6. Processing Settlement Netting

This chapter explains processing Net Settlement of Cash and Securities in Oracle Banking Treasury Management application.

Bank can trade in listed derivative deals through multiple brokers and maintains multiple settlement accounts with each broker. Daily statement for each account is received from the Broker on the next business day. Back-office user verifys the statement and initiate the broker settlement process.

Collateral Margin to be transferred can be netted with other components to be settled with the same counterparty, based on the netting preferences applicable for the transaction. Settlement can be initiated for the net value as agreed with the party.

Net settlement of Cash or Securities can be performed across contracts belonging to,

•same or different modules, products or deal types

•same or different agreements or portfolios

•same or different components

Components can be marked for Netting from the functions used for,

•contract booking, manual payments and liquidation of contracts

•collateral assignment, substitution and margin calls processing

6.2 Cash-Margin Netting Initiation

Net settlement of Cash components can be initiated by performing pre-netting for all transactions linked to an Agreement or Portfolio, using ‘Cash-Margin Netting Initiation’ function.

All uninitiated cash margin transfers and unsettled deal cashflows of the contracts linked to the same Agreement or Portfolio are eligible for pre-netting can be netted based on the applicable preferences configured for the respective Agreement or Portfolio. Pre-netting operations can be initiated for,

•Initial Margin to be provided for the net margin required for all the deals with the Initial Margin accounts linked to the selected scheme

•Variation Margin to be provided for the net profit loss to be settled from all the deals with the Variation Margin accounts linked to the selected scheme

•Deal cashflows to be settled for the net amount of the Cash components for all the deals linked to the selected scheme

The details that can be captured for Cash-Margin Netting Initiation include,

•Party, Settlement Scheme, Currency, Module and Agreement or Portfolio for which pre-netting would be initiated

•Type of operation as pre-netting for Deal cashflows, Initial or Variation Margin

•Margin Type and Margin Account for cash margin transfer

•Component type and Due date for deal cashflows

•Settlement Amount to be net settled

•User Defined Fields configured for cash-margin netting initiation process

User can view the details for,

•List of deals, linked to the Agreement or Portfolio selected, that are available for pre-netting for the selected operation

•Events triggered for the pre-netting transaction along with accounting entries posted and advice(s) generated for each event

Cash-Margin pre-netting transactions can be initiated only for the branch to which user has access.

6.2.1 Process to initiate a new transaction

This topic provides the systematic instructions to initiate a new transaction.

Context:

To initiate a new transaction

1.Click the New button at the top of the screen.

2.Enter the values for all the required fields.

3.Click on the Save button to initiate the transaction and send for authorization.

4.Click on the Hold button to save as draft.

6.2.2 Process to query and view the details of an existing transaction

This topic provides the systematic instructions to query and view the details of an existing transaction.

Context:

To query and view the details of an existing transaction

1.Click the Enter Query button at the top of the screen.

2.Enter the Netting Reference of the transaction.

3.Click the Execute Query button.

6.2.3 Modifying an existing transaction

This topic provides the systematic instructions to modify an existing transaction.

Context:

To modify an existing transaction or to revisit the data saved as draft

1.Enter the Netting reference of the transaction and query the existing transaction.

2.Click the Unlock button to enable the screen for editing the details.

3.Review the existing values saved or kept on hold.

4.Enter the new values for the fields to be modified. Please refer the table of fields to know whether the field can be modified after first authorization of the transaction.

5.Click on the Save button to modify the transaction and send for authorization.

6.2.4 Discard, reverse and print transactions

This topic provides the systematic instructions to discard and reverse transactions and print details of the transactions.

1.Click on the Delete button to discard the transaction before first authorization.

2.Click on Reverse button to reverse the transaction after first authorization.

3.Click on the Print button to print the details of the transaction.

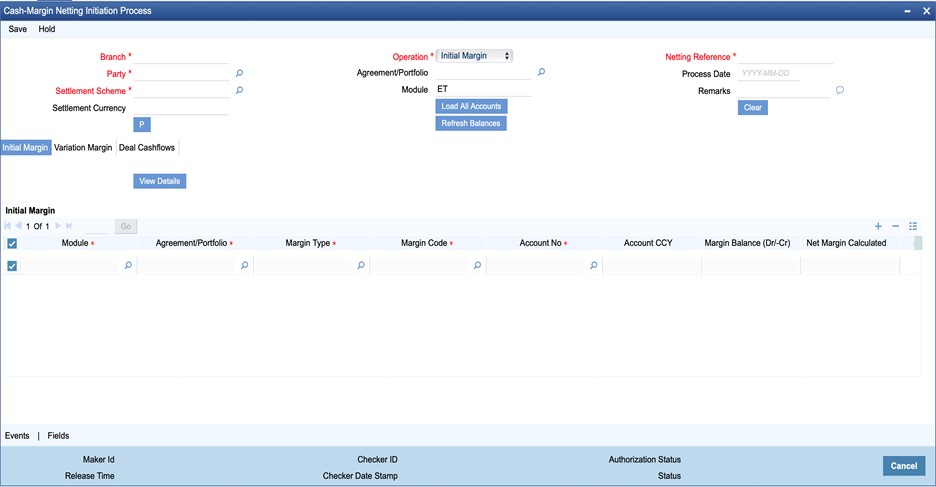

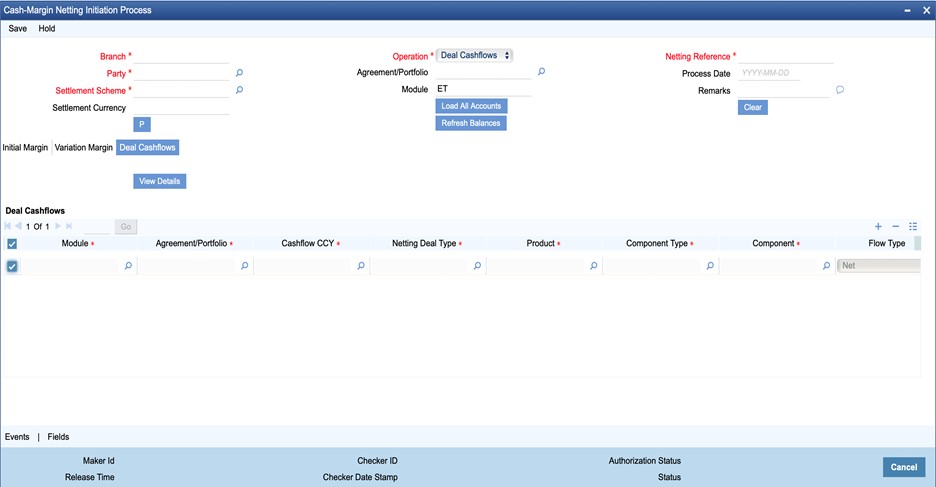

6.2.5 Cash-Margin Netting Initiation Process screen

User can initiate pre-netting of the cash-margin components linked to the scheme in this Cash-Margin Netting Initiation Process screen.

1.On the Homepage, type MGDCMINI in the text box, and click the next arrow.

Step Result: Cash-Margin Netting Initiation Process screen is displayed.

Figure 6.47: Cash-Margin Netting Initiation Process

2.On Cash-Margin Netting Initiation Process screen, Click New.

3.On the Cash-Margin Netting Initiation Process- New screen, Specify the details as required.

4.Click Save to save the details or Cancel to close the screen.

For information on fields, refer table below:

* Indicates mandatory fields.

Table 6.31: Cash-Margin Netting Initiation Process

|

Field |

Description |

|---|---|

|

Branch |

Displays the current branch code to which the user has logged in. |

|

Party |

Select the party with whom the pre-netting is initiated. •This field cannot be amended after saving the pre-netting transaction |

|

Settlement Scheme |

Select the Settlement Scheme for which pre-netting is initiated. •This field cannot be amended after saving the pre-netting transaction •Only those active schemes with the selected party and available for the current branch, is displayed for selection •Both Margin Schemes and Cash Netting Schemes is displayed for selection, based on the selected ‘Operation’ |

|

Settlement Currency |

Displays the currency of the settlement scheme selected, in which the settlement happens. |

|

Operation |

Select the cashflow type for which pre-netting operation is initiated. •This field cannot be amended after saving the pre-netting transaction •Select ‘Initial Margin’, if pre-netting to be initiated is for the purposes of Initial Margin to be provided for the net margin required for all the deals with the Initial Margin accounts linked to the selected scheme •Can be used for pre-netting of Independent Amount, or any margin other than variation margin, for all the deals with the respective margin accounts linked to the selected scheme •Select ‘Variation Margin’, if pre-netting to be initiated is for the purposes of Variation Margin to be provided for the net profit loss to be settled from all the deals with the Variation Margin accounts linked to the selected scheme •Select ‘Deal Cashflows’, if pre-netting to be initiated is for the net amount to be settled for the Cash components for all the deals linked to the selected scheme •If not specified, this field is set to ‘Initial Margin’ by default |

|

Agreement/Portfolio |

Select the Agreement or Portfolio for which pre-netting is initiated for the deals linked. •This field cannot be amended after saving the pre-netting transaction •Only those active Agreements with the selected party, available for the current branch, enabled for the Module (if selected) and having Expiry Date >= Process date of the pre-netting, is displayed for selection •Only those active portfolios for the Module (if selected), available for the current branch and customer portfolios for the selected Party (if available), is displayed for selection •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules in which portfolios can be defined separately |

|

Module |

Select the module of the deal(s) for which pre-netting of cash-margin is initiated. •This field cannot be amended after saving the pre-netting transaction |

|

Netting Reference |

Displays a unique reference number for the pre-netting transaction. •Automatically generated when the user clicks on ‘P’ button |

|

Process Date |

Displays the date on which the pre-netting transaction was saved. •Branch date is set by default |

|

Remarks |

Enter any additional comments for the pre-netting transaction. •A maximum of 250 characters can be entered for remarks |

On click of P button, system automatically generates and displays a unique ‘Netting Reference’ for the transaction. Also, according to the selected ‘Operation’, the associated Tabs are enabled or disabled.

On click of Load All Accounts button, system automatically identifies all margin accounts or cash flow components linked to the selected scheme, based on the operation. And populates details for the net margin required for the deals linked to each Margin account identified or the net amount to be settled for each Component identified.

On click of Refresh Balances button, system automatically updates the current balance displayed for each margin account available in the Initial Margin or Variation Margin tabs.

On click of Clear button, system automatically clears the values selected for the fields and the details populated in the tabs.

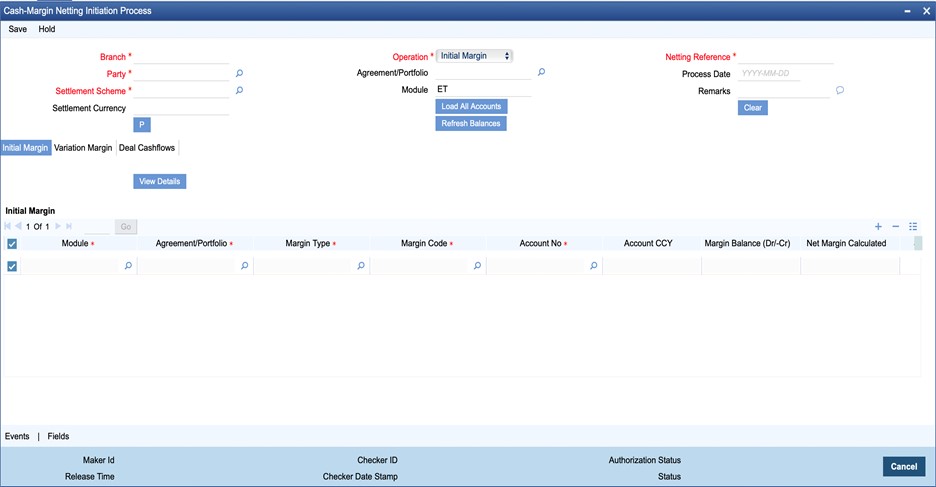

6.2.6 Pre-Netting for Initial Margin

User can select the list of Margin accounts, linked to the selected scheme, for which net margin transaction is initiated for the purposes of Initial Margin, Independent Amount, or any margin other than variation margin.

The details that can be captured for Initial Margin pre-netting include,

•Module, Agreement or Portfolio and Margin Type for which pre-netting is initiated

•Margin Accounts linked to the selected Scheme and Agreement or Portfolio

•Margin as per the Collateral Party’s statement

•Settlement Amount to be transferred as net margin call

User can view the details for,

•Account currency and Current balance in the Margin account

•Exchange rate to be used when Account currency is different from the Settlement Currency

•Transfer Amount and Transfer Action as Pay or Receive

On click of Load All Accounts button, all margin accounts linked to the selected scheme, module and Agreement or Portfolio (as selected) would be automatically identified. The details for the net margin required for the deals linked to each Margin account identified are automatically populated in Initial Margin tab.

•User can choose to remove the Margin accounts for which pre-netting need not be initiated as part of this transaction

•Can edit the Statement Margin for each record

Click the Initial Margin tab of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen

Figure 6.48: Cash-Margin Netting Initiation Process – Initial Margin

The following table describes the fields captured for initiating net margin transaction for Initial Margin.

* Indicates mandatory fields.

Table 6.32: Cash-Margin Netting Initiation Process – Initial Margin

|

Field |

Description |

|---|---|

|

Module |

Displays the module of the deal(s) for which pre-netting of margin is initiated. •Same as the Module (if) selected in the header •This field cannot be amended after saving the pre-netting transaction |

|

Agreement/Portfolio |

Displays the Agreement or Portfolio for which pre-netting is initiated for the net margin required for the deals linked. •Same as the Agreement or Portfolio (if) selected in the header •This field cannot be amended after saving the pre-netting transaction •Only those active Agreements with the selected party, available for the current branch, enabled for the Module and having Expiry Date >= Process date of the pre-netting, is displayed for selection •Only those active portfolios for the Module, available for the current branch and customer portfolios for the selected Party (if available), are displayed for selection •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules in which portfolios can be defined separately |

|

Margin Type |

Displays the Margin Type for which pre-netting is initiated for the net margin required for the exposure from the deals linked to the selected Agreement or Portfolio. •This field cannot be amended after saving the pre-netting transaction •Only those Margin Types configured for the selected Agreement or Portfolio is displayed for selection •Can be ‘Initial Margin’ (IM), for transferring net initial margin required •Can be ‘Independent Amount’ (IA), for transferring additional margin, independent of the initial margin •Can be ‘Netted Margin’ (NM), for transferring net amount of all types of margin applicable for the deals linked to the selected Agreement or Portfolio •Can be ‘Funding’ (DF), for transferring margin for the purposes of creating a trading limit or contributing to the default fund •If not specified, sets to Initial Margin (IM) by default |

|

Margin Code |

Displays the Margin Code defined for the selected Agreement and Margin Type. •This field cannot be amended after saving the pre-netting transaction •Defaulted to the active Margin Code defined for the selected Margin type in the selected Agreement •When Portfolio is selected, sets to same value as Margin Type |

|

Account No |

Displays the Margin Account for which pre-netting is initiated for the net margin required for the deals linked. •This field cannot be amended after saving the pre-netting transaction •Only those Margin Accounts Linked to the selected Scheme and configured for the selected Margin Type and Agreement or Portfolio is displayed for selection |

|

Account CCY |

Displays the currency of the selected Margin Account. •Example: Account CCY = ‘USD’ |

|

Margin Balance (Dr/-Cr) |

Displays the current balance in the Margin Account before this pre-netting transaction. •Amount displayed is positive when the account has a Debit balance, implying that the bank has deposited the margin with the collateral party •Example: Margin Balance (Dr) = USD 38,000 •Amount displayed is negative when the account has a Credit balance, implying that the collateral party has deposited the margin with the bank •Example: Margin Balance (Cr) = USD -16,000 •User can click on ‘Refresh Balances’ button to update the current balance displayed for all the margin accounts available in the ‘Initial Margin’ tab. |

|

Net Margin Calculated |

Displays the calculated Margin Required in Account CCY, for the exposure determined as of the Process Date, for the selected Margin Type. •Displays Net Margin Required, netted for all Linked Deals having the same Initial Margin Account and linked to the selected Agreement or Portfolio •Example: Net Margin Calculated = USD 42,670 •Applicable, only if Margin Calculation is performed internally in OBTR •Otherwise, it is blank |

|

Statement Margin |

Enter the net margin required in Account CCY as mentioned in the Collateral Party’s statement, for the selected Margin Type and Margin Account applicable for the selected Agreement or Portfolio. •Example: Statement Margin = USD 42,700 •If not specified, then Net Margin Calculated is set by default when Margin Calculation is performed internally in OBTR •Otherwise, it is set to Zero |

|

Settlement Amount |

Displays the Net Margin Call amount in Account CCY to be transferred as of the Process Date, for the selected Margin Type. •Displays the difference between the Statement Margin and (Current) Margin Balance, by default •Example: Settlement Amount = Margin Balance - Statement Margin = 38,000 - 42,700 = USD - 4,700 •However, User can edit the settlement amount if required to match the margin call amount as per the statement •If the amount displayed is negative, then bank needs to pay the margin shortfall •If the amount displayed is positive, then bank needs to receive the excess margin available |

|

Fx Rate |

Displays the exchange rate to be used when Account CCY is different from the Settlement Currency of the Scheme. •Example: If Account ccy = ‘USD’ and Settlement currency = ‘GBP’, then Fx Rate = 0.79 •When Account CCY is same as the Settlement Currency, then Fx Rate = 1 |

|

Transfer Amount |

Displays the Net Margin Call amount to be transferred in Settlement Currency. •Transfer Amount is displayed as an absolute value without sign •When Account CCY is different from the Settlement Currency, then Settlement Amount is converted to Transfer Amount using the Fx Rate •Example: Transfer Amount = ABS(Settlement Amount) * Fx Rate = ABS(- 4,700) * 0.79 = GBP 3,713 •When Account CCY is same as the Settlement Currency, then Transfer Amount = Settlement Amount |

|

Transfer Action |

Displays the direction of the Net Margin Call to be transferred. •If the Settlement amount displayed is negative, then Transfer Action is set to ‘Pay’ •Example: If Settlement Amount = -4,700 then Transfer Action = ‘Pay’ •If the Settlement amount displayed is positive, then Transfer Action is set to ‘Receive’ |

|

User Comments |

Enter any additional comments for the net margin transfer for the selected Margin Account. •A maximum of 100 characters can be entered |

|

Netting ESN |

Displays the accounting event sequence number for the accounting entries posted for the net margin transfer. |

6.2.6.1 View Linked Deals for Initial Margin

User can view the list of all Linked Deals having the same Initial Margin Account and linked to the selected Agreement or Portfolio.

The details that can be viewed for the Linked Deals include,

•Contract Reference, Deal Type and Value date

•Exposure and Margin details for each deal when Margin Calculation is performed internally in OBTR

Click the View Details button in Initial Margin tab of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen.

Figure 6.49: Initial Margin

The following table describes the fields displayed for the deals linked to the selected margin account in Initial Margin tab.

* Indicates mandatory fields.

Table 6.33: Cash-Margin Netting Initiation – Initial Margin

|

Field |

Description |

|---|---|

|

Contract Reference |

Displays the Contract Reference of the linked deal. |

|

Value Date |

Displays the Value Date of the deal. |

|

Deal Type |

Displays the Deal Type of the deal. |

|

Exposure Type |

Displays the type of the deal amount considered as exposure for calculating margin required for the deal. •Can be ‘Contract Value’, ‘Market Value’, ‘Principal’ or ‘Maturity Amount’ |

|

Exposure Amount |

Displays the deal amount considered as exposure for calculating margin required for the deal. |

|

Calculation Level |

Displays the level at which the exposure would be aggregated for margin calculation purposes for the selected Margin Type. •Can be ‘Agreement’, ‘Portfolio / Product’ or ‘Trade’ |

|

Calculation Type |

Displays where the margin required was calculated for the deal. •Can be ‘Internal’ or ‘External’ |

|

Calculation Method |

Displays the method that is used for calculating margin required for the deal. •Can be ‘SPAN', 'SIMM', 'GRID', ‘Standard Rate(%)’ or ‘Flat Amount’ |

|

Margin CCY |

Displays the currency in which the margin required is calculated for the deal. |

|

Margin Calculated |

Displays the Margin Calculated for the deal in Margin currency for the exposure determined as of the process date. •Applicable, only if Calculation Level is ‘Trade’ and Calculation Type is ‘Internal’ •Otherwise, it is blank |

|

Margin Required |

Displays the Margin Required for the deal in Account ccy of the linked Margin Account. •Same as Margin Calculated if Account ccy is same as Margin Ccy •Applicable, only if Calculation Level is ‘Trade’ and Calculation Type is ‘Internal’ •Otherwise, it is blank |

|

Apply |

Indicates whether the deal is included in the net margin calculation as of the process date for the Margin Account. •Checked by default |

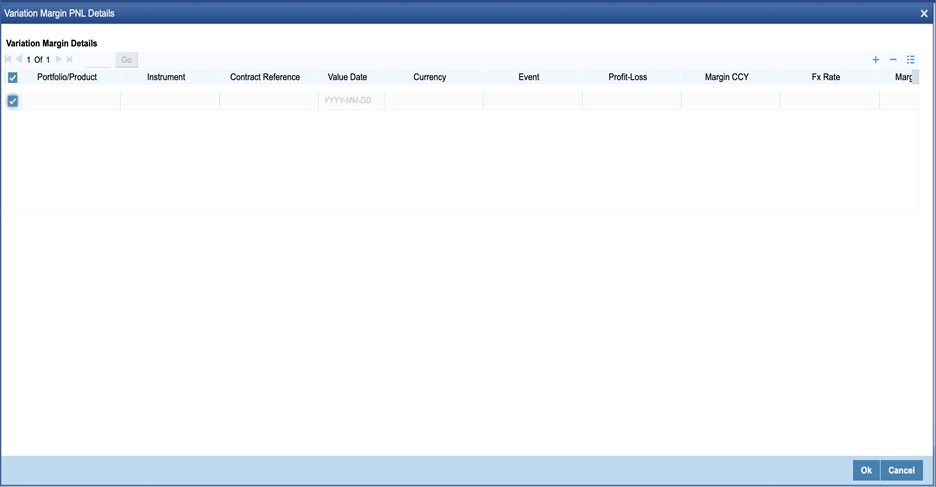

6.2.7 Pre-Netting for Variation Margin

User can select the list of Margin accounts, linked to the selected scheme, for which net margin transaction is initiated for the purposes of Variation Margin.

The details that can be captured for Variation Margin pre-netting include,

•Module, Agreement or Portfolio and Margin Code for which pre-netting would be initiated

•Margin Accounts linked to the selected Scheme and Agreement or Portfolio

•Profit-Loss balance as per the Counterparty’s statement

•Settlement Amount to be transferred as net variation margin

User can view the details for,

•Account currency and Current Unrealized PL balance in the Margin account

•Exchange rate to be used when Account currency is different from the Settlement Currency

•Transfer Amount and Transfer Action as Pay or Receive

On click of Load All Accounts button, all variation margin accounts linked to the selected scheme, module and Agreement or Portfolio (as selected) would be automatically identified. The details for the net margin required for the deals linked to each Margin account identified are automatically populated in ‘Variation Margin’ tab.

•User can choose to remove the Margin accounts for which pre-netting need not be initiated as part of this transaction

•Can edit the Statement PL Balance for each record

Click the Variation Margin tab of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen.

Figure 6.50: Cash-Margin Netting Initiation Process – Variation Margin

The following table describes the fields captured for initiating pre-netting transaction for Variation Margin.

* Indicates mandatory fields.

Table 6.34: Cash-Margin Netting Initiation Process – Variation Margin

|

Field |

Description |

|---|---|

|

Module |

Displays the module of the deal(s) for which pre-netting of margin is initiated. •Same as the Module (if) selected in the header •This field cannot be amended after saving the pre-netting transaction |

|

Agreement/Portfolio |

Displays the Agreement or Portfolio for which pre-netting is initiated for the net margin required for the deals linked. •Same as the Agreement or Portfolio (if) selected in the header •This field cannot be amended after saving the pre-netting transaction •Only those active Agreements with the selected party, available for the current branch, enabled for the Module and having Expiry Date >= Process date of the pre-netting, is displayed for selection •Only those active portfolios for the Module, available for the current branch and customer portfolios for the selected Party (if available), is displayed for selection •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules in which portfolios can be defined separately |

|

Margin Code |

Displays the Margin Code defined for the selected Agreement and Variation Margin Type. •This field cannot be amended after saving the pre-netting transaction •Defaulted to the active Margin Code defined for Variation Margin type in the selected Agreement •When Portfolio is selected, set to ‘Variation Margin’ by default |

|

Account No |

Displays the Margin Account for which pre-netting is initiated for the net variation margin required for the deals linked. •This field cannot be amended after saving the pre-netting transaction •Only those Margin Accounts Linked to the selected Scheme and configured for Variation Margin Type and Agreement or Portfolio is displayed for selection |

|

Account CCY |

Displays the currency of the selected Margin Account. •Example: Account CCY = ‘USD’ |

|

Unrealized PL Balance (Cr/-Dr) |

Displays the current Unrealized PL balance in the Margin Account before this pre-netting transaction. •Amount displayed is positive when the account has a Credit balance, implying that the bank has Unrealized Profit receivable from the counterparty •Example: Unrealized PL Balance (Cr) = USD 5,000 •Amount displayed is negative when the account has a Debit balance, implying that the bank has Unrealized Loss payable to the counterparty •Example: Unrealized PL Balance (Dr) = USD -3,000 •User can click on ‘Refresh Balances’ button to update the current PL balance displayed for all the margin accounts available in the ‘Variation Margin’ tab. |

|

Additional PL |

Displays the net movement in Profit-Loss, in Account CCY, posted for all the Linked Deals as of the Process Date. •Both Revaluation and Realized PL entries posted for that date are netted for all Linked Deals having the same Variation Margin Account and linked to the selected Agreement or Portfolio •Example: Additional PL = USD - 8,000 |

|

Statement PL Balance |

User to enter the net MTM PL balance in Account CCY as mentioned in the Counterparty’s statement, for the selected Variation Margin Account applicable for the selected Agreement or Portfolio. •Example: Statement PL = USD - 8,500 •If not specified, then Sum of Unrealized PL Balance and Additional PL is set by default |

|

Settlement Amount |

Displays the Net amount in Account CCY to be transferred for Variation Margin, as of the Process Date. •Displays the difference between the Statement PL Balance and (Current) Unrealized PL Balance, by default •Example: Settlement Amount = Statement PL Balance - Unrealized PL Balance, = -8,500 - 5000 = USD - 13,500 •However, User can edit the settlement amount if required to match the margin call amount as per the statement •If the amount displayed is negative, then bank needs to pay the additional loss •If the amount displayed is positive, then bank needs to receive the additional profit |

|

Fx Rate |

Displays the exchange rate to be used when Account CCY is different from the Settlement Currency of the Scheme. •Example: If Account ccy = ‘USD’ and Settlement currency = ‘GBP’, then Fx Rate = 0.79 •When Account CCY is same as the Settlement Currency, then Fx Rate = 1 |

|

Transfer Amount |

Displays the Net Variation Margin to be transferred in Settlement Currency. •Transfer Amount is displayed as an absolute value without sign •When Account CCY is different from the Settlement Currency, then Settlement Amount is converted to Transfer Amount using the Fx Rate •Example: Transfer Amount = ABS(Settlement Amount) * Fx Rate = ABS(- 13,500) * 0.79 = GBP 10,665 •When Account CCY is same as the Settlement Currency, then Transfer Amount = Settlement Amount |

|

Transfer Action |

Displays the direction of the Net Variation Margin to be transferred. •If the Settlement amount displayed is negative, then Transfer Action is set to ‘Pay’ •Example: If Settlement Amount = -13,500 then Transfer Action = ‘Pay’ •If the Settlement amount displayed is positive, then Transfer Action is set to ‘Receive’ |

|

User Comments |

Enter any additional comments for the net variation margin transfer for the selected Margin Account. •A maximum of 100 characters can be entered |

|

Netting ESN |

Displays the accounting event sequence number for the accounting entries posted for the net variation margin transfer. |

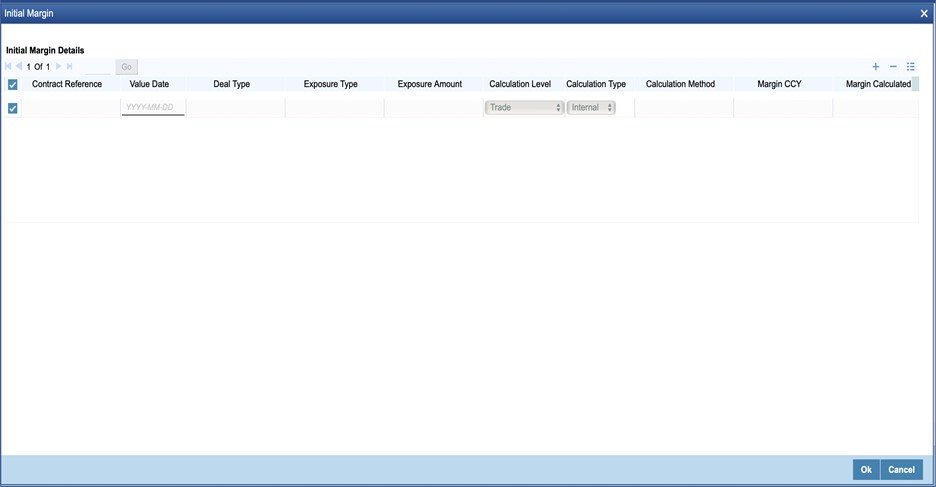

6.2.7.1 View Linked Deals for Variation Margin

User can view the list of all Linked Deals having the same Variation Margin Account and linked to the selected Agreement or Portfolio.

The details that can be viewed for the Linked Deals include,

•Contract Reference, Deal Type and Value date

•Exposure and Margin details for each deal when Margin Calculation is performed internally in OBTR

Click the View Details button in Variation Margin tab of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen.

Figure 6.51: Variation Margin PNL Details

The following table describes the fields displayed for the deals linked to the selected margin account in Variation Margin tab.

* Indicates mandatory fields.

Table 6.35: Variation Margin PNL Details

|

Field |

Description |

|---|---|

|

Portfolio/Product |

Displays the Portfolio in which the linked deal is booked. •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules •Displays Deal Product of the linked deal for other modules |

|

Instrument |

Displays the Instrument-series of the linked deal is booked. •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules •Blank for other modules |

|

Contract Reference |

Displays the Contract Reference of the linked deal. |

|

Value Date |

Displays the Value Date of the deal. |

|

Currency |

Displays the Contract currency of the deal. |

|

Event |

Displays the Accounting event which posted Profit-Loss posted for the deal. |

|

Profit-Loss |

Displays the Profit-Loss amount posted for the deal in Margin currency as of the process date. |

|

Margin CCY |

Displays the currency in which the Profit-Loss is posted for the deal. |

|

Fx Rate |

Displays the exchange rate to be used when Account CCY is different from the Margin CCY. •Example: If Margin ccy = ‘EUR’ and Account ccy = ‘USD’, then Fx Rate = 1.15 •When Account CCY is same as the Settlement Currency, then Fx Rate = 1 |

|

Margin Required |

Displays the Variation Margin Required for the deal in Account ccy of the linked Margin Account. •Same as Profit-Loss if Account ccy is same as Margin Ccy |

|

Apply |

Indicates whether the deal is included in the net margin calculation as of the process date for the Margin Account. •Checked by default |

6.2.8 Pre-Netting for Deal Cashflows

User can select the list of Cashflow Components to be net settled for the deals linked to the selected Scheme and Agreement or Portfolio.

The details that can be captured for Deal Cashflows pre-netting include,

•Module, Agreement or Portfolio and Deal Product for which pre-netting is initiated

•Component type, Component, Currency, and Due date of the Cashflows to be netted

•Tenor and Netting Type for calculating the net amount

•Settlement Amount to be transferred after netting the cashflows

User can view the details for,

•Net Amount calculated for the component

•Exchange rate to be used when Cashflow currency is different from the Settlement Currency

•Transfer Amount and Transfer Action as Pay or Receive

On click of Load All Accounts button, all cashflow Components marked for net settled for the deals linked to the selected Scheme and Agreement or Portfolio are automatically identified. The details for the net amount to be settled would be automatically populated in Deal Cashflows tab.

•User can choose to remove the Components for which pre-netting need not be initiated as part of this transaction

•Can edit the Settlement Amount for each record

Click the Deal Cashflows tab of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen.

Figure 6.52: Cash-Margin Netting Initiation Process - Deal Cashflows

The following table describes the fields captured for initiating pre-netting transaction for Deal Cashflows.

* Indicates mandatory fields.

Table 6.36: Cash-Margin Netting Initiation Process – Deal Cashflows

|

Field |

Description |

|---|---|

|

Module |

Displays the module of the deal(s) for which pre-netting of cashflows are initiated. •Same as the Module (if) selected in the header •This field cannot be amended after saving the pre-netting transaction |

|

Agreement/Portfolio |

Displays the Agreement or Portfolio for which pre-netting is initiated for the components to be netted for the deals linked. •Same as the Agreement or Portfolio (if) selected in the header •This field cannot be amended after saving the pre-netting transaction •Only those active Agreements with the selected party, available for the current branch, enabled for the Module and having Expiry Date >= Process date of the pre-netting, is displayed for selection •Only those active portfolios for the Module, available for the current branch and customer portfolios for the selected Party (if available), is displayed for selection •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules in which portfolios can be defined separately |

|

Cashflow CCY |

Displays the currency of the Cashflows netted. •Example: Cashflow CCY = ‘USD’ •Only those cashflows in the same Currency can be netted together |

|

Netting Deal Type |

Displays the Deal Type for which pre-netting is initiated for the deals linked to the selected Agreement or Portfolio. •Only those Deal Types configured for netting for the selected Agreement or Portfolio is displayed for selection •Only those cashflows of deals having the same Deal type can be netted together |

|

Product |

Displays the Deal Products for which pre-netting is initiated for the deals linked to the selected Agreement or Portfolio. •Only those Deal Products configured for netting for the selected Agreement or Portfolio is displayed for selection •Only those cashflows of deals having the same Product can be netted together |

|

Component Type |

Displays the cashflow Component Type for which pre-netting is initiated for the deals linked to the selected Agreement or Portfolio. •Only those Component Types configured for netting for the selected Agreement or Portfolio is displayed for selection •Only those cashflows of the same Component Type can be netted together |

|

Component |

Displays the cashflow Component for which pre-netting is initiated for the net amount for the deals linked. •Only those Components configured for netting for the selected Agreement or Portfolio is displayed for selection •Only those cashflows of the same Component can be netted together |

|

Flow Type |

Indicates whether both cashflows paid and received are netted together or aggregated separately. •Can be ‘Net’, implying that both cashflows paid and received are netted together •Can be ‘Aggregate’, implying that cashflows paid are netted and cashflows received are netted separately, for the same component |

|

Tenor |

Indicates whether cashflows are netted across deals having different tenors or only same tenor. |

|

Cashflow Due Date |

Displays the maximum Due date of the cashflows netted together for the deals linked. |

|

Net Amount |

Displays the net cashflow amount calculated for the linked deals for the selected component and currency. •Amount displayed is positive when the net amount is receivable by the bank •Example: Net Amount = USD 258,150 •Amount displayed is negative when the net amount is payable by the bank •Example: Net Amount = USD -400,000 |

|

Settlement Amount |

Enter the Settlement Amount, in Cashflow CCY, as agreed with the Counterparty, for the selected Component for the selected Agreement or Portfolio. •Example: Settlement Amount = USD 258,000 •Net Amount is set by default |

|

Adjustment |

Displays the amount to be adjusted after netting for the selected cashflow component for the linked deals. •Displays the difference between the Settlement Amount and Net Amount, if they are different •Example: Adjustment = Settlement Amount – Net Amount = 258,000 – 258,150 = USD - 150 •Adjustment entries are posted to write back this amount against net payable or receivable calculated for the component |

|

Fx Rate |

Displays the exchange rate to be used when Cashflow CCY is different from the Settlement Currency of the Scheme. •Example: If Cashflow ccy = ‘USD’ and Settlement currency = ‘GBP’, then Fx Rate = 0.79 •When Cashflow CCY is same as the Settlement Currency, then Fx Rate = 1 |

|

Transfer Amount |

Displays the Net Cashflow Amount to be transferred in Settlement Currency. •Transfer Amount is displayed as an absolute value without sign •When Cashflow CCY is different from the Settlement Currency, then Settlement Amount is converted to Transfer Amount using the Fx Rate •Example: Transfer Amount = ABS(Settlement Amount) * Fx Rate = ABS(258,000) * 0.79 = GBP 203,820 •When Cashflow CCY is same as the Settlement Currency, then Transfer Amount = Settlement Amount |

|

Transfer Action |

Displays the direction of the Net Cashflow Amount to be transferred. •If the Settlement amount displayed is negative, then Transfer Action is set to ‘Pay’ •Example: If Settlement Amount = -13,500 then Transfer Action = ‘Pay’ •If the Settlement amount displayed is positive, then Transfer Action is set to ‘Receive’ |

|

User Comments |

Enter any additional comments for the net cashflow transfer for the selected Component. •A maximum of 100 characters can be entered |

|

Netting ESN |

Displays the accounting event sequence number for the accounting entries posted for the net cashflow transfer. |

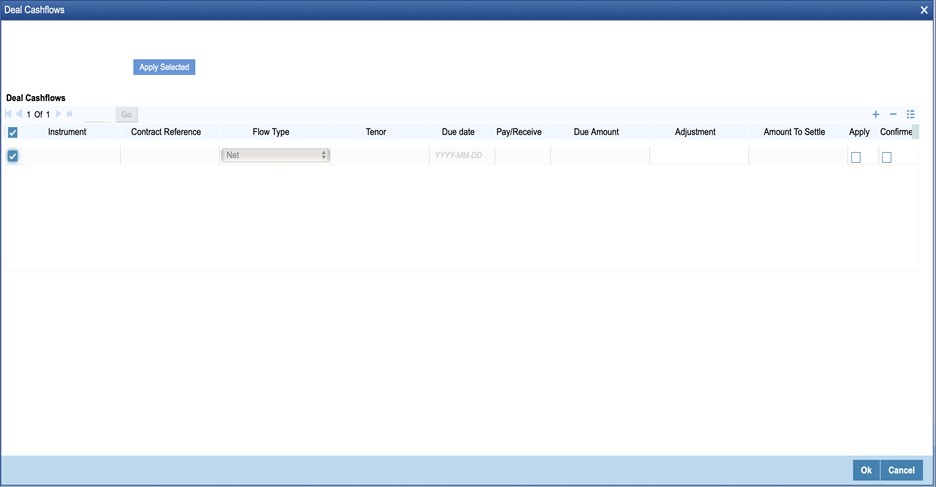

6.2.8.1 View Linked Deals for Deal Cashflows

User can view the list of all Linked Deals having the same Cashflow Component and linked to the selected Agreement or Portfolio.

User can enter any Adjustment to be made against the Due amount for each deal individually, if applicable.

The details that can be viewed for the Linked Deals include,

•Contract Reference, Instrument, Flow Type, Tenor, and Value date

•Cashflow Due Amount and Date

•Amount to Settle after adjustment

Click the View Details button in Deal Cashflows tab of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen.

Figure 6.53: Deal Cashflows

The following table describes the fields displayed for the deals linked to the selected cashflow component in Deal Cashflows tab.

* Indicates mandatory fields.

Table 6.37: Cash-Margin Netting Initiation – Deal Cashflows – View Details

|

Field |

Description |

|---|---|

|

Instrument |

Displays the Instrument-series of the linked deal. •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules •Blank for other modules |

|

Contract Reference |

Displays the Contract Reference of the linked deal. |

|

Flow Type |

Displays the preference applicable for the deal for netting payable and receivable cashflows. •Can be ‘Net’, implying that both cashflows paid and received are netted together •Can be ‘Aggregate’, implying that cashflows paid are netted and cashflows received are netted separately, for the same component |

|

Tenor |

Displays the standard tenor captured for the deal. |

|

Due Date |

Displays the actual Due Date of the cashflow. |

|

Pay/Receive |

Displays whether the cashflow is payable or receivable for the bank. |

|

Due Amount |

Displays the actual amount due for the cashflow. •Example: Due Amount = 7,205 |

|

Adjustment |

Enter any adjustment to the cashflow as agreed with the counterparty. •Can be due to rounding off or any discount provided •Example: Adjustment = -5 •Adjustment entries are posted to write back this amount against payable or receivable for the deal |

|

Amount To Settle |

Displays the Amount to be settled after adjustment. •Displays the difference between the Settlement Amount and Net Amount, if they are different •Example: Amount To Settle = Due Amount + Adjustment = 7,205 – 5 = 7,200 •User can click on ‘Apply’ button to calculate and update the Amount to Settle for all cashflows included for this netting. |

|

Apply |

Indicates whether the cashflow should be included for this netting. •Checked by default |

|

Confirmed |

Indicates whether the cashflow for the deal is confirmed with the counterparty. •Unchecked by default |

On click of Apply button, system automatically updates the Amount To Settle by considering the adjustment entered for each cashflow selected for including in this netting

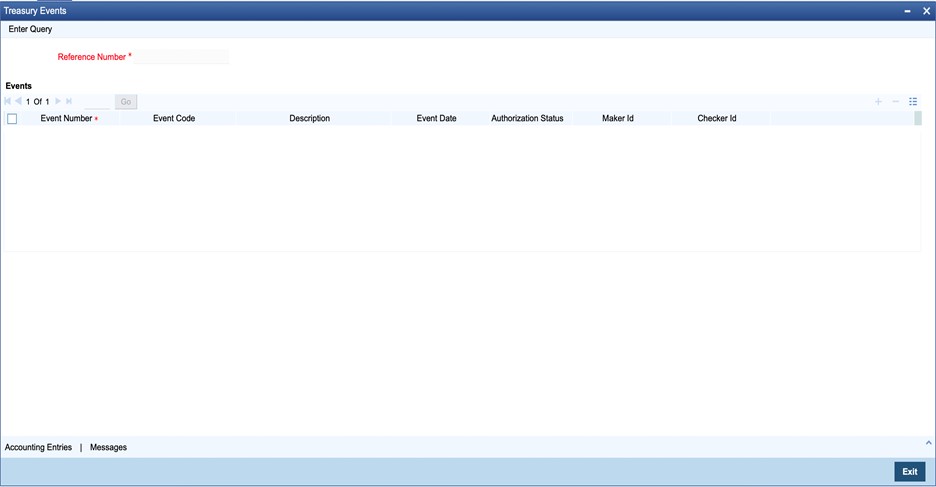

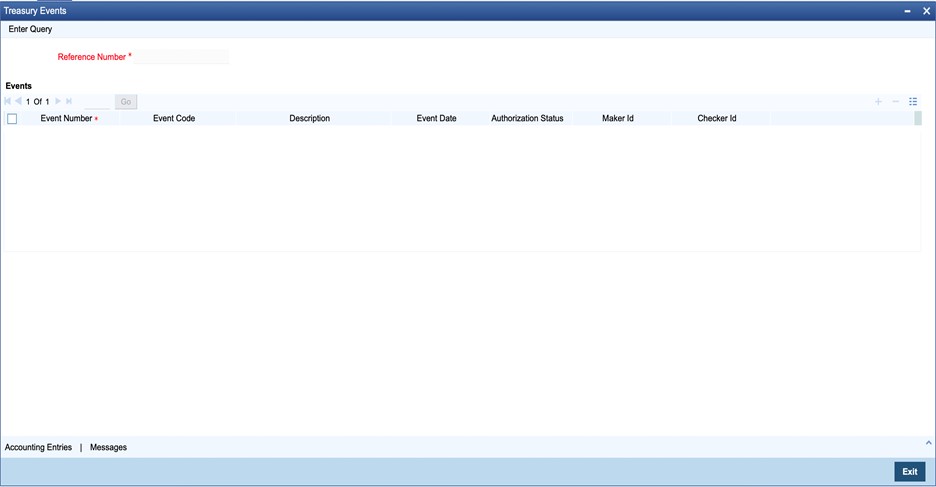

User can view the list of Lifecycle Events triggered for the cash-margin netting initiation transaction.

•Can view the Accounting Entries posted for each event

•Can view the Advice(s) and Messages generated for each event

Click the Events button at the bottom of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen.

Please refer Events and Accounting Entries for more details about the list of events and accounting entries applicable for cash-margin netting initiation processes.

Figure 6.54: Treasury Events

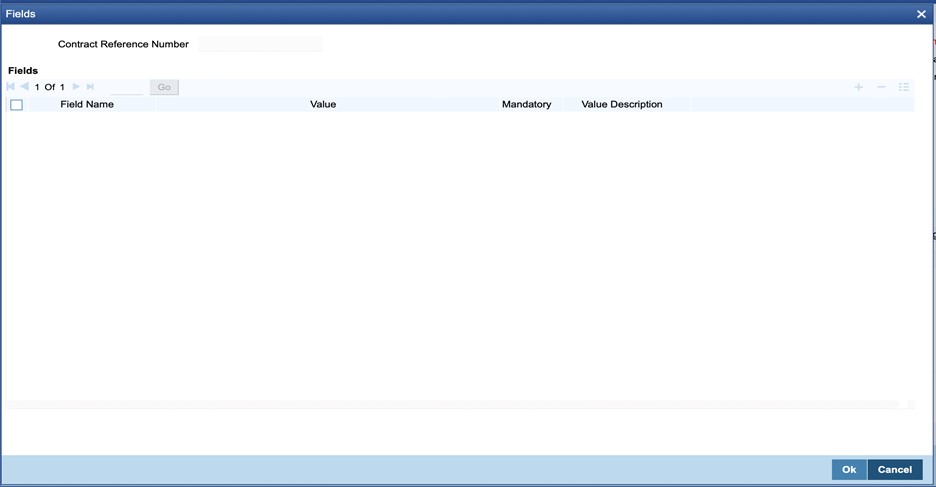

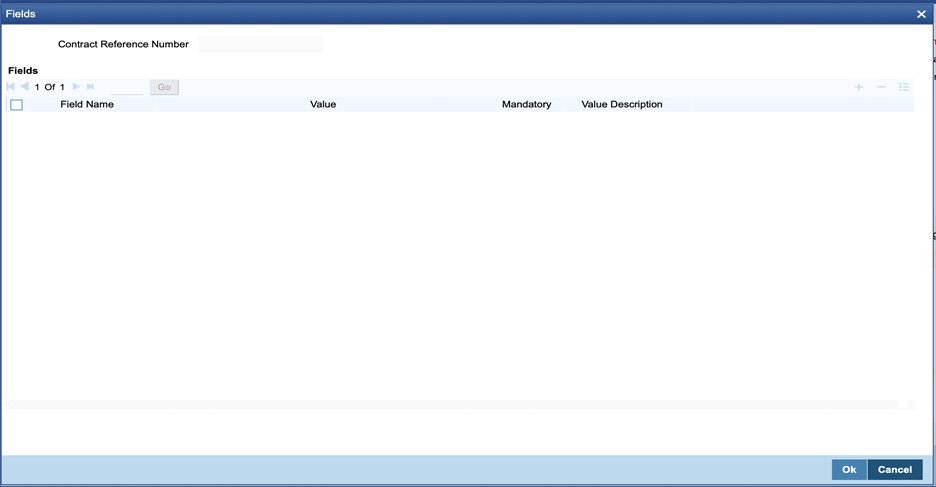

User can enter values for the UDF associated with the Cash-Margin Netting Initiation Process function.

•These fields can be referred while reporting the cash-margin netting initiation transactions.

Click the Fields button at the bottom of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen.

‘User Defined Fields’ user guide can be referred for more details on the steps involved in configuring and using UDF applicable for the function.

Figure 6.55: Fields

For the cash-margin pre-netting transactions initiated or modified, another user (checker) different from the user who initiated (maker) should verify the details, as a cross-checking mechanism, and click Authorize button at the top of the screen.

•Auto authorization can be enabled for this function

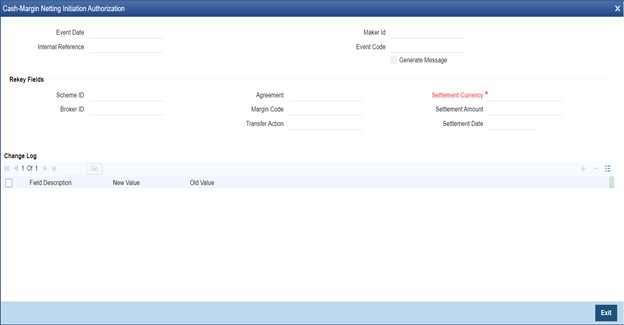

Figure 6.56: Cash-Margin Netting Initiation Authorization

Checker should enter the correct values for the Rekey fields to ensure that the user is authorizing the intended transaction. Re-key fields applicable for the Cash-Margin pre-netting transaction are configured for the margin product.

The following table describes the fields available as Re-key fields for Cash-Margin pre-netting transaction. For those fields that are not configured for re-key in the margin product, the respective values selected for the fields are displayed.

Table 6.38: Cash-Margin Netting Initiation – Authorization

|

Field |

Description |

|---|---|

|

Scheme Id |

Enter the Settlement Scheme for which the pre-netting transaction is initiated. |

|

Broker Id |

Enter the Party for whom the pre-netting transaction is initiated. |

|

Agreement |

Enter the Agreement or Portfolio for which the pre-netting transaction is initiated. |

|

Margin Code |

Enter the Margin code selected for the margin pre-netting transaction. •When pre-netting is initiated for multiple margin codes together, any one of the margin codes should be entered |

|

Transfer Action |

Enter the pre-netting transaction is initiated to pay or receive from the party. •When pre-netting is initiated for multiple margin codes or cashflow components together, user should enter the transfer action for the margin code or component entered as re-key |

|

Settlement Currency |

Enter the currency of the Scheme selected for the transaction. |

|

Settlement Amount |

Enter the transfer amount for the pre-netting transaction. •When pre-netting is initiated for multiple margin codes or cashflow components together, user should enter the settlement amount for the margin code or component entered as re-key |

|

Settlement Date |

Enter the process date on which the pre-netting transaction is initiated. |

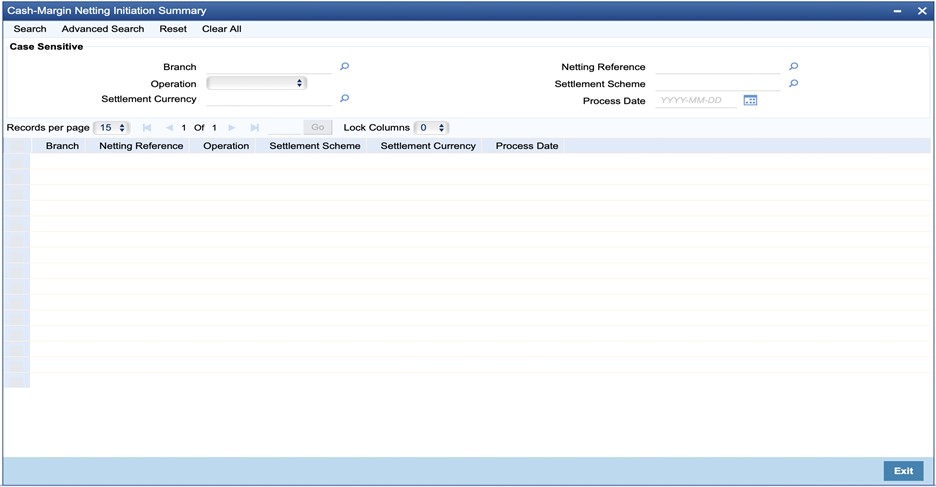

6.2.12 Cash-Margin Netting Initiation Summary

User can view the list of pre-netting transactions processed so far, using ‘Cash-Margin Netting Initiation Summary’ function.

•User can select the values for different fields available for filtering / searching the transactions

•User can Reset and Clear all the values selected for the search fields

•User can specify values for additional fields for refining the search by clicking on Advanced Search button

6.2.12.1 Cash-Margin Netting Initiation Summary screen

Context:

You can view the summary details maintained using the Cash-Margin Netting Initiation Summary screen.

1.On the Homepage, type MGSCMINI in the text box, and click the next arrow.

Step Result: Cash-Margin Netting Initiation Summary screen is displayed.

Figure 6.57: Cash-Margin Netting Initiation Summary

2.On the Cash-Margin Netting Initiation Summary screen, specify the details as required.

In the above screen, you can base your queries by inputting any or all of the parameters and fetch records.

3.Click the Search button to view the details.

6.3 Cash-Margin Net Settlement

Net settlement of Cash components can be performed using ‘Cash-Margin Net Settlement’ function.

All cashflows that are marked for netting, including cash margin transfers, can be settled together for the net amount.

•All pre-netting transactions initiated using ‘Cash-Margin Netting Initiation (MGDCMINI)’ function are available for Net Settlement

The details that can be captured for Cash Net Settlement include,

•Settlement Scheme, Party, Currency, Amount and Value date for the net settlement

•Optionally can filter the pre-netting transactions for the selected Agreement or Portfolio

•Settlement details to be used for funds transfer, as agreed with the party and applicable for the scheme selected

•User Defined Fields configured for cash net settlement process

User can view the details for,

•Pre-netting transactions for Initial Margin, Variation Margin and Deal cashflows considered for net settlement using the selected scheme

•Events triggered for the net settlement transaction along with accounting entries posted and advice(s) generated for each event

Cash-Margin Net settlement transactions can be initiated only for the branch to which user has access.

6.3.1 Process to initiate a new transaction

This topic provides the systematic instructions to initiate a new transaction.

Context:

To initiate a new transaction

1.Click the New button at the top of the screen.

2.Enter the values for all the required fields.

3.Click on the Save button to initiate the transaction and send for authorization.

4.Click on the Hold button to save as draft.

6.3.2 Process to query and view the details of an existing transaction

This topic provides the systematic instructions to query and view the details of an existing transaction.

Context:

To query and view the details of an existing transaction

1.Click the Enter Query button at the top of the screen.

2.Enter the Settlement Reference of the transaction.

3.Click the Execute Query button.

6.3.3 Modifying an existing transaction

This topic provides the systematic instructions to modify an existing transaction.

Context:

To modify an existing transaction or to revisit the data saved as draft

1.Enter the Settlement reference of the transaction and query the existing transaction.

2.Click the Unlock button to enable the screen for editing the details.

3.Review the existing values saved or kept on hold.

4.Enter the new values for the fields to be modified. Please refer the table of fields to know whether the field can be modified after first authorization of the transaction.

5.Click on the Save button to modify the transaction and send for authorization.

6.3.4 Discard, reverse and print transactions

This topic provides the systematic instructions to discard and reverse transactions and print details of the transactions.

1.Click on the Delete button to discard the transaction before first authorization.

2.Click on Reverse button to reverse the transaction after first authorization.

3.Click on the Print button to print the details of the transaction.

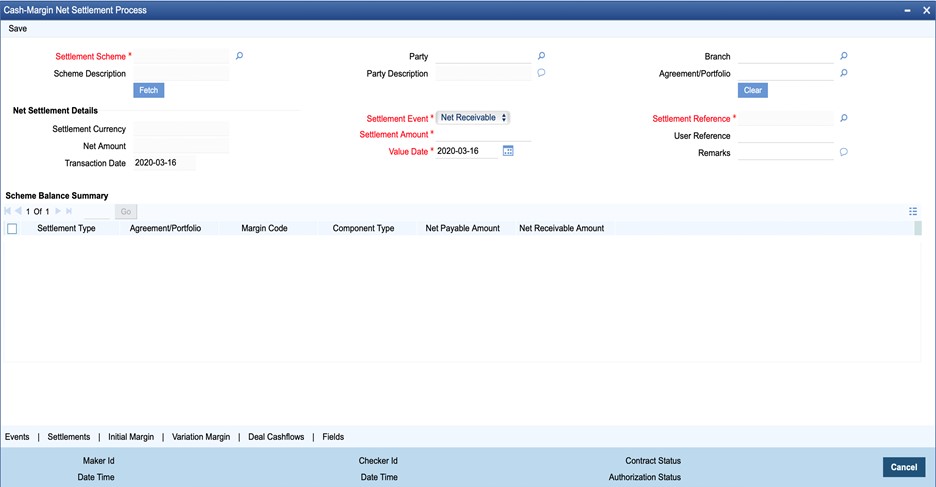

6.3.5 Cash-Margin Net Settlement Process screen

User can initiate net settlement for the cash components linked to the scheme in the Cash-Margin Net Settlement Process screen.

1.On the Homepage, type MGDSETLM in the text box, and click the next arrow.

Step Result: Cash-Margin Net Settlement Process screen is displayed.

Figure 6.58: Cash-Margin Net Settlement Process

2.On the Cash-Margin Net Settlement Process screen, Click New.

3.On the Cash-Margin Net Settlement Process- New screen, Specify the details as required.

4.Click Save to save the details or Cancel to close the screen.

For information on fields, refer table below:

* Indicates mandatory fields.

Table 6.39: Cash-Margin Net Settlement Process

|

Field |

Description |

|---|---|

|

Settlement Scheme |

Select the Settlement Scheme for which net settlement is performed. •This field cannot be amended after saving the net settlement transaction •Only those active schemes with the selected party and available for the current branch, is displayed for selection |

|

Scheme Description |

Displays the Description of the settlement scheme selected. |

|

Party |

Select the party with whom the net settlement is performed. •This field cannot be amended after saving the net settlement transaction |

|

Party Description |

Displays the Description of the party selected. |

|

Branch |

Displays the current branch code to which the user has logged in. |

|

Agreement Code |

Select the Agreement or Portfolio to filter the transaction for net settlement. •This field cannot be amended after saving the net settlement transaction •Only those active Agreements with the selected party, available for the current branch and having Expiry Date >= Transaction date of the net settlement, is displayed for selection •Only those active portfolios available for the current branch and customer portfolios for the selected Party (if available), are displayed for selection •Applicable only for Securities, Exchange Traded Derivatives and Credit Derivatives modules in which portfolios can be defined separately |

|

Net Settlement Details |

Group of fields to capture the details for net settlement transaction. |

|

Settlement Currency |

Displays the currency of the settlement scheme selected, in which the net settlement happens. |

|

Settlement Event |

Displays the direction of the Net Settlement transaction. •Can be ‘Net Receivable’ or ‘Net Payable’ for the bank |

|

Settlement Reference |

Displays a unique reference number for the net settlement transaction. •Automatically generated when the user clicks on ‘Fetch’ button |

|

User Reference |

Enter a unique reference for the net settlement transaction, which is used in payment message generated for this transaction. •If not specified, defaulted to Settlement Reference. |

|

Net Amount |

Displays the net amount, in Settlement currency, of the net payable/receivable balances for the selected settlement type, component type and agreement or portfolio from the scheme balances summary for the selected settlement scheme. •Includes pending net settlement for Initial Margin, Variation Margin and Deal Cashflows settlement types |

|

Settlement Amount |

Enter the Settlement Amount, in Settlement Currency, to be transferred for this net settlement. •Set to same as Net Amount by default •An override message is displayed, if the difference between Settlement Amount and Net Amount is greater than the ‘Override Limit %’ defined for the scheme •An error message is displayed, if the difference between Settlement Amount and Net Amount is greater than the ‘Stop Limit %’ defined for the scheme and the transaction is not allowed to be saved |

|

Transaction Date |

Displays the date on which the net settlement transaction was saved. •Branch date is set by default |

|

Value Date |

Enter the value date for the settlement. •Set by default to Branch date + Settlement Days defined for the scheme •Settlement Days considered is working days •Value date can be same as branch date or future dated or back dated •Validated for working day using the Holiday preferences defined for the scheme •When Value date < Branch date, payment message generation can be suppressed |

|

Remarks |

Enter any additional comments for the net settlement transaction. •A maximum of 250 characters can be entered for remarks |

|

Settlement Status |

Displays the status of the settlement transaction in the external settlement system. •Set to ‘Pending’ by default •User can update the status to ‘Success’ or ‘Failed’ later |

|

Failure Reason |

Displays the reason for settlement failure in the external settlement. •User should update the reason when Settlement Status is updated to ‘Failed’ |

User can verify the Scheme balances for each group of transactions linked to the selected settlement scheme and select the group of transactions to be included in this net settlement transaction.

•Scheme balances are displayed as net payable or receivable calculated for all transactions grouped based on the Settlement Type, Agreement or Portfolio, Margin Code and Component Type

•Includes all pre-netting transactions and other cash transfers marked for netting, that are selected to be included in this net settlement transaction

Table 6.40: Scheme Balance Summary

|

Field |

Description |

|---|---|

|

Settlement Type |

Displays the Cashflow Type of the group of transactions selected for the net settlement. •Can be ‘Initial Margin’, ‘Variation Margin’ or ‘Deal Cashflows’ |

|

Agreement/Portfolio |

Displays the Agreement or Portfolio of the group of transactions selected for the net settlement. •This field cannot be blank |

|

Margin Code |

Displays the Margin Code defined for the selected Agreement and applicable for the group of transactions selected for the net settlement. •Displays the ‘Margin Type’ when the value displayed for Agreement/Portfolio field is a Portfolio •This field is not applicable and is blank, when the Settlement Type is ‘Deal Cashflows’ |

|

Component Type |

Displays the Component Type of the group of transactions selected for the net settlement. •This field is not applicable and is blank, when the Settlement Type is ‘Initial Margin’ or ‘Variation Margin’ |

|

Net Payable Amount |

Displays the Net Amount Payable by the bank, in Settlement Currency, calculated for the group of transactions based on the selected Settlement Type, Agreement or Portfolio and Margin Code or Component Type. •Blank, if the Net Amount calculated is receivable by the Bank |

|

Net Receivable Amount |

Displays the Net Amount Receivable by the bank, in Settlement Currency, calculated for the group of transactions based on the selected Settlement Type, Agreement or Portfolio and Margin Code or Component Type. •Blank, if the Net Amount calculated is payable by the Bank |

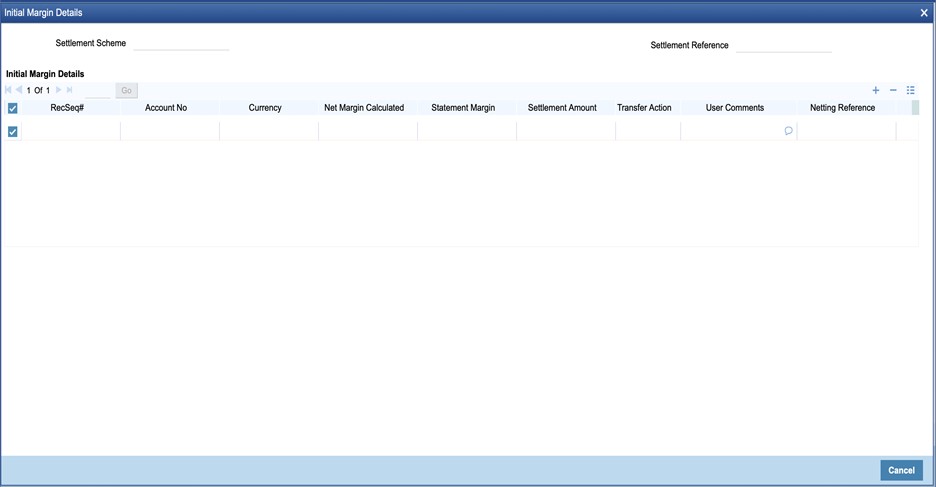

User can view the list of those pre-netting transactions and cash transfers for Initial Margin, linked to the selected scheme and considered for this net settlement.

Click the Initial Margin button at the bottom of the Cash-Margin Net Settlement Process (MGDSETLM) function to open this screen.

Figure 6.59: Initial Margin Details

The following table describes the fields displayed for Initial Margin transactions included for this Net settlement.

* Indicates mandatory fields.

Table 6.41: Cash-Margin Net Settlement – Initial Margin Details

|

Field |

Description |

|---|---|

|

Settlement Scheme |

Displays the Settlement Scheme of the net settlement transaction. |

|

Settlement Reference |

Displays a unique reference number of the net settlement transaction. |

|

Initial Margin Details |

Group of fields to display the details about the Initial Margin transaction to be net settled. |

|

RecSeq# |

Running sequence number of the transactions displayed. |

|

Account No |

Displays the Margin Account of the Initial Margin transaction to be net settled. |

|

Currency |

Displays the currency of the selected Margin Account. |

|

Net Margin Calculated |

Displays the calculated Margin Required, in Account CCY, as captured for the Initial Margin transaction to be net settled. |

|

Statement Margin |

Displays the net margin, in Account CCY, as mentioned in the Collateral Party’s statement, as captured for the Initial Margin transaction to be net settled. |

|

Settlement Amount |

Displays the Net Margin Call amount, in Account CCY, to be transferred for the Initial Margin transaction to be net settled. |

|

Transfer Amount |

Displays the Net Margin Call amount, in Settlement scheme CCY, to be transferred for the Variation Margin transaction to be net settled. |

|

Transfer Action |

Displays the direction of the Net Margin Call, to be transferred for the Initial Margin transaction to be net settled. |

|

User Comments |

Displays the additional comments captured for the Initial Margin transaction to be net settled. |

|

Netting Reference |

Displays a unique reference number for the Initial Margin transaction to be net settled. |

|

Netting ESN |

Displays the accounting event sequence number for the accounting entries posted for the Initial Margin pre-netting transaction to be net settled. •Otherwise, it is blank |

User can view the list of those pre-netting transactions and cash transfers for Variation Margin, linked to the selected scheme and considered for this net settlement.

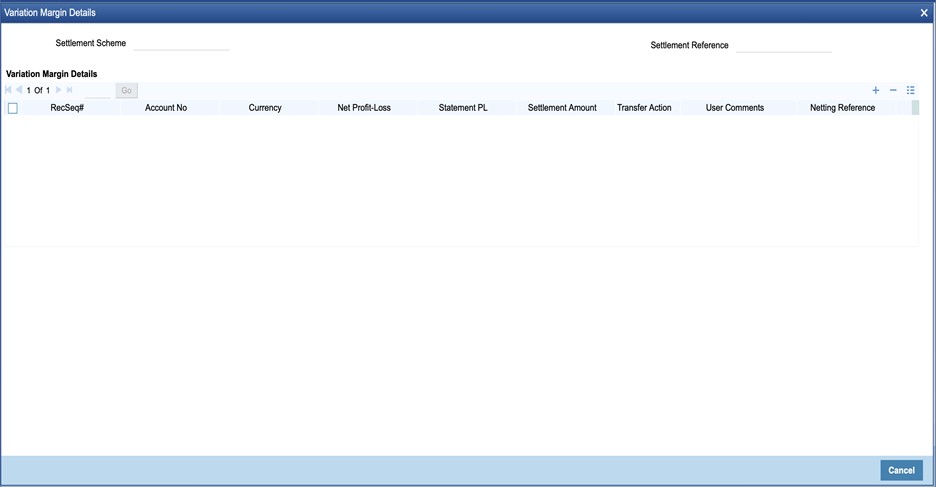

Click the Variation Margin button at the bottom of the Cash-Margin Net Settlement Process (MGDSETLM) function to open this screen.

Figure 6.60: Variation Margin Details

The following table describes the fields displayed for Variation Margin transactions included for this Net settlement.

* Indicates mandatory fields.

Table 6.42: Cash-Margin Net Settlement – Variation Margin

|

Field |

Description |

|---|---|

|

Settlement Scheme |

Displays the Settlement Scheme of the net settlement transaction. |

|

Settlement Reference |

Displays a unique reference number of the net settlement transaction. |

|

Variation Margin Details |

Group of fields to display the details about the Variation Margin transaction to be net settled. |

|

RecSeq# |

Running sequence number of the transactions displayed. |

|

Account No |

Displays the Margin Account of the Variation Margin transaction to be net settled. |

|

Currency |

Displays the currency of the selected Margin Account. |

|

Net Profit-Loss |

Displays the net movement in Profit-Loss, in Account CCY, as captured for the Variation Margin transaction to be net settled. |

|

Statement PL |

Displays the net MTM PL balance, in Account CCY, as mentioned in the Collateral Party’s statement, as captured for the Variation Margin transaction to be net settled. |

|

Settlement Amount |

Displays the Net amount, in Account CCY, to be transferred for the Variation Margin transaction to be net settled. |

|

Transfer Amount |

Displays the Net amount, in Settlement scheme CCY, to be transferred for the Variation Margin transaction to be net settled. |

|

Transfer Action |

Displays the direction of the Net amount, to be transferred for the Variation Margin transaction to be net settled. |

|

User Comments |

Displays the additional comments captured for the Variation Margin transaction to be net settled. |

|

Netting Reference |

Displays a unique reference number for the Variation Margin transaction to be net settled. |

|

Netting ESN |

Displays the accounting event sequence number for the accounting entries posted for the Variation Margin pre-netting transaction to be net settled. •Otherwise, it is blank |

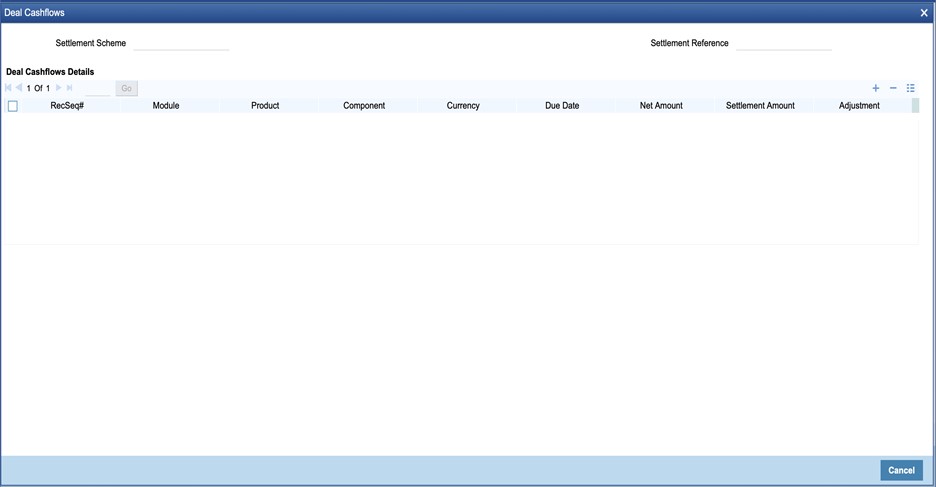

User can view the list of those Pre-netting transactions and cash transfers for Deal Cashflows, linked to the selected scheme and considered for this net settlement.

Click the Deal Cashflows button at the bottom of the Cash-Margin Net Settlement Process (MGDSETLM) function to open this screen.

Figure 6.61: Deal Cashflows

The following table describes the fields displayed for Deal Cashflows transactions included for this Net settlement.

* Indicates mandatory fields.

Table 6.43: Cash-Margin Net Settlement – Deal Cashflows

|

Field |

|

|---|---|

|

Settlement Scheme |

Displays the Settlement Scheme of the net settlement transaction. |

|

Settlement Reference |

Displays a unique reference number of the net settlement transaction. |

|

Deal Cashflow Details |

Group of fields to display the details about the Deal Cashflow transaction to be net settled. |

|

RecSeq# |

Running sequence number of the transactions displayed. |

|

Module |

Displays the module of the Deal Cashflows transaction to be net settled. |

|

Product |

Displays the product of the Deal Cashflows transaction to be net settled. |

|

Component |

Displays the cashflow component of the Deal Cashflows transaction to be net settled. |

|

Currency |

Displays the currency of the Deal Cashflows transaction to be net settled. |

|

Due Date |

Displays the due date of the Deal Cashflows transaction to be net settled. |

|

Net Amount |

Displays Net amount calculated by the system, in Cashflow CCY, as captured for the Deal Cashflows transaction to be net settled. |

|

Settlement Amount |

Displays the Net amount entered by the user, in Cashflow CCY, to be transferred for the Deal Cashflows transaction to be net settled. |

|

Adjustment |

Displays the adjustment amount, in Cashflow CCY, as captured for the Deal Cashflows transaction to be net settled. |

|

Transfer Amount |

Displays the Net amount, in Settlement scheme CCY, to be transferred for the Deal Cashflows transaction to be net settled. |

|

Transfer Action |

Displays the direction of the Net amount, to be transferred for the Deal Cashflows transaction to be net settled. |

|

User Comments |

Displays the additional comments captured for the Deal Cashflows transaction to be net settled. |

|

Netting Reference |

Displays a unique reference number for the Deal Cashflows transaction to be net settled. |

|

Netting ESN |

Displays the accounting event sequence number for the accounting entries posted for the Deal Cashflows pre-netting transaction to be net settled. •Otherwise, it is blank |

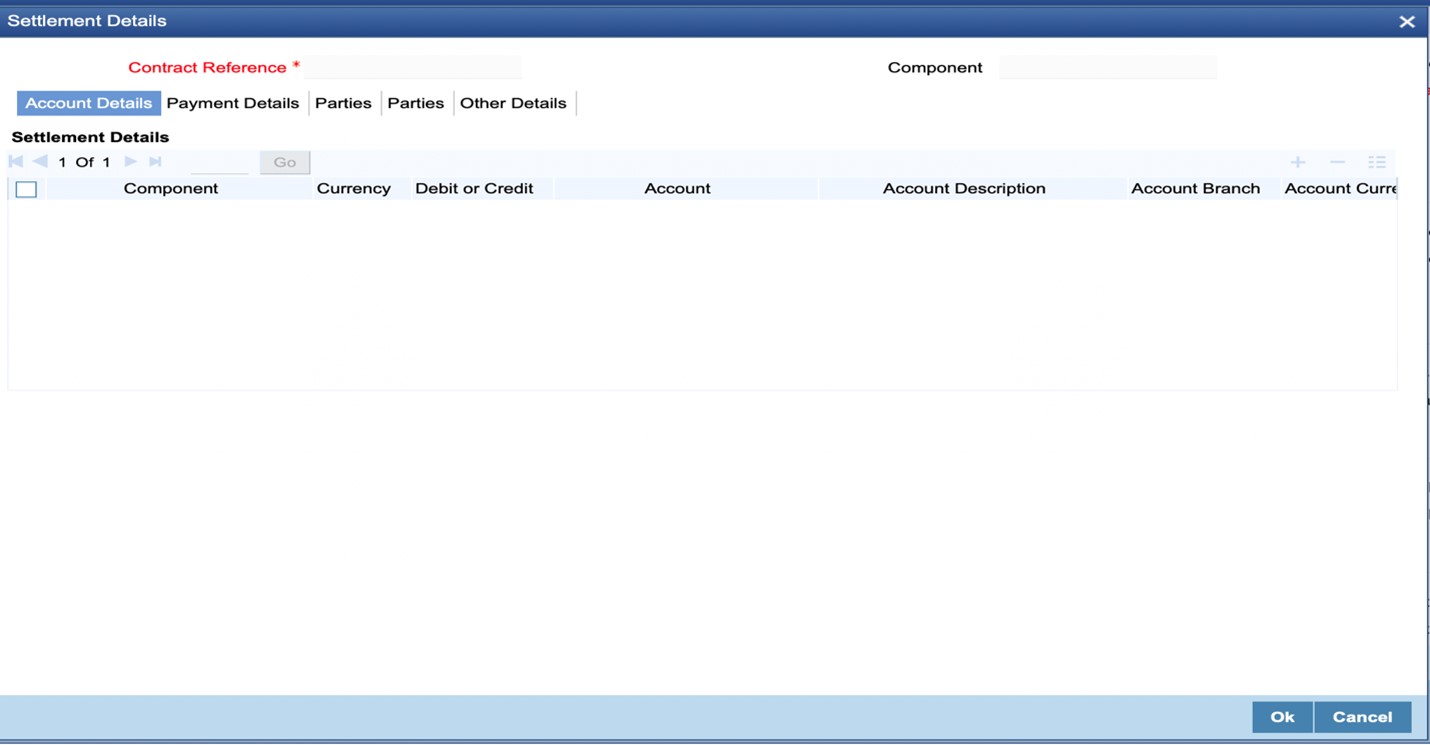

User can view the SSI used for settling the net settlement transaction.

•Can view the settlement Account and Party details for each cash component associated with the transaction

SWIFT messages for settlement can be generated few days in advance according to the settlement days configured for the currency of settlement and the configuration for the events in the margin product.

Click the Settlement button at the bottom of the Cash-Margin Net Settlement Process (MGDSETLM) function to open this screen.

‘Settlements’ user guide can be referred for more details on Settlement details and SGEN event.

Figure 6.62: Settlement Details

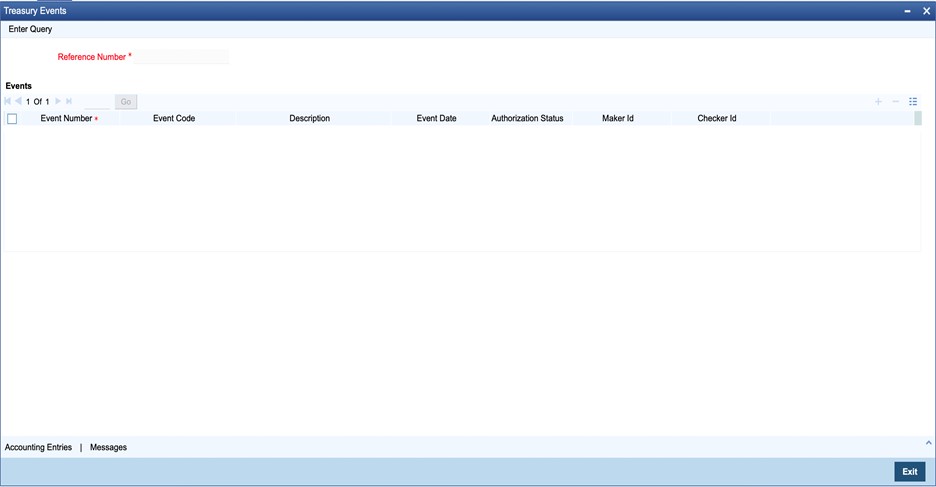

User can view the list of Lifecycle Events triggered for the cash-margin net settlement transaction.

•Can view the Accounting Entries posted for each event

•Can view the Advice(s) and Messages generated for each event

Click the Events button at the bottom of the Cash-Margin Net Settlement Process (MGDSETLM) function to open this screen.

Please refer Events and Accounting Entries for more details about the list of events and accounting entries applicable for cash-margin netting initiation processes.

Figure 6.63: Treasury Events

User can enter values for the UDF associated with the Cash-Margin Net Settlement Process function.

•These fields can be referred while reporting the cash-margin net settlement transactions.

Click the Fields button at the bottom of the Cash-Margin Net Settlement Process (MGDSETLM) function to open this screen.

‘User Defined Fields’ user guide can be referred for more details on the steps involved in configuring and using UDF applicable for the function.

Figure 6.64: Fields

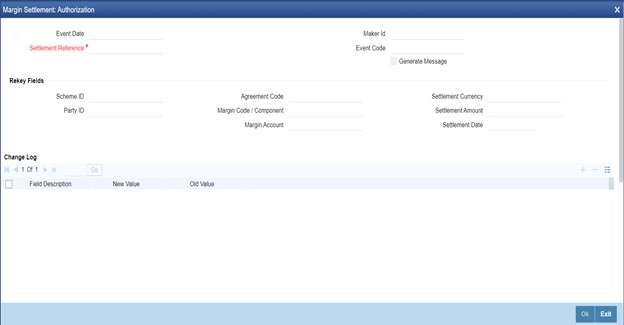

For the cash-margin net settlement transactions initiated or modified, another user (checker) different from the user who initiated (maker) should verify the details, as a cross-checking mechanism, and click Authorize button at the top of the screen.

•Auto authorization can be enabled for this function

Figure 6.65: Margin Settlement Authorization

Checker should enter the correct values for the Rekey fields to ensure that the user is authorizing the intended transaction. Re-key fields applicable for the Cash-Margin net settlement transaction are configured for the margin product.

The following table describes the fields available as Re-key fields for Cash-Margin net settlement transaction. For those fields that are not configured for re-key in the margin product, the respective value selected for the fields are displayed.

Table 6.44: Margin Settlement – Authorization

|

Field |

Description |

|---|---|

|

Scheme Id |

Enter the Settlement Scheme for which the net settlement transaction is initiated. |

|

Party Id |

Enter the Party for whom the net settlement transaction is initiated. |

|

Agreement |

Enter the Agreement or Portfolio for which the net settlement transaction is initiated. |

|

Margin Code / Component |

Enter the Margin code or cashflow component selected for the net settlement transaction. •When net settlement is initiated for multiple margin codes or components together, any one of the margin codes or components should be entered |

|

Margin Account |

Enter the margin account selected for the linked margin transaction. •When net settlement is initiated for multiple margin accounts together, user should enter the margin account linked to the margin code entered as re-key |

|

Settlement Currency |

Enter the currency of the Scheme selected for the transaction. |

|

Settlement Amount |

Enter the net amount settled for the transaction. |

|

Settlement Date |

Enter the value date on which the net settlement transaction is settled. |

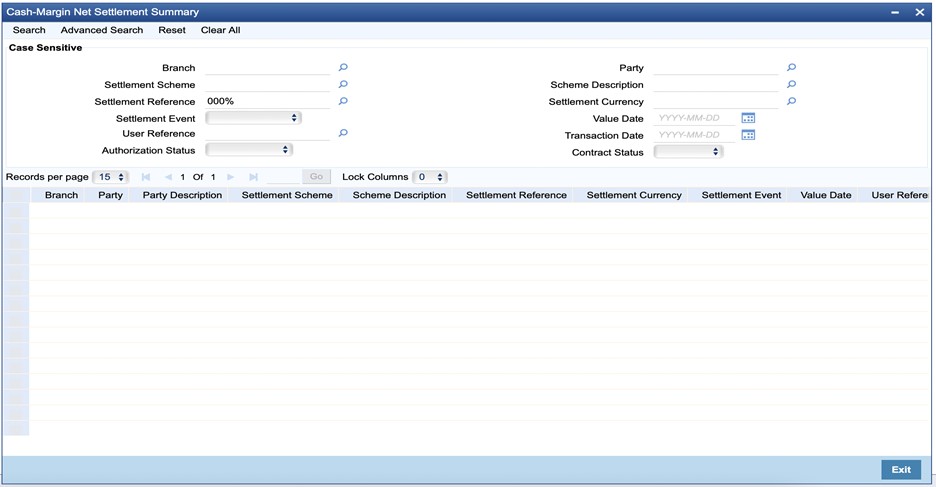

6.3.14 Cash-Margin Net Settlement Summary

User can view the list of Net Settlement transactions processed so far, using ‘Cash-Margin Net Settlement Summary’ function.

•User can select the values for different fields available for filtering / searching the transactions

•User can Reset and Clear all the values selected for the search fields

•User can specify values for additional fields for refining the search by clicking on Advanced Search button

6.3.14.1 Cash-Margin Net Settlement Summary screen

Context:

You can view the summary details maintained using the Cash-Margin Net Settlement Summary screen.

1.On the Homepage, type MGSSETLM in the text box, and click the next arrow.

Step Result: Cash-Margin Net Settlement Summary screen is displayed.

Figure 6.66: Cash-Margin Net Settlement Summary

2.On the Cash-Margin Net Settlement Summary screen, specify the details as required.

In the above screen, you can base your queries by inputting any or all of the parameters and fetch records.

3.Click the Search button to view the details.

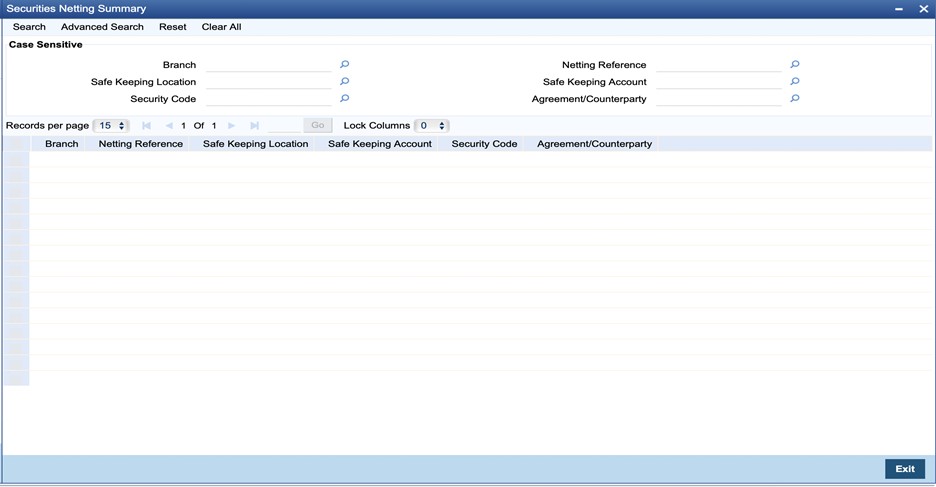

Net settlement of Securities can be performed using ‘Securities Netting’ function.

All security contracts that are marked for netting, including security contracts created for margin transfers, can be settled together for the net quantity.

The details that can be captured for Securities Netting include,

•SK Location, Account, Agreement or Counterparty, Security and Settlement date

•Optionally can filter the contracts for the selected Module or Portfolio

•Select the contracts to be included for netting

User can view the details for,

•List of contracts, that are to be settled through the selected Security, SK Location and Account and linked to the selected Agreement or done with the same Counterparty

•Events triggered for the securities netting transaction along with the advice(s) generated for each event

Securities Netting transactions can be initiated only for the branch to which user has access.

6.4.1 Process to initiate a new transaction

This topic provides the systematic instructions to initiate a new transaction.

Context:

To initiate a new transaction

1.Click the New button at the top of the screen.

2.Enter the values for all the required fields.

3.Click on the Save button to initiate the transaction and send for authorization.

4.Click on the Hold button to save as draft.

6.4.2 Process to query and view the details of an existing transaction

This topic provides the systematic instructions to query and view the details of an existing transaction.

Context:

To query and view the details of an existing transaction

1.Click the Enter Query button at the top of the screen.

2.Enter the Netting Reference of the transaction.

3.Click the Execute Query button.

6.4.3 Modifying an existing transaction

This topic provides the systematic instructions to modify an existing transaction.

Context:

To modify an existing transaction or to revisit the data saved as draft

1.Enter the Netting reference of the transaction and query the existing transaction.

2.Click the Unlock button to enable the screen for editing the details.

3.Review the existing values saved or kept on hold.

4.Enter the new values for the fields to be modified. Please refer the table of fields to know whether the field can be modified after first authorization of the transaction.

5.Click on the Save button to modify the transaction and send for authorization.

6.4.4 Discard, reverse and print transactions

This topic provides the systematic instructions to discard and reverse transactions and print details of the transactions.

1.Click on the Delete button to discard the transaction before first authorization.

2.Click on Reverse button to reverse the transaction after first authorization.

3.Click on the Print button to print the details of the transaction.

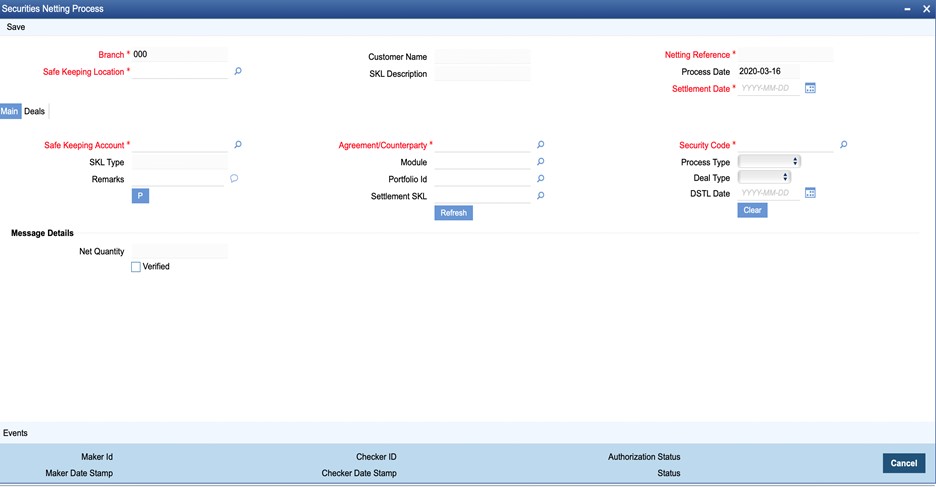

6.4.5 Securities Netting Process screen

User can initiate net settlement for the securities in this Securities Netting Process screen.

1.On the Homepage, type SEDSDMNT in the text box, and click the next arrow.

Step Result: Securities Netting Process screen is displayed.

Figure 6.67: Securities Netting Process

2.On the Securities Netting Process screen, Click New.

3.On the Securities Netting Process- New screen, Specify the details as required.

4.Click Save to save the details or Cancel to close the screen.

For information on fields, refer table below:

Table 6.45: Securities Netting Process

|

Field |

Description |

|---|---|

|

Branch |

Displays the current branch code to which the user has logged in. |

|

Safe Keeping Location |

Select the Safe Keeping Location (Custodian) through whom the Security is net settled. •This field cannot be amended after saving the securities netting •All active SK Locations are displayed for selection |

|

Customer Name |

Displays the description of the Customer linked to the SK Location selected. |

|

SKL Description |

Displays the description of the SK Location selected. |

|

Netting Reference |

Displays a unique reference number for the securities netting transaction. •Automatically generated when the user clicks on ‘P’ button |

|

Process Date |

Displays the date on which the securities netting transaction was saved. •Branch date is set by default |

|

Settlement Date |

Enter the value date for the settlement. •Set by default to Branch date |

The following table describes the main fields captured for Securities Netting transactions.

* Indicates mandatory fields.

Table 6.46: Securities Netting - Main

|

Field |

Description |

|---|---|

|

Safe Keeping Account |

Select the Safe Keeping Account, linked to the selected SK Location, where the Security is maintained. •This field cannot be amended after saving the securities netting •All active SK Accounts, linked to the selected SK Location, are displayed for selection |

|

SKL Type |

Displays the SK Location Type. •Can be Internal or External |

|

Remarks |

Enter any additional comments for the Securities Netting transaction. •A maximum of 250 characters can be entered for remarks |

|

Agreement / Counterparty |

Select the Agreement or Counterparty for the securities netting transaction. •This field cannot be amended after saving the securities netting •Only those active Netting Agreements available for the current branch, with Expiry Date >= Process date and having linked security deals not yet settled, are displayed for selection •Only those active portfolios for the selected module (if applicable) of the parent deals and available to the current branch where user has logged in, are displayed for selection •Applicable only for Exchange Traded Derivatives and Credit Derivatives modules in which portfolios can be defined separately •Only those active treasury Customers having linked security deals not yet settled, are displayed for selection |

|

Module |

Select Securities module to filter only market security deals or the module of the parent deals (if applicable) having linked security deals to be listed for netting. •This field cannot be amended after first authorization of the netting transaction •If not specified, then this field is set to ‘All’, by default |

|

Portfolio Id |

Select the Securities Portfolio having the security deals to be listed for netting. •This field cannot be amended after first authorization of the netting transaction •Only those active portfolios in Securities module, available to the current branch where user has logged in, are displayed for selection •If not specified, then this field is set to ‘All’, by default |

|

Settlement SKL |

Select the Settlement SKL through which selected security is settled. •By default, is set to the Settlement SKL linked to the market of issue of the selected Security |

|

Security Code |

Select the Security to be net settled. •This field cannot be amended after saving the securities netting •All active Securities, having a position linked to the selected SK Location, are displayed for selection |

|

Process Type |

Select the process during which the security deals, to be listed for netting, are created. •This field cannot be amended after first authorization of the netting transaction •Select ‘Market Deal’, to net only the security deals booked in the market for trading or investment purposes •Select ‘Margin Call’, to net only the security deals created for collateral assignment or margin call purposes •If not specified, this field is set to ‘All’ by default |

|

Deal Type |

Select the type of the security deals to be listed for netting. •This field cannot be amended after first authorization of the netting transaction •Select ‘Buy / Sell’, to net only the deals booked for buying or selling or transferring the security to counterparty •Select ‘Block’, to net only the deals booked for blocking the securities provided as collateral to counterparty •If not specified, this field is set to ‘All’ by default |

|

Dstl Date |

Enter the Dstl Date of the security deals to be listed for netting. •Enter the Dstl Date of the security deals to be listed for netting. •This field cannot be amended after first authorization of the netting transaction |

|

Message Details |

Group of fields to display the netting details that is used in the securities delivery messages. |

|

Net Quantity |

Displays the net quantity to be settled, calculated by considering the deals selected for netting in ‘Deals’ tab. •Value for this field is automatically set, when the user clicks on ‘Apply Netting’ button ‘Deals’ tab, after selecting the deals for netting |

|

Verified |

Indicate whether he has verified the calculation of net quantity and agrees to the value displayed. •Able to save the netting transaction only after ‘Verified’ is checked |

Figure 6.68: Securities Netting Process– Deals

The following table describes the fields displayed for Securities transactions included for this Netting.

* Indicates mandatory fields.

Table 6.47: Securities Netting Process– Deals

|

Field |

Description |

|---|---|

|

Deal Reference |

Displays the contract reference of the security deal. |

|

Leg Reference |

Displays the leg reference of security leg of the deal. |

|

DSTL Date |