4. Defining Attributes of an SLT Product

This chapter contains the following sections:

4.1 Introduction

In this chapter, you can define attributes specific to a Secondary Loan Trading product.

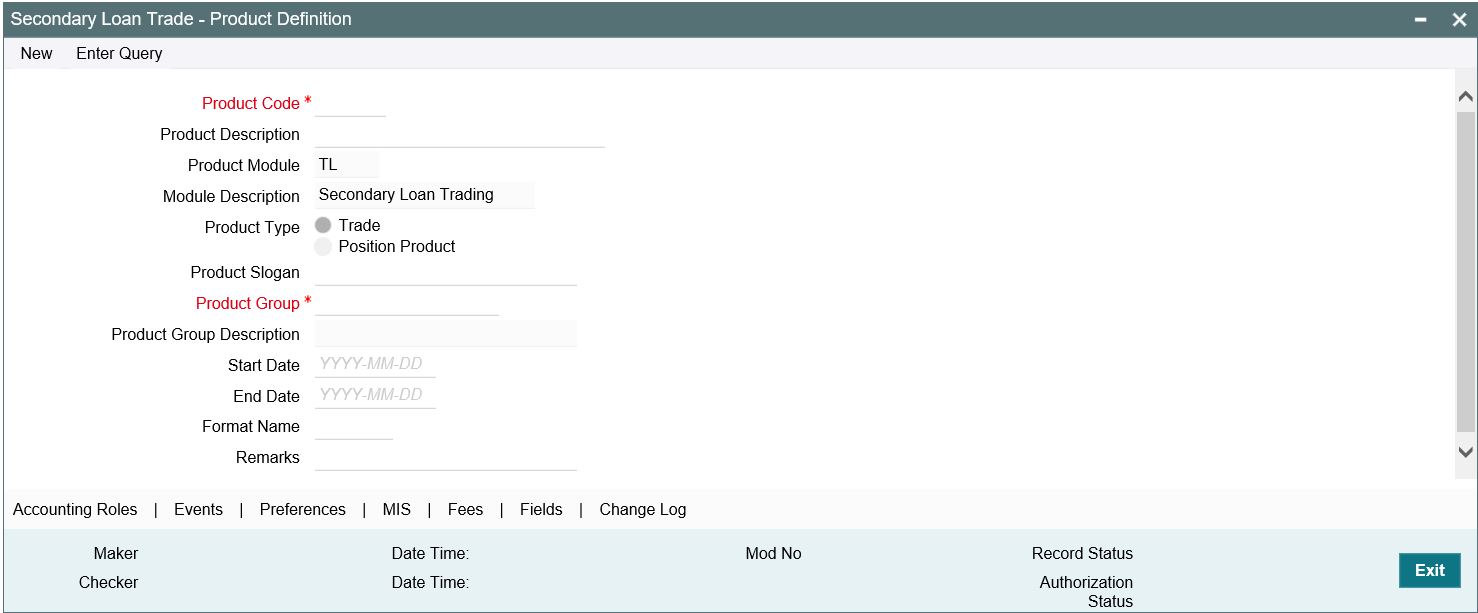

You can create an SLT product and maintain basic information relating to the product such as the product code, description, product type and so on, in the ‘Secondary Loan Trade - Product Definition’ screen.

This section contains the following topics:

You can invoke the ‘Secondary Loan Trade- Product Definition’ screen by typing ‘TLDPRMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

For an SLT product, you can define generic attributes such as branch, currency, customer restrictions, and so on, by clicking on the appropriate icon in the horizontal array of icons in this screen. In addition to these generic attributes, you can define attributes specifically for an SLT product. These attributes are discussed in detail in this chapter.

For further information on these generic product attributes, refer the following Oracle Banking Corporate Lending User Manuals.

- Products

- Charges and Fees

- User Defined Fields

- Settlements

You can specify the following details specific to SLT module, in this screen:

Product Code

Specify a unique identification code for the SLT product.

Product Module

The product module displays a default value ‘LT’ indicating Secondary Loan Trading.

Product Type

Select the type of the SLT product from the drop-down list. The following options are provided:

- Trade

- Position Product

Description

Specify a suitable description for the product.

Product Slogan

Specify a slogan for promoting the product.

Product Group

Select the group to which the product belongs from the option list provided.

Start Date

Specify the date on which the product becomes effective.

End Date

Specify the date on which the product ceases to be effective.

Format Name

Select the format name to be used to generate the customer reference number.

Remarks

Specify additional remarks regarding the SLT product, if any.

4.1.1 Specifying Product Preferences

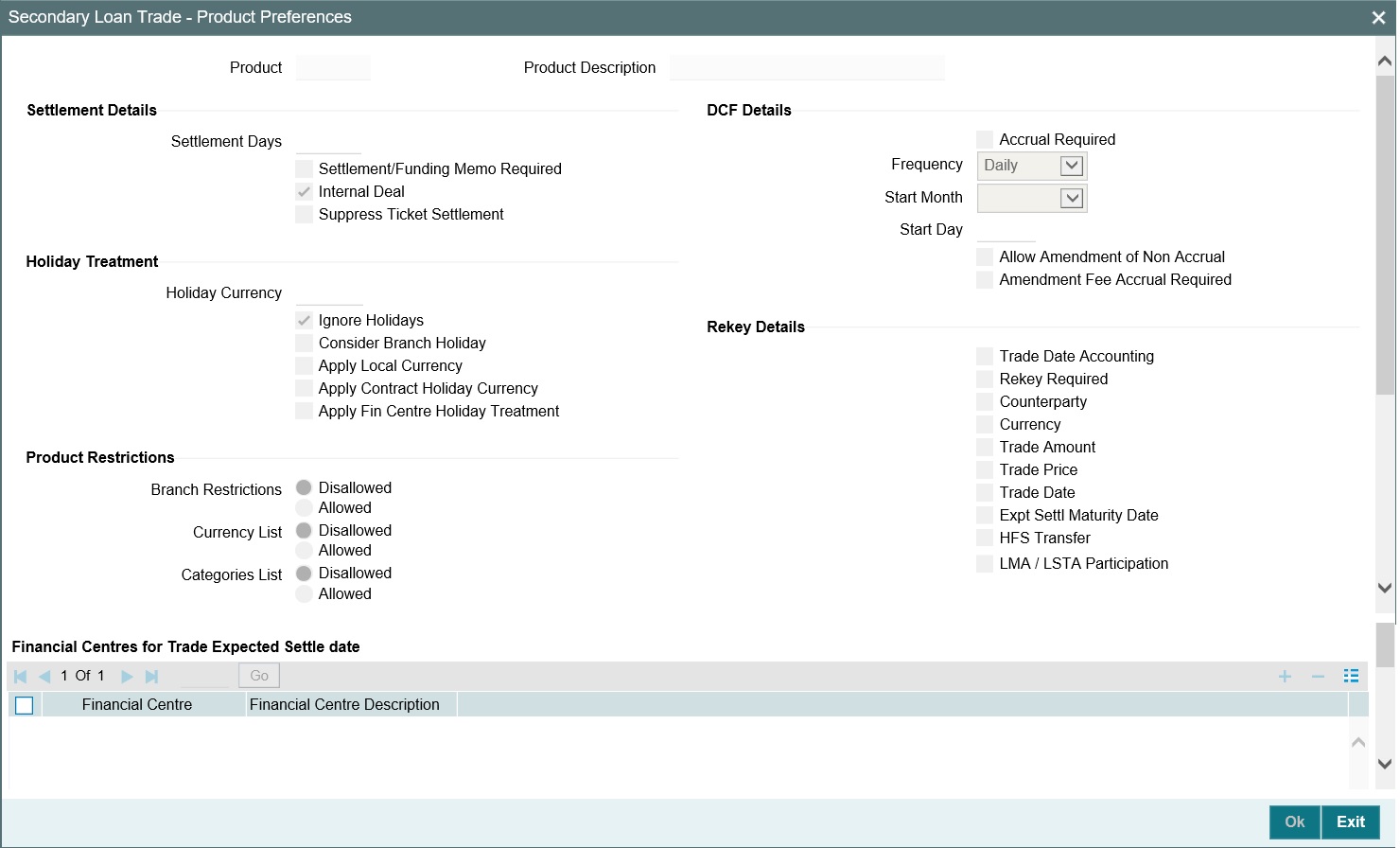

Preferences are the options available for defining the attributes of a product. You can specify the preferences associated with an SLT product in ‘Secondary Loan Trade – Product Preferences’ screen. To invoke this screen, click ‘Preferences’ in the Product Definition screen.

You can specify the following details in this screen:

Settlement Days

Specify the number of days after the trade, within which settlement should happen.

Settlement/Funding Memo Required

Select this check box to indicate that a settlement or a funding memo needs to be sent to the trade counterparty.

Internal Deal

Select this check box to indicate that the trade deal involved is an inter company deal.

Note

You need to deselect ‘Settlement/Funding Memo Required’ for internal deals.

Suppress Ticket Settlement

The ‘Suppress Ticket Settlement’ check box is cleared by default. You can select this check box as part of product amendment.

You are not allowed to select ‘Suppress Ticket Settlement’ check if the ‘Automate Ticket Settlement’ check box is not selected and authorized in the 'Loans Parameters' screen.

Note

The system does not validate if the ‘Automate Ticket Settlement’ check box is not selected in the 'Loans Parameters' screen when the ‘Suppress Ticket Settlement’ is selected and authorized in the 'Secondary Loan Trade- Product Definition’ screen.

The system does not validate if the ‘Suppress Ticket Settlement’ check box is not selected in the 'Secondary Loan Trade- Product Definition’ screen when the new flag ‘Automate Ticket Settlement’ is checked/unchecked in the 'Loans Parameters' screen.

If the ‘Suppress Ticket Settlement’ check box is selected, the trades booked under the product are excluded from systematic settlement even if the ‘Automate Ticket Settlement’ check box is selected in the 'Loans Parameters' screen.

If the ‘Suppress Ticket Settlement’ check box is not selected, the trades are settled systematically if the ‘Automate Ticket Settlement’ check box is selected in the 'Loans Parameters' screen.

If you copy an existing product with the ‘Suppress Ticket Settlement’ check box selected, the check box value is not copied.

Markit Trade Settlement Allowed Check box - Loans Parameters Screen |

Automate Ticket Settlement Check box - Loans Parameters Screen |

Suppress Ticket Settlement Check box - SLT Product Definition Screen |

Processing in Corporate Lending |

Selected |

Selected |

Not Selected |

The system processes the effective Markit SDN message and the settlement systematically. Only effective SDN notices that are received from Markit are processed. Other notices are not processed. |

Not Selected |

Selected |

Not Selected |

Any notice received from Markit is not processed. You should process trade settlement manually. |

Selected |

Not Selected |

Not Selected |

The notices received from Markit is processed. However systematic trade settlement is not processed on receipt of notices from Markit. All the notices such as trade match, syndicated loan trade allocation, trade status update, settlement details and trade closed notice are processed. |

Not Selected |

Not Selected |

Not Selected |

Any notice received from Markit is not processed. You should process trade settlement manually. |

Selected |

Selected |

Selected |

For the trades contracts booked under this product, neither the new automated settlement process on receipt of effective SDN is done nor the old set of Markit notices are processed. You should process trade settlement manually. |

Not Selected |

Selected |

Selected |

Any notice received from Markit will not be processed. User should process trade settlement manually. |

Selected |

Not Selected |

Selected |

The notices received from Markit will be processed. However systematic trade settlement will not be processed on receipt of notices from Markit. All the notices such as trade match, syndicated loan trade allocation, trade status update, settlement details and trade closed notice will be processed by Oracle Banking Corporate Lending. |

Not Selected |

Not Selected |

Selected |

Any notice received from Markit will not be processed. User should process trade settlement manually. |

Specifying Holiday Preferences

You can indicate your preferences for holiday treatment, here.

Holiday Ccy

Select the currency associated with a trade deal, for which you want to specify the holiday preferences.

Ignore Holidays

Select this check box to indicate that the settlement date is fixed without taking the holidays into account.

Consider Branch Holiday

Select this check box to indicate that the settlement date is fixed taking into consideration the holidays specified for the branch.

Apply Local Holiday Currency

Select this check box to indicate that local currency holidays need to taken into consideration while fixing the settlement date.

Apply Contract Holiday Currency

Select this check box to indicate that the contract currency holidays need to taken into consideration while fixing the settlement date.

Apply Fin Centre Holiday Currency

This check box allows you to enable financial centre holiday treatment and add the financial centres for the holiday treatment.

For more information about maintaining financial centre for holiday treatment refer to Products User Manual.

Specifying DCF Details

Delayed compensation fee is associated with trades for which the trade settlement date exceeds the expected settlement date. You can specify the following preferences related to DCF here:

Accrual Required

Select this check box to indicate that you need to accrue the delayed compensation fee component at specific intervals.

Frequency

Select the frequency at which you would like to accrue the delayed compensation fee, from the options provided in the drop-down list. The following options are available:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Start Month

Select the month in which the accrual of the fee component has to begin, from the drop-down list provided.

This is applicable if you specify any accrual frequency other than daily or monthly.

Start Day

Specify the date on which the accrual should be done during the month. For example, if you specify the date as ‘20’, accrual is carried out on that day of the month, depending on the accrual frequency.

Allow Amendment of Non Accrual

Select this check box to indicate that the system allows you to change the preference maintained for the box ‘Stop DCF Accrual’ at Position contract level.

Specifying Rekey Details

Trade Date Accounting

Select this check box to indicate that the trade date accounting functionality is applicable for the following products maintained for CFPI trading:

- SLT trade product

- Internal product

- Position product

If this check box is deselected for any product, then system does not post trade date accounting entries for the contract associated with the product. This results in position break in control accounts.

Note

You cannot amend this check box once the product is authorized.

Rekey Required

Select this check box to indicate that certain important details related an SLT need to be rekeyed, at the time of authorization. You can specify any or all of the following as rekey fields:

- Counterparty

- Currency

- Trade Amount

- Trade Price

- Trade Date

- Expt Settl. Date

HFS Transfer

Select this check box to indicate that trades under this product should be considered as HFS transfer transactions. Note that you can select this check box only if the check box ‘HFS transfer and Sale’ is selected in the ‘Loan Parameters’ screen.

Once the product is authorized, you cannot deselect this check box.

LMA/LSTA Participation

The ‘LMA / LSTA Participation’ (Loan Market Association /Loan Syndications and Trading Association, Inc.) check box is not selected by default. This check box is enabled only for ‘Trade’ products. Even after authorization, you can edit this check box.

However, the change in the value of check box impacts only the new trades booked under the product. Existing trade contracts are not impacted. The value of the check box is copied when you copy an existing trade product with the check box selected.

Product Restrictions

When you create a product, you can provide product restrictions. That is, you can specify the branches of your bank that can offer this product, the currencies that are allowed or disallowed and the customers who can avail the product.

You can set preferences in this screen and the same is defaulted to 'Bilateral Loan and Commitment Restrictions' screen.

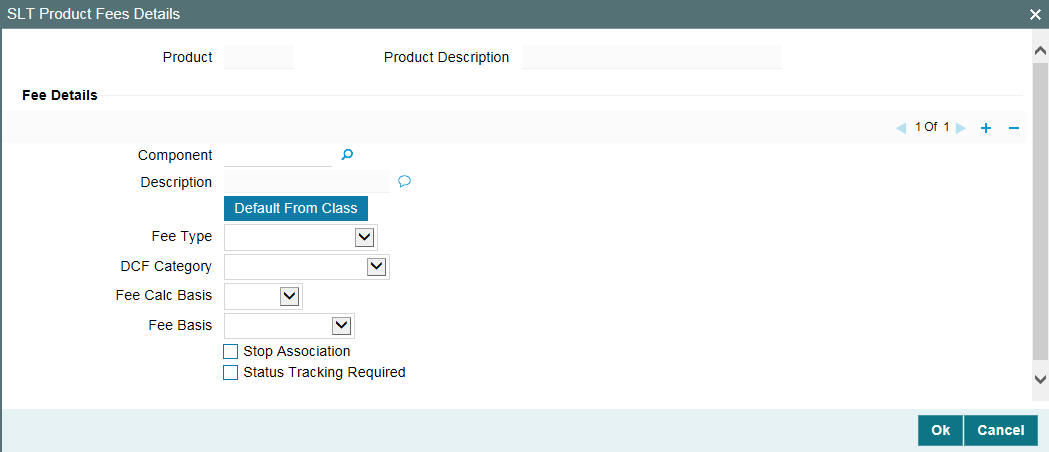

4.1.2 Specifying Fee Details

You can specify the details regarding the fee associated with an SLT in ‘SLT Product Fees Details’ screen. To invoke this screen, click ‘Fees’ in the ‘Secondary Loan -Product Definition’ screen.

You can specify the following details regarding fee, in this screen:

Component

Specify the name of the fee component for which you are maintaining the details.

Description

Specify a suitable description for the fee component.

Fee Type

Select the type of the fee from the drop-down list. The following options are provided:

- Broker Fee

- Break-fund Fee

- Waiver Fee

- Assignment Fee

- Amendment Fee

- Adhoc Buyer Fee

- Adhoc Seller Fee

- Line/Accommodation Fee

- DCF or Delayed Compensation Fee

DCF Category

Select the sub category associated with the delayed compensation fee from the drop-down list. The following options are provided:

- DCF_FIX_INT – all-in-rate interest for fixed type drawdowns

- DCF_FIX_MARGIN – interest using margin for fixed type drawdowns

- DCF_FLT_INT – all-in-rate interest for floating type drawdowns

- DCF_FLT_COF – cost of funds for floating type drawdowns

- DCF_COC - calculates COC for all type of funded amounts together.

- DCFUTILIZ – utilization fee

- DCFFACILITY – facility fee

- DCFSTBYLC – standby LC fee

- DCFCOMMLC – commercial LC fee

- DCFCOMM – commitment fee

DCF category is enabled only if you select the fee type as ‘DCF’.

The formula to calculate COC is given below;

- (Funded Amount * Price - (Unfunded Amount + Commitment Reduction) * (1-Price)) * (Average LIBOR Rate) * (No of Days) / Denominator basis.

The computation is done based on the method ‘Rule of 25’ and will continue until the actual settlement date. The derivation of ‘Rule 25 on T+20 and T+21’ is mentioned below:

[(Fund*Price– (Unfunded + Commitment Reduction)*(1–Price)] as of T+20 (Expected Settlement Date)

Rule-25-factor on T+20 = -----------------------------------------------------------------------------------

[(Fund*Price– (Unfunded + Commitment Reduction.)*(1–Price)] as of Trade Date

[(Fund*Price– (Unfunded + Commitment Reduction.)*(1–Price)] as of T+21

Rule-25-factor on T+21 = -----------------------------------------------------------------------------------

[(Fund*Price– (Unfunded + Commitment Reduction.)*(1–Price)] as of Trade Date

Note

- For distress trades, the Rule-25 factor is computed starting from the Expected settlement date (T+20) till the actual settlement date.

- DCF category is applicable only for distress type of desk.

- If Rule of 25 becomes 'Yes' for the current application date, then it remains 'Yes' for all the subsequent dates, even if the variance changes to less than 25% for the same date due to some Back valued activities entered in the subsequent date.

- If Rule of 25 remain 'No' from the Expected settlement date till the previous application date and if it becomes “Yes” while computing the factor on the current application date due to some back valued activities, then the Rule of 25 is applicable from the current application date only, not from the past dates.

- DCF COC value remains positive during the computation period.

- Till the Rule of 25 is ‘No’, the basis amount for DCF-COC computation is the COC basis amounts as on Expected Settlement Date (T+20). From the date Rule of 25 is ‘Yes’, basis amount for DCF-COC computation is derived on daily basis.

- Once the Rule of 25 becomes ‘Yes’, the daily balances are considered for the COC even if the Rule of 25 factors is ‘No’ on any subsequent date. In other words, once COC catches Rule of 25, it remain with Rule of 25 for the rest of the delayed period.

- If the variance of the Rule-25-factor is greater than or equal to 25% (i.e. Rule-25-factor <= 0.75 OR Rule-25-factor >= 1.25) then Rule-of-25 is applicable for the computation. Otherwise Rule-of-25 is not applicable.

- If Rule-of-25 is applicable then the system computes DCF COC on daily basis from the Expected Settlement Date to the Actual Settlement Date, as per the below formula:

For the trade currency,

- (Fund * Price – ( Unfunded + Commitment Reduction) * (1-Price) ) * Average LIBOR * Days / Denominator basis

For the other funded currencies,

- (Fund * Price) * Average LIBOR * Days / Denominator basis

- If Rule-of-25 is not applicable then system computes DCF COC as the balance available on Expected Settlement Date as per the below formula;

For the trade currency,

- (Fund amount as of Expected Settlement Date * Price – ( Unfunded amount as of Expected Settlement Date + Commitment Reduction amount as of Expected Settlement Date) * (1-Price) ) * Average LIBOR * Days / Denominator basis

For the other funded currencies,

- (Fund amount as of Expected Settlement Date * Price) * Average LIBOR * Days / Denominator basis

- Formula to calculate DCF (Fixed and Floating type of drawdowns) is given below; Funded amount * (Actual Settlement Date - Expected Settlement Date) * All-in Rate/ Denominator basis

Fee Calc Basis

Select the source for deriving the ‘Fee Basis’ for calculating the fee amount, from the drop-down list. The following options are provided:

- Agency - Fee Basis is arrived from LB Module for the respective component

- SLT – Fee Basis needs to be manually specified at the SLT product or contract level

This is enabled if you select the fee type as ‘DCF’ or ‘Break-fund Fee’.

Fee Basis

The Fee Basis indicates the method in which a given fee amount has to be calculated. The values in the drop-down list are:

- 30(Euro)/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

This is enabled if you select the fee type as ‘DCF’ or ‘Break-fund Fee’. If you specify the Fee Calc Basis as ‘Agency’, this will get disabled.

Stop Association

Select this check box to indicate the fee component should not be associated with the product henceforth.

Note

There are no fee components associated with internal deal type of products.

Status Tracking Required

Select this check box to allow the system to start and restart accrual of DCF components.

Note

You can select this check box only for the following type of DCF components:

- DCF FUNDED FLOATING COF

- DCF FUNDED FLOATING INT

- DCF FUNDED FIXED INTEREST

- DCF FUNDED FIXED MARGIN

- DCF UNFUNDED COMMLC

- DCF UNFUNDED COMM

- DCF UNFUNDED FACILITY

- DCF UNFUNDED STANDBYLC

- DCF UNFUNDED UTILIZED

4.2 Control Accounts for SLT Trades

This section contains the following topics:

- Section 4.2.1, "Processing Products with Control Accounts"

- Section 4.2.2, "Processing SLT Batch for Trade Date Accounting"

- Section 4.2.3, "Control Account for Origination Contracts"

Control accounts can be a GL or a customer account, which is used to distinguish the trade date and settlement date balances for a given SLT trade. The following table gives a brief description of the various control accounts:

Control Account |

Description |

Control Account#1 |

Account to track the latest trade portion of funded amount |

Control Account#2 |

Account to track the trade portion of funded amount as of settlement date |

Control Account#3 |

Account to track the Premium/Discount and PNL amount as of trade date |

Control Account#4 |

Account to track the Premium/Discount and PNL amount as of settlement date |

In SLT module, accounting entries are defined for the following products with control accounts:

- SLT trade product

- Internal product

- Position product

4.2.1 Processing Products with Control Accounts

System does a zero-based computation to arrive at the trade portion of funded and unfunded amount. System also computes the premium discount and PNL amount. Based on the accounting setup, system appropriately posts the accounting entries to the control accounts for SLT trades and origination contracts. For zero-based computation, system considers the latest trade amount from SLT as well as the funded and unfunded amount as on the application date for the CUSIP from agency.

Funded and unfunded percentage is calculated as follows:

- Funded percentage = (Tranche outstanding amount/Sum of tranche outstanding and tranche available amount)*100

- Unfunded percentage = (Tranche available amount/Sum of tranche outstanding and tranche available amount)*100

Note

- Tranche outstanding amount is the total of the underlying non-LC drawdown’s outstanding

- Tranche available amount is the total of Tranche availability and underlying LC drawdown’s outstanding.

- During commitment reduction or trade amendment, system considers the balances already posted to the inventory accounts and any difference is additionally posted as trade date accounting.

- If the CUSIP does not exist in agency (LB) module, then system considers the tranche to be fully funded.

System posts the accounting entries in SLT module as follows:

- During SLT trade booking system considers the latest funded and unfunded percentage from agency as on the Application date and computes the trade portion of funded, unfunded, premium/discount and PNL amount, and then passes the trade date accounting entries

- During SLT trade amendment for open trades including commitment reduction, system looks at the balances already posted to the inventory accounts and any difference is additionally posted. Funded and unfunded balance in agency as of application date and the latest trade amount from SLT are used for zero based computation.

- For commitment reduction on settled trades, system posts the delta entries for the differential funded amount at the internal trade level. There is no change in the functionalities of internal trades which are booked during commitment reduction on settled trades, other than posting the additional funded amount for CFPI trade date accounting entry.

- During trade settlement, unsettled position becomes settled and the trade portion of funded amount and PNL/premium discount balance is moved to the control accounts.

- During trade settlement, offsetting entries are booked in control accounts instead of reversing the posted accounting entries in trade booking.

- Any agency activity for tranches and drawdowns resulting in change of the available or outstanding amount of the tranche will change the funded and unfunded percentage of the trade amount for SLT trades. System tracks these changes for SLT trades as part of end of day batch process.

- Since accounting entries cannot be posted for the settled trades, system posts the delta accounting entries for the funded portion at the position contract level during the batch process.

- For any trade amendment post settlement, the settlement has to be reversed first and then the amendment has to be applied and resettled operationally.

- Reversal of settlement reverses the settlement entries and the position is moved from settled to unsettled. Any subsequent amendments to these trades go through zero-based calculation and post additional entries.

- Reversal of trade reverses all the trade dated and settlement dated accounting entries

- Memo account is used only for partially funded or completely unfunded scenarios.

- To recall, you can make changes to the accounts (GLs) mapped at the product level accounting entry setup. However, there will not be any change in the accounting entries already posted for the contracts associated with the product for such product level account (GL) amendments and reconciliation of balances for such accounts should be handled operationally.

4.2.2 Processing SLT Batch for Trade Date Accounting

The SLT Batch for trade date accounting is used to track the funded or unfunded balance change for the associated CUSIP in the agency module. System computes the funded and unfunded percentage based on funded and unfunded balance from agency as of application date and applies the percentage on the latest trade amount in SLT to arrive at the trade portion of the funded and unfunded amount.

The computed trade portion of funded and unfunded balances is compared with the funded and unfunded balances already posted for the SLT trades. If there is any difference, then system posts the additional entries for the funded and unfunded amount as follows:

- The event ‘TDCH’ (Trade Date Balance Change) posts additional funded and unfunded amounts

- If the trade is open, then the TDCH event is registered for the trade to pass accounting entries for the differential funded and unfunded amount

- If the trade is settled, then the TDCH event is registered for the position contract to pass accounting entries only for the differential funded amount

4.2.3 Control Account for Origination Contracts

Trade settlement flowing to origination module through STP processing impacts the control accounts instead of the inventory accounts for the loan contracts

You should manually maintain the appropriate control account (Control Account#2) at the origination loan product level so that the accounting entries are posted at control account 2 during trade settlement which flows to origination module through STP.

All the independent loan activities manually performed by a user such as new loan booking, value dated amendment for loan principal increase/decrease, loan payment and all the corresponding reversal events will post the accounting entries at control account 2, based on the product accounting setup.

Note

- CFPI trade date accounting entries are not applicable for CLP trades.

- CFPI positions are tracked in a separate Oracle Banking Corporate Lending branch and new set of products are used in agency, origination and SLT modules for CFPI trading in Oracle Banking Corporate Lending.

- Appropriate accounting entry set up should be done at the SLT and OL loan products to pass accounting entries for unfunded portion of the trade amount. This should be operationally controlled.

- Control accounts may not get reconciled if there are STP failures between TL to LB or LB to OL. This should be operationally controlled.

- Control account is applicable for funded amount and memo GL is applicable for unfunded amount.

- Since the accounting entries are defined at the product level for the trade settlement with identified accounting roles/accounting entry, if there is any change to the mapped GL then balance re-class has to be handled manually.