2. Loans Syndication

Loan Syndication is a lending process in which a group of lenders provide loan to one or more borrowers. Each lender in the syndicate contributes part of the loan amount, and they all share in the lending risk. The loan is governed by a single Loan Agreement. However, each Lender of the Syndicated Loan maintains a separate claim on and bears the credit risk for the respective portion of the loan provided by it.

OBCLPM is capable of managing Pre Mandate, Post-Mandate, Closing stages of Loan Syndication Origination and Drawdown.

OBCLPM has the below processes:

- Pre Mandate Lead Arranger Process – To handle the Bank role to invite Arrangers and to finalize the Mandate with the Borrower.

- Pre Mandate Co-Arranger Process – To support the Lead Arranger to finalize the Mandate with the Borrower.

- Post Mandate Agent Process – To manage the Agency role in Syndication Origination as a continuation of any of the Pre Mandate Process or as standalone process.

- Post Mandate Arranger Process – To manage the Arranger role in Syndication Origination to arrange Participants as a continuation of any of the Pre Mandate Process or as standalone process.

- Post Mandate Participant Process – To manage the Participant role in Syndication Origination.

- Operations Enrichment Process - To capture the details available during the Syndication Origination stages as

- a continuation of any of the Post Mandate process or as standalone process to handover the details for the creation of Syndicated Deal in the back office.

- Participant Drawdown – to manage Syndicated Loan Participant Drawdown of a participant bank.

- Agency Drawdown – to manage Syndicated Loan Drawdown of an Agent Bank.

This chapter contains the following sections:

- Section 2.1, "Pre-Mandate Lead Arranger"

- Section 2.2, "Pre-Mandate Co-Arranger"

- Section 2.3, "Post Mandate Agent"

- Section 2.4, "Post Mandate Arranger"

- Section 2.5, "Participant Process"

- Section 2.7, "Operations Enrichment"

- Section 2.8, "Agency Drawdown"

- Section 2.9, "Participant Drawdown"

- Section 2.16, "Syndication Payment"

- Section 2.18, "Natural Language Processing (NLP)"

2.1 Pre-Mandate Lead Arranger

Pre-Mandate Lead Arranger Process manages the beginning of the Syndication process until the execution of the Mandate Letter. This process can manage initial analysis of Borrower requirement, Solution Proposal and negotiation with Borrower, Inclusion of Co-Arrangers before or after the Solution Proposal, Obtaining Credit Approvals, Preparation of Mandate Documents and its execution. Upon Completion of Pre-mandate process, the details will be handed over for the creation of respective Post Mandate Process.

The process flow for Pre-Mandate Lead Arranger undergoes goes the below stages:

- Entry

Pre-Mandate process starts with the biding from the Borrower or the Bank approaching the Borrower User capture the basic details such as Borrower Information, Borrower Related Parties, Syndication Requirement, Expected Collateral value. Borrower and Borrower Related parties will be to Borrower on-boarding team to start the Borrower evaluation process. If more than one Borrower and related parties are there, then that many process will be initiated.

- Review Pre Analysis

User will wait for the response from Borrower domain to get the initial analysis on the parties. Based on the response user will take the appropriate decision to proceed. Up on proceeding with the syndication application will create a task with internal legal department to prepare or review the draft Confidentiality Agreement (NDA).

- NDA Preparation

Internal legal teams prepare and share the draft Confidentiality Agreement (NDA).

- NDA Scrutiny

Up on receipt of draft NDA from the legal with their respective comment, user will send the NDA to the Borrower for review after the Scrutiny. I f any amendments required, then the document will be sent back to the Legal team for modification. User will be able to send multiple advises at this stage with attaching the different versions of the NDA.

- Borrower Review - NDA

Borrower reviews and sign the NDA if the Borrower is agreeable with the format else sends the borrower comments to the Legal for modification of the draft. (Execution of the documents takes place outside the system and Loans will only track the status of the Document).

- Initiate QE

Once the NDA is signed, the user initiates quick evaluation on the customer with the Credit System and waits for the evaluation results or user himself performs the evaluation in credit system. User will be able view the status of the evaluation and will receive the result of the evaluation.

- Review QE and Solution Structuring

Upon reviewing the customer evaluation, the user will take a decision to proceed with the syndication and draft a solution. Also the user will take a decision to proceed with the arrangers or not. If the Arranger Invitation DS is filled at least with one arranger then the application will trigger a different flow, in which the user will invite the arrangers to participate and help in providing the solution.

- Solution Firming

This decision will be reviewed by the approver. Approver can either approve the solution or cancel the application or proceed with the application in two ways one with co-Arranger and one without Co-arranger. If the process is without co-arrangers, then after the solution firming approval, user can send the solution to the borrower or modify the solution or cancel the application.

- Solution with Arrangers

If any arranger details are captured other than the home bank, then user will be able to follow this process. Send invitation to the Arrangers captured in the Arranger Invitation data segment. Advice will be sent to the Arrangers along with Confidentiality Agreement (NDA). User will wait for the response from arrangers. User will be able to track the acceptance response and the status of NDA execution. Also will be able to send the reminders.

For the arrangers which are shown interest in the syndication and returned the signed NDA, the user will be able to send the additional details about the Borrower. Advice will be sent to the Arrangers with attachments. (Inter stage advises). For arrangers which are responded with not interested can mark as rejected. User will be able to capture more arrangers if required other than the invitations send earlier.

- Solution Restructuring

All the above activities performed in the previous stage will be reviewed by the Approver and every action will be processed after the approval at this stage. User proceed to prepare the Proposal in coordination with the Arrangers (These discussions are outside the system and only proposal is captured in the system). After the solution firming approval, user can send the solution to the borrower and arrangers or modify the solution or cancel the application.

User can send the solution to the Borrower and arrangers and wait for the Borrower response.

- Customer Acceptance

In this user can follow up with the Borrower if no response. Advice will be sent at this stage (Inter stage). Modify the proposal based on the comments from the Borrower. Cancel the application if the Borrower is not agreeing with the Proposal. Advises will be sent to borrower and arrangers. Proceed with the next phase Pre-Mandate once the proposal is finalized with the Borrower. Advises will be sent to borrower and arrangers.

- Arranger Invitation

Once the proposal is agreed with the Borrower, the user can proceed with the syndication with co-arrangers if not included already. This stage will be occurred only if the user decided to proceed with co-arrangers and the co-arrangers are not selected before the solution proposal. This flow is not applicable if the arrangers are already finalized.

Capture the details of the Arrangers and send the invitations to the selected arrangers. Advice to be sent to the Arrangers along with Confidentiality Agreement (NDA). Up on sending the invites, user will come back to the Arranger invite stage to track the responses from the arrangers. User will be able to track the acceptance response and the status of NDA execution. Also will be able to send the reminders.

For the arrangers which are shown interest in the syndication and returned the signed NDA, the user should be able to send the additional details about the Borrower. Advice to be sent to the Arrangers with attachments. (Inter stage advises). For arrangers which are responded with not interested should mark as rejected. User will be able to capture more arrangers if required other than the invitations send earlier.

Once all the arrangers signed the NDA, user will be able to proceed to the next stage or user will be able to take decision to proceed with the responded arrangers. User will intimate the Arrangers regarding the finalization of arrangers.

- Approval

All the above activities performed in the previous stage will be reviewed by the Approver and every action will be processed after the approval at this stage.

- Arranger Commitment Confirmation

At this stage user will conduct the arranger meeting and capture the proposed amount from each arranger for their participation. Meeting will be outside the application.

User will also finalize the syndication party roles of each arranger.

Upon discussion with the arrangers, user will finalize the allocation for each arrangers and send for the approval.

If the Co-arrangers are finalised before Customer acceptance of the solution, then the process will starts from this stage. Also if the Lead Bank is proceeding without any co-arranger, then the process will starts from this stage.

- Allocation Approval

If the approver is not agreeable to the allocation, the user will redo the allocation.

Upon finalization of the allocation user will initiate the credit approval for self Arranged portion if the syndication arrangement is underwriting.

- Review Credit Approval

If the Credit approval is not received for the self-allotted amount then the user should go back and redo the allocation. Once the Credit approval is obtained, finalized allocation information will be sent to the Arrangers. Advises will be sent to the Arrangers.

If the self arrangement is on Best effort basis, then no credit approval is required and the user will be able to initiate the preparation of the mandate document with the help of internal legal upon finalization of the allocation.

- Prepare Mandate Docs

Internal legal prepares the Mandate documents and sends to the user for review.

- Mandate Docs Scrutiny

User do the scrutiny of the documents and sends back to the legal if any modification required. Else the user send the documents to the arrangers for their review. Advice will be sent to the Arrangers.

- Arranger Comments

User will wait for Arrangers comments on the mandate documents and if the arrangers are not agreed with the mandate documents, then the user will send the mandate documents to the internal legal for modification. Once the Arrangers agree on the mandate documents, then the mandate documents will be send to the Borrower for the review. Advice will be sent to the Borrower.

- Borrower Review - Mandate Docs

If the Borrower is not acceptable with the mandate documents the same will be sent to the internal legal for amendments along with the comments from the Borrower. Cancel the application if Borrower is not interested. If the Borrower agrees with the mandate documents then the mandate documents will be sent to all the parties for execution. Advises will be sent to all the parties.

- Execution Status

User will track the status of the execution of mandate documents from all the parties. User will send the fully executed documents to all the parties. Advice will be sent. With this the pre-mandate stage will be closed.

Initiating Pre-Mandate Lead Arranger

The basic registration details for Pre-Mandate Lead Arranger for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Pre Mandate Arranger

How to initiate a Pre Mandate Arranger:

- In the Pre Mandate Arranger screen, provide the required details:

Basic Details

- Business Product: Click Search to view and select the required business product.

- Application Date: Select an effective application date from the drop-down calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

Click Initiate to begin the process.

2.2 Pre-Mandate Co-Arranger

Pre-Mandate Co-Arranger Process manages the beginning of the Syndication process until the execution of the Mandate Letter along with the Lead Arranger. This process can manage initial analysis of Borrower requirement, Solution Proposal and negotiation with Borrower, Obtaining Credit Approvals, Preparation of Mandate Documents and its execution. Upon Completion of Pre-mandate process, the details will be handed over for the creation of respective Post Mandate Process.

The process flow for Pre-Mandate Co-Arranger undergoes goes the below stages:

- Entry

Pre-Mandate Co-Arranger starts with the receipt of the invitation from the Lead Bank, to join the arrangement of the Syndication. User capture the basic details such as Borrower Information, Borrower Related Parties, Syndication Requirement, Expected Collateral value. Borrower and Borrower Related parties will be to Borrower on-boarding team to start the Borrower evaluation process. If more than one Borrower and related parties are there, then that many process will be initiated.

- Review Pre Analysis

User will wait for the response from Borrower domain to get the initial analysis on the parties. Based on the response user will take the appropriate decision to proceed. If the decision is to proceed with the Syndication, user signs the NDA and send the acceptance confirmation to the Lead Bank. Else confirm the rejection. Advice will be sent along with attachments. User waits for the additional details to receive from the Lead Bank.

- Initiate QE

Up on receipt of the additional details, the user initiates quick evaluation on the customer with the Credit System and waits for the evaluation results or user himself perform the evaluation in credit system. User will be able view the status of the evaluation and should receive the result of the evaluation.

- Review QE

Upon reviewing the customer evaluation, the user will take a decision to proceed with the syndication or not.

- Approval

This decision will be reviewed by the approver. Approver can either approve the solution or cancel the application or proceed with the application. Advice will be sent to the Lead bank confirming the outcome.

- Solution Structuring

If the Syndication Solution has already agreed by the Borrower with the Lead Bank, then the user will move to the Commitment Confirmation Stage. If the solution is not finalized, then the user will finalize the solution in discussion with the Lead Bank.

- Solution Firming

Approver can approve the agreed Syndication Solution or reject. Once the solution finalized and agreed by the Borrower, then the user will move to the Commitment Confirmation Stage

- Commitment Proposal

At this stage user will up on discussion with the Lead Bank and other Co-Arrangers if any, user will finalize the commitment allocation for the Co-Arranger and send for the approval.

- Commitment Approval

If the approver is not agreeable to the allocation, the user should redo the allocation. Upon finalization of the allocation user will initiate the credit approval for self Arranged portion if the syndication arrangement is underwriting.

- Review Credit Approval

If the Credit approval is not received for the self-allotted amount then the user should go back and redo the allocation. Once the Credit approval is obtained the user will be able to communicate the Proposed Arranged amount to the Lead Bank and move to the next stage to wait for the confirmation from the Lead Bank. Advice will be sent to the Lead Bank.

If the self arrangement is on Best effort basis, then no credit approval is required and the user will be able to communicate the Proposed Arranged amount to the Lead Bank and move to the next stage to wait for the confirmation from the Lead Bank. Advice will be sent to the Lead Bank.

If no credit approval then cancel the application if the arrangement is underwriting.

- Commitment Confirmation

User reviews the Arrangement allocation from the Lead Bank. If there is any difference in the allocation then the user will redo the allocation else move to the next stage to wait for the Mandate Docs. If no allocation cancel the application. User will also finalize the syndication roles of each arranger.

- Mandate Docs Review

User receives the Draft mandate Docs from the Lead bank and send the same for the review of the internal legal.

- Docs Review by Legal

Internal Legal Team reviews the documents and provides the comments.

- Review Legal Comments

Up on receipt of the Legal comments, user sends the comments to the Lead Bank. Advice will be sent to the Lead bank along with attachments.

- Document Execution

Up on receipt of execution version of the Docs, then the user will be able to move to the signing stage if there is no comments on the documents. If the Docs are not agreed by the Borrower then cancel the application.

User execute the documents and send the signed copy to the Lead Bank for consolidation. Advice will be sent along with attachments.

- Track Executed Docs

User will track the receipt of fully executed documents.

With this the pre-mandate stage will be closed.

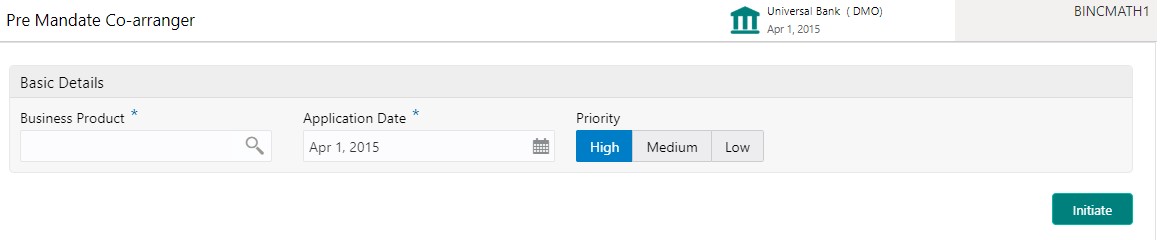

Initiating Pre-Mandate Co-Arranger

The basic registration details for Pre-Mandate Co-Arranger for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Pre-Mandate Co-Arranger

How to initiate a Post Mandate Agent:

- In the Post Mandate Agent screen, provide the required details:

Basic Details

- Business Product: Click Search to view and select the required business product.

- Post Mandate Ref No.: Enter the reference number. (Only if the Syndication Origination is managed by OBCLPM).

- Application Date: Select an effective application date from the drop-down calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

Click Initiate to begin the process.

2.3 Post Mandate Agent

Post Mandate Agent process manages agency related activities of the Agent post assuming the role of an Agent after the execution of the Mandate Letter. This process manages the Preparation of Transaction Documents, Co-ordination with Arrangers and participant Banks, KYC of all the syndication parties, Execution of Transaction Documents and Condition Precedent Satisfaction. Upon completion of the Origination process, the details will be handed over to Operations Enrichment Process for the creation of Facility and Tranches in OBCL.

The process flow for Post Mandate Agent undergoes goes the below stages:

- Entry

The data available during the Pre Mandates will be automatically fed in or captured manually. The user captures the additional data required. User captures the details and send the details to the Legal Counsel for the preparation of the Transaction Docs.

- Transaction Docs Scrutiny

The user reviews the draft transaction docs. If any amendments required, it is send back to the legal counsel. If no amendments required, then send it to arrangers for review.

- Arranger Comments Review

After the arrangers review, the arranger comments are reviewed. If any amendments required, it is send back to the legal counsel. If no amendments required, then send it to Borrower for review.

- Borrower Comments Review

After the Borrower’s review, the Borrower comments are reviewed. If any amendments required, it is send back to the legal counsel. If no amendments required, then final allocation of lenders is checked.

- KYC and Allocation Verification

After the docs is finalized, final allocation of lenders, KYC and all the internal departmental approvals are checked for completion. If the allocation is not finalized, send back to legal with the finalized allocation. If KYC completion and internal department’s approvals are pending, then user will wait until these are completed. Completion of KYC and internal departmental approvals are outside OBCLPM.

- Transaction Docs Execution

After the KYC of all parties, all the internal departmental approvals and final allocation of lenders are in place, send Transaction docs to all the parties for execution. The user will track the execution status of all the docs for all the parties. After sending executed docs to all the parties, data is handed off to the operations team for creation of Facility and Tranche.

- Review Condition Precedent Satisfaction

User will wait for the Condition Precedent to be satisfied, after satisfaction send it for approval.

- Approve Condition Precedent Satisfaction

If Condition Precedent Satisfaction is satisfied. The user will approve it and then with this Post Mandate Agent process will end.

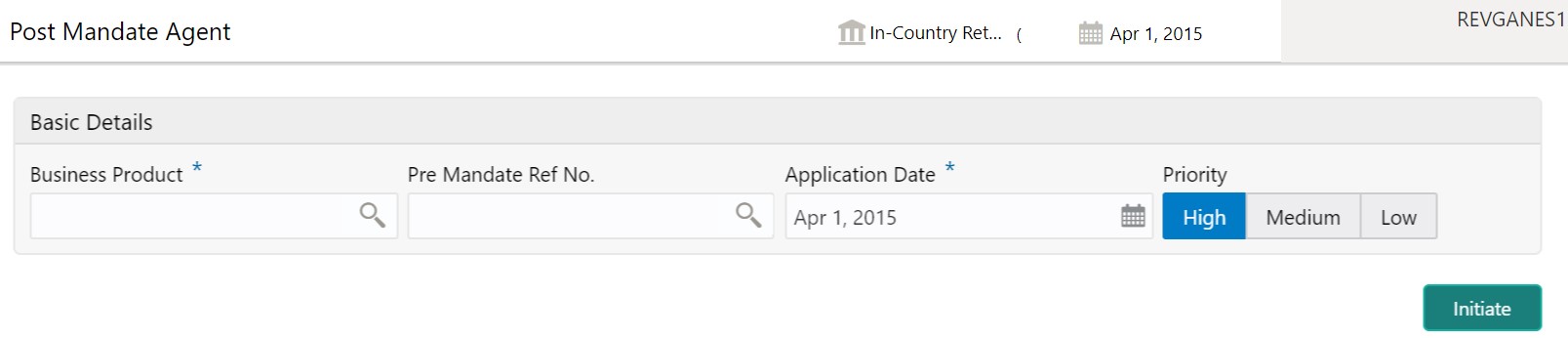

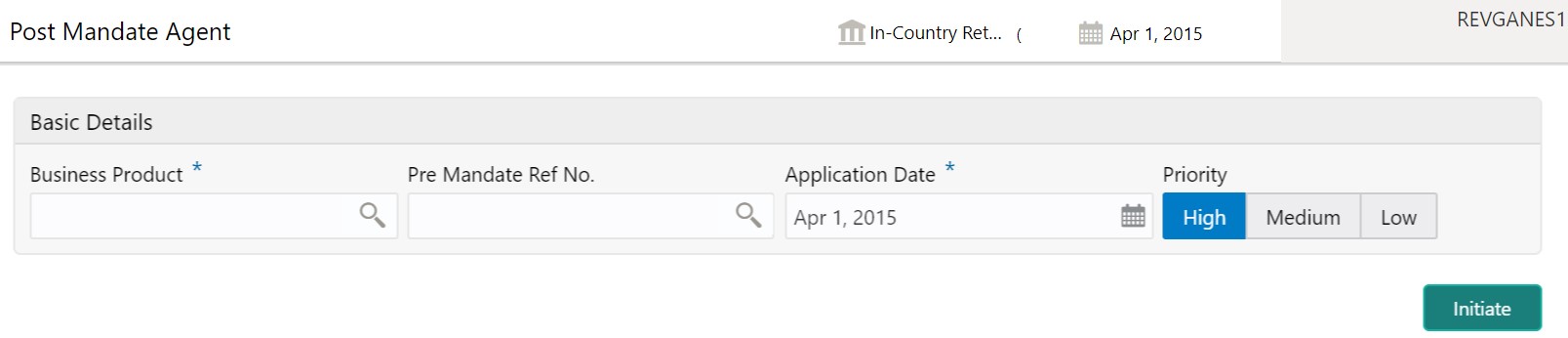

Initiating Post Mandate Agent

The basic registration details for Post Mandate Agent for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Post Mandate Agent

How to initiate a Post Mandate Agent:

- In the Post Mandate Agent screen, provide the required details:

Basic Details

- Business Product: Click Search to view and select the required business product.

- Post Mandate Ref No.: Enter the reference number. (Only if the Syndication Origination is managed by OBCLPM).

- Application Date: Select an effective application date from the dropdown calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

Click Initiate to begin the process.

2.4 Post Mandate Arranger

Post Mandate Arranger process helps the Bank to manage role of an Arranger post executing the Mandate Letter. This process involves the Syndication Invitation to the Participant Banks, Participation Allocation, Risk Review for self-participation, KYC, Internal Approvals, Execution of Transaction Docs and Condition Precedent confirmation. Upon completion of origination process, the details will be handed over to the Operations Enrichment Process accordingly.

The process flow for Post Mandate Arranger undergoes goes the below stages:

- Entry

The data available during the Pre Mandates will be automatically fed in or captured manually.

Movement of this stage will create two parallel processes for the user and which will be worked separately.

- Participant Allocation

- Transaction Documents Review

Participant Allocation can be processed in two ways:

- Proceed with Additional Participants

- Proceed without Additional Participants

For Proceed without Additional Participants, User will move to the Participant Allocation stage after entry.

Process flow for Proceed with Additional Participants undergoes goes the below stages:

- Participant Invitation

User will capture the details of the Participants and send the invitations to the selected Participants. After sending the invites, user will track the responses from the Participants and the status of NDA execution.

- Approval

User will send the additional details about the Borrower to the Participants, who has shown interest in the Syndication and returned the signed NDA. For Participants, who has responded with not interested should be marked as rejected. If required, user should capture more Participants, other than the ones invited earlier.

- Participant Commitment Confirmation

Once all the Participants sign the NDA, user will decide to proceed to next stage or to proceed with the responded Participants. Finalization of Participants will be intimated to the Participants. User will then move to the Participant Allocation stage. User will capture the proposed amount from each Participant for their participation. After discussion with the Participants, user will finalize the allocation for each Participant and send for the approval.

- Allocation Approval

The approver will review the allocation. If the approver does not agree to the allocation, the user should re-allocate. On finalization of the allocation user will initiate the credit approval request for self-participant portion with CFPM. If there is self-participation for the Arranger, ensure there is self-participant commitment allocation given.

- Review Credit Approval

The credit response will be reviewed. If the Credit approval request is rejected for the self-allotted amount, then the user should re-allocate. Once the Credit approval is obtained, the user will proceed to the next stage after sending the notice to the Participants. If there is no self-participation, then no credit approval is required and the user will to move to the next stage after sending the notice to the Participants.

- KYC and Internal Approvals

- The user checks KYC and all the internal departmental approvals for completion. Completion of KYC and Internal departmental Approvals are outside this application. If KYC and Internal departments are pending and the docs are not in order, then user should wait until it is confirmed.

- Track Executed Docs

The user will track the execution status of all the docs and check if the same bank is managing the Agency role and if there is self-participation for arranger. If there is no self-participation, then the process will end. If the arranger is self-participant and playing the role of the Agent, then move to Receive Condition Precedent Satisfaction. If the arranger is self-participant and the Agent is different, then hand over the data to the Operations Enrichment and move to Receive Condition Precedent Satisfaction.

- Receive Condition Precedent Satisfaction

User will wait for the Condition Precedent to be satisfied, after satisfaction send it for approval. After Condition Precedent Satisfaction is satisfied. The user will approve it and then with this Post Mandate Arranger process will end.

Transaction Documents Review

This will be managed as a parallel process. Process flow for Transaction Documents Review undergoes goes the below stages:

- Transaction Docs Review

User will receive the Draft mandate Docs from the Agent and will send it to internal legal for review.

- Docs Review by Legal

The docs is reviewed by the internal legal and the response is given to the RM

- Review Legal Comments

The legal comments are reviewed. If any amendments required, then the user will send it to Agent to make the changes. On receipt of execution version of the Docs, with no further comments on the documents, the user should move to the KYC and Internal Approvals stage.

Initiating Post Mandate Arranger

The basic registration details for Post Mandate Arranger for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Post Mandate Arranger

How to initiate a Post Mandate Arranger:

- In the Post Mandate Arranger screen, provide the required details:

Basic Details

- Business Product: Click Search to view and select the required business product.

- Post Mandate Ref No.: Enter the reference number. (Only if the Syndication Origination is managed by OBCLPM).

- Application Date: Select an effective application date from the drop-down calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

Click Initiate to begin the process.

2.5 Participant Process

Participant Process handles Syndication Facility Origination process for Bank as Participant. This includes Syndication Invitation from the Arranger, Due diligence of the Borrower, KYC, Risk review, Participation decision and Transaction document execution. Upon completion of the Origination process, the application will hand over the details to Operations Enrichment Process for the Operation user to enrich and handover to OBCL.

The process flow for Participant process undergoes goes the below stages:

- Entry

The user captures the borrower information and related party details manually. Borrower and Borrower Related parties details should be send to the Borrower on-boarding team to start the Borrower evaluation process.

- Review Pre Analysis

The user reviews the borrower information and related party details. After review of the Borrower details, the user will decide to proceed with the Participation or to terminate the process. To proceed with the participation, user will confirm the interest to the Arranger along with the signed NDA.

- Review Additional Details

The user will have to wait for the additional details about the facility including Terms Sheet. After review of the details received, user will propose the intended participation amount for approval.

- Approval

The intended participation amount is reviewed for approval. If no amendments required, then the data is send for credit approval. If any amendments required, then send back to Review Additional Details. The user initiates credit request with CFPM.

- Review Credit Approval

The credit response is reviewed and the user will decide to proceed with the Participation or to terminate the process. To participate, user sends confirmation to the arranger.

- Commitment Allocation

User waits for the allocation confirmation from the arranger. If the allocation is not done, then the application will be cancelled or user will proceed to receive the draft transaction docs from the agent. If the user accepts the allocation, then the agent is informed.

- Transaction Docs Review

The transaction docs are reviewed and send to the internal legal team for their review.

- Docs Review by Legal

The docs is reviewed by the internal legal. Legal provides the comments to the Business user for their review.

- Review Legal Comments

The legal comments are reviewed and communicated to the Agent. If no amendments required, then move to KYC and Internal Approvals. If any amendments required, then it is communicated to the agent and wait for the amended documents.

- KYC and Internal Approvals

KYC of all parties are checked to be complete. In addition, all the internal departmental approvals are checked to be in place. If KYC completion and internal department’s approvals are pending, then user will wait until these are completed. Completion of KYC and internal departmental approvals are outside OBCLPM. If the KYC of all parties and all the internal departmental approvals are in place, then proceed for Document execution.

- Track Executed Docs

The executed docs is tracked. If the participant bank is managing the Agency role, then the data will be handed off to OBCL. If the participant bank is not an agent, then the data is handed off to the operations team for creation of Facility and Tranche. Post data hand off if the Condition Precedent is not satisfied, then it is moved to Review Condition Precedent Satisfaction.

- Review Condition Precedent Satisfaction

User will wait for the Condition Precedent to be satisfied. After satisfaction, the user will approve it and then with this participant process will end.

Initiating Participant Process

The basic registration details for Participant Process for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Participant Process

How to initiate a Participant Process:

- In the Participant Process screen, provide the required details:

Basic Details

- Business Product: Click Search to view and select the required business product.

- Post Mandate Ref No.: Enter the reference number. (Only if the Syndication Origination is managed by OBCLPM).

- Application Date: Select an effective application date from the dropdown calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

Click Initiate to begin the process.

2.6 Participant Transfer

Participant Transfer is the process of allocating the Participants Commitment between the existing Participants or with a new Participants. This process also supports the removal of an existing Participant by allocating their commitment to another existing or new Participant. This process helps the user to amend the Participants commitment based on the amended Facility Agreement.

Initiating Participant Transfer Process

Participant Transfer Process can be initiated by giving the basic registration details in the Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Participant Transfer

- In the Participant Transfer Process initiate screen, provide the required details:

Basic Details

- Customer Number: Select the Borrower for which the Participant Transfer to be made.

- Business Product: Click Search to view and select the required business product.

- Application Date: System date will be defaulted as application date.

- Facility Details: Select the applicable Facility listed upon selecting the Borrower.

- Tranche Details: Select the respective Tranche under the Facility

- Click Initiate to begin the process.

The process flow for Participant Transfer Process undergoes the below stages:

- Participant Transfer Entry

User will be able to make the input at the entry stage. User can view the details about the existing Tranche Participants and will be able to amend the respective data segments to amend the Parties or Participants Commitments or related details.

Below Data Segments will be used in this stage.

Parties

Existing Parties details will be defaulted and user will be able to add or remove Participants in the Parties data segment, however user should not add or remove any parties other than the Participants

Tranche Details

Existing details of the Tranche will be defaulted and user should not make any changes to the Tranche Details.

Additional Tranche Details

Existing details of the Tranche will be defaulted and user should not make any changes to the this data segment.

Lenders Commitment

Participant share of the existing Tranche will default in this data segment and user can amend the details to reflect change in Participant commitment.

Entity Details

Details of the existing Participants will default in this data segment and user can make changes if any Participant is included or removed.

Settlement Details

Details of the existing Participants will default in this data segment and user can make changes if any Participant is included or removed.

- . Participant Transfer Approval

User will be able to review and approve all the details captured in the previous stage. If any corrections to be done in the data captured in Entry stage, user will be able to send back the application to the Entry stage for correction. Upon approving the application, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to amend the existing Tranche in OBCL with the details captured in the Entry stage.

Below Data Segments will be used in this stage as read-only and User will be able to review all the details in the data segment and will not be able to edit any details.

- Parties

- Tranche Details

- Additional Tranche Details

- Lenders Commitment

- Entity Details

- Settlement Details

2.7 Operations Enrichment

Operations Enrichment is the process to capture the details available during the Syndication Origination stages as a continuation of any of the Post Mandate process or as standalone process to handover the details for the creation of Syndicated Deal in the back office. Capturing of details can occur in the following ways:

- As a continuation of Post Mandate process, if the Syndication Origination is managed by OBCLPM, then the required data segments are filled in automatically.

- Syndication Origination details are captured manually.

- Back office specific details are captured manually.

The process flow for Operations undergoes goes the below stages:

- Entry

The data available during the Syndication Origination will be automatically fed in or captured manually. In addition, the user reviews the prefilled data and amends it if required.

- Operations Enrichment

The user captures the additional data required for the back office.

- Approval

The loan details are reviewed for approval. If pre-filled data is not edited and no amendments required, then the data will be handed off to OBCL.

If any of the pre-filled data is edited, then send for Exceptional Approval.

If any amendments required, then send back to Entry. Post hand off if the Condition Precedent is not satisfied, then it is moved to Review Condition Precedent Satisfaction.

- Review Condition Precedent Satisfaction

User will wait for the Condition Precedent to be satisfied, after satisfaction send it for approval.

- Approve Condition Precedent Satisfaction

If Condition Precedent Satisfaction is satisfied. The user will approve it and then with this Operations Enrichment process will end.

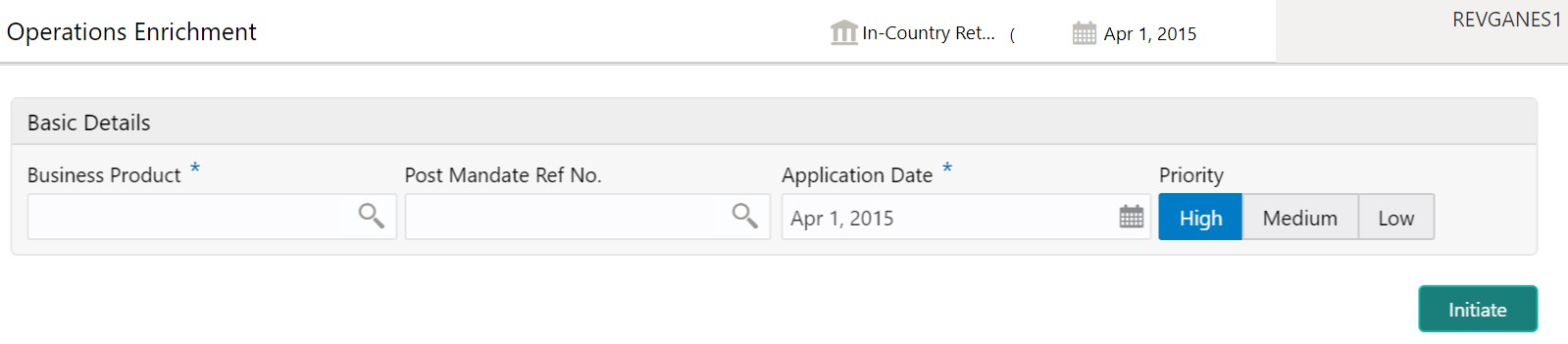

Initiating Operations Enrichment

The basic registration details for Operations Enrichment for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Operations Enrichment

How to initiate an Operations Enrichment:

- In the Operations Enrichment screen, provide the required details:

Basic Details

- Business Product: Click Search to view and select the required business product.

- Post Mandate Ref No.: Enter the reference number. (Only if the Syndication Origination is managed by OBCLPM).

- Application Date: Select an effective application date from the drop-down calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

- Click Initiate to begin the process.

2.8 Agency Drawdown

Agency Drawdown is a process in which the borrower will submit the Drawdown notice to Agent Bank to arrange the funds on a certain date. Agent bank will perform its due diligence on the Drawdown Notice and if satisfied then proceeds will be send to Borrower on the given date.

The process flow for Drawdown Agency undergoes the below stages:

- Entry

In this stage, Agent bank will capture the funding requirement and perform the due diligence on the Drawdown notice received in form of PDF from the customer. Agent bank will also verify if all the Condition precedent along with Further Condition precedents and Drawdown Conditions has been satisfied.

- Verification

All the data gathered in the previous stage will be checked and verified. If data input is incorrect, then the verifier can reject the application or send it back for correction. If the verifier is satisfied with all the data, then he can proceed. While submitting the stage all the notice configured will be generated and send to respective parties. In case of any discrepancy, bank will revert to borrower for more details or will move to next stage.

- Treasury Rate

If agent is also participating as one of the lenders to the deal and has to cover exposure, then for the same amount treasury ticket to be booked. Treasury reference number and rate will be captured.

- Enrichment

Under this stage, bank can configure additional data segment to capture more data which are required.

- Funds Recon

Bank will send out the notices to all the lenders to arrange the funds on a Drawdown date. In addition, tracking for the lenders reply slip, if not received then reminder to be send.

Agent will reconcile each lenders share in Drawdown shares. If funds not received then reminders would be sent.

- Exceptional Settlement Risk Approval

If the funds from any lender is not received or sighted, then Intra-day Risk approvals for funds will be arranged. User will request for intraday approval, if any lender has not sent the funds on DD date.

- Exceptional Compliance Approval

In case of Drawdown, a Sanction check is performed on borrower. If any hits are found, then compliance approval can be obtained.

- Approval

Post all the above step application will land into the final approval. After the approvals, cash will be remitted to the Borrower, before currency cut off.

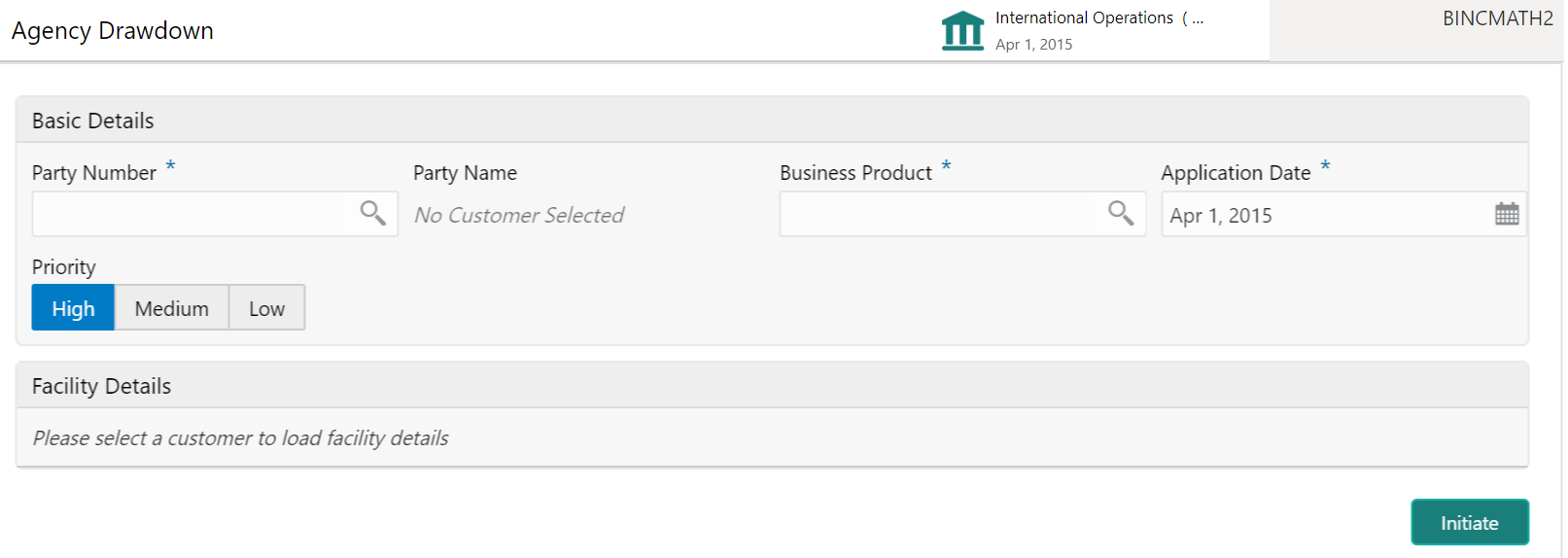

Initiating Agency Drawdown

The basic registration details for Agency Drawdown for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Agency Drawdown

How to initiate an Agency Drawdown:

- In the Agency Drawdown screen, provide the required details:

Basic Details

- Party Number: Click Search to view and select the required party number.

- Party Name: As per the party number selected, party name gets auto-populated.

- Business Product: Click Search to view and select the required business product.

- Application Date: Select an effective application date from the dropdown calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

- Click Initiate to begin the process.

2.9 Participant Drawdown

Participant Drawdown is a non-agency process in which the agent will submit the Drawdown notice to Lender to arrange the funds on a certain date. Lender bank will perform due diligence on the drawdown notice and if satisfied, then proceed will be send to agent on the given date.

The process flow for Participant Drawdown undergoes goes the below stages:

- Entry

Lender will capture the funding requirement and perform the due diligence on the Drawdown notice received in form of PDF from the agent. In addition, lender will also verify if all the Condition precedent is satisfied. Further Condition precedent and Drawdown Condition has been satisfied.

- Verification

Data gathered in the previous stage along with facility and tranches booked in system will be checked and verified. If data input is not correct, then the verifier can reject the application or send it back for correction. If the verifier is satisfied with all the data, then lender will sign the reply slip and send to agent via fax or an email. In case of any discrepancy, lender will revert to agent for more details or will move to next stage.

- Treasury Rate

As Lender bank is also lending to the deal and has to cover exposure, then for the same amount treasury ticket to be booked. Treasury reference number and rate will be captured.

- Enrichment

Under this stage, bank can configure additional data segment which are required.

- Exceptional Compliance Approval

In case of Drawdown, a Sanction check is performed on borrower. If any hits are found, then compliance approval can be obtained.

- Approval

Post all the above step, application will land into the final approval. After the approvals, cash is remitted to the agent, before currency cut off.

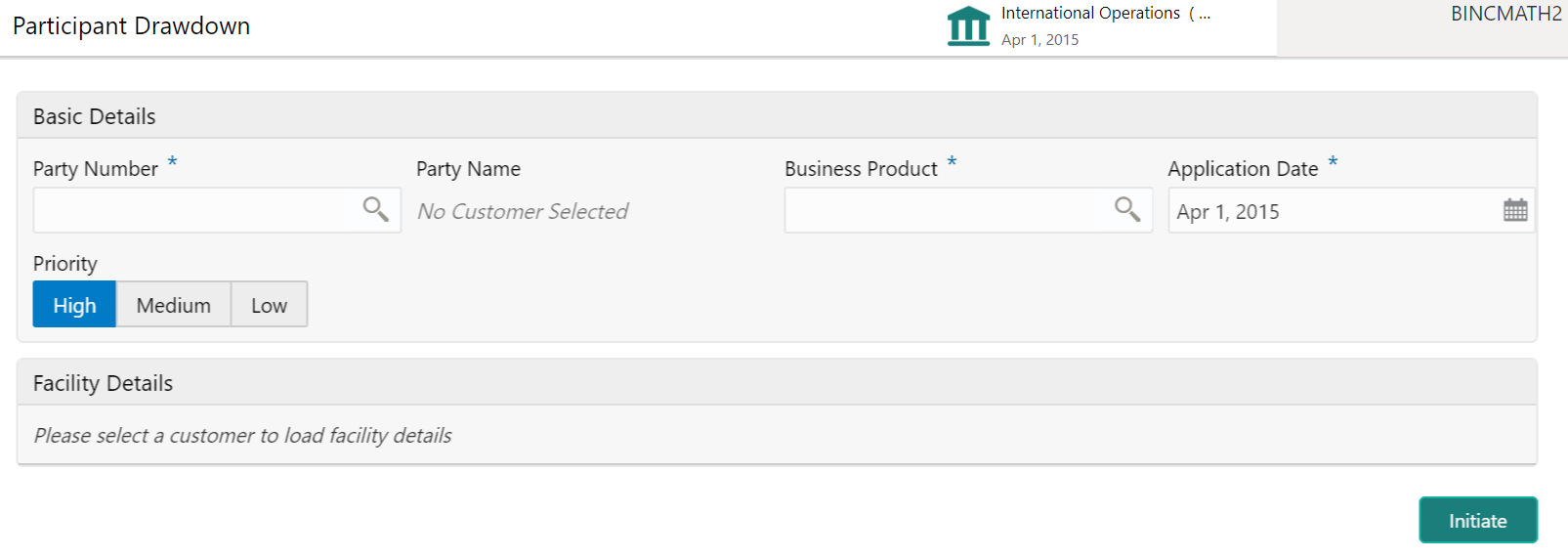

Initiating Participant Drawdown

The basic registration details for Participant Drawdown for a prospective borrower can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Participant Drawdown

How to initiate a Participant Drawdown:

- In the Agency Drawdown screen, provide the required details:

Basic Details

- Party Number: Click Search to view and select the required party number.

- Party Name: As per the party number selected, party name gets auto-populated.

- Business Product: Click Search to view and select the required business product.

- Application Date: Select an effective application date from the drop-down calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

- Click Initiate to begin the process.

2.10 Syndication Drawdown Amendment

Syndication Drawdown Amendment Process helps the user to modify the existing draw down contract. User will be able to increase the Principal amount, change loan maturity date or change the interest margin of the existing Agency or Participant draw down contract.

Initiating Syndication Drawdown Amendment Process

The basic registration details for Drawdown Amendment Process can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Drawdown Amendment

- In the Drawdown Amendment Process initiate screen, provide the required details:

Basic Details

- Customer Number: Select the Borrower for which the Loan amendment to be made.

- Business Product: Click Search to view and select the required business product.

- Application Date: System date will be defaulted as application date.

- Effective Date: Select an effective date from the dropdown calendar.

- Priority: Click High/Medium/Low button as per the priority.

- Facility Details: Select the applicable Facility listed upon selecting the Borrower.

- Tranche Details: Select the respective Tranche under the Facility

- Drawdown Details: Select the Drawdown contract to which the amendment to be done from the list of drawdowns under the selected Tranche

- Click Initiate to begin the process.

The process flow for Syndication Drawdown Amendment Process undergoes the below stages:

- Amendment Application Entry

User will be able to make the input at the entry stage. User can view the details about the existing Drawdown and will be able to amend the respective data segments to amend the Principal amount, Maturity date or Interest margin.

Below Data Segments will be used in this stage.

Parties

Existing Parties details will be defaulted and user will not edit any details

Loan Details

User can view the existing Drawdown details and will not be able to edit any details.

Additional Loan Details

User can view the existing details and will not be able to edit any details.

Restructuring Amendment Details

User can make changes to Principal amount or maturity date in this data segment.

Interest margin Details

User can make changes to the existing Interest rate in this data segment.

- Amendment Application Approval

User will be able to review and approve all the details captured in the previous stage. If any corrections to be done in the data captured in Entry stage, user will be able to send back the application to the Entry stage for correction. Upon approving the application, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to amend the existing draw down in OBCL with the details captured in the Entry stage.

Below Data Segments will be used in this stage as read-only and User will be able to review all the details in the data segment and will not be able to edit any details.

- Parties:

- Loan Details:

- Additional Loan Details:

- Restructuring Amendment Details:

- Interest margin Details

2.11 Drawdown Rollover

Syndication Drawdown Rollover process helps the user to rollover or split existing drawdown contract. A Borrower could opt to split the drawdown into 1 or more drawdowns and roll them over. The product & interest preferences for the new child contract could be captured on this process flow.

Initiating Syndication Drawdown Rollover Process

Drawdown Rollover Process can be initiated by giving the basic registration details in the Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Rollover

- In the Rollover Process initiate screen, provide the required details:

Basic Details

- Customer Number: Select the Borrower for which the Rollover to be made.

- Facility Details: Select the applicable Facility listed upon selecting the Borrower.

- Tranche Details: Select the respective Tranche under the Facility

- Drawdown Details: Select the drawdown contract to be rolled over

- Business Product: Click Search to view and select the required business product.

- Effective Date: Choose the effective date of the transaction

- Priority: Appropriate priority can be selected

- Click Initiate to begin the process.

The process flow for Rollover Process undergoes the below stages:

- Rollover Entry

User will be able to make the input at the entry stage. User can view the details about the existing Drawdown and will be able to amend the respective data segments to Rollover or Split the drawdown along with the Rollover.

Below Data Segments will be used in this stage.

Parties

Existing Parties details will be defaulted and user should not amend any of the information

Rollover Detail

Existing details of the Drawdown will be defaulted and user will be able to capture the details of the new Rollover drawdowns details. Also user will be able to capture the necessary details to split the drawdown along with the rollover

Interest Margin Details

The interest and margin details of the rollover or contract will be defaulted in this data segment and user can make necessary amendments if any.

- Rollover Approval

User will be able to review and approve all the details captured in the previous stage. If any corrections to be done in the data captured in Entry stage, user will be able to send back the application to the Entry stage for correction. Upon approving the application, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to rollover the existing drawdown contract.

Below Data Segments will be used in this stage as read-only and User will be able to review all the details in the data segment and will not be able to edit any details.

- Parties

- Rollover Detail

- Interest Margin Details

2.12 Syndication Restructure

Syndication Restructure process enables the user to pay down the existing Drawdown under a specific Tranche and terminate the Tranche. Through the same process user will be able to create a new Tranche with a difference in Lender allocation based on the amendment agreements received as part of the restructure process and book a new Drawdown under the newly created Tranche. All these activities can be handled through the single Syndication Restructure process.

Initiating Syndication Restructure Process

The basic registration details for Restructure Process can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Restructure

- In the Restructure Process initiate screen, provide the required details:

Basic Details

- Customer Number: Select the Borrower for which the Restructure to be made.

- Business Product: Click Search to view and select the required business product.

- Application Date: System date will be defaulted as application date. User can change this and this will be considered as the Effective date of the Application.

- Facility Details: Select the applicable Facility listed upon selecting the Borrower.

- Tranche Details: Select the respective Tranche under the Facility

- Click Initiate to begin the process.

The process flow for Syndication Restructure Process undergoes the below stages:

- Restructure Entry

User will be able to view the details of the Tranche which needs to be restructured and will be able to select the type of Restructure in this stage. User can fetch the available drawdowns and the selected Tranche and the restructure action as Liquidate and New

Below Data Segment will be used in this stage.

Restructure Tranche:- Details of the selected Tranche can be viewed and select the action on the available draw down accordingly.

- Restructure Enrichment

User will be able to view the details of the existing Drawdown contract and Tranche contract in this stage. User will be able to make pay down to the existing draw down and make amendment to the existing tranche by making necessary modification. Whatever modification made to the existing tranche details will be considered as the data for the new tranche. Also the user will be able to capture the details of the new draw down to be booked under the newly created Tranche in this stage.

Below Data Segments will be used in this stage.

Loan Details

User will be able to view the details of the existing Drawdown contract and will not be able to edit any details.

Payment Details

User will be able to view the outstanding under the existing loan under various components along with tax. User can capture the payment amount accordingly.

Review Settlement Account

User can park any of the component in to the suspense account using this data segment.

Restructure party

Existing Parties of the Tranche will be defaulted in this data segment and user can make amendment to reflect in the new Tranche

Tranche Details

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Lender Commitments

Participant share of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Margin Details

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Fee Details

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Tranche Repayment Schedules

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Additional Tranche Details

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Margin and Schedules

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Restructure Entity Details

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Restructure Settlement Details

Details of the existing Tranche will default in this data segment and user can amend the details to reflect in the new Tranche.

Restructure Loan Details

User can capture the details of the new loan to be booked under the new Tranche

Additional Loan Details

User can capture the details of the new loan to be booked under the new Tranche

Interest margin Details

User can capture the interest details of the new loan to be booked under the new Tranche

Payment Schedules

User can capture the Payment Schedules of the new loan to be booked under the new Tranche

Sighting Funds Match Review

User will be able to reconcile and sight the expected payment from Borrower. Fund sighting can be either automatic through ML Process or manual.

Below Data Segment will be used in this stage.

Match Sighting Fund:- User can view the expected amount details and match the receivable with the Funds sighted through ML process or manually.

4. Restructure Approval

User will be able to review and approve all the details captured in the previous stages. If any corrections to be done in the data captured in Entry stage, user will be able to send back the application to the Entry stage for correction. Upon approving the transaction, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to pay down the draw down in the existing Tranche and crate new Tranche in OBCL and book new drawdown under the newly created Tranche.

Below Data Segment will be used in this stage.

Application Verification:- User will be able to view the summary view of all the data segments used in the previous stages and will be able to verify the data by opening each summary tile.

2.13 Tranche Margin Amendment

Syndication Tranche Margin Amendment process enables the user to make the changes to the Interest margin of an existing Agency or Participant Tranche contract. User will be able to specify the Interest margin for various currencies at various effective dates.

Initiating Tranche Margin Amendment Process

The basic registration details for Margin Amendment Process can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Tranche Margin Amendment

1. In the Tranche Margin Amendment Process initiate screen, provide the required details:

Basic Details

- Customer Number: Select the Borrower for which the Margin Amendment to be made.

- Business Product: Click Search to view and select the required business product.

- Application Date: System date will be defaulted as application date and user can change this.

- Facility Details: Select the applicable Facility listed upon selecting the Borrower.

- Tranche Details: Select the respective Tranche under the Facility

2. Click Initiate to begin the process.

The process flow for Tranche Margin Amendment Process undergoes the below stages:

- Application Entry

User will be able to make the input at the entry stage. User will be able to view the details about the existing Tranche and can be able to amend the respective data segments to amend the Interest Margin.

Below Data Segments will be used in this stage.

Tranche Details

Details of the selected tranche will default in this data segment and this information is non editable.

Margin Details

User will be able to make the necessary Interest Margin changes in this data segment.

Margin Amendment Application Approval

User will be able to review and approve all the details captured in the previous stage. If any corrections to be done in the data captured in Entry stage, user will be able to send back the application to the Entry stage for correction. Upon approving the application, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to amend the existing Tranche in OBCL with the details captured in the Entry stage.

Below Data Segments will be used in this stage as read-only and User will be able to review all the details in the data segment and will not be able to edit any details.

Tranche Details

Details of the selected tranche will default in this data segment and this information is non editable.

Margin Details

User will be able to make the necessary Interest Margin changes in this data segment.

- Margin Amendment Application Approval

User will be able to review and approve all the details captured in the previous stage. If any corrections to be done in the data captured in Entry stage, user will be able to send back the application to the Entry stage for correction. Upon approving the application, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to amend the existing Tranche in OBCL with the details captured in the Entry stage.

Below Data Segments will be used in this stage as read-only and User will be able to review all the details in the data segment and will not be able to edit any details.

- Tranche Details:

- Margin Details

2.14 Tranche Financial Amendment

Tranche Financial Amendment is the process of modifying the financial details of the existing Tranche Through this functionality, user will be able to make changes to the existing Agency or participant tranche contract. User will be able to increase or decrease the Principal amount or change tranche maturity date.

Initiating Tranche Financial Amendment Process

Tranche Amendment Process can be initiated by giving the basic registration details in the Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Tranche Financial Amendment

- In the Participant Transfer Process initiate screen, provide the required details:

Basic Details

- Customer Number: Select the Borrower for which the Tranche Amendment to be made.

- Business Product: Click Search to view and select the required business product.

- Application Date: System date will be defaulted as application date.

- Effective Date: Choose the effective date of the transaction

- Priority: Appropriate priority can be selected

- Facility Details: Select the applicable Facility listed upon selecting the Borrower.

- Tranche Details: Select the respective Tranche under the Facility

- Click Initiate to begin the process.

The process flow for Tranche Financial Amendment Process undergoes the below stages:

- Tranche Amendment Entry

User will be able to make the input at the entry stage. User can view the details about the existing Tranche and will be able to amend the respective data segments to amend the Tranche amount or maturity date

Below Data Segments will be used in this stage.

Parties

Existing Parties details will be defaulted and user should not amend any of the information

Tranche Details

Existing details of the Tranche will be defaulted and user should not make any changes to the Tranche Details.

Tranche Amendment Details

User can make the changes to the Tranche amount or maturity date in this data segment.

- Tranche Amendment Approval

User will be able to review and approve all the details captured in the previous stage. If any corrections to be done in the data captured in Entry stage, user will be able to send back the application to the Entry stage for correction. Upon approving the application, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to amend the existing Tranche in OBCL with the details captured in the Entry stage.

Below Data Segments will be used in this stage as read-only and User will be able to review all the details in the data segment and will not be able to edit any details.

- Parties

- Tranche Details

- Tranche Amendment Details

2.15 Bulk Payment

Syndication Bulk Payment process enables the user to pay down multiple draw down contracts under the same facility in a single payment process. User will be able to pay down both Principal and Interest components of multiple Loan drawdowns selected under various Tranches of the same Facility.

Initiating Bulk Payment Process

The basic registration details for Bulk Payment Process can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Bulk Payment

- . In the Bulk Payment Process initiate screen, provide the required details:

Basic Details

- Customer Number: Select the Borrower for which the Bulk Payment to be made.

- Business Product: Click Search to view and select the required business product.

- Application Date: System date will be defaulted as application date and user can change this.

- Facility Details: Select the applicable Facility listed upon selecting the Borrower.

- Tranche Details: Select the respective Tranches under the Facility

- Click Initiate to begin the process.

The process flow for Bulk Payment Process undergoes the below stages:

- Bulk Payment Entry

User will be able to view the details of the Facility and Tranche selected during the initiation, in respective data segments and will be able to amend the details. User will be able to view the details of all the drawdowns under the selected facility and can filter by tranche or borrower. User will be able to select the drawdowns which are to be paid. User can set the limit date and effective date of the bulk payment and can enable if cash match is required or taxes are waived.

Below Data Segments will be used in this stage.

Parties

Existing Parties details will be defaulted and user will not edit any details

Bulk Loan Details

User will be able to view the details of all the drawdowns under the selected facility and will be able to filter by tranche or borrower to pay down.

Bulk Payment Details

User will be able to view the outstanding under the selected loans under various components along with tax. User can capture the payment amount accordingly.

Review Settlement Account

User can park any of the component in to the suspense account using this data segment.

Settlement Details

All the available Settlement accounts of all the parties will be defaulted in this data segment.

- Sighting Funds Match Review

User will be able to reconcile and sight the expected payment from Borrower or Agent. Fund sighting can be either automatic through ML Process or manual.

Below Data Segment will be used in this stage.

Match Sighting Fund

User can view the expected amount details and match the receivable with the Funds sighted through ML process or manually.

- Bulk Payment Approval

User will be able to review and approve all the details captured in the previous stage. If any corrections to be done in the data captured in previous stages, user will be able to send back the application to the Entry stage for correction. Upon approving the application, OBCLPM will hand over all the information to OBCL. With this hand off OBCLPM will be able to pay down multiple draw down contracts in OBCL.

Below Data Segments will be used in this stage as read-only and User will be able to review all the details in the data segment and will not be able to edit any details.

- Parties:

- Bulk Loan Details:

- Bulk Payment Details:

- Review Settlement Account:

- Settlement Details:

- Match Sighting Fund

2.16 Syndication Payment

Syndication Payment Process is to make the repayment of the Principal and interest of the Syndication Loan contract. This process will handle the Loan repayment for both Agency and Participant deals.

The process flow for Payment Process undergoes the below stages:

- Payments Entry

Upon initiating the Payment process by selecting the right Facility,

Tranche and Loan contract, user will be able to capture the Payment details

of the Loan in the Payments Entry stage. User will be able to view the

Scheduled breakup of the Loan also will be able to override the settlement

instruction if required.

- Sighting Funds Match Review

User will be able to reconcile and sight the expected payment either from Borrower or Agent. Fund sighting can be either automatic through ML Process or manual.

- Payments Approval

The Payment details are reviewed for approval. If all the information are correct and no amendments required, then the data will be handed off to OBCL to process the Loan Payment.

Initiating Payment Process

The basic registration details for Payment Process can be initiated using this Initiation Screen, provided the user has the required access rights.

How to reach here:

Corporate Lending > Operations > Syndication > Payment

- In the Payment Process screen, provide the required details:

Basic Details

- Customer: Select the Borrower for which the Loan payment to be made.

- Facility Reference Number: Select the Facility Reference Number

- Tranche Reference Number: Select the respective Tranche under the Facility

- Contract Reference Number: Upon searching the contracts under the Facility and Tranche select the Loan Contract

- Business Product: Click Search to view and select the required business product.

- Effective Date: Select an effective application date from the dropdown calendar. The system defaults the current system date as the application initiation date.

- Priority: Click High/Medium/Low button as per the priority.

- Click Initiate to begin the process.

2.17 Consolidate Rollover

User can consolidate one or more contracts into a single parent contract. This can be done through the Consolidation Rollover menu under syndication module. User can initiate the process flow and the application will move through various stages of the business process flow. The process of consolidate rollover can be initiated by the Relationship Manager or any bank user (with relevant rights).

The list of stages that are required for a Consolidate Rollover process will be pre-defined in Conductor process and the data segments that are applicable for every stage can be configured in Business Process maintenance. Based on this setup, system derives the process flow for every loan application.

The process flow pre-defined for Consolidate Rollover is provided for quick reference:

- Consolidation Rollover Entry

- Consolidation Rollover Approval

- Retry Consolidation Rollover Handoff

Initiating Consolidation Rollover

How to reach here:

Corporate Lending > Operations > Syndication > Consolidation Rollover

How to initiate Consolidation Rollover Process Flow:

- In the Consolidation Rollover screen, provide the required details:

Basic Details

- Borrower Number: Click Search to view and select the required Customer Identification number or you can also type the Customer Number.

- Customer Name: Based on the Customer Number selected, the information is auto-populated.

- Business product: Click Search to view and select the required Business product. Based on the

- Business product, system derives the following details to process

the loan application:

- Applicable stages and its data segments

- Required documents and checklists

- Stage level advices

- Application Date: Select an application date from the drop-down calendar. The system defaults the current system date as the application initiation date.

Facility Details

Displays the list of all facilities that are created for the Customer Number. You can select the appropriate Facility ID.

Tranche Details

Displays the list of all tranches under the facility that are created for the Customer. You can select the appropriate tranche ID under which the loans to be consolidated.

- Click Initiate to begin the process.

On submit of the screen, a unique Application Registration number will be auto generated by the system, which are used throughout the process and for further tracking.

Based on the user rights the system will navigate the user to the first manual stage of the process flow.

Data Segments

Provides information about the usage of data segments that are configured at each stage. Every data segment can be configured as a mandatory or non-mandatory at Business Process Code maintenance based on the business product code defined. Each data segment has the following action buttons.

- Back: System will move the task to the previous segment.

- Next: System will move the task to the next screen. If mandatory fields are not entered, system will display error.

- Save and Close: You can save and close the task and reopen it to work later.

- Cancel: You will be able to cancel the task window and return to dashboard. The data input will not be saved.

Each data segment has the option to upload the specific documents required for the application.

Below are the sample date segment which can be configured for this process flow.

2.17.1 Consolidation Main Details

Under this Datasegment user will be able to capture the basic details of the transaction detailed below.

Tranche Reference No

Display the tranche detail which was selected in initiate screen.

Value date

Parameter for selecting the drawdowns for consolidation is the value date. In effect, this date refers to the maturity date of the child drawdowns that have to be consolidated as part of rollover. In addition to the same combination of counterparty, product, and currency, the child drawdowns should also have the same maturity date for consolidation to occur.

Counterparty

You have to select the counterparty of the drawdowns that have to be consolidated as part of rollover. The option list displays the list of all active customers of the branch.

Contract Currency

You have to select the currency of the drawdowns that have to be consolidated as part of rollover. The option list displays the allowable currencies for the tranche. Select a currency from this list.

Product Code

You have to select the drawdown product based on which the system selects the drawdowns for consolidation. This option list the drawdown products associated with the tranche product under which the selected tranche is processed

Rollover Type

You have to indicate the type of rollover you wish to perform. The available options are:

(a)Consolidated – In this case, all selected drawdowns with the same combination of Tranche + Drawdown Product + Counterparty + Currency + Maturity Date is consolidated into a single contract upon rollover.

(b)Consolidated + Split – In this case, the system first consolidates the selected drawdowns as per the consolidation instructions and then splits the net result of consolidation as per the split instructions.

Rollover Amount

User can select Principal or Principal + Interest

Rollover Mode

Here use can select an one option among the available to option (a)Auto: The transaction will be automatically handed over to back office. (b) Manual: Application will be waiting under a stage “Manual Handover stage”.

Maturity Date

You can capture the maturity date of the rolled over drawdown here. If you do not specify the maturity date, the system arrives at the maturity date based on the ‘Roll By’ value and the ‘Maturity Days’ specified for the drawdown.

Maturity Days

User can input the number of days that is to be added to the value date of the new split Drawdown to arrive at the maturity date of the drawdown.

Roll By

Indicate the tenor basis upon which the maturity days specified for the rolled-over contract will be derived. The options are:

- Days, Months, Quarters, Semi-annuals, Years

Consolidation Main Details

Child Contract Ref No

You have to select the child drawdowns that have to be consolidated as part of rollover. The option list displays all drawdowns with the same combination of counterparty, product, currency and maturity date that you select. Select a drawdown from this list.

Click the ‘Add Consolidation Details’ button to select the next drawdown from the list.

Principal Roll Amount

The system displays the outstanding principal that can be rolled over for each child drawdown. You can amend the outstanding principal, if required. This amount can be either greater than or lesser than the outstanding principal amount. The system treats this as a special amount rollover.

Interest Roll Amount

In addition to displaying the outstanding principal, the system displays the interest to be capitalized for each drawdown in the ‘Interest Roll Amt’ field. You cannot amend this amount.

Total Roll Amount

Sum of Principal Roll amount and Interest Roll amount

Driver Contract

From the list of child drawdowns selected for consolidation, you have to designate one of them as the ‘Driver Contract’. The consolidated drawdown (generated upon rollover) inherits the preferences (information such as settlement details, schedules, MIS details and so on) of the driver contract you select here.

2.18 Natural Language Processing (NLP)

NLP is a process in which the system identifies the document id, document type and content from an uploaded file and initiates the respective process.

The process flow for NLP undergoes goes the below stages:

- When a document is uploaded from or a poller receives a document of loan processing type NLP framework will initiate the NLP process from syndication service with the document id (from document management system), document type and document content.

- These data will be stored in NLP Data Segment. During this initiation, the process will land in a system task called Enrich NLP Details. Enrich NLP will extract the values along with the request and identify the respect business values for the extracted tags and also will enrich the information.