Setting Up Paycheck Modeling

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PY_MOD_ADM_COMPANY |

Specify system performance options for paycheck modeling. |

|

|

PY_MOD_ADM_PAYGRP |

Set up and control employee access to the Paycheck Modeler by company and pay group. Access can be disabled either permanently or for temporary periods of time. |

|

|

PY_MOD_ADM_ERNINGS |

For each eligible company and pay group, define the earnings that will be presented for selection by employees using the Paycheck Modeler when adding earnings to the model paycheck. |

|

|

PY_MOD_ADM_DEDCTNS |

For each eligible company and pay group, define the deductions that will be presented for selection by employees using the Paycheck Modeler when adding deductions to the model paycheck. |

Paycheck modeling is an integration of a modeler with live payroll and human resources and benefits records. The modeling feature leverages the Online Single Check functionality described in Processing Online Single Checks in your PeopleSoft Payroll for North America product documentation.

Employees can use Paycheck Modeler to simulate their own paychecks through a self-service web application, investigate their own what-if scenarios, and answer most of their own questions without having to call your payroll department.

Warning! Self-service Paycheck Modeler supports US employees with US-based jobs only. The functionality is currently not available to USF or CAN employees, or US employees with non-US-based jobs.

Note: Self-service Paycheck Modeler is available to payroll administrators, however administrators are strongly encouraged to use only the Online Single Check functionality to generate or model paychecks. While Paycheck Modeler leverages the Online Single Check functionality, the Online Single Check functionality has settings that are available only to administrators.

Self-service paycheck modeling is useful when employees want to quickly calculate and simulate estimated paychecks for various scenarios including:

When an employee is working large amounts of irregular overtime and they want to estimate a check with the overtime pay included.

When an employee wants to enter new health care contribution amounts, for example during Open Enrollment, to determine the effect on taxes and net pay.

When an employee received a large tax refund and they want to estimate tax withholding and net pay amounts by manipulating tax withholding status, credit, or exemptions to determine how they might increase net pay and reduce the tax refund in the future.

To protect the live payroll production data from impact, paycheck modeling data is stored in temporary work tables. Model paycheck results are automatically cleared when the user exits the paycheck modeling component, and modeling history is not retained for future access. To prevent modeled checks from being offered as real paychecks or proof of pay, and to protect personal and pay information, a model check printout contains no data that identifies either the employee or the company and the watermark says Estimate.

To help manage system performance, system administrators can set Paycheck Modeler to automatically prevent all users from accessing it when regular payroll calculation and confirmation processes are running, and to automatically restore access when the processes have completed. System administrators can also use the to lock employees out of Paycheck Modeling components for specified periods of time, control the number of concurrent users that can access the system at the same time, and control the number of times an individual employee can calculate a model check in one day. See Company Controls Page and Pay Group Parameters - Access Controls Page.

For an administrative overview of the employee’s self-service paycheck modeling process, see Understanding the Self-Service Paycheck Modeling Process.

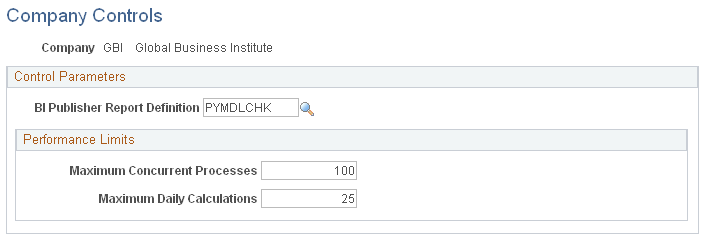

Use the Company Controls page (PY_MOD_ADM_COMPANY) to specify system performance options for paycheck modeling.

Navigation:

This example illustrates the fields and controls on the Company Controls page.

Control Parameters

Field or Control |

Description |

|---|---|

BI Publisher Report Definition |

Enter the alpha numeric code for of the report template for the XML-to-PDF publisher to use to format the model check for printing. |

Performance Limits

Field or Control |

Description |

|---|---|

Maximum Concurrent Processes |

(Optional) Enter the number to use to restrict how many users can concurrently access the paycheck modeler at the same time. Enter a number that accounts for both payroll administrators and self-service employees. When the maximum number of concurrent users is met, the next employee to try to access the modeler is denied access and receives an error message indicating that the modeler is currently unavailable, and instructing them to try again later. If the field is blank or contains 0, the system places no restriction on the number of concurrent paycheck modeling calculations that can be processed at the same time. |

Maximum Daily Calculations |

(Optional) Enter the number to use to restrict the number of times that the same user can run the paycheck modeling calculation process in a day. If the maximum daily calculations are exceeded, upon trying to access the modeler again, the employee receives an error message saying they have exceeded the maximum number of times that a model paycheck can be calculated in one day, to please try again tomorrow. If the field is blank or contains 0, the system places no restriction on the number of paycheck modeling calculations that the same user can process in one day. |

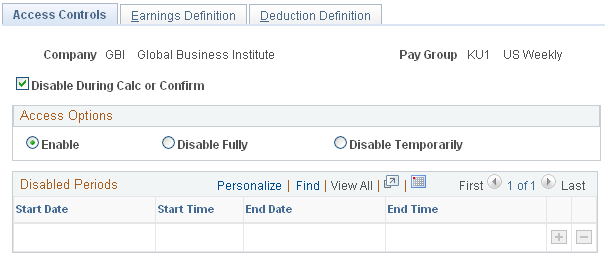

Use the Pay Group Parameters - Access Controls page (PY_MOD_ADM_PAYGRP) to set up and control employee access to Paycheck Modeler by company and pay group.

Navigation:

This example illustrates the fields and controls on the Pay Group Parameters - Access Controls page.

Use the Pay Group Parameters - Access Controls page to enable or disable access to Paycheck Modeler for each combination of company and pay group that you want to be eligible to use Paycheck Modeler.

Note: The self-service Paycheck Modeler link appears for everyone, however Paycheck Modeler may not be available to everyone. Employees in any pay group for which Paycheck Modeler is not enabled are ineligible to use it. When an employee who is ineligible to use Paycheck Modeler selects the link, a message appears saying that Paycheck Modeler is unavailable for use or that the employee is ineligible to use Paycheck Modeler. The system must be able to retrieve an employee’s Job Data pay rate and generate paysheets to model the paycheck. Therefore, employees that belong to an eligible pay group but who have no pay to calculate for the current pay period (for example, with a status of terminated, retired, unpaid leave of absence, and so on) also cannot access Paycheck Modeler. Newly-hired employees who are not active as of the pay period end date of the previously confirmed regular on-cycle paycheck are also unable to use Paycheck Modeler.

Field or Control |

Description |

|---|---|

Disable During Calc or Confirm |

Select this check box to prevent all users (administrators and self-service employees in the defined company and pay group) from accessing Paycheck Modeler when regular on-cycle payroll calculation and confirmation processes are running. A batch run control flag preventing access to Paycheck Modeler is automatically turned on by the COBOL batch program. If an employee has accessed and is in the process of using Paycheck Modeler when the payroll process starts, an error message prevents them from performing further modeling until the production process completes. Upon successful completion of the regular payroll calculation and confirmation processes, the COBOL batch program automatically turns off the batch run control flag, making Paycheck Modeler available again to all users in the defined company and pay group. If the check box is deselected, the COBOL batch program ignores the batch run control flag, and users have full access to Paycheck Modeler while the batch processes are running. Important! This setting only disables paycheck modeling during on-cycle processing. |

Restore Access |

This check box appears only when the payroll calculation or confirmation process is running or if the COBOL batch program fails. Select the check box as an emergency measure to manually turn off the batch run control flag when the batch program fails, and re-enable users to access Paycheck Modeler. If the batch program fails, the check box remains visible until it is either selected or the next payroll calculation or confirmation process completes successfully. |

Access Options

You can disable access either permanently or for temporary periods of time.

Field or Control |

Description |

|---|---|

Enable, Disable Fully, or Disable Temporarily |

Select the option to control access to Paycheck Modeler:

|

Disabled Periods

Field or Control |

Description |

|---|---|

Start DateStart Time,End Date, and End Time |

Enter parameters to identify the periods of time during which you want to temporarily disable Paycheck Modeler for system performance or other reasons. You can enter multiple date durations. All parameters are required. |

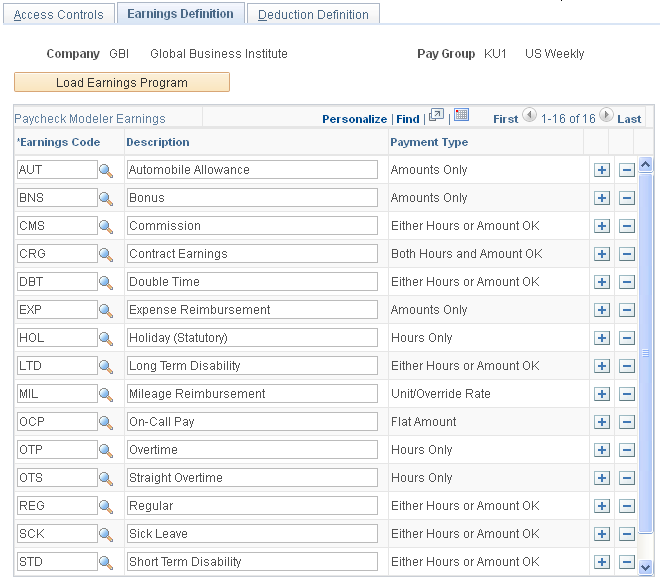

Use the Pay Group Parameters - Earnings Definition page (PY_MOD_ADM_ERNINGS) to define for each eligible company and pay group, the earnings that will be presented for selection by employees using Paycheck Modeler when adding earnings to the model paycheck.

Navigation:

This example illustrates the fields and controls on the Pay Group Parameters- Earnings Definition page.

The system uses earnings codes to identify the type of earnings that an employee is paid. Each earnings code consists of various compensation attributes dictating how the earnings will be handled. Use this table to identify and control the earnings codes that employees in the specified company and pay group can select for addition to their model paycheck.

Note: The model check assumes the employee’s standard earnings and deductions. The earnings defined on this page are the earning that employees will be able to add to modeled checks in addition to their normal payroll calculation.

Field or Control |

Description |

|---|---|

Load Earnings Program |

(Optional) Select this button to populate the Paycheck Modeling Earnings grid with all of the earnings codes from the Earnings Program table that are associated with the specified pay group. |

Paycheck Modeler Earnings

Field or Control |

Description |

|---|---|

Earnings Code and Description |

Enter the code and description for each earnings code that you want employees in the eligible company and pay group to be able to add to their model paycheck. Only the earnings codes that are attached to the Earnings Program table associated with the specified pay group are available for selection. The earnings code descriptions that appear here are from the Earnings Table and are used on the actual paychecks (PAY003), direct deposit advices (DDP003), and in Paycheck Modeler. Overriding a description here overrides it only for Paycheck Modeler. Earnings codes with the same description must be modified to uniquely identify each earnings code. All earning codes should be reviewed and updated for clarity and ease of use by self-service employees. |

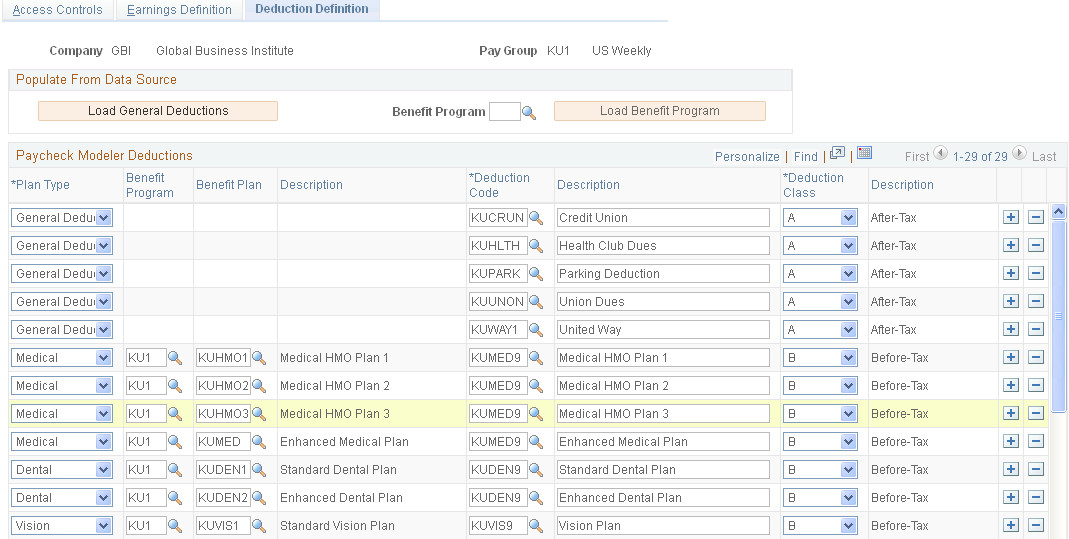

Use the Pay Group Parameters - Deduction Definition page (PY_MOD_ADM_DEDCTNS) to define for each eligible company and pay group, the deductions that will be presented for selection by employees using Paycheck Modeler when adding deductions to the model paycheck.

Navigation:

This example illustrates the fields and controls on the Pay Group Parameters - Deduction Definition page.

Populate from Data Source

Use fields on the Pay Group Parameters - Deduction Definition page to identify and control the deduction codes that you want employees in the specified company and pay group to be able to add when modelling their paychecks.

Note: The model check assumes the employee’s standard earnings and deductions. The deductions defined on this page are the deductions that employees will be able to add to modeled checks in addition to their normal payroll calculation.

Field or Control |

Description |

|---|---|

Load General Deductions |

(Optional) Select this button to populate the Paycheck Modeler Deductions grid with all of the deduction codes from the Company General Deductions table that are associated with the specified company. |

Benefit Program and Load Benefit Program |

(Optional) Specify the benefit program from which to clone all benefit plan deduction data, and then select the Load Benefit Program button to populate the Paycheck Modeling Deductions grid with that data. |

Note: For initial setup, load the general deductions, load the benefit program, and save the page before making any other entries. Each time that you select the Load General Deductions or the Load Benefit Program button and save the results, the system clears all existing entries and populates the grid with results of the new selection. The Load General Deductions and Load Benefit Program functions are intended to assist with the initial setup of the Paycheck Modeler Deductions table.

Paycheck Modeler Deductions

Field or Control |

Description |

|---|---|

Plan Type, Benefit Program, and Benefit Plan |

Select a plan type, benefit program, and benefit plan for each deduction to use. |

Deduction Code and Description |

Enter the code and description for each deduction code that you want employees in the eligible company and pay group to be able to add to their model paycheck. Only the deduction codes that are attached to the Company General Deductions table associated with the specified pay group are available for selection. Because employees within one pay group can belong to a variety of benefit programs, all benefit plan deductions are available for selection. Note: Garnishment deductions are not defined on the Deduction Definition page. A garnishment amount, if any, from the calculated check is included in the model check. The employee cannot add or update it, but they can delete it using either the modeler Clear Amount or Clear All Amounts functions. The deduction code descriptions that appear here are from the Deduction Table and are used on the actual paychecks (PAY003), direct deposit advices (DDP003), and in Paycheck Modeler. Overriding a description here overrides it only for Paycheck Modeler. Deduction codes with the same description must be modified to uniquely identify each deduction code. All deduction codes should be reviewed and updated for clarity and ease of use by self-service employees. |

Deduction Class |

Select the deduction tax classification for the deduction code. To exclude a deduction, such as taxable benefits, from being available for update in Paycheck Modeler, you must exclude it from this table. |

This overview describes what the payroll administrator should know to support the employee’s self-service paycheck modeling page-by-page process.

Paycheck Modeling VFO

The self-service Paycheck Modeler end-user process is demonstrated in the following Oracle YouTube VFO (Video Feature Overview):

Video: PeopleSoft Paycheck Modeler

Common Controls

The field and page controls described here behave the same throughout the self-service Paycheck Modeler component (PY_MOD_SS_MODELER).

Term |

Definition |

|---|---|

Clear All Amounts |

Deletes ALL amounts, making them zero, including the original real amounts and any that the user has entered from Paycheck Modeler. To display the original, current pay calendar amounts again, users must exit Paycheck Modeler and start over. |

Clear Amounts |

Deletes the amount for the specific item, making the amount zero. |

Edit |

Displays an edit page where you can view and modify details for the specific item. |

Next and Previous |

Use these buttons (and not your browser’s Back or Forward buttons), to step backwards or forwards through the steps while retaining session data. Note: You can also click the link for any step (Earnings, Deductions, Taxes, and so on, except Start) to return to that step and move through the steps while retaining session data. To return to Start and the original data, you must exit and re-enter Paycheck Modeler. |

Exit |

Paycheck Modeler does not save data from session to session. Select Exit only when you are ready to leave Paycheck Modeler and all of the data that you have entered during the session. When you enter Paycheck Modeler, the employee’s original (real) amounts for the current pay calendar appear. |

Paycheck Modeler - Start Page

Text on the Paycheck Modeler - Start page (PY_MOD_SS_START) tells employees that they start with their standard earnings, deductions, and taxes and can change them to create a hypothetical check. The page requires that before the user can move forward, they must select the check box that shows they agree to the Usage Terms and Conditions. After that, they can select the Let’s Get Started button.

When the employee selects the Yes, I have reviewed and agree to the terms and conditions check box, the system determines if the employe has one or multiple jobs. If the employe has only one job, the system retrieves the employee’s earnings, deductions, and tax information, and calculates the employee’s check ready to model. When the calculation completes and the single-job employee selects the Let’s Get Started button, the employee is automatically transferred to the Paycheck Modeler - Earnings page. The multi-job employee is transferred to the Paycheck Modeler - Jobs page.

Paycheck Modeler - Jobs page

Paycheck Modeler can model only one paycheck for one job at a time. If the system determines that the employee has multiple jobs, then, when the employee selects the Yes, I have reviewed and agree to the terms and conditions check box, the system retrieves the multiple jobs information but does not yet prepare a calculated check to model. When the multiple-job employee clicks the Let’s Get Startedbutton, the employee is transferred to the Paycheck Modeler - Jobs page (PY_MOD_SS_JOBS), a page that appears only for multiple-job employees between the Paycheck Modeler - Earnings page and Paycheck Modeler - Deductions page.

All of the employee’s jobs that are available for paycheck modeling are available for selection on the Paycheck Modeler - Jobs page. The default job is the job for employment record 0, or the lowest numbered active employee record if job 0 is inactive or does not exist.

Users must select the job to use for the model check, and click the Prepare My Modeled Check button to trigger the initial payroll calculation for that job and prepare the check for modeling. After that, the user moves forward as any single-job employee would.

Paycheck Modeler - Earnings Page

Items listed on the Paycheck Modeler - Earnings page (PY_MOD_SS_EARNINGS) are the employee’s standard earnings based on the standard hours in the Job Data record.

The additional earnings that are available to add to paycheck modeling are based on the earnings defined on the Pay Group Parameters - Earnings Definition Page.

The system retrieves and uses the employee’s Job Data pay rate that was in effect on the pay period end date of the previously confirmed regular on-cycle paycheck.

Note: The model check does not include pay rate changes that may apply to the current pay period. As a result, existing employees cannot see current or future pay increases. Also, newly hired employees who are not active as of the pay period end date of the previously confirmed regular on-cycle paycheck cannot use Paycheck Modeler.

If OK to Pay is selected on the Create Additional Pay Page, any additional pay that is applicable to the current pay period is included and calculated based on the employee’s normal shift rate as defined on the job record. Additional pay items are not included in a modeled paycheck if they are paid on a separate check (any check greater than Addl Seq Nbr of 1 on the Create Additional Pay page).

Note: If the Add to Gross check box is deselected on the Earnings Table - Taxes Page (EARNINGS_TABLE2) for the earnings code, then the earnings amount appears on the model check, but it is not included in the Total Earnings.

Paycheck Modeler does not use the FLSA Alternate Overtime (FLSA/Alt OT) process. See Create Additional Pay Page.

Earnings must be greater than zero to move forward.

Paycheck Modeler - Deduction Page

The items listed on the Paycheck Modeler - Deduction page (PY_MOD_SS_DEDUCTNS) are the employee’s standard deductions that are scheduled to be taken in the next open calendar.

The additional deductions that are available to add to paycheck modeling are based on the deductions defined on the Pay Group Parameters - Deduction Definition Page.

Employees can use fields and controls in the My Deductions grid to add or modify flat amount or percentage-of-gross amount deductions to a model paycheck.

Following is an example of how the system calculates deductions based on a percent.

If no overrides are made to the 401K (add or edit), the deduction is calculated based on the deduction setup:

If the deduction is based on a special accumulator, the amount in the special accumulator is used for the calculation.

If the deduction is based on a percentage of gross, the deduction is calculated as a percent of total gross.

If the employee overrides the percent in Paycheck Modeler, the system uses percent of total gross.

Note: Employees can only clear the amount for a garnishment deduction. They cannot edit the amount in any other way. Garnishment calculations are based on the setup in the Garnishment Spec (garnishment specifications) component. See Specifying Employee Garnishment Data.

Paycheck Modeler - Taxes Page

The tax jurisdictions that appear on the Paycheck Modeler - Taxes page (PY_MOD_SS_TAXES) are based on the employee’s current tax information. Only the jurisdictions that allow withholding changes using a tax withholding form are available.

Employees can change their State Withholding Status if their current Special Withholding Tax Status is one of the following:

None

Maintain Taxable Gross (Only the Additional Amount is editable.)

Non-Resident Alien (Employees cannot, however, change Tax Treaty information.)

The page says Not Applicable and no data appears if the employee has a tax status of No Taxable Gross, No Tax Taken Status (exempt).

Paycheck Modeler - Calculate Page

If the user has made changes, the Calculate My Modeled Check button is available on the Paycheck Modeler - Calculate page (PY_MOD_SS_CALC). The Next button remains unavailable until after the user selects the Calculate My Modeled Checkbutton. When the modeled check is calculated, a message appears and the Next button becomes available.

If the employee has made changes, only the Next button is available.

Paycheck Modeler - Results Page

Modeled check results appear on the Paycheck Modeler - Results page (PY_MOD_SS_RESULTS).

Note: Only employee amounts appear. Employer amounts are not part of a paycheck model.

Employees can:

View a pie chart of the results.

View totals and details of their modeled earnings, taxes, and deductions.

Print a copy of the Modeled Paycheck. This report is a non-negotiable, unofficial copy of the estimated modeled check. It does not contain any information that identifies either the employee or the employer.

Print a Paycheck Modeling Audit report to view the changes made this session.

Note: To print, popup blocker must be turned off.

Employees can use the Related Links on the Paycheck Modeler - Results page to access other paycheck related self-service pages.