Entering Information for Tax Processing

The correct calculation and reporting of tax depends on the employee data that is stored in the system.

This topic discusses ways to enter information for tax processing.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_EE_TAX_DTLS |

Enter individual payees' tax data. |

|

|

GPAU_RC_TX01_SQR |

Report employees' tax scales or update the tax scales if the TFN exemption expiry date has passed. |

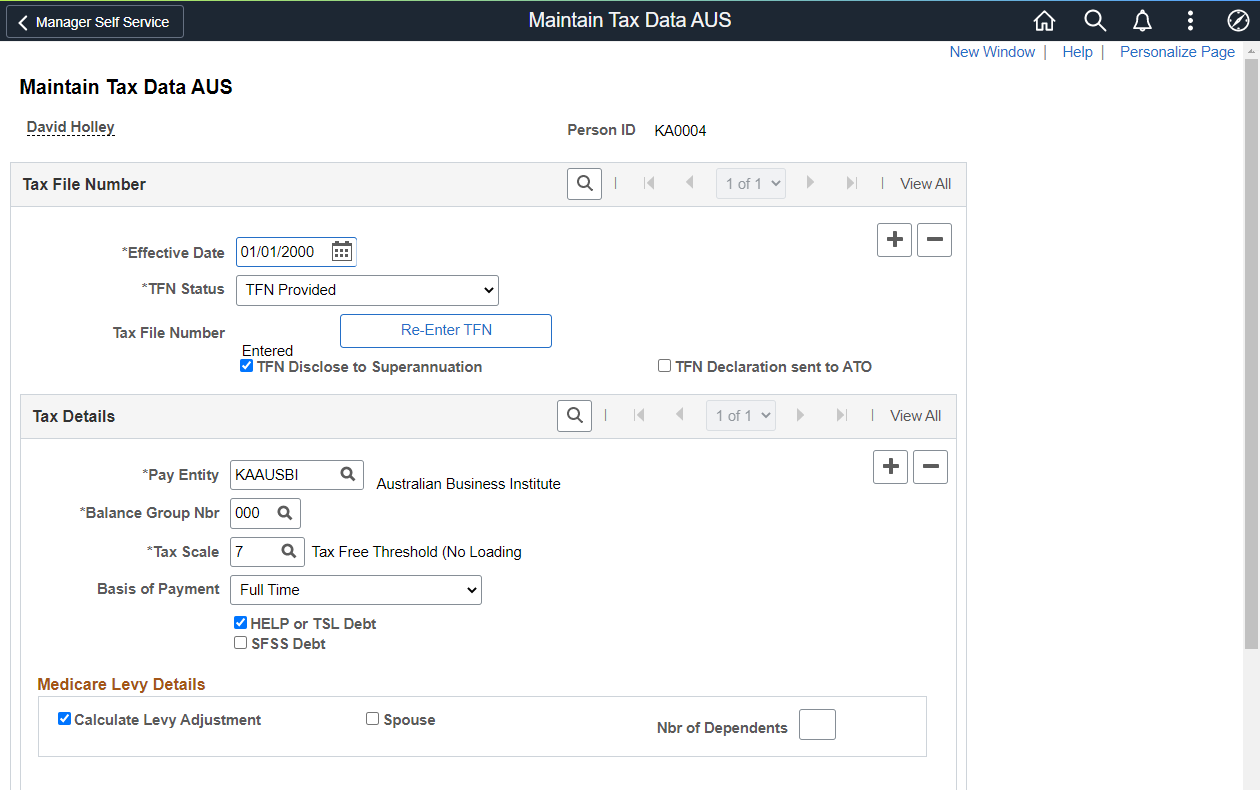

Use the Maintain Tax Data AUS page (GPAU_EE_TAX_DTLS) to enter individual payees' tax data.

Navigation:

This image is the first of two examples illustrating the fields and controls on the Maintain Tax Data AUS page. You can find definitions for the fields and controls later on this page

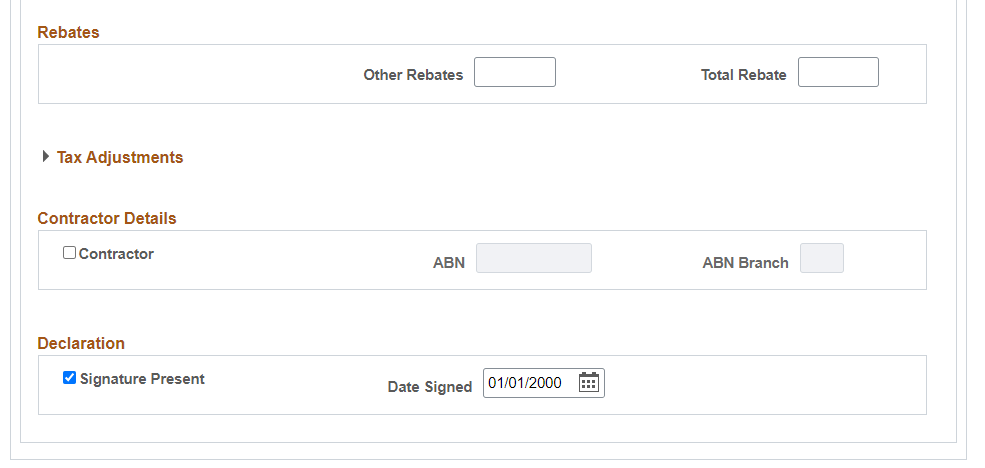

This image is the second of two examples illustrating the fields and controls on the Maintain Tax Data AUS page. You can find definitions for the fields and controls later on this page

To calculate a payee's tax, the array TAX AR EE TX DTL retrieves each payee's tax data. If you have not entered all the data required, an error message indicates that payee tax information is required.

Field or Control |

Description |

|---|---|

TFN Status |

Select the status. Options are: Applied: The payee has shown on the employment declaration that there is an application for a TFN. The system adds the current date as the TFN exempt start date and a date 28 days later as the TFN exempt end date. In the interim, the system displays 111111111 as the payee's TFN. Note: The exempt start and end date fields are unavailable for all statuses except Applied and Not Supp (not supplied). F/P Pens (full or part pension): If the payee is on a full or part pension, the employee is exempt from providing a TFN. The system displays 444444444 as the payee's TFN. Incrct TFN (incorrect TFN): If the payee has supplied an incorrect TFN, the system does not allow you to enter a TFN. Not Supp (not supplied): If the payee has not supplied a TFN, the system adds the current date as the TFN exempt start date and a date 28 days later as the TFN exempt end date. In the interim, the system displays 000000000 as the payee's TFN. TFN NotReq (TFN not required): Used when a TFN is not required; for example, for contractors. The system displays 000000000 as the payee's TFN. TFN Prov (TFN provided): The payee has provided a TFN. After you enter the TFN, the system hides the entry, displays Entered in the field, and displays a Re-Enter TFN button. If you enter an invalid TFN, the system warns you. To re-enter a tax file number, click the Re-Enter TFN button. If an interim notice is in force for the employee, select TFN Provided and enter 222 222 222. Under 18: An employee under 18 years of age is exempt from quoting a TFN. The system automatically displays 333333333 as the payee's TFN. |

Tax File Number |

Enter the TFN number. Validation occurs, and you receive a warning message if the number fails validation. |

Re-Enter TFN |

This field is available until you enter a valid TFN. Use it to enter a different TFN if the number that you enter fails validation. |

TFN Disclose to Superannuation |

Select this check box to indicate that the payee has authorized you to disclose the TFN to a superannuation organization. There is no processing associated with this check box. You can use it when reporting to a superannuation provider. |

Pay Entity |

Enter the pay entity to which the payee supplied the tax file declaration. |

Balance Group No (balance group number) |

Use balance group numbers to identify the accumulator in which the system stores tax balances. You can only select balance group numbers entered for the employee on the Job Data - Payroll page. |

Tax Scale |

Enter the tax scale. Options are: 1: Tax Free Threshold Not Claimed 2: Tax Free Threshold Claimed 3: Non Residents 4N: TFN Not Provided - Non-Resident 4R: TFN Not Provided - Resident 5: Full Medicare Levy Exemption 6: Half Medicare Levy Exemption 7: Tax Free Threshold (No Loading) 8: Seniors - Single 9: Seniors - Separated by Illness 10: Seniors - Member of a Couple |

Basis of Payment |

Select the basis of payment. Options are Casual, Full Time, Labour Hire, and Part Time. |

HELP Debt |

Select if the payee has HELP debt. |

SFSS Debt |

Select if the payee has an SFSS debt. |

Medicare Levy Details

Field or Control |

Description |

|---|---|

Calculate Levy Adjustment |

Deselect this check box to prevent the system from calculating Medicare levy adjustments. By default, the check box is selected. If you do deselect this check box, the system does not process any other selected options in the group box. |

Spouse |

Select if the payee has a dependent spouse only. |

No. of Dependents (number of dependents) |

Enter the number of dependents, including the spouse if the spouse is a dependent. |

Rebates

The Tax offset Amount is to inform government of the employment or engagement relationship and define the withholding rates applied by the payer. This is an annual dollar amount of total offsets claimed by employee to vary their withholding, this field should be supplied only if employee claims an offset.

Payees may be eligible to claim a tax offset to vary their PAYGW amount. The offset is claimed by providing the payer with the completed Withholding Declaration form/s (NAT 3093, 5072)

Field or Control |

Description |

|---|---|

FTB Rebate |

If the payee is applying to have this benefit paid by reduced withholding tax, enter the amount of the reduction that the payee is requesting. |

Other Rebates |

If the payee is applying to have combined dependent-spouse, special, or zone rebates paid by reduced withholding tax, enter the amount of the reduction that the payee is requesting. |

Total Rebate |

The system displays the total of the FTB and other rebates. |

Tax Adjustment

Field or Control |

Description |

|---|---|

PAYG Adjustment |

A check box exists for each type of tax: PAYG, Annualised, HELP and SFSS. Select the check box for each tax for which you want to make an adjustment. This makes the adjustment fields available for entry. For each tax, you can set an adjustment of override percentage or amount, or an adjustment of additional percentage or amount. |

Contractor Details

Field or Control |

Description |

|---|---|

Contractor |

Select if the payee is a contractor. |

ABN |

If you select Contractor, enter the ABN. The system warns you if the number that you enter is not a valid ABN. |

ABN Branch |

If you select Contractor, enter the ABN branch |

Declaration

Field or Control |

Description |

|---|---|

Signature Present |

Select if the payee has signed the tax declaration form. |

Date Signed |

Enter the date that appears on the declaration. |

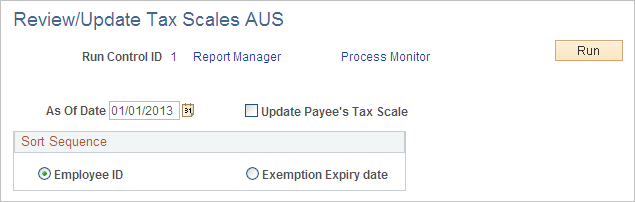

Use the Review/Update Tax Scale Update page (GPAU_RC_TX01_SQR) to enter individual payees’ tax data.

Navigation:

This example illustrates the fields and controls on the Review/Update Tax Scales AUS page. You can find definitions for the fields and controls later on this page.

When you hire a new payee and select a tax scale, that tax scale might need to be changed. For example, when someone applies for a TFN, they have a 28-day exemption period. If a TFN is not entered in the system before the expiry of the 28 days, the tax scale must be reset. You can run the GPAUTXO1.SQR process on the Tax Scale Update page to have the system do this for you. This process checks the TFN status to determine if it is Applied or Not Supp (not supplied). If the 28 days have expired, the system performs the following actions:

Inserts a new effective-dated row of status Not Supp (for both Applied and Not Supp).

Sets the exempt start and end dates to null.

Resets the payee's tax scale to 4N or 4R.

To create a report of only employees whose tax scale needs to be changed—for example, if you want to change them manually—you can use the process page to generate the report without making automatic updates. To create a report only, deselect the Update Payee's Tax Scale check box.