Generating Payment Summary Data

When data preparation is complete, you can generate the payment summary data for each employee. You can view the data before printing payment summaries for issue to payees.

After you have generated the payment summary data, you must print the payment summaries before you can create the electronic file for the ATO.

This topic discusses ways to generate payment summary data.

Note: The system only includes FBT in the payment summary if its gross-up value exceeds the PeopleSoft-maintained minimum amount. You can see the minimum amount on the FBT/GST Rate page.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Collect FBT Earns AUS Page |

GPAU_RC_FBT_COLLEC |

Enter the tax year and the payee population, which can be Pay Entity, Pay Group, or Payee. There is an Update if Record Exists check box. If you have already run the process, (and the payment summary status Created), this process overwrites the stored values in the record. The process is Application Engine process GPAU_FBT_COL. |

|

Rvw/Update Payee FBT Earns AUS Page |

GPAU_EE_FBT |

View the results of running the Collect FBT Earns AUS report. |

|

Create Pmnt Summary Data AUS Page |

GPAU_RC_FBT_COLLEC |

This process generates a payee's payment summary information. Enter the tax year and the payee population, which can be pay entity, pay group, or payee. The process is Application Engine process GPAU_PSM_CRE. |

|

GPAU_EE_PSM |

View the results of running the Create Payroll Summary process. |

|

|

Payment Summary Exceptions AUS Page |

GPAU_RC_PSM_EXCPT |

This process generates the Payment Summary Exceptions report. This report is used to list discrepancies between YTD amounts and actual results per period. Note: You must validate and take appropriate actions regarding negative values before running the Payment Summary/ETP Certs AUS process. |

|

Payment Summary Reconcile AUS Page |

GPAU_RC_PSM_RECON |

Generates the Payment Summary Reconciliation Report. It reconciles all of the amounts reported in the online payment summary panels. There are 3 separate sections, one for employees, one for contractors with ABN and one for contractors with no ABN, as well as the company totals. |

|

Payment Summary/ETP Certs AUS Page |

GPAU_RC_PSM_PRINT |

Set the parameters to print payment summaries and/or ETP Certificates for payees or groups of payees. |

|

GPAU_RC_PSM_ELEC |

Set the parameters for the generation of the electronic file to the ATO. |

|

|

GPAU_EE_FRGN |

View the results of running the Foreign Payment Data process. |

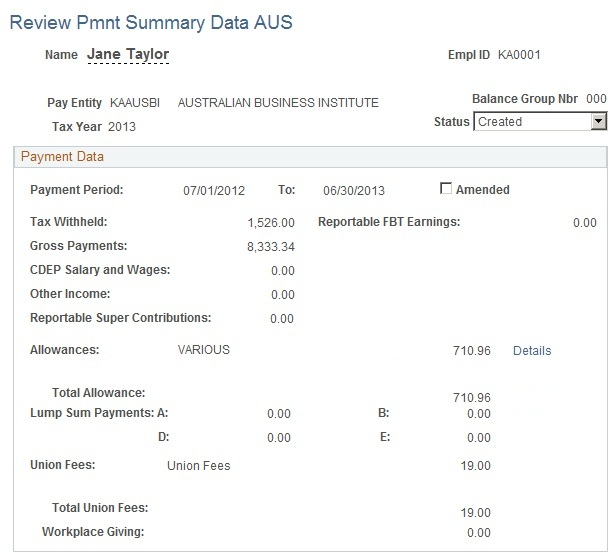

Use the Review Pmnt Summary Data AUS page (GPAU_EE_PSM) to view the results of running the Create Payroll Summary process.

Navigation:

This example illustrates the fields and controls on the Review Pmnt Summary Data AUS page. You can find definitions for the fields and controls later on this page.

After running the Create Payment Summary Data process for the tax year and payee population that you select, you can view the results. The EOY VR CATEGORY Supporting Element Override value that you set for each earning and deduction dictates in which total their values are included. The display is by employee name and ID, pay entity, balance group ID, and tax year.

Field or Control |

Description |

|---|---|

Payment Period |

For normal end-of-tax-year processing, this shows 01/07/YY - 1 to 30/06/YY. For terminated employees, it shows 01/07/YY - 1 to termination date. For hired employees, it shows hire date to 30/06/YY. |

Tax Withheld |

Total of all category T deductions. |

Gross Payments |

Total of all category G earnings. |

CDEP Salary and Wages |

Total of all category C earnings. |

Other Income |

Total of all category O earnings. |

Reportable Super Contributions |

Displays the Reportable Employer Super Contributions (RESC). The system provides two override values for the EOY VR CATEGORY:

|

Allowances |

Total of all category A earnings. If an employee has one or two allowances, then it is listed here. If there are more than two allowances, it will be listed as VARIOUS and the total of the allowances under this category will be displayed. A Details link is also displayed, which opens a window listing all the allowances. |

Total Allowances |

Total of all allowances. |

Lump Sum Payments (A, B, D and E) |

All earnings of category LA, LB, LD, and LE, respectively. |

Type |

Displays the type of Lump Sum A payment, based on the Action Reason of the termination specified in the Job Data pages. This field does not display a value when the employee has not received any Lump Sum A payments. The system displays the value Rwhen the termination Action Reason is Elimination of Position (redundancy), Partial/Total Disability (invalidity), or Early Retirement. displays the value T for all other reasons. |

Union Fees |

All deductions of category U. If an employee has one or two types of deductions under Union Fees and Professional Association Fees, then it is listed here. If there are more than two deductions, it will be listed as VARIOUS and the total of the deductions under this category will be displayed. A Details link is also displayed, which opens a window listing all the deductions under Union Fees. |

Workplace Giving |

Total of all workplace giving. If the employer had made payments to more than one deductible gift recipient on behalf of the employee, then it will be listed as VARIOUS and the sum of the payments will be displayed. A Details link is also displayed, which opens a window listing all the payments made under Workplace Giving. |

Note: Lump Sum C earnings don't appear, because Lump Sum C ETPs are extracted and reported separately.

When all your data is correct, you can use the Payment Summary/ETP Certs page to print either or both of the two variations of the payment summary and any ETP certificates the system generated during the Create Payment Summary process.

If the payment summary has ‘VARIOUS’ listed against any of the items, an addendum is issued for each item, which details the payments made/amounts withheld during the year.

Note: After you have generated the payment summary data, you must print the payment summaries before you can create the electronic file for the ATO.

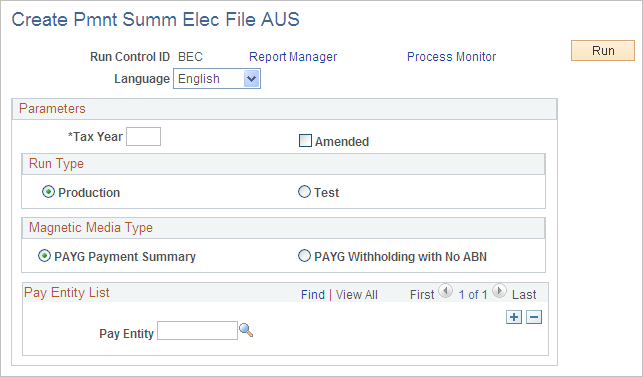

Use the Create Pmnt Summ Elec File AUS page (GPAU_RC_PSM_ELEC) to set the parameters for the generation of the electronic file to the ATO.

Navigation:

Note: After you have generated the payment summary data, you must print the payment summaries before you can create the electronic file for the ATO.

This example illustrates the fields and controls on the Create Pmnt Summ Elec File AUS page. You can find definitions for the fields and controls later on this page.

The ATO requires an electronic file containing all the data that the system has extracted for payment summaries and ETP certificates. You can create a single file for multiple pay entities. The ATO also requires two separate files: one for regular payees and one for contractors who do not have an ABN. The file contains software information, payer information such as ABN and contact details, and payee information such as the tax file number, gross payment, and withheld tax.

The file is created by Application Engine program GPAU_PSM_ELEC. This program uses data extracted by the Application Engine program that created the payment summary.

Before you remit payment summary information electronically to the ATO or distribute printed summaries to your payees, you can use the Payroll Summary Exceptions and Payment Summary Reconciliation reports to verify the data extracted by the Application Engine program.

Run Type

Field or Control |

Description |

|---|---|

Production or Test |

Select Test when preparing a file to send to the ATO for validity testing. Ensure that a test submission can never be mistaken for production data. |

Magnetic Media Type

Field or Control |

Description |

|---|---|

PAYG Payment Summary |

Select to produce a file of data for regular payees. |

PAYG Withholding with No ABN |

Select to produce a file of data for contractor payees who do not have an ABN. |

Pay Entity List

Field or Control |

Description |

|---|---|

Pay Entity |

Select as many pay entities as you want to include in the file. |

Use the Review Frgn Pmnt Data AUS page (GPAU_EE_FRGN) to report the data extracted by the GPAU_PSM_CRE process.

Navigation: