3. Processing Charges

This chapter contains the following sections:

- Section 3.1, "Charge Class"

- Section 3.2, "Defining charge components for a product"

- Section 3.3, "Specifying Charge details for a contract"

3.1 Charge Class

This section contains the following topics:

- Section 3.1.1, "Defining a Charge Class"

- Section 3.1.2, "Associating an Event/Role to Head Class with a Charge Class"

- Section 3.1.3, "Maintaining Charge Class mapping details"

- Section 3.1.4, "Charge Processing across modules in Oracle Lending"

3.1.1 Defining a Charge Class

A class is a specific type of component that you can build with certain attributes. You can build a charge class, for instance, with the attributes of a specific type of charge, such as ‘Charges for amending the terms of a loan’, or ‘Charges for provision of services’.

When building a charge class, you define certain attributes such as:

- The module in which you would use the class

- The charge type (whether borne by the counterparty or by the bank)

- The association event

- The application event

- The liquidation event

- The default settlement currency

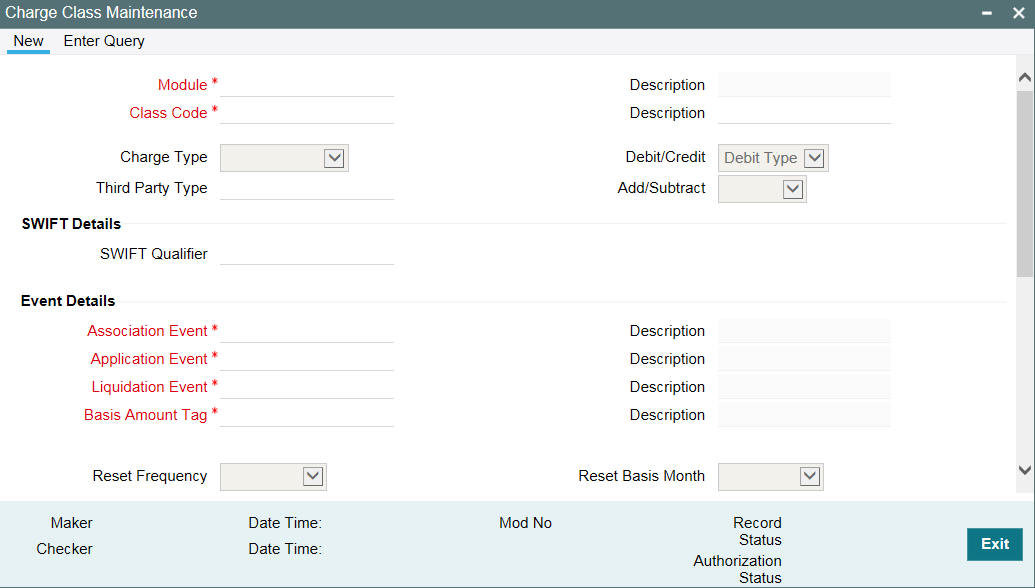

- The default charge rule

You can define the attributes of a charge class in the ‘Charge Class Maintenance’ screen, You can invoke the ‘Charge Class Maintenance’ screen by typing ‘LFDCHGCE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Before defining the attributes of a charge class, you should assign the class a unique identifier, called the Class Code and briefly describe the class. A description would help you easily identify the class.

Module

A charge class is built for use in a specific module. As a charge component would be applied on different basis amounts, in different modules.

Note

The Basis Amount Tags available would depend on the module for which you build the class.

Charge Type

The charges or fee that you levy is recovered, typically, from the counterparty involved. Therefore, when building a charge class, you would indicate the charge to be of a ‘Counterparty’, ‘Third Party’ and ‘Their Charges’ type. The following example illustrates how a charge could be of a ‘Credit’ type.

Example

You are buying a bond issued by the central bank, on behalf of the government. The central bank levies a processing charge on the instrument.

When defining a charge class, you would indicate the charge type to be Credit. This means that you would bear the charge.

Third-party Type

If a charge component that you associate with a product is of ‘third party’ type, indicate it in the ‘Third Party Type’ field.

Debit/Credit

Charges are considered either as inflow or outflow based on Debit type/Credit Type flag at charge class level.

Add/Subtract

If you choose to include the charge component in the net value, you should indicate if the charge component is to be added, while calculating the net consideration amount, or subtracted.

SWIFT Qualifier

You can report the charge component of a contract in the SWIFT messages that you generate. To do this, identify the component, when building it in the ‘Charge Class Maintenance’ screen, with the appropriate SWIFT code.

Example

Assume you buy securities from a counterparty. The different components of the deal are:

- The value of the securities USD 50,000.

- The applicable tax USD 1000

- The accrued interest USD 1500

- The applicable charge USD 50

Result

If you choose the Net Consideration option, and decide to add the charge component to the value of the deal (and deduct the tax involved), the net value of the deal would be: USD 50,550.

If you choose the Net Consideration option, and decide to subtract the charge component from the value of the deal (and deduct the tax involved), the net value of the deal would be USD 50,450.

If you do not choose the Net Consideration option and choose to deduct the tax component, the value of the deal would be USD 50,500. The charge component would not be included.

3.1.1.1 Defining the Events and the Basis Amount

A contract goes through different stages in its life cycle, such as:

- Initiation

- Amendment

- Rollover and so on

Each of these stages is referred to as an ‘Event’ in Oracle Lending.

At any of these events, you can choose to apply a charge or fee. When defining a charge class, you should specify the following:

- Association Event

- Application Event

- Liquidation Event

The event at which you would like to associate a charge component to a contract is referred to as the Association Event. At this event, no accounting entry (for the charge component) is passed.

The event at which the charge component is actually calculated is referred to as the Application Event. The charge or fee is liquidated at the Liquidation Event that you specify.

The basis on which interest, charge, fee, or tax is calculated is referred to as the Basis Amount. (A charge or fee can be on the basis of the loan amount, for instance.) The different basis amounts, available in a module, are associated with a unique ‘tag’. When building a charge component, you have to specify the tag associated with the Basis Amount. When charge or fee is calculated for a contract, the basis amount corresponding to the tag is taken up automatically.

3.1.1.2 Indicating whether the Derivation of the Charge Rule is required

While defining a charge class you can indicate whether the class should have a default charge rule or whether the appropriate rule is to be derived on the basis of the transaction count.

If you enable this option you need to identify various transaction limits for a Charge Class, Module, Customer Group, Customer, and Account combination and associate the charge rule which is to be applied when customer transactions within a group exceed the specified limit. In addition, you are not allowed to specify the Default Charge Rule. Typically, you need to enable this option while building charge classes for the CF module.

Note

You are not allowed to enable this option while defining a charge class meant for the LD module.

3.1.1.3 Specifying the Reset Frequency and the Reset Basis Month

If you have indicated that the charge rule is to be derived on the basis of the transaction count, you must specify the Reset Frequency.

The reset frequency indicates the frequency at which the transaction count that is tracked at the charge component and account level is to be reset. You can specify the required frequency.

Note

If you choose the monthly, quarterly, half-yearly, or yearly frequency the transaction count is reset on month-ends. However, in the case of quarterly, half-yearly, or yearly reset cycles you must identify the basis month that need to be considered for arriving at the date on which transaction count needs to be reset by choosing the Default Charge Rule

You can link a charge rule that you have defined to the charge component that you are building. When you link a rule to a component, the attributes that you have defined for the rule defaults to the component.

To recall, a charge rule identifies the method in which charge or fee of a particular type is to be calculated. A rule is built with, amongst others, the following attributes:

- The charge currency

- Whether the charge or fee is to be a flat amount or calculated on a rate basis

- The minimum and maximum charge that can be applied

- The tier or slab structure on which the charge is to be applied

- The customer and currency restrictions and so on

The charge component to which you link a rule acquires these properties. Charges for the product with which you associate a charge component is calculated, by default, according to the rule linked to the component. However, when processing a contract, you can choose to waive the rule altogether.

When building a charge class, you can choose to allow the amendment of the rule linked to it, in the following conditions:

- You can choose to allow amendment after the association event

- You can choose to allow amendment after the application event

- You can choose to allow amendment of the charge amount

3.1.1.4 The Settlement currency

Charges or fees levied on a contract are settled in the Settlement Currency that you specify for the charge class associated with the product (under which the contract is processed). However, when processing a contract, you can choose to settle the charge in another currency.

3.1.1.5 Including a component in SWIFT messages

You can report the charge component of a contract in the SWIFT messages that you generate. To do this, identify the component, when building it in the Charge Class Maintenance screen, with the appropriate SWIFT code.

Example

You would like to report the details of the corporate actions that you perform on a customer portfolio, over SWIFT. Assume you would like to report the charge component (amongst others) in the message that you send your customer.

Each component is identified in SWIFT with a unique code. When building the component Charges for provision of services, in the Charge Class Maintenance screen, you can enter its SWIFT Code.

In the SWIFT Qualifier field, you should enter CHAR.

3.1.1.6 Specifying the SWIFT Charges

While building a charge class for the Loans module you can indicate the charge application treatment for handling incoming funds transfers which need to be repaired.

If you want to apply the repair charge fee for the customer, you need to maintain the preference for collecting repair charges. The options available are.

- SWIFT: the charge is levied on the bearer of the charge. The bearer is determined from field 7A.

- Repair: the charge component is collected from the Remitter.

Note

The repair charges that you have defined are applied on all incoming messages involving the module. In case you do not specify the charge type; the repair fee is collected from the beneficiary of the bank.

3.1.1.7 Allowing Rule Amendments

If you would like to allow the amendment of a rule for a charge component, indicate this by selecting the ‘Allow Rule Amendment’ option.

3.1.1.8 Amendment Options

When you associate a charge component with a product, you can choose to allow the amendment of the rule linked to it, under the following conditions:

- You can choose to allow amendment after the association event

- You can choose to allow amendment after the application event

- You can choose to allow amendment of the charge amount

3.1.1.9 Default Waiver

The charge component to which you link a charge rule acquires the properties defined for the rule. Charges for contracts (maintained under the product with which you associate the class you are building) are calculated, by default, according to the rule linked to the component. However, when maintaining a product, you can choose to waive the rule altogether. If you want to indicate that the charge rule must be deemed as waived by default, select this option.

3.1.1.10 Consider as Discount

While defining a charge class for either the loans or the bills module, you can indicate whether the charge component is to be considered for discount accrual on a constant yield basis.

If you select this option the charge received for the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract.

3.1.1.11 Accrual Required

If you select this option, the charge received for the component is accrued based the constant yield and subsequently amortized over the tenor of the associated contract.

3.1.1.12 Propagation Required

Select this option to indicate that the charge collected from the borrower must be passed on to the participants of the contract.

3.1.1.13 Net Consideration

The sum of the different components of a contract determines the net value of the contract. You can indicate that a charge component should be taken into account when determining the net value of a contract by choosing the Net Consideration option.

3.1.1.14 Charge Statement Required

You can indicate whether the details of charges that are booked under the charge class should be displayed in the charge statement that is sent to the customer.

3.1.1.15 Specifying the Charge details

While building a charge class you must specify the Charge related details which include the following:

Charge Mode

The charging mode can be any one of the following:

- Online – charges can be liquidated as and when you are processing a transaction. The charge entries are booked while saving the transaction. The accounting entries are picked up from the product involving the transaction to which the charge component is linked.

- Deferred – Such charges are collected and liquidated at the end of a specified period. If you choose to defer the entries, the entries are posted as per the charge frequency defined for the charge class. The accounting entries are picked up from the Role-to-Head/Event Class linked to the charge class.

- Periodic – periodic charges are collected from customer accounts at a specified periodicity.

- Ad-hoc - There may be occasions when you may need to apply specific charges on a customer account. You can use the ad-hoc charging feature for such charging.

You can define charge classes specific to each type of charging mode.

Note

Online, periodic, and ad-hoc charges cannot be consolidated. In case of deferred charges you can also choose to consolidate charges across modules. Deferred charges are stored at the Charge Class level. Liquidation of these charges is done on the basis of the charge liquidation frequency that you specify.

For deferred, periodic, and ad-hoc charges, you must associate the Role-to-Head and Event classes with the Charge Class. Since it is not possible to associate the relevant Role-to-Head and Event classes at the time of creating a new charge class you can follow the sequence of operations given below:

- Create a new charge class without specifying the Role-to-Head and Event classes.

- Authorize the class. This creates the relevant accounting roles and amount tags.

- Define the Role-to-Head and Event classes using the accounting roles and amount tags.

- Associate the relevant Role-to-Head and Event classes by amending the Charge class and authorize the amendment.

Charge Class Priority

You can specify the sequence in which charges should be liquidated when the charging mode is deferred or periodic by assigning a priority with each class that you define. Lets assume you have defined five charge classes for FT module and assigned different priorities to them. During liquidation charges are liquidated in the order of priority.

Deferred and Periodic charges are liquidated through the Charge Liquidation batch function, which should be executed both at BOD and EOD. Refer to the section titled End of Day Processing for Charges for information on the end of day processing for the sub-system.

Charge Frequency

If you prefer the Deferred or Periodic mode of charging you have to indicate the frequency at which charges are to be debited to the customer’s charge account. You can select any of the frequency listed below:

- Daily

- Monthly

- Quarterly

- Half-yearly

- Yearly

The frequency that you specify applies to all accounts to which the component applies. You are not allowed to change the charge frequency at the product level.

Charge Liquidation Day

You can choose to liquidate charges either during EOD on the last working day of the period or during BOD of the first working day of the new period. If you have selected the Monthly, Quarterly or Yearly as the charge frequency, liquidation is performed only during month-ends.

The option is not applicable for Online and Ad-hoc charges.

Charge Liquidation Value Day

The value date of the charge entry can either be on the first calendar day of the next period or it can be on the first working day of the next period.

This option is applicable only when for deferred consolidation (entry or component level) charges.

Basis Month

When the charging mode is Deferred or Periodic you have to identify the basis month for charge liquidation if the selected frequency is Quarterly or Yearly. In case of a quarterly frequency, the subsequent quarters are calculated based on the basis month that you specify. In case of a Yearly frequency, the charge liquidation is performed in the month that you select.

Charge Consolidation Type

When the charge mode is deferred you can choose to indicate whether charges should be consolidated across modules. If you opt to consolidate charges you can indicate whether the consolidation should be performed at the Entry level or at the Component level.

Example

The following deferred charges are outstanding for a customer account:

Charge Component |

Reference Number |

Charge Currency |

Amount |

CHG1 |

100L100030010001 |

USD |

1000 |

CHG1 |

100L100030010002 |

USD |

800 |

CHG1 |

100L100030010003 |

USD |

600 |

CHG1 |

100L100030010004 |

USD |

500 |

The balance in the customer account is USD 1900.

Case I – you choose not to consolidate charges

The following entries are posted.

Debit |

Account |

USD 1000 |

Debit |

Account |

USD 800 |

For the other records, the system creates individual blocks on the customer based on the accounting entry setup.

Case II – Entry-level consolidation

If you select the entry-level consolidation option the following entries are posted to the account:

Debit |

Account |

USD 1800 |

For the other charge records, the system may create individual blocks on the customer based on the accounting entry setup.

Case III – Charge consolidation

No entries are posted to the account.

For all the charge records, the system creates a single block on the customer account based on the accounting entry set up.

Consolidation Basis

The consolidation basis indicates whether consolidation is to be performed for all currencies (involved in transactions linked to the product) or only for the account currency of the transaction.

You are allowed to specify the consolidation basis only if you have indicated that charges should be consolidated either at the entry level or at the component level.

If the basis is Account Currency, the charge is consolidated only if the charge currency is same as the charge account currency. If the basis is All Currency, charges are consolidated irrespective of the charge amount currency and charge account currency.

Charges are consolidated at the following levels:

- Module

- Branch

- Account

- Component

- Charge Currency

The system generates a new transaction reference number for posting the consolidated entries.

If you prefer not to consolidate deferred charges, the accounting entries are posted with the same reference and event sequence number as of the contract when the charge liquidation event is triggered. To facilitate this you need to associate the charge liquidation (CLIQ) event with the product using the charge class.

Online or Non-consolidated charges are stored in the following sequence:

- Branch

- Account

- Module

- Component

- Transaction reference number

- Event sequence number

Refer to the section titled Maintaining Charge Class details for consolidating Charges across modules for additional information on this feature.

3.1.2 Associating an Event/Role to Head Class with a Charge Class

Every charge class you maintain should be linked to an Event and Role to Head mapping class. The ICCF Rule and the three classes together provides the infrastructure to define the accounting entries, charge advices, and computation scheme for the charging required for accounts associated with this class.

Note

If you select Online as the Charge Mode you are not allowed to specify accounting and MIS details like Role-to-Head class, Event class, and MIS Group. This is because the accounting entries for the online charge mode are picked up from the product involving the transaction to which the charge component is linked.

3.1.2.1 Identifying the Rate Code and Type

The rate associated with this rate code is used to get the exchange rate when applying a charge component in a currency other than the account currency. You also need to identify the Rate Type which is to be associated with the rate code.

3.1.2.2 Associating an MIS Group with the charge class

If you have indicated that Charges should be consolidated across modules you need to identify the MIS Group that is to be associated with the charge class. While posting the consolidated entry for a particular charge the MIS details are picked up from the MIS group associated with the charge class.

3.1.3 Maintaining Charge Class mapping details

A charge class (component) is defined for a specific module. However, you can define a charge class which allows for consolidation of charges across modules by defining a charge class and associating it with a module called CF. Although data is stored for the CF module all components defined for the CF module is available across modules, thus enabling consolidation of charges across modules.

Since the events for charge booking, initiation, liquidation, and the basis amount tags differ from module to module, a pre-defined set of events and basis amount tags are defaulted to the respective fields in the Charge Class Maintenance screen, when you select CF as the module that is to be associated with the charge class. The pre-shipped events and amount tags that are defaulted for the CF module are:

Association Event |

CBOK (Contract Booking) |

Application Event |

CINI (Contract Initiation) |

Liquidation Event |

CLIQ (Contract Liquidation) |

Basis Amount Tag |

TXN_AMT (Transaction Amount) |

However, you can identify the events and basis amount tags for specific modules, which uses the Charge Class meant for the CF module. You can specify module specific events and amount tags the ‘Charge Class Maintenance’(LFDCHGCE) screen.

Note

You can select the module for which you would like to specify separate events and basis amount tags and associate the events/basis amount tags with the respective module.

3.1.4 Charge Processing across modules in Oracle Lending

Listed below are a few pointers which you need to bear in mind while defining Charge Classes for the following modules:

- The charging mode can only be deferred when you are building a Charge Class for the LF modules.

- Deriving charge rules and levying charges on the basis of the transaction count is not applicable for the OL module. While defining a charge class for the LF module you need not be able to map OL to the charge class. However, you are allowed to consolidate and defer charge posting for the module.

- For the OL module the charge account associated with the settlement instruction is debited for charges.

3.2 Defining charge components for a product

This section contains the following topics:

- Section 3.2.1, "Associating a charge class with a product"

- Section 3.2.2, "Associating several charge classes with a product"

- Section 3.2.3, "Stop Association"

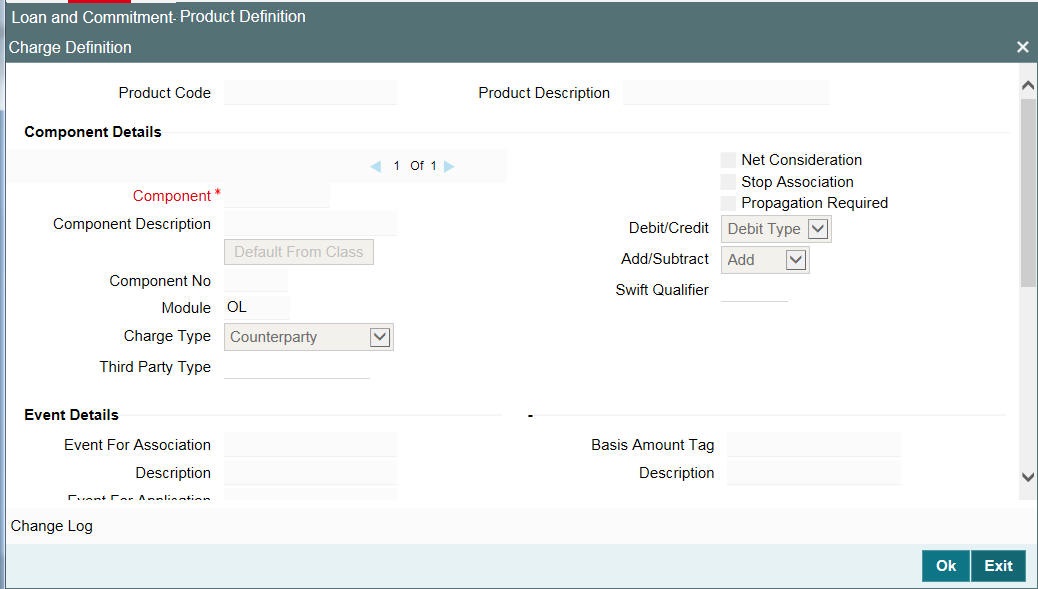

You can specify the charge components applicable to a product, in the Charge Definition sub- screen of ‘Loans and Commitment Product Definition’ (OLDPRMNT) screen. Click ‘Charges’ from ‘Loans and Commitment Product Definition’ screen to invoke the ‘Charge Definition’ sub-screen.

You should necessarily use a charge class to indicate the charge components applicable to a product. A charge class is a specific type of component that you can build with certain attributes.

3.2.1 Associating a charge class with a product

To associate a charge class with a product, select the appropriate charge class from the list of classes defined specifically for the particular module of Oracle Lending. Click ‘Default From Class’ from the ‘Charge Definition’ screen.

The attributes defined for the charge class are displayed. You have the option to change the attributes defined for the charge class to suit the requirement of the product you are creating.

3.2.2 Associating several charge classes with a product

You can associate several charge classes with a product. To add to the list of classes associated with the product click the ‘Add row’ button. Thereafter, click ‘Default From Class’ and select a class from the option list that is displayed.

To navigate between the charge classes associated with a product, you can use the icons provided for the same.

To disassociate a class from the product, navigate to the class, and click the ‘Delete row’ button.

3.2.3 Stop Association

You can choose to waive a charge component for a product that you are defining by clicking on this option. The charge component displayed in the Component field is not associated with the portfolios maintained under the product that you are defining.

Note

- The charge details specified for a product is automatically applied on all contracts involving the product.

- The options ‘Accrual Required’ and ‘Debit/Credit’ is defaulted from the ‘Charge Class Maintenance’ screen. You cannot change these preferences in this screen.

3.3 Specifying Charge details for a contract

This section contains the following topics:

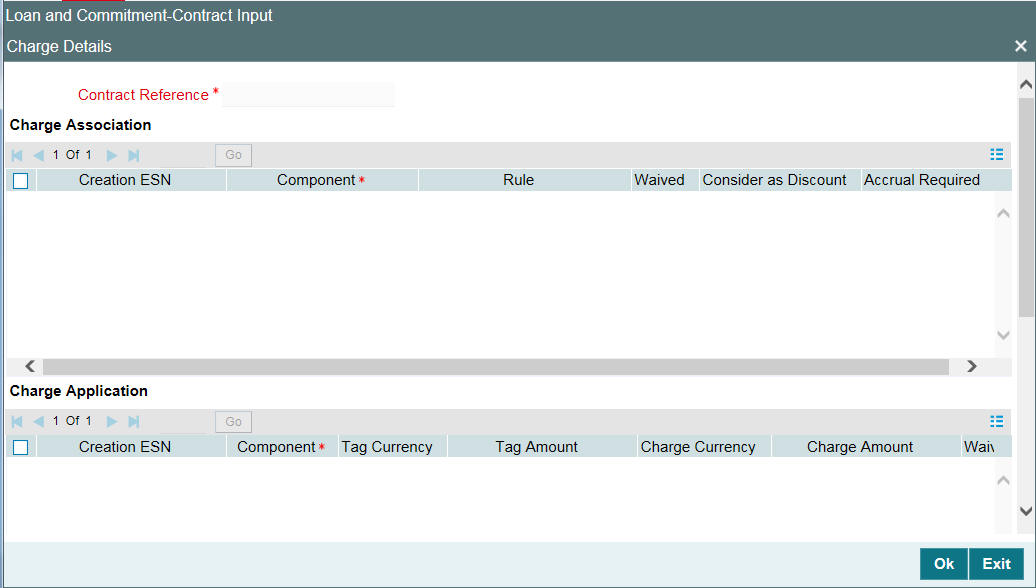

From the Loan and Commitment - Contract Input (‘OLDTRONL’) screen, click ‘Charges’ to invoke the ’Charge Details’ sub-screen.

When the details of a contract are captured, the charge components defined for the product is automatically applied. However, while processing a contract, you can change certain attributes of the charge component.

3.3.1 Features of the Contract Charge Details screen

The contract reference number of the contract you are processing is displayed on this screen.

3.3.2 Charge details

The charge components specified for the product to which you have linked the contract is displayed in tabular columns. You can choose to waive these components for the contract you are processing.

Component

The name given to the charge component is displayed here. The attributes defined for this component is displayed in the subsequent fields.

For a charge component the following details are displayed:

- The event that triggers the application of the charge being defined

- If the charge is a rate, it is defaulted from the product. This can be changed here.

- The currency in which the charge is specified if it is a flat amount and the flat amount itself.

Waiver

The attributes of a charge or fee defined for a product, are applied on all contracts involving the product. To waive the charge or fee on a contract you are processing, choose this option. The charge or fee is calculated but not applied.

At the time of processing the contract, you can change the following attributes:

- The rate

- The rate code for the contract

These default to the contract from the product, and can be changed for the contract.

Example

You have defined a Charge Rule, SplChgPor02. The structure of the Rule is as follows:

- Basis amount Currency – Euro

- Slab Min/Max Currency - USD

- Rule Currency – USD

- Settlement Currency INR

Amount |

Rate |

Min Amount |

Max Amount |

0 to 250 Thousand |

0.05% |

100 |

1000 |

> 250 Thousand <= 1 Million |

0.06% |

|

|

> 1 Million <= 3 Million |

0.07% |

|

|

> 3 Million |

0.08% |

|

|

The exchange rates maintained for the currency pair involved are as follows:

- EUR/FRF = 6.55957

- USD / FRF = 6.76

- USD / INR = 47.45

When this rule is applied on a deal of value 300 thousand FRF, the charge is calculated as follows

Step 1

The Contract Amount is converted to the Basis Amount Currency -

300000/6.55957 = EUR 45734.71

So the rate applicable is the first slab rate, that is, 0.05%

Step 2

The Charge is calculated as follows –

300000 * 0.05 = FRF 15000

Step 3

The Charge is converted to the Slab Min/Max Currency -

15000/6.76 = USD 2218.93

Since the amount is more than the maximum amount the charge is computed as USD 1000

Step 4

The charge amount is converted to the Rule Currency. Since the rule currency is also USD the charge amount is computed as USD 1000.

This charge is settled in the settlement currency INR as INR 21.07 while processing the contract.

Note

The charge is debited from the charge account in the currency of the charge account.

Consider as Discount

While associating a charge class for either a loans or bills contract, you can indicate whether the charge component is to be considered for discount accrual on a constant yield basis.

If you select this option the charge received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract.

Accrual Required

This field is defaulted from the Charge Class Maintenance screen. You cannot change it in this screen.

During the charge liquidation if this option is selected, the system uploads the charge as Upfront Fee Component. The FELR event is activated and FACR happens based on the frequency maintained at the product level.

Any subsequent liquidation of the charges of the same component is treated as amendments to the existing uploaded fee component.

You are not allowed to perform any manual operation on the uploaded fee component.

Note

If both the options ‘Consider as Discount’ and ‘Accrual Required’ are selected, the charge amount is considered for Internal Rate of Return calculation. But it is not part of the total discount to be accrued amount.