6. Contracts

6.1 Introduction

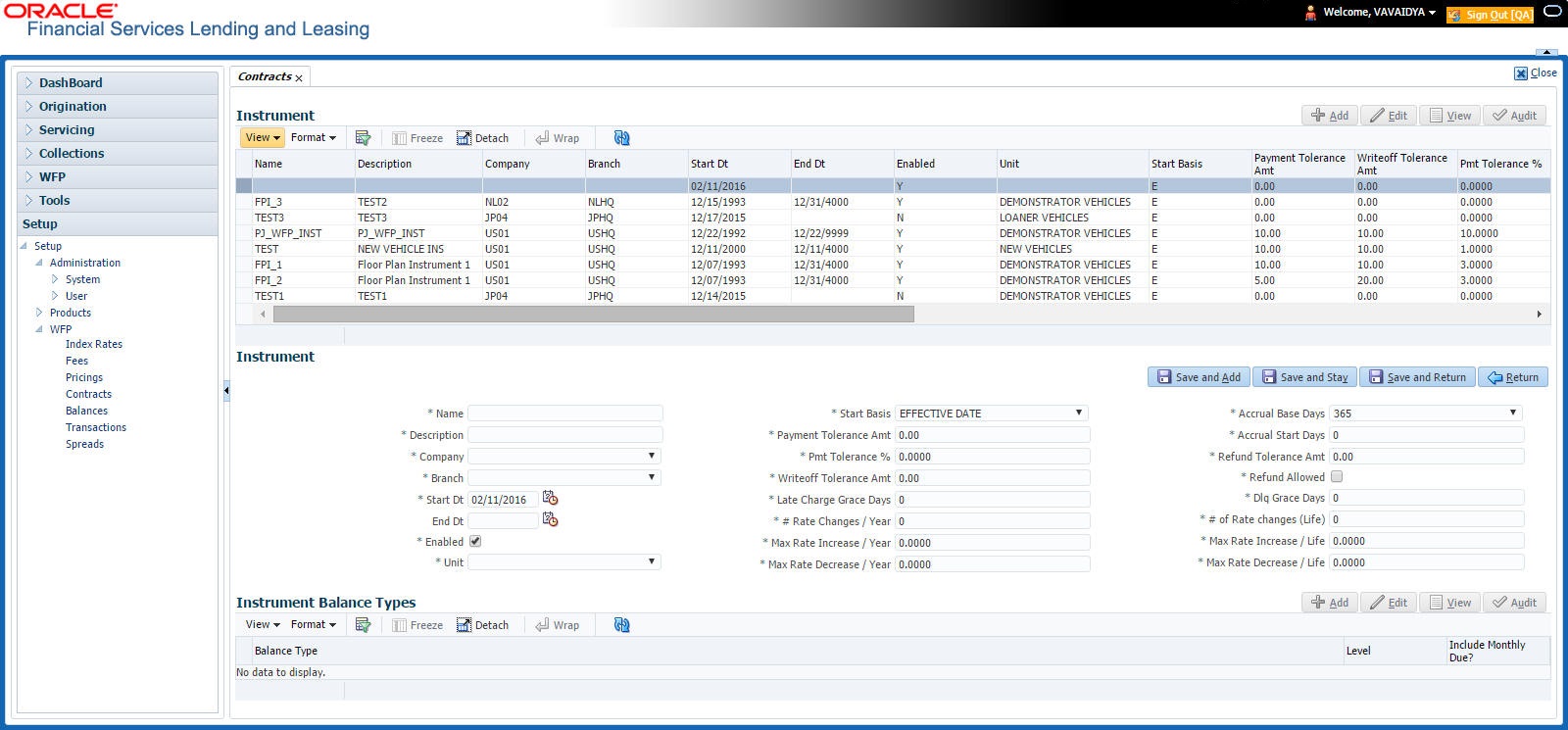

The Contract link allows you to define the terms and conditions of your contracts. Contracts can be defined according to company, branch, and type of unit. You can add new contracts and modify the existing ones.

6.2 Contracts Link

Oracle Financial Services Lending and Leasing selects which instrument to offer based on whether:

- The instrument company/ branch matches the producer company/ branch. Note: We recommend setting up an instrument where the company / branch is ALL/ ALL to ensure proper performance in Oracle Financial Services Lending and Leasing

- The contract date at unit level should be between the instrument start and end date

- The instrument is enabled.

To use the Contract link

On the Oracle Financial Services Lending and Leasing home screen, click Setup > Setup > WFP > Contracts

In the Instrument section, select the record you want to work with and click Show in the Details column.

- If you choose, use Search Criteria to limit the display of records.

- If you are entering a new record, click Add.

- If you are changing an existing record, click Edit.

- In the Instrument section, enter, view, or edit the following information:

In this field:

Do this:

Name

Enter the unique name of the instrument (required).

Description

Enter the instrument description. This entry should briefly describe the instrument (required).

Company

Select the company for which the instrument is applicable (required).

Branch

Select the branch of the company for which the instrument is applicable (optional).

Start Date

Enter the start date. This is the date after which the instrument is in use and is available on the Wholesale Floor Planning Maintenance form (required).

End Date

Enter the end date after which the instrument is invalid and unavailable on the Wholesale Floor Planning Maintenance form. While this field can be empty, it cannot be less than the current date or start date (required).

A blank field indicates no end date (optional).

Enabled

Select to enable the contract instrument.

Unit

Select the unit type (required).

This field links the policies to contracts. There should be at least one enabled contract for every unique unit type (required).

Start Basis

Select the accrual start date basis. This indicates the date from which the interest rate would be calculated. For example, a start basis that equals the payment date implies that the interest rate calculation starts with the first payment date (required).

Payment Tolerance Amount

Enter the payment tolerance amount. This defines the acceptable shortfall in the monthly payment in dollars for which no penalty would be imposed (required).

Writeoff Tolerance Amount

Enter the writeoff tolerance amount. This is the tolerance acceptable while a unit gets paid off. The unit will be considered paid even if payment is falling short of actual due by this amount (required).

Pmt Tolerance%

Enter the payment tolerance percent. This defines the acceptable percent of the monthly payment due which no penalty would be imposed. For example, the tolerance can be set for 95 percent of payment due (required).

Late Charge Grace days

Enter the late charge grace days. This is the number of days after the payment due date during which no late fee would be charged (required).

# Rate Changes/Year

Enter the number of rate changes in a year. This is the maximum number of times the rate can be changed in a year for a unit. Note: The number of rate changes in a year cannot exceed the number of rate changes for the life of the contact (required).

Max Rate Increase Year

Enter the maximum rate increase in a year. This is the ceiling limit for rate increases in a year (required).

Max Rate Decrease Year

Enter the maximum rate decrease in a year. This is the floor limit for rate decreases in a year (required).

Accrual Base Days

Select the accrual base days. This is the number of days the instrument assumes in a year for interest computation: 360, 365, or 366. If the accrual base is selected as 365, the interest computation would be based on actual days (365) and the base would be 365. However, in this case, if the year happens to be a leap year and the actual day’s computation includes the month of February, then the additional day of leap year is not considered (required).

Accrual Start Days

Enter the accrual start days. This is the number of days after which interest accrual starts once the instrument is in use (required).

Refund Tolerance Amount

Enter the refund tolerance amount. If the refund due to the producer is more than this, the tolerance amount is refunded. Note: You cannot complete this field if the Refund Allowed box is selected (required).

Dlq Grace Days

Enter the delinquency grace days. This is the number of days after the payment due date during which the account will not be considered delinquent (required).

# Rate Change Life

Enter the number or rate changes in life. This is the maximum number of times the rate can be changed during the life of the contract (required).

Max Rate Increase Life

Enter the maximum rate increase in life of loan. This is the ceiling limit for rate increase during the entire life of the contract (required).

Max Rate Decrease Life

Enter the maximum rate decrease in life. This is the floor limit for rate decrease during the entire life of the contract (required).

Refund Allowed

If selected, this check box indicates this instrument allows a refund in case the producer pays in excess of what is due (required).

The Instrument Balance Types section allows you to define the balance type for the selected instrument at the producer, credit line, or unit level.

- In the Instrument Balance Types section, select the record you want to work with.

- If you choose, use Search Criteria to limit the display of records.

- If you are entering a new record, click Add.

- If you are changing an existing record, click Edit.

- In the Instrument Balance Types section, enter, view, or edit the following information:

In this field:

Do this:

Select

If selected, indicates that this is the current record.

Balance Type

Select the balance type (required).

Level

View the level indicator. This entry is based on the selected Balance Type and is non-editable (required).

Include Monthly Due ?

Select to compute the minimum monthly payment.

- Click Save in the Instrument section.