12. Processing a Commitment

his chapter contains the following section:

- Section 12.1, "Introduction"

- Section 12.2, "Defining a Commitment Product"

- Section 12.3, "Initiating a Commitment"

- Section 12.4, "Linking a Loan to a Commitment"

- Section 12.5, "Viewing Billing Notice History"

- Section 12.6, "Maintaining Slab/ Tier Based Fee for Commitment"

- Section 12.7, "Viewing Quick Query Details of Loans"

- Section 12.8, "Viewing Quick Query Details of Commitments"

- Section 12.9, "Revaluation of Commitment"

12.1 Introduction

A ‘commitment’ is a formal understanding between you and your customer that you are willing to advance a loan during a certain period in the future. A fee may be charged at the time of entering into this understanding. You can have a repayment schedule for this fee.

When a loan is disbursed against this commitment, since there is no movement of funds involved but only a setting aside of funds, you should specify that contingent entries are to be passed on initiation of the commitment, at the time of defining the commitment product.

The entries should be reversed on Maturity (if the commitment is not used), or whenever a loan involving the product (or loans are) is issued.

When a loan is linked to the commitment, commitment utilization entries should be defined for the loan. On the Maturity Date of the commitment, the reversal of the contingent entries should be defined.

A commitment can be linked to more than one loan, as long as funds are available. It can be:

- Revolving (where the amount available is reinstated whenever there is a payment against a loan linked to it)

- Non-revolving (where the amount repaid is not reinstated)

12.2 Defining a Commitment Product

You can define a product for commitments just as you can define one for loans. When you define a product, and enter into commitments involving the product, the commitments inherit the attributes of the product. However, you can change most of these attributes at the time of initiating a commitment.

A product is created as a general framework. Though a commitment generally inherits the attributes of the product it involves, it also have certain details specific to it, such as:

- The counterparty details

- The amount

- The contract reference number

- The user reference number

In the product definition screen, you have to specify the Product Type as ‘Commitment.’ You should specify the other details, such as the product code, a description, a slogan, the product group, the start and end dates and the remarks, just as you would for a loans product.

You can invoke the ‘Product Definition’ screen by typing ‘OLDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify your preferences (or options) through the Product Preferences screen:

- Specify the authorization re-key fields

- Specify the minimum, maximum and standard tenor of the commitment product

- Specify the frequency of accruals for the fee

- Specify the mode of liquidation for the principal and the fee schedules

- Specify the schedule type

- Specify the exchange rate variance

Through the ICCF screens, specify the fee applicable to the commitment. The fee can be:

- A flat amount

- A rate

For a product, you should define schedules for the fees that you levy. You have to:

- Define the reference date -- the Calendar date (date of the first fee schedule) or the Value Date (the date of initiation of the commitment),

- The frequency - monthly, half yearly

- The unit, month and date

- The number of schedules

Similarly, for the Principal you should define a schedule where the entire principal or the unused portion is liquidated at maturity.

Through the Product Status Control screen, you can specify the following for the fee component:

- Whether status change has to be automatic

- Whether accruals are to be stopped, when the commitment is in a particular status

- The accounting role and accounting head of the new GL to which accounting entries would be posted when the status of the commitment changes

- The advices, if any, to be generated for each status

- The number of days to achieve the status being defined for interim schedules

- The number of days to achieve the status being defined for the maturity schedule

For the commitment product, you should define the following:

- The accounting role and accounting head

- The accounting entries

- The advices to be generated when a particular event takes place -- for example, you can specify that a repayment advice has to be generated for the fee

- The branches which can use this product

- The currencies which can be allowed for the product

- The customer categories and the customers who can use the product

12.3 Initiating a Commitment

A commitment is initiated through the Contract On-line screens. Through the Contract Details screen, you have to specify the following:

- Counterparty (customer)

- Currency

- Credit line

- Amount

- Settlement Account

- Maturity Date (fixed)

- Tenor

While booking or amending a commitment, if the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for the commitment contract, dual authorization is required.

For more information about dual authorization, refer to Dual Authorization section in this manual.

Through the Contract Preferences screen, you have to specify the type of the commitment. A commitment can be:

- Revolving or

- Non-revolving

Revolving

In a revolving type of commitment, the amount available is reinstated whenever there is a payment against a loan linked to it.

Non Revolving

In a revolving type of commitment, the amount repaid against a loan is not reinstated.

Through this screen, you can also indicate whether the status movement (aging analysis) has to be done automatically or manually for the commitment.

You can convert the existing revolving commitment contract to non revolving commitment (Term commitment) contract using, ’Revolving to Non-Revolving Term Conversion’ screen.

You can change the contract preference from revolving to non-revolving in ’Revolving to Non-Revolving Term Conversion’ screen.

You can invoke the ‘Revolving to Non-Revolving Term Conversion’ screen by typing ‘OLDTMCNV’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Contract Reference Number

Specify the contract reference number of the revolving commitment contract which you want to convert to non-revolving commitment contract.

Current Balance

Commitment Amount

The total commitment amount before conversion is displayed in this field.

Available Amount

The total unutilized amount of a commitment contract before conversion is displayed in this field.

Expected Balance – Post Conversion

Commitment Amount

The total commitment amount after conversion is displayed in this field.

Available Amount

The total unutilized amount of a commitment contract after conversion is displayed in this field.

The contract balances are not rebuilt by the system while converting the commitment from Revolving to Non-Revolving. You should handle any balance changes during the conversion or subsequent to conversions by means of Value dated amendments for the respective commitments.

In the preferences screen, you have to indicate your schedule preferences:

- Whether holidays are to be ignored when schedule dates are calculated

- Whether schedule dates are to be moved (backward or forward) if a schedule date falls on a holiday

- Whether a movement of the schedule date across the month is allowed

- Whether the mode of liquidation of the repayment schedules has to be automatic

For a commitment, the schedule you have defined for the product is applied to the fee, by default. You can reverse these schedules through the Contract online screen, Schedules tab by providing the following details.

- The start date

- The number of schedules

- The frequency and unit

- The amount if the fee is a flat amount

For the principal schedule defined to maturity, you have to give the principal amount through this screen. You can also indicate your preference for cost of credit valuation.

At maturity, all the contingent entries that were passed at the time of initiating the commitment are reversed (if the commitment is not used or whenever a loan is linked to it). When a loan is linked to the commitment, loan-related entries are passed.

The fee and principal schedules can be liquidated automatically or manually, through the Manual Liquidation screen.

Cost of Credit Valuation

The system displays the option entered at the product level. If the option is deselected at the product level, it is disabled in this screen and you cannot select this option at the contract level. If this option is selected at the product level, then you can deselect it. During contract amendment, you can select it or deselect it based on its value in the previous version.

The system performs cost of credit valuation for the contract for both performing and non-performing contracts only if the ‘Cost of Credit Valuation Reqd’ check box is selected for the contract.

12.3.1 Making Value Dated changes

Through the Value Dated Changes function, you can do the following:

- Increase or decrease the commitment amount

- Change the fee rate or amount

- Change the maturity date

12.3.2 Capturing Auto Step-up and Auto Step-down of a commitment

Oracle Lending supports auto step-up and step-down of a commitment through the Contract online screen, Schedules Tab.

For auto step-down of a commitment, from Schedule details section, select 'C' from ‘Type’ and ‘Principal’ from the Component along with the other parameters. System calculates and reduces the commitment availability amount. The events VAMB and VAMI are triggered.

Account entries are given below:

GL |

Amount Tag |

Dr/Cr |

Con Asset Offset GL |

PRINCIPAL_DECR |

Dr |

Con Asset GL |

PRINCIPAL_DECR |

Cr |

For auto step-up of a commitment, from Schedule details section, select 'I' from Type along with other parameters. System calculates and increases the commitment availability amount. The events VAMB and VAMI are triggered.

Account entries are given below:

GL |

Amount Tag |

Dr/Cr |

Con Asset GL |

PRINCIPAL_INCR |

Dr |

Con Asset Offset GL |

PRINCIPAL_INCR |

Cr |

Click ‘Commitment Reduction Schedules’ button to check the commitment schedule details.

The screen displays the following details:

- Due Date

- Reduction amount

- Processed Amount

- Step Up (+) or Step Down (-) as the schedule of the commitment.

- Status indicates the commitment step up/step down schedule as:

- Unprocessed – Future Schedules

- Processed – Successfully completed

- Failed – Failed due to Unavailability

While updating the schedules for auto step up and auto step down overlapping is not allowed. If there is an insufficient amount the partial commitment reduction is processed based on the flag ‘Allow Partial reduction’ at the commitment product level. You cannot reverse a processed commitment step up/down schedules.

An exception is logged in case of failure of commitment reduction and no subsequent attempts are activated. Future commitment step up/down schedules are not considered while performing the back dated/current dated/ future dated loan activities. For back valued commitment booking, you cannot define schedules for back valued auto step up/step down.

12.4 Linking a Loan to a Commitment

A loan can be ‘linked’ to a deposit, commitment or an account. A linkage of this nature with a commitment will mean:

- You can utilize the entire amount of a commitment, or a portion of it, for a loan. The available balance in the commitment is reduced from the commitment.

- You can also link a portion of the loan to the commitment

The contingent entries that were passed when the commitment was initialized will be reversed for the loan amount that has been linked.

A commitment can be linked to more than one loan, as long the amount is available for utilization.

To specify the details of the linkage you have to invoke the Contract Linkages screen.

12.4.1 Specifying the Details of the Linkage

If the linkage is with a commitment specify the Reference Number of the commitment.

The currency of the commitment to which the loan is being linked is also be displayed on the screen, once the linkage details are specified.

12.4.2 Specifying the Linked Amount

You should indicate the amount that has to be linked to the commitment. This amount can be the entire principal of the loan, or a portion of it. The amount that you specify should be in the currency of the loan.

This amount should be available in the commitment. The available amount is arrived at taking into account the other loans linked to the commitment.

12.4.3 Specifying the Exchange Rate

You need to specify the exchange rate only if the currency of the loan is different from the currency of the commitment to which it is being linked.

If the two currencies are different, the mid-rate for the day is taken by default. This rate is displayed in the field and can be changed by you. If the rate entered by you differs from the mid-rate by the normal variance percentage defined for the product, then you are asked for an override. If it differs from the mid-rate by the maximum variance specified for the product, then it does not allow the record to be stored.

12.4.4 The Converted Link Amount

This amount is displayed only if the currency of the loan is different from that of the commitment. This amount is arrived at using the Exchange Rate specified in an earlier field.

12.4.5 Type and Total Linked Amount for each Type

You can link a loan to many commitments, deposits or accounts. The total amount linked to each type (commitment, deposit or account) is displayed in this screen.

12.4.6 Uncovered Amount

When you are linking a loan to a commitment you can link either the entire principal amount or a portion of it. The amount of the loan that is not linked will be shown in this screen.

12.4.7 Accounting Entries for a Linkage

For a non-revolving type of commitment, once the commitment amount is utilized, the accounting entries are reversed.

For a revolving type of commitment, where the commitment amount is refurbished once a repayment is made, the accounting entries are re-instated, every time the commitment amount is refurbished.

12.4.8 Amending Commitment Linkage Details

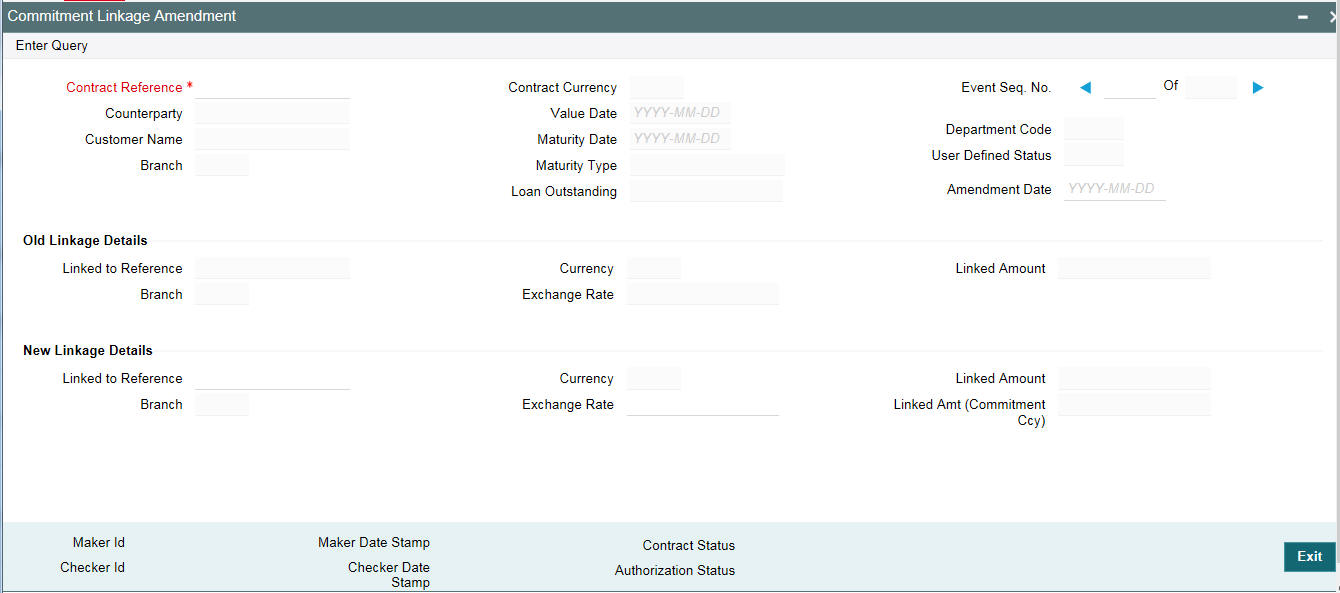

A new commitment and an existing commitment can be linked to a loan contract and you can modify the new commitment through the ‘Commitment Linkage Amendment’ screen.

You can invoke the ‘Commitment Linkage Amendment’ screen by typing ‘OLDLNKAM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details:

Contract Ref No

Specify the contract reference number of the contract for which you need to amend the commitment linkage.

Amendment Date

Specify the amendment date of the loan contract.

Old Linkage Details

The system displays the values of old linkage details and you cannot modify these details.

New Linkage Details

Linked to Ref

Specify the reference number of the new commitment which is to be linked. The adjoining option list displays all the commitment reference numbers maintained in the system. You can choose the appropriate one.

Exchange Rate

Specify the exchange rate of the linked amount.

Note

If a contract is pending for authorization in any screen and if you try to unlock in ‘OLDLNKAM’ to do changes, then an error message “Unauthorized amendments exist for contract in ‘function id’ “appears.

12.4.9 Processing Commitment Linkage Changes

LAMD (Linkage Amendment) event is used for this operation. This event fires at the loan level and no accounting entries are posted. If LAMD event is used for linking a commitment to a loan for the first time, then the LINK event activates at the commitment level.

If LAMD is done at the loan level to remove and add a new commitment, then the DLNK event fires at the old commitment level (even for non revolving commitments) and LINK event activates at the new commitment level. Linked amount is tracked only for new commitments.

Back valued activities beyond the commitment linkage date for principal increase/decrease is not allowed. If there is a partial reprice, then delinking of the commitment is done for the parent and child contract separately. The DLNK amount is based on the current outstanding of the loan for the loan contract that is linked to a revolving/non revolving commitment.

On partial payment of the loan principal, LAMD is done to delink the commitment and the system activates the DLNK for the current outstanding amount of the loan on old commitments. This is applicable for revolving and non revolving commitments.

Following operations can be performed:

- UNLOCK

- SAVE

- AUTHORISE

- DELETE

Note

- Commitment linkage is applicable for revolving and non-revolving commitments. Value date wise balances of the commitments can be tracked and future dated LAMD is not allowed.

- LAMD of the loan to modify/add the commitment linkage is not allowed if a Rollover / Reprice instruction is captured.

- LAMD is also not allowed if, for the commitment, propagation of status to the underlying loans of the commitment is allowed (‘Propagate Status to Loan ‘preference is selected at commitment level)

- Reversal of LAMD is not allowed. The value date of the LAMD cannot be beyond the schedule date or value date whichever is greater than the fee liquidation of the commitment.

- The following commitment level validations will be performed during

the LAMD activity.

- Sub-limits

- Borrower

- Currency

- Commitment Blockage Period (if any)

- Commitment reduction schedules (if any)

- The value date of the LAMD cannot be beyond the last DLNK event date of the underlying commitment. If a contract has overdue schedules, then LAMD is not allowed. If a future dated loan is linked to a commitment, then LAMD is allowed, however the value date of the same should be the loan contract value date.

- The existing commitment currency and new commitment currency should be the same. However, if there is no existing commitment, then user can link commitment of any currency.

- New Linkage details are mandatory.

- LAMD beyond LAMD will be blocked.

- The old and new commitment type should be the same, that is, if old commitment is revolving then new commitment should also be revolving.

- Reversal of payments, which are done prior to the LAMD, are not allowed. Reversal of VAMI, which is done prior to the LAMD is not allowed.

In case of REVC of a loan contract, system reverses all the accounting entries posted at the loan and commitment (old and new) level are reversed. However, the net effect at the old commitment is the same.

12.4.10 Defining Schedules for Reduction of Commitment Amounts

A commitment is a formal agreement between you and your customer, according to which, you agree to advance a loan to your customer at a future period. When you actually disburse a loan against the commitment, the amount that you have committed reduces to the extent of the loan availed.

If the commitment amount should be reduced at regular intervals, a schedule for reductions can be specified. These schedules would be executed during the Beginning of Day processing on the specified dates.

You can define such reduction schedules in the Schedules tab of the Loans and Commitment Contract Online screen, when you initiate the loan. Select ‘C’ in the Rev field to indicate that the schedule is being defined for a commitment, in which the commitment amount is being reduced at regular intervals.

You can view the reduction schedules on a contract by clicking ‘Commitment Reduction Schedules ' in the Contract Schedules screen.

12.4.10.1 Batch Process for Reductions

During the execution of the automatic loan batch processes, the reduction schedules are processed. The reduction schedules are sequenced to run after auto liquidations and before accruals.

12.4.10.2 Partial Reductions

Reduction of the commitment amount according to the reduction schedule depends on the outstanding commitment amount when each schedule falls due. Due to availment of any linked loans, on a schedule date, the outstanding commitment amount could be insufficient to be reduced to the extent of the schedule amount.

You can define partial reduction to be applicable for the schedule. If defined, the commitment amount is reduced to the extent possible. If partial reduction is not defined, the reduction is not processed until the outstanding commitment amount is replenished sufficiently to the extent of the reduction, by repayments made by the customer.

To specify partial reductions to be applicable, you specify it in the Product Preferences for a loans product. Select the ‘Allow Partial Reduction’ box in the Product Preferences screen.

The following example will illustrate the concept of reduction of commitment amounts:

Example

Your bank has committed to lend a sum of 100000 USD to Mr. Joseph Nbele, one of your customers. The commitment is entered into on 1st January 2002, and reaches maturity one year later.

Mr. Nbele requests you to provide a reduction schedule for your commitment, to the tune of 10000 USD at the beginning of each month, beginning on 1st February 2002.

On 1st July 2002, the commitment amount has been reduced to 40000 USD, through the automatic execution of the reduction schedules by the batch process.

On the same day, Mr. Nbele avails a loan under the commitment, to the extent of 35000 USD. On 1st August, when the batch process attempts to execute the next reduction schedule, there is an insufficiency in the outstanding commitment amount, to the extent of 5000 USD.

If partial reduction is specified for the commitment product, then the reduction schedule on 1st August is executed, and 5000 USD is reduced from the commitment amount, bringing the amount available to zero.

If partial reduction is not specified, the schedule is not executed on 1st August. It is attempted on a daily basis by the batch process, and only be executed when the outstanding commitment amount is sufficient enough to make the reduction of 10000 USD.

Now, Mr. Nbele repays 10000 USD of the loan, on 15th August, bringing the outstanding commitment amount to 15000 USD. On that day, the batch process successfully execute the reduction schedule that was to have been executed on 1st August.

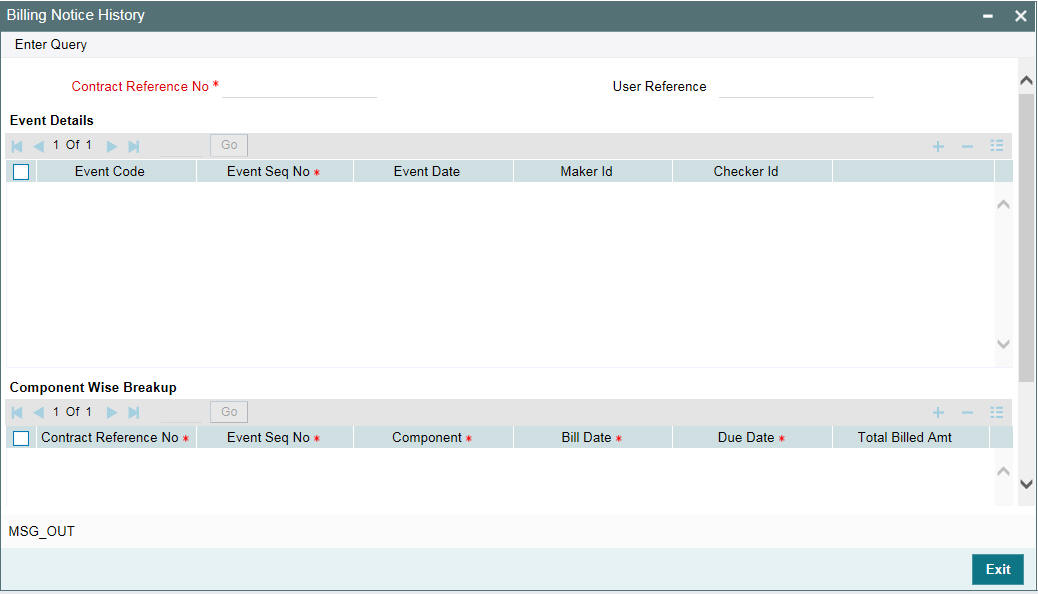

12.5 Viewing Billing Notice History

Oracle Lending facilitates storing the billing notice internally, which is generated as part of NOTC event. You can use this information for reporting activities.

You can view the component wise break up of a contract reference number through the ‘Billing Notice History’ screen.

You can invoke the ‘Billing Notice History’ screen by typing ‘OLDNOTCH’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can view the following details about the billing notice, generated as part of NOTC event:

- Contact Reference Number

- User Reference number

- Event Details

- Component Wise Breakup Details

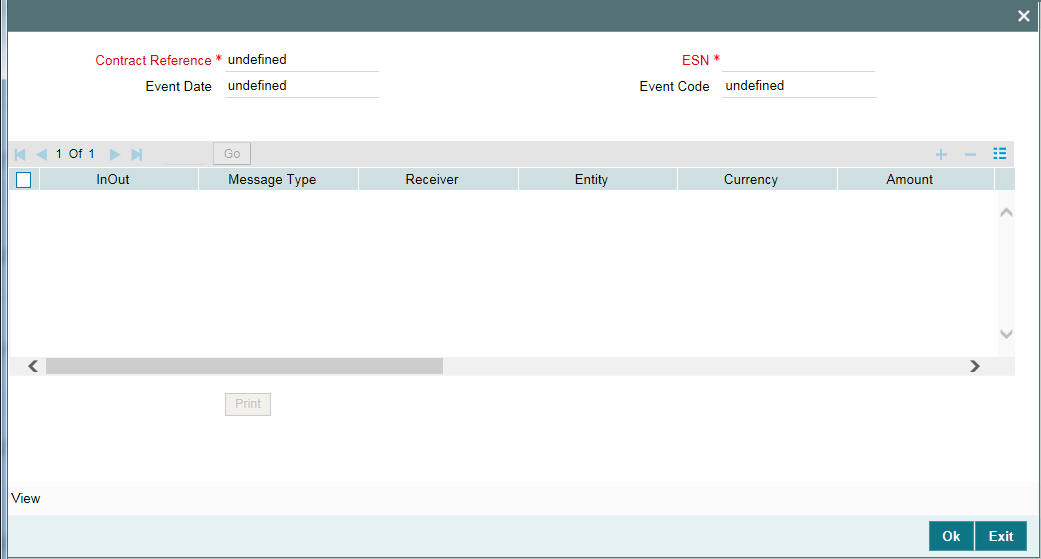

You can view the history of NOTC events generated under a given contract through the ‘View Events’ screen.

For more information about Event Details, refer to ‘Viewing Event details’ section in the User Manual.

You can view the details of the notice in the ‘Message Details’ screen. To invoke this screen click the ‘Messages’ in the above screen.

Here the system displays the following details of the notice:

- Reference Number

- ESN

- Event

- Txn Date

- Outgoing/ Archival

- Message Type

- Receiver

- Entity

- Currency

- Amount

- Status

- Name

- Location

- Address

- Exception

You are allowed to reprint the generated bill for a given contract reference number by clicking the ’Print’ in the above screen.

12.6 Maintaining Slab/ Tier Based Fee for Commitment

Oracle Lending allows you to maintain a slab/tier based fee computed on the unutilized or utilized balance of commitment. You are also allowed to waive a portion of fee at the time of fee payment for various fee components. In order to facilitate this, you have to perform certain maintenance for the fee structure, they are:

- Fee Rule Definition Structure

- Fee Rule Maintenance Structure

- Fee Component Definition at the Product Level

- Fee component Definition at the Contract Level

- Liquidation of Fee component

- Reversal of Fee Liquidation

12.6.1 Maintaining Fee Rule Definition Structure

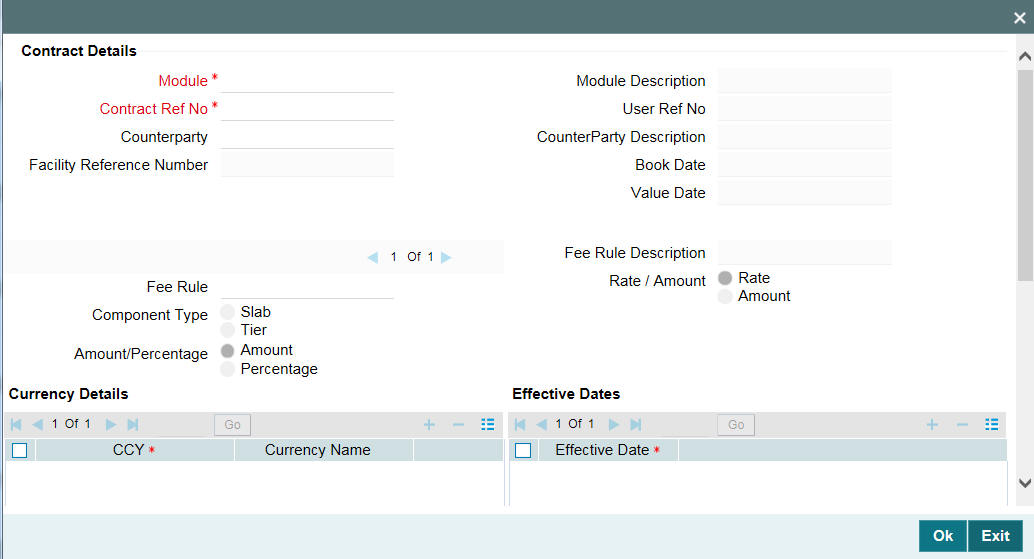

In the ‘Fee Rule Definition’ screen, you can define a rule for a particular fee component. It can be either Slab or Tier based. The fee computation can be either Rate or Amount based.

12.6.2 Associating Fee at Product Level

You can associate the fee by clicking the ’Fee’ in the ‘Loans and Commitment-Contract Input’ screen.

Here you can attach multiple fee components to the Product. The following are the preferences to be maintained:

- Select the Basis Amount available as one of the following as required:

- Principal

- UTIL—Only Arrear type of fees

- User Input

- UNUTIL—Only Arrear type of fees

- OUTSTANDING

- Select the Fee Rule type as ‘Margin’

- Fee should be collected in Arrears or in Advance

- The preferences for the fee class to be maintained as follows:

- Allow Start Date Input – If you select this check box at the product level, the system allows start date input at the contract level.

- Allow End Date Input: If you select this check box at the product level, the system allows end date input at the contract level.

- Billing Notice Required – Select this flag for generating the billing notices

- No of days – The system generates the billing notices ‘x’ days before the fee liquidation is due, where ‘x’ is the days maintained.

- Allow rule Amendment – Select this flag to amend the Fee Rule at the contract level.

- Allow Amount amendment – Select this flag to amend the amount at the contract level.

- Stop Association – Select this flag to stop calculating the fees for the underlying contracts.

12.6.2.1 Maintaining Fee Rule Details

In the ‘Fee Rule Maintenance’ screen, you can define the Slab or Tier details, based on the rule and the fee amount or rate for each slab or tier for each of the fee components like loan fee and commitment fee. The fee basis amount is defined in amount or in percentage.

12.6.2.2 Computing Facility Fee for Commitment

You can calculate the Facility Fee for a commitment to track the latest commitment amount. You can define the Facility Fee component using the Basis Amount Tag ‘TRANSFER_AVL’ available in the Fee Class screen and Fee Definition screen for Commitment product maintenance.

‘TRANSFER_AVL’ balance represents the sum of the Available Balance for a commitment and underlying Loans Outstanding Balance for a given value date.

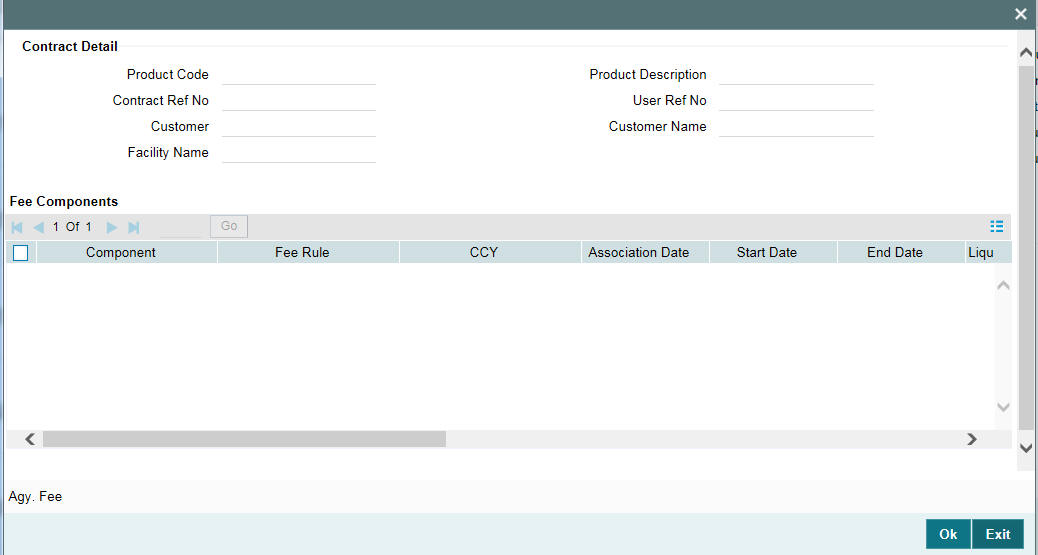

12.6.3 Associating Fee at Contract Level

You can associate the fee by clicking the ’Fee’ in the ‘Loans and Commitment-Contract Input’ screen. The ‘Fee Component’ screen is displayed.

For more information on Contract details, refer to Disbursing a Loan section in this User Manual.

Here, the system defaults the following value from the product:

- Component

- Fee Rule

- Liquidation Mode

- Fee Basis Notice Required

- Notice Days

The system defaults all the other values on the contract value. You are allowed to change the following values:

- Start Date – Only if you select this check box at the product level, you can amend it.

- End Date - Only if you select this check box at the product level, you can amend it.

- Currency

- Liquidation Mode

- Fee Basis

- Notice Required

- No of Notice Days

- Fee Rule

The system performs the following validations:

- Start Date cannot be earlier than the Contract Value Date

- End Date cannot be greater than the Contract Maturity Date

You can modify the preferences in the ‘Fee Rule Maintenance’ screen. To invoke this screen, click ‘Fee Rule button in the ‘Loans and Commitment-Contract Inputs’ screen.

Here you can modify the preferences only for a particular contract maintained at the contract level.

You can define the fee payment schedules in the ‘Loans and Commitment-Contract Input’s screen under ‘Schedules’ tab.

Here the fee payment schedules are defined under Schedule Details as seen above.

To amend the schedules of a particular component of a contract click buttons.

Here you can amend the schedules of a particular component of a contract if required.

For more information about fees and charges, refer to Fees and Charges User Manual.

The system posts the following entries in case of Fee Liquidation:

- Fee collected in Advance

- At Fee Collection ( FLIQ):

Accounting Role |

Dr / Cr |

Amount Tag |

CUSTOMER |

Dr. |

Component_LIQD |

Component_RIA |

Cr. |

Component_LIQD |

- At Fee Accrual (FACR):

Accounting Role |

Dr / Cr |

Amount Tag |

Component_RIA |

Dr. |

Component_ACCR |

Component_INC |

Cr. |

Component_ACCR |

- Component_RIA - Fee Component Received in Advance

- Component_INC - Fee Component Income

- CUSTOMER - Borrower

- Component_ LIQD - Fee Component Liquidated

- Component_ACCR - Fee Component Accrued.

- Fee collected in arrears

- At Fee Accrual (FACR):

Accounting Role

Dr. / Cr.

Amount Tag

Component_REC

Dr.

Component_ACCR

Component_INC

Cr.

Component_ACCR

- At Fee Collection ( FLIQ):

- At Fee Accrual (FACR):

Accounting Role |

Dr. / Cr. |

Amount Tag |

CUSTOMER |

Dr. |

Component_LIQD |

Component_REC |

Cr. |

Component_LIQD |

- Component_REC - Fee Component Receivable

- Component_INC - Fee Component Income

- CUSTOMER - Borrower

- Component_LIQD - Fee Component Liquidated

- Component_ACCR - Fee Component Accrued.

During Fee Liquidation reversal, the system triggers the event FREV.

The system posts the following entries as part of FLIQ reversal.

Accounting Role |

Dr. / Cr. |

Amount Tag |

CUSTOMER |

Dr. |

Component_LIQD |

Component_REC |

Cr. |

Component_LIQD |

Example:

The system posts the following entries as part of FLIQ:

Accounting Role |

Dr / Cr |

Amount Tag |

Amount |

CUSTOMER |

Dr. |

Component_LIQD |

1000 |

Component_REC |

Cr. |

Component_LIQD |

1000 |

The system posts the following entries as part of FREV:

Accounting Role |

Dr / Cr |

Amount Tag |

Amount |

CUSTOMER |

Dr. |

Component_LIQD |

-1000 |

Component_REC |

Cr. |

Component_LIQD |

-1000 |

12.6.3.1 Maintaining Parameter to Define Fee Schedule for Commitments

Based on the value maintained for the parameter ‘ALLOW_FEE_SCHEDULE’ in the ‘Parameter Mapping’ screen, you can define the fee schedule for commitment contracts.

If the parameter ‘ALLOW_FEE_SCHEDULE’ is maintained as ‘Y’, then system does the following:

- System does not allow you to define Interim and Bullet fee schedules from Fee module.

- System does not allow tracking fees for a commitment from both Fee and ICCF modules.

- While defining a commitment product, you should associate the fee component from either the Fee or ICCF module and not from both the modules.

- While saving the commitment contract, if the fee component is attached from both Fee and ICCF modules, then system displays an appropriate error message.

If the parameter ‘ALLOW_FEE_SCHEDULE’ is maintained as ‘N’, then processes the fees as applicable for non-agency contracts.

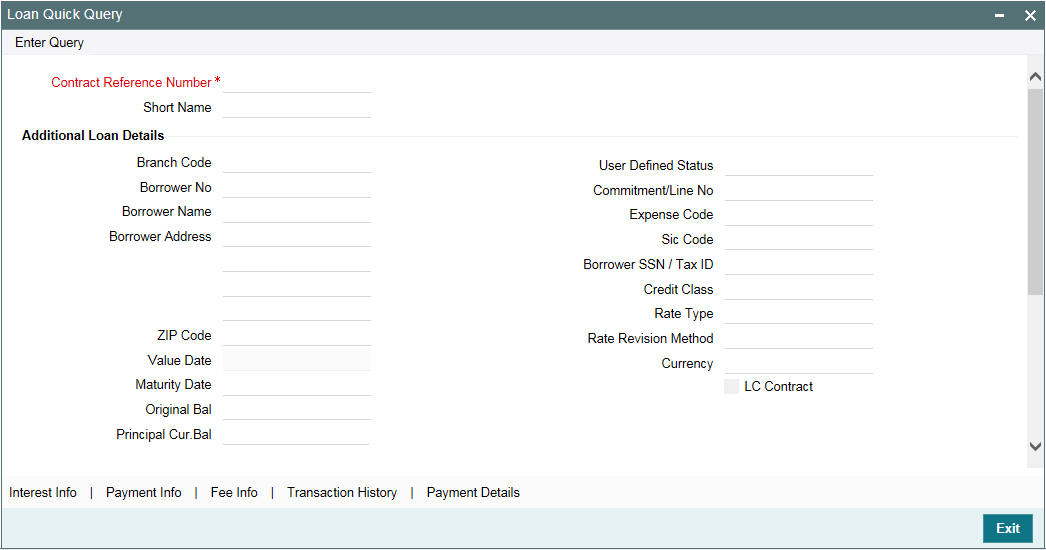

12.7 Viewing Quick Query Details of Loans

You can view the basic details of a loan using ‘Loans Quick Query’ screen.

You can invoke the ‘Loan Quick Query’ screen by typing ‘OLDQCKRD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Contract Reference Number

Specify the reference number of the contract whose details you want to view.

Loan Details

- Branch Code

- Borrower No

- Borrower Name

- Borrower Address

- ZIP Code

- Value Date

- Maturity Date

- Original Bal

- Principal Cur Bal

- User Defined Status

- Commitment/Line No

- Expense Code

- SIC Code

- Borrower SSN/Tax ID

- Credit Class

- Rate Type

- Rate Revision Method

- Currency

- LC Contract

Bankers Acceptance

- Reg Class

- Facility Type

- Status

- Currency

- Principal Balance

- USD Equivalent

- LOCR Availability

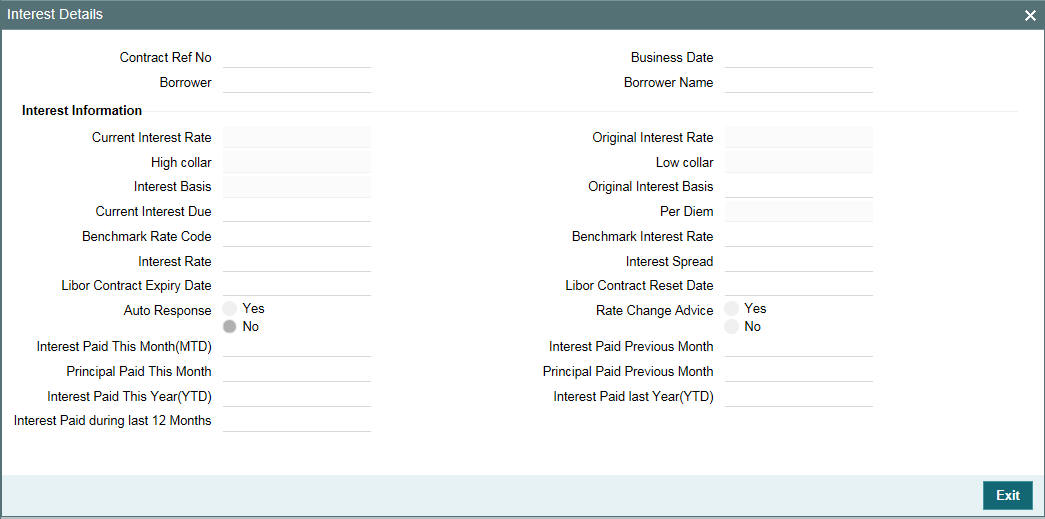

Click ‘Interest Info’ to view the Interest Info details of the contract.

The following fields are displayed in this screen.

- Current Interest Rate

- High Collar

- Interest basis

- Current Interest Due

- Benchmark Rate Code

- Contract Expiry Date

- Contract Renewal Date

- Interest Paid This Year (YTD)

- Interest Paid during last 12 months

- Original Interest Rate

- Low Collar

- Original Interest Basis

- Per Diem

- Benchmark Interest Rate

- Interest Spread

- Interest paid Last Year (YTD)

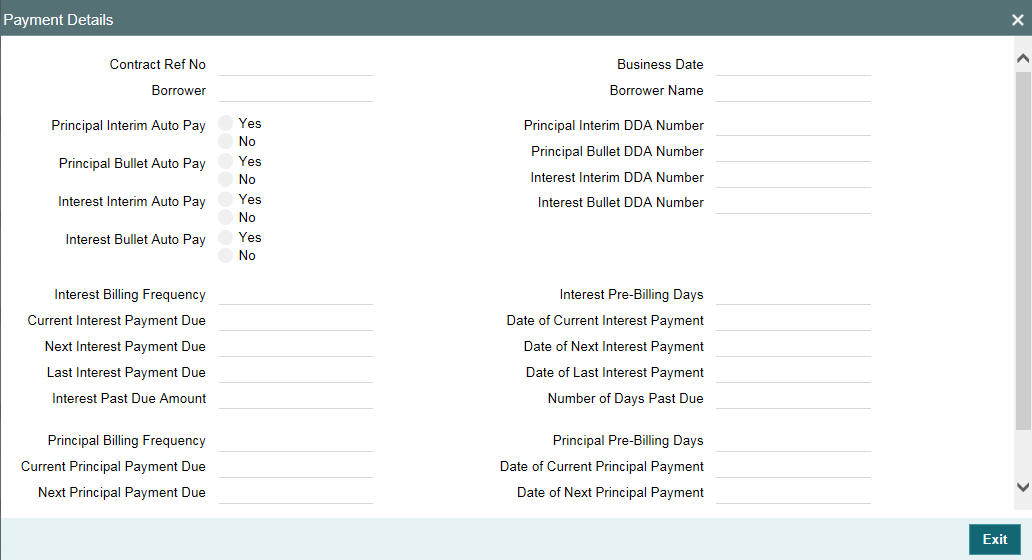

Click ‘Payment Info’ to view the payment Info details of the contract.

You can view the following details in this screen:

Interest Details

- Auto Pay Indicator

- Auto Pay Debit Account Number

- Interest Billing Frequency

- Current Interest Payment Due

- Next Interest Payment Due

- Last Interest Payment Due

- Interest Past Due Amount

- Date of Current Interest Payment

- Date of Next Interest Payment

- Date of Last Interest Payment

- Number of Days Past Due

Principal Details

- Principal Billing Frequency

- Principal Billing Frequency

- Current Principal Payment Due

- Next Principal Payment Due

- Last Principal Payment Due

- Principal Past Due Amount

- Date of Current Principal Payment

- Date of Next Principal Payment

- Date of Last Principal Payment

- Number of Days Past Due

The payment information needed for identifying amount to be paid in case of foreclosure can be viewed from OL Manual Payment screen.

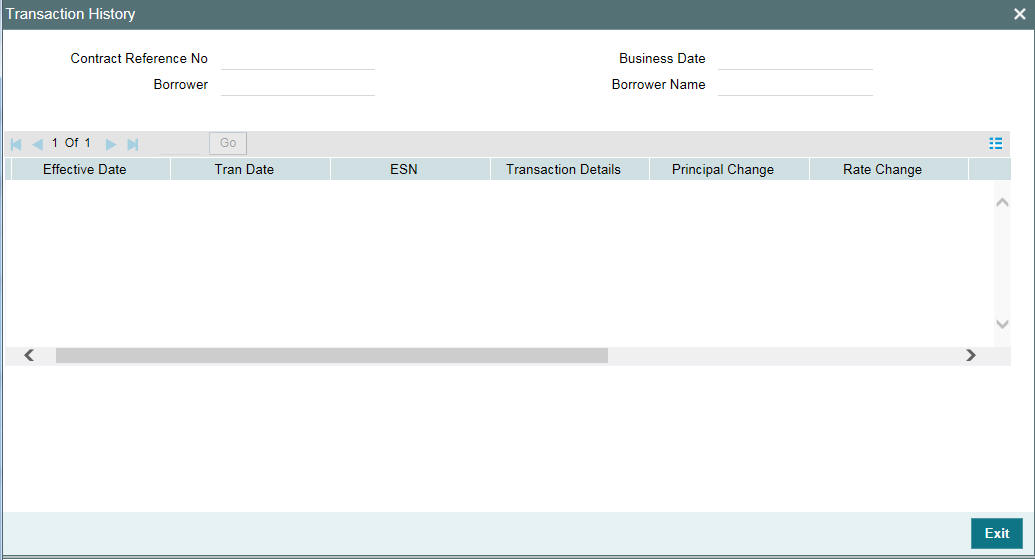

Click ‘Transaction History’ to view the Transaction History details of the contract.

You can view the following details in this screen:

- Effective date

- Transaction date

- Transactional Details

- Principal Change

- Interest Change

- Principal Balance

- Interest Due

12.7.1 Viewing Loan Quick Reference Summary Details

You can view summary details of Loan Quick Reference in ‘Loan Quick Reference Summary’ screen.

You can invoke the ‘Loan Quick Query Summary’ screen by typing ‘OLSQCKRD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

12.8 Viewing Quick Query Details of Commitments

You can view the most viewed details of commitments using ‘Commitment Quick Details’ screen.

You can invoke the ‘Commitment Quick Query Detailed’ screen by typing ‘OLDCLQRY’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Commitment/Line Number

Specify the number of the commitment/Line whose details you wish to view.

The following fields are displayed in this screen.

- Company ID

- Exp Code

- Facility Memo Number

- Expiry Date’

- Facility Type

- Secured Indicator

- Guarantee Indicator

- Status

- Closing Date

- Revolver Indicator

- Participation Indicator

- Borrower Number

- Borrower SSN/Tax Id

- Borrower name

- Borrower Address

- Original Commitment/Line Amount

- Currency

- USD Equivalent

- Current Commitment/Line Amount

- Currency

- USD Equivalent

- Total Disbursed Amount

- Currency

- USD Equivalent

- Direct

- Currency

- USD Equivalent

- Contigent

- Currency

- USD Equivalent

- Available Amount

- Currency

- USD Equivalent

- Number of Consecutive Days with 0 balance

Current YTD

- Average Outstanding Line Balance

- Lowest Outstanding Balance

- Highest Outstanding Balance

Last Calendar Year

- Average Outstanding Line Balance

- Lowest Outstanding Balance

- Highest Outstanding Balance

Click ‘Linkages’ to view the Loans/LOCR Linked to the Commitment/Line.

The following details are displayed:

- Loan/LOCR Number

- Facility Type

- Interest Rate

- Interest Type

- Maturity Date

- Currency Priority/Prior Balance

- CMT/Line Number

- Currency

- USD equivalent

Click ‘Facility Fee’ to view the Facility/Restructuring (FASB/FASC)/Upfront Fee details.

The following details are displayed:

- Fee type

- Total Fee Amount

- Currency

- USD Equivalent

- How Payable (as charge etc.)

- DDA Number

- Accrued Fee Amount Due

- Current Fee Due Date

- Last Fee Paid Amount

- Last Fee Paid Date

- Next Fee Amount

- Next Fee Due Date

- Past Due Fee Amount

- No Of Days Past Due

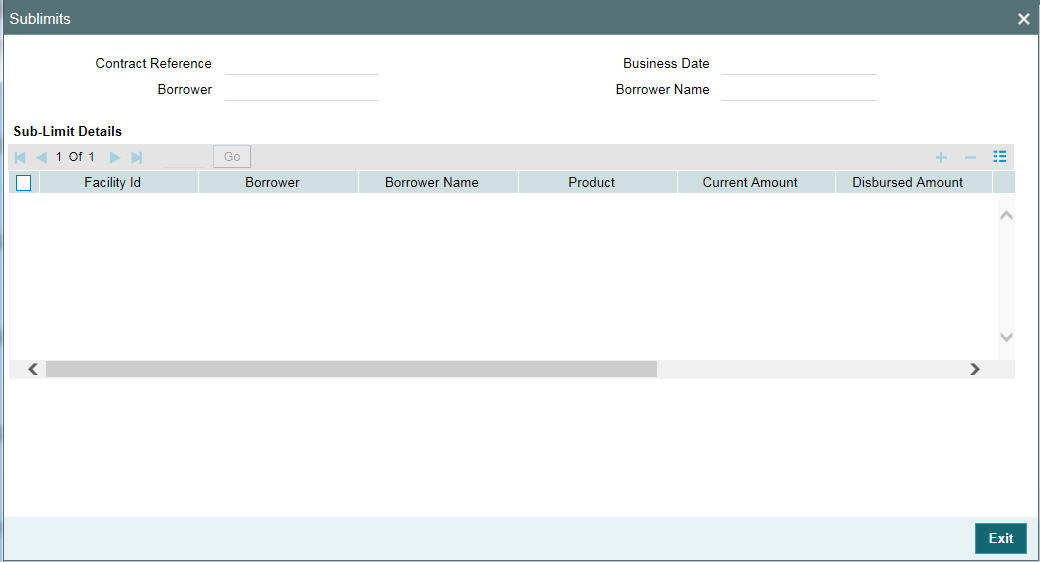

Click ‘Sublimits’ to view the Sublimits details.

The following details are displayed:

- CMT/Line Number

- Borrower

- Current Amount

- Disbursed Amount

- Avail Amount

- Currency

- USD Equivalent

Click ‘Unused comt. Fees’ to view the Unusual Commitment Fee details.

The following details are displayed:

- Unused Commitment Fee Rate

- Accrued Fee Amount from Last Period to Date

- Unused Fee Pay Schedule

- How Payable

- DDA Number

- Unused Commitment Fee Due

- Unused Commitment Fee Due Date

- Last Unused Commitment Fee Paid Amount

- Last Unused Commitment Fee Paid On

- Next Unused Commitment Fee Amount

- Next Unused Commitment Fee Due Date

- Past Due Unused Commitment Fee Amount

- Number of Days Past Due

Click ‘Transaction History’ to view the Transaction History details.

The following details are displayed:

- Effective Date

- Transaction Date

- Transactional Details

- Principal Change

- Fee Change

- Principal Balance

- Fee Due

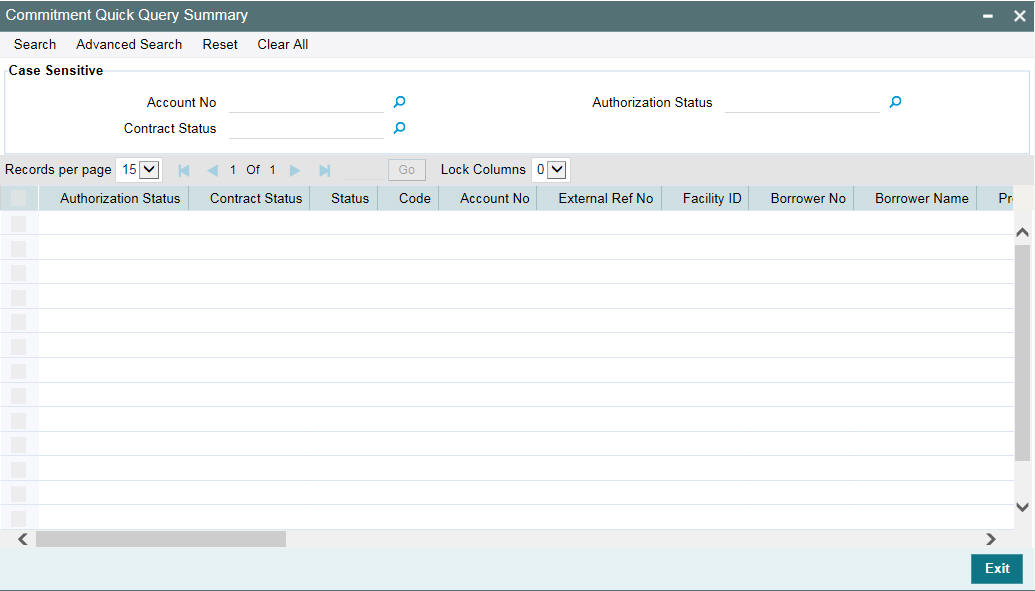

12.8.1 Viewing Commitment Quick Reference Summary Details

You can view summary details of Commitment Quick Reference in ‘Commitment Quick Reference Summary’ screen.

You can invoke the ‘Commitment Quick Reference Summary’ screen by typing ‘OLSCLQRY’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

12.9 Revaluation of Commitment

Oracle Lending process revaluation of a commitment as an EOD batch process. The system identifies active distinct commitment contracts, for each CUSIP/ISIN and revaluates net outstanding amount of the commitment as the ‘Settled Position’ using market price. During revaluation, the system considers ‘Settled Position as ‘Total Position’.

The EOD batch programs MTMREVL/ MTMRRVL process revaluation entry and the reversal entry for past revaluation entry, for a commitment in OL module, if a Market price is maintained for the CUSIP at Loan and Commitment Maintenance level.

During MRVL event at EOD batch, the system posts the accounting entries for the commitment contract.

During MREV event at BOD batch of the next working day, the system posts the accounting entries, posted on the previous EOD, with a negative symbol.

Example

System posts EOD/BOD accounting entries as follows:

Day |

Unrealized PL Computed |

Entry Posted at BOD (MREV event) |

Entry posted at EOD (MRVL event) |

||

1 |

(400,000.00) |

|

|

Dr UNREAL_MTM_EXP |

400,000.00 |

|

|

|

|

Cr UNREAL_MTM_OFF |

400,000.00 |

2 |

(300,000.00) |

Dr UNREAL_MTM_EXP |

(400,000.00) |

Dr UNREAL_MTM_EXP |

300,000.00 |

|

|

Cr UNREAL_MTM_OFF |

(400,000.00) |

Cr UNREAL_MTM_OFF |

300,000.00 |

3 |

(1,000,000) |

Dr UNREAL_MTM_EXP |

(300,000.00) |

Dr UNREAL_MTM_EXP |

1,000,000 |

|

|

Cr UNREAL_MTM_OFF |

(300,000.00) |

Cr UNREAL_MTM_OFF |

1,000,000 |

4 |

32,500.00 |

Dr UNREAL_MTM_EXP |

(1,000,000) |

Dr UNREAL_MTM_OFF |

32,500.00 |

|

|

Cr UNREAL_MTM_OFF |

(1,000,000) |

Cr UNREAL_MTM_INC |

32,500.00 |

5 |

|

Dr UNREAL_MTM_OFF |

(32,500.00) |

|

|

|

|

Cr UNREAL_MTM_INC |

(32,500.00) |

|

|

The PNL Calculations are as follows:

As part of Day1 EOD:

Loan= $10mm and Price 96%

Par value of total facility * price = value of the total facility

10,000,000 * (96/100) = 9,600,000

PnL = 10,000,000.00 – 9,600,000.00 = 400,000.00

DR 442303301 TradRev/Loss-CommlLns-FVOptFAS159 400000

CR 125107202 CommercialLoansFVOptionSFAS159 MTM 400000

As part of Day2 BOD:

DR 442303301 TradRev/Loss-CommlLns-FVOptFAS159 -400,000

CR 125107202 CommercialLoansFVOptionSFAS159 MTM -400,000

As part of Day2 EOD where price changes to 97%

10,000,000 * (97/100) = 9,700,000

PnL = 10,000,000.00 – 9,700,000.00 = 300,000.00

DR 442303301 TradRev/Loss-CommlLns-FVOptFAS159 300,000

CR 125107202 CommercialLoansFVOptionSFAS159 MTM 300,000

After the above entry the MTM loss will be 300000, creating a daily MTM P&L impact of $100,000 profit

As part of Day3 BOD:

DR 442303301 TradRev/Loss-CommlLns-FVOptFAS159 -300,000

CR 125107202 CommercialLoansFVOptionSFAS159 MTM -300,000

As part of Day3 EOD where price changes to 90%

10,000,000 * (90/100) = 9,000,000

PnL = 10,000,000.00 – 9,000,000.00 = 1,000,000.00

DR 442303301 TradRev/Loss-CommlLns-FVOptFAS159 1,000,000

CR 125107202 CommercialLoansFVOptionSFAS159 MTM 1,000,000

After the above entry the MTM loss will be 1,000,000, creating a daily MTM P&L impact of $700,000 loss

Note

During revaluation of commitments of CUSIP, the system assumes 100% holding cost/weighted average cost for ‘Total Position’.