(USF) Enrolling Employees in Benefit Programs and Plans

This section describes how to enroll employees in benefit programs and plans.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_BENDATA_SEC |

Enroll participants into benefit programs and plans. |

|

|

GVT_BENDATA1_SEC |

Select the participant's FEGLI plan coverage, manage the employee's retirement coverage, and designate FICA status. |

|

|

GVT_ASSIGNEE |

Designate one or more assignees for an employee's FEGLI benefits coverage. Each assignee is given a share of the total coverage being assigned. The total of these percentages must be 100. |

|

|

GVT_ASSIGNEE_BEN |

Designate one or more beneficiaries. Use to assign the FEGLI benefits of U.S. federal government employees and retirees. |

|

|

GVT_TSP_AUTO |

Enroll employees in the TSP Agency Automatic 1% Contribution plan. |

|

|

GVT_TSP_INVEST |

Select investment options. |

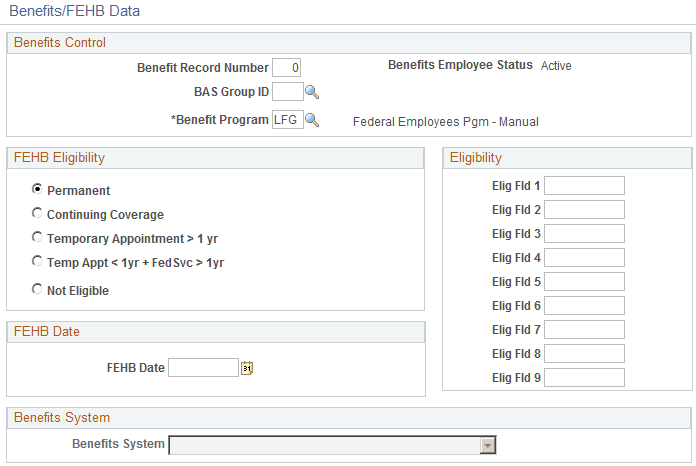

Use the Benefits/FEHB Data (benefits/federal employee health benefits data) page (GVT_BENDATA_SEC) to enroll participants into benefit programs and plans.

Navigation:

Select the Job Data tab.

Click the Benefits/FEHB Data link.

This example illustrates the fields and controls on the Benefits/FEHB Data page. You can find definitions for the fields and controls later on this page.

Benefits Control

This group box is used for Benefits Administration processing.

Field or Control |

Description |

|---|---|

BAS Group ID (benefits administration group identification) |

Applies only if your benefits system uses Benefits Administration. Use it to link the participant to a particular benefits administration group for Benefits Administration processing later. |

Benefit Program |

Automatically set to the benefits program specified for the employee's pay group, which you specify in the Position Data page. |

FEHB Eligibility

This group box identifies FEHB eligibility.

Field or Control |

Description |

|---|---|

Permanent |

Select this option for employees with a career conditional career appointment. Employees are eligible for FEHB if fields 1−9 in the Eligibility group box are also for users of Benefits Administration. Here you enter eligibility values that refer to eligibility configuration values in the Eligibility Rules Table. |

Continuing Coverage |

Select this option for employees who are transferring into a position from another agency without a break in service and for rehires with a break in service of fewer than 30 days. Employees are eligible for FEHB. |

Temporary Appointment > 1 yr (temporary appointment greater than one year) |

Select this option for an employee with a temporary appointment greater than one year. Employees are eligible for FEHB. |

Temporary Appointment < 1 yr + FedSvc > 1 yr (temporary appointment less than one year plus federal service greater than one year) |

Select this option for an employee with a temporary appointment less than one year and continuous service greater than one year. Employees with this eligibility pay the entire cost of their FEHB coverage. |

Not Eligible |

Select this option for employees who are ineligible for FEHB plan coverage. This option is most commonly used for employees with a temporary appointment of less than one year of service. |

Eligibility

This group box is for Benefits Administration only. You enter the eligibility values that refer to the eligibility configuration values in the Eligibility Rules Table.

FEHB Date

This group box is for Federal users. Enter the future date on which an employee will be eligible for FEHB coverage. Typically, the FEHB Date is one year from the employee's hire date.

Benefits System

Benefits System

Select the appropriate benefits system. Select Not Managed in PeopleSoft (benefits managed by a system other than PeopleSoft) to filter out persons who have insufficient employment and job information to support benefit enrollment.

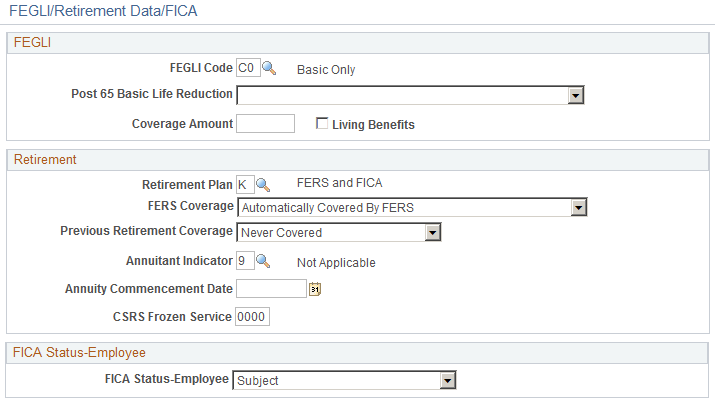

Use the FEGLI/Retirement Data/FICA (federal employee government life insurance/retirement data/Federal Insurance Contributions Act) page (GVT_BENDATA1_SEC) to select the participant's FEGLI plan coverage, manage the employee's retirement coverage, and designate FICA status.

Navigation:

Select the Job Data tab.

Click the FEGLI/Retirement/FICA link.

This example illustrates the fields and controls on the FEGLI/Retirement Data/FICA page. You can find definitions for the fields and controls later on this page.

FEGLI

Field or Control |

Description |

|---|---|

FEGLI Code |

Use this field to select the participant's FEGLI (Federal Employees' Group Life Insurance ) plan coverage, including termination, waiving coverage, and coverage ineligibility. Only active employees are allowed to increase their FEGLI coverage. You can assign beneficiaries and allocate survivor benefits through the Life and AD/D Benefits - Beneficiaries page. Note: When you have two or more FEGLI-related transactions to process for one employee that are effective on the same date, each one must be processed separately. You must enter the first transaction and save it before inserting a row to process the second transaction. When a second transaction is entered without saving the first, the system returns a message reporting that the transaction will be canceled. Federal employees may assign their FEGLI benefits to another person, trust, or settlement company that will pay them a cash amount for these benefits. Assignation of benefits is handled in the FEGLI Assignments page group of the Administer Base Benefits (USF) menu. |

Post 65 Basic Life Reduction |

After federal employees pass the age of 65, their basic life plan coverage may be reduced. In the Post 65 Basic Life Reduction field, determine whether the chosen employee's life plan value will be reduced by 50%, 75%, or not at all. |

Living Benefits |

Select for terminally ill federal employees and retirees who have a life expectancy of nine months or less. With living benefits, a full or partial payment of the FEGLI Basic Life Insurance benefit is paid directly to the employee or retiree. When an employee's request for living benefits has been approved by OFEGLI, use the PAR pages to process the election. Select an NOA code of 805 (Elect Full Living Benefit) or 806 (Elect Partial Living Benefit). When you select Living Benefits to process a partial living benefit, the Coverage Amount field becomes available. After an employee selects living benefits, the only FEGLI code values available to the employee are Terminate All and Waive All Life Insurance. |

Coverage Amount |

Used for employees who elect a partial living benefit. In this field, enter the Basic Insurance Amount (BIA). This is the balance of the coverage amount remaining. |

Retirement

Field or Control |

Description |

|---|---|

Retirement Plan |

Select the employee's retirement plan coverage. You can select from an entire list of available U.S. federal government retirement programs that may be available to your employees. Whether your agency actually offers all of these programs depends upon whether you have set them up in the Retirement Plan Table and have associated them with the benefit programs that your agency offers. |

FERS Coverage (federal employees retirement system coverage) |

Indicate the level of FERS coverage allocated to employees who had federal retirement plan coverage prior to 1984. Employees who had this coverage before 1984 can select from the following values: Elected Coverage Under FERS or Not Covered by FERS. All employees who started federal retirement coverage after 1984 have a FERS coverage of Automatically Covered by FERS. |

Previous Retirement Coverage |

Employees transferring from another agency previously covered by a federal benefit plan should select Previously Covered. If the employee was not covered, select Never Covered. |

Annuitant Indicator |

Use for employees who are being rehired from retirement. If a formerly retired employee is receiving an annuity such as a pension plan payment, his or her pay may be offset by that annuity amount. Determine whether the retirement annuity is applicable to the employee's wages. Indicate the former employment status of the employee, regardless of whether the employee was a retired enlisted or military officer, and the employee's retirement plan type (CSRS or FERS). |

Annuity Commencement Date |

The date when retirement annuities for a retired or soon-to-be-retired employee began or will begin. The system uses this date when determining how to calculate agency contributions and employee deductions for FEHB and FEGLI during the employee's last pay period. Note: When an employee has worked less than a full pay period, the PeopleSoft Payroll Pay Calculation process prorates FEHB and FEGLI deductions according to OPM (Office of Personnel Management) rules. |

CSRS Frozen Service (civil service retirement system frozen service) |

Frozen service is the U.S. federal government term for the total years and months of civilian and military service that is creditable in a CSRS component of an FERS employee (retirement plans FERS and FICA, FERS and FICA - Air Traffic Control, FERS and FICA - Special, and FERS and FICA - Reserve Tech), or in the case of a CSRS offset employee (retirement plans FICA + CSRS – Partial and FICA + CSRS Special – Partial), the service that would be covered in a CSRS component if the employee ever became covered by FERS. In the CSRS Frozen Service field, enter this time span as a four-number code. The first and second positions indicate the number of years, while the third and fourth positions indicate the number of months. For example, a time span of five years and three months would be entered in CSRS Frozen Service as 0503. |

FICA Status - Employee

Select the employee's FICA status. Select from the following values: E − Exempt, M − Medicare only, or N − Subject.

After you set up an employee's initial benefit program and plan enrollments through the PAR, you can proceed to the individual benefit pages to continue benefit plan enrollments, add plan coverage detail, enroll dependents, and assign beneficiaries. You can make changes in these pages without opening a PAR.

Use the FEGLI Assignments - Assignee (federal employee government life insurance - assignee) page (GVT_ASSIGNEE) to designate one or more assignees for an employee's FEGLI benefits coverage.

Each assignee is given a share of the total coverage being assigned. The total of these percentages must be 100.

Navigation:

Field or Control |

Description |

|---|---|

Assignee Number |

This number is designated automatically by the system; it automatically increases by one with each new assignee that you designate for an employee. |

Assignee Name, National ID, and Assignee Share (Pct) (assignee share percentage) |

Enter the information for each assignee. The total assignee shares for all assignees associated with an employee should equal 100. |

After you enter assignee information and save it, the system selects the Assigned check box in the FEGLI - Elections page for coverage that has been assigned, with the exception of FEGLI plan options that have been Waived. When an employee elects a partial living benefit, the BIA is assigned along with any optional insurance. This is with the exception of Option C - Family coverage.

Use the FEGLI Assignments - Assignee Benef (federal employee government life insurance - assignee beneficiary) page (GVT_ASSIGNEE_BEN) to designate one or more beneficiaries.

Use to assign the FEGLI benefits of U.S. federal government employees and retirees.

Navigation:

Field or Control |

Description |

|---|---|

Assignee Beneficiary Number |

The system designates and automatically increases this number by one for each beneficiary added to an assignee. |

Assignee Name, Relationship, and Benef Share (Pct) (benefit share percentage) |

Enter the information for each assignee. |

Same Address as Assignee |

Select this check box if the beneficiary shares this information with the assignee. While this check box is selected, the Address and Phone Information fields are unavailable. |

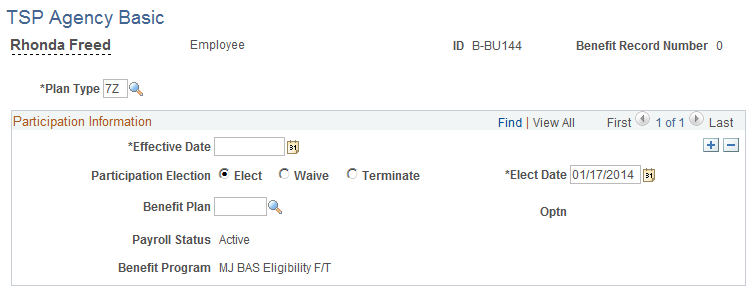

Use the TSP Agency Basic (thrift savings plan - agency basic) page (GVT_TSP_AUTO) to enroll employees in the TSP Agency Automatic 1% Contribution plan.

Navigation:

This example illustrates the fields and controls on the TSP Agency Basic page. You can find definitions for the fields and controls later on this page.

Enter the effective date. By default, the system sets Participation Election to Elect and the elect date to the system date.

Use Benefit Plan to enroll the employee in the TSP 1% Agency Contribution plan. TSP 1% Agency Contribution plans have a plan type of 7Z.

Employees typically must complete a waiting period of two open seasons after their hire date before they can be enrolled in the TSP 1% Agency Contribution plan.

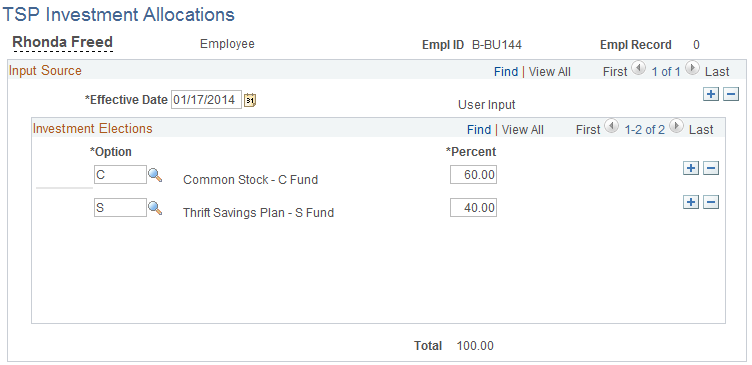

Use the TSP Investment Allocations (thrift savings plan investment allocations) page (GVT_TSP_INVEST) to select investment options.

Navigation:

This example illustrates the fields and controls on the TSP Investment Allocations page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Option |

Enter the type of investment in which you are allocating an investment percentage. If more than one investment option is associated with the chosen employee's savings plan, you can add more rows. |

Percent |

Enter the investment percentage allocated for each option associated with this savings plan. Investment percentages must total 100 before they can be saved into the system. |