5. Processing an SLT Contract

This chapter contains the following sections:

- Section 5.1, "Introduction"

- Section 5.2, "Viewing Exceptions Summary"

- Section 5.3, "Viewing Draft Trade Summary"

- Section 5.4, "Processing Internal Trades for HFI to HFS Transfer"

- Section 5.5, "Viewing Processed Trades"

- Section 5.6, "Querying Trade Contract"

- Section 5.7, "Capturing Agency Details"

- Section 5.8, "Capturing Origination Trade Details"

- Section 5.9, "Trading with PIK Facility"

- Section 5.10, "Querying Position Balances"

- Section 5.11, "Calculating Realized Profit and Loss"

- Section 5.12, "Re-valuating Positions"

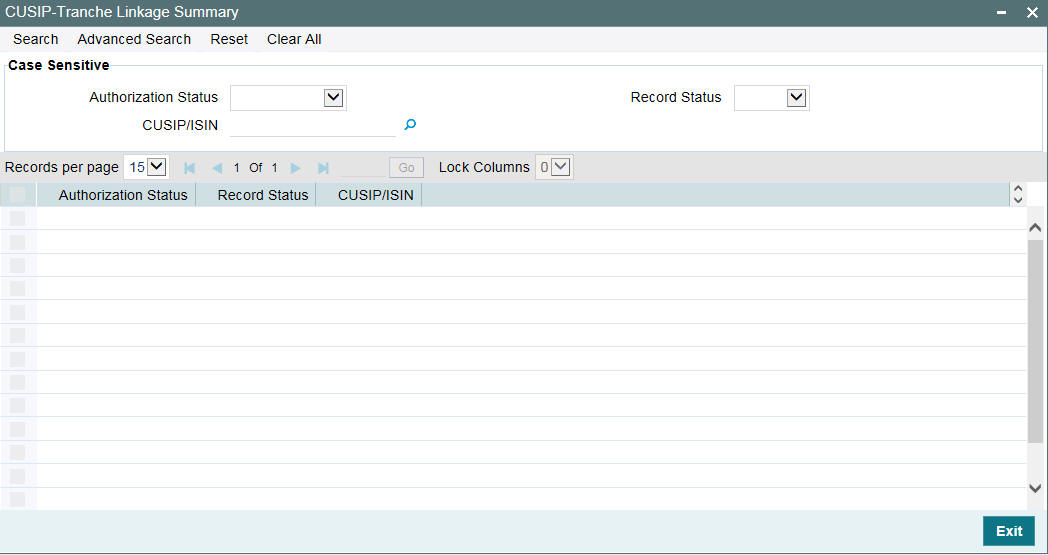

- Section 5.13, "Maintaining CUSIP-Tranche Linkage"

- Section 5.14, "Viewing CUSIP-Tranche Linkage Summary"

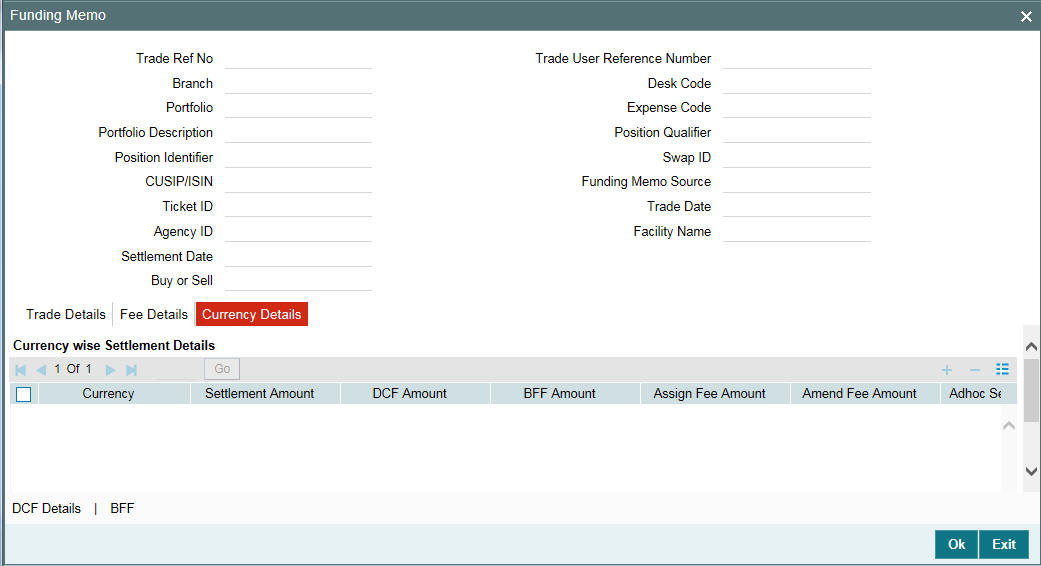

- Section 5.15, ".Capturing Funding Memo Details"

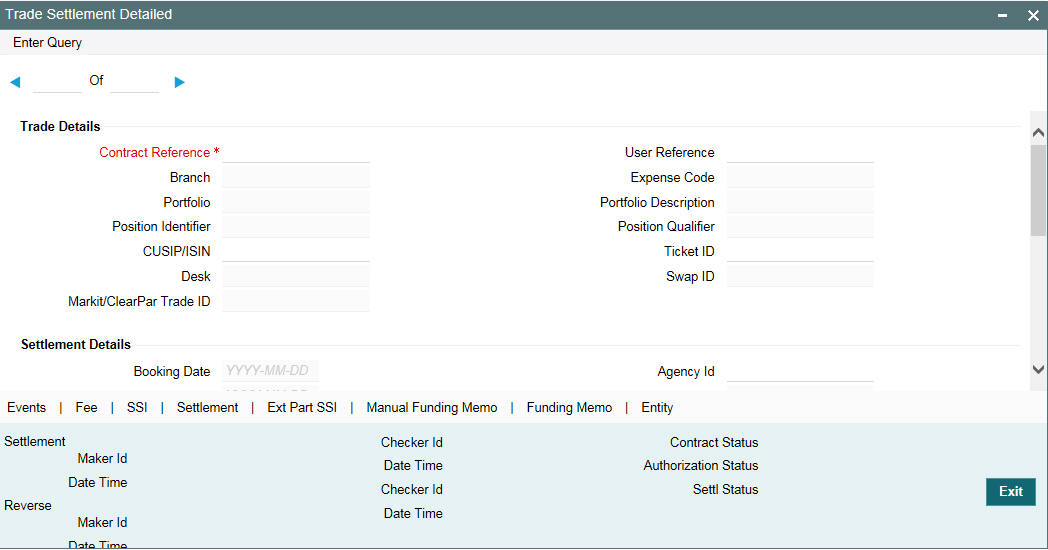

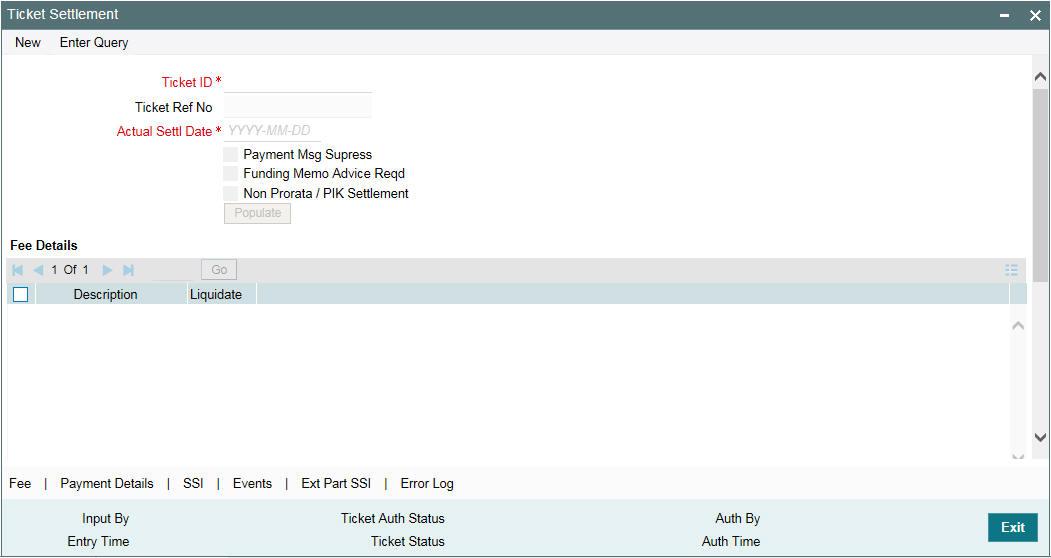

- Section 5.16, "Settling Trades Individually"

- Section 5.17, "Settling Trades at Ticket Level"

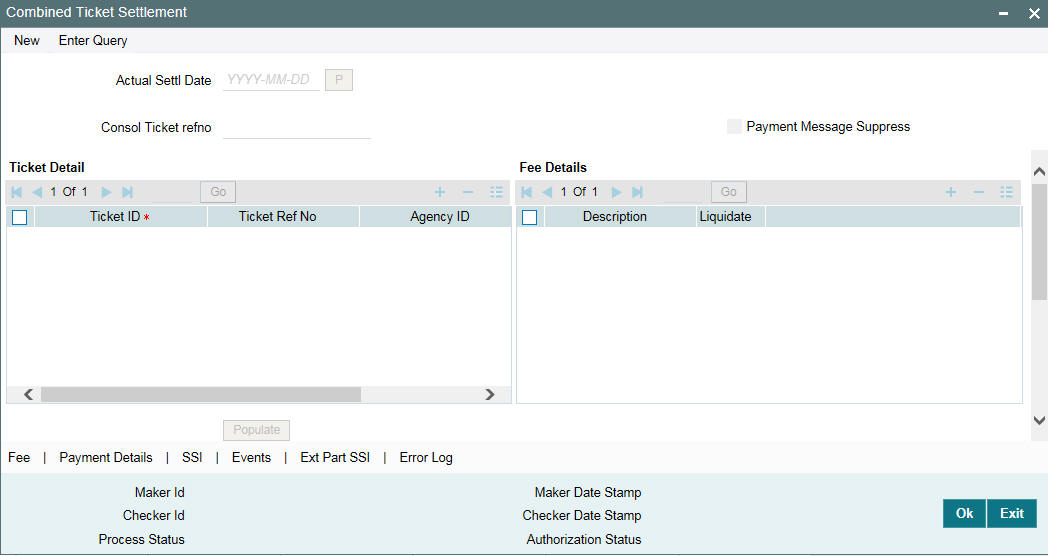

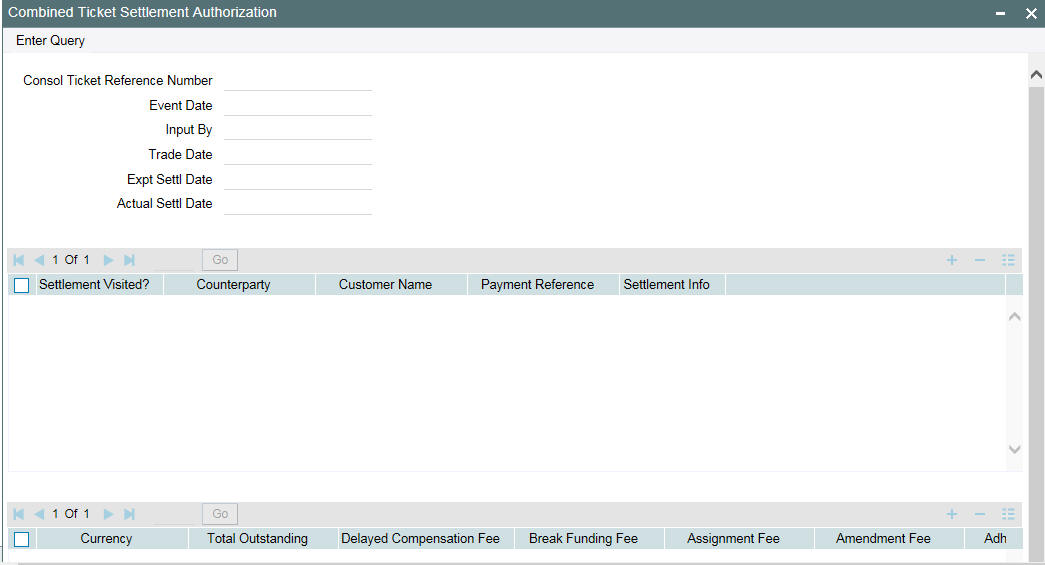

- Section 5.18, "Settling Combined Tickets"

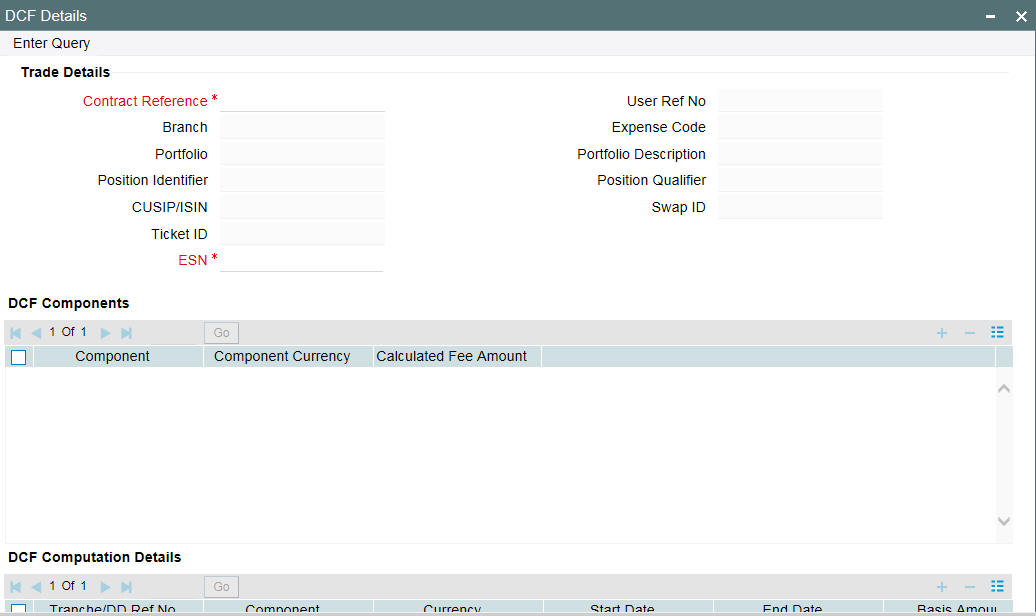

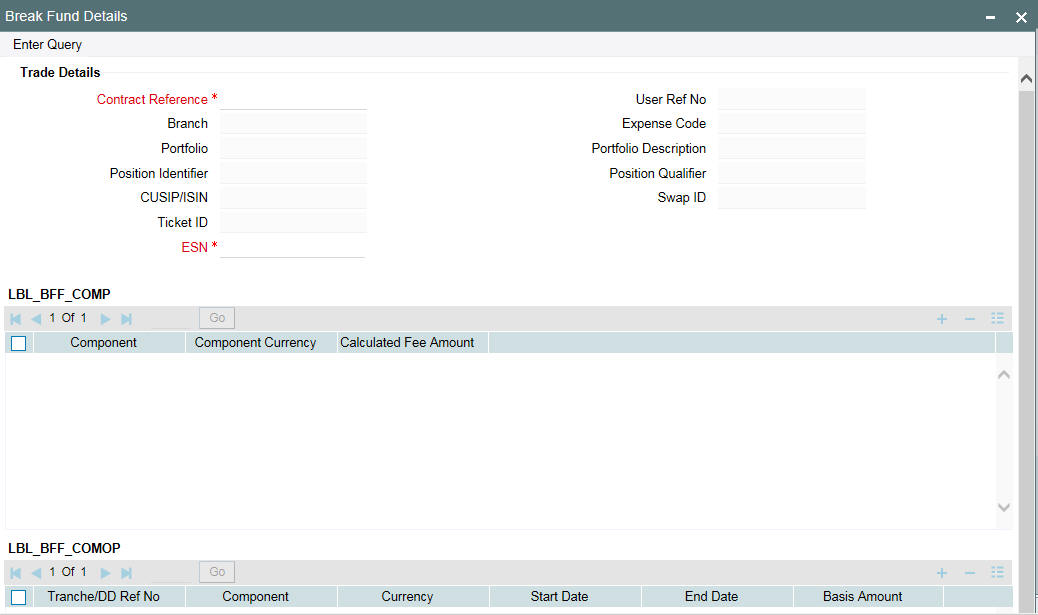

- Section 5.20, "Settling DCF on First-time"

- Section 5.21, "Reversing Trade Settlement"

- Section 5.22, "Reversing Trade"

- Section 5.23, "Calculating Reserve "

- Section 5.24, "Reclassification"

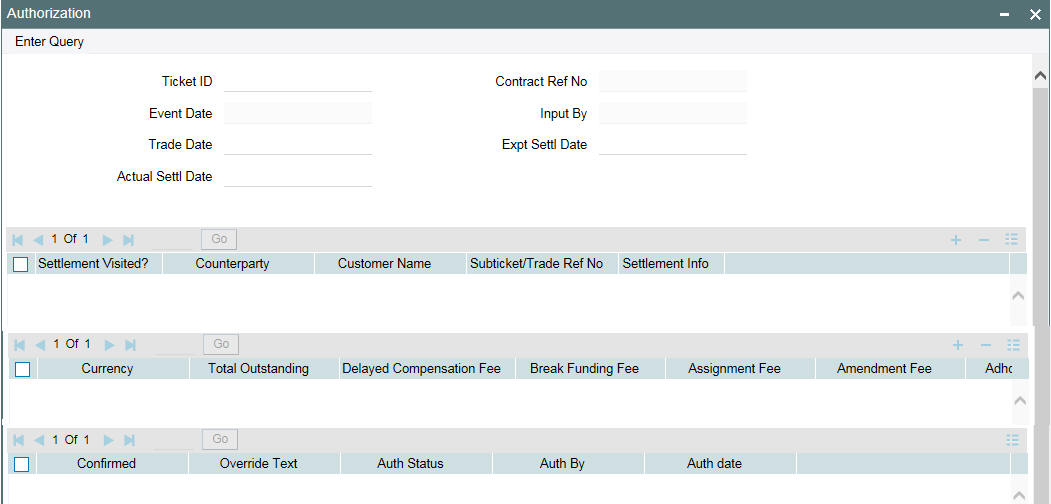

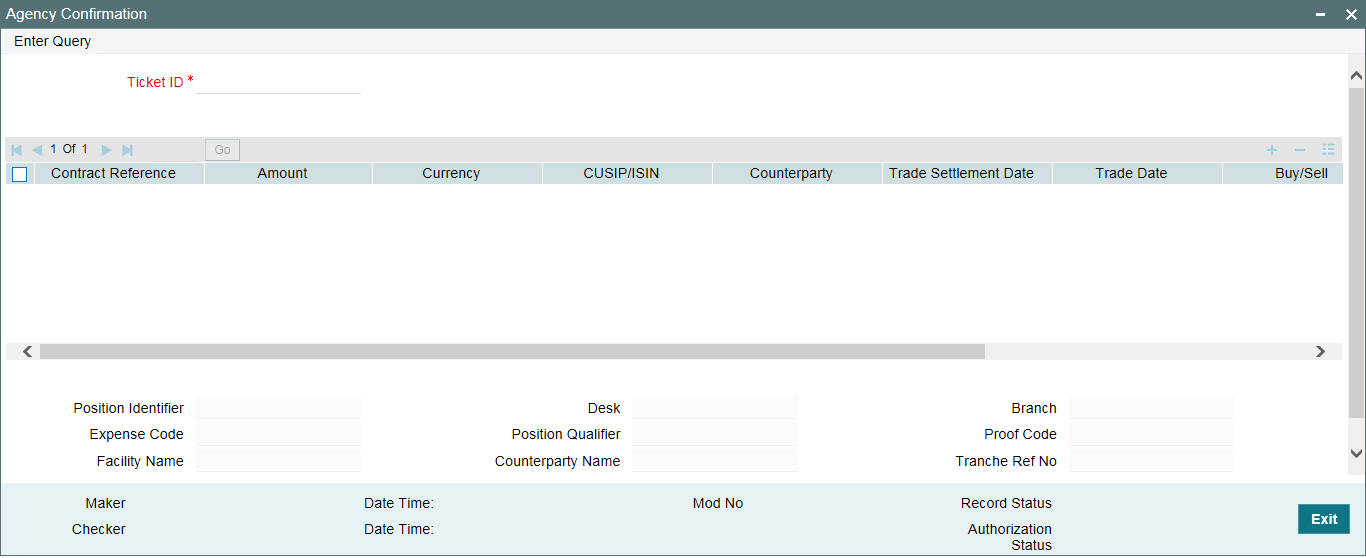

- Section 5.25, "Agency Confirmation"

- Section 5.26, "Amending an SLT Contract "

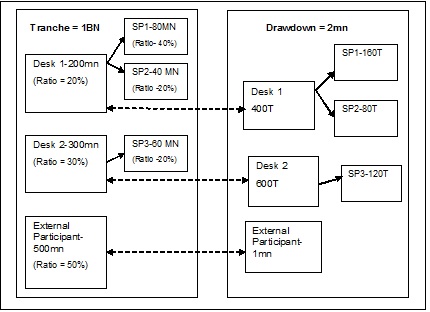

- Section 5.27, "Processing Silent Participation"

- Section 5.28, "Processing Swap Deals"

- Section 5.29, "Forward Processing of Events "

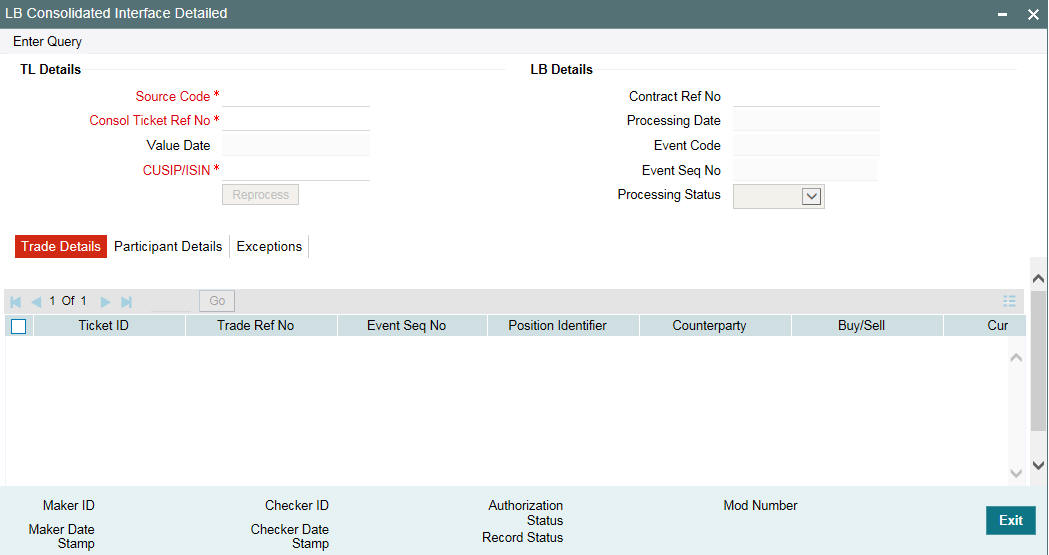

- Section 5.30, "SLT Processing for LMA / LSTA Participation"

- Section 5.31, "SLT Processing for Primary Delayed Compensation"

5.1 Introduction

A contract is a specific agreement or transaction entered into between two or more entities. In SLT module, the trade details for initiating a contract can originate from any of the following sources:

- Trade details can be manually entered in SLT module

- Trade details can be uploaded from the external system, Loans QT

- Trade deal can originate from the LB module

Except for trades originating from LB, you can use the ‘Secondary Loan Trading - Draft Trade’ screen to enter the details of the contract.

This section contains the following topics:

- Section 5.1.1, "Specifying Trade Details"

- Section 5.1.2, "Specifying Markit/ClearPar Details"

- Section 5.1.3, "Specifying Contract Details"

- Section 5.1.4, "Specifying Booking Details"

- Section 5.1.5, "Specifying Other Details"

- Section 5.1.6, "Specifying Holiday Preferences"

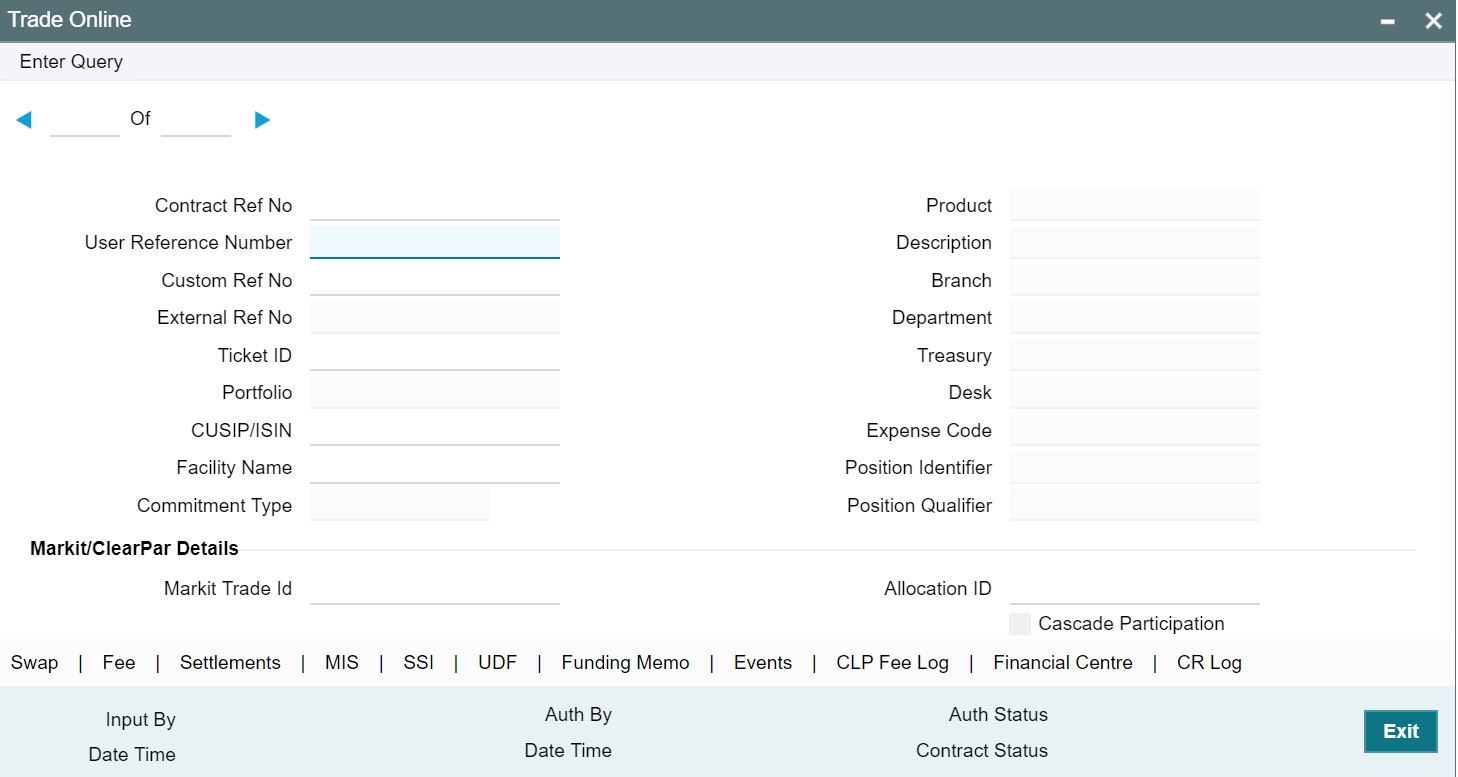

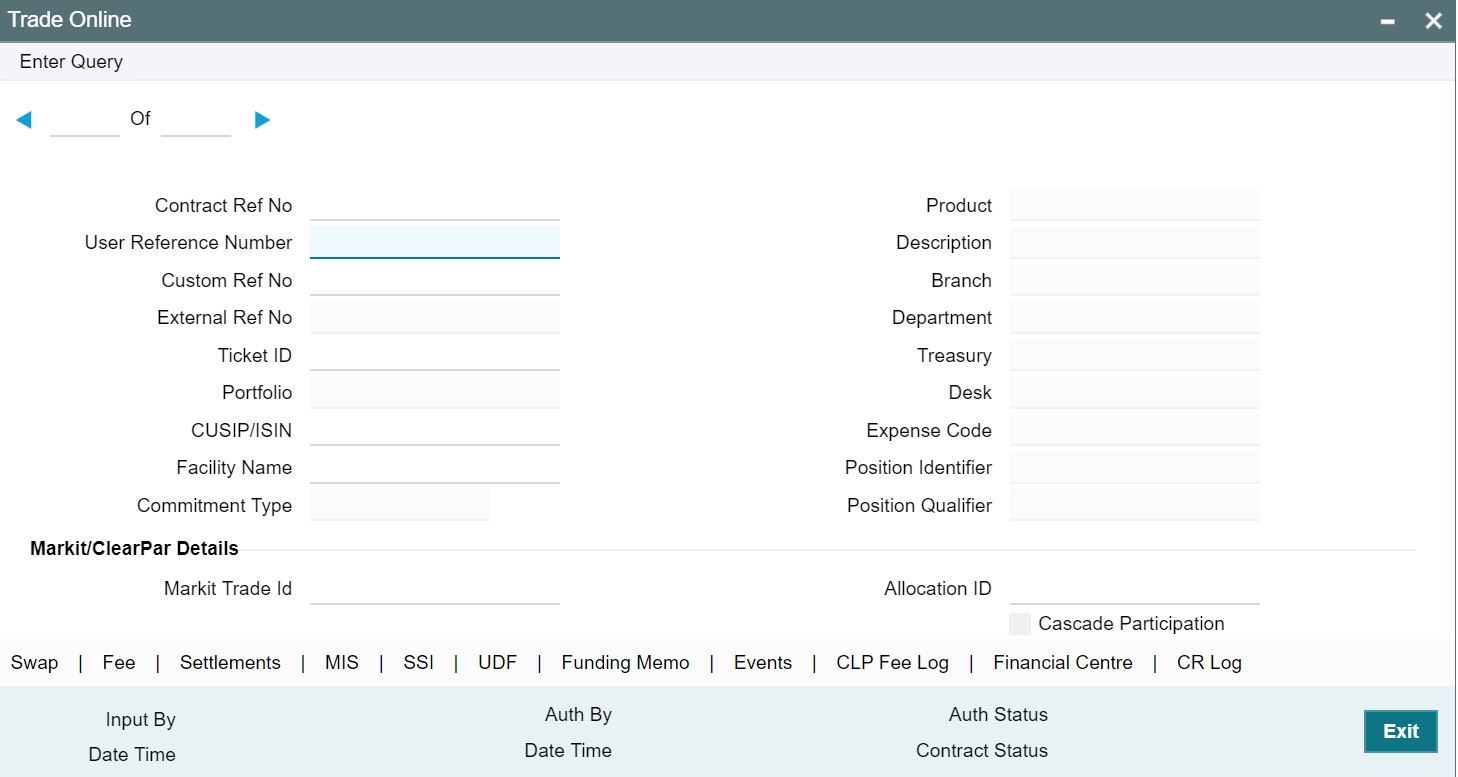

You can invoke the ‘Trade- Online’ screen by typing ‘TLDTDONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

When you click the ‘New’ from the menu, the ‘Trade Type’ screen is displayed where you can specify the type of the trade you want to perform.

You can specify the following details in this screen:

Trade Type

Select the type of your trade from the drop-down list provided. From the menu, select ‘New’ to specify the details for a new trade deal.or select ‘Modify’ if you want to modify the details of an existing deal

Contract Ref. No.

Select the reference number of the contract whose details you want to modify, from the option list provided. This is applicable only for ‘’Modiy’ type of trades.

Product

Select the product code of the trade product you want to use for the trade deal, from the option list. All trade products maintained in the ‘Secondary Loan Trade - Product Definition’ screen are displayed in the list.

Product is enabled only for ‘New’ trades.

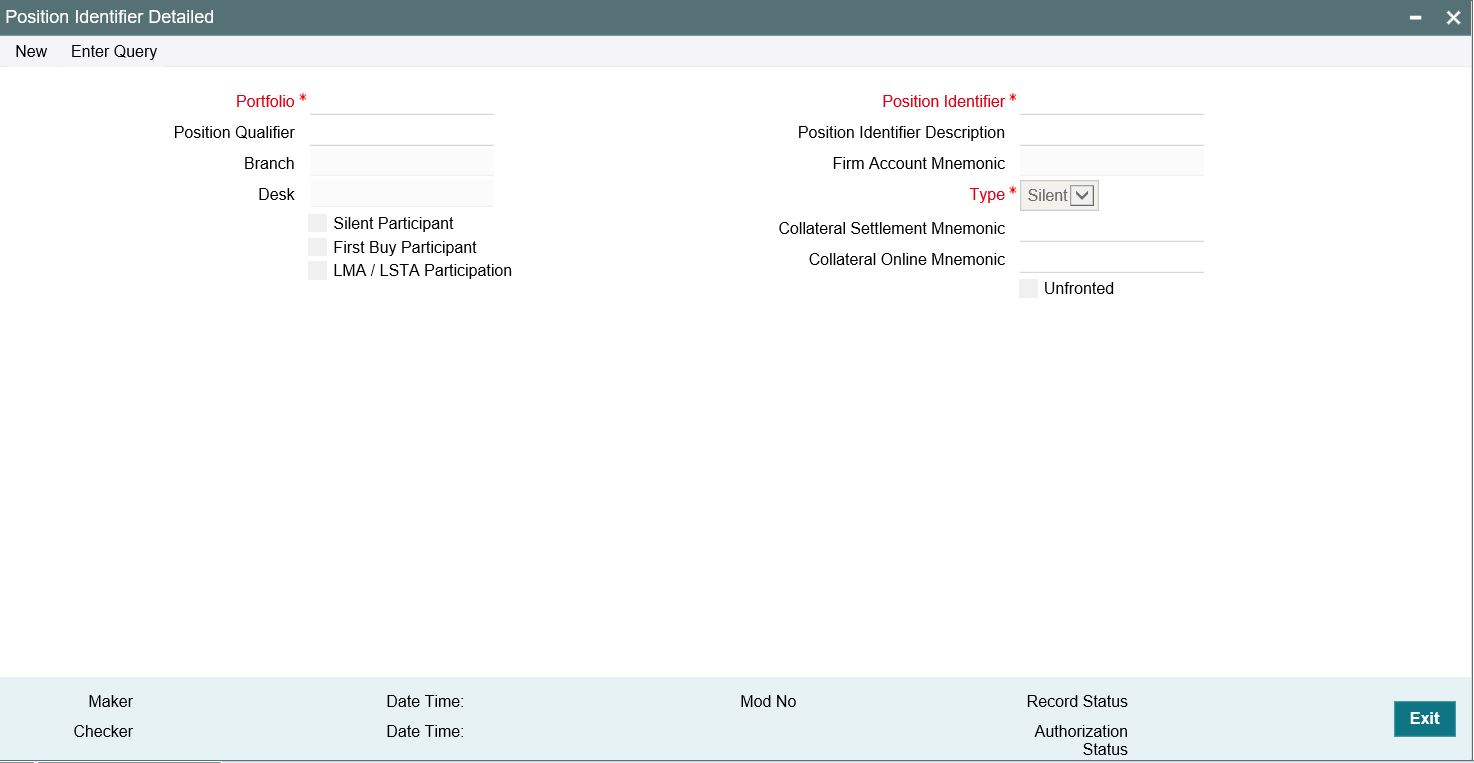

Position Identifier

Select the position identifier or the branch-desk-expense code combination, to be used to track the position details of a portfolio. Position identifiers corresponding to all the portfolios defined for the current branch are displayed in the option list.

Position identifier is enabled only for ‘New’ trades.

5.1.1 Specifying Trade Details

The following details are defaulted for a new trade:

- External Contract Ref No which indicates the reference number in the external system Loans QT

- Upload reference number and User reference number

- Product code, department and treasury details

- Branch, desk, expense code and portfolio details

- Position identifier and position qualifier

- Booking date of the trade

The trade reference number gets generated on successful processing of the trade contract.

You can specify the following details related to the trade, in this screen:

CUSIP/ISIN

Specify the unique reference number indicating the facility to be associated with the deal. You can specify either a new CUSIP number or an existing CUSIP whose details have already been captured in the LB module.

Facility Name

Specify a name for the facility, if you are entering a new CUSIP. For existing CUSIP, the related facility name gets defaulted here.

Ticket Id

Specify a ticket Id to be associated with the trade. Many trades can be grouped together under one ticket.

All trades under the same ticket must have same trade date, expected settlement date and counterparty. In case of line trades, the counterparty can be different.

Note

Ticket Id can be ‘NULL’ if the trade originated as part of agency creation.

Cascade Participation

This option is selected by default. You can deselect this check box if the trade is Non Pro-rata CUSIP and the agency details are not available in the system. This is applicable only for ‘Par’ and ‘Distress’ types of trade.

For the trades in the Non Pro-rata, the DCF computation is considered as follows:

- DCF-FIX-MARGIN - Applicable only for ‘Par’ trades

- DCF-FIX-INT and DCF-FIX-COC – applicable for ‘Distress’ trades

5.1.2 Specifying Markit/ClearPar Details

Trade ID

Specify the trade id to uniquely identify the associated SLT trade in Oracle Banking Corporate Lending for each of the trade sent from Markit.

Note

If LQT trade that is received for trade booking (TBOK) is in ‘Failed’ /‘ Enrich’ / ‘Extracted’ status then you are not allowed to input (if ClearPar trade ID is blank) or override (if ClearPar trade ID is not blank) the ClearPar trade ID value in 'Draft Trade' screen while processing such trades.

You are allowed to input the ClearPar trade ID in 'Draft Trade' screen when trade is manually booked (TBOK) in Oracle Banking Corporate Lending.

The maximum length for ClearPar trade ID is 25.

Trade booking or amendment fails in LQT trade browser if LQT sends ClearPar trade ID with special characters. You have to reject and resend the trade from LQT with corrected ClearPar trade ID.

You cannot save trade in draft trade screen (manual TBOK) with special characters in Markit /ClearPar trade ID.

Note: Blank space is allowed in ClearPar trade ID. If more than one ClearPar trade ID is associated with a trade then those can be separated by a blank space.

You cannot amend ClearPar trade ID during trade amendment (TAMD) processing. However, Oracle Banking Corporate Lending updates the trade systematically with the new ClearPar trade ID during trade amendment when LQT sends the revised value.

If a trade amendment leads to reversal and rebook, then the new trade is updated with the ClearPar trade ID from the old (reversed) trade

Allocation ID

Specify the allocation id for the matching processing and manual linkage of SLT and Markit trades.

5.1.3 Specifying Contract Details

Counterparty

Select the unique identification of the counterparty involved in the trade deal from the option list. The list of all valid customers is displayed from which you can select the counterparty.

Note

The buyer or seller should be an existing customer of your bank.

Currency

Select the currency to be associated with the tranche from the option list provided.

Trade Amount

Specify the tranche amount that you want to buy or sell. The amount you specify here should not exceed the total amount for the tranche.

Trade Price

Specify the price at which the trade transaction is being carried out.

Original Trade Amount

The trade amount specified at the time of booking the contract gets displayed. Original trade amount is not impacted by any further amendments to the trade amount. This is used for calculating the broker fee involved in the trade.

Type

Select the contract type from the options available. The type of contract is not considered while processing the trade.

Quotation

Select the type of quotation to be associated with the trade, from the drop-down list. The following options are available:

- Flat – delayed compensation fee will not be computed for deals booked under this quotation method, even if there is delay in settlement

- SWOA - Delayed compensation fees will be computed from the expected settlement date(T+7 or T+21)

PIK Amount

Specify the PIK portion associated with the funded amount for the trade.

Buy/Sell Indicator

Select ‘Buy’ option to indicate that the related trade is a buy transaction or select ‘Sell’ to indicate that it is a sell transaction.

Trade Type

Select the type of the trade from the drop-down list. The options available are as follows:

- Customer Trade

- Line Accommodation

Deal Type

Select the type of the trade deal from the drop-down list. The following options are available:

- Assignment – where bank is directly involved in the trade

- Participation – where bank is silently participating in the trade

Commitment Reduction Amount

Specify the amount indicating a reduction in the commitment amount for the tranche.

Commitment Reduction Price

Specify the commitment reduction discount/ premium price for trade booking and trade amendment. You cannot amend ‘Commitment Reduction Price’ alone as part of commitment reduction amendment.

Note

‘Commitment Reduction Price’ in the ‘Draft Input’ screen cannot be amended as part of any normal amendment.

Collateral %

Specify the collateral percentage.

Transfer Price

The system displays the price entered while processing the associated HFS transfer as part of PRAM in the LB module. This value is displayed only for trades processed as part of HFI to HFS transfer.

HFS Transferred Cost Basis

The system displays the lowest of LOCOM Carry Value and Transfer price, and displays it here for internal sell trades processed as part of HFI to HFS transfer.

5.1.4 Specifying Booking Details

You can specify the following details related to the booking of a trade deal

Booking Date

Booking date is the date on which the trade transaction is initiated. The system date gets defaulted here.

Trade Date

Specify the date on which the actual trade happens.

Note

Trade date cannot be greater than the expected settlement date.

Expt. Settl. Date

Expected settlement date is defaulted based on the trade date and the settlement days, maintained in the ‘Product Preferences’ screen. You can modify this, if required.

Maturity Date

Specify the contract maturity date or select the maturity date from the calendar available. Maturity date is not considered while processing the trade.

5.1.5 Specifying Other Details

You can specify following other details related to the trade deal:

Agency Id

Select the Id of the lead agent of the transaction, to whom the assignment fee needs to be sent.

Broker

Select the Id of the broker involved in the deal, if any, to whom the broker fee needs to be sent.

Assignment Fee Remitter

Select the party that remits the assignment fee to the lead agent. The options available are as follows:

- Buyer

- Seller

Ext CUSIP/ISIN

Specify the external CUSIP number to be associated with the trade deal.

Borrower

Specify/select the borrower from the options available. Borrower is not considered while processing the trade.

Commitment Reduction/Increase Amendment

Select this check box to indicate that the amendment is due to commitment reduction/increase..

PIK Amendment

Select this check box to indicate that the amendment is due to PIK component associated with the trade amount.

Parent Line Trade

Select this check box to indicate that the associated customer trade is created as a result of a line trade.

Note

This is applicable only for trades of type ‘Customer Trade’.

Apply Cmt Redn/PIK for CUSIP Amendment

Select this check box to indicate that reduction in commitment amount is applicable for the tranche during CUSIP amendment. The reduction is applicable only if the trade has commitment reduction/PIK amount.

Primary Trade

If the ‘Primary Trade’ is selected, the system identifies the trade as a primary trade.

The value of the ‘Primary Trade’ check box is defaulted from the 'Draft Trade Input' screen. For the trades booked from LQT, the value of the ‘Primary Trade’ is defaulted from the value of the field ‘Primary Trade’ from LQT.

Document Type

The DCF (Delayed Compensation Fees) categories for a trade are derived based on the document type specified.

Select the document type from the adjoining drop down list. The list displays the following values:

- Par

- Distress

Note

- This option cannot be modified as part of trade amendment if the system date is greater than or equal to the expected settlement date.

- Once the draft trade is processed, the document type field can be viewed in trade online screen also.

If the document type is 'Par' then the following funded DCF categories are applicable;

- DCF-FIX-MARGIN

- DCF-FLT-INT

- DCF-FLT-COF

If the document type is 'Distress' then the following funded DCF categories are applicable;

- DCF-FLT-INT

- DCF-FIX-INT

- DCF-COC

Trade Standard

The following are the list of values in the ‘Trade Standard’ drop-down list.

- LMA

- LSTA

- Non-Standard

This field is only a display-only field and the value is defaulted while processing the feed from LQT.

Firm Account Mnemonic

The system displays the corresponding firm account mnemonic based on the position identifier/portfolio.

5.1.6 Specifying Holiday Preferences

The holiday treatment preferences specified for the product gets defaulted here. You can modify there details, if required.

Ignore Holidays

Select this check box to indicate that the settlement date is fixed without taking the holidays into account.

Consider Branch Holiday

Select this check box to indicate that the settlement date is fixed taking into consideration the holidays specified for the branch.

Holiday Ccy

Select the currency associated with a trade deal, for which you want to specify the holiday preferences.

Apply Local Ccy

Select this check box to indicate that local currency holidays need to taken into consideration while fixing the settlement date.

Apply Contract Ccy

Select this check box to indicate that the contract currency holidays need to taken into consideration while fixing the settlement date.

Apply Fin Centre Holiday Currency

This check box allows you to enable financial centre holiday treatment and add the financial centres for the holiday treatment.

For more information about maintaining financial centre for holiday treatment refer to Products User Manual.

Remarks

Specify remarks, if any, to be associated with the trade contract.

After entering the basic trade details, you can validate the same

by clicking ‘Verify’ button.

On successful validation, you can select the ‘Submit’ option to send the trade details for further processing, after authorization. All trades specified in this screen remains in the draft stage until they are selected for submission. Before submitting the details for further processing, you can modify the details any number of times by unlocking the record and amending the details. You can also delete the details, if required, before it is submitted for further processing.

After successful validation of the trade details, if you select the ‘Reject’ option, the details specified can be rejected, in case of any discrepancies.

You can also perform an amendment of the trade details in this screen, before trade settlement.

Note

Trades uploaded from Loan QT are treated as confirmed trades by default. You cannot modify the expected settlement date, in this case.

A unique reference number called the Trade Reference Number gets generated for every processed trade and the position details of the trade are also updated. The trade details are processed further in the SLT module.

You can view the details of a processed trade in the ‘Trade Online’ screen.

For more details on Trade Online screen, refer the section ‘Viewing Processed Trades’ in this user manual.

Note

The details of trades uploaded from Loans QT are processed automatically with the default selection of ‘Validation’ and ‘Submit’ options.

5.1.7 Financial Centre Holiday Treatment

Click ‘Financial Centre’ tab in ‘Trade Online’ screen to open ‘Financial Centres for Trade Expected Settle date’ screen.

Financial center maintained at product level is defaulted in ‘Draft Trade’ (TLDTDUPL) screen. If required, you can add or remove the financial center.

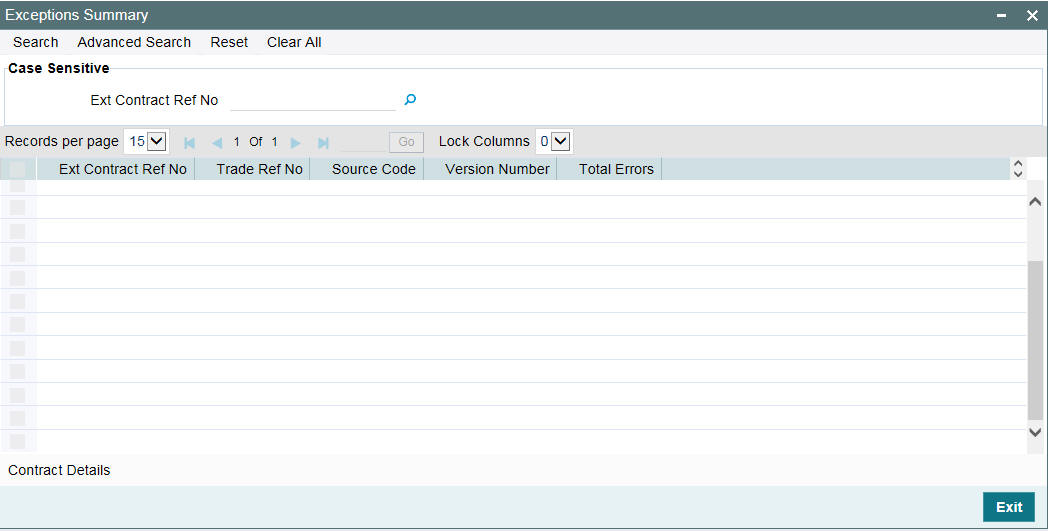

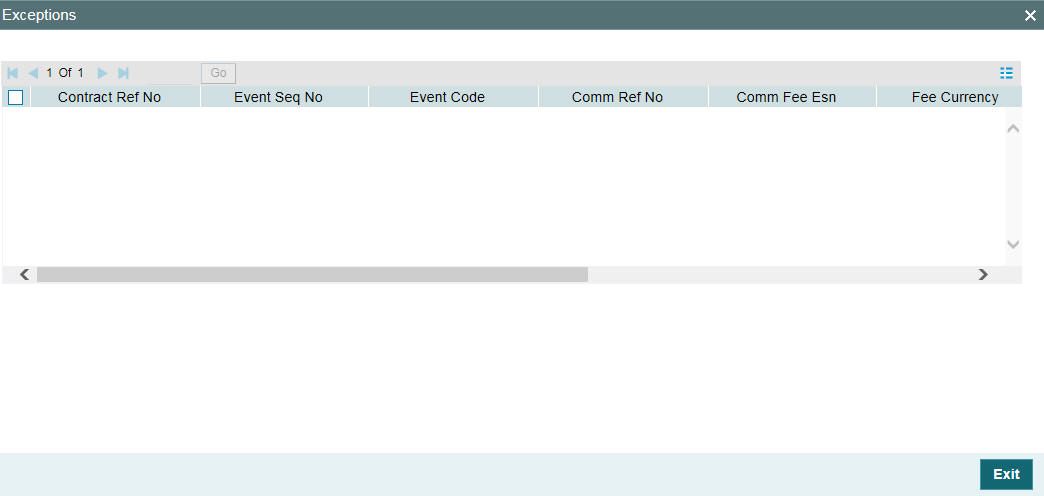

5.2 Viewing Exceptions Summary

The exceptions arising out of validation or processing of draft trade details can be viewed in this screen. You can proceed further by unlocking the draft trade record and correcting the exceptions.

You can also view a summary of exceptions for all the failed contracts in the ‘Exceptions Summary’ screen. You can invoke the ‘Exceptions Summary’ screen by typing ‘TLSERONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To view the exceptions related to a particular contract, click the ‘Contract Details’ of the contract. Alternatively, you can double-click to view the exceptions .

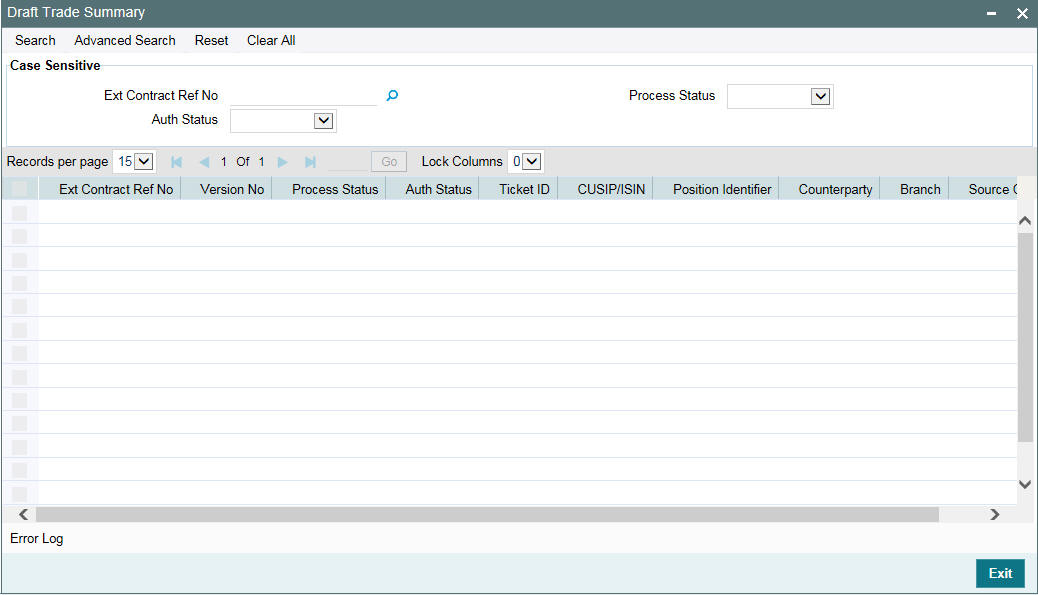

5.3 Viewing Draft Trade Summary

You can view a summary of all the trades entered in the Draft Trade screen, in the ‘Trade Input Summary’ screen. You can invoke the ‘Draft Trade Summary’ screen by typing ‘TLSTDUPL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen you can view all trade contracts at different processing status like Unprocessed, Submit, Failed, Rejected, Drafted, and Processed.

For ‘Failed’ trades, you can view the errors that occurred while processing the trade by clicking ‘Error Log’. Double-clicking the trade contract takes you to the ‘Draft Trade’ screen with the contract details.

5.4 Processing Internal Trades for HFI to HFS Transfer

In case of HFS transfer, the system automatically creates two internal trades (a ‘Buy’ and a ‘Sell’) in the SLT module based on participant transfer instructions. The ‘Buy’ trade increases the settled position of HFS Portfolio (by the amount of the transfer to HFS) whereas the ‘Sell’ trade reduces the settled position of the HFI Portfolio by a corresponding amount.

The counterparty used for the internal trades are internal customers and the settlement account maintained for these internal customers will be internal GLs. The accounting role ‘CUSTOMER’ represents internal GLs.

The Buy trade is booked against the HFS product mapped to the origination-HFS desk. The ‘Trade Amount’ for this sell trade is the ‘Transfer Amount’ entered in the ‘Participant Transfer’ screen and the Trade Priceis the ‘HFS Transferred Cost Basis’ value computed for the Sell trade. Profit and Loss is not applicable for this trade. There are no accounting entries posted for the HFS buy internal trade processed as part of HFI to HFS transfer, including settlement entries. Weighted Average Cost) WAC is always be ‘100’ and it is not recomputed during the life cycle of the trades involving HFS portfolio. Transfer Mark is computed during HFI to HFS Transfer as Transfer amount * (100 – HFS Transferred Cost Basis). This amount is uploaded systematically on HFS commitment contract as an Amort fee during internal HFS buy trade processing.

You should have maintained and attached income and expense type of amortization fee components with ‘CLP Buy Price Diff’ check box selected, to the HFS commitment product. These components should be unique to a commitment product.

The entire trade amount is considered as unfunded amount while posting accounting entries during HFS transfer for internal Sell deals.

The HFI Sell trade is booked using the Origination trade product that is mapped in the ‘Product Mapping’ screen for CLP trade for the branch. The ‘Trade Amount’ for this sell trade is the ‘Transfer Amount’ entered in the ‘Participant Transfer’ screen and the Trade Price is the ‘HFS Transferred Cost Basis’ value.

The system picks up this HFS Transferred Cost Basis and display it in the ‘Secondary Loan –Trade Online’ screen during trade upload processing. The LOCOM Carry value, HFS Transferred Cost Basis and Transfer Price is computed and stored in % terms. Note that LOCOM Carry value is not displayed in the ‘Secondary Loan –Trade Online’ screen.

Profit and Loss due to HFI to HFS transfer is posted for the HFI internal ‘Sell’ deals

5.4.1 Impact on CoC Balance

Based on the ‘Transfer Amount’ and the overall commitment amount, the system computes the pro-rata amount for each of the following balances:

- Pro-rata reduction of write-off

- Pro-rata reduction of contra interest

- Pro-rata reduction of FAS 114 reserve

- Pro-rata reduction of FAS 91 fees, Asset Transfer Marks

Origination queue is updated for the CoC balances and automatically confirmed. Amort fee is reduced systematically on HFI commitment during internal HFI sell trade processing as part of HFS transfer. The balances computed as part of the internal trades are based on the HFS transfer amount. The amounts to be released for underlying commitment and loan/LC loan contracts in the Originations modules are computed as part of the actions (VAMI) performed on the actual contracts.

Accounting entries are posted for the prorate CoC balances for the internal sell deal.

5.4.2 Reversing Internal Trades

You have to reverse the PRAM event processed for HFI to HFS transfer in the agency module. STP for this PRAM is not processed systematically in the trading module. Upon reversal of PRAM, you have to trigger reversal events in the trading module for the internal buy and sell trades separately, to reverse the HFI to HFS transfer.

It is not possible to reverse an internal trade if the position goes negative due to the reversal.

You are not allowed to reverse the HFS internal buy trade that is processed as part of HFI to HFS transfer, if there are any open or settled trades for the CUSIP and HFS portfolio. However, you can reverse the HFS internal trade, if all the HFS open trades (sale from HFS) are reversed.

During reversal of the internal trade for HFI sell and HFS buy, WAC remains as ‘100.’ Internal trade reversal is allowed only for the trades that are systematically processed from agency as part of HFI to HFS transfer.

5.5 Viewing Processed Trades

The trades input in ‘Draft Trade’ screen that have been successfully processed can be viewed in the ‘Secondary Loan – Trade Online’ screen. This section contains the following topics:

- Section 5.5.2, "Specifying Fee Details"

- Section 5.5.5, "Specifying SSI Mnemonics"

- Section 5.5.6, "Viewing Funding Memo Details"

- Section 5.5.8, "Viewing the Amortized Fee Log Details"

- Section 5.5.11, "Reversing Trade Contract"

You can invoke the ‘Trade- Online’ screen by typing ‘TLDTDONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The details specified in the draft trade screen are defaulted here. From this screen, you can view the accounting entries and the events associated with the trade.

You can also capture following additional details related to the trade, in this screen:

- Fee details

- SSI mnemonic details

- Funding memo details

- CLP Fee Log details

- Collateral % details

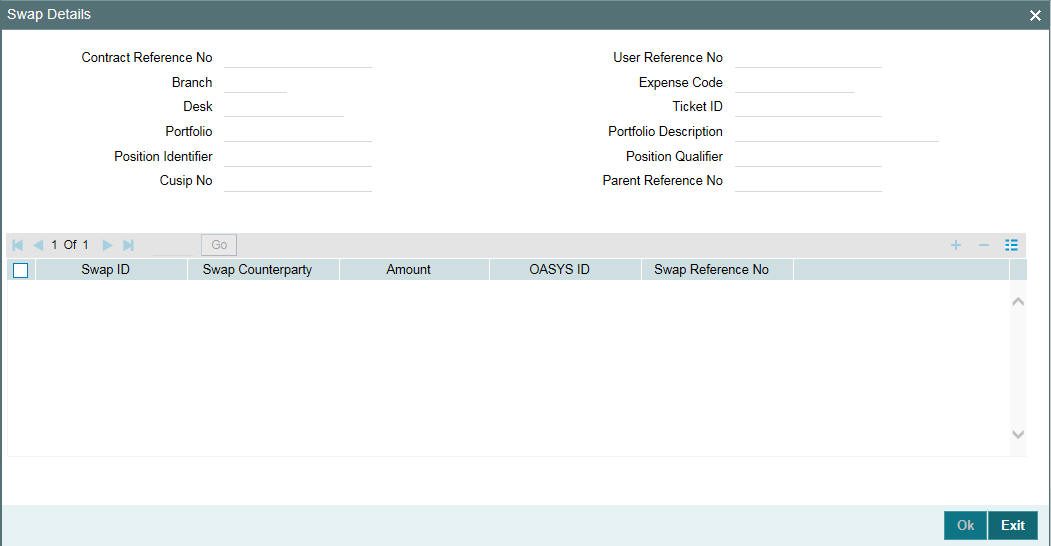

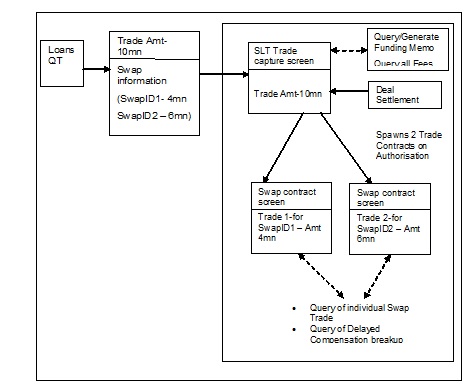

5.5.1 Capturing swap Details

Once the trade contract is authorized, Oracle Banking Corporate Lending spawns Swap contracts for each of the swap ID, Quantity captured in the Trade Online screen.

Once the Swap contracts are created for each swap ID allocation, Oracle Banking Corporate Lending creates/updates Unsettled position for the Branch (Legal Entity), Desk code, Expense code, and swap ID combination.

The Swap contract screen can be used for only viewing the individual swap ID deals. No operations can be performed from this screen.While the aggregate of Amendment, Assignment, Brokerage, and Delayed Compensation Fees can be viewed from the ‘Trade Online’ screen. The contribution/distribution of the same across the various swap contracts can be viewed from the ‘Swap Details’ screen.

Settlement of the Swap Trade needs to be triggered from the ‘Trade Settlement’ screen.

The trade details are defaulted from the SLT contract.

Swap Details

Swap ID

Swap ID to be entered by the user.

Swap Counterparty

Counterparty corresponding to the swap ID.

Amount

Trade amount for the swap ID. The sum of trade amount for all swap ID should be equal to the total trade amount.

OASYS ID

OASYS ID to be entered by the user.

Swap Reference Number

The system creates trade contract for each of the swap IDs. The contract ref no of the swap level trade contract is displayed here.

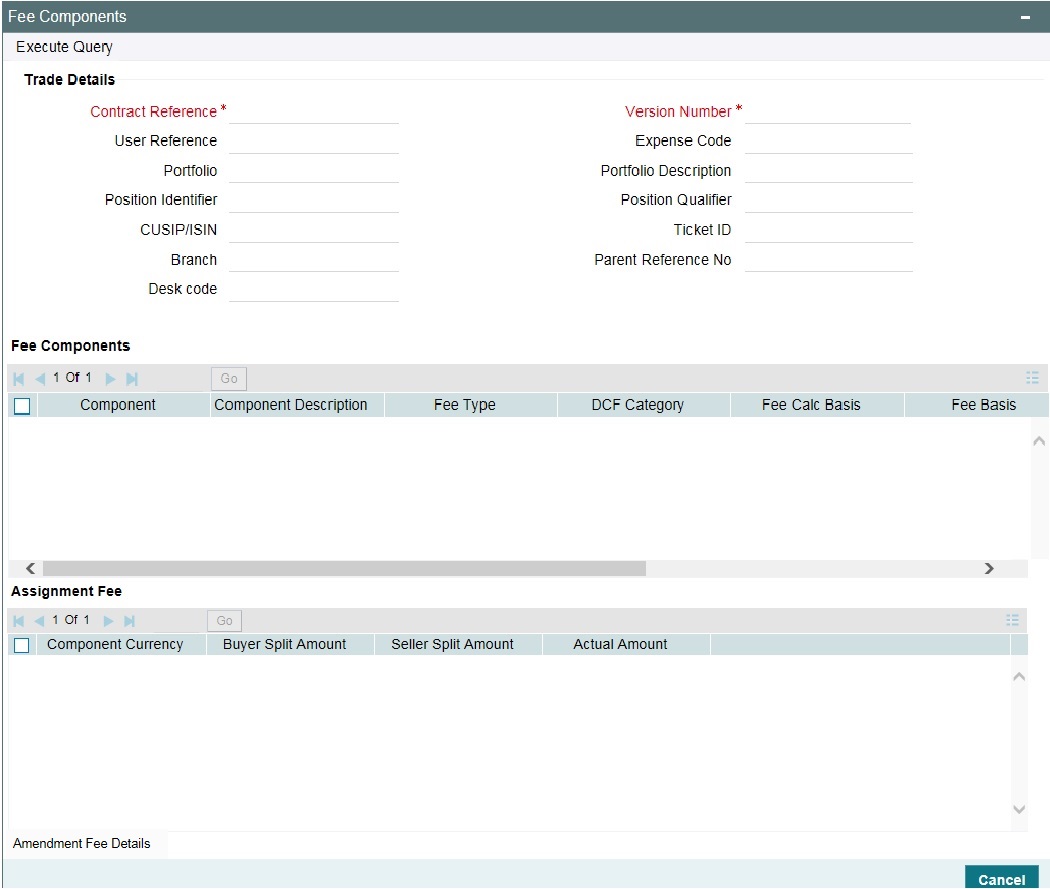

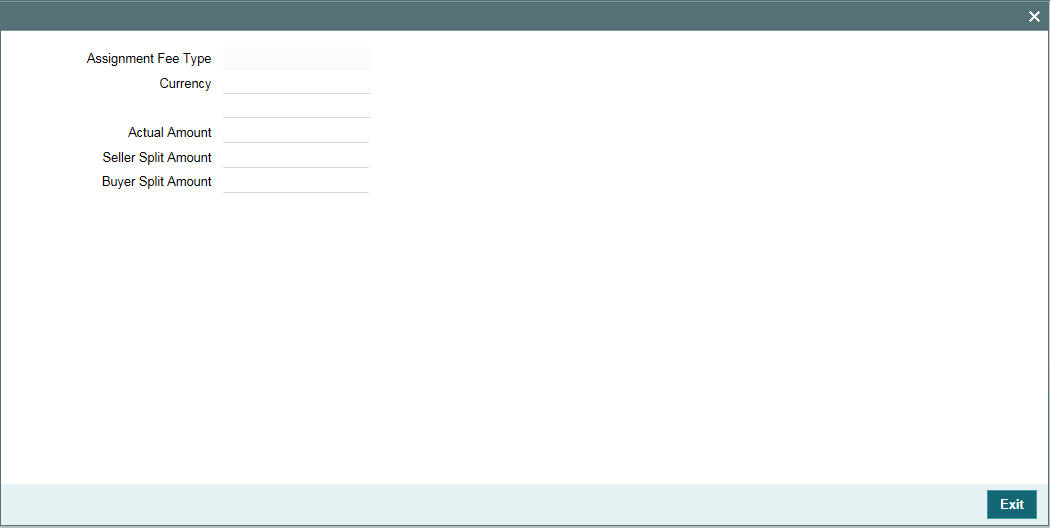

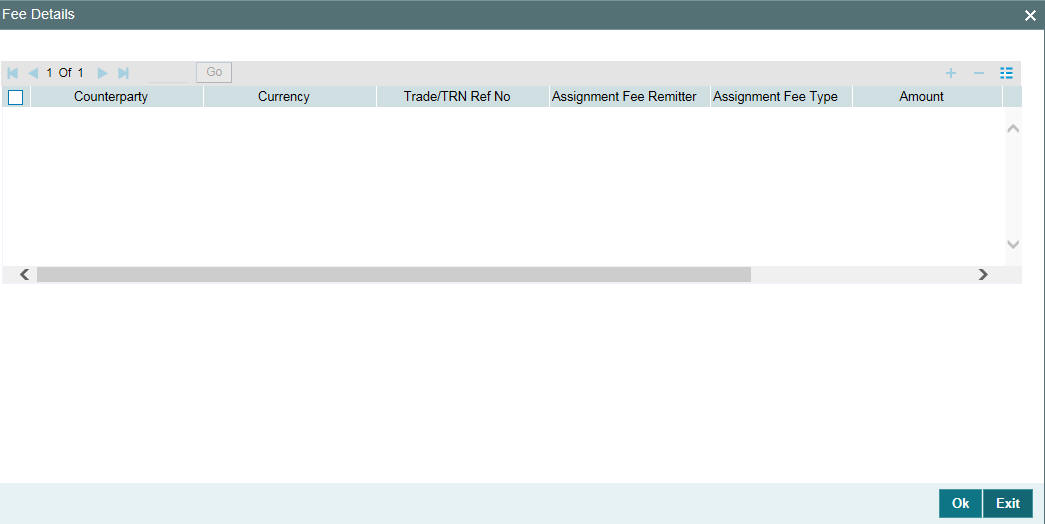

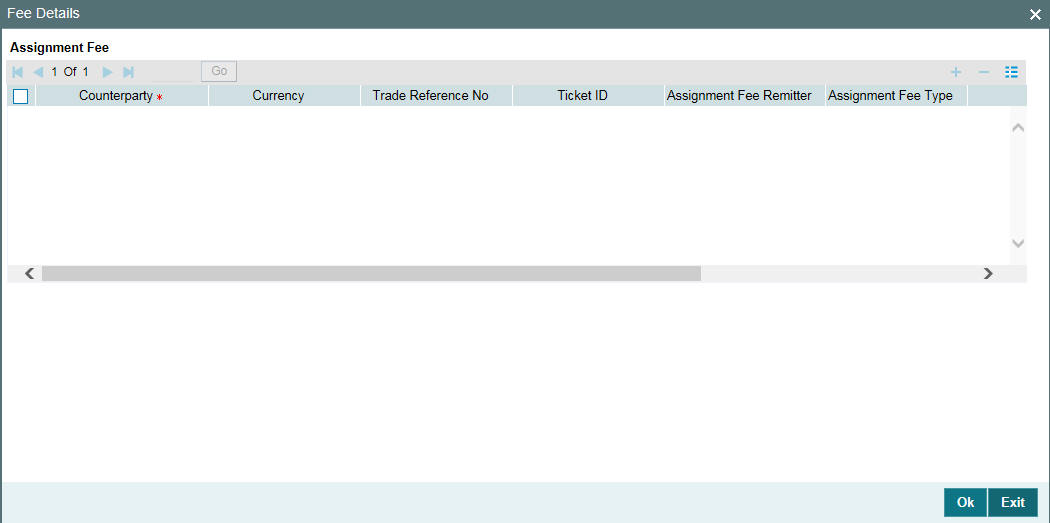

5.5.2 Specifying Fee Details

You can capture the fee details associated with a trade contract in the ‘Fee Components’ screen. To invoke this screen, click ‘Fee’ in Trade Online screen.

The basic trade details, given below are defaulted from the Trade Online screen:

- External contract reference number, trade reference number and upload reference number

- Branch, desk and expense code

- Portfolio Id, position identifier and position qualifier

- CUSIP/ISIN and ticket Id

The following details related to the fee components are defaulted from the product level:

- Fee Component

- Fee Type

- DCF Category

- Fee Calc Basis

- Fee Basis

You can modify ‘Fee Calc Basis’ and ‘Fee Basis’, if required.

Fee Rate

Specify the fee rate to be used by the system to arrive at the fee amount. You can specify either the ‘Fee Rate’ or the ‘Amount’.

Note

This is enabled only for fee types ‘Broker Fee’ and ‘Line/Accommodation Fee’.

Amount

Specify the fee amount to be associated with the selected fee component. You can specify either the ‘Fee Rate’ or the ‘Amount’.

For ‘Assignment fee’ the sum of the Buyer’s Split Amount and Seller’s Split Amount gets displayed here.

Note

This is not applicable for fee types ‘DCF’ and ‘Break-fund Fee’.

Currency

Select the trade currency from the adjoining option list. This list displays all valid currency maintained at the currency level. This option is enabled only for ‘Assignment’ type of fee.

You need to maintain a valid SSI Mnemonic either for the agent and/or for the trade counter party based on the assignment fee remitter and assignment fee type for the currency selected. This is used during the trade/ticket settlement.

The SSI Mnemonic needs to be maintained for the different parties as specified below:

- For the trade counter party - if the assignment FEE remitter is the trade counter party and bank has to pay its contribution

- For the agent - if the assignment FEE remitter is bank and bank has to pay its contribution,

- For the Agent and trade counter party - if the assignment FEE remitter is bank and both bank and the trade counter parties has to pay their contribution

Waiver

Select this check box to indicate that you want to waive off all fee components except delayed compensation fee (DCF), for the trade contract.

DCF Waiver

Select this check to indicate that you want to waive off the delayed compensation fee (DCF) associated with the trade contract.

Note

This gets displayed only for ‘DCF’ fee types.

5.5.2.1 Specifying Assignment Fee Details

For fee components of type ‘Assignment’ you can specify the following details:

Assignment Fee Type

Select the method of sharing the assignment fee between the buyer and seller, from the drop-down list. The following options are provided:

- Buyer - the entire assignment fee amount is booked against the buyer

- Seller - the entire assignment fee amount is booked against the seller

- Split - assignment fee amount can be split between the buyer and seller

- Paid In Advance - assignment fee can be paid in advance.

Buyer’s Split Amount

Specify the assignment fee amount that has to be booked against the buyer associated with the trade deal.

Seller’s Split Amount

Specify the assignment fee amount that has to be booked against the seller associated with the trade deal.

Note

- Buyer’s Split Amount and Seller’s Split Amount are enabled only for assignment fee of type ‘Split’.

- The sum of Buyer’s Split Amount and Seller’s Split Amount gets updated as the ‘Amount’, in this case.

5.5.2.2 Viewing Amendment Fee History

From ‘Fee Components’ screen, click ‘Amendment Fee Details’ button to open ‘Amendment Fee History ‘screen. You can use this screen to only view ‘Amendment Fee History ‘ screen.

- You are not allowed to modify the amendment fee in the ‘TL Fee Amendment’ (TLDFEAMD) screen for both active and settled trades.

- Amendment fee component is not displayed in the ‘TL Fee Amendment’ screen

- You are allowed to capture/amend/waive fee in the ‘TL Fee Amendment’ screen for the remaining components

5.5.2.3 Other Trade Processing Changes for Fees

1. Amendment fee is applied systematically on a new trade when the trade is booked from LQT or manually in Oracle Banking Corporate Lending or when the trade is booked as part of trade amendment resulting in trade reversal and rebook.

2. Amendment fee is applied systematically on new trades when below mentioned conditions are met.

- ‘Auto Apply Amendment Fee’ check box is selected.

- Open amendment fee maintenance exists in the ‘Amendment Fee Input’ screen for the associated CUSIP with amendment date greater than or equal to trade date.

- Oracle Banking Corporate Lending applies amendment fee systematically for new trades as explained below

- New trade is populated in the ‘Amendment Fee Input’ screen for each amendment date.

- ‘Waive’ check box is cleared by default for all the amendment dates if the trade is booked from LQT or manually in Oracle Banking Corporate Lending. This is applicable even if ‘Waive All’ check box was selected while capturing amendment fee for a specific amendment date under the CUSIP.

- If the new trade is booked as part of trade amendment resulting into

trade reversal and rebook then

- ‘Waive’ check box is copied from the old trade (reversed trade) for each amendment date.

- If amendment fee is waived at the component level for old trade then amendment fee is waived at the component level for the child trade as well. Amendment fee is applied systematically on new trade for each amendment date.

- However, amendment fee is not allowed to be settled if amendment fee is waived at the component level.

- If multiple amendment records exist for the CUSIP before and after trade date then ‘Amendment Fee Input’ screen is populated only for the records having amendment date greater than or equal to the trade date.

Example:-

Maintenance exists for CUSIP 1 as below

Amendment Date |

Fee Rate |

Waive |

10-May-2015 |

0.4% |

Yes |

1-Jun-2015 |

0.3% |

No |

1-Jul-2015 |

0.2% |

No |

Scenario 1:- New trade is booked with CUSIP1

Trade Date |

10-May-2015 |

Trade Amount |

200,000.00 |

Record will be populated for the new trade in amendment fee input screen as below

Amendment Date |

Fee Rate |

Waive |

Fee Amount |

10-May-2015 |

0.4% |

No |

800.00 |

1-Jun-2015 |

0.3% |

No |

600.00 |

1-Jul-2015 |

0.2% |

No |

400.00 |

Amendment fee amount for the new trade is 1,800.00

Scenario 2:- New trade is booked with CUSIP1 due to trade amendment

Trade Date |

10-May-2015 |

Trade Amount |

200,000.00 |

Record will be populated for the new trade in ‘Amendment Fee Input’ screen as below

Amendment Date |

Fee Rate |

Waive |

Fee Amount |

10-May-2015 |

0.4% |

Yes |

800.00 |

1-Jun-2015 |

0.3% |

No |

600.00 |

1-Jul-2015 |

0.2% |

No |

400.00 |

Amendment fee amount for the new trade will be 1000.00

- Trade amount as of the amendment date is used to calculate the amendment fee. This is explained in detail below.

- FAMD event is registered and auto authorized.

- Once the trade is booked, you are allowed to waive or un-waive the trade record for a specific amendment date in the ‘Amendment Fee Input’ screen

- Amendment fee is systematically applied as explained above for the trades booked with Par, Distress and Origination desks.

- There is no change in amendment fee for the existing trades (trades booked prior to this enhancement). Existing trades are impacted only in the below mentioned scenarios.

- Trade amendment results into reversal and rebook

- Trade amendment to waive or un-waive the amendment fee at component level

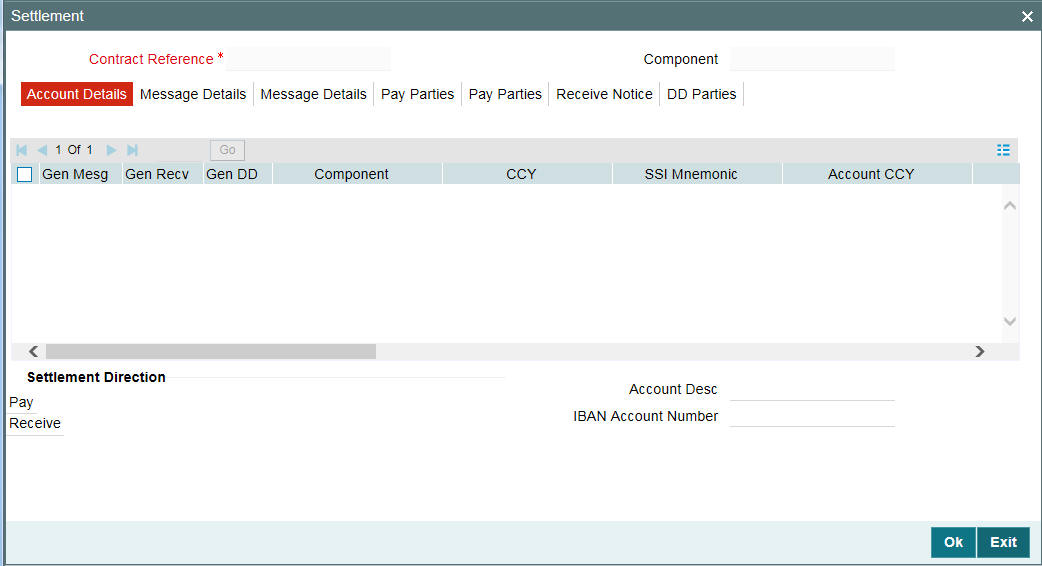

5.5.3 Specifying Settlements Details

For information on settlement details, refer to ‘Processing Settlements’ topic in Settlements User Manual.

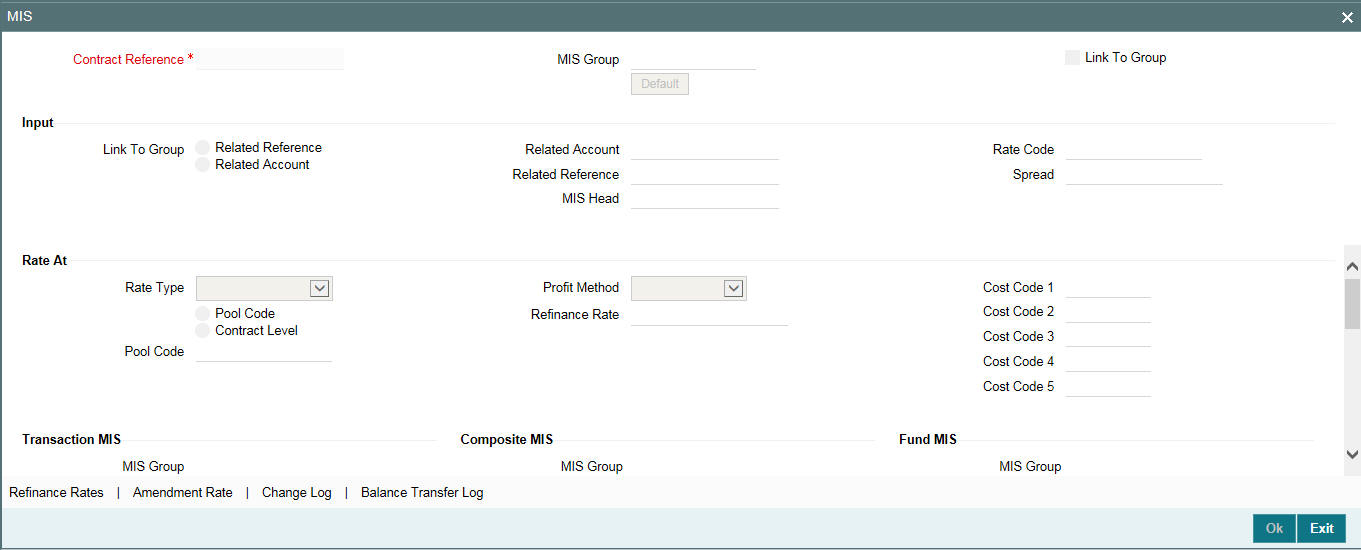

5.5.4 Specifying MIS Details

To invoke the MIS details screen for a contract, click on the ‘MIS’ button.

For a contract, the transaction type of MIS class, the cost code and pool code are picked up from the product under which the contract is processed. The composite MIS code is picked up from the definition made for the customer, on behalf of whom the contract is being processed.

The interest calculation method for the refinancing rates of the pool is picked up default from Pool Codes maintenance.These can be changed. For an account, the transaction type of MIS class is picked up from the account class, along with the cost codes and pool codes. The composite type of MIS class is defaulted from those defined for the customer. These too can be changed.

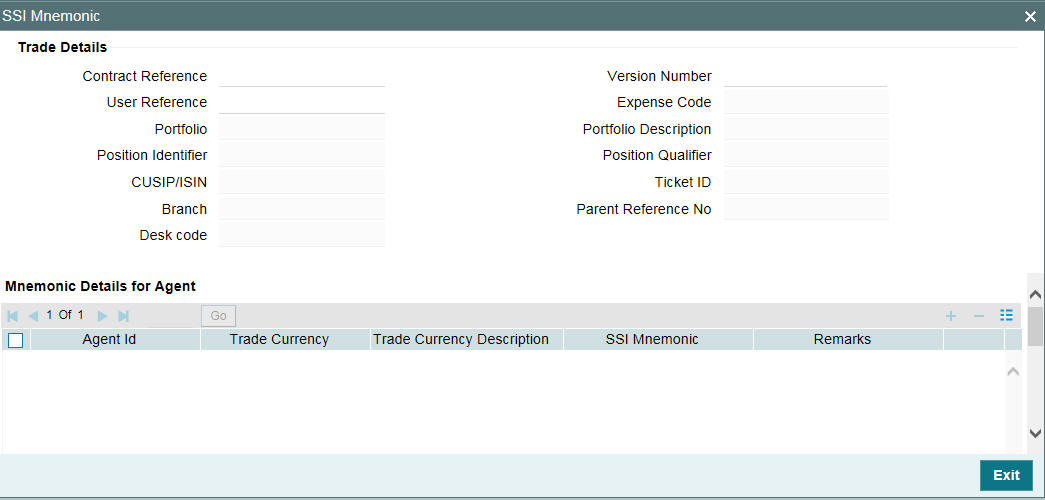

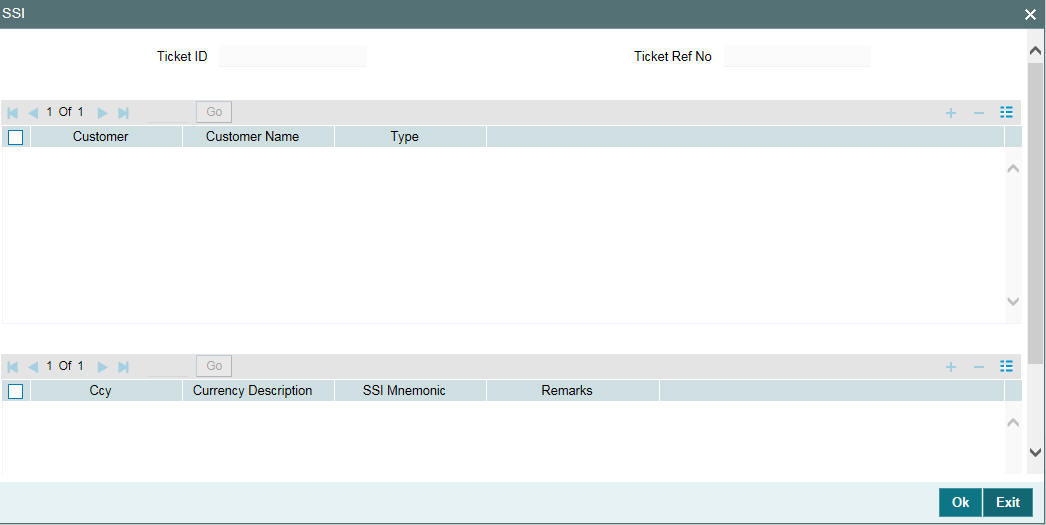

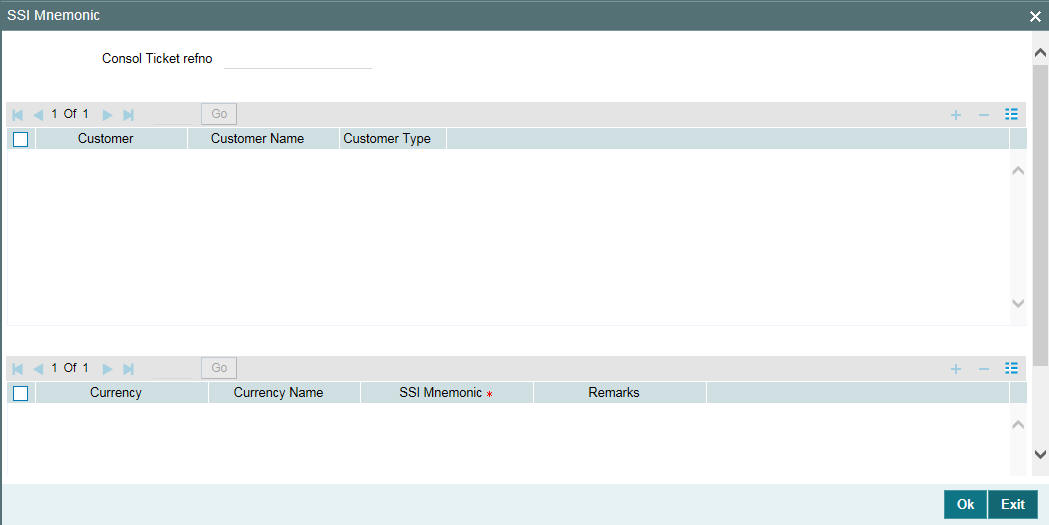

5.5.5 Specifying SSI Mnemonics

You can capture currency-wise SSI mnemonics in the ‘SSI Mnemonics’ screen. To invoke this screen, click ‘SSI’ in the Trade Online screen.

The basic trade details associated with the trade contract are defaulted in this screen.

5.5.5.1 Capturing Agent Mnemonic Details

If assignment fee is involved in a trade contract, you can capture the SSI mnemonic for the currency of the agent, to whom the assignment fee needs to be paid.

SSI Mnemonic

Select the SSI mnemonic value to be linked to the agent currency, from the option list provided.

5.5.5.2 Capturing Mnemonic Details for Trade Counterparties

You can also capture the SSI mnemonics for the currencies associated with different counterparties involved in the trade deal.

Ccy

Select the currency associated with the trade counterparty from the option list provided.

SSI Mnemonic

Select the SSI mnemonic value to be linked to the currency associated with the trade counterparty, from the option list.

Remarks

Specify any additional information about the mnemonics details.

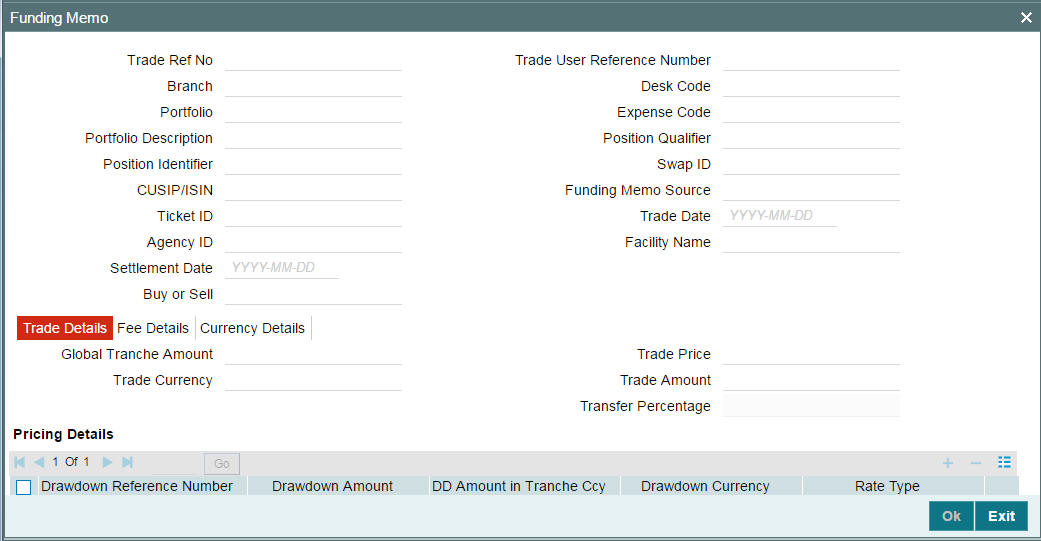

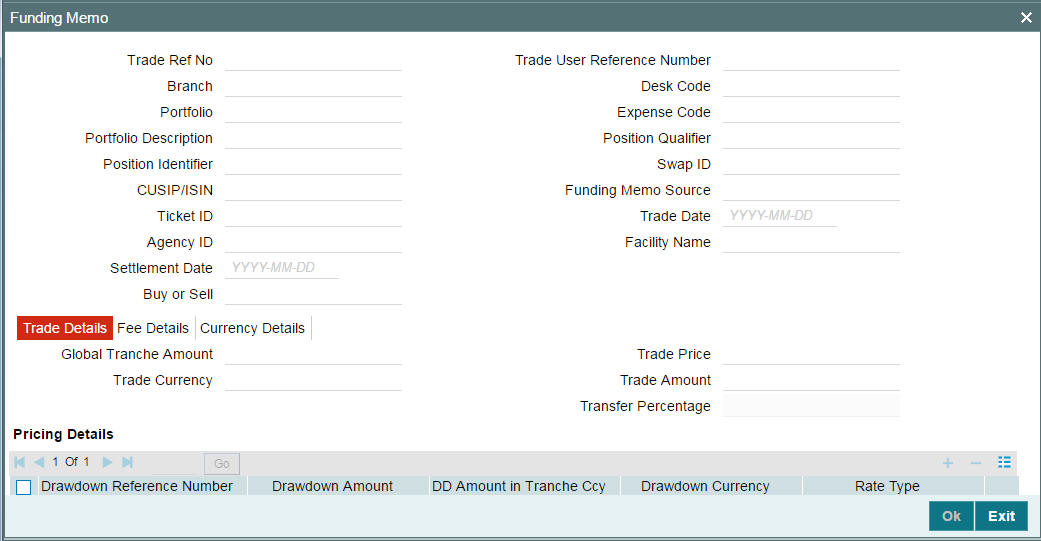

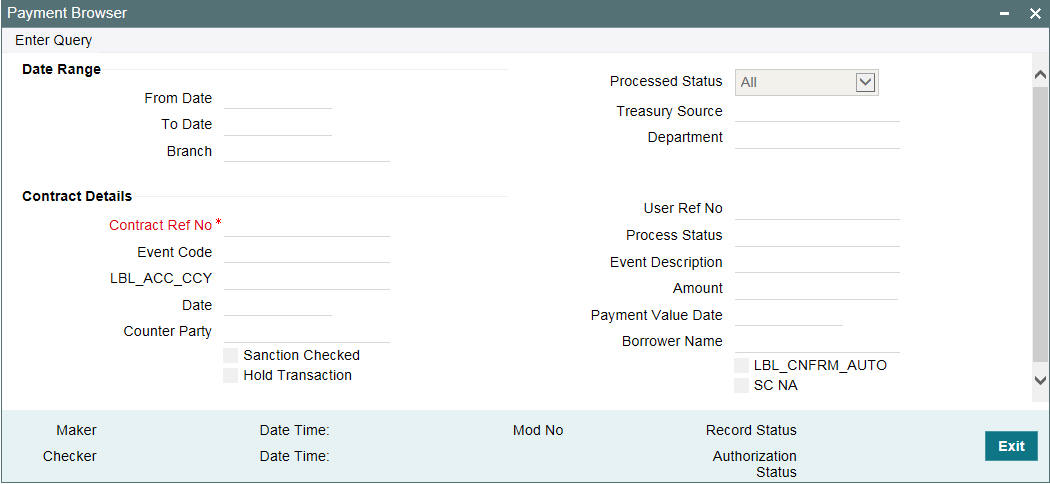

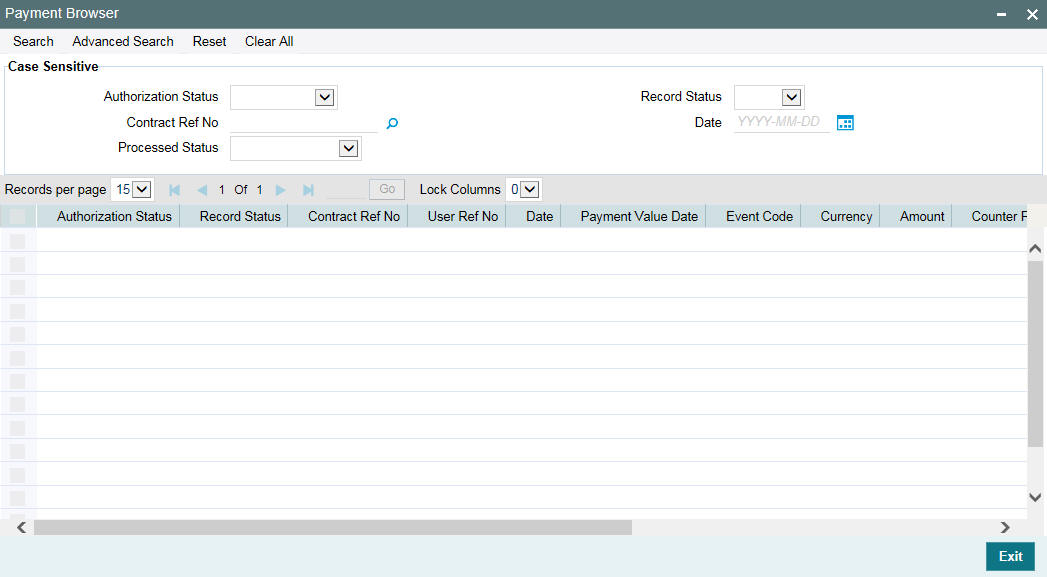

5.5.6 Viewing Funding Memo Details

You can view the funding memo details associated with a trade contract

by clicking the ‘Funding Memo’tab

in the Trade Online screen. The funding memo details for the current

trade get displayed, if it has already been extracted. You cannot make

any changes in the funding memo details.

For more details on funding memo refer the section ‘Capturing Funding Memo Details’ in this user manual.

5.5.7 Maintaining Events

A contract goes through different stages in its life cycle. In Oracle Banking Corporate Lending, the different stages a contract passes through in its life cycle are referred to as ‘Events‘.

At an event, typically, you would want to post the accounting entries to the appropriate account heads and generate the required advices.

For more information on events, refer to ‘Maintaining Details Specific to SLT’ topic in Bilateral Loans User Manual.

5.5.8 Viewing the Amortized Fee Log Details

You can view the amortized fee log details in the ‘Un Amortized Fee Log’ screen. To invoke this screen, click ‘CLP Fee Log’ in the Trade Online screen. The screen displays the status of amortization fee processed during settlement (TSTL) or reversal of settlement (RSTL) event of origination buy trade.

Any action which is resulting in the trade settlement reversal of the CLP Buy, attempts to refund the FEE component amounts computed for the current trade being reversed. In case if the FEE component does not have enough balance due to any of the following reasons, system will log the exception without performing the refund:

- If the FEE components are chosen for daily accruals, the accrual would have started from the day the FEE component is liquidated as part of BUY trade settlement. Now, while reversing such trades, some amount would have been accrued and the entire amount is not available for refund.

- After creating/liquidating the new amortization FEE components as part CLP Buy trade settlement, if the CLP desk is involved in a Sell trade, the pro-rata share of this fee would have been considered while arriving at the carrying value/COC for the Sell trade and the FEE component amount would be refunded to that extent as part of CLP Sell trade booking. Now, while reversing the Buy trades, some amount would have been refunded as part of Sell trade booking and the entire amount is not available for refund.

5.5.9 Financial Centre Holiday Treatment

Click ‘Financial Centre’ tab in ‘Trade Online’ screen to open ‘Financial Centres for Trade Expected Settle date’ screen.

Financial center maintained at trade draft level is displayed in ‘Trade Online’ (TLDTDONL) screen.

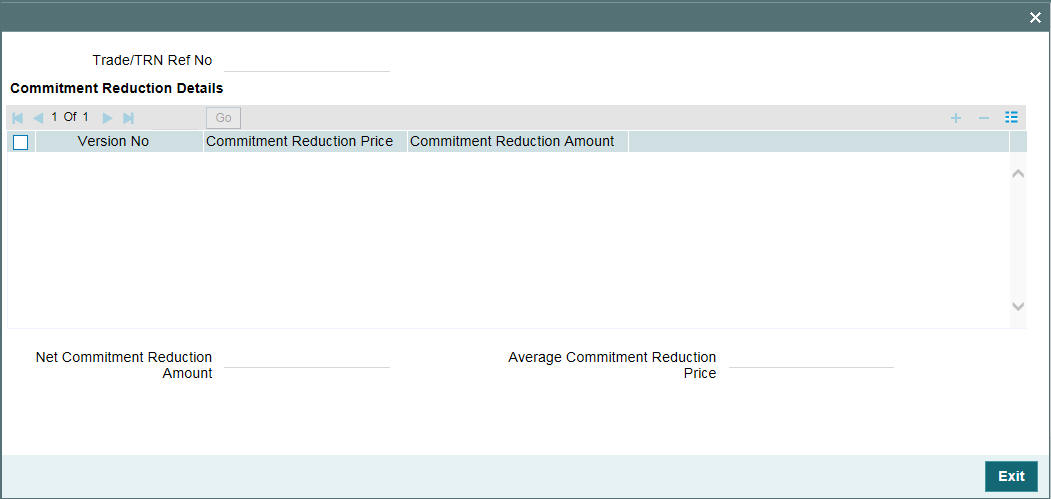

5.5.10 Viewing Commitment Reduction Log

You can view the details of each commitment reduction for a trade by clicking the ‘CR Log’ tab.

In this screen, you can also view the net commitment reduction amount and the average commitment reduction price.

While calculating the final settlement reduction amount for a trade during the trade settlement, the net commitment reduction amount is considered at the average commitment reduction price.

5.5.11 Reversing Trade Contract

You can reverse the trade contract details before or after trade settlement in the ‘Trade Online’ screen. You can also authorize the trade reversal transaction in this screen.

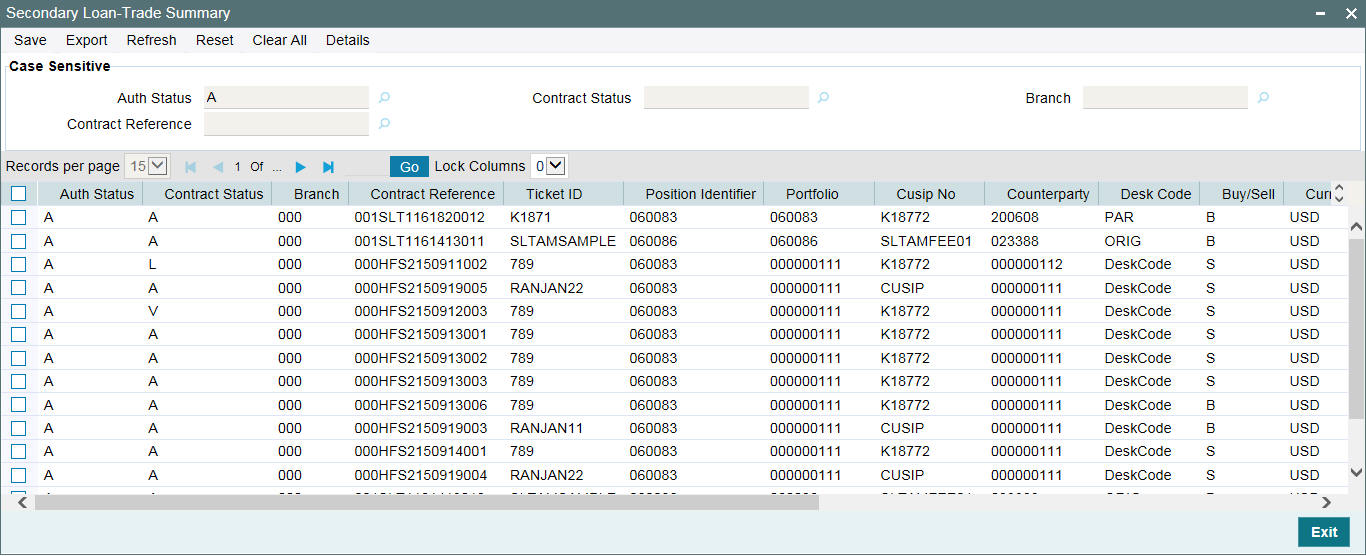

5.6 Querying Trade Contract

You can view a summary of all the processed draft trades and query for a trade in the ‘Secondary Loan - Trade Summary’ screen. You can invoke the ‘Secondary Loan - Trade Summary’ screen by typing ‘TLSTDONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Click ‘Search‘ to view summary of all processed draft trades.

You can view the details of a trade in the ‘Trade Online’ screen by selecting a desired row in the summary screen and double-clicking the same.

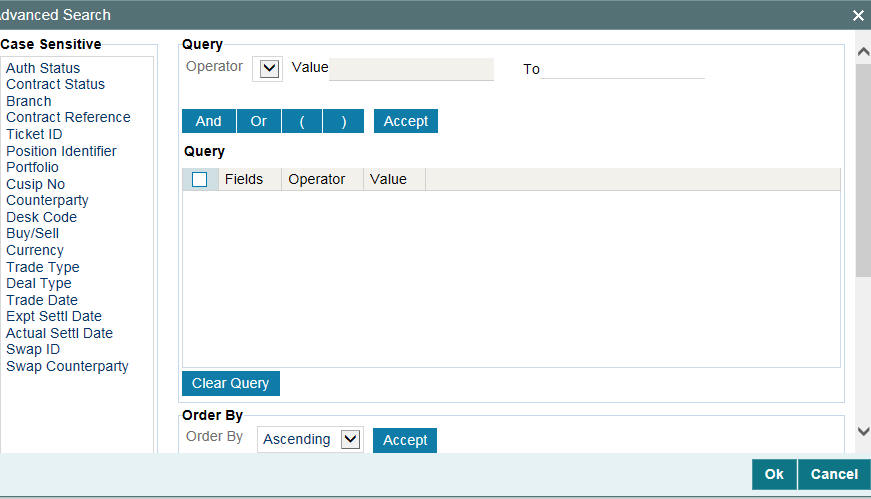

You can also query for a trade using the ‘Advanced Search’ screen which can be invoked by clicking ‘Advanced Search’ in this screen.

In this screen you can perform the following types of queries for all contracts booked for a CUSIP:

- All trades bought or sold

- All contracts booked between two trade dates

- All contracts booked between two settlement dates

- All contracts booked with a particular counterparty

- All contracts booked for a particular desk

- All contracts booked for a Swap Id

5.7 Capturing Agency Details

You can capture agency branch details in the ‘Agency Detail Input’ screen.

This section contains the following topics:

- Section 5.7.1, "Capturing the Pricing Details"

- Section 5.7.2, "Capturing Interest Details"

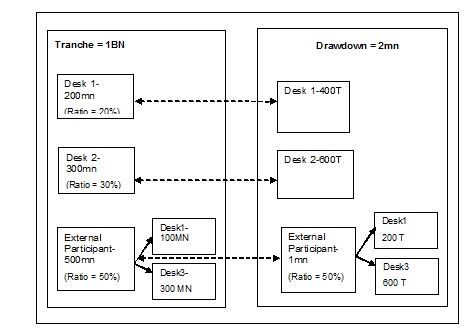

- Section 5.7.3, "Auto Booking of Drawdown Details"

- Section 5.7.4, "Capturing Additional Drawdown Details"

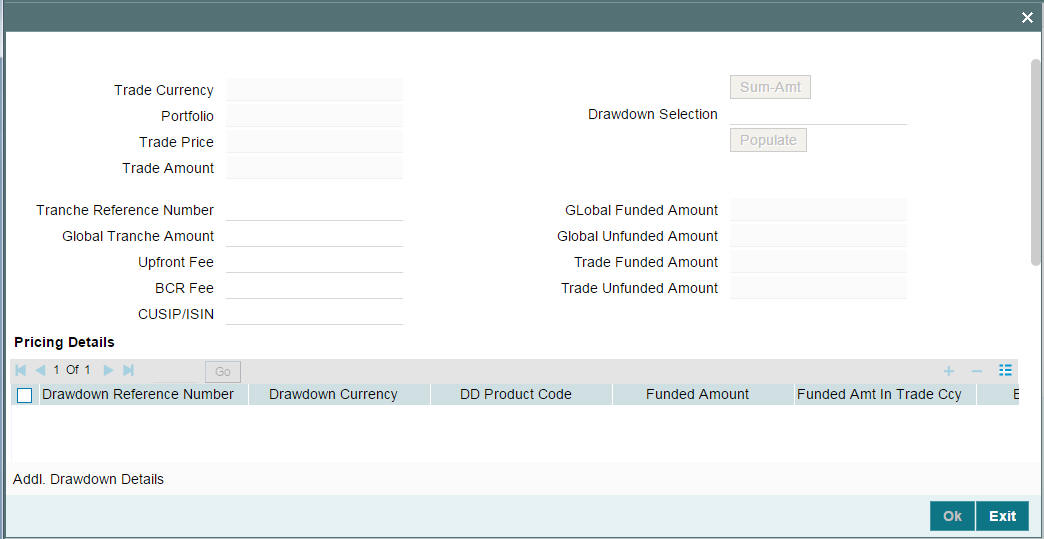

From ‘Trade Settlement Detailed’ screen (TLDSETTL), click ‘Manual Funding Memo’ tab.

The following trade related details are displayed here:

- Contract Ref No is the SLT contract number.

- Trade Price is the price at which the deal is booked

- Trade amount is the amount which is bought/sold

- Portfolio is each Branch-Desk combination with in a unique Portfolio.

Tranche ref no

Specify the tranche no from the adjoining option list.

Note

- This field is disabled if the parameter ‘Buy back for Zero Position tranche’ is not checked

- If ‘Buy-back for Zero Position tranche’ is checked, ‘Tranche Reference Number’ of all zero-position non-lead tranches linked to the CUSIP is populated in the adjoining option list.

- If ‘Buy-back for Zero Position tranche’ is selected and the Funding Memo source is ‘Manual’ for a tranche with position, the Tranche option list is not disabled. The option list does not have any values.

- You need to enter the drawdown details in the ‘funding memo upload screen’. You are not allowed to select the existing Drawdowns even though the drawdown outstanding is zero, using ‘drawdown selection’ screen for zero-position tranche.

Global Tranche Amount

Specify the total tranche amount for a CUSIP

Upfront Fee

Specify the upfront fee here. The fee is not used while processing any settlement.

BCR Fee

Specify the BCR Fee (Benefit of Commitment reduction) here. The fee is not used while processing any settlement.

The following details are displayed and computed based on the drawdown details specified:

- Global Funded Amount (system arrives at this amount based on the pricing details captured in this screen)

- Global Unfunded Amount (system arrives at this amount based on the Global Tranche amount, Trade amount and drawdown details)

- Trade Funded Amount

- Trade Unfunded Amount

5.7.1 Capturing the Pricing Details

Drawdown ref no

Specify the drawdown reference number. The adjoining option list displays all valid drawdown products maintained at the Tranche level. You can select the appropriate one.

Note

In order to create a single drawdown for multiple trades, you need to select the same dummy reference number for all the relevant trades

For the first trade under a Ticket ID for which dummy reference numbers are yet to be generated, You are required to ‘Generate’ the first dummy reference number by clicking on the ‘Generate’ button; since no values will be available for selection from the option list.

If you select a dummy reference number from the option list and press ‘Generate’ button the selected reference number will be replaced with newly generated reference number.

You can generate a dummy reference number using ‘Generate’ option and then overwrite the generated value with a value selected from the pick list. The Total Drawdown amount under a particular dummy reference is the cumulative sum of the funded amounts under the trades for the ticket

Drawdown CCY

Specify the currency of the Drawdown which can be sued for processing.

Drawdown Product

Specify the drawdown of the product. The adjoining option list displays all valid drawdown products maintained at the Tranche level. You can select the appropriate one.

Funded Amount

The total drawdown amount in the drawdown currency

Funded Amount in Trade CCy

The system displays the funded amount in trade currency.

Ex Rate

Specify the fixed exchange rate between the Funding currency and Tranche/Trade currency if both are not same. Funded amount in Trade currency gets displayed in the adjacent field using the exchange rate given.

Borrower

Specify the borrower number. The adjoining option list displays all valid borrowers maintained at the Tranche level. You can select the appropriate one.

Value Date

Specify the value Date of the Drawdown

Maturity Date

Specify the maturity date of the Drawdown. The date should be greater than the Drawdown date

The system will validate the drawdown value date and maturity date to be within the tranche value date and tranche maturity date.

Original Start Date

Specify the original start date of the Drawdown. The date should be less than or equal to Drawdown date.

Rate Type

Specify the interest rate type of the Drawdown from the options available:

- Fixed

- Floating

Rate Basis

Specify the rate basis. The adjoining option list displays all valid rate basis maintained in the system. You can select the appropriate one.

Buyer’s Share

Specify the buyer’s share amount as on the actual settlement details. This is used for DCF computation.

For Pro-Rata agency contracts, the system populates the details based on the trade ratio whereas for Non Pro-rata agency contract, you need to provide the details for each drawdown. Only those drawdown should be captured in which the Seller of the trade is an active participant.

5.7.2 Capturing Interest Details

Alternative Risk-Free Rates Preferences

The options of ‘Alternative Risk-Free Rates Preferences’ are defaulted from 'Loans Syndication – Borrower Product Definition’ (LBDPRMNT). If required, you can modify it.

For more information on ‘Alternative Risk-Free Rates Preferences’ fields, refer to Interest User Manual.

Component

Specify the interest component of a Drawdown

Amount

Specify the amount of the specified component

Buyer’s Share

Specify the buyer’s share amount.

Start Date

Specify the start date of interest component computation

Re-price Date

Specify the end date of interest component computation

Base Rate

The base rate for the interest component

Margin

Specify the margin details of the interest component

Final Rate

Specify the final rate of the interest component after calculating the base rate and margin.

Note

For more details on negative rate processing, refer the title ‘Maintaining Loans Parameters Details’ in the chapter ‘Bank Parameters’ in Core Services User Manual.

5.7.3 Auto Booking of Drawdown Details

The drawdown is created automatically in agency if you input the drawdown details in ‘Agency Details Input’ screen of funding memo during ticket / trade settlement. The Auto book of drawdown in agency through STP from SLT is applicable only Ii it satisfies all the following conditions:

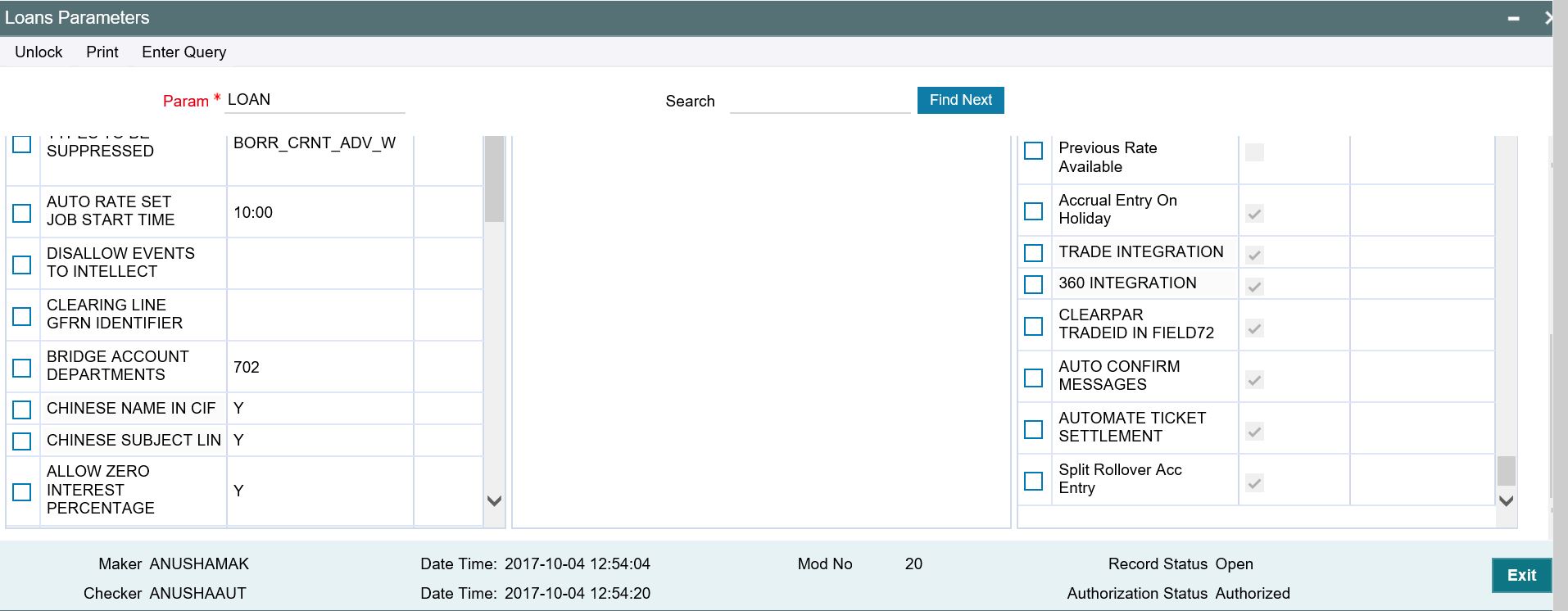

- DD Upload by Trade settlement should be ‘Yes’ in the ‘Loan Parameters’ screen

- ‘Non-Prorata / PIK settlement’ flag is checked during trade / ticket settlement

- Pro- rata Tranche (Cascade Participation – Yes)

- Par or Distress type of trades

- Buy type of trades

- Non-lead trades / Non-bank agented trades

- Cusip should have only one participant with 100% ratio or multiple participant with one participant as 100% and other participants with 0% and it should be the buyer in the trade

- Ticket / Trade settlement with new drawdown’s details captured

If you have selected the 'Non-Prorata/PIK Settlement' option in ticket / trade settlement, the system defaults all the existing drawdown details with buyer's share and corresponding drawdown amounts in the ‘Agency Detail Input’ screen.

If the drawdown exists under a CUSIP during the trade/ticket settlement, the system does the following:

- Changing the buyer's share of the individual drawdown which triggers VAMI after the TL-LB processing

- Deleting the existing drawdown details in ‘Agency Detail Input’ screen and allowing to capture the new drawdown details

- the net buyer’s share across drawdown in tranche currency should not exceed the trade amount

In case, if the both new drawdown and existing details are available, the system displays an error message.

The system checks if the ‘Non-prorata / PIK settlement’ option is selected, then it arrives at the corresponding drawdown amounts based on the buyer’s share for the individual drawdown’s while processing the records from the TL-LB handoff browser.

Once the trade is settled and processed in LB browser, the system does not reverse the Drawdown newly created when Trade Settlement is reversed.

If the trade settlement is reversed, then the system fires an offset VAMI that is, negative VAMI for buy reversal for all drawdowns affected as part of the settlement. But it allows the creation of drawdown for back dated ticket settlement provided there is no ticket settlement / agency activity with value date after ticket settlement date.

In case of multiple open trades with different new drawdown details in ‘Agency Details Input’ screen, the system creates multiple new drawdowns during TL-LB STP after ticket settlement.

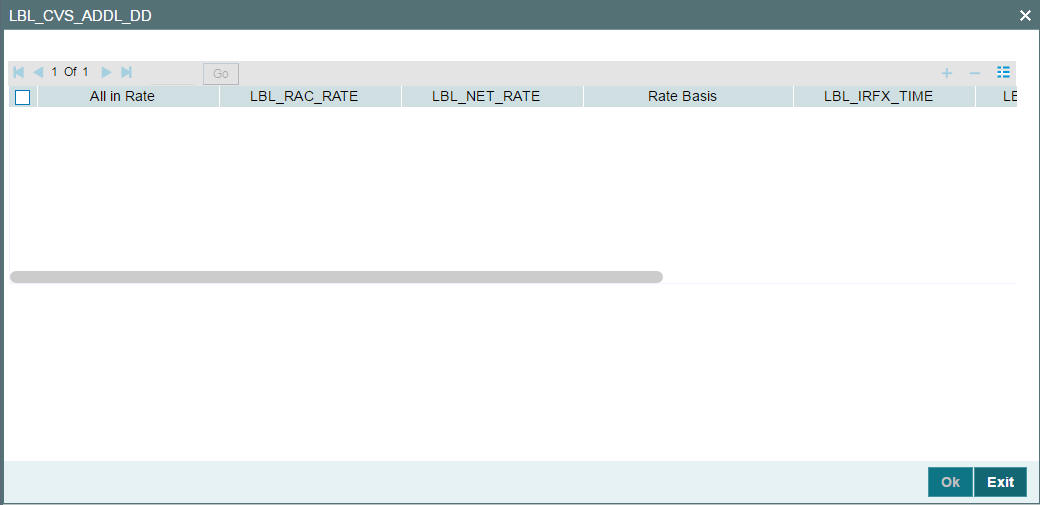

5.7.4 Capturing Additional Drawdown Details

You can capture additional drawdown details in ‘Additional Drawdown Details’ screen by clicking ‘Addl Drawdown Details’ in the ‘Agency Detail Input’ screen.

Specify the following details:

RAC Rate

Specify the RAC rate. The RAC rate is difference between net rate and base rate which is always zero and validates if RAC rate is not zero.

Rate Basis (LIBOR/EURIBOR)

Specify the rate basis. The adjoining option list displays all valid rate basis maintained in the system. You can select the appropriate one.

The new drawdown is created only based on the rates mentioned in the ‘Agency Detail Input’ screen and not the details specified here.

The system displays the following details:

- All In Rate

- Net Rate

- Interest Rate Fixing Time

- Exchange Rate Fixing Time

- Location

- Interest Period

5.8 Capturing Origination Trade Details

Line trades are trades which are handled by a desk on behalf of another desk. Origination trade supports not only ‘Assignment type’, but also ‘Participation type’. However, the actual participation happens only during the internal Origination trade.

Trade deals involving the Origination desk are handled as line trades in Loans QT. These deals, discussed in detail in subsequent sections, can be either CLP Buy or CLP Sell.

This section contains the following topics:

- Section 5.8.1, "Processing CLP Sell Line Trades"

- Section 5.8.2, "Processing Cost of Credit Valuation for Commitments"

- Section 5.8.3, "Validating Unamortized Fee"

- Section 5.8.4, "Processing CLP Buy Line Trades"

5.8.1 Processing CLP Sell Line Trades

For CLP Sell line trades involving the origination desk, the following three separate trade deals are generated.

- Par desk selling to customer

- Par desk buying from Origination desk

- Origination desk selling to Par desk

Note

Loans QT may send multiple sell trade from Par desk to Customer (the first type of trade mentioned above) for line trades within a single ticket.

These three deals are created under the same ticket and are settled together during the ticket settlement. For the first trade, where par desk sells to customer, you need to select the ‘Parent Line Trade’ check box.

The origination trade processing is carried out as follows:

- When the third trade details, that is, origination desk selling to par desk, are handed off from Loans QT to Oracle Banking Corporate Lending, the system checks if the related trade is a line trade.

- If it is a line trade, then the details of this origination sell trade get populated in the ‘Line Trade – Origination Details’ screen. Unamortized fee amount, Reserve amount and the Contra amount applicable for the origination desk corresponding to the Participation sell gets defaulted, whereas Participation buy should be handled manually.

- The origination line trade is processed once you confirm these details.

Note

If the contra and reserve are captured in cross currency loans, then the contra and reserve is not defaulted and it is assumed to be zero.

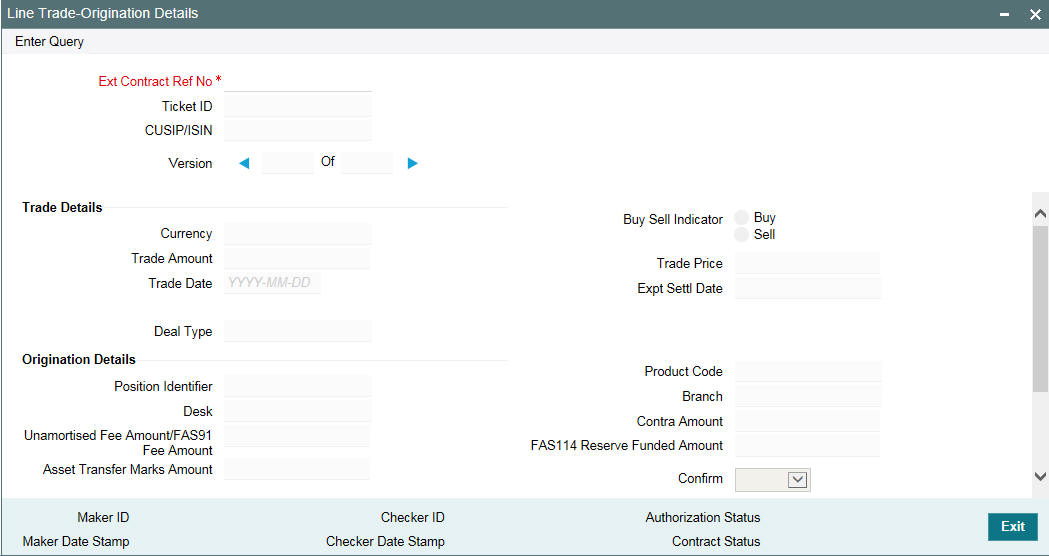

You can invoke the ‘Line Trade - Origination Details’ screen by typing ‘TLDORGQU’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Following details related to the origination line trade are displayed here:

- Trade amount, price, trade booking date, trade currency and the expected settlement date

- Deal Type

- Position identifier, product, and portfolio

- Desk, branch, and expense code

- Unamortized fee amount (or FAS91 Fee Amount), contra amount and Writeoff Amount. If the cost of credit valuation is being done for the commitment, then the sytem displays the ‘FAS91 Fee Amount’; else the system displays the ‘Unamortised Fee Amount’.

- Asset Transfer Marks Amount, FAS114 Reserve Funded Amount, FAS114 Reserve Unfunded Amount. These amounts are computed by applying the pro-rata percentage of Sell on the relevant Origination total amounts at commitment level

Note

For CLP buy line trade, if the deal type is ‘Participation’, the SLT position and the agency activities to be tracked independently for the normal participant and silent participant. In such cases, when the Participation Buy is entered for the first time, system does not have the corresponding CLP Participation commitment in place. The FEE components should be handled manually as part of manual creation of agency and origination details.

Confirm/Reject

Select the option to indicate whether you want to confirm or reject the details specified in this screen.

The line fee gets settled as part of line trade booking. Line fee income for the par desk is passed during the line trade and line fee expense for the origination desk is passed during the origination sell deal.

For origination sell deal, the unamortized fee, reserve amount and contra amount are considered for PnL calculation.

The carrying value, cost of carry and PnL are computed based on the following formulae:

- Carrying Value = (Fund Amount Sold / Outstanding Fund Amount) * (Outstanding Fund Amount – Unamortized Fee – Reserve – Contra)

- Cost of carry = Carrying Value – Fund Amount * Price + Unfunded amount *(1– Price) + LC amount * (1– Price)

- Cost of Carry (PnL) = Trade amount * (1– Price) + Unamortized FEE + Reserve + Contra

The PnL entries, in case of loss, are passed as part of trade booking, whereas the PnL entries, in case of profit, are passed as part of trade settlement for the origination desk.

Any amendments to the CLP Sell line origination trades resulting in change of position or PnL, results in an internal reversal of the trade and the trade is re-booked with the revised details. The PnL entries of the original trade is reversed and the reserve, contra and unamortized fee amount as per the revised trade is considered for PnL computation. However, amendment from assignment to Participation type or vice versa is not allowed. It has to be handled by means of reversing the current trade and rebooking the revised trade with the proper deal type.

The amendments also get populated in the ‘Line Trade – Origination Details’ screen and the amended details have to be confirmed before it can be processed further.

A batch program in the OL module handles the reclassification of an exposure as Held for Sale (HFS), for the origination trade amounts. It identifies the list of open trades and trades booked on the current date and arrives at the reclassification break up required for funded amount, unfunded amount and LC amount for each of the origination entity. The reclassification entries are passed for the affected loans and commitment contracts as part of the ‘TRCL’ event. If the cost of credit valuation is selected for the commitment underlying the trades, instead of the re-classification happening during batch, the system does the re-classification during trade booking itself.

Note

- In case of inter desk trading; only the buy leg of the transaction is handed off to agency.

- In case of the new Agency tranche creation involving originations, Oracle Banking Corporate Lending automatically creates the buy trades for the origination desk to reflect the proper position in the SLT layer.

5.8.2 Processing Cost of Credit Valuation for Commitments

If a cost of credit valuation is required for a commitment, when booking is done for a sell trade and the confirmation is received from the origination queue, the following events takes place:

- For the Commitment:

- Refund of unamortized fee for Asset Transfer Marks(FELR) for the reduction in Asset Transfer Marks because of the sell trade

- Refund of FAS 91 fees(FELR) based on the pro-rata % - since FAS 91 fees is combination of all amortization fees except Asset Transfer Marks, refund for FAS91 fees is done by taking the percentage of the loan sales against outstanding of each of the amortization fee components, and refunded, except Asset Transfer Marks

- FAS 114 Unfunded Reserve Release(FRSV) event on the commitment based on the FAS 114 Reserve Unfunded amount confirmed by the Origination Queue

- For the loan

- Write-off (RESR for Principal Decrease) is done on each of the loans based on the pro-rata % of loan sales

- FAS 114 Reserve Funded Release (FRSV) event happens for each of the loan based on the pro-rata % of the loans sales

Note

The offset entry (Credit leg) for these events are posted to the SLT OL Bridge GL (maintained in ‘SLT Branch parameters’ screen) instead of the regular account it would have been posted into, if the triggering had been done manually at the commitment level.

Additionally, the system computes the following balances:

- Direct Write-off (if the computed net PnL results in loss (negative))

- Net Loss

- Net Recovery (if the sale results in profit, PnL being positive)

If there is any amendment in the trade amount, then all the balances required to be computed for the cost of credit valuation is recomputed based on the latest trade amount and new entries posted.

As part of the settlement (TSTL), the system does the net recovery in the following order:

- to the extent of the write-off reduced due to trade booking

- to the extent of Contra reduced due to trade booking

- to the extent of FAS91 fees refunded due to trade booking

- to the extent of Asset Transfer Marks refunded due to trade booking

After net recovery is done, the residual of each of the amounts that was not recovered is recorded, so that the balances in the GL’s for each of these amounts are correct. The net entries for the difference between the Recovery amount for each of the Write-off / Contra / FAS91 fees / Marks and the actual balance populated in Origination Queue is posted at the trade level.

5.8.3 Validating Unamortized Fee

You can re-compute the unamortized fees at TL and OL layer during the origination queue confirmation. If the recomputed fee is different from the existing computed fee then an override is displayed to show the newly computed unamortized fee amount. Click OK if you want the system to overwrite the existing fee and do the processing based on the recomputed fee.

5.8.4 Processing CLP Buy Line Trades

For CLP Buy line trades involving the origination desk, the following three separate trade deals are generated.

- Par desk buying from Customer.(Customer trade)

- Par desk selling to Origination/CLP desk

- Origination/CLP desk buying from Par desk

These three deals are created under the same ticket and are settled together during the ticket settlement.

The origination trade processing is carried out as follows:

- When the third trade details, i.e, origination desk buying from par desk, are handed off from Loans QT to Oracle Banking Corporate Lending, the system checks if the related trade is a line trade.

- If it is a line trade, then the details of this origination buy trade get populated as a separate queue in the ‘Line Trade – Origination Details’ screen.

- Unamortized fee amount, Reserve amount and the contra amount applicable for the Origination desk corresponding to the trade is not fetched to the origination queue for CLP buy trades.

- The origination line trade is processed once you confirm these details.

Upon trade settlement authorization, the system does the amortization FEE liquidation to pass the accounting entries for the price differential during the elevation process of the trade. If the CLP commitment is not associated with the relevant Income/expense amortization FEE components, accounting entries are not passed during trade elevation. The amortization FEE adjustments are to be handled manually.

If the new amortization FEE entries are passed during trade settlement authorization, it does not have any impact on the FEE component due to any kind of CLP Buy trade amendments before the settlement.

Any amendment to the Line Origination buy trades resulting in change of position, the original trade is internally be reversed and rebooked for the revised details. Any change in the unamortized fee which is triggered by Buy trades which is leading to the exceptional cases have to be handled manually.

5.9 Trading with PIK Facility

A PIK loan is a type of loan that does not involve any cash flows from the borrower to the lender, between the drawdown date and the maturity date. Trades involving PIK always need to have the quotation method specified as ‘Flat’.

For trades involving the PIK component, the following three scenarios are possible:

- Tranche has partial availability of the PIK amount

- Tranche has no availability of the PIK amount

- Tranche has sufficient availability of the PIK amount

If the PIK allocation has already happened before the trade is booked, there is not any separate trade processing for the PIK portion. PIK also is treated as part of normal trade amount.

If the PIK happens in the agency, resulting in a commitment increase, the commitment increase details are handed off to Loans QT with the indication that the increase in the commitment is due to PIK. The commitment increase due to PIK is considered at a prize equal to zero except for origination trades, where it is considered at price equal to 100. Loans QT sends an internal deal to Oracle Banking Corporate Lending to the extent of the commitment increase and settled position gets updated with the PIK amount. This internal trade is booked and settled immediately in SLT. For a buy deal, the costing details are updated and for a sell deal the PnL entries are updated. For open trades, Loans QT sends trade amendments to the extent of PIK amount. During settlement, the PIK amount is not considered as it is priced at zero.

If the PIK changes in the agency do not result in commitment increase, the existing settled position remains unchanged. For open trades, the funded portion increases by the PIK amount and the unfunded portion decreases by the PIK amount.

Note

- Delayed compensation fee is not applicable for PIK trades, as they are always quoted as ‘Flat’.

- PIK is applicable only for drawings in the trade currency.

5.10 Querying Position Balances

Positions are maintained for each CUSIP for a combination of desk, branch, expense code, and swap Id/settlement party in case of silent participation. The positions get updated when you book a trade and also when any amendment happens to the trade amount or the buy/sell indicator.

A buy deal results in an open position which gets reduced by a subsequent sell of the CUSIP. A short sell results in a negative position. Position for a CUSIP, can be negative due to short sells, before the settlement date. On the actual settlement date a CUSIP cannot have a negative position.

You can view the position balances for a given position identifier in the ‘Position Balances’ screen.

This section contains the following topics:

- Section 5.10.1, "Resolving Multiple Portfolio Mapping to a Single Expense Code"

- Section 5.10.2, "Updating Positions for Commitment Reductions/ Increases"

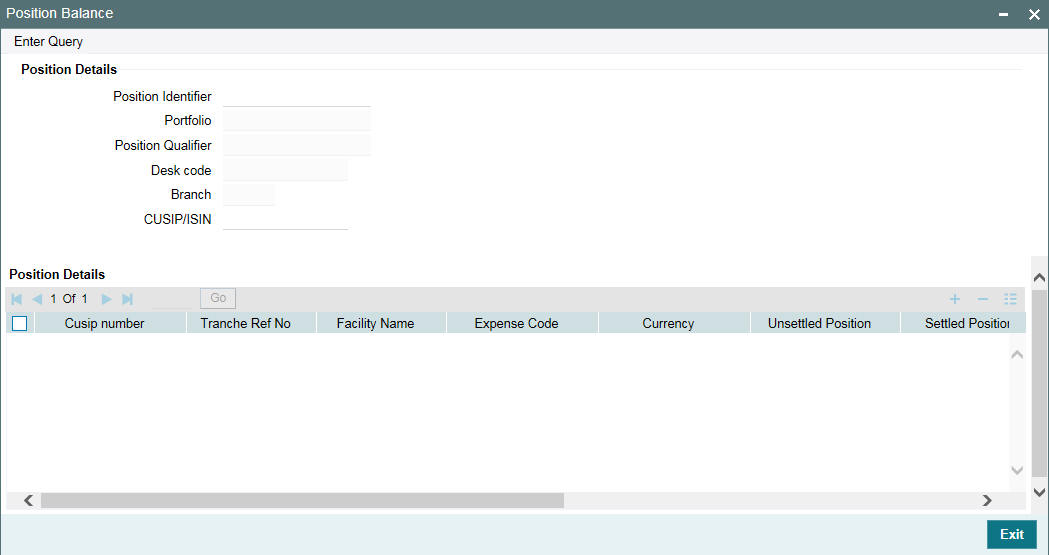

You can invoke the ‘Position Balance’ screen by typing ‘TLDPOSBL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in this screen:

Position Identifier

Select the position identifier for which you want to view position balances for the associated CUSIP.

Following details related to the CUSIP associated with the position identifier selected, are displayed:

- Currency

- Tranche Ref number

- Facility Name

- Expense Code

- Settled position

- Unsettled position

- Total position

- Weighted average costing for the total position of CUSIP

- Settled WAC for the combination of Position Identifier, CUSIP and Expense code

- HFS Cost Basis

- Firm Account Mnemonic

Commitment reduction and PIK amounts are considered for computing settled WAC, at the prices of 100% and zero respectively. The remaining trade amounts are considered at the trade price. The settled WAC is calculated for the net trade amount using the trade price, during trade settlement or reversal of trade settlement. Settled WAC is calculated for all the costing methods (LIFO, FIFO, and WAC) and is applicable for internal trades also.

Note

Settled WAC is not used for any processing in SLT. It is used only for funding activities.

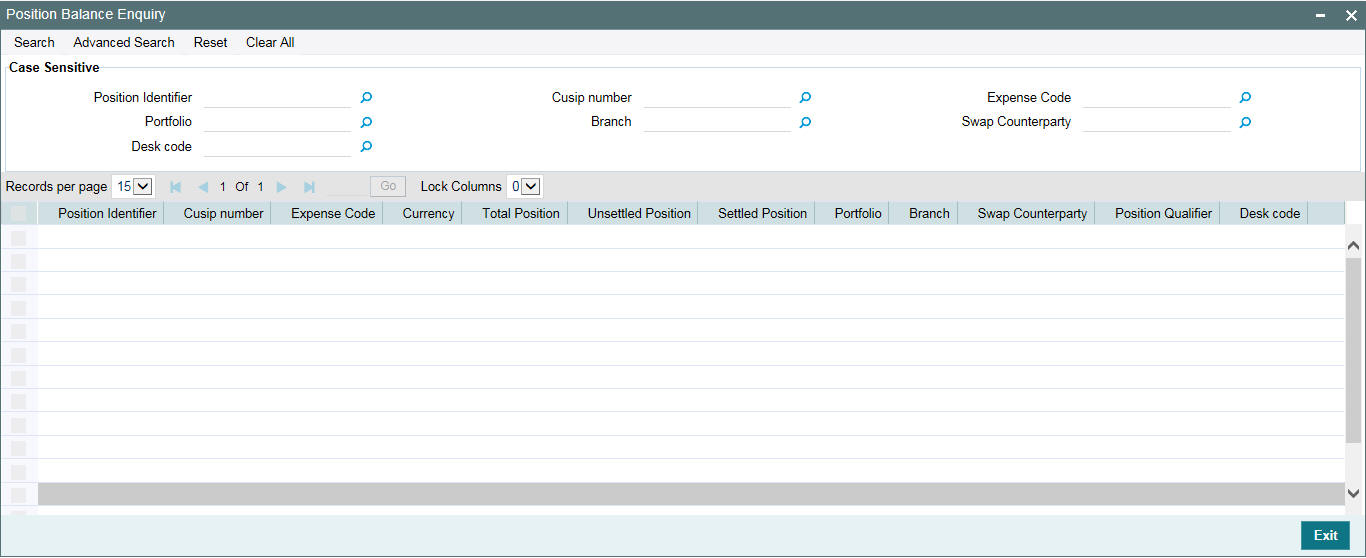

You can get a more detailed view of the balances in the ‘Position Balance Enquiry’ screen. You can invoke the ‘Position Balance Enquiry’ screen by typing ‘TLSPOSBQ’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen you can specify any of the following search parameters:

Position Identifier

Select the position identifier to be used to query the position balances for the CUSIPs.

Portfolio

Select the portfolio to be used to query the position balances for the CUSIPs.

Position Qualifier

Select the position qualifier to be used to query the position balances for the CUSIPs.

Desk

Select the desk for which you want to query the position balances.

Branch

Select the branch for which you want to query the position balances.

Expense Code

Select the expense code for which you want to query the position balances for the CUSIPs.

SWAP Counterparty

Select the SWAP counterparty of the CUSIP for which you want to query the position balances.

The details related to position balances get displayed, according to the search parameters specified. All records satisfying the values specified get displayed for the combination of position identifier and CUSIP.

Note

Branch, desk, and expense code are defaulted, if you specify a value for portfolio.

5.10.1 Resolving Multiple Portfolio Mapping to a Single Expense Code

In case of multiple portfolio mappings for the same expense code, desk code and branch code combinations, system checks if the position (settled or unsettled) is non-zero for any of the mapped portfolios. If system finds any such portfolio, then it is taken as trade portfolio and further processing is done. However, if no position is found or the position (settled and unsettled) is zero, then system takes the default portfolio and proceed with trade processing.

5.10.2 Updating Positions for Commitment Reductions/ Increases

Commitment reductions can happen during trade amendment either using ‘Draft Trade’ screen or from Loans QT. Commitment reduction can happen in the agency, when there is a re-payment for a non-revolving tranche or when there is a reduction in the tranche amount. Commitment increases also can happen during value dated amendments.

The details of the commitment reductions or increases happening in the agency are handed off to Loans QT. The settled positions for the trade amounts for open trades and inter company sell trades are amended, corresponding to these details that are handed off.

Internal trades are automatically settled in the system. For internal trades created because of commitment reduction, system posts accounting entries during settlement since price is involved for the commitment reduction.

To handle commitment reduction for open position, Loans QT sends trade amendments for each open trade. Each of these commitment reductions will be treated with their respective price to calculate PnL or to update the WAC.

The impact of commitment reduction should be considered in case of reversal and rebook (TCNC + TREV + TBOK) of a trade due to trade amendment. Since each commitment reduction can have different price associated with it, the net commitment reduction amount is considered at an average price for such cancellation and rebook.

As part of trade reversal, system cancels and reverses the events (TCNC + TREV).

Note

In case of commitment reduction for CLP trades, the CR price is always considered as 100 for all the three trades irrespective of the CR price received from LQT.

The following a/c entries will be posted during settlement of internal trade created because of commitment reduction:

For Internal Buy Trade with discounted price

Accounting Role |

Amount Tag |

Dr/Cr |

CUSTOMER (Internal GLs) |

UNFND-DIS-BUY |

Dr |

SLT-PREM-DISC

|

UNFND-DIS-BUY |

Cr |

For Internal Buy Trade with premium price

Accounting Role |

Amount Tag |

Dr/Cr |

SLT-PREM-DISC |

UNFND-PRM-BUY |

Dr

|

CUSTOMER (Internal GLs) |

UNFND-PRM-BUY

|

Cr |

For Internal Sell Trade with discounted price

Accounting Role |

Amount Tag |

Dr/Cr |

SLT-PREM-DISC |

UNFND-DIS-SEL |

Dr |

CUSTOMER (Internal GLs) |

UNFND-DIS-SEL |

Cr |

For Internal Sell Trade with premium price

Accounting Role |

Amount Tag |

Dr/Cr |

CUSTOMER (Internal GLs) |

UNFND-PRM-SEL |

Dr |

SLT-PREM-DISC |

UNFND-PRM-SEL |

Cr |

5.11 Calculating Realized Profit and Loss

Realized PnL is calculated during the booking of a trade as well as during cancellation of a trade. During trade amendment, if there are any changes in the position or price, then also realized PnL is calculated.

The costing method to be used for calculating PnL is derived from the portfolio for which the deal has been booked. The costing methods used can be any of the following:

- WAC (Weighted Average Cost)

- FIFO (First in First Out)

- LIFO (Last in First Out)

Realized P&L could result out of either a sale of CUSIP under the same position, or a buy of CUSIP under the same position, if the position is short.

5.11.1 Calculating Realized PnL for Commitment Reductions

When an amendment record comes from Loans QT, a corresponding amendment event gets initiated for the SLT contract also. During amendment the realized PnL entries are not reversed. For the amendment, realized PnL entries are posted for the difference between the initial trade amount and the amended amount.

If the costing method for the portfolio is WAC, it remains unchanged for commitment reductions. The commitment reduction amount is considered at par price for PnL and WAC calculations.

The following example illustrates the computation of realized PnL during commitment reductions:

Example

Let us assume that there is an unsettled buy deal for 100mn, where the costing method used is WAC. If there is a commitment reduction to the extent of 20%, the trade amount is amended to 80mn. PnL entries are posted for a sale of 20mn at par. The PnL is computed by comparing the par price with the price at which the trade was done.

Similarly, if the costing method is WAC and there is an unsettled sell deal for 100mn, in the event of commitment reduction of 20%, the trade amount is amended to 80mn.

PnL entries are posted for a buy of 20mn at par.

5.12 Re-valuating Positions

Revaluation is performed for each open position under a CUSIP against the corresponding position identifier. For each combination of CUSIP and position identifier, the system generates a unique position contract reference number. The revaluation and reserve events along with the related accounting entries are passed for this position reference number.

The revaluation accounting entries are posted for the total position (settled + unsettled) as part of EOD batch program. These accounting entries posted are reversed during the BOD batch for the next working day.

Revaluation is performed using the market price details captured for the CUSIP. If the costing method defined for the portfolio is WAC, the system compares the market price with the WAC for the position. If the costing method is either LIFO or FIFO, then the system compares the trade price with the market price for each deal. A single set of accounting entries are posted for the position contract reference number, netting the revaluation entries for all deals under the CUSIP.

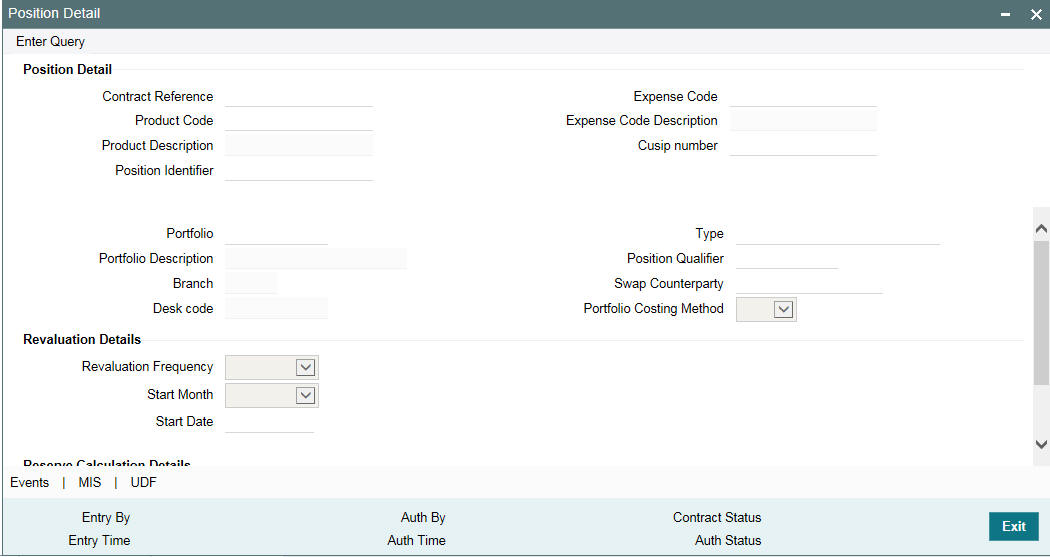

You can view the re-valuation preferences for a position contract in the ‘Position Detail’ screen. You can also view the revaluation accounting entries associated with the contract in this screen.

You can invoke the ‘Position Detail’ screen by typing ‘TLDPOSDT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

A position contract reference number gets automatically generated when a trade is booked for the first time. This reference number is generated for a combination of the position identifier and CUSIP. In this screen, you can only view the details of position contract and the events. The following details related to position contract are displayed:

- Position Identifier – defaults from the trade contract, but for Swap trades it is auto-generated by the system

- CUSIP/ISIN – defaults from trade contract

- Portfolio – defaults from trade contract

- Position Qualifier – defaults from contract

- SWAP counterparty - for all trades other than ‘SWAP’, this defaults to NULL. For swap trades, SWAP counterparty specified at the contract level gets defaulted here

The following details are defaulted from portfolio maintenance.

- Position Product

- Portfolio Costing Method

- Revaluation preferences

- Reserve calculation details

You can view the accounting entries related to revaluation by clicking ‘Events’ in the ‘Position Detail’ screen.

Note

Revaluation for HFS position is done for total position based on HFS cost basis and market price.

For more details on market price maintenance, refer the section ‘Maintaining Market Price Details’ in this user manual.

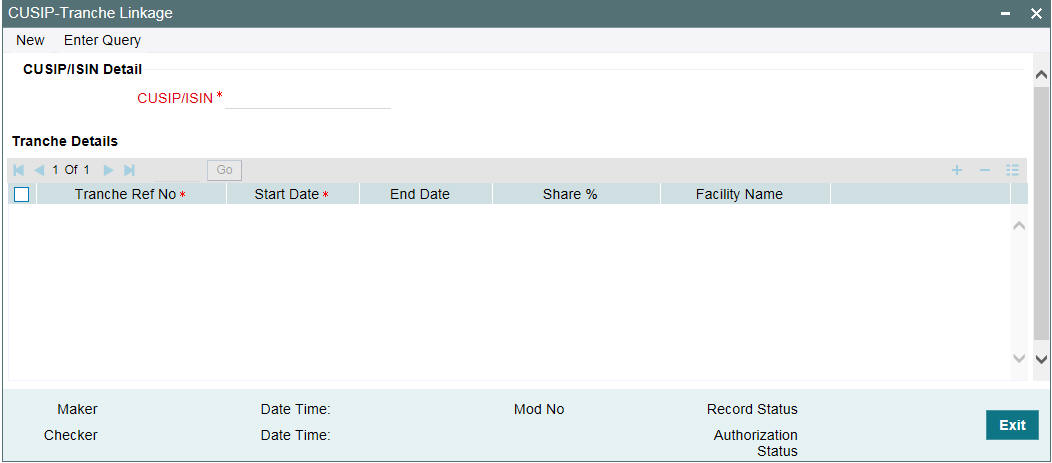

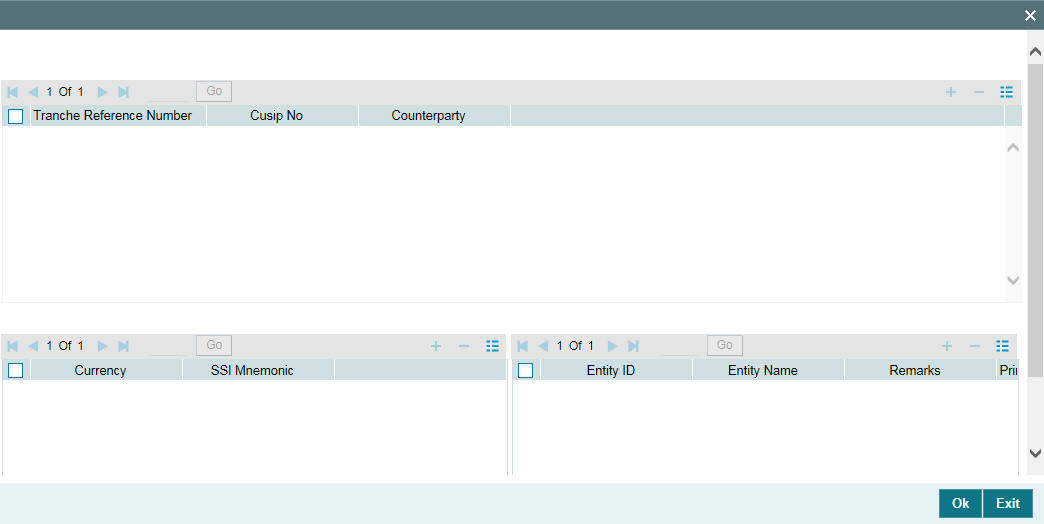

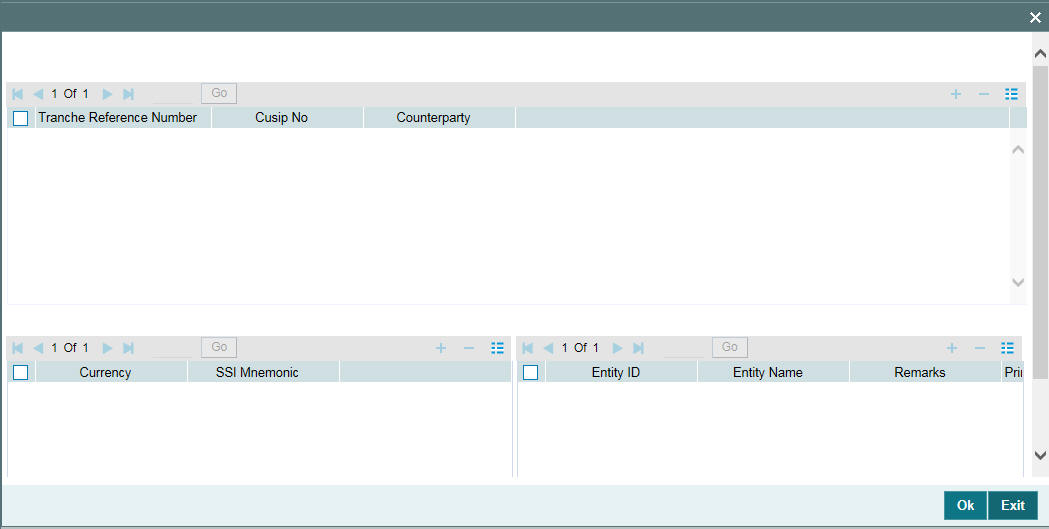

5.13 Maintaining CUSIP-Tranche Linkage

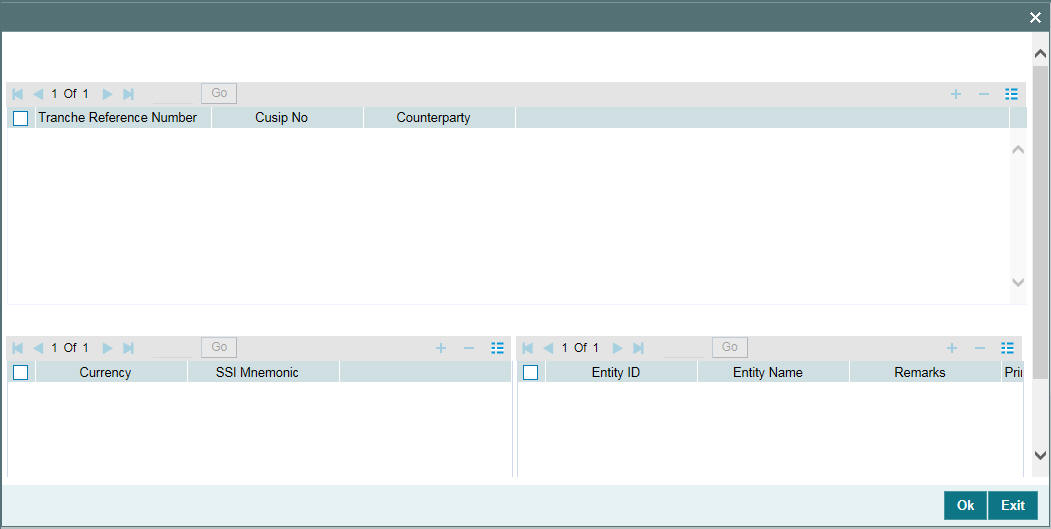

You can link a CUSIP to multiple tranches using the ‘CUSIP-Tranche linkage’ screen.

You can invoke the ‘CUSIP-Tranche Linkage’ screen by typing ‘TLDCULNK’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The system uses the CUSIP-Tranche linkage to accrue DCF for that CUSIP. Note that you can maintain records in this screen only if the box ‘Allow CUSIP/ISIN Swing’ is selected in the ‘Loan Parameters’ screen.

Specify the following details.

CUSIP/ISIN No

Specify the CUSIP for which you want to maintain linked tranche details. The adjoining option list displays all valid CUSIP/ISIN numbers maintained in the system. You can also select the appropriate one from it.

Tranche Details

Specify the following tranche details for the CUSIP/ISIN.

Tranche Ref no

Specify the tranche to which you want to link the CUSIP. The adjoining option list displays all active and liquidated tranches maintained in the system. If the specified CUSIP is linked to both lead and non lead (wrapper) tranches or with only lead tranches, then the option list displays only lead tranches. If the specified CUSIP is linked to non lead (wrapper) tranches, then the option list displays only non lead tranches for which CUSIP amendment has been performed on a tranche contract.

You can also select the appropriate one from it.

Note that you have to maintain the Tranche which is currently associated in the agency for the CUSIP, if the tranche is active.

In addition, you cannot delete a tranche if it is linked to the CUSIP in the agency. The deleted tranche is not considered for DCF calculation.

Start Date

Specify the date from which the tranche should be linked to the CUSIP. This date should lie between the associated tranche value date and maturity date.

End Date

Specify the date until which the tranche should be linked to the CUSIP. This date must be greater than the start date. You should leave this field blank if the Tranche is active. Accrual is done till this date.

Share %

If the dates given for tranches overlap, then you have to provide the share percentage for those tranches. The sum of all share percentages should add up to 100.

If you mention the share percentage for multiple tranches, you should ensure that the start and end dates are the same for all those tranches.

Facility Name

The system displays the facility linked to the specified tranche.