Managing Garnishments

Garnishments are deductions. You set up garnishment deductions just as you set up any other deduction.

This topic discusses ways to manage garnishments.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_GARN_DTLS |

Enter details about a particular garnishment for a payee. |

|

|

Specify Protected Net Pay AUS Page |

GPAU_PROTECT_NET |

Enter the protected net pay amount for a payee. The system cannot take the whole COURT ORDER deduction if taking it would make the employee's net pay less than the protected amount. It can deduct to that protected amount, but no more. Protected net pay is only protected in relation to the COURT ORDER deduction. After the system has processed COURT ORDER, the accumulator AUS NET is the minimum net pay amount. That minimum net pay is not protected against any other deductions that might apply. |

The PeopleSoft system provides three garnishment deduction elements: CHILDSUPPORT, WRIT, and COURT ORDER. Each is resolved differently.

Child Support

The CHILDSUPPORT deduction element has calculation rule Amount, and the amount is set at 50 AUD.

Writ

The WRIT deduction element has the calculation rule Base × Percent, where:

Base = Accumulator AUS AC DISP EARNS (disposable earnings)

Percent = 5.0

Accumulator AUS AC DISP EARNS members are:

Accumulator AUS GROSS (+)

Accumulator AUS TAX (−)

Court Order

The COURT ORDER deduction element has a generation control, GRN GC COURTORDER, which uses formula GRN FM PROC STATUS to verify that the processing status of the garnishment (set on the Garnishment Details page) is Approved.

The calculation rule for COURT ORDER is Amount, where the amount is formula GRN FM ALL BUT NET. The formula deducts all but the protected net pay amount from disposable earnings. Disposable earnings are stored in accumulator AUS AC DISP EARNS:

Segment accumulator AUS GROSS − Segment accumulator AUS TAX = AUS AC DISP EARNS (disposable warnings)

AUS AC DISP EARNS (disposable earnings) − DED VR PROTECT NET (protected net pay) = COURT ORDER deduction

The protected net pay variable is the amount that you enter in the single field on the Protected Net Pay page. The amount that you enter becomes the variable through the array AUS AR PROTECT NET in the INITIALISATION section in the AUS PAYROLL process list.

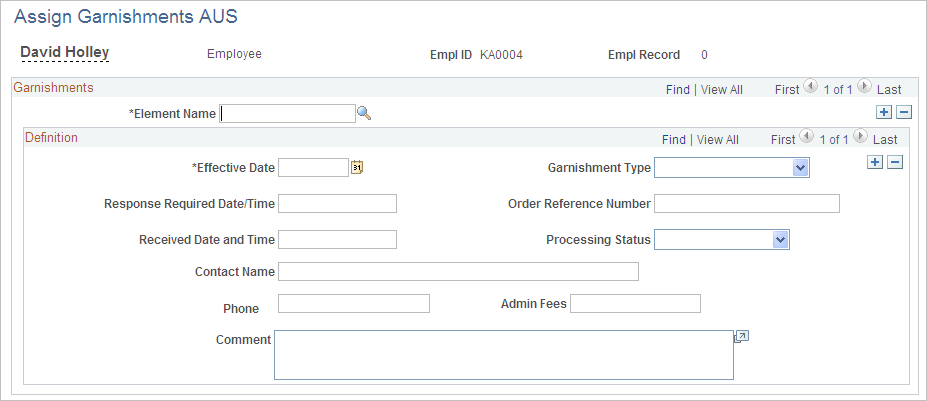

Use the Assign Garnishments AUS page (GPAU_GARN_DTLS) to enter details about a particular garnishment for a payee.

Navigation:

This example illustrates the fields and controls on the Assign Garnishments AUS page. You can find definitions for the fields and controls later on this page.

The garnishment deduction elements calculate the amount to deduct, but you may need to record other garnishment details. The Garnishments page is for recording information only. There is no system processing associated with the data, except that the generation control for COURT ORDER checks the status.

Field or Control |

Description |

|---|---|

Element Name |

Enter the garnishment deduction. |

Garnishment Type |

Select the type. Options are Assignment, Bankruptcy, Child Supt (child support), Tax Levy, Dependant, and Writ. |

Response Required Date/Time |

Enter the date and time that a response is required, as indicated on the garnishment order. |

Order Reference Number |

Displays the reference number, which is supplied with the order for the garnishment. |

Received Data and Time |

Record the date and time that you received the garnishment order. |

Processing Status |

Select from Approved, Completed, Received, Rejected, and Suspended. The garnishment deduction COURT ORDER is taken only if the status is Approved. |

Contact Name and Phone |

Enter the recipient's contact name and phone number. |

Admin Fees (administrative fees) |

Enter the amount of any fees that you can charge for administering the garnishment. |

Comment |

Enter any comments about the garnishment specification. |