Setting Up Additional Deduction Recipient Information

To set up additional deduction recipient information, use the Deduction Recipients AUS (GPAU_RECIPIENT) component.

This topic discusses ways to set up additional deduction recipient information.

Note: Use the Deduction Recipients AUS page only if you need to attach membership information to deduction elements. Otherwise, use the generic Add Deduction Recipients page.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_RCPPYE_EXT |

Link a payee to a deduction recipient and enter the payee's membership number with that recipient. |

|

|

Deduction Recipient Page |

GPAU_RCPPYE_SUPER |

Enter Super Reporting details for the payee. |

|

GPAU_RECIPIENT_EXT |

Enter Australia-specific additional information about recipients that are set up in the core application for Global Payroll. |

|

|

GPAU_RECIPNT_SPREC |

Enter receiver, target fund, and sender information according to SuperEC standards. |

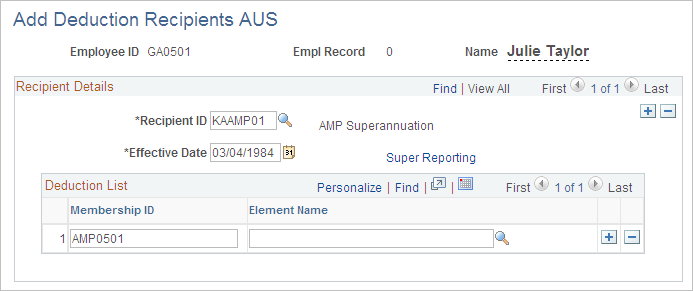

Use the Add Deduction Recipients AUS page (GPAU_RCPPYE_EXT) to link a payee to a deduction recipient and enter the payee's membership number with that recipient.

Navigation:

This example illustrates the fields and controls on the Add Deduction Recipients AUS page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Recipient ID |

Identifier for the recipient of the deduction element. |

Membership ID |

Membership ID associated with the recipient ID. |

Element Name |

Name of the deduction element. |

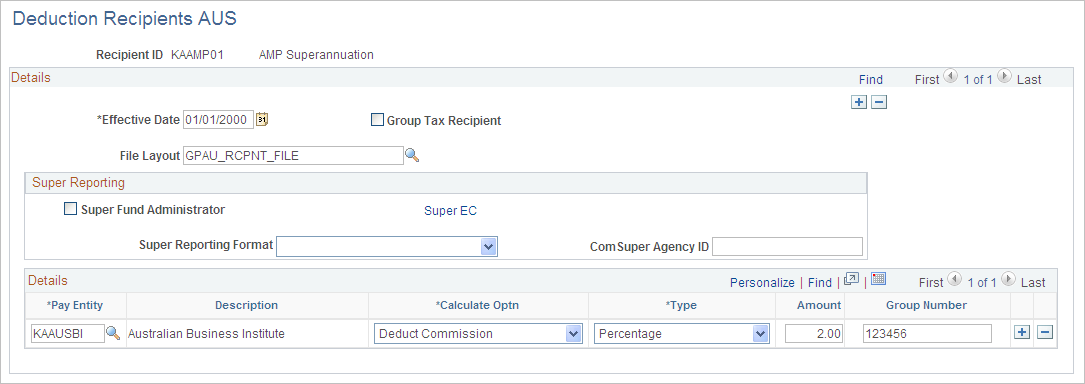

Use the Deduction Recipients AUS page (GPAU_RECIPIENT_EXT) to enter Australia-specific additional information about recipients that are set up in the core application for Global Payroll.

Navigation:

This example illustrates the fields and controls on the Deduction Recipients AUS page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Deduction Recipients AUS page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Group Tax Recipient |

Select if the recipient is the ATO, the recipient of group tax. |

File Layout |

Select the appropriate file layout from those that you have created in Application Designer for report files that you submit to recipients. When you run the Recipient File - Electronic report, the Application Engine process uses the file layout that you enter here. Note: The GPAU_RCPFILE Application Engine process uses only the GPAU_RCPNT FILE recipient schedule file. You can make minor changes to that file—for example, field order. However, if you make major file layout changes, you must create additional Application Engine programs to process them. |

Note: The lodgment reference for net pay is the employee ID plus payment date. For recipient payments, it is the group number plus payment date. For group tax payments, it is the EFT code plus payment date.

Super Reporting

Field or Control |

Description |

|---|---|

Super Fund Administrator |

Select to designate the recipient as a Super Fund administrator. Note: This field is not visible when ‘SuperStream File Format’ is selected as the Super Reporting Format. |

Super EC |

Click to access the SuperEC Detail page. |

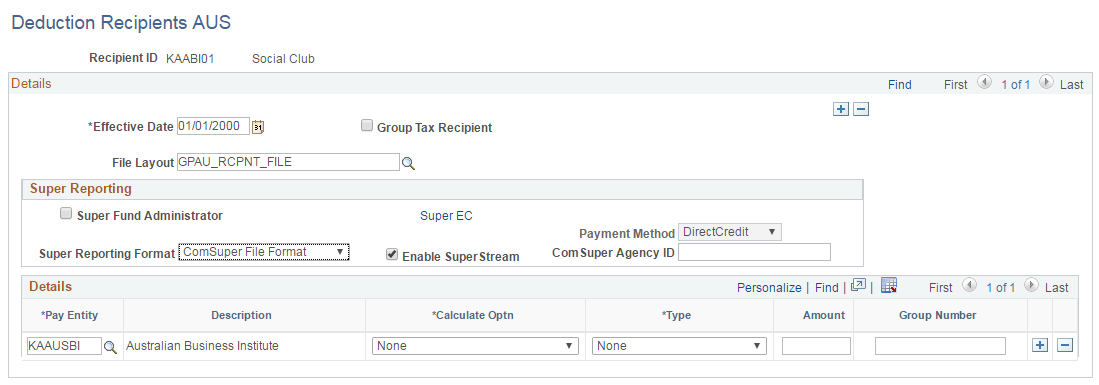

Super Reporting Format |

Select a reporting format. Valid values are Agest, ComSuper File Format, SuperEC file Format and SuperStream File Format. When you select SuperStream File Format for the respective Super Fund scheme. Deduction Recipients AUS page refreshes to display Payment Method field. If ComSuper File Format is selected, a new check box with Enable SuperStream and the chosen Payment Method Direct Credit become visible. The Enable SuperStream flag is set to True by default. This flag enables the recipient for SuperStream report. If the flag is set to False, the deduction recipient cannot be processed for SuperStream report and will be available only for PIF format file generation. |

Payment Method |

The payment method being used to transfer the superannuation contributions to the Super Fund. Select the payment method from the following options: BPAY: Select “BPAY” if the Deduction Recipient (Super Fund / Scheme) is paid using the BPAY facility. If payment is made using BPAY, the employer must include the Biller Code and the Customer Reference Number. DirectCredit: Select DirectCredit if the Deduction Recipient (Super Fund / Scheme) is paid using the DirectCredit facility. DirectDebit: Select DirectCredit if the Deduction Recipient (Super Fund / Scheme) is paid using the DirectDebit facility. Note: This field appears only when ‘SuperStream File Format’ is selected as the Super Reporting Format. |

ComSuper Agency ID |

Enter the ComSuper agency ID. Note: This field is not visible when ‘SuperStream File Format’ is selected as the Super Reporting Format. |

Details

Field or Control |

Description |

|---|---|

Pay Entity |

Enter the pay entity that receives this commission. If the commission is deducted from the payment due to the recipient, the debit to the pay entity's source bank account is reduced by the commission amount. |

Calculate Optn (calculate option) |

Select from the following values: Ded Comm (deduct commission): The system deducts the commission amount from the payment due to the recipient. Rpt Only (report only): The system reports the commission amount in the EFT file but does not deduct it from the payment. |

Type |

Select Flat Amt (flat amount) or Percentage. |

Amount |

Enter the flat amount or percentage to be calculated. |

Group Number |

Enter the unique identifier that the recipient has supplied for the pay entity. For payment to recipients excluding the group tax recipient and payee level recipients, the group number is part of the unique lodgment reference that is part of each recipient EFT file. |

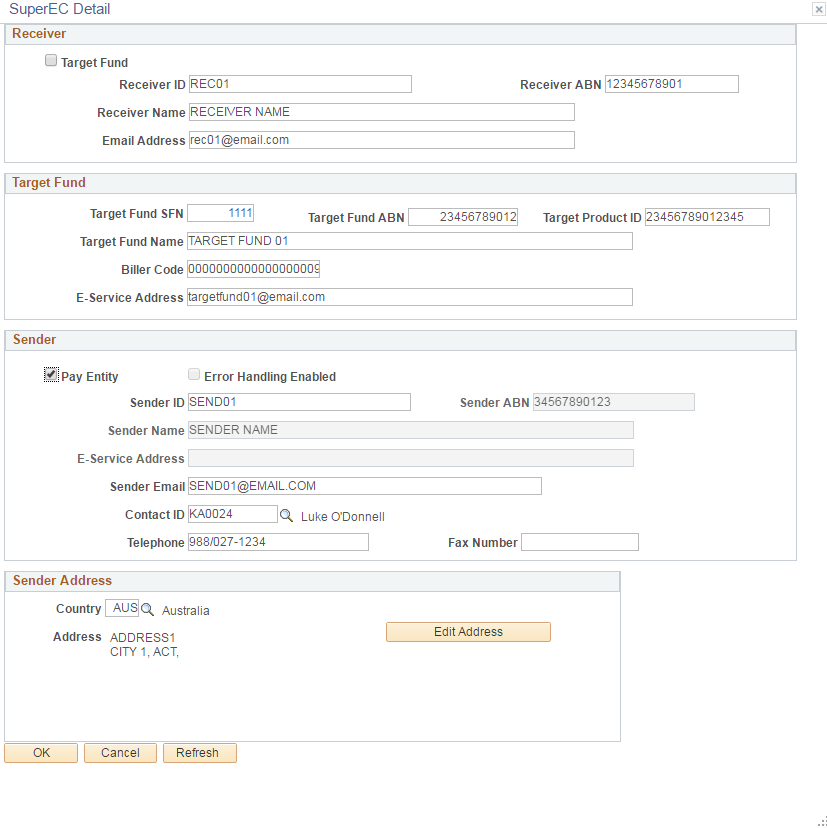

Use the Super EC link available in Deduction Recipients AUS page to navigate to the SuperEC Detail secondary page to setup Sender/Receiver/Target Fund information for the Deduction Recipient

SuperEC Detail page

Receiver

Field or Control |

Description |

|---|---|

Target Fund |

Check the Target Fund check box if the target fund and reciver are same. If selected, the Target Fund Name and Target Fund ABN will be used in place of the Receiver Name and Receiver ABN fields in the report. Note: This field appears only when ‘SuperStream File Format or ComSuper File Format’ is selected as the Super Reporting Format. |

Receiver ID |

Enter the ID of the Message Receiver. |

Receiver ABN |

Enter the Australian Business Number (ABN) of the receiver. Note: This field appears only when ‘SuperStream File Format or ComSuper File Format’ is selected as the Super Reporting Format. |

Receiver Name |

Enter the Organization Name of the Message Receiver. Note: This field appears only when ‘SuperStream File Format or ComSuper File Format’ is selected as the Super Reporting Format. |

Email Address |

Enter the email address of the Message Receiver. |

Target Fund

This section contains details of the Super Fund Organization and the Super Fund Scheme Product ID.

Field or Control |

Description |

|---|---|

Target Fund ABN |

Enter the Australian Business Number (ABN) of the Super Fund Organization. |

Target Product ID |

Enter the Super Fund USI. |

Target Fund Name |

Enter the fund name. |

Biller Code |

Enter the Biller Code of the Super Fund. Note: This field is applicable only for BPAY payment transactions. |

E-Service Address |

Enter the ‘E-Service Address’ field to specify the Electronic Service Address of the Super Fund scheme. Note: This field appears only when ‘SuperStream File Format or ComSuper File Format’ is selected as the Super Reporting Format. |

Sender

Field or Control |

Description |

|---|---|

Pay Entity |

Check the Pay Entity check box to indicate if the Pay Entity is the sender of the file. If checked, the AE program GPAU_COM_RPT will fetch and load the Pay Entity’s details in places where ‘Sender’ information is to be reported. |

Error Handling Enabled |

Select the check box if the ‘Sender’ of the file is capable of decoding the member registration/contribution error responses generated by the target system. Note: This field appears only when ‘SuperStream File Format or ComSuper File Format’ is selected as the Super Reporting Format. |

Sender ID |

Enter the ID of the sender. |

Sender ABN |

Enter the Sender ABN |

Sender Name |

Enter the name of the sender. |

Sender Email |

Enter the email address of the sender. |

Contact ID |

Select the ID of the contact person. Note: For this purpose the user should have already added a person (Add a Person) within the Workforce Administration > Personal Information section identifying the person as POI (Person of Interest). |

You can use the Edit Address option to edit the saved address of the sender.