Setting Up WGEA Remuneration Details

To set up WGEA Remuneration Details, use the WGEA Remuneration Details AUS (GPAU_WGEA_SECTN) component.

The remuneration details are calculated from the Global Payroll earnings and deductions paid in the reporting period. The WGEA Remuneration Details AUS page is used to configure the earnings and deductions for reporting Annualized Average Full Time Equivalent Base Salary and Total Remunerations.

In PeopleSoft HCM, the remuneration details are categorized under six sections:

Base salary

Bonus

Discretionary pay

Overtime

Other remuneration

Superannuation

You can also add new pay components for earnings or deduction to any of the existing sections.

This section discusses how to set up the WGEA remuneration details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_WGEA_SECTN |

Configure the remuneration details of the employees for workplace gender equality reporting. |

Use the WGEA Remuneration Details AUS page (GPAU_WGEA_SECTN) to configure the remuneration details of the employees for workplace gender equality reporting.

Navigation:

WGEA Remuneration Details AUS

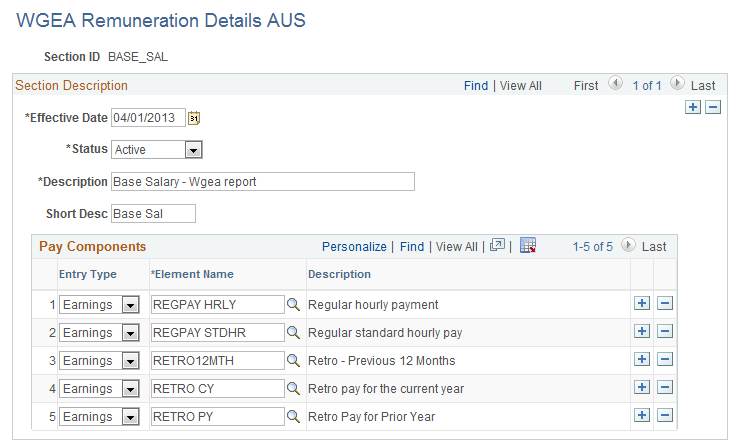

This example illustrates the fields and controls on the WGEA Remuneration Details AUS page (Base_Sal). You can find definitions for the fields and controls later on this page.

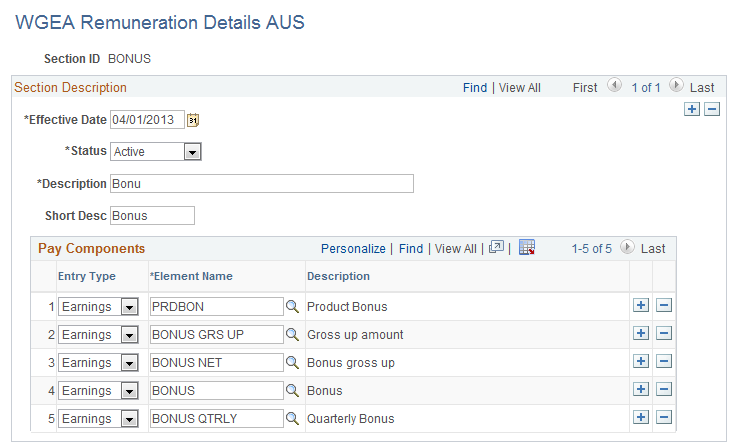

This example illustrates the fields and controls on the WGEA Remuneration Details AUS page (Bonus). You can find definitions for the fields and controls later on this page.

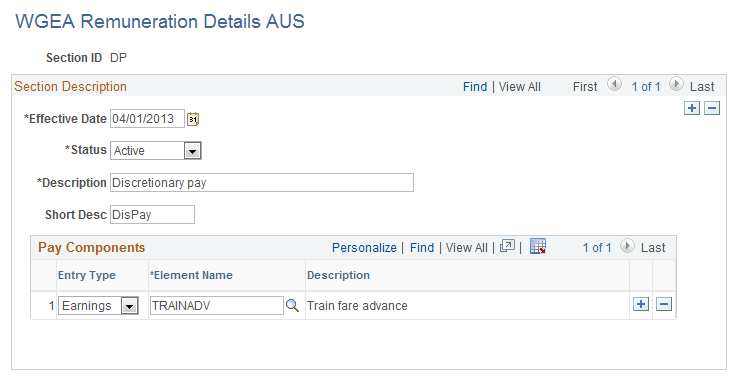

This example illustrates the fields and controls on the WGEA Remuneration Details AUS page (Discretionary Pay). You can find definitions for the fields and controls later on this page.

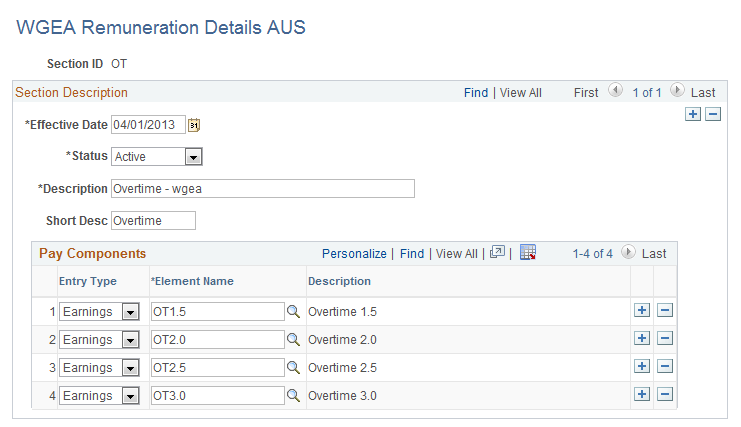

This example illustrates the fields and controls on the WGEA Remuneration Details AUS page (Overtime). You can find definitions for the fields and controls later on this page.

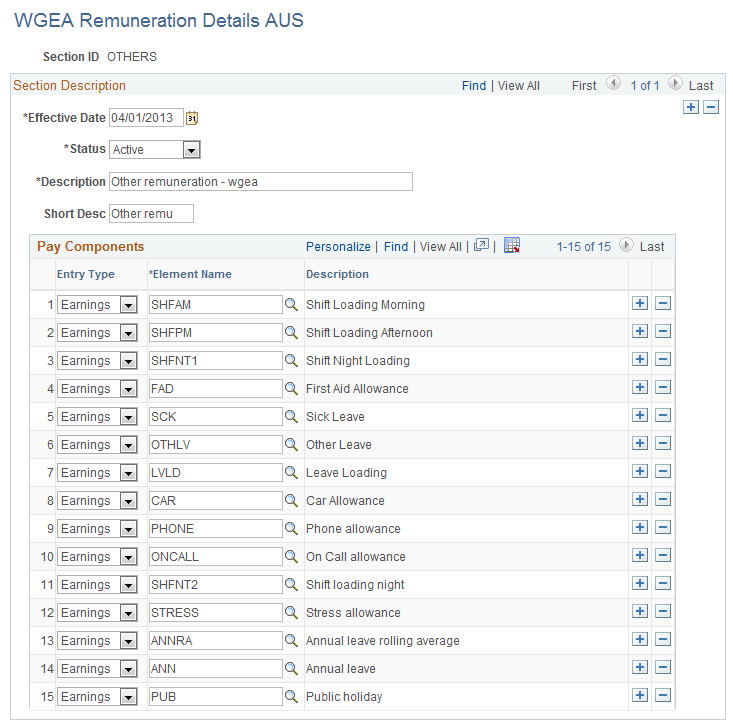

This example illustrates the fields and controls on the WGEA Remuneration Details AUS page (Other Remuneration). You can find definitions for the fields and controls later on this page.

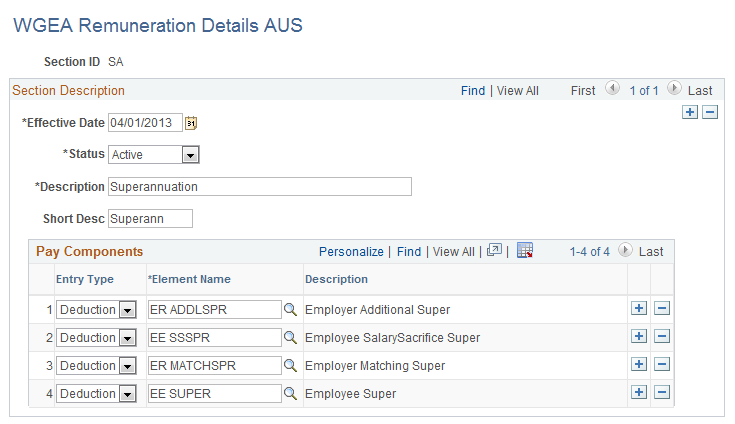

This example illustrates the fields and controls on the WGEA Remuneration Details AUS page (Superannuation). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Section ID |

Displays the category of the remuneration details. |

Eff Date |

Enter the effective date of the Earnings/Deduction section. |

Status |

Enter the status of the Earnings/Deduction section. There are two options: Active and Inactive. |

Description/Short Desc |

Enter the description/short description for the Earnings/Deduction section. |

Entry Type |

Select the Pay Component. It can be either Earnings or Deductions. |

Element Name |

Select the Element name of the Pay Component. |

Description |

This is a display only field which has the description of the selected Pay Component. |

Back Payments

Back payments for a previous tax year (this period may fall within the same reporting year or a previous reporting year) are also included in the WGEA report. These are reported under the appropriate sections in the WGEA Remuneration Details AUS page. The elements used to report back payments are: Retro CY (retro payment for the current year), Retro PY (retro payment for the prior year), and RETRO12thMTH (retro payment accrued for any pay period that is 12 months prior to the current pay period).