3. Integration Process

This chapter contains the following sections:

- Section 3.1, "Deposit Creation in Oracle Lending"

- Section 3.2, "Deposit Redemption on Loan liquidation"

- Section 3.3, "Deposit Creation on OL Contract Disbursement"

- Section 3.4, "Deposit Amendment on Loan Amendment"

3.1 Deposit Creation in Oracle Lending

3.1.1 Mapping of Corporate Deposit Product in Loans

The following are steps need to be done for mapping of corporate deposit product in Loans.

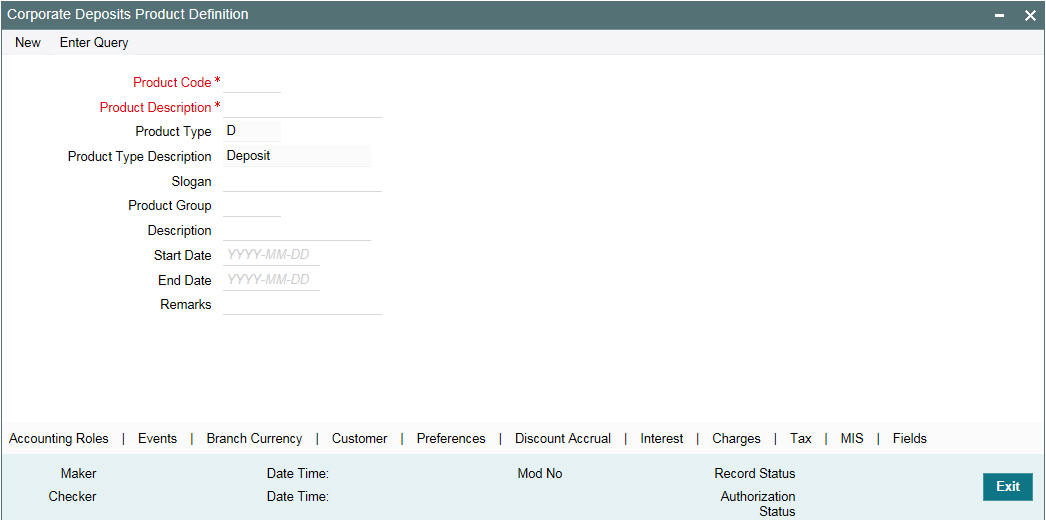

- The corporate deposit product defined in the FCUBS ‘Corporate Deposits Product Definition’ screen (CDDPRMNT) is available in OBCL through webservice. The same is available in OBCL external table OLTB_IF_OLPRODUCT_MASTER and OLTB_IF_OLPRODUCT_ICCF.

- For deposit contract creation, rates are picked from 'Treasury Floating Rate Maintenance' screen (LFDTRSRM)

- The values maintained in 'Treasury Floating Rate Maintenance' screen are mapped to Loan-Commitment - Contract Input screen. The following list provide field-wise mapping.

- Effective Date (Treasury Floating Rate Maintenance)- Application Date (Loan-Commitment - Contract Input )

- Start date (Treasury Floating Rate Maintenance) - Value Date (Loan-Commitment - Contract Input )

- End Date (Treasury Floating Rate Maintenance) - Maturity Date (Loan-Commitment - Contract Input)

- Rate (Treasury Floating Rate Maintenance) - Refinance Rate (Loan-Commitment - Contract Input > MIS screen)

- The corporate deposit creation is based on the product mapped in the following screens.

- Corporate Deposits Product Definition screen

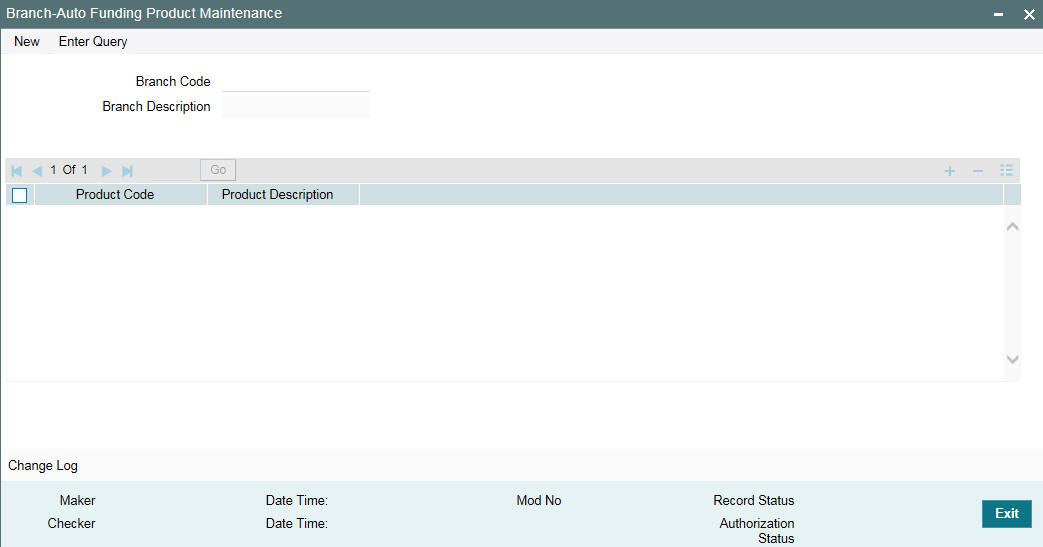

- Branch Auto funding screen

- Auto Fund product screen

- Bilateral Loans Product Definition screen

This section contains the following topics:

- Section 3.1.2, "Product Creation"

- Section 3.1.3, "Processing of Loans Deposit Product"

- Section 3.1.4, "Viewing Failed Transaction Log Details"

3.1.2 Product Creation

Link from FCUBS Corporate Deposits to Loan Deposits Product

The corporate deposit product defined in the FCUBS, that is ‘Corporate Deposits Product Definition’ (CDDPRMNT) screen is sent to OBCL.

Branch Auto funding screen

You can use this screen for mapping a branch to corporate deposits products.

You can invoke the ‘Branch Auto Funding’ screen by typing ‘OLDBRAFP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

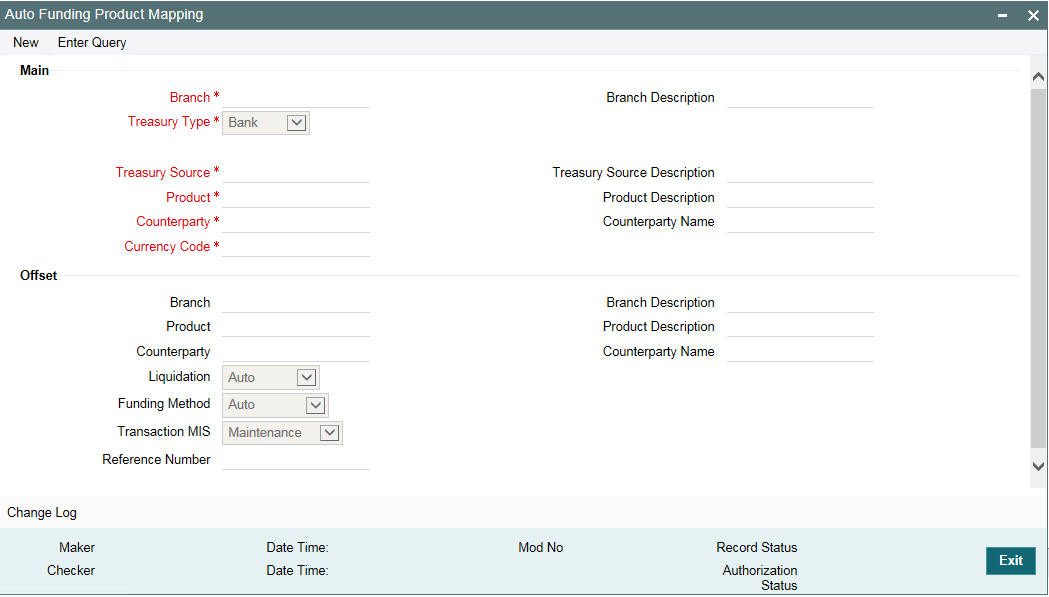

Auto Fund product screen

You can use this screen, to select the OL product that can use the loan deposit product.

You can invoke the ‘Auto Fund Product’ screen by typing ‘OLDAFMAP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You need to enter the 'Branch', ‘Treasury Type’, 'Treasury Source', 'Product', 'Counterparty' and 'Currency Code'. Based on these loan contract parameters, the following deposit parameters are derived.

- Branch

- Product

- Counterparty

Counterparty field allows you to maintain different deposit parameters for a specific counterparty of the loan.

During auto-funding, the system follows the below priority order to derive the deposit parameters. This is done irrespective of the 'Treasury Type'.

|

Branch |

Treasury Source |

Product |

Currency |

Counterparty |

Priority 1 |

Specific |

Specific |

Specific |

Specific |

Specific |

Priority 2 |

Specific |

Specific |

Specific |

Specific |

ALL |

Priority 3 |

ALL |

Specific |

Specific |

Specific |

ALL |

Below is an example of auto-funding mapping maintenance.

Loan Contract Parameter |

Value |

Branch |

567 |

Treasury Source |

TREASURY |

Product |

RES1 |

Currency |

USD |

Counterparty |

000000321 |

Deposit Contract Parameter |

Value |

Branch |

567 |

Treasury Source |

TREASURY |

Product |

CL04 |

Currency |

USD |

Counterparty |

000000323 |

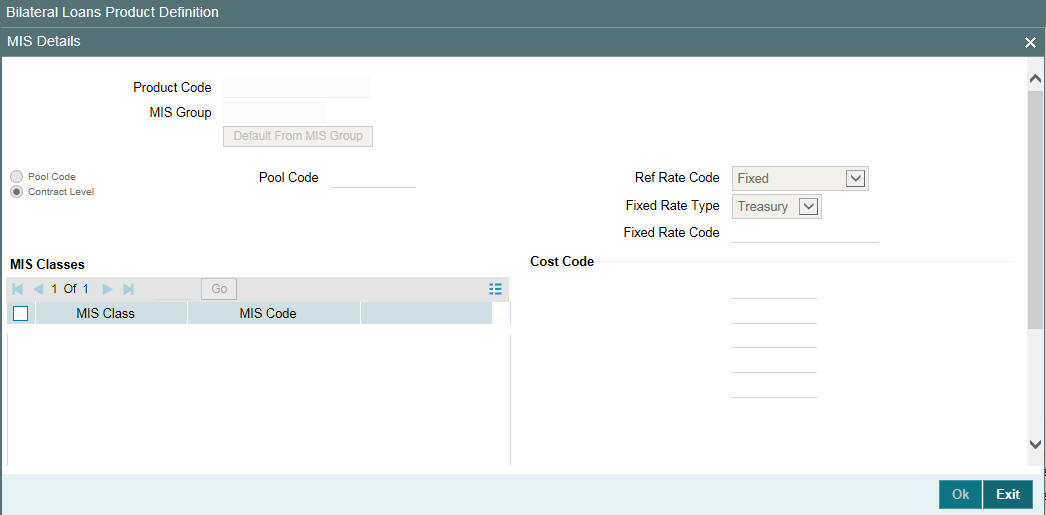

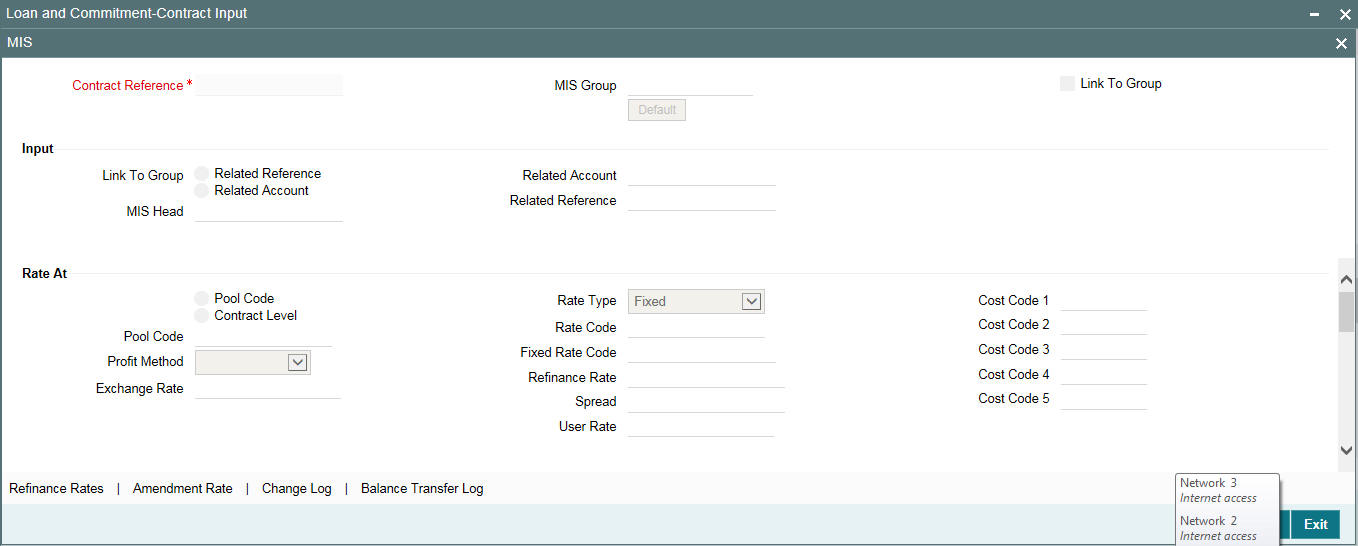

Bilateral Loans- Product Definition/ Loan and Commitment-Contract Input -MIS screen

You need to maintain ‘Ref Rate Code’, ‘Fixed Rate

Type’, ‘Fixed Rate Code’ in Bilateral Loans Product

Definition- MIS’ screen and the same rate codes are defaulted to

Loan and Commitment-Contract Input -MIS screen. Based on these rates,

‘Refinance Rate’ will be fetched from the ‘Treasury

Floating Rate Maintenance’ screen.

3.1.3 Processing of Loans Deposit Product

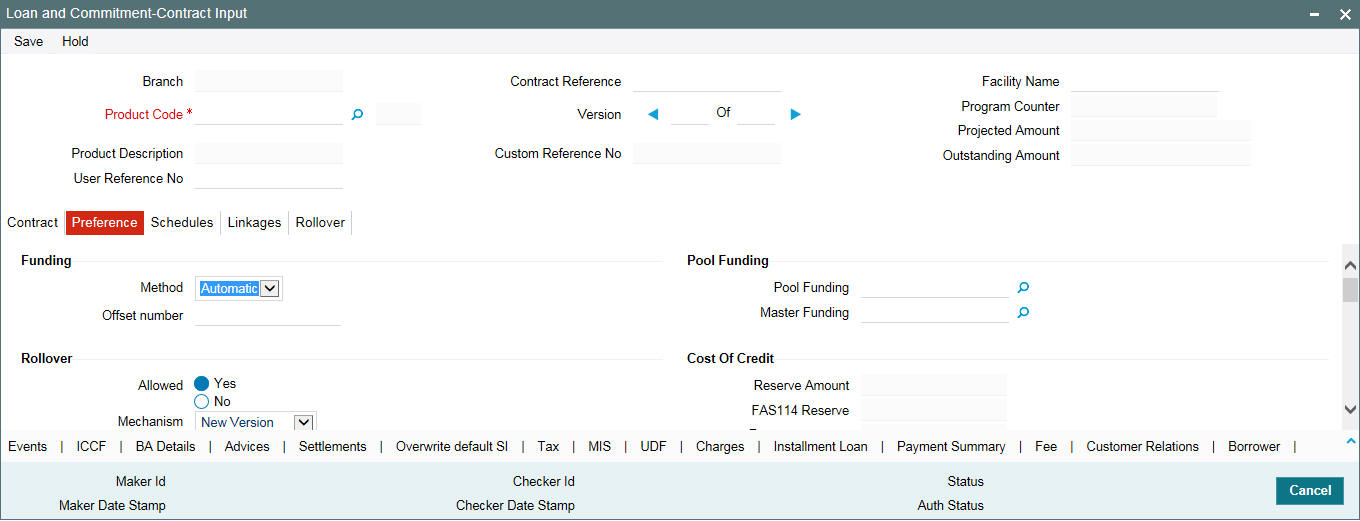

Deposit creation in Loan and Commitment - Contract Input screen

In Loan and Commitment-Contract Input screen (OLDTRONL), under ‘Preferences’ tab ensure to select ‘Funding Method’ as ‘Automatic’. If the disbursement is mode is auto, on contract creation deposit is initiated for the amount disbursed.This triggers deposit creation automatically on contract save.

On save of deposit creation the following takes place in the staging table.

- Fetches deposit details from the 'Branch Auto Funding Product Maintenance' screen and rates from the 'Treasury Floating Rate Maintenance' screen.

- Value date of the deposit will be based on the following dates

- Back dated contract - Application date will be value date of deposit

- Current dated and Future dated contract-Value date of the contract

- Deposit Amount will be sum of principal due amount starting from the application date of the contract for that disbursement.

- Web service is exposed for Deposit creation.

OL Contract Authorization - Auto Disbursement

OL Contract authorization is validated with the deposit contract initiation status. If deposit creation is successful, then OL contract authorization is allowed.

If deposit creation is failed/ unprocessed, then OL contract authorization will not be allowed.

OL Contract Reverse Authorization - Auto Disbursement

OL Contract reverse authorization is validated with the reverse deposit contract initiation status. If the reverse deposit authorization is processed, then OL Contract reverse authorization is allowed. If the reverse deposit authorization is unprocessed or failed, then OL Contract reverse authorization is not allowed.

OL Contract modification- Auto Disbursement

If deposit creation is unprocessed, then OL contract modification will not be allowed

If deposit creation is processed, then OL contract modification will be allowed

- Loan modification is Saved

- Initiates Reverse Deposit request for already processed deposit

- Initiate a new deposit creation request (if loan modification on ‘Amount’, ‘Maturity Date’, ‘Value Date’ of the contract)

- Previous request status is updated to 'D' (Deleted)

If deposit creation is failed, then OL contract modification will be allowed

- Loan modification is Saved

- Initiate a new deposit creation request (if loan modification on ‘Amount’, ‘Maturity Date’, ‘Value Date’ of the contract)

- Previous request status is updated to 'D' (Deleted)

OL Contract Deletion - Auto Disbursement

If deposit creation is in unprocessed, then OL contract deletion will not be allowed.

If deposit creation is failed,

- OL contract deletion will be allowed

- Previous request status is updated to 'D' (Deleted)

OL Contract Reversal - Auto Disbursement

On reversal of loan contract, reverse deposit request will be initiated.

Reversal of OL Contract after Authorization - Auto Disbursement

If the reverse deposit is processed, then OL Contract reverse authorization is allowed. If the reverse deposit is unprocessed or failed, then OL Contract reverse authorization is not allowed.

If deposit reverse is failed/ unprocessed, then OL contract reversal authorization will not be allowed.

Once deposit reverse gets processed, contract reversal deletion will not be allowed.

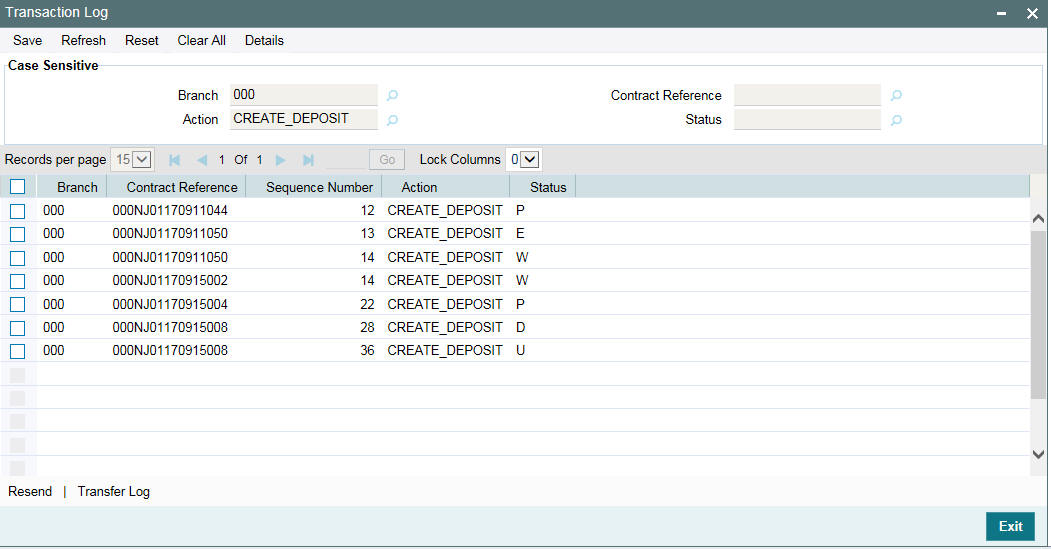

3.1.4 Viewing Failed Transaction Log Details

You can view list of all failed deposit contract transactions with all the request details, status, failure reason if applicable and then initiate for re-processing.

You can invoke the ‘Transaction Log’ screen by typing ‘OLSIFCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

3.2 Deposit Redemption on Loan liquidation

Once the loan linked deposit contract is created from OL, the redemption is done when the linked loan contract is liquidated. The deposit redemption is done through web service.

If ‘Liquidate Deposit’ is selected in the ‘Manual Payment’ (OLDPMNT) screen, the deposit redemption takes place accordingly.

- On payment of backdated and current dated principal pre-payments in loans, for the same amount with current system date as value date.

- Initiates future dated principal payments in the deposit side, on the value date of the payment of the loan contract

- Initiates full deposit contract liquidation as part of full-pre-payment of the loans or final schedule payment.

3.2.1 Processing of Deposit Redemption

OL Contract Payment Deletion

If CD redemption is unprocessed/failed, then OL contract payment deletion is not allowed.

If CD redemption is processed,

- OL contract payment deletion is allowed

- Initiates reverse deposit redemption

OL Contract Payment Authorization

- OL Contract payment authorization is validated with the deposit redemption status.

- If deposit redemption is processed, then OL contract payment authorization is allowed.

- If deposit redemption is failed/unprocessed, then OL payment contract authorization will not be allowed.

OL Payment Reversal

On reversal of OL Payment contract, deposit redemption reversal request will be initiated

OL Contract Payment Reversal Authorization

- OL Contract payment reverse authorization is validated with the deposit redemption reversal status.

- If the reverse deposit redemption is processed, then OL contract payment reversal authorization will be allowed.

- If the reverse deposit redemption authorization is unprocessed or failed, then OL Contract payment reverse authorization is not allowed.

- Once deposit redemption reverse gets processed, OL contract payment reversal deletion will not be allowed.

3.3 Deposit Creation on OL Contract Disbursement

In ‘Contract Disbursement Input’ screen (OLDMNDSB), the disbursements for OL contracts are done. This triggers deposit creation or amendment automatically based on the scenario. On disbursement save, there are two possible cases.

- If the OL contract is disbursed for the first time Deposit creation is initiated.

- For consecutive disbursements Deposit amendment for the appropriate new principal is initiated.

On save of deposit creation the following takes place in the staging table.

- Fetches deposit details from the 'Branch Auto Funding Product Maintenance' screen and rates from the 'Treasury Floating Rate Maintenance' screen.

- Value date of the deposit is based on the following dates

- Back dated contract - Application date will be value date of deposit

- Current dated and Future dated contract-Disbursement date of the contract

- Deposit amount will be sum of principal due amount starting from

the application date of the contract for that disbursement.

- Web service is exposed for deposit creation.

The system creates a new CD contract when you disburse the amount for a contract after deleting or reversing the previous disbursement.

You can initiate redemption on reverse of VAMI and you cannot reverse the deposit.

Screen |

Operation |

Description

|

CD Action |

OLDTRONL |

Authorize |

You can authorize OL contract once CD is processed |

|

|

Delete |

You can delete OL contract once CD processed or if CD creation fails |

|

|

Reverse |

You can reverse OL contract |

CD reverse |

|

Reverse-Deletion |

You cannot delete reverse

action in OL contract for processed/unprocessed record |

|

OLDVAMND |

|||

|

Authorize |

You can authorize VAMI in OL once request is processed in CD |

|

|

Delete |

You can delete VAMI in OL once CD processed or if VAMI fails in CD |

|

|

Reverse |

You can reverse VAMI |

Redemption |

|

Reverse-Deletion |

You cannot delete reversed

VAMI for processed/unprocessed record |

|

OLDPMNT |

|||

|

Authorize |

You can authorize payment once request is processed in CD |

|

|

Delete |

You can delete payment in OL once CD processed or if payment process fails in CD |

Reverse Redemption |

|

Reverse |

You can reverse payment |

Reverse Redemption |

|

Reverse-Del |

You cannot delete reversed

payment record for processed/unprocessed record |

|

OLDMNDSB |

|||

|

Authorize |

You can authorize disbursement record once CD is processed |

|

|

Delete |

You can delete Disbursement record once CD processed or If CD creation fails |

Reverse CD contract |

|

Reverse |

You can reverse Disbursement |

Reverse CD contract |

|

Reverse-Deletion |

You cannot delete reversed

disbursed record for processed/unprocessed record |

|

3.4 Deposit Amendment on Loan Amendment

Once a CD linked OL contract is booked and disbursed a deposit is created. On amendment of Maturity date or Principal amount, in the value added amendment screen, the same can be propagated to the deposit. Only these two attributes can be amended for the deposit. The deposit amendment is done through web service.

3.4.1 Processing of Deposit Amendment

OL Contract Amendment Deletion

If CD Amendment is unprocessed/failed, then OL contract Amendment deletion is not allowed.

If CD Amendment is processed,

- OL contract Amendment deletion is allowed

- initiates up to two actions based on the scenario as follows,

- Deposit redemption if the OL amendment was only for principal increase.

- Deposit VAMI with change in maturity date back to the old maturity date, if the OL amendment was only for maturity date change.

- Both redemption and VAMI in case if OL amendment has both modified.

OL Contract Amendment Authorization

- OL contract amendment authorization is validated with the deposit amendment status.

- If deposit amendment is processed, then OL contract amendment authorization is allowed.

- If deposit amendment is failed/unprocessed, then OL amendment contract authorization is not allowed.

OL Amendment Reversal

On reversal of OL Amendment contract, initiates up to two actions based on the scenario as follows,

- Deposit redemption if the OL amendment was only for principal increase.

- Deposit VAMI with change in maturity date back to the old maturity date, if the OL amendment was only for maturity date change.

- Both redemption and VAMI in case if OL amendment has both modified.

OL Contract Amendment Reversal Authorization

OL contract amendment reverse authorization is validated with the deposit amendment reversal status.

- If the reverse deposit redemption is processed, then OL contract amendment reversal authorization is allowed.

- If the reverse deposit amendment authorization is unprocessed or failed, then OL Contract Amendment reverse authorization is not allowed.

- Once deposit Amendment reverse gets processed, OL contract Amendment reversal deletion is not allowed