Processing Retroactive Payments

The default retro method and the on-conflict retro method for Australia are both forwarding. You set this on the Country Setup page.

The core retro functionality suits all Australian requirements except the requirement to apply a different tax rate to retro payments that relate to periods more than 12 months before the date the forwarded retro payment is made.

To meet this requirement, the PeopleSoft system provides the formula RTO FM SET OVRDSET, which uses the duration RTO DR MTH ARREARS to determine if a period of more than 12 months has elapsed between any of the periods being retroactively paid and the payment date of the retro. If any elapsed period is greater than 12 months, the system selects a new override set—also provided by the PeopleSoft system—to forward all the processed earnings to the single new earning, RETRO12MTH, that the system taxes at the lower rate.

These are lump sum E payments, so the RETRO12MTH earning contributes to accumulator PD LUMP E as well as AUS GROSS, PAYROLL TAX PROV (Provision for Payroll Tax) and its own automatically assigned calendar and fiscal period, month, quarterly, and yearly accumulators.

The system provides one retro processing definition, AU RETRO (which is set to forwarding) and two override sets.

Note: If you add any earnings that can be retroactively paid, you need to add them to both override sets and to the appropriate accumulators.

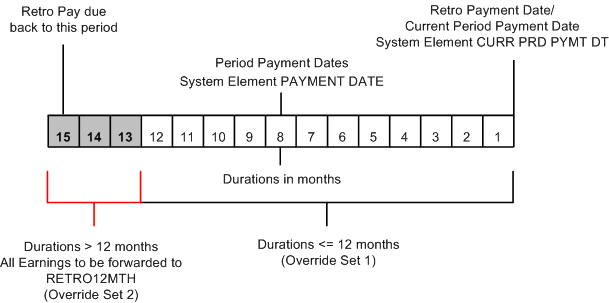

The duration calculation result determines which override set to use by calculating the duration for each period. When the duration exceeds 12 months, the second override set applies.

This diagram shows that the system calculates the duration for each period and uses the second override set when the total duration exceeds 12 months.

Here are the processing steps:

Formula RTO FM SET OVRDSET—the formula specified on the Retro Process Overrides AU RETRO page—is called for each pay period identified for retro processing.

The formula uses duration RTO DR MTH ARREARS to calculate the months between the pay date of each pay period identified for retro processing (the duration From date—system element PAYMENT DATE) and the date the retro is to be paid (the duration To date—system element CURR PRD PYMT DT).

If the duration is 12 months or less, the formula returns 1, and the system uses override set 1 for forwarding retro; if the duration is greater than 12 months, the formula returns 2, and the system uses override set 2 for forwarding retro.

For each period that's more than 12 months before the retro payment date, the system forwards all the retro earnings to the single earning element RETRO12MTH.

The sum of the earnings forwarded to the single earning RETRO12MTH represents a lump sum E payment, and the tax calculation uses the appropriate rate on the earning.