Setting Up FSA Plans

To set up FSA plans, use the FSA Benefits Table (FSA_BENEFITS_TABLE) and HSA Excluded Coverages (HSA_EXCLUDED_CVRGS) components.

This section provides an overview of FSA plans.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

FSA_BENEFITS_TABLE |

Define spending account plan details for US and Canada |

|

|

HSA_CONTRIB_LIMITS |

Define the contribution limits for HSA plans. Note: This page is available for Benefits Administration only. |

|

|

FSA_ADMIN_CONFIG |

Define the FSA Admin Configuration. |

|

|

HSA_EXCLUDED_CVRGS |

Define specific plans that will be excluded from coverage when one selects an HSA. |

The PeopleSoft system enables you to manage two types of spending accounts: Flexible spending accounts (FSAs) and Health savings accounts (HSAs).

Flexible spending accounts (FSAs) are before-tax employee savings plans that can be used for certain approved expenses, such as health care or dependent care. The following plan types are predefined for FSAs:

Plan type 60 - FSA health care for U.S. companies.

Plan type 61 - FSA dependent care for U.S. companies.

Plan type 65 - FSA health care for Canadian companies.

Plan type 66 - Canadian retirement counseling accounts.

HSAs are tax-advantaged accounts that enable eligible people to save money and subsequently use that money and any earnings from that money to pay for medical expenses tax-free. People are eligible to contribute to an HSA if they are covered under a high deductible health plan (HDHP).

The PeopleSoft system delivers the plan type 67 to use for HSAs, however any 6x plan type can be used. However, PeopleSoft does not recommend using 60, 61, 65 and 66, as these are delivered plan types for FSA Health and Dependent care for US and Canada.

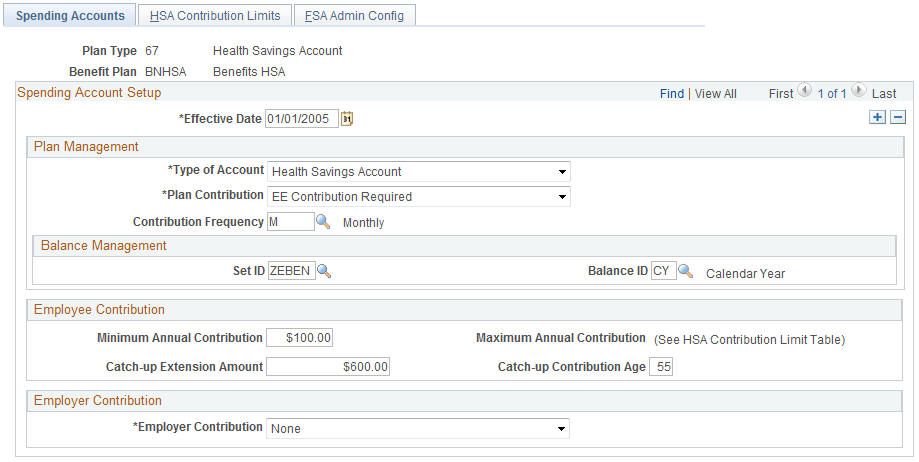

Use the Spending Accounts page (FSA_BENEFITS_TABLE) to define spending account plan details for US and Canada.

Navigation:

This example illustrates the fields and controls on the Spending Accounts page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

(CAN) Employer Carryforward Choice |

Carry forward credit or claim amounts from one plan year to the next. |

(CAN) Future Borrowing |

Select to allow plan enrollees to spend FSA credits prior to their inclusion within the plan year. |

Plan Management

Field or Control |

Description |

|---|---|

Type of Account |

Select whether the spending account is a Flexible Spending Account or a Health Savings Account. If you are using PeopleSoft Benefits Administration, the system shows the HSA Contribution Limits page when you select Health Savings Account. |

Plan Contribution |

Indicate whether employees are expected to contribute to the plan by selecting one of the following options:

|

Contribution Frequency |

Select a frequency to define how you quote amounts for this spending account plan. If, when you are entering an employee's election, an employee contribution percentage is specified in addition to an annual pledge, then it is specified in terms of this contribution frequency. |

Balance ID |

The system uses the pay period end date or check date and the schedule of balance periods associated with this balance ID to calculate deductions. |

Employee Contribution

Field or Control |

Description |

|---|---|

Minimum Annual Contribution |

Enter the minimum contribution employees can make annually. |

Maximum Annual Contribution |

Enter the maximum contribution employees can make annually either here or on the HSA Contribution Limits page. See Entering HSA Contribution Limits. |

Catch-up Extension Amount |

Enter the annual HSA catch-up extension amount as defined by the IRS. |

Catch-up Contribution Age |

Enter the age as of which employees can contribute the additional catch-up amount. |

Employer Contribution

Field or Control |

Description |

|---|---|

Employer Contribution |

Indicate whether and how an employer matches contributions to this plan:

Note: HSA plans only use the None and Flat Amount options. |

Flat Contribution Amount |

If you are using Benefits Administration, enter the employer contribution on the HSA Contribution Limits page only if the plan is an HSA plan. If the plan is an FSA, then enter the contribution amount on this page. See Entering HSA Contribution Limits. |

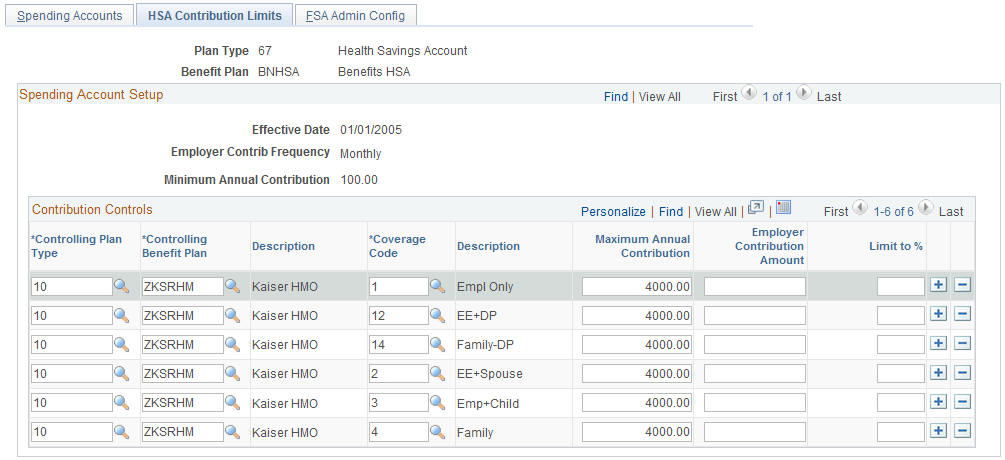

Use the HSA Contribution Limits page (HSA_CONTRIB_LIMITS) to define the contribution limits for HSA plans.

Note: This page is only available when using Benefits Administration.

Navigation:

This example illustrates the fields and controls on the HSA Contribution Limits page. You can find definitions for the fields and controls later on this page.

Employees can contribute to an HSA only if they are covered by an HDHP. Their contributions to an HSA are determined by the HDHP and the coverage code. For each controlling plan you enter, make sure that you include a row for each coverage code.

Contribution Controls

Field or Control |

Description |

|---|---|

Controlling Plan Type |

Select the benefit plan type whose membership controls eligibility for this plan. |

Controlling Benefit Plan |

Select the HDHP benefit plan whose membership controls eligibility for this plan. |

Coverage Code |

Select the plan's coverage code. |

Maximum Annual Contribution |

Enter the maximum annual amount that can be contributed to the HSA when an employee is covered by this plan and coverage code. This maximum is the total limit for both employee and employer contributions combined. |

Employer Contribution Amount |

Enter the amount that employers will contribute based on the Employer Contribution Frequency to the HSA for employees covered by this plan and coverage code. |

Limit to % (limit to percent) |

Leave blank because employer contributions must be nondiscriminatory. |

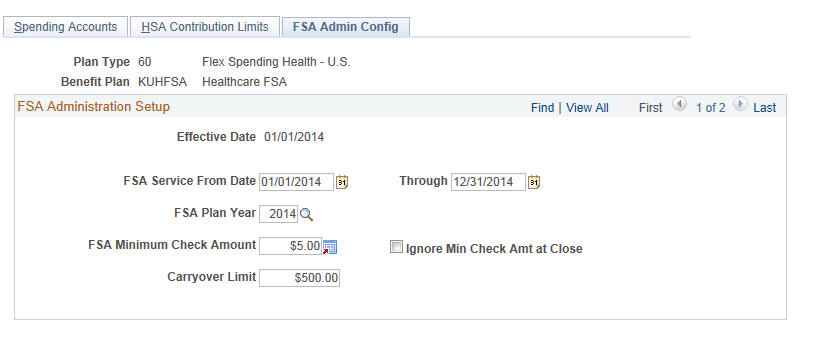

Use the FSA Admin Config page (FSA_ADMIN_CONFIG) to define the FSA Admin Configuration.

Navigation:

This example illustrates the fields and controls on the FSA Admin Config page. You can find definitions for the fields and controls later on this page.

Use the following fields to determine the service dates that are valid for submitted claims:

Field or Control |

Description |

|---|---|

FSA Service From Date |

This field by default displays the effective date of the plan and must be within the service date range to be paid under the plan. This value can also be longer than 12 months and overlap the service dates of other plans that the employer offers and in which the employee is enrolled. |

Through |

This field by default displays the date that is 12 months after the effective date of the plan. |

FSA Plan Year |

Select the year pertaining to this plan. |

FSA Minimum Check Amount (flexible spending account check amount |

Enter a cost below which the system does not pay out any claims. |

Ignore Min Check Amt at Close (ignore minimum check amount at close) |

Select to close out the plan and process and pay out any approved, pending claims below the minimum amount. All claims are paid when the system runs the closure process for the benefit plan. Note: If this option is not selected, all claims below the minimum amount remain unpaid. If the pending claim has a service date that overlaps two FSA plans in which an employee is enrolled, the system moves the claims to the second FSA plan until enough claims exist to meet the minimum check amount of the second FSA plan. |

Carryover limit |

Define the maximum FSA carryover limit. Note: The maximum carryover amount should not exceed $500. For more information on setting the FSA carryover, see Understanding U.S. Health FSA Carryover |

Use the HSA Excluded Coverages page (HSA_EXCLUDED_CVRGS) to define specific plans that will be excluded from coverage when one selects an HSA.

Navigation:

If an employee enrolls in an HSA, he or she cannot enroll in some plans. These nonpermitted plans are defined in an HSA Excluded Coverages table by plan type and plan. This table validates all HSA enrollments through eBenefits and Benefits Administration.

This example illustrates the fields and controls on the HSA Excluded Coverages page. You can find definitions for the fields and controls later on this page.