Cycle and Charge Type. The details maintained here are used for billing calculation based on a particular asset usage.

For more information on how OFSLL handles Usage based leasing, refer to Appendix - Usage Based Leasing chapter and for Rental based leasing, refer to ‘Rental Agreement’ section in Lease Origination User Guide.

- In the ‘Usage Charge Matrix’ section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Billing Cycle |

Select the frequency of the billing cycle for the asset from the drop-down list. |

Units From |

Specify the minimum number of units from which the current usage charge matrix is applicable. |

Charge Per Unit |

Specify the amount to be charged for every unit. |

Charge Type |

Select the Charge Type as one of the following from the drop-down list. The list is displayed based on CHARGE_TYPE_CD lookup. - BASE (Units considered as base and chargeable at base rate) - EXCESS CYCLE (Units beyond base units and chargeable considering excess cycle) - EXCESS LIFE (Units exceeding the total contracted units and chargeable considering excess life cycle) Excess life is not applicable for Rental agreement type. |

Enabled |

Check this box to enable the charge matrix for usage calculation. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.1.3 Rental Charge Matrix

The Rental Charge Matrix sub tab allows you to define and maintain different chargeable slabs based on the combination of Billing Cycle, Rental Duration, Charge Per Cycle and Charge Type. The details maintained here are used for billing calculation based on a particular asset usage.

For more information on how OFSLL handles Usage based leasing, refer to Appendix - Usage Based Leasing chapter and for Rental based leasing, refer to ‘Rental Agreement’ section in Lease Origination User Guide.

- In the ‘Rental Charge Matrix’ section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Billing Cycle |

Select the frequency of the billing cycle for the asset from the drop-down list. |

Rental Duration From |

Specify the minimum duration for which the rental charge is applicable. |

Charge Per Cycle |

Specify the amount to be charged for every rental cycle. |

Charge Type |

Select the Charge Type as one of the following from the drop-down list. The list is displayed based on CHARGE_TYPE_CD lookup. - BASE (Chargeable units exceeding from base units allowed) - EXCESS CYCLE (Chargeable units exceeding from billing cycle units) - EXCESS LIFE (Chargeable units exceeding the total contract term) Excess life is not applicable for Rental / Usage Rental agreement type. |

Enabled |

Check this box to enable the charge matrix for usage calculation. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

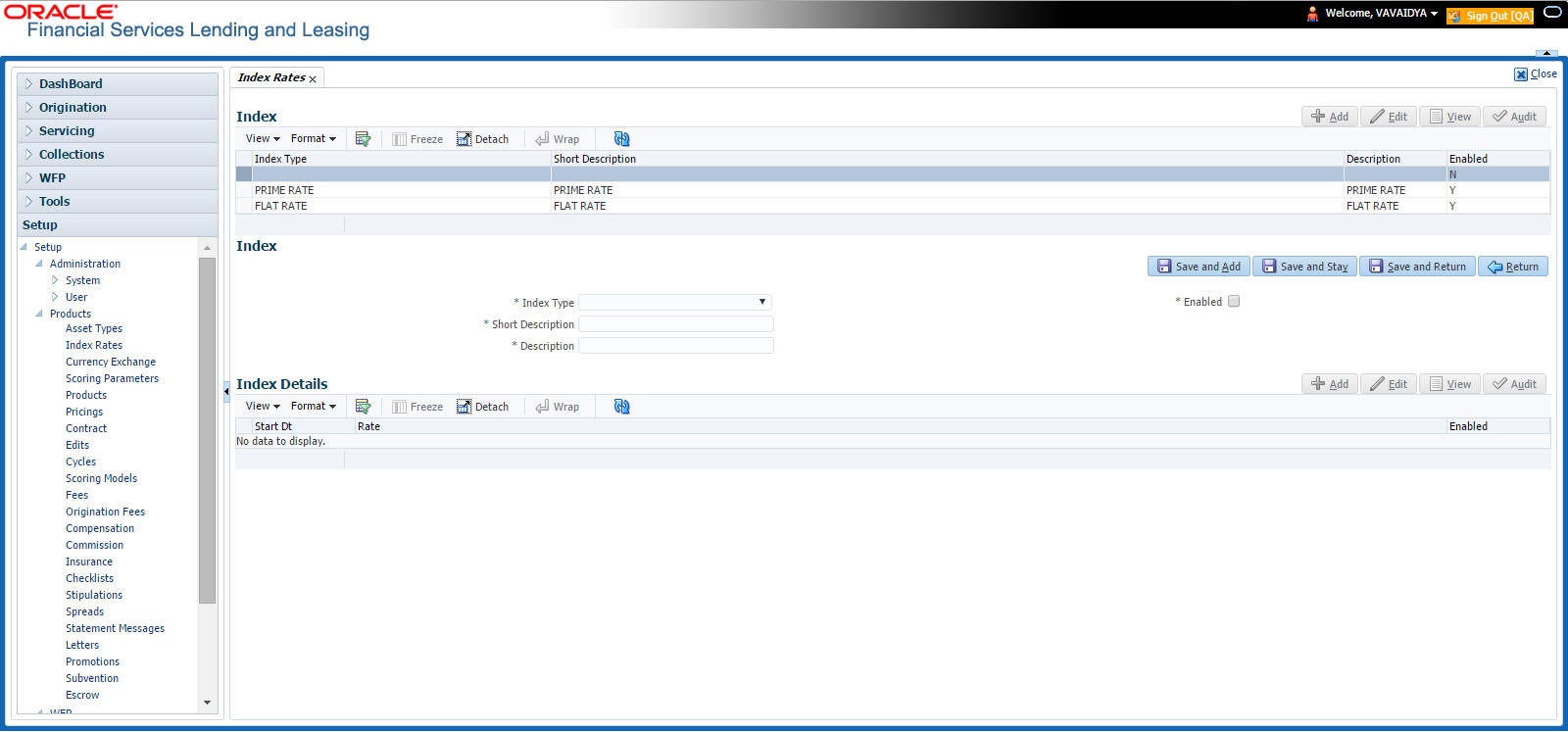

4.2 Index Rates

The Index Rates screen maintains your organization’s history of periodic changes in index rates. It allows you to define index rates to support variable rate lines of credit. The index rate provides the base rate for a credit line where:

interest rate = index rate + margin rate.

The Index section displays the currently defined indexes on the Lookups screen. You may create additional user-defined lookup codes for this lookup type as needed.

Note

You cannot tie an index rate to a product rate.

You can also record any index rate change on the Index Rates screen. During nightly batch processing, all the accounts with that index type are included when posting the RATE CHANGE transaction. After the system processes the batch, the interest rate of the account is changed. The system will use this new interest rate when computing all future interest calculations.

To set up Index Rates

- Click Setup > Setup > Products > Index Rates.

- In the Index section, perform any of the Basic Operations mentioned in Navigation chapter.:

- A brief description of the fields is given below:

Field:

Do this:

Index Type

Select the type of index from the drop-down list.

Short Description

Specify a short description of the index.

Description

Specify the index description.

Enabled

Check this box to activate the index type.

- Perform any of the Basic Actions mentioned in Navigation chapter.

The Index Details section allows you to define multiple index values using the Start Dt and Rate fields.

Note

The history appears in descending order, with the most current record at the top.

- In the Index Details section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Start Dt |

Specify the effective start date for the index rate. You can even select the date from the adjoining Calendar icon. |

Rate |

Specify the new index rate effective from above mentioned date as a percentage. Note: For the FLAT RATE index there should be only one entry with a Start Dt. = 01/01/1900 and a RATE = 0.0000. |

Enabled |

Check this box to activate the index rate effective from start date mentioned above. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

Note

Variable rate functionality is not extended to pre-compute accounts.

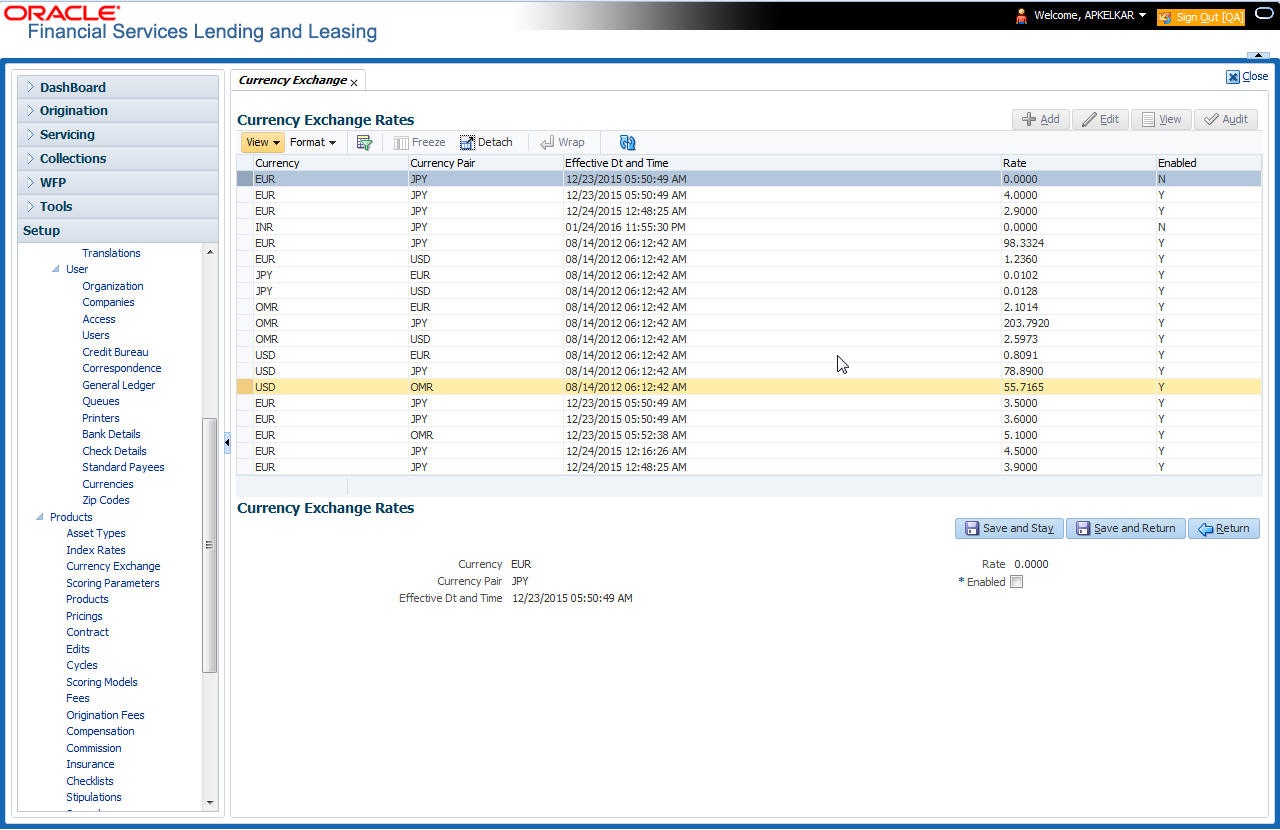

4.3 Currency Exchange

The Currency Exchange screen maintains currency exchange rates. You can define the currency exchange details and schedule a batch job (SET-IFP- ICEPRC_BJ_100_01 - CURRENCY EXCHANGE RATE FILE UPLOAD) which in-turn pulls the currency exchange rates from desired source at scheduled intervals through input file processing.

To set up the Currency Exchange

- Click Setup > Setup > Products > Currency Exchange.

- In the Currency Exchange Rates section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Currency |

Select the currency being exchanged from the drop-down list. |

Currency Pair |

Select the currency to be paired with from the drop-down list. |

Effective Date and Time |

Specify date and time of the exchange rate. You can even select the date from the adjoining Calendar icon. |

Rate |

Specify the exchange rate (required). |

Enabled |

Check this box to activate the currency exchange rate. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

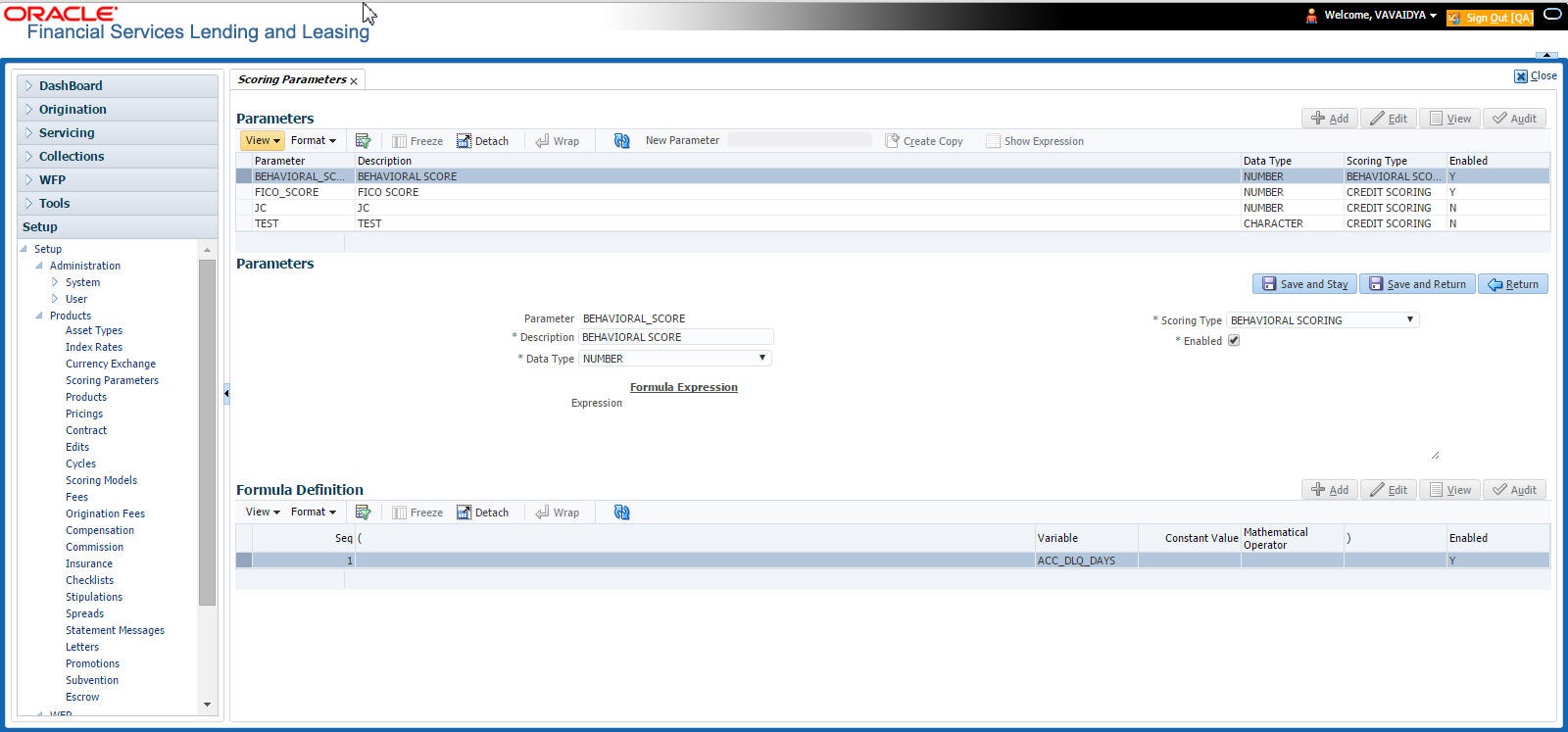

4.4 Scoring Parameters

With the Scoring Parameters, you can define the scoring parameters of a company’s credit scorecard and behavioral scoring.

While the system’s pricing scores apply to applications and are based on information recorded during origination, behavioral scoring applies to accounts and is based on account history attributes and performed on a monthly basis.

Behavioral scoring

Behavioral scoring examines the repayment trends during the life of the account and provides a current analysis of the customer. This logical and systematic method identifies which accounts are more likely to perform favorably versus accounts where poorer performance is probable. This is useful when determining which other Lines of credit/loan products a customer may qualify for. Behavioral scoring applies to all the three products: loans, lines of credit and leases.

This information appears on the Customer Service form in the Account Details screen’s Activities section.

Credit Scoring

Parameters define the factors that can be used when scoring an application during underwriting and generating an initial decision on whether you wish to fund an amount. The combination of the flexible definition of these parameters, along with the scoring set up on the Scoring Models screen, allows you to automate much of the initial decision process in underwriting accounts.

The Formula Definition section on the Scoring Parameters screen allows you to build a mathematical expression to express the scoring parameter, test its validity, and locate specific information with the resulting scoring parameters. The system calculates scoring parameters using application data, credit bureau information, and applicant details.

To set up the Scoring Parameters

You can either define new Scoring Parameters or specify a new name in the New Parameter field and click Create Copy to create a copy of selected parameter with details.

- Click Setup > Setup > Products > Scoring Parameters.

- In the Parameters section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Parameter |

Specify the name of the scoring parameter. The system recommends entering a name that in some way reflects how the parameter is used; for example, use FICO_SCORE instead of PARAMETER_1. |

Description |

Specify a description of the parameter. Again, Specify a name that reflects how the parameter is used; for example, use FICO SCORE and WEIGHTED FICO SCORE instead of FICO SCORE NUMBER 1 and FICO SCORE NUMBER 2. |

Data Type |

Select the data type of the scoring parameter being defined from the drop-down list. This determines how the system handles the values. (While DATE and CHARACTER are available data types, generally only NUMBER should be used when defining a scoring parameter. |

Scoring Type |

Select the scoring type from the drop-down list: credit scoring or behavioral scoring. |

Enabled |

Check this box to enable and indicate that the scoring parameter is available. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

The Formula Definition section allows you to define a mathematical expression of the scoring parameter you want to define. The expression may consist of one or more sequenced entries. All arithmetic rules apply to the formula definition. If errors exist in the formula definition, the system displays an error message in this section when you choose Show Expression.

- In the Formula Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Seq |

Specify the sequence number (the order in which the formula definition variable will be assembled and evaluated). |

( |

Specify a left bracket, if you need to group part of your formula definition. |

Variable |

Select the variable from a validated field based on the user-defined table SCR_CRED_SUMMARY: SCORING PARAMETERS, from the drop-down list. |

Constant Value |

Specify the constant value (optional). You can specify varchar values which includes Numbers, Alphabets/letters, special character/symbols. |

Mathematical Operator |

Select the math operator to be used on the adjacent formula definition rows, from the drop-down list. |

) |

Specify a right bracket, if you are grouping part of your formula definition. |

Enabled |

Check this box to enable the formula and indicate that it is included when building a definition for the scoring parameter. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

- In the Parameters section, click Show Expression.

The mathematical expression appears in the Formula Expression section (in sequential order) in the Expression field.

4.5 Products

The Product screen defines the closed ended products your organization offers. This screen is enhanced to support Islamic along with the conventional.

A product is based on the following attributes:

- The collateral type and sub type

- The billing cycle

- Whether the amount is paid directly or indirectly to the customer

The Product Definition section records details about the product such as the description, start and end dates, collateral type and sub type, credit bureau reporting attributes, billing cycle, index and rate calculation attributes.

System supports ‘Biennial’ (once every 2 years) and Triennial (once every 3 years) type of billing cycles. Based on the following lookups, the billing cycle ‘frequency’ can be defined:

- BILL_CYCLE_CD

- LOC_BILL_CYCLE_CD - for Line of Credit accounts

The Product Itemization section is used to define itemized entries for a product. This information is used on the Itemization sub screens of the Application Entry and Application screens.

The Rate Adjustments section is used to define the frequency of rate change allowed during interest rate calculations.

To set up the Product

You can either define new Product details or specify a new product code in the New Product field and click Create Copy to create a copy of selected product with details.

- On the Oracle Financial Services Lending and Leasing home screen, Setup > Setup > Administration > User > Products > Products > Line.

- In the Product Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Product |

Specify the product code as defined by your organization (in other words, how you want to differentiate the products). For example, products can be differentiated according to asset. The product code, or name, is unique. |

Description |

Specify the description of the product. (This is the product description as it appears throughout the system). |

Start Dt |

Specify the start date for the product. You can even select the date from the adjoining Calendar icon. |

End Dt |

Specify the end date for the product. You can even select the date from the adjoining Calendar icon. |

Direct |

Check this box, if you need the product to be originated directly to customer. (In this case, the compliance state is the state listed in the customer’s current mailing address.) If unchecked, the product is an indirect lending product; that is, payment is made to the producer. (In this case, the compliance state is the state listed in the producer’s address.) |

Close Account After Paid-Off |

Check this box to allow the account to be closed once the account is paid off i.e. system closes the account after the number of days specified in the system parameter has elapsed. This option is selected by default. If not selected, system ignores the system parameter and does not close the account even if the account is paid off i.e. system keeps the accounts active so that the equity can be traded with other accounts. For information on accounts trading, refer to ‘Appendix - Trading of Accounts’ chapter. Note: If the business practice of a financial institution is ‘not’ to close the accounts then this Indicator need to be unchecked. Mainly in the Vacation Ownership where a Timeshare Loan can be traded anytime even if the account is paid-off, this feature is used. |

Customer Credit Limit |

Check this box to enable ‘Customer Credit Limit’ tab in Origination module. Using the ‘Customer Credit Limit’ tab, an underwriter can define a specific credit limit for the customer while funding the first application and based on that credit limit, subsequent applications can be funded. For more information, refer to ‘Customer Credit Limit’ details in User Guide. |

Same Billing Cycle |

Check this box to set the same billing cycle (supported only billing cycles Monthly and Weekly) for all the future applications funded for an existing customer. |

Enabled |

Check this box to activate the product. Note: You can check this box only when Rate adjustment schedule is maintained, i.e., All the products should be variable rate products. |

Skip Credit Bureau Reporting |

Check this box to skip credit bureau reporting of all Accounts funded with this product type - i.e. on funding an application, that particular account is enabled with this parameter and is excluded when the metro II batch job is run for credit bureau reporting. This option can also be enabled/disabled at individual account level in Servicing by posting ‘Skip Credit Bureau Reporting Maintenance’ non-monetary transaction. However note that existing behaviour of ‘Stop Bureau Account’ condition would still be applicable. |

Collateral Type |

Select the collateral type for the product, from the drop-down list. This field identifies what type of collateral is associated with the and assists the system in identifying the correct screen(s) to display. |

Collateral Sub Type |

Select the collateral sub type for the product, from the drop-down list. |

Credit Bureau Portfolio Type* |

Select the credit bureau portfolio type for the product, from the drop-down list. |

Credit Bureau Account Type* |

Select the account type for the product, from the drop-down list. *Note: The Credit Bureau Portfolio Type and Credit Bureau Account Type fields determine how the portfolio is reported back to the credit bureaus. |

Billing Cycle |

Select the billing cycle for the product, from the drop-down list.if |

Category |

Select the category as Standard for the conventional product and Islamic for the Islamic product, from the drop-down list. This serves to group products for reporting purposes. |

Index Rounding |

Select the index rate rounding factor for the product, from the drop-down list. Note: For more information, refer Appendix C: Rounding Amounts and Rate Attributes. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.5.1 Product Itemizations

- Click Setup > Setup > Administration > User > Products > Products > Line > Product Itemizations.

- In the Product Itemization sub screen, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Itemization |

Select the itemization type for the product selected in product definition section, from the drop-down list. |

Discount Rate |

Specify the discount rate. |

Sort |

Specify the sort order. |

Sign |

Select +ve for a positive number and -ve for a negative number. Note: The +ve and -ve buttons determine whether the values will increase or decrease the itemization total for the product based on the selected product. Together the contents of the Product Itemization sub screen, positive and negative, add up to the amount. |

Enabled |

Check this box to indicate that this product itemization is currently available. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.6 Pricings

The Pricing screen records pricing information related to your products. the system uses the information in the Pricing Definition section to identify the correct pricing for an application, depending upon the product and the specific application parameters. the system will always search for a unique match.

When you choose the Select Pricing while making a decision on the Underwriting window, the system displays the best match and completes the Pricing and Approved sections under Summary sub tab. The information in the Approved section cite the minimum amounts for the loan, though the user can edit these figures.

The system determines the best match by looking at all enabled pricing strings on the Pricing screen that meet the following criteria:

- Exactly match the application values for the Promotion and Billing Cycle fields.

- Are less than or equal to the application values for the Term, Amount, Age, and Start Date fields.

- Match either the application value or ALL for all other criteria.

Exact matches for each field are given a higher weight than matches of ALL. The returned rows are then ranked based on the weighted values and the hierarchical position of the field (see above). They are then ranked by start date. The system recognizes the first row returned as the best match.

Note

- You should set up a default pricing for each billing cycle and pricing that the system can select to ensure error-free performance. Oracle Financial Services Software recommends creating a single version of each edit type, where ALL is the value in the selection criteria fields listed above. If the system cannot find a pricing match, it will display an error message.

- The system supports the bulk uploading of product pricing setup data. This allows you to upload multiple setup data, avoid re-entering setup data, and more importantly, reduce data entry mistakes. The system currently supports uploading using a fixed-length format only, where each data is at a pre-fixed position. You can run batch jobs with the Set Code SET-BLK to upload pricing and GL data.

System supports ‘Biennial’ (once every 2 years) and Triennial (once every 3 years) type of billing cycles. Based on the following lookups, the billing cycle ‘frequency’ can be defined:

- BILL_CYCLE_CD

- LOC_BILL_CYCLE_CD - for Line of Credit accounts

To set up the Pricing

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > User > Products > Pricings > Line.

- In the Pricing Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Pricing* |

Specify the code for the pricing. |

Description* |

Specify the description for the pricing. |

* Together these two fields define the name of the pricing. |

|

Start Dt |

Specify the start date for this pricing. You can even select the date from the adjoining Calendar icon. |

End Dt |

Specify the end date for this pricing. You can even select the date from the adjoining Calendar icon. |

Enabled |

Check this box to enable the pricing. |

Result section |

|

Draw Period |

Specify the draw term for which this pricing is valid. |

Repmt Period |

Specify the repayment term for which this pricing is valid |

Max Credit |

Specify the maximum credit Limit for this pricing. |

Index |

Select the index type associated as FLAT/PRIME RATE from the drop-down list. |

Margin From |

Specify the minimum margin rate for the selected index type. |

Margin To |

Specify the maximum margin rate for the selected index type. |

Maturity Index |

Select the maturity index type associated as FLAT/PRIME RATE from the drop-down list. |

Maturity Margin Rt From |

Specify the minimum margin rate for the selected maturity index type. |

Maturity Margin To |

Specify the maximum margin rate for the selected maturity index type. |

Selection Criteria |

|

Company |

Select the portfolio company for this pricing, from the drop-down list. This may be ALL or a specific company. |

Branch |

Select the portfolio branch for this pricing. This may be ALL or a specific branch. (This must be ALL if in the Company field you selected ALL), from the drop-down list. |

Billing Cycle |

Select the billing cycle for this pricing, from the drop-down list. |

Product |

Select the product for this pricing, from the drop-down list. This may be ALL or a specific product. The available values come from a validated field based on the selected billing cycle and the product setup. |

State |

Select the state for this pricing, from the drop-down list. This may be ALL or a specific state. |

Pro Group |

Select the producer group for this pricing, from the drop-down list. This may be ALL or a specific producer group. |

Pro Type |

Select the producer type for this pricing, , from the drop-down list. This may be ALL or a specific producer type. |

Producer Region |

Select the region of the producer. |

Producer Territory |

Select the territory of the producer. |

Producer |

Select the producer from the drop-down list. This may be ALL or a specific producer. The available values come from a validated field based on the product group and product type. |

Grade |

Select the credit grade for this pricing, from the drop-down list. This may be ALL or a specific grade. |

Credit Limit |

Specify the minimum credit limit for which this pricing is valid. |

Asset Class |

Select the asset class from the drop-down list. This may be ALL or a specific asset class. The available values come from a validated field based on the collateral type. You may create additional user-defined lookup codes for these lookup types as needed. |

Asset Type |

Select the asset type from the drop-down list. This may be ALL or a specific asset type. The available values come from a validated field based your assets setup. |

SubType |

Select the asset sub type from the drop-down list. This may be ALL or a specific asset sub type. The available values come from a validated field based your assets setup, and is linked to the selected asset type. |

Asset Make |

Select the asset make from the drop-down list. The available values come from a validated field based your assets setup and is restricted based on the selected Asset Type and Asset Sub Type. For example, If ALL was selected for either Asset Type or Asset Sub Type, then ALL will be the only available selection for the asset make. |

Asset Model |

Select the asset model from the drop-down list. The available values come from a validated field based your assets setup, and is restricted based on the selected Asset Type and Asset Sub Type. If ALL was selected for either Asset Type or Asset Sub Type, then ALL will be the only available selection for the asset model. |

Age |

Specify the asset age (the minimum age for the selected pricing). Note: If your entry in this field is based on the number of years of age of the asset and not the actual year of make, you must update this entry annually to ensure that the proper pricing is available. |

Trade-In |

Specify if there is a trade in of an asset by selecting Yes/No. |

Mileage |

If there is a Trade-In of an existing asset, then specify its mileage in km. |

Currency |

Select the currency for this pricing, from the drop-down list. |

Promotion |

Select the promotion applicable to this pricing from the drop-down list. The available values come from a validated field based on the promotions setup. |

Asset Value |

Specify the asset value. |

LTV |

Specify the loan to value ratio. |

Existing Customer |

Select one of the following options from the drop-down list to define the applicability of the current pricing definition: ALL - Applicable to both existing and new customers YES - Applicable to existing customer only NO - Applicable to new customer only. Based on the selection criteria, system defaults the first pricing for applications with ‘Existing customer flag = Y’ at primary applicant details. |

Existing Customer Since (In Years) |

Specify the duration from when customer account was created in the system up to the current date in years. |

Selection Criteria : Business - allows you to indicate the age of business by evaluating the total number of years elapsed. |

|

Years In Business |

Specify the total number of years in business. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.7 Contract

The Contract screen allows you to define the instruments used within your system. A instrument is a contract used by a financial organization with specific rules tied to it. When processing an application, an instrument associated with the application informs the system of the type of contract being used for the approved loan. This ensures that all parameters tied to the instrument are setup for the account as it is booked - without requiring you to do it.

Instruments can be setup at different levels:

- Company

- Branch

- Product

- Application state

- Currency

The following groups of parameters are setup at the instrument level (Each has its own section on the Contract screen):

- Selection Criteria

- Accrual

- Capitalization

- Scheduled Dues

- Billing

- Delinquency

- Extension

- Advance Details

- Rate Cap And Adjustments

- Other

Items defined in the contract are “locked in” when you choose Select Instrument on the Funding form’s Contract link.

The Contract screen’s Instrument and Description fields allow you to enter the financial instrument’s name and description.

System supports ‘Biennial’ (once every 2 years) and Triennial (once every 3 years) type of billing cycles. Based on the following lookups, the billing cycle ‘frequency’ can be defined:

- BILL_CYCLE_CD

- LOC_BILL_CYCLE_CD - for Line of Credit accounts

To set up the Contract

You can either define new Contract Definition details or specify a new name in the New Instrument field and click Create Copy to create a copy of selected contract with details.

- On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > Administration > Products > Contract > Line

- On the Contract Definition section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Instruments section |

|

Instrument |

Specify the code identifying the instrument. |

Description |

Specify the description of the instrument being defined. |

Start Dt |

Specify the start date for the instrument. You can even select the date from the adjoining Calendar icon. |

End Dt |

Specify the end date for the instrument. You can even select the date from the adjoining Calendar icon |

Enabled |

If you check this box, the system will consider this contract definition when selecting a instrument for an application. Note: Once the field is enabled load balances button in balances sub tab will be disabled |

Selection Criteria section |

|

Company |

Select the company for the instrument from the drop-down list. This may be ALL or a specific company. |

Branch |

Select the branch within the company for the instrument from the drop-down list. This may be ALL or a specific branch. This must be ALL, if you have selected ‘ALL’ in the Company field. |

Billing Cycle |

Select the billing cycle selected from the drop-down list. |

Product |

Select the product for the instrument from the drop-down list. This may be ALL or a specific product. |

State |

Select the state in which the instrument is used from the drop-down list. This may be ALL or a specific state. |

Currency |

Select the currency for the instrument from the drop-down list. IMPORTANT: By selecting which type to use, the system searches for a best match using the following attributes: 1. Billing Cycle 2. Start Date 3. Company 4. Branch 5. Product 6. State Hence, Oracle Financial Services Software recommends creating one version of each type, where ALL is the value in these fields. |

Pricing |

Select the pricing in which the instrument is used from the drop-down list. This may be ALL or a specific pricing. |

Accrual section |

|

Accrual Post Maturity |

Check this box to indicate that this is the post maturity default rate. Extensions allow you to extend the maturity of the contract by one or more terms by allowing the customer to skip one or more payments. The skipped terms are added to the end of the contract. |

Accrual Method |

Select the accrual method used to calculate interest accrual for this instrument from the drop-down list. |

Start Dt Basis |

Select to define the start date from when the interest accrual is to be calculated for this instrument from the drop-down list. Note: If you select the Effective Date, then the interest is calculated from the Contract date. If you select the Payment Date, then the interest is calculated based on (first payment date minus one billing cycle). |

Base Method |

Select the base method used to calculate interest accrual for this instrument from the drop-down list. |

Accrual Start Days |

Specify the number of days for which the interest accrual is to be calculated. |

Int Amortization Freq |

Select one of the following interest amortization frequency from the drop-down list: - DAILY - if selected, the interest amortization (TAM) GL entries hand-over happens every day. - EVERY BILLING CYCLE MONTH END - if selected, the interest amortization (TAM) GL entries hand-over happens on month end of the account billing cycle. For example, if account billing cycle is quarterly, the GL handover happens on month end of the quarter. |

Capitalization section This section allows you to define capitalization parameters which helps to capitalize the corresponding account balances to the principal balance of the account based on specific frequency. For example, you can capitalize the accumulated Interest or Late Fees to principal balance of the account. You can either capitalize all the balances based on same frequency or define different frequency for each type of balance. Note: Capitalization parameters can also be updated by posting ‘CAPITALIZATION MAINTENANCE’ monetary transaction. |

|

Capitalize |

Check this box to enable capitalization parameters for the contract. By default, this option is un-checked. The option is available only for the following product types: - Interest Bearing Loans and Mortgage Loans - Interest Rate Method Lease - Average daily balance Method Line of Credit |

Frequency |

Select the required capitalization frequency from the drop-down list. The list contains the following types of frequency to either capitalize all the balances based on same frequency or define different frequency for each type of balance. - Based on specific intervals such as Monthly, Quarterly, Annual and so on. - Based on contract Billing Frequency, Billing Date, or Due date. - Specifically on every Month End. - Or - - Based on Balance Frequency to define different capitalization frequency for each balance. This can further be defined in Balances sub tab. |

Capitalization Start Basis |

Select the capitalization start date from the drop-down list as either Contract Date or First Payment Date to calculate the capitalization frequency accordingly. However, this field is not enabled for Billing date or Due Date type of capitalization frequency. |

Grace Days |

Specify the grace days allowed in the frequency (minimum 0, maximum 31) before capitalizing the balances to account. This is also the deciding factor for executing the capitalization batch job which is based on Capitalization Frequency + Grace Days. However, note that Grace Days are not accounted for Month End type of capitalization frequency and is ignored even if specified. |

Cap Tolerance Amt |

Specify the capitalization tolerance amount which is the minimum amount to qualify for capitalization. Any amount less than this is not considered for capitalization of balances. This helps to avoid capitalization of nominal or decimal amounts. Note: There is no specific accounting maintained for non-capitalized decimals with reference to setup. |

Scheduled Dues section |

|

Max Due Day Change Days |

Specify the maximum number of days a due date can be moved. |

Due Day Min |

Specify the minimum value allowed for the due day for this instrument. |

Due Day Max |

Specify the maximum value allowed for the due day for this instrument. Note: If billing cycle is selected as weekly, then Due Day Max field value cannot be greater than 7. |

Max Due Day Change / Year |

Specify the maximum number of due day changes allowed within a given year for this instrument. |

Max Due Day Change / Life |

Specify the maximum number of due day changes allowed over the life of a product funded with this instrument. |

Billing section |

|

Pre Bill Days |

Specify the prebill days. This is the number of days, before the first payment due, that accounts funded with this instrument will be billed for the first payment. Thereafter, the accounts will be billed on the same day every month. If an account has a first payment date of 10/25/2003 and Pre Bill Days is 21, then the account will bill on 10/04/2003, and then bill on the 4th of every month. |

Billing Type |

Select the billing type for accounts funded using this instrument from the drop-down list. |

Draw Period Billing Method Billing Method |

Select the draw period billing method for accounts funded using this instrument from the drop-down list. |

Repmt Billing Method |

Select the billing method for the repayment period from the drop-down list. |

Draw Billing % |

Enter the payment percentage for the draw period. |

Repmt Term Payment % |

Enter the payment percentage for the repayment draw period. |

Multiple Billing Asset Rate |

Check this box to indicate if multiple asset rates are applicable for one billing period. System considers billing period from current due date to the next due date. Multiple rates are fetched only when rate end date (rate start date + rate frequency) ends one or more cycle(s) before the next due date i.e. current rate record does not cover the entire billing period. |

Delinquency section |

|

Late Charge Grace Days |

Specify the number of grace days allowed for the payment of a due date before a late charge is assessed on the account. |

Stop Accrual Days |

Specify the number of days a contract can be in delinquent state, after which the interest accrual must stop for an account. A Batch Job is run daily to select accounts in delinquent status for a pre-defined number of days and post ‘No Accrual transaction’ for such accounts on current date. When the account recovers from Delinquency, the system will then post a ‘Start Accrual Transaction’ on the date the account is recovered from delinquency. |

Delq Grace Days |

Specify the number of grace days allowed for the payment of a due date before an account is considered delinquent. This affects DELQ Queues, the system reporting, and the generation of collection letters. |

Time Bar Years |

Specify the total number of years allowed to contact the customer starting from the first payment date and beyond which the account is considered delinquent. You can specify any value between 0-999. |

Cure Letter Gen Days |

Specify the number of delinquency days to initiate cure letter generation. |

Cure Letter Valid Days |

Specify the number of days during which the issued cure letter is valid. Usually financial institutions will start the collection activities after the lapse of cure letter validity date. |

Delq Category Method |

Select the delinquency category method to determine how the system populates delinquency counters on the Customer Service form. Note: This value does not affect credit bureau reporting. |

Cycle Based Fees - This section allows to define the parameters for calculating cycle based fees at individual account level. Using the below parameters, system derives the Cycle Base Fees and updates the account balances on processing the following batch jobs - TXNCBC_BJ_100_01 (CYCLE BASED COLLECTION LATE FEE PROCESSING) and TXNCBL_BJ_100_01 (CYCLE BASED LATE FEE PROCESSING). For more information, refer to ‘Fee Consolidation Maintenance’ section in Appendix chapter. System calculates the below type of fee in combination of associated and master account and is assessed only when total due crosses ‘Threshold’ amount (that is defined in Setup > Products > Contract > Fees tab and Setup > Products > Fees screen): Fee Late Charge (FLC)

Cycle Based Collection Late Fee

Cycle Based Late Fee

|

|

Cycle Based Collection Late Fee |

Check this box to enable cycle based collection late fee assessment on the account. If selected, the balance type CYCLE BASED COLLECTION LATE FEE is made available in the Balances tab which further allows to define how system should derive the balances when an account is booked and funded. If unchecked (default), system does not display the ‘Cycle based Collection Late Fee’ balance in Contract >Balances tab on clicking ‘Load Balances’ button. |

Cycle Based Late Fee |

Check this box to enable cycle based late fee assessment on the account. If selected, the balance type CYCLE BASED LATE FEE is made available in the Balances tab which further allows to define how system should derive the balances when an account is booked and funded. If unchecked (default), system does not display the ‘Cycle Based Late Fee’ balance in Contract >Balances tab on clicking ‘Load Balances’ button. |

Cycle Based Collection Late Fee Grace Days |

Specify the number of grace days allowed before cycle based collection late fee is assessed on the account. This field is enabled only if the Cycle Based Collection Late Fee option is checked above. |

Cycle Based Late Fee Grace Days |

Specify the number of grace days allowed before cycle based late fee is assessed on the account. This field is enabled only if the Cycle Based Late Fee option is checked above. |

Fee Consolidation - If Cycle Based Late Fee is assessed based on above parameters, this section allows to enable/disable the option to consolidate the late fee at Master Account level. |

|

Late Charge at Master Account |

Check this box to allow system to consolidate the late charge assessment at master account level. |

Cycle Based Collection Late Fee at Master Account |

Check this box to allow system to consolidate the cycle based collection late fee assessment at master account level. Ensure that, the option ‘Cycle Based Collection Late Fee’ is also checked for fee consolidation at Master Account level. |

Cycle Based Late Fee at Master Account |

Check this box to allow system to consolidate cycle based late fee assessment at master account level. Ensure that, the option ‘Cycle Based Late Fee’ is also checked for fee consolidation at Master Account level. |

Extension section |

|

Max Extn Period / Year |

Specify the maximum number of terms that the contract may be extended, within a given rolling calendar year. |

Max Extn Period / Life |

Specify the maximum number of terms that the contract may be extended, within the life of the loan. |

Max # Extn / Year |

Specify the maximum number of extensions that may be granted within a given rolling calendar year. |

Max # of Extn / Life |

Specify the maximum number of extensions that may be granted within the life of the loan. |

Minimum # Payments |

Specify the minimum number of payments that must be made before extension. |

Extension Gap in Months |

Specify the gap between previous extension provided in the account and current one as specific number of months. |

Advance Details section |

|

Min Initial Advance |

Specify the minimum initial advance amount allowed. This is the smallest possible initial advance that can be disbursed to the borrower after funding. |

Max Initial Advance |

Specify the maximum initial advance amount allowed. This is the largest possible initial advance that can be disbursed to the borrower after funding. |

Min Advance |

Specify the minimum advance amount. This is the smallest advance amount that a borrower may subsequently request after the initial advance. |

Max Advance |

Specify the maximum advance amount. This is the largest advance amount that a borrower may subsequently request after the initial advance. |

Rate Cap & Adjustments section |

|

Max Rate Increase / Year |

Specify the maximum rate increase allowed in a year. |

Max Rate Increase / Life |

Specify the maximum rate increase allowed in the life of the loan. |

Max Rate Decrease / Year |

Specify the maximum rate decrease allowed in a year. |

Max Rate Decrease / Life |

Specify the maximum rate decrease allowed during the life of the loan. |

Max # Adjustments / Year |

Specify the maximum number of rate changes allowed in a year. |

Max # Adjustments / Life |

Specify the maximum number of rate changes allowed during the life of the loan. |

Min Interest Rate (Floor) |

Specify the minimum rate. |

Max Interest Rate (Ceiling) |

Specify the maximum rate. |

Statement section This section allows to define the preferences for Mock Statement generation at Master Account level. Generating a Mock Statement helps to mock the asset billing process with a future date and to get an upfront statement indicating future dues of Master and Associated Accounts. In ‘Vacation Ownership’ industry, such statements are required to forecast future dues based on current ‘Timeshare’ holdings. The selected preference here are propagated to Application > Contract screen when the instrument is loaded. |

|

Mock Statement Req |

Select this check box to indicate if the account is to be include in Mock statement Generation. Note: Based on this selection, others fields related to Mock Statement below are enabled and becomes mandatory for providing details. |

Mock Start Month |

Select the start month of Mock Statements period from the drop-down list. Note: During the ‘Mock Statement Next Run Date’ validation if next run date is less than Contract Date or GL Date, system moves the ‘Mock Start Month’ to same month of next year. For more information, refer to ‘Mock Statement Maintenance’ in Appendix - Non Monetary transactions sections. |

Mock Statement Cycles |

Select the total number of billings (between 1-12) that are to be generated post Mock Statement Start Date. |

Mock Pre Statement Days |

Specify the number of Pre bill days allowed before for Mock Statements generation. |

Other section |

|

Refund Allowed |

Check this box to indicate that refunding of customer over payments are allowed. |

Refund Tolerance |

Specify the refund tolerance amount. If the amount owed to the customer is greater than the refund tolerance, the over payment amount will be refunded if Refund Allowed box is selected. |

WriteOff Tolerance Amt |

Specify the write off tolerance amount. If the remaining outstanding receivables for accounts funded using this instrument is less or equal to the write off tolerance amount, the remaining balance on the account will be waived. |

Pmt Tolerance Amt* |

Specify the payment tolerance amount. This is the threshold amount that must be achieved before a due amount is considered PAID or delinquent. If (Payment Received + Pmt Tolerance: $Value) >= Standard Monthly Payment, the Due Date will be considered as satisfied in terms of delinquency. The amount unpaid is still owed. |

Pmt Tolerance%* |

Specify the payment tolerance percentage. This is the threshold percentage that must be achieved before a due amount is considered PAID or delinquent. If Payment Received >= (Standard Monthly Payment * Pmt Tolerance% / 100), the due date will be considered satisfied in terms of delinquency. The amount unpaid is still owed. The system uses the greater of these two values. |

Promise Tolerance Amt* |

Specify the promise tolerance amount. This is the threshold amount that must be achieved before a due amount is considered kept or Broken. If (Payment Received + Promise Tolerance: $Value) >= Promise Amount, the Due Date will be considered kept (satisfied). |

Promise Tolerance %* |

Specify the promise tolerance percentage. This is the threshold percentage that must be achieved before a due amount is considered kept or Broken. If Payment Received >= (Promised Amt * Promise Tolerance%), the due date will be considered kept (satisfied). The system uses the greater of these two values. |

Adv Tolerance |

Enter the advance tolerance amount. |

Adv Tolerance % |

Enter the advance tolerance percentage |

Default Pmt Spread |

Select the default payment spread to be used when receiving payments for this account if one is not explicitly chosen, from the drop-down list. |

Min Finance Charge |

Enter the minimum finance charge amount. |

Minimum Pmt |

Enter the minimum billed amount. |

Anniversary Period |

Enter the anniversary term. |

Repmt Currency |

Select the currency from the drop-down list. |

PDC Security Check |

Check this box to indicate that post dated checks are the method of repayment for this contract. |

ACH Fee Ind |

Check this box to indicate that direct debit fee is included. Note: The ACH Fee/Direct Debit Fee balance will be displayed in Balances sub tab only when this checkbox is selected. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

Extension of Terms

The system facilitates extension of terms, provided the following conditions are satisfied:

- Specified number or more payments made in the account

- Gap between the previous and current extension provided in the account must be a specific number of months that could be specified

If the above conditions are not satisfied, then the system displays an appropriate error message.

A new transaction Force Extension will be available. This transaction will be posted when you want the system to bypass the extension validations defined at the contract level.

When a backdated transaction with TXN Date exists before the transaction date of extension, all the transactions are reversed and posted again. If extension transaction is posted again, then the validation rules are not validated again.

Staged Funding

Staged funding for closed-end loans allows you to disburse funds to customers through multiple advances or draws up to the approved amount within a specified “draw period.”

To create a multiple disbursement contract for a transaction

- In the Contract Definition section, click Add and complete the fields following the instructions above, making sure to complete the following steps:

- In the Advance Details section, select the Multiple Disbursement Permitted check box. When you select a contract instrument that permits staged funding (multiple disbursements) on the Funding screen, the system copies the information for that instrument from the Setup Module screen’s Contract screen to the Funding screen’s Contract screen.

Note

You cannot clear the Multi Disbursement Allowed box in the Advance section on the Contract screen.

- Complete the fields in the Advance Details section to define the limits for initial and subsequent advances for staged funding.

Note

This information appears in the Advance section of the Funding screen’s Contract link.

- If you choose, set the following application contract edits as an Error or Warning on the Setup Module screen’s Edits screen.

Note

For more information, see the Edits link (Edits screen) section in this chapter.

- REQUIRED: ADV DRAW END DATE

- XVL: ADV DRAW END DT MUST BE AFTER CONTRACT DT

- XVL: ADV DRAW END DT MUST BE LESS THAN FIRST PMT DT - PREBILL DAYS

These edits appear on the Funding screen’s Verification screen.

Repayment scheduling for staged funding

When funding a loan, the system computes repayment schedules from the contract date, irrespective of whether funds have been disbursed or not. The system uses the approved amount (amount financed) for computing repayment schedules on the contract date.

As the might have been disbursed through multiple draws, or the draws have been less than the approved amount, or the amount may have been repaid in some amount before the draw end date, you may need to change the payment amount. In such cases, you can manually change the payment in the system by posting the monetary transaction CHANGE PAYMENT AMOUNT on the Customer Service screen’s Maintenance link.

Disbursements for staged funding

The approved amount for staged funding can be disbursed with the Funding screen or at a later time using the Advances screen. If the first disbursement is requested during funding, you may enter it on the Itemization sub screen of the Funding screen’s Contract screen.

If the entire approved amount is not disbursed during initial funding, it can be disbursed using the Advances screen’s Advance Entry screen.

If the initial amount on the Advance Entry screen is not within the minimum or maximum limits (as entered in the Advance Details section on the Setup Module screen’s Contract screen), the system displays any of the following error or warning messages in the Advances section’s Error Reason field:

- Advance amount is less than the initial advance amount minimum

-or-

- Advance amount is more than the initial advance amount maximum

The Advance Entry screen also allows you to enter subsequent funding / disbursements. If subsequent advances are not within the predetermined minimum or maximum amounts, the system displays any of the following warning or error messages in the Advances section’s Error Reason field:

- Advance amount is less than the allowed subsequent advance amount

-or-

- Advance amount is more than the allowed subsequent advance amount

Additional messages in the Error Field regarding Staged Funding

If you attempt to post an advance after the draw end date, then the system displays the message in the Advances section’s Error Reason field as, "ADVANCE DT IS AFTER DRAW PERIOD END DATE".

If you attempt to post an advance above the approved amounts, including tolerance, the system displays the message in the Advances section’s Error Reason field as "ADVANCE AMOUNT IS MORE THAN THE TOTAL APPROVED AMOUNT INCLUDING TOLERANCE".

Since this is not a revolving loan, if any repayment is made against the approved amount principal balance, the system will not adjust the disbursed amount allowing for subsequent additional staged funding or advances.

Note

There is no change to the payoff quote functionality in the system. The system uses the actual amount of the advance(s) and any interest accrued since the date of the last payment or credit in the PAYOFF QUOTE VALID UPTO DATE value when the payoff quote is requested before the draw end date.

4.7.1 Balances

The Balances sub screen lists the balances that will be established when an account is booked and funded.

CAUTION: Please contact your Implementation Manager for changes to this section.

To set up the Balances

- Click Setup > Setup > Administration > User > Products > Contract > Line > Balances.

- On the Balances sub screen, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Balance Type |

Displays the balance type. |

Chargeoff Method |

Select the charge off method to determine how the outstanding amount of this balance type will be handled from the drop-down list, if the account becomes uncollectable and the product is charged off. |

Writeoff Method |

Select the write off method to determine how the outstanding amount of this balance type will be handled from the drop-down list, if the account is within the write off tolerance of being PAID. |

Reschedule Method |

Select the reschedule method to determine how the outstanding amount of this balance type will be handled from the drop-down list, if the account is rescheduled. |

Sort |

Specify the sort order of how account balances will appear on the Customer Service form’s Balance screen. |

Billed |

Check this box to indicate that outstanding amounts for this balance type are considered a part of the billed amount. This also determines whether payments applied to this balance type are considered when satisfying outstanding amounts due. |

Accrued |

Check this box to indicate that outstanding amounts for this balance type will be included when interest is accrued against the account. |

Non Performing Rollover |

Check this box to indicate that “non-performing” is used as an intermediary status on your general ledger prior to charge off and want to create balances for non-performing accounts for this balance type. Note: (The Non-Performing Rollover box applies only to Balance Types of Advance/Principal and Interest. For all other Balance Types, this box would be cleared). |

Non Performing Balance Type |

Select the balance type you want to rollover from drop-down list, if you select the Non-Performing Rollover box (Advance/Principal). |

Enabled |

Check this box to indicate that this balance type will be created when the account is booked and funded |

This section is applicable if the capitalization frequency is selected as Balance Frequency for the contract and allows you to define capitalization parameters for a specific type of account balance such as ‘Interest’. Note: The value of parameters defined in this section supersedes the values defined in header section. |

|

Capitalize |

Check this box to enable capitalization parameters for the selected balance type. By default, this option is un-checked. Note: The option is disabled for ‘Advance / Principal’ type of Loan or Line contracts and for Lease Receivables. |

Frequency |

Select the capitalization frequency from the drop-down list. Frequency can be selected using any of the following options: - Based on specific intervals such as Monthly, Quarterly, Annual and so on. - Based on contract Billing Frequency, Billing Date, Due date. - Specifically on every Month End. |

Grace Days |

Specify the grace days allowed in the frequency (minimum 0, maximum 31) before capitalizing the balances to account. This is also the deciding factor for executing the capitalization batch job which is based on Capitalization Frequency + Grace Days. However, note that Grace Days are not accounted for Month End type of capitalization frequency and is ignored even if specified. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

The system loads the currently defined balances for accounts.

If your organization maintains additional balances, contact your Implementation Manager for information regarding those balances.

4.7.2 Amortized Balances

With the Amortize Balances sub screen, you can select one or more balances to be amortized over the life of the loan. You can also define the amortization method.

To set up the Amortization Balances

- Click Setup > Setup > Administration > User > Products > Contract > Line > Amortized Balances.

- In the Amortization Balances section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Amortize Balance Type |

Select the amortize transaction type from the drop-down list. |

Amortization Method |

Select the amortization method used to calculate the net amortization amount from the drop-down list. |

Cost/Fee method |

Select the amortization cost/fee method. |

Sort |

Specify the sort sequence to define the order of the amortize balances. |

Enabled |

Check this box to enable the amortize balance to be created when the account is booked and funded. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.7.3 Itemizations

On the Itemizations sub screen, you can define the itemized components for each type of contract, indicate if it is required, and determine whether it has a positive or negative bearing on the contract itemization math. You can establish the following groups of itemization transactions:

Type |

Description |

Advance |

Total amount of the product that is not a part of financed fees; in other words, the total amount the customer requested to be advanced. |

Financed Fees |

Fees rolled into the principal balance of the product. Financed fees are also considered to be a part of the finance charge. |

Pre-Paid Fees |

Fees that are paid by the consumer prior to the funding of the loan. These fees are not rolled into the balance of the product but are considered as part of the finance charge and are included in the calculation of the APR. |

Producer |

Fees that are paid to or by the producer of the loan; for example, a fee that is being charged to the producer. These transactions will affect proceeds. |

Escrow |

Allows you to connect the actual escrow itemization with the escrow type and the funding transaction. |

To set up the Itemizations

- Click Setup > Setup > Administration > User > Products > Contract > Line > Itemizations.

- On the Itemization sub screen select the option button to indicate the type of itemization you are working with: Advance, Financed Fees, Pre-Paid Fees, Producer, or Escrow.

- On the Itemization sub screen, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Itemization |

Select the itemization from the drop-down list. |

Disbursement Type |

Select the disbursement type from the drop-down list. |

Transaction |

Select the funding transaction type from the drop-down list. |

Itemization Type |

Select the itemization type from the drop-down list. Notes: 1. On selecting the "Prefunding Txns" as itemization type, it indicates that this particular itemization expects a payment from the customer prior to funding. 2. The itemization type "Prefunding Txns" is available only for loans. |

Sort |

Specify the sort order to define the order of the itemization transactions. |

Sign |

If the itemized transaction increases the group balance, click +ve. -or- If the itemized transaction decreases the group balance, click -ve. |

Enabled |

Check this box to enable the itemization and indicate that this itemization transaction will be created when the account is booked and funded. |

Amortize Balance |

Select the amortize balance affected by this itemization transaction from the drop-down list. Note: Advance itemizations do not affect amortize balances. |

Refund Calculation Method |

Select the refund calculation method from the drop-down list |

Taxable |

Check this box, if the itemization type is taxable. However, note that the taxable option defined in Setup > Administration > System > Sale Tax screen will supersede with this preference. |

Seller Pmt |

Check this box to enable seller payment |

Escrow |

Select the escrow from the drop-down list. |

Itemization Formula |

Select the itemization formula description from the drop-down list. |

Refund Calculation Method |

Check this box to enable Refund calculation Method. |

Escrow Required |

If this is an escrow account, check this box to indicate that an escrow is required during the application process (though at that time the user can choose Opt Out to decline.) |

Discount. Rate |

Specify the discount rate for the itemization. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.7.4 Fees

Any fees that are defined in the contract are set up on the Fees sub screen. The system currently supports the following contract fees:

- Late charges

- Non sufficient funds

- Extensions

- Prepayment penalties

- Delay Fee

- ACH Fee

The Fees sub screen allows you to define those fees whose value and method of calculation are set at the time of the loan. As these amounts cannot be changed after the product is booked and funded, you should only set up fees here that will not change over the life of the loan. Individual contract fee types may be defined multiple times in order to create graduated fees.

Note

Certain fees, like late fees, can be set up at contract, as well as state level. In such cases, the contract fee, if present, is used first.

To set up the Fees

- Click Setup > Setup > Administration > User > Products > Contract > Line > Fees.

- In the Fees section, perform any of the Basic Operations mentioned in Navigation chapter.

A brief description of the fields is given below:

Field: |

Do this: |

Type |

Select the fee type from the drop-down list. |

Txn Amt From |

Specify the lowest transaction amount or balance amount against which this contract fee definition may be applied. |

Credit Limit From |

Specify the minimum value of credit limit for the pricing. |

Method |

Select the method of calculating the fee to be assessed from the drop-down list. |

Frequency |

Select the frequency of calculating the fee to be assessed from the drop-down list. |

Threshold Amt |

This field is enabled only if the Contract Fee type is either CYCLE BASED COLLECTION LATE FEE or CYCLE BASED LATE FEE. Specify the threshold amount which is less than or equal to minimum fee amount to be assessed. Based on this amount, system calculates and posts the Cycle Based Collection Late Fee or Cycle Based Late Fee based on the account. If calculated fee amount is less than threshold amount, fee is posted with transaction amount = 0. If calculated fee amount is greater or equal to threshold amount, fee is posted based on existing min amt and max amt comparing logic. |

Min Amt |

Specify the minimum fee amount to be assessed. |

Max Amt |

Specify the maximum fee amount to be assessed. If you selected FLAT in the Method field, then this field is not used and is normally populated as $0.00. |

Percent |

Specify the fee percentage of the outstanding transaction amount to be assessed as a fee. This amount will be adjusted to fall within the Min Amount and the Max Amount. |

Enabled |

Check this box to create the selected contract fee when the account is booked and funded. |

- Perform any of the Basic Actions mentioned in Navigation chapter.

4.8 Edits

Edits ensure your organization’s guidelines are properly followed and that all exceptions are sent to the appropriate personnel to review.