6. Processing Fee Details

This chapter contains the following sections:

- Section 6.1, "Introduction"

- Section 6.2, "Amending Fee Details"

- Section 6.3, "Liquidating Fee Components"

6.1 Introduction

Different types of fees are involved in the trading of a syndicated loan. The following are the various types of fees involved in trading:

- Assignment fee

- Amendment fee

- Line/Accommodation fee

- Delayed compensation fee

- Break funding fee

- Waiver Fee

- Benefit of commitment reduction fee

- Upfront fee

The following two adhoc fee components are also involved in the trading process:

- Buyer to seller fee

- Seller to Buyer fee

The different types of the fees and their significance in the trading process are explained in the subsequent sections.

This section contains the following topics:

- Section 6.1.1, "Specifying Assignment Fee Details"

- Section 6.1.2, "Suppressing Wire Messages for Assignment Fees"

- Section 6.1.3, "LQT Trade Upload"

- Section 6.1.4, "Specifying Amendment Fee Details"

- Section 6.1.5, "Specifying Line/Accommodation Fee Details"

- Section 6.1.6, "SLT - Accounting for Amendment Fee"

- Section 6.1.7, "Specifying Delayed Compensation Fee Details"

- Section 6.1.8, "Specifying Break Fund Fee Details"

- Section 6.1.9, "Specifying Waiver Fee Details"

- Section 6.1.10, "Specifying Benefit of Commitment Reduction Fee (BCR) Details"

- Section 6.1.11, "Specifying Upfront Fee Details"

- Section 6.1.12, "Specifying Adhoc Fee Details"

- Section 6.1.13, "Specifying Brokerage Details"

6.1.1 Specifying Assignment Fee Details

The assignment fee refers to the flat fee that needs to be paid to the agent facilitating the trade. This fee can be paid either by the buyer or the seller fully, or can be shared between the buyer and the seller.

Following steps are involved in capturing and processing the assignment fee associated with a trade contract:

- The assignment fee component gets linked to the SLT product in the ‘SLT Product Fee Details’ screen.

- The assignment fee details for a trade contract are specified in the ‘Fee Components’ screen associated with the contract.

- The buyer’s and the seller’s contribution to the assignment fee is captured in this screen.

- You can capture the customer number of the agent to whom the assignment fee is to be paid and also indicate the remitter of the assignment fee in the ‘Draft Trade’ screen and the ‘Trade settlement’ screen.

- Based on the value of ‘Assignment Fee Remitter’, ‘Assignment Fee Type’, and the buy/sell attribute of the trade, the assignment fee gets remitted to the agent or the counterparty involved in the deal.

For ‘Split’ type of assignment fee payments, the split amounts get posted to the agent and counterparty accounts.

The accounting entries posted for different scenarios of assignment fee collection is given below:

Fee Type |

Bank is Buyer |

Bank is Seller |

Assignment Fee Type =BUYER & ‘BUYER WILL REMIT’ |

Dr Expense A/c Cr Agent A/c |

No entries |

Assignment Fee Type =BUYER & ‘SELLER WILL REMIT’ |

Dr Expense A/c Cr Counterparty A/c |

Dr Counterparty A/c Cr Agent A/c |

Assignment Fee Type =SELLER & ‘SELLER WILL REMIT’ |

No entries |

Dr Expense A/c Cr Agent A/c |

Assignment Fee Type =SELLER & ‘BUYER WILL REMIT’ |

Dr Counterparty A/c Cr Agent A/c |

Dr Expense A/c Cr Counterparty A/c |

Assignment Fee Type =SPLIT & ‘BUYER WILL REMIT’ |

Dr Counterparty A/c (for the specified fee amount for Seller) Dr Expense A/c (for the specified fee amount for Buyer) Cr Agent A/c (for the full Fee amount) |

Dr Expense A/c (for the specified fee amount for Seller) Cr Counterparty A/c (for the specified fee amount for Seller) |

Assignment Fee Type =SPLIT & ‘SELLER WILL REMIT’ |

Dr Expense A/c (for the specified fee amount for Buyer) Cr Counterparty A/c (for the specified fee amount for Buyer) |

Dr Counterparty A/c (for the specified fee amount for Buyer) Dr Expense A/c (for the specified fee amount for Seller) Cr Agent A/c (for the full Fee amount) |

6.1.2 Suppressing Wire Messages for Assignment Fees

- If the value is ‘PAID IN ADVANCE’, the wire messages that should be remitted to the agent with reference to assignment fee is suppressed.

Note

If the value of the field ‘Assignment Fee Type’ is other than ‘PAID IN ADVANCE’, the wire messages with reference to assignment fee are remitted to the agent.

- The accounting entries related to assignment fee is posted and other wire messages to the external counterparty are remitted.

- If the value of the field ‘Assignment Fee Type’ is ‘PAID IN ADVANCE’, but SDN message is received for settlement of the trade contract, the fee type is considered as ‘Split’ and wire message is generated for the assignment fee amount.

- If the value of the field ‘Assignment Fee Type’ is ‘PAID IN ADVANCE’ and the trade contract is settled manually, the accounting entries are posted for the amount tag ‘ASGNF_SPT1’.

6.1.3 LQT Trade Upload

- LQT trade upload processes the ‘PAID IN ADVANCE’ value in ‘ASSIGNMENTFEE_TYPE’ field from the LQT feed.

- Defaults the value of the field ‘Assignment Fee Type’ as ‘PAID IN ADVANCE’ in the Draft Trade Input, Trade Online and Settlement screens, if the value ‘PAID IN ADVANCE’ is received from the LQT feed.

- If you amend the value of the field ‘ASSIGNMENTFEE_TYPE’ through LQT trade upload, the system does not reverse and rebook the trade with the new value.

6.1.4 Specifying Amendment Fee Details

Amendment fee is the fee that needs to be paid for any changes in the agency between the trade date and the settlement of the trade. This fee is paid by the seller to the buyer.

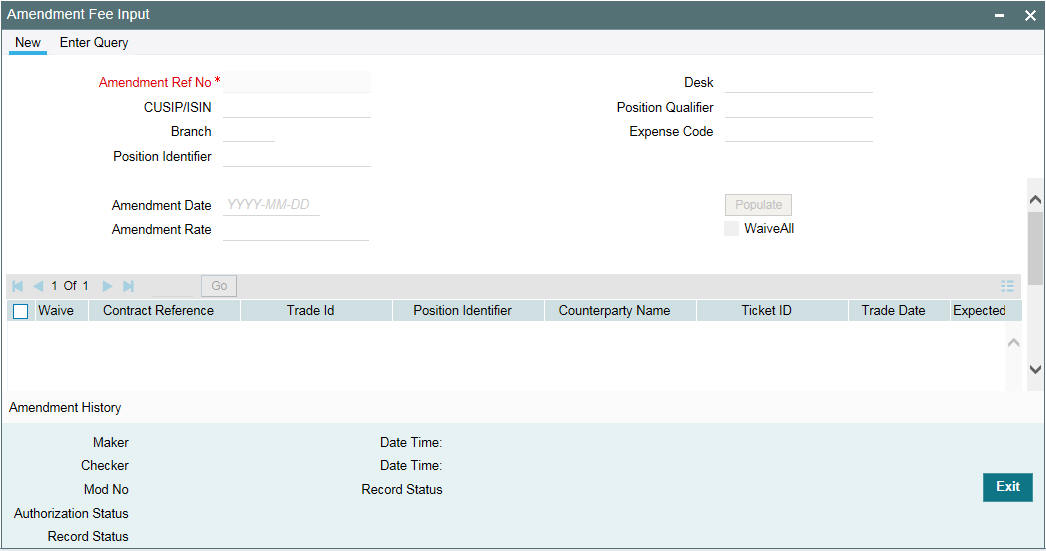

You can capture the details of the amendment fee in the ‘Amendment Fee Input’ screen. You can invoke the ‘Amendment Fee Input’ screen by typing ‘TLDAMFEE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in this screen:

CUSIP/ISIN

Select the CUSIP number of the facility associated with the trade you wish to amend, from the option list provided.

Amendment Date

Specify the date on which the amendments on the trade should become effective.

Click ‘Populate’ to display the details of all open trades under the CUSIP with trade date less than or equal to the amendment date.

You can also provide the following additional search values to select the trade for amendment.

Position Identifier

Select the position identifier associated with the trade you wish to amend, from the option list provided.

Position Qualifier

Select the position qualifier associated with the trade you wish to amend, from the option list provided.

Branch

Select the branch associated with the trade you wish to amend, from the option list provided.

Desk

Select the desk where trade you want to amend originated, from the option list provided.

Expense Code

Select the branch expense code with the trade you want to amend, from the option list provided.

Amendment Rate

Specify the amendment fee rate to be applied to all open trades under the CUSIP. Fee amount gets calculated automatically for all open trades listed.

Note

You can modify the auto calculated fee amount, if required.

Waive All

If this check box 'Waive All' is selected then amendment fee is waived for all the trades for an amendment date. You are allowed to clear 'Waive' check box for a specific trade after selecting 'Waive All' check box.

Waive

By default, the ‘Waive’ check box for each trade is not selected. If ‘Waive’ check box is selected for a trade, then the amendment fee is waived for the current amendment date.

Example:-

Amendment Fee for Trade 1 |

100.00 |

Trade Date |

1-Apr-2015 |

Amendment fee is captured multiple times for trade1 in amendment fee input screen as below

Amendment Date |

Fee Amount |

Waive |

1-May-2015 |

50.00 |

No |

1-Jun-2015 |

30.00 |

No |

1-Jul-2015 |

20.00 |

No |

Another amendment fee input is processed for the amendment date 1-Aug-2015 for the fee amount of 25. If ‘Waive’ check box is cleared for 1-Aug-2015 then amendment fee for trade 1 is 125. If the ‘Waive’ check box is selected then trade continues to have the prior fee amount of 100 as the fee amount of 25 is waived for the amendment date 1-Aug-2015.

Fee Amount

Specify the amendment fee amount for each open trade listed for the CUSIP. You can also specify the fee rate, based on which the amount is calculated automatically.

After the details specified are authorized, the amendment fee gets updated for all open trades, correspondingly. If any amendment fee already exists for the trade, the new amount gets added to the existing amount to arrive at a consolidated amendment fee amount.

For a trade, if amendment fee needs to be applied for various days between the trade date and settlement date, the fee amount for each gets summed up and defaulted to the trade for its settlement.

The accounting entries posted for amendment fee is specified below.

Bank is Buyer |

Bank is Seller |

Dr Trade Counterparty A/c Cr Income a/c |

Dr Expense a/c Cr Trade Counterparty A/c |

Waiving amendment fees

You are allowed to unlock a record for a specific amendment date and waive amendment fee for one or more trades. Only ‘Waive’ and ‘Waive All’ check box are allowed to change during unlock operation. Remaining all fields are view only during unlock and you are not allowed to change fee rate or fee amount once the amendment fee record is saved for a given amendment date.

Example:-

Amendment fee for trade 1 before amendment - 100

Amendment Date |

Fee Amount |

Waive |

1-May-2015 |

50.00 |

No |

1-Jun-2015 |

30.00 |

No |

1-Jul-2015 |

20.00 |

No |

Amendment fee for trade 1 after amendment

Amendment Date |

Fee Amount |

Waive |

1-May-2015 |

50.00 |

No |

1-Jun-2015 |

30.00 |

Yes |

1-Jul-2015 |

20.00 |

No |

Amendment fee amount becomes 70 as the fee is waived for trade 1 for the amendment date 1-Jun-2015

- Amendment fee is allowed to be waived or un-waived even after the liquidation of amendment fee. In such cases, the residual amendment fee amount is allowed to be liquidated in the existing fee liquidation screen as per the existing functionality.

Example:

Amendment fee is liquidated for 50.

Amendment Date |

Fee Amount |

Waive |

1-May-2015 |

50.00 |

No |

1-Jun-2015 |

30.00 |

Yes |

- Amendment fee is allowed to be un-waived for 30 and the total amendment fee amount becomes 80. The residual 30 can be liquidated in the ‘Fee Liquidation’ screen.

- Amendment fee is allowed to be waived for 50 and the total amendment fee amount becomes 30. The residual (-50) can be liquidated in the ‘Fee Liquidation’ screen.

- Currently, amendment fee can be amended or captured in ‘Amendment Fee Input’ screen for settled and unsettled trades having trade date lesser than or equal to the amendment date and actual settlement date greater than or equal to the amendment date.

- After settlement, when amendment fee is waived for an amendment date then if the fee amount will be in negative; when amendment fee is un-waived for an amendment date then the fee amount will be in positive.

- The differential fee amount can be liquidated in the existing fee liquidated screen.

- Currently, amendment fee change is not allowed when the trade is captured (but not settled) in ‘Ticket Settlement’ or ‘Combined Ticket Settlement’ screen and the payment message is generated at the sub-ticket level (Payment message netting).

- Since payment message is already generated, if amendment fee is changed before settlement then amendment fee amount during settlement is different than the amount that is sent in PMSG. Hence the fee amendment is blocked in such cases

- Additionally, waiver or un-waiver also is not allowed in the ‘Amendment Fee Input’ screen.

- Currently, modification is allowed in ‘Amendment Fee Input’ screen for the trades with Par, Distress and Origination desks.

7. All three legs of CLP trades are populated for modification as per the existing functionality. You are allowed to waive any leg (for example, PL trade, par selling/buying from origination) and this should be manually done.

8. You are allowed to close a specific amendment fee record. On save of ‘Close’ operation, system reduces the amendment fee amount that was applied for the specific amendment date from all the applicable trades.

Example:-

Amendment Date |

Fee Amount |

Waive |

Open |

1-May-2015 |

50.00 |

No |

Yes |

1-Jul-2015 |

20.00 |

No |

Yes |

Total amendment fee for trade 1 is 70.

Amendment Date |

Fee Amount |

Waive |

Open |

1-May-2015 |

50.00 |

No |

Yes |

1-Jul-2015 |

20.00 |

No |

No |

Total fee amount becomes 50 as 1-Jul-2015 record is closed.

9. Deletion of amendment fee record is allowed for a specific amendment date before authorization. FAMD event is deleted and fee amount associated with the amendment date is reduced appropriately for each trade.

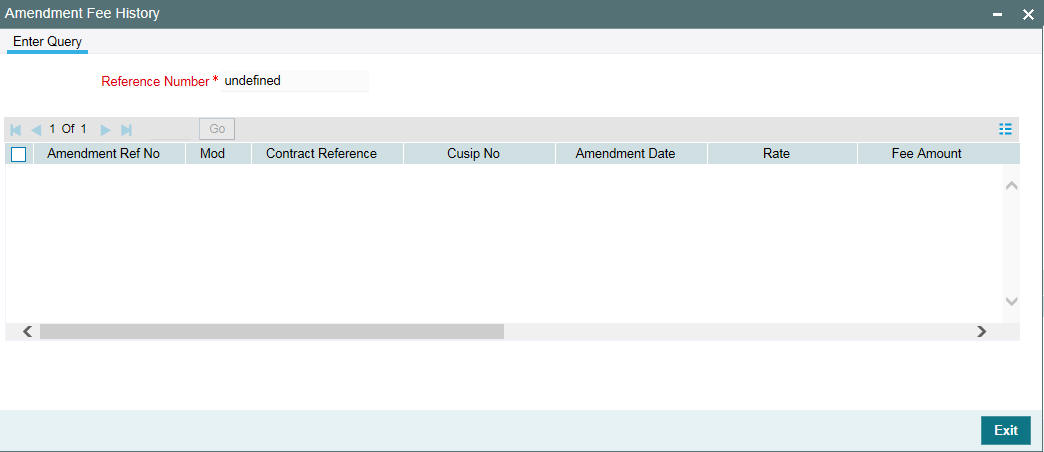

6.1.4.1 Amendment Fee History

You can invoke the ‘Amendment Fee Input’ screen by typing ‘TLDAMFEH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

- You can view amendment history for each trade

- You can view history details for a specific trade with prior amendments

- You can only view history details

Example:-

You have performed multiple amendments for trade1 as below for the amendment date 1-Jun-2015.

Amendment Date |

Fee Amount |

Waive |

Amendment # |

1-May-2015 |

50.00 |

No |

1 |

1-Jun-2015 |

30.00 |

Yes |

1 |

1-Jun-2015 |

20.00 |

No |

2 |

1-Jun-2015 |

10.00 |

Yes |

3 |

1-Jul-2015 |

20.00 |

No |

1 |

Amendment#3 for trade 1 is displayed in the main screen. Amendment#1 and 2 with appropriate audit trial details for trade 1 is displayed in the ‘Amendment Fee History’ screen.

1. Below validations are performed in the amendment fee input screen.

- Only one open record should exist for the combination of CUSIP, amendment

date and query fields (branch, desk, expense code, position identifier,

and position qualifier).

- If an open maintenance exists for the combination of CUSIP and amendment date with blank value for the query fields then you are not allowed to maintain one more record for the same combination of CUSIP and amendment date. However, you can maintain amendment fee record for a different amendment date for the same CUSIP with query fields as blank or with specific value.

Example1:-

Maintenance exists for the combination of CUSIP and amendment date with blank value for query fields.

CUSIP |

Amendment Date |

Branch |

Desk |

Expense Code |

Position Identifier |

Position Qualifier |

CUSIP1 |

1-Feb-16 |

|

|

|

|

|

Maintenance as mentioned below is not allowed

CUSIP |

Amendment Date |

Branch |

Desk |

Expense Code |

Position Identifier |

Position Qualifier |

CUSIP1 |

1-Feb-16 |

001 |

PAR |

04321 |

060083 |

12345 |

- If an open maintenance exists for the combination of CUSIP and amendment date with specific value for the query fields then you are not allowed to maintain one more record for the same combination of CUSIP and amendment date with blank value for the query fields.

Example2:-

Maintenance exists for the combination of CUSIP and amendment date with specific value for query fields.

CUSIP |

Amendment Date |

Branch |

Desk |

Expense Code |

Position Identifier |

Position Qualifier |

CUSIP1 |

1-Feb-16 |

001 |

PAR |

04321 |

060083 |

12345 |

Maintenance as mentioned below is not allowed

CUSIP |

Amendment Date |

Branch |

Desk |

Expense Code |

Position Identifier |

Position Qualifier |

CUSIP1 |

1-Feb-16 |

|

|

|

|

|

However, the below maintenance are allowed as the portfolio, expense code and position identifier are different

CUSIP |

Amendment Date |

Branch |

Desk |

Expense Code |

Position Identifier |

Position Qualifier |

CUSIP1 |

1-Feb-16 |

001 |

ORIG |

00031 |

060086 |

12345 |

If specific value is maintained for one query field then all query field should have a specific value

Example3:-

Below maintenance is not allowed

CUSIP |

Amendment Date |

Branch |

Desk |

Expense Code |

Position Identifier |

Position Qualifier |

CUSIP1 |

1-Feb-16 |

001 |

ORIG |

00031 |

060086 |

BLANK |

Note

Maintenance have to be closed for the combination of CUSIP, amendment date and query fields and new maintenance have to be created for the same combination to apply different amendment fee rate for the trades under the CUSIP.

- Above mentioned validations are performed during

- Amendment fee is captured manually in ‘Amendment Fee Input’ screen

- Amendment fee record is reopened for a specific amendment date.

- At least one active or settled trade should be present for the combination of CUSIP and amendment date to save amendment fee input.

- Trade settlement fails if amendment fee input is unauthorized for the trade.

- Trade is not displayed in the ‘Amendment Fee Input’ screen

when ‘Populate’ button is pressed during the below mentioned

scenarios

- Trade settlement is unauthorized for the trade

- Ticket settlement is unauthorized with the trade

- Combined ticket settlement is unauthorized with the trade

- Fee liquidation is unauthorized for the trade

Currently, amendment fee can be captured in the ‘Amendment Fee Input’ screen though the fee is waived at the component level but settlement is not allowed for the amendment fee.

When actual settlement date is lesser than the amendment date and amendment fee exists for the trade with amendment date greater than actual settlement date then amendment fee is recomputed during settlement by excluding the fee amount associated with the amendment date which is greater than the actual settlement date. This can occur in two scenarios

- When future dated amendment fee input is captured and the trade is settled today

- When the trade is settled with actual settlement date in past and amendment fee input is captured for today or back dated.

6.1.4.2 Systematic (Re) Calculation of Amendment Fee

- Oracle Banking Corporate Lending systematically recalculates the amendment fee amount for each amendment date during the below trade activities.

- During trade amount amendment for the Par and Distressed desks, system recalculates amendment fee for all the amendment dates available for the trade. TAMD event is registered for such amendments and there are no accounting entries during TAMD.

Note

Currently, accounting entries are not posted for amendment fee if fee is captured or updated during trade booking, trade amendment and fee amendment.

- The latest trade amount is considered for the amendment fee computation if there is no commitment reduction / PIK amendment for the trade. If commitment reduction / PIK amendment exists then trade amount as of the amendment date is considered for the calculation of amendment for each amendment date.

Example without PIK and Commitment Reduction:-

Activity for Trade1 |

Value Date |

Trade Amount |

Commitment Reduction/Increase |

PIK |

Trade booked |

1-Apr-15 |

100,000.00 |

- |

- |

Amount amendment On 20-May-2015 |

1-Apr-15 |

95,000.00 |

- |

- |

Note

Trade booked on 1-Apr-2015 with trade date as 1-Apr-2015

Amendment fee computation in amendment fee input screen for trade 1 after trade amount amendment

Amendment Date |

Fee Rate |

Trade Amount |

Fee Amount |

Waive |

10-May-15 |

0.40% |

95,000.00 |

380.00 |

No |

1-Jun-15 |

0.30% |

95,000.00 |

285.00 |

No |

|

Amendment Fee for the trade |

665.00 |

|

|

Example with PIK and Commitment Reduction:-

Activity for Trade1 |

Value Date |

Trade Amount |

Commitment Reduction/Increase |

PIK |

Trade booked |

1-Apr-15 |

100,000.00 |

- |

- |

Commitment Reduction |

9-May-15 |

95,000.00 |

(5,000.00) |

- |

PIK |

20-May-15 |

96,000.00 |

|

1,000.00 |

Commitment Increase |

30-May-15 |

98,000.00 |

2000.00 |

- |

Commitment Reduction |

10-Jun-15 |

88,000.00 |

(10,000.00) |

- |

Amendment fee computation in amendment fee input screen for trade 1

Amendment Date |

Fee Rate |

Trade Amount |

Fee Amount |

Waive |

10-May-15 |

0.40% |

95,000.00 |

380.00 |

No |

1-Jun-15 |

0.30% |

98,000.00 |

294.00 |

No |

|

Amendment Fee for the trade |

674.00 |

|

|

- PIK and commitment reduction events processed with value date lesser

than or equal to the amendment date is considered for re-calculation

of the amendment fee amount.

- In the above example, commitment reduction processed on 9-May-2015 has been considered for the amendment date 10-May-2015

- PIK and commitment reduction events processed with value date after

the amendment fee date is not considered for re-calculation of the amendment

fee amount.

- In the above example, commitment reduction processed on 10-Jun-2015 has not been considered for the amendment fee calculation.

- When amendment fee is un-waived for a trade for a specific amendment date then amendment fee is recomputed for the trade amount as on the amendment date; trade amount is arrived based on the latest commitment reduction / PIK balance as on the amendment date.

Note

Original trade amount is not used for the amendment fee computation.

- Records in amendment fee input screen will remain unchanged when user performs trade amendment and waive the amendment fee component. In such cases, amendment fee is not allowed to be settled.

If user performs trade amendment and un-waive the amendment fee component then the amendment fee is considered for settlement.

6.1.4.3 Other Fee related changes

- You are not allowed to edit the amendment fee amount and rate from the trade Input screen (‘Draft Trade’ screen). However, you can waive amendment fee at the component level even if amendment fee exists for the contract. In such cases, system does not allow to settle amendment fee.

- Amendment is allowed for the remaining fee components from the ‘Draft Trade’ screen.

- For CUSIP swing, if a new trade is booked with a new CUSIP and there is no maintenance for the new CUSIP in ‘Amendment Fee Input’ screen then amendment fee will not be applied on the new trade. This should be manually done.

- During CUSIP amendment, system reverses the existing trade and book a trade with a new CUSIP. Amendment fee is not applied on the new trade if maintenance is not available for the new CUSIP in ‘Amendment Fee Input’ screen.

- Currently there are multiple fields to filter the population of trade reference number in ‘Amendment Fee Input’ screen (branch, position identifier, expense code, so on); if these fields are used for query during ‘Amendment Fee Input’ screen then amendment fee is calculated for the new/re-booked trades only if all the conditions are met.

Example:- Amendment fee maintenance exist in the ‘Amendment Fee Input’ screen for the below combination.

Branch |

001 |

CUSIP |

CUSIP1 |

Portfolio |

060083 |

Trade booked with CUSIP1 under the branch 001 but portfolio is 179471 then amendment fee is not applied for the new trade.

- Trade reversal does not remove the trade record(s) from ‘Amendment Fee Input’ screen..

- Funding memo regeneration will be required when amendment fee is waived or un-waived in the ‘Amendment Fee Input’ screen after capturing future dated ticket or trade settlement. Funding memo status will be changed to ‘Regenerate FMEM’ in the trade settlement screen during authorization of amendment fee input in such cases.

6.1.5 Specifying Line/Accommodation Fee Details

Line or accommodation fee is involved for trades executed by a desk on behalf of some other desk. Line or accommodation fee is calculated based on the commission rate received from the external system, Loans QT.

Following steps are involved in capturing and processing the line/accommodation fee associated with a trade contract:

- The line/accommodation fee component gets linked to the SLT product in the ‘SLT Product Fee Details’ screen.

- The commission rate for the trade contract is captured as the ‘Fee Rate’ in the ‘Fee Components’ screen associated with the contract.

- The line/accommodation fee is calculated as per the formula given below:

Fee = Trade Nominal Amount * Commission Rate

The account entries posted for line/accommodation fee posted for the trade booking event (TBOK) for the SLT trade products (Origination Line (OL) and Par Line (PL) trade) is given below:

For Origination buy/sell from Par (OL) |

For Par Desk in the Line trade |

Dr Line Fee GL Cr SLT Bridge Account |

Cr Line Fee GL Dr SLT Bridge Account |

Note

- After the Par desk Line Trade is booked using the department code, all accounting entries, including the line/accommodation fees that are posted for the line trade of par desk will be posted using the defaulted department code.

- Line/Accommodation Fee GL should be maintained as part of the Accounting Role to Head mapping in the SLT Trade Product.

- SLT Bridge Account is derived while posting the entries from the SLT Branch Parameters setup for the trade branch and trade currency.

- Line or accommodation fee is not supported when ‘ORIG desk to External Counterparty ‘check box is selected for Origination desk.

6.1.6 SLT - Accounting for Amendment Fee

During EOD Oracle Banking Corporate Lending post the accounting entries for an amendment fee for the trades booked in a day. This can due to following changes.

- Trade is waived or not waived in 'Amendment Input' screen

- Amendment fee transaction containing the trade is closed or re-opened in 'Amendment Input' screen

- Amendment fee is waived at component level in 'Trade -Draft' screen

- If amendment fee is changed and then settlement or fee liquidation happens on the same day

- Reverse the amendment fee accrual entries as part of trade reversal

6.1.6.1 Specifying Amendment Fee Accrual

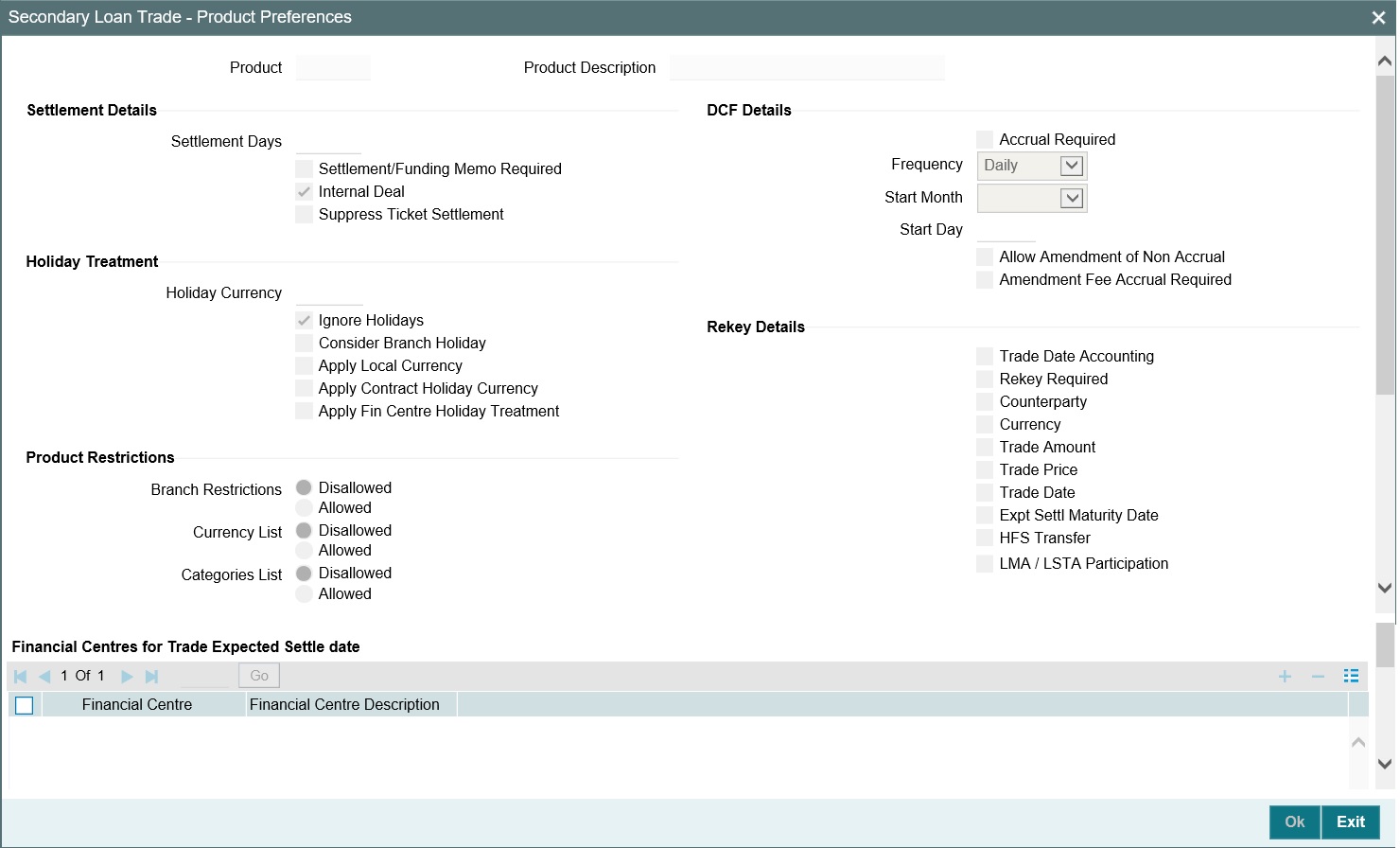

You can select ‘Amendment Fee Accrual Required’ check box for trade products from ‘Secondary Loan Trade -Product Preferences’ (TLDPRMNT) screen. If this is check box is selected, then amendment fee accrual processing is applicable.

Note

Amendment fee accrual is not applicable for CLP trades.

6.1.6.2 Amendment Fee Accrual during Settlement and Fee Liquidation

- Accrual entries are posted for amendment fee during settlement when

- When actual amendment fee amount is changed in ‘Funding Memo’ screen

- The trade is booked with amendment fee and settled on the same day.

- Settlement is performed on the same day of trade amendment where the amendment fee is revised as part of trade amendment.

- Settlement is performed on the same day of trade amendment where the amendment fee is waived at the component level.

- Amendment fee record is closed or reopened in ‘Amendment Fee Input’ screen and settlement is performed on the same day.

- Amendment fee record is waived or not-waived in ‘Amendment Fee Input’ screen and settlement is performed on the same day.

Note

The above changes will be done when a trade is settled in trade settlement or ticket settlement or combined ticket settlement screen.

- Accrual entries are posted for amendment fee during fee liquidation when

- Fee Liquidation is performed on the same day of trade amendment where amendment fee input record is created for the settled trade with amendment date between trade date and actual settlement date.

- Amendment fee record is closed or reopened in ‘Amendment Fee Input’ and fee liquidation is performed on the same day.

- Amendment fee record is waived or un-waived in ‘Amendment Fee Input’ and fee liquidation is performed on the same day.

- Amendment fee accrual entries are not reversed when trade settlement is reversed (RSTL) or fee liquidation is reversed (FREV). Amendment fee amount remains same after RSTL and FLIQ and it is not updated with the amendment fee amount that exists prior to the settlement.

- Amendment fee accrual entries are reversed for a trade when the trade is reversed.

For information accounting entries, refer to ‘Accounting Entries for Amendment Fees’ section in this User Manual.

6.1.7 Specifying Delayed Compensation Fee Details

Delayed compensation fee (DCF) is calculated for trades whose settlement gets delayed. If the settlement does not happen as on T+7/T+20, according to standards, a delayed compensation fee is calculated and applied for ‘SWOA’ type of quotations. DCF is not applicable if the trade quotation method is ‘FLAT’.

The delayed compensation fee component is linked to the SLT product in the ‘SLT Product Fee Details’ screen. Calculation of DCF is triggered only if the actual settlement date exceeds the expected settlement date as specified in ‘Draft Trade’ screen.

There are various components associated with DCF which can be summarized as follows:

6.1.7.1 DCF on Funded Amount

DCF for the funded amount will be calculated for the period from expected settlement date till the actual settlement date.

Par and TRS Trades

For Par and TRS trades the following fee components are calculated for funded amount:

- Interest computed on Libor Funded Amount, exchanged from seller to

buyer. The DCF category used is ‘DCF-FIX-MARGIN’ (DCF interest

using margin for Fixed type drawdowns) calculated as follows:

- Libor Funded amount * (Actual Settlement Date – Expected Settlement Date) * Margin/Denominator basis

Where,

Libor Funded amount is the sum of outstanding amount of all the Libor (Fixed) type drawdowns under the CUSIP

Margin = Spread + Oracle Banking Corporate Lending Margin

Denominator basis is arrived based on the value of Fee calc Basis.

- Interest computed on Prime Funded Amount, exchanged from seller to

buyer. The DCF category used is ‘DCF-FLT-INT’ (DCF All-in-rate

interest for Floating type drawdowns) calculated as follows:

- Prime Funded amount * (Actual Settlement Date – Expected Settlement Date) * All-in Rate

Where,

Prime Funded amount is the sum of outstanding amount of all the Prime (Float) type drawdowns under the CUSIP

All-in Rate = Base rate+ Spread+ Oracle Banking Corporate Lending Margin

Denominator basis is arrived based on the value of Fee calc Basis

- Cost of Fund computed on Prime Funded Amount, exchanged from buyer

to seller. The DCF category used is ‘DCF-FLT-COF’ (DCF Cost

of Funds for Floating type drawdowns) calculated as follows:

- Prime Funded amount on Expected settlement Date(T+7) * (Settlement Date – Expected Settlement Date)* Average Libor Rate/ Denominator basis

Where,

Prime Funded amount on Expected settlement Date (T+7) is the sum of outstanding amount of all the Prime (Floating) type drawdowns under the CUSIP on the expected settlement date (T+7).

Average Libor Rate is derived using data from ‘Average Libor rate Maintenance’ and is calculated from T+7 through settlement date.

Distressed Trades

For Distressed trades the following fee components are calculated for funded amount:

- Interest computed on Prime Funded Amount, exchanged from seller to buyer. The DCF category used is ‘DCF-FLT-INT’ (DCF All-in-rate interest for Floating type drawdowns) calculated as explained before.

- Interest computed on Libor Funded Amount, exchanged from seller to

buyer. The DCF category used is ‘DCF-FIX-INT’ (DCF All-in-rate

interest for Fixed type drawdowns) calculated as follows:

- Libor Funded amount * (Actual Settlement Date – Expected Settlement Date) * All-in Rate

Where,

Libor Funded amount is the sum of outstanding amount of all the Libor (Fixed) type drawdowns under the CUSIP

All-in Rate = Base rate+ Spread+ Oracle Banking Corporate Lending Margin

Denominator basis is arrived based on the value of Fee calc Basis.

- Cost of Carry computed on Prime Funded Amount, exchanged from buyer

to seller. The DCF category used is ‘DCF-FLT-COC’ (DCF Cost

of Carry for Floating type drawdowns) calculated as follows:

- Prime Funded amount on Expected settlement Date(T+7)*Trade Price * (Actual Settlement Date – Expected Settlement Date)* Average Libor Rate/ Denominator basis

Where,

Prime Funded amount on Expected settlement Date (T+7) is the sum of outstanding amount of all the Prime (Float) type drawdowns under the CUSIP on the expected settlement date (T+7)

Average Libor Rate is derived using data from ‘Average Libor rate Maintenance’ and is calculated from T+7 through settlement date.

- Cost of Carry computed on Libor Funded Amount, exchanged from buyer

to seller. The DCF category used is ‘DCF-FIX-COC’ (DCF Cost

of Carry for Fixed type drawdowns) calculated as follows:

- Libor Funded amount on Expected settlement Date(T+7)*Trade Price * (Actual Settlement Date – Expected Settlement Date)* Average Libor Rate/ Denominator basis

Where,

Libor Funded amount on Expected settlement Date (T+7) is the sum of outstanding amount of all the Libor (Fixed) type drawdowns under the CUSIP on the expected settlement date (T+7)

Average Libor Rate is derived using data from ‘Average Libor rate Maintenance’ and is calculated from T+7 through settlement date.

6.1.7.2 DCF on Unfunded Amount

DCF for the unfunded amount is further sub-divided into different categories and are calculated as explained below:

- Commitment Fee = Commitment Amount * Commitment Fee rate * number of days delay / Fee basis.

The associated fee category is ‘DCFCOMM’.

- Utilization Fee = Utilization Amount * Utilization Fee rate * number of days delay / Fee basis

The associated fee category is ‘DCFUTILIZ’.

- Facility Fee = Facility Amount * Facility Fee rate * number of days delay / Fee basis

The associated fee category is ‘DCFFACILITY’.

- Stand By LC Fee = Stand By LC Amount * Stand By LC Fee rate * number of days delay / Fee basis

The associated fee category is ‘DCFSTBYLC’.

- Commercial LC Fee = Commercial LC Amount * Commercial LC Fee rate * number of days delay / Fee basis

The associated fee category is ‘DCFCOMMLC’.

These fee components are calculated on their respective drawdown/tranche currencies and are displayed in the ‘Funding Memo’ screen. You can modify these, if required.

For tranches with drawdowns in multiple currencies, the Interest DCF is summed up for each currency across the drawdowns.

The currency wise fee accounting entries will be posted. The following table shows the basic accounting entries posted for DCF.

Bank is Buyer |

Bank is Seller |

Dr Trade Counterparty A/c Cr Income a/c |

Dr Expense a/c Cr Trade Counterparty A/c |

You need to capture the LIBOR rate for computing ‘Cost of Fund’ and ‘Cost of Carry’ components of delayed compensation fee.

For more details on LIBOR rates, refer the section titled ‘Capturing LIBOR Rate Details’ in this user manual.

6.1.7.3 Flat Fee Component Maintenance under DCF Categories

DCF flat unrealized components will track the traded portion of unpaid interest / fee amount and DCF flat realized components will track the traded portion of paid interest or fee amount.

DCF Flat Unrealized |

DCF Flat Realized |

||

Category |

Purpose |

Category |

Purpose |

F_UNRLZ_INT |

To perform accrual based on the interest rate of drawdowns |

F_RLZ_INT |

To track cash payment of interest |

F_UNRLZ_COMFEE |

To perform accrual based on rate of commitment fee at tranche level |

F_RLZ_COMFEE |

To track cash payment of commitment fee |

F_UNRLZ_FACFEE |

To perform accrual based on rate of facility fee at tranche level |

F_RLZ_FACFEE |

To track cash payment of facility fee |

F_UNRLZ_SLCFEE |

To perform accrual based on rate of Stand By LC fee at tranche level |

F_RLZ_SLCFEE |

To track cash payment of Stand by LC fees |

F_UNRLZ_CLCFEE |

To perform accrual based on rate of Commercial LC fee at tranche level |

F_RLZ_CLCFEE |

To track cash payment of Commercial LC fees |

The following table shows the basic accounting entries posted for DCF Flat unrealized and Flat realized components:

Bank is Buyer |

Bank is Seller |

Dr Trade Counterparty A/c Cr Income a/c |

Dr Expense a/c Cr Trade Counterparty A/c |

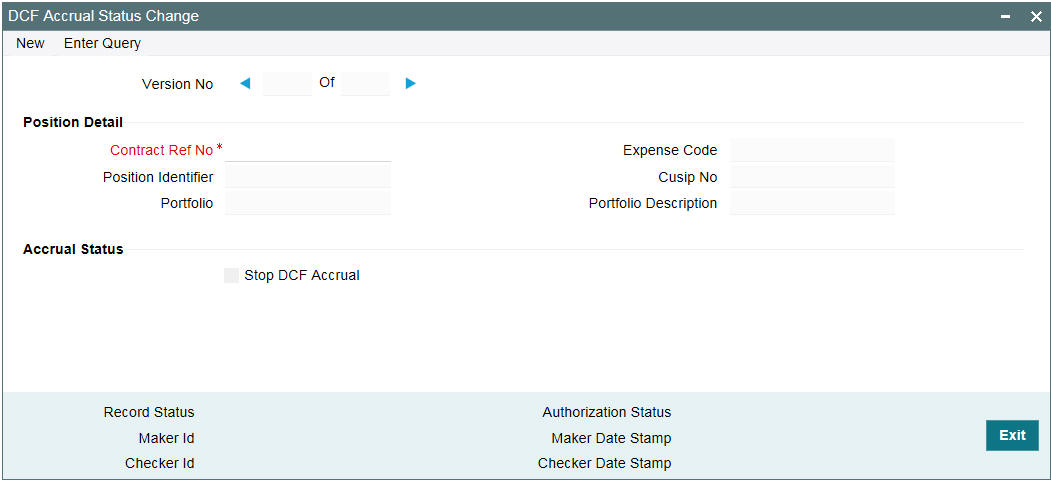

6.1.7.4 Maintaining DCF Accrual Status Change

In Oracle Banking Corporate Lending, you can maintain preference to reverse/restart a DCF accrual. Based on this maintenance, accrual is carried out for all the active trades associated with the position contract. This can be done through the ‘DCF Accrual Status Change’ screen. You can invoke the ‘DCF Accrual Status Change’ screen by typing ‘TLDPODCF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details:

Contract Ref No

Specify the position contract reference number. Alternatively, select the position contract reference number from the adjoining option list. The list displays all the values maintained in the system.

Based on the contract reference number selected/ specified, the system displays the following position details:

- Expense Code

- Position Identifier

- Cusip No

- Portfolio

Stop DCF Accrual

Select this check box to indicate that DCF accrual should be stopped.

Note

You can deselect this check box only if the ‘Allow Amendment of Non Accrual’ box is selected in the Product preferences sub-screen of the ‘Secondary Loan Trade – Product Definition’ screen.

When this check box is selected or deselected, the system defaults the application date as the Non Accrual Effective date. This date is used to derive the last liquidation date for interest components of drawdown when the associated loan is in performing status.

You can perform the following operations:

- New

- Save

- Unlock

- Delete

- Authorize

Note

- Unauthorized records can be deleted.

- You can navigate to view the previous records to see when the ‘Stop DCF Accrual’ box is checked or unchecked.

- Unauthorized maintenance records appear in the EOD pending query and the system does not allow the Day End Batch to run unless the maintenance is authorized. Also, DCF accrual status is not considered unless the maintenance is authorized

6.1.7.5 Accruing Delayed Compensation Fee

Delayed compensation fee is applicable for trades booked under SWOA quotation type, if the trade does not get settled on the expected settlement date. The DCF fee involved in such trades are accrued till the actual settlement date.

Currency-wise accounting entries are posted against each applicable DCF category. You can specify the preferences for DCF accrual in the ‘Product Preferences’ screen. You need to select the ‘Accrual Required’ option and specify the ‘Accrual Frequency’ as daily. You also need to select the ‘Allow Amendment of Non Accrual’ check box if you want to reverse/restart a DCF accrual. In addition, in the ‘Product Fee Details’ screen you need to select the check box ‘Status Tracking Required’. The reversal or restarting of DCF accrual is based on whether the ‘Stop DCF Accrual’ box in the ‘DCF Accrual Status Change’ screen is enabled or disabled

Accrual starts during the EOD on expected settlement date, if the trade settlement does not happen on that date. Further accruals happen as part of the EOD batch. During trade settlement, if you waive off DCF, then all the accrual entries posted gets reversed.

The DCF Accrual batch process can reverse or catch up accrual for DCF components, based on whether the ‘Status Tracking Required’ box is selected or deselected. The processing is done as part of the EOD on the same day this check box is selected or deselected.

If ‘Status Tracking Required’ is checked for the trade product, the system checks the DCF accrual status at the associated position contract level.

- If the check box ‘Stop DCF Accrual’ is selected:

- The system derives the Non-Accrual Effective date and finds the greatest of the contract value date and the last liquidation date for each drawdown before the Non-Accrual Effective date.

- The basis amount for the DCF calculation is considered as ‘0’ from the last liquidation/contract value date before the Non-Accrual Effective date till processing date of the batch.

- If the last liquidation date derived is not the application date, the system reverses the DCF amount which has been accrued from the last liquidation date/contract value date, till processing date - 1 of batch. No accrual is posted for the application date.

- If the check box ‘Stop DCF Accrual’ is not selected:

- System derives the latest Non-Accrual Effective date as the application date on which the box ‘Stop DCF Accrual’ is checked and finds the greatest of the contract value date and the last liquidation date for each drawdown before the latest Non-Accrual Effective date.

- The basis amount for the DCF calculation is considered as per the functionality when ‘Status Tracking Required’ is not checked for the trade product, but from the last liquidation date/contract value date before the latest Non-Accrual Effective date.

- If the last liquidation date derived is not the application date, the system catch-ups the DCF amount from the last liquidation date/contract value date till processing date - 1 of batch. Daily accrual amount is added to the catch-up accrual amount and the total accrual amount is posted for the application date. One FACR event is registered for the catch up accrual till today

During ticket settlement, the system re-calculates the DCF amount and posts catch up accrual.

- If the box ‘Stop DCF Accrual’ is checked just before settlement and the last liquidation date arrived is not the application date, the system reverses the DCF accrual amount from the last liquidation date/contract value date till the actual settlement date - 1.

- If the box ‘Stop DCF Accrual’ is unchecked just before settlement and the last liquidation date is not the application date, the system catches-up the DCF amount from the last liquidation date/contract value date till actual settlement date - 1 and post the catch up accrual.

Note

- When the box ‘Stop DCF Accrual’ is unchecked in later stages, even if there is any interest payment for the loan after the status has been changed to non performing, the system still checks the last interest payment date/value date when contract was in performing status and will perform the catch-up accrual.

- If you manually amend/specify the DCF amount during settlement, status tracking functionality for DCF accrual does not work. In such cases, catch-up accrual will be done based on the DCF amount specified by you.

If ‘Status Tracking Required’ is not checked for the trade product, the system continues the accrual process for the trade as follows:

- While passing the accounting entries during accrual, delayed compensation fee is calculated as the difference between the accrued value till date and the accrued value till the previous date. Hence, any changes in the outstanding amount or the spread is considered for the current date.

The following example illustrates the accrual of DCF and the corresponding accounting entries involved:

Assume that the Expected Settlement Date is 11-Dec-2006

Remarks |

Date |

DD LIBOR outstanding |

Spread |

Accrued amount |

Accounting Entry |

Balance in Deferred Fee Payable A/c |

Accrual entry commences from 11th Dec EOD |

11-Dec-06 |

1,000,000 |

3.50% |

97.22 |

Dr Int exp - 97.22 |

97.22 |

Spread is changed on 12-Dec, hence accrual from 12-Dec is computed using the new spread |

12-Dec-06 |

1,000,000 |

4.00% |

111.11 |

Dr Int exp - 111.11 |

208.33 |

Payment performed on 13-Dec with VD 12-Dec, hence accrual is recomputed from 12-Dec and entry will be posted for the net amount |

13-Dec-06 |

400,000 |

4.00% |

-22.22 |

Dr Int exp - (22.22) |

186.11 |

Trade Settled on 14-Dec |

14-Dec-06 |

|

|

|

FACR Dr Int exp - 3.89 TSTL Dr Def Fee Payable - 190.00 |

0 |

6.1.8 Specifying Break Fund Fee Details

Break Fund Fee needs to be calculated only when there is a difference in LIBOR Base rate linked to the contract and LIBOR rate existing at the time of transfer. Break fund fee is calculated for the difference in these rates. This fee is settled between the counter party and bank taking into account the increase or decrease in LIBOR rate and the buy or sell attribute of the trade.

Following steps are involved in capturing and processing the break fund fee associated with a trade contract:

- The break fund fee component is linked to the SLT product in the ‘SLT Product Fee Details’ screen.

- The main interest component for each drawdown associated with the CUSIP is taken into consideration for calculating break fund fee.

- Break funding fee for this interest component is computed as follows:

Funded trade amount* (Libor rate quoted- Libor rate on transfer date)*(Next Interest Schedule (rollover) date– Transfer Date) /Denominator basis

Where, Denominator basis is derived based on the value of ‘Fee Calc Basis’.

- The sum of these amounts for all the drawdowns is taken as the ‘Break Fund’ fee and it gets displayed in the ‘Funding Memo’ screen.

The accounting entries posted for break funding fee is specified below:

Bank is receiving the break funding FEE from Counter Party |

Bank is Paying the break funding FEE to Counter Party |

Dr Trade Counterparty A/c Cr Income a/c |

Dr Expense a/c Cr Trade Counterparty A/c |

6.1.9 Specifying Waiver Fee Details

Waiver fee is an adhoc fee paid by the trade counterparty to Bank.

The waiver fee component is linked to the SLT product in the ‘SLT Product Fee Details’ screen. You can specify the waiver fee details in the ‘Fee Components’ screen associated with the contract. You can also specify the waiver fee amount in the ‘Funding Memo’ screen.

6.1.10 Specifying Benefit of Commitment Reduction Fee (BCR) Details

Benefit of Commitment Reduction (BCR) fee is calculated if there is a commitment reduction by the borrower between trade date and the settlement date, inclusive of both the dates. BCR fee is calculated as per the formula given below

BCR fee = (Principal paid between Trade date & Settlement date) * (1-Price)

The following example illustrates BCR fee calculation:

Consider a trade performed on 1st Sept and assume that there is a principal payment on 1st Sept. The payment for 1st Sept is considered for BCR computation.

Note

There is no separate fee definition and settlement for BCR fee.

6.1.11 Specifying Upfront Fee Details

Upfront fee is collected for the undrawn amount of the trade. Upfront fee is calculated as follows.

Upfront fee = Unfunded Amount * (1-Price)

Note

There is no separate fee definition and settlement for upfront fee.

6.1.12 Specifying Adhoc Fee Details

Two types of adhoc fees are available to account for any adhoc fee exchanges that happen between the buyer and the seller. They are as follows:

- Adhoc Buyer Fee - paid by the buyer to the seller

- Adhoc Seller Fee - paid by the seller to the buyer

The fee types are linked to the SLT product in the ‘SLT Product Fee Details’ screen. The adhoc fee details for the contract are specified in the ‘Fee Components’ screen associated with the contract.

6.1.13 Specifying Brokerage Details

Secondary loan trading can involve brokers who charge a commission fee for their brokerage services. Brokerage is always calculated on the original trade amount. Any amendment in the trade amount as a result of commitment reduction does not affect the calculation of broker’s commission, as it is calculated on the initial trade amount.

For line trades involving the origination desk, brokerage is applicable only for the Origination sell line trade and not for the other two Par trades linked to the line trade.

Following steps are involved in capturing and processing the brokerage fee associated with a trade contract:

- Broker Id of the broker involved in the trade is captured in the ‘Draft Trade’ screen, while booking the SLT contract.

- The brokerage fee component gets linked to the SLT product in the ‘SLT Product Fee Details’ screen.

- The brokerage fee type, rate, and the fee amount are captured in the ‘Fee Components’ screen associated with the contract.

- The brokerage fee gets displayed in the ‘Funding Memo’ screen, where it can be waived off, if required. You can waive off this fee in the ‘Draft Trade’ screen or ‘Fee Amendment’ screen also.

The accounting entries posted for brokerage as part of trade settlement or fee liquidation is specified below.

Dr |

Expense A/c |

Brokerage Amount |

Cr |

Brokerage Payable A/c |

Brokerage Amount |

The actual liquidation of brokerage is handled by the Brokerage module.

For more details on brokerage liquidation refer the section titled ‘Liquidating Brokerage Manually’ in Brokerage user manual.

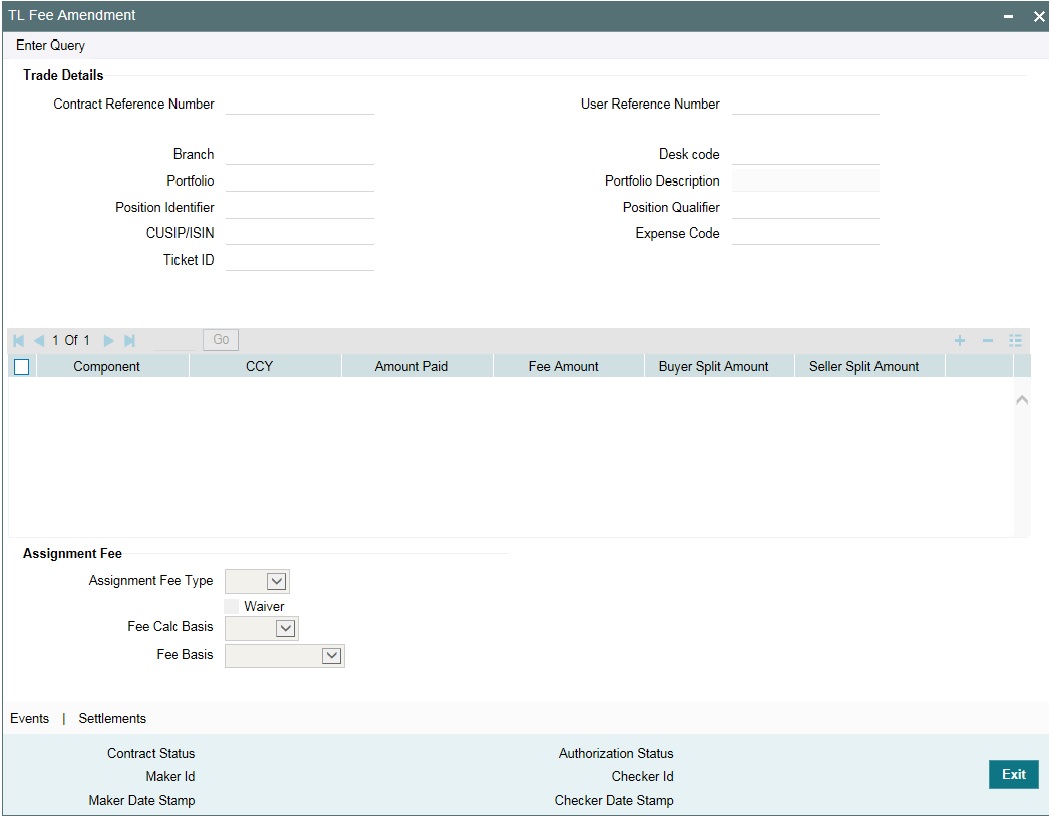

6.2 Amending Fee Details

You can amend the fee details for the various components in the ‘SLT Fee Amendment’ screen.

You can invoke the ‘TL Fee Amendment’ screen by typing ‘TLDFEAMD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The basic trade details are defaulted here. You can specify the following details for fee amendment:

Fee Amount

The fee amount associated with each fee component is listed here. You can modify the fee amount specified.

You can modify the amounts specified for Assignment Fee, Amendment Fee, Broker Fee, Waiver Fee, and Adhoc Fee. For DCF and Break-fund fee you can only modify the Fee Calc Basis and Fee Basis, but not the fee amount.

Waiver

Select this check box to indicate that you wish to waive off a fee component during fee amendment.

Note

You cannot waive off DCF during amendment. DCF can be waived only at Trade level.

Fee Calc Basis

The fee calculation basis associated with the contract is defaulted here. You can modify this, if required. Select the fee calculation basis from the following options:

- Agency - Fee Basis is arrived from LB Module for the respective component

- SLT – Fee Basis needs to be manually specified at the SLT product or contract level

This is enabled only for fee types ‘DCF’ and ‘Break-fund Fee’.

Fee Basis

The fee basis associated with the contract is defaulted here. You can modify this, if required. Select the fee basis from the following options:

- 30(Euro)/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/365.25

- 30(US)/365.25

- Actual/365.25

- Working Days/360

This gets enabled only if you have selected the fee calculation basis as ‘SLT’.

For more information on fee basis, refer to Charges and Fees User Manual.

Assignment Fee Details

The assignment fee details associated with the contract are displayed here. You can modify the following details, if required.

Buyer’s Split Amount

Specify the assignment fee amount that has to be booked against the buyer associated with the trade deal.

Seller’s Split Amount

Specify the assignment fee amount that has to be booked against the seller associated with the trade deal.

You can amend the fee details before it gets liquidated. But for Amendment Fee and Broker Fee, amendment can be performed even after liquidation, though they are settled as part of trade settlement. In this case, the difference in the fee is posted as fee adjustment.

Broker fee payable booking happens during trade booking/trade amendment where in the brokerage fee is moved from expense to payable GL. Broker fee payable booking is zero-based on every amendment, thereby reversing the earlier payable booking and rebooking with the revised broker fees as part of the trade amendment. Broker fee payable liquidation happens only after the trade/ticket is settled successfully.

For more details on brokerage liquidation, refer section ‘Liquidating Brokerage Manually’ in the Brokerage User Manual.

Example

The following example explains the payable booking accounting entries during trade booking/amendment:

|

Action |

OBCL Process |

OBCL Event |

Case 1 |

Trade booking with Broker amount of $50,000 |

Debit expense GL for $ 50,000 Credit payable GL for $ 50,000 |

TBOK |

Case 2 |

Trade booked without Broker amount and then Trade amendment with broker amount of $50,000 |

Debit expense GL for $ 50,000 Credit payable GL for $ 50,000 |

TAMD |

Case 3 |

Trade booking with Broker amount of $40,000 |

Debit expense GL for $ 40,000 Credit payable GL for $ 40,000 |

TBOK |

Trade amendment with Broker amount of $50,000 |

Reverse the existing entries Credit expense GL for $40,000 Debit payable GL for $40,000 Rebooking with the latest amount Debit expense GL for $ 50,000 Credit payable GL for $ 50,000 |

TAMD |

|

Case 4 |

Trade booking with Broker amount of $50,000 |

Debit expense GL for $ 50,000 Credit payable GL for $ 50,000 |

TBOK |

Trade amendment with Broker amount of $50,000 |

No entries |

TAMD |

In all the above cases, the final amount of $50,000 in payable is used for final payable liquidation for the trade. If any trade is reversed and rebooked systematically due to trade amendment, then the payable booking is cancelled on the old trade and re-applied on the new trade.

If Funding Memo was generated in advance and the fee components are amended before trade settlement, the funding memo gets regenerated.

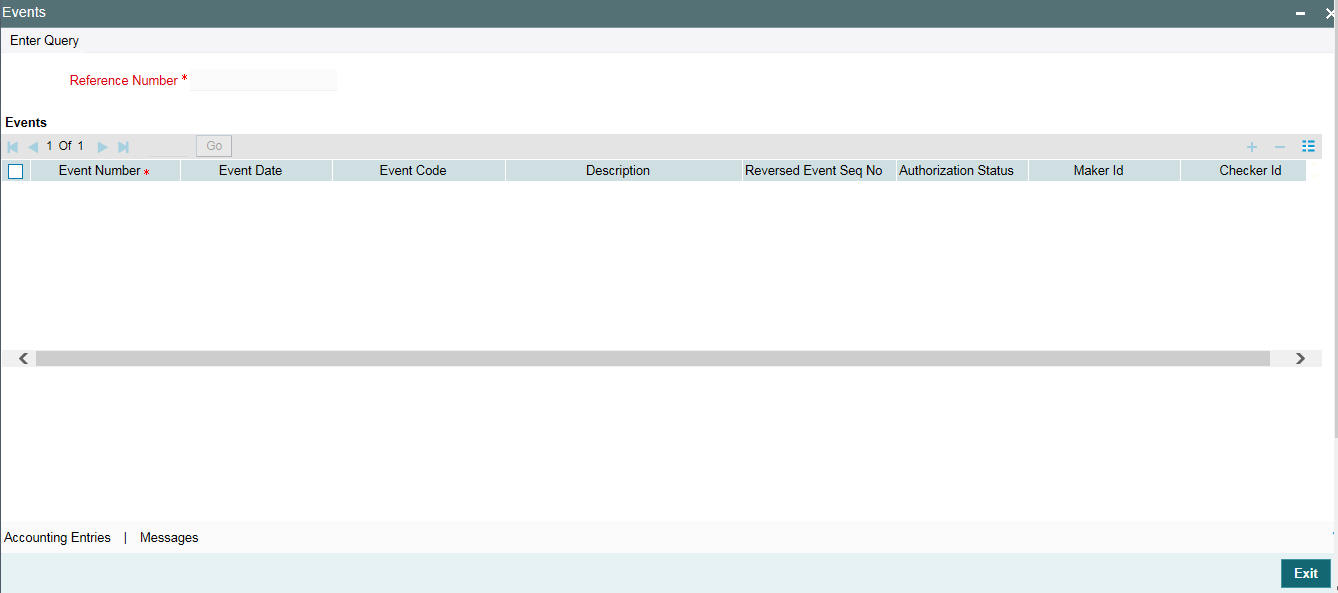

6.2.1 Viewing Event Details

You can view the event details maintained in the 'User Defined Events' screen under 'Events' screen of a contract screen. You can invoke the ‘Events’ screen by typing ‘OLDEVENT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Reference Number

Specify the reference number.

The system displays the following details:

- Event Number

- Event code

- Description

- Event Date

- Authorization Status

- Maker Id

- Checker Id

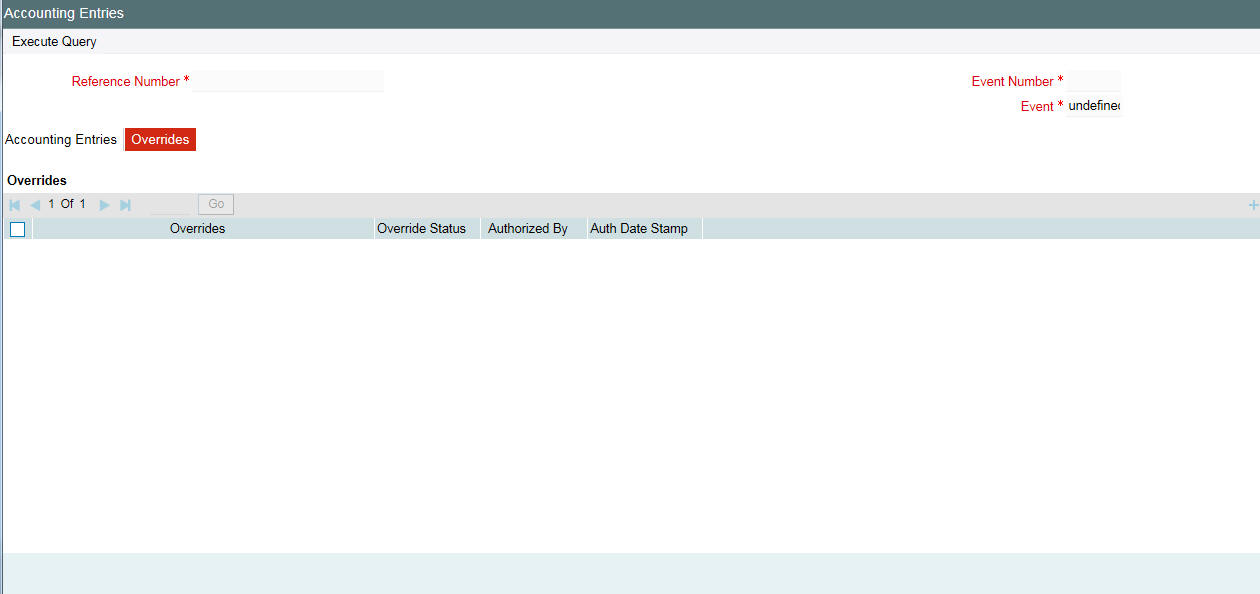

Viewing Accounting Entries

You can view the accounting entries maintained for an event in the ‘Accounting Entries’ screen by selecting an event and clicking on ‘Accounting Entries’ button in the’ Events’ screen. To invoke the screen type ‘OLDACENT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Reference Number

Specify the transaction reference number

See Position Entries

Check this box to view currency position of the entries.

Event

Specify the event.

Event Number

The system displays the event number.

The following details are displayed in the Accounting Entries:

- Event

- Branch

- Account

- Account Description

- Dr/Cr

- Amount Tag

- Account Ccy

- Foreign Currency Amount

- Rate

- Local Currency Amount

- Date

- Value Date

- Txn Code

The following details are displayed in the Accounting Under Process:

- Event

- Branch

- Account

- Dr/Cr

- Amount Tag

- Account Ccy

- Foreign Currency Amount

- Rate

- Local Currency Amount

- Date

- Value Date

- Txn Code

Override Details

Click on ‘Overrides’ button to view the override details of the accounting entries.

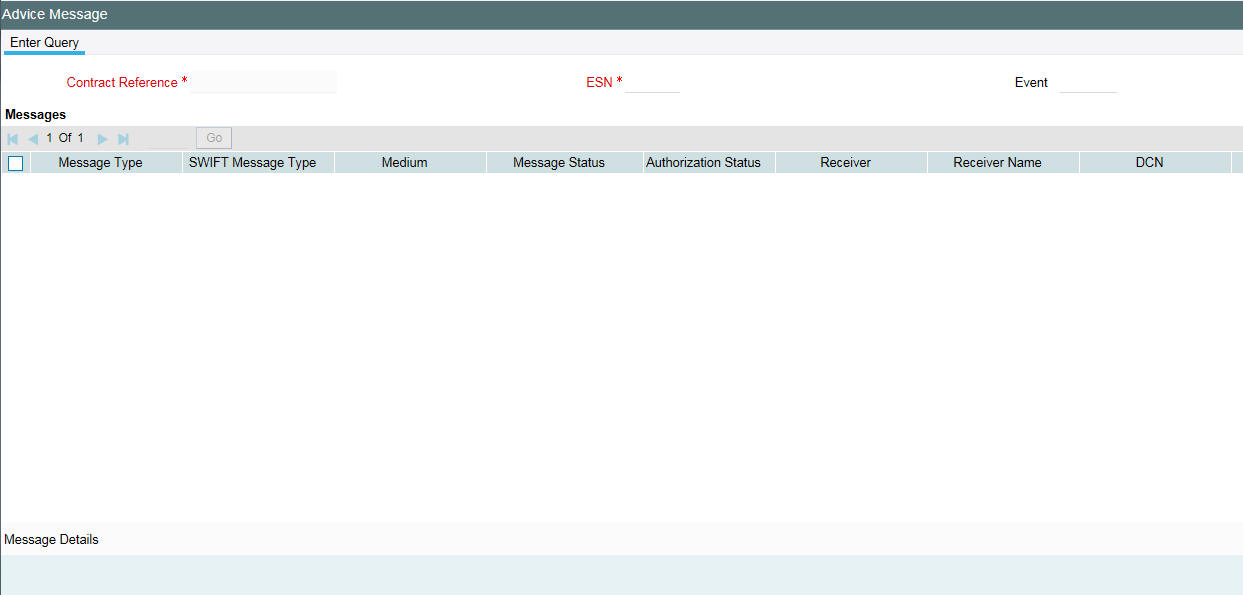

Viewing Messages

You can view the messages by selecting an event and clicking on ‘Messages’ button in the’ Events’ screen. To invoke the screen type ‘OLDMSGVW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The system displays the following details:

- Contract Reference

- ESN

- Event

- Message Type

- SWIFT Message Type

- Medium

- Message Status

- Authorization Status

- Receiver

- Receiver Name

- DCN

Message Details

You can view the details of a message by selecting a message from the ‘Message’ screen and clicking on ‘Message Details’ button.

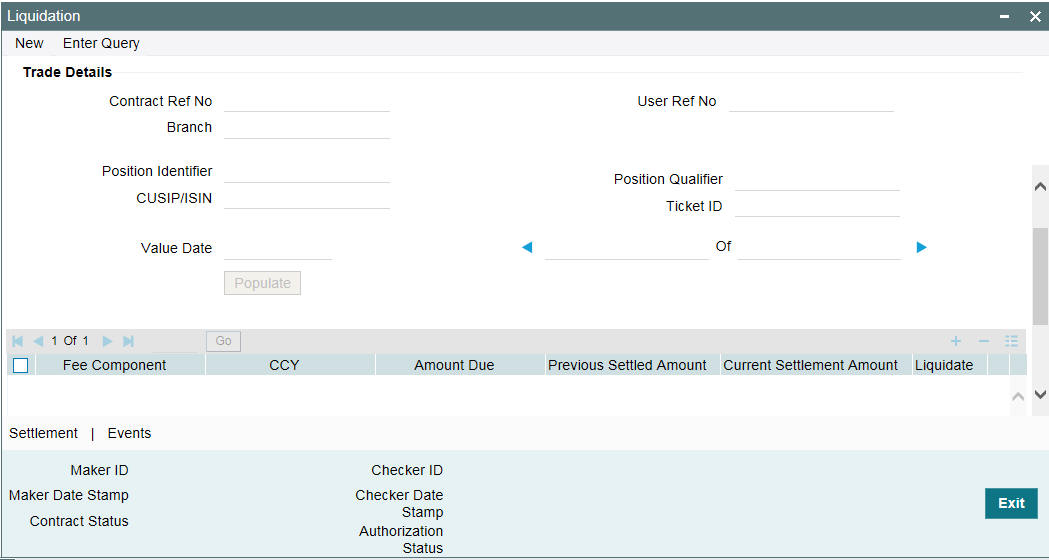

6.3 Liquidating Fee Components

You can liquidate the Brokerage Fee and Amendment Fee components, post trade settlement, in the ‘SLT Fee Liquidation’ screen. You can invoke the ‘Liquidation’ screen by typing ‘TLDFEELQ’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The basic trade details are defaulted in this screen. You can specify the following details in this screen:

Value Date

The current system date gets defaulted as the value date for the liquidation.

Liquidate

Select this check box against ‘Amendment Fee’ or ‘Broker Fee’ to liquidate the corresponding fee component.

Note

- You cannot liquidate the fee components manually, before trade settlement.

- You cannot liquidate the fee components partially.

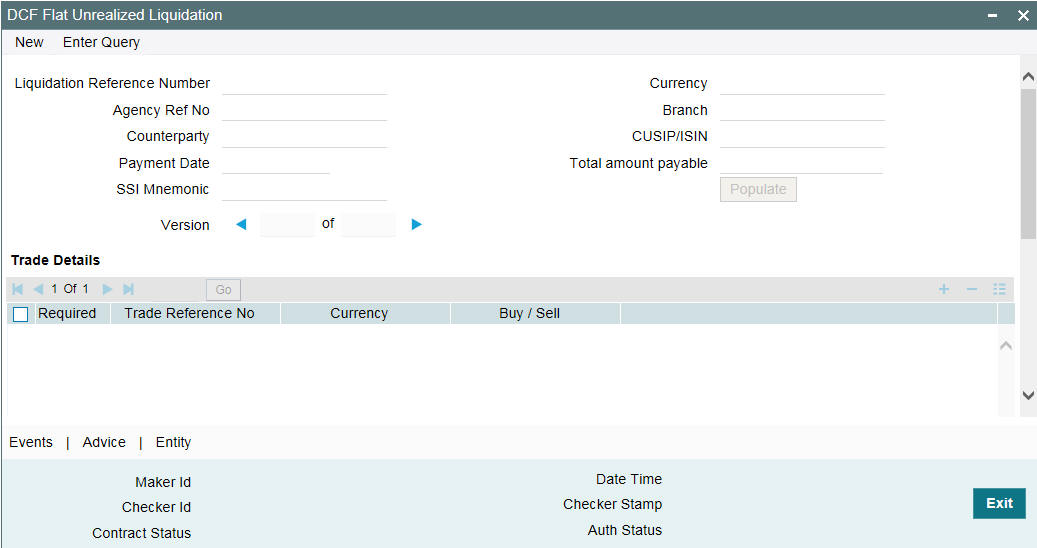

6.3.1 DCF Flat Unrealized Liquidation

DCF flat realized components are settled during trade/ticket settlement to settle the trade portion of interest / fee payment amount. If interest / fee payment is processed in LB module after the trade is settled then the corresponding payment amount can be settled from the screen ‘DCF Flat Unrealized Liquidation’

You can invoke the ‘DCF Flat Unrealized Liquidation’ screen by typing ‘TLDDCFLQ’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can perform payment for the trade counterparty under tranche reference number for cash fee payment and under drawdown reference number for cash interest payment.

Agency Ref No

Specify the drawdown or Tranche reference number from the adjacent list of values.

Payment Date

Specify the payment value date.

Counterparty

Select the counterparty from the adjacent list of values.

SSI Mnemonic

Select the SSI from the adjacent list of values.

On click of ‘Populate’ button, the system generates the Liquidation reference number which will be unique for the combination of contract reference number (drawdown/tranche reference) and counterparty. The system defaults the same liquidation reference number if payment is performed multiple times for the same combination of agency reference number and counterparty. The system displays all the settled trades for the combination of Drawdown/ Tranche CUSIP and trade counterparty.

Component(s) gets defaulted with outstanding interest / fee accrued (amount due) in the ‘Component Details’ section.

You can choose the components for which the payment to be processed by selecting the check box against each component. It is not mandatory to settle all the components together but at least one component should be selected for payment. By default, the check box are not selected while populating the components.

You can specify the amount paid for each component which should be lesser than or equal to amount due. Amount paid can be zero for the components which are not selected for the liquidation. Liquidation of DCF flat unrealized components can be partial or full.

Click ‘Sum’ button to sum up the amount paid across all the components and currency and populate the total amount payable.

Payment message gets generated under liquidation reference number for the total amount payable (if bank have to pay to the counterparty). To compute total amount payable, paid amount is considered positive for sell trade and negative for buy trade. If total amount payable is negative then bank receives the payment else bank pays the amount to counterparty.

During DCF flat unrealized liquidation for drawdowns, If trade currency is different than the drawdown currency then accounting entries for trade are posted by appending currency with amount tag (only in case of foreign currency Drawdowns).

Settlement pick is based on counterparty and currency combination and the settlement instructions are used to post accounting entries for trade reference number.

You can suppress the advice in ‘Advice Details’ sub-screen that is launched on click of ‘Advice’ button.

Deletion of DCF flat liquidation deletes the DCLQ event and accounting entries for the trade reference number.

6.3.2 Trade Settlement Threshold Limit

You can maintain threshold limit for the fee components such as DCF, CoC and amendment fee for a product and currency combination.

You can invoke the ‘Trade Settlement Threshold Limit’ screen by typing ‘TLDCFTOL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Product Code

Displays all the ‘Active’ and ‘Authorized’ of SLT products. You can select from the LOV.

Currency

Displays all the currencies which are available for the SLT product selected. You can select from the LOV.

Populate Components

Click 'Populate Components' to get the fee components which are available for a product.

Threshold Limit for All Components

You can enter a value in this field and click on the tab, the entered value is defaulted to all the fee components populated. If required you can modify the defaulted value for each individual component.

Component

The DCF fee and amendment fee components available for the SLT product selected are displayed in this field once you click on the ‘P’ button.

Note

The fee component for DCF interest comprises the fee amounts for DCF fixed interest, DCF floating interest and DCF fixed margin.

Threshold Limit

If you do not want to define threshold limit for a component, you can enter zero. You cannot enter negative value. You can enter more than 4 digits.