Understanding Absence Rules for Paid Vacation

This section discusses:

Absence elements for paid vacation.

Absence entitlement rules for paid vacation.

This table lists the absence entitlement and absence take elements that PeopleSoft delivers for paid vacation:

|

Absence Reason |

Take Element |

Entitlement Element |

|---|---|---|

|

Standard paid vacation |

CPT CG PAYES |

CPE CG PAYES |

|

Split vacation days |

CPT FRACTMT |

CPE FRACTMT |

|

Seniority paid vacation |

CPT ANCIENTE |

CPE ANCIENTE |

|

Anticipated paid vacation |

CPT CG ANTICIP |

CPE CG PAYES |

|

Other paid vacations |

CPT AUTRES |

CPE AUTRES |

This table lists the variables (and variable category) and brackets that you can update for paid vacation, along with the sample values that PeopleSoft delivers:

|

Element Name |

Use |

Delivered Value |

Category |

|---|---|---|---|

|

CPA VR MOIS DEB REF |

Reference period. Stores the number of the starting month of the reference period. |

6 |

CPA |

|

CPA VR MAX PD DAYS |

Maximum entitlement. Stores the maximum number of paid vacation days that an employee can accumulate during the reference period. The value of this variable should be consistent with the value entered for CPA VR JRS/1 SEM described later in this table. |

30 (working days) |

CPA |

|

CPA VR GEST FRACT |

Split vacation days (conges payes pour fractionnement). Specifies whether the system should track split vacation days. (1 = yes; 0 = no) |

1 |

CPA |

|

CPA VR JRS/1 SEM |

Day weight. Stores the number of days to be decreased when an employee takes one week of vacation. This enables you to specify if you want to use business days or working days as the basis for counting paid vacation days. |

6 working days |

CPA |

|

CPA VR J JNE MERE |

Extra paid vacation days. Specifies the number of extra days of paid vacation available to employees (for example, young mothers). |

0 |

CPA |

|

CPA VR C 1/10 |

Comparison of 1/10 rule to salary upholding. Tells the system when to perform the comparison. 1 = compare at each take; 2 = compare at the last take (when all entitlement has been taken). |

1 |

CPA |

|

CPA VR 4 SEM |

Tells the system how to consider the periods of four worked weeks for the calculation of paid vacation entitlements: either in calendar days or in business days. |

JO |

CPA |

|

CPA BR DRTS |

Stores the number of days of paid vacation to which an employee is entitled for a number of periods of four worked weeks. |

2,5 working days and 2,08 business days for each period of 4 weeks |

Not applicable |

|

ABS BR ASS TRV LOI ABS BR ASS TRAV CC |

Identifies the types of absences that are considered as effective work days when calculating entitlement and the period of time that a payee must work before eligible to accrue entitlement. |

See Effective Work Days (ABS BR ASS TRV LOI, ABS BR ASS TRAV CC) |

Not applicable |

|

CPA BR JRS ANCIEN |

Seniority. Stores the number of days of paid vacation to which an employee is entitled according to years of seniority. |

See Extra Paid Vacation Days for Seniority (CPA BR JRS ANCIEN) |

Not applicable |

|

ABS BR ANC_ABS LOI ABS BR ANC_ABS CC |

Identifies which types of absences are considered as effective work days when calculating seniority. |

See Effective Work Days for Seniority Accrual (ABS BR ANC_ABS LOI, ABS BR ANC_ABS CC) and Effective Work Days (ABS BR ASS TRV LOI, ABS BR ASS TRAV CC) |

Not applicable |

Paid Vacation Reference Period (CPA VR MOIS DEB REF)

Entitlement for paid vacation is based on a reference year. The reference year, usually June 1 to May 31, represents the 12 previous, consecutive months during which an employee accumulates entitlement to paid vacation. Employees can use the accrued entitlement only after completing the reference year.

When you receive Global Payroll for France, the reference year is set to 6 to represent June 1, the legal begin date that applies in most cases. If you want to change the reference year, update the value of the CPA VR MOIS DEB REF variable element.

Maximum Entitlement for Paid Vacation (CPA VR MAX PD DAYS)

You can specify the maximum number of paid vacation days an employee can accumulate during the reference period. When entitlement exceeds the limit, the system rounds entitlement to the maximum value.

The maximum entitlement value is set to 30 when Global Payroll for France is delivered. To change this number, update the value of the variable element CPA VR MAX PD DAYS.

Note: The values stored by CPA VR MAX PD DAYS and CPA VR JRS/1 SEM should represent the same type of days—business days or working days.

Split Vacation Days (CPA VR GEST FRACT)

Employees may be eligible for up to two extra days of paid vacation or split vacation days (conges payes pour fractionnement), when they split their principal paid vacation and take some vacation days after the end of the legal vacation period (May 1 and October 31). To be granted the split vacation days, a person must take more than 12 and less than 24 consecutive paid vacation days during the legal vacation period.

If you want the system to calculate extra days of vacation for employees who qualify for split vacation entitlement, set the value of the CPA VR GEST FRACT variable to 1. Otherwise, set the value to 0. (You must also assign the entitlement element CPE FRACTMT to eligible payees.)

The entitlements for Split Vacation Days (CPE FRACTMT) is either triggered in November, or if the payee is not included in the November payroll run, it is triggered in the payee's next payroll run.

The Day Weight Factor (CPA VR JRS/1 SEM)

When a payee takes one week of paid vacation, the system can decrease entitlement by six working days (jours ouvrables) or five business days (jours ouvres), depending on the value of the variable element CPA VR JRS/1 SEM. The delivered variable is set to 6.

The system uses the value of CPA VR JRS/1 SEM as a weighting factor so that it can correctly reduce paid vacation entitlement for both full-time and part-time employees. It also uses CPA VR JRS/1 SEM to determine the denominator for the rate it applies when calculating positive input for the earnings and deductions associated with the absence. For example, if CPA VR JRS/1 SEM is set to 5 (for business days), the system calculates the payee's earnings for each paid vacation day by dividing the monthly base salary by the number of business days in the month. If you enter 6, the valuation is in working days.

The values stored by CPA VR JRS/1 SEM and CPA VR MAX PD DAYS should represent the same type of days—business days or working days.

Note: When a paid vacation day falls on a holiday that is normally a work day, the system first adds the weighted value to the paid days and also adds the weighted value of the vacation day to the entitlement balance.

Warning! You can choose between business days or working days only once. If you change your selection later, the consequences may be unpredictable. In addition, if you transfer entitlement accumulators from one company to another within your organization and the companies use different calculation methods for paid vacation, the entitlement results will not be accurate.

Here are two examples of the weighting factor calculations:

Example 1: Company counts paid vacation in working days (CPA VR JRS/1 SEM = 6).

Assume that a payee normally works two days per week. The weighting for each day is three (or 6/2). Each time that the payee takes one vacation day, the system deducts three days (the weighting factor of 3 x 1 absent day).

Example 2: Company counts paid vacation in business days (CPA VR JRS/1 SEM = 5).

Assume that a payee normally works one day a week. The weighting factor for each worked day for the payee is 5/1 or 5. When the payee takes one day of paid vacation, the system deducts five days of entitlement (5 x 1 day).

If the entitlement balance is greater than 0 and the absence take weight exceeds the balance, the system replaces the take weight with the balance accumulator. In other words, if the take exceeds the entitlement balance, the system reduces the balance to 0. For example, if the entitlement balance is 0.85 days and the payee takes a vacation day with a weight of 1.66, the balance replaces the absence weight. The balance accumulator value after this absence is then equal to 0.

Extra Paid Vacation Days (CPA VR J JNE MERE)

If you want to grant extra days of paid vacation to employees, use the variable element CPA VR J JNE MERE to specify the number of extra days. Use the element to define extra days of paid vacation for young mothers, or to grant extra paid vacation for any other reason.

CPA VR J JNE MERE returns the entitlement amount for CPE AUTRES, the entitlement element that you use to record other paid vacation take. The value of CPA VR J JNE MERE is set to 0 when you receive Global Payroll for France.

Unused entitlement for extra days of paid vacation is not carried forward at year-end.

Note: If you enter a value for CPA VR J JNE MERE, every person to whom the entitlement element CPE AUTRES is assigned accrues entitlement regardless of the person's age or gender.

The 1/10 Rule and Salary Upholding Rule (CPA VR C 1/10)

The allowance for paid vacation is determined by comparing two calculations: the 1/10 rule and the salary upholding rule. For the 1/10 rule, the basis for calculating paid vacation is one-tenth of the payee's earnings in the previous year. For the salary upholding rule, the basis is the payee's current year earnings.

Use the variable element CPA VR C 1/10 to specify whether you want the system to compare the two calculation methods for each absence take or for the last take only—the take that reduces the entitlement balance to 0.

Set CPA VR C 1/10 to 1 to compare the calculation methods for each take and to apply the most favorable outcome to the payee. This is the delivered value.

Set CPA VR C 1/10 to 2 to do the comparison only when the last absence occurs.

Four-Week Period Day Count (CPA VR 4 SEM)

By law, employees are entitled to 2,5 working days (jours ouvrables) or 2,08 business days of paid vacation for each period of four weeks of work. Working days include all weekdays except the legal day off, usually Sunday.

Determine how you want to consider the four weeks period count in days through the variable element CPA VR 4 SEM. Set this variable element to JC to calculate the period and the absence days in calendar days. Selecting JO, the system's default, forces the system to calculate the period in business days. Also, when you choose JO, each absence business day is multiplied by 28/20/FTE (full time equivalent). The number of worked days during the reference period is then divided by 28.

Entitlement for Four-Week Periods (CPA BR DRTS)

Store entitlement values for paid vacation in the bracket element CPA BR DRTS. The keys to this bracket are CPA FM CALC DRTS and LABOR AGREEMENT. For each combination of these two keys, the bracket returns the number of working days of entitlement (in the bracket, itself) and the number of business days of entitlement (in the variable CPA VR DRT OUVRES).

Note: The value of CPA VR JRS/1 SEM determines whether the system retrieves entitlement in working days (CPA VR JRS/1 SEM = 6) or business days (CPA VR JRS/1 SEM = 5).

You can update the bracket with the values for each valid combination of keys in your organization. The entitlement values that you enter should represent four-week periods. For example: 1 period of 4 weeks = 2,5 working days or 2,08 business days; 2 periods of 4 weeks = 5 days working days and 4,16 business days, and so on, up to 30 working days or 25 business days (depending on the value of the variable CPA VR MAX PD DAYS).

This table lists the sample values that PeopleSoft delivers with CPA BR DRTS:

|

CPA FM CALC DRTS (key) |

LABOR AGREEMENT (key) |

CPA BR DRTS (return column for working days) |

CPA VR DRT OUVRES (return column for business days) |

|---|---|---|---|

|

1 |

|

2,5 |

2,08 |

|

2 |

|

5 |

4,16 |

|

3 |

|

7,5 |

6,24 |

The system uses proration to calculate the exact number of paid vacation days to which the payee is entitled at the end of the reference year and when an employee leaves your organization.

Effective Work Days (ABS BR ASS TRV LOI, ABS BR ASS TRAV CC)

Two periods of time affect entitlement for paid vacation:

The period of time that an employee must work (four weeks) before he can begin to accumulate entitlement. This period is also referred to as the opening of entitlement.

The reference period upon which entitlement calculations are based.

These two periods of time do not use the same definition of working days. For example, certain absences that are treated as effective work days when calculating entitlement are not considered effective work days when determining whether the four-week period has been met.

PeopleSoft delivers these bracket elements that you can update, if necessary, to specify which absences the system should interpret as effective workdays in each of these cases:

ABS BR ASS TRV LOI specifies which absences the system should interpret as effective workdays according to the law.

The key for the bracket is TAKE CONFIG2. For each value of TAKE CONFIG2, the bracket returns two values: one for the bracket itself and one for the variable element ABS VR CP OUV LOI (0 = count as effective working day; 1 = do not count as an effective work day). The first value returned for the bracket tells the system how to interpret absences for entitlement calculations (0 = count as effective work day). The second value tells the system how to interpret absences for the opening of entitlement (the 28 day period). For the list of valid TAKE CONFIG2 values, see Understanding the User-Defined (TAKE CONFIG) Fields.

ABS BR ASS TRAV CC specifies which absences the system should interpret as effective work days according to collective agreements.

The keys for this bracket are TAKE CONFIG2 and LABOR AGREEMENT. For each combination of these keys, the bracket returns two values: one for the bracket itself and one for the variable element ABS VR CP OUV CC. The first value returned for the bracket tells the system how to interpret absences for entitlement calculations. The second value tells the system how to interpret absences for the opening of entitlement (the 28 day period). For example, suppose that you want to interpret sick days as effective working days when calculating the opening of entitlement for collective agreement XYZ. In this case, access the bracket element ABS BR ASS TRAV CC, and for the combination of the keys TAKE CONFIG2 = MAL and Labor Agreement = XYZ, set the value returned in the variable ABS VR CP OUV CC to 0.

|

TAKE CONFIG2 (key) |

ABS BR ASS TRV LOI (return column for entitlement calculations) |

ABS VR OUV CP LOI (return column for opening of entitlement) |

|---|---|---|

|

MAL |

1 |

1 |

|

AT |

0 |

1 |

|

ATRCH |

1 |

1 |

|

TAKE CONFIG2 (key) |

LABOR AGREEMENT (key) |

ABS BR ASS TRAV CC (return column for entitlement calculations) |

ABS VR OUV CP CC (return column for opening of entitlement) |

|---|---|---|---|

|

MAL |

AFB |

1 |

1 |

|

ATRCH |

AFB |

1 |

1 |

|

AT |

AFB |

0 |

1 |

Extra Paid Vacation Days for Seniority (CPA BR JRS ANCIEN)

The entitlement element CPE ANCIENTE defines rules for granting extra days of paid vacation to payees based on seniority (conges payes anciennete). The bracket element CPA BR JRS ANCIEN returns the appropriate entitlement value for CPE ANCIENTE.

CPA BR JRS ANCIEN has the following keys:

ABS AC RECUP ANC, an accumulator element that stores years of service.

LABOR AGREEMENT, a system element that identifies the collective agreement.

For each combination of these keys, the bracket returns the number of business days of entitlement (in the bracket itself).

The following table shows the sample entitlement values PeopleSoft delivers with CPA BR JRS ANCIEN. You can change these values and specify seniority entitlement by collective agreement, if applicable.

|

ABS AC RECUP ANC (Key: Years of Seniority) |

LABOR AGREEMENT (Key: Labor Agreement) |

CPA BR JRS ANCIEN (Return column: Entitlement) |

|---|---|---|

|

2 |

|

2 |

|

3 |

|

3 |

|

6 |

|

6 |

Note: When calculating entitlement, the system refers to the payee's years of service as of the first day of the absence. If the payee crosses a seniority boundary during his absence, the system does not increase entitlement for that absence.

Effective Work Days for Seniority Accrual (ABS BR ANC_ABS LOI, ABS BR ANC_ABS CC)

Two bracket elements define how the system should consider a payee's absences when calculating years of seniority. One bracket (ABS BR ANC_ABS LOI) specifies the legal requirements; the second (ABS BR ANC_ABS CC) specifies the requirements by collective agreement.

ABS BR ANC_ABS LOI uses the system element TAKE CONFIG2 as the key. The bracket returns one of the following values:

0 if the absence is not considered an effective work day.

1 if the absence is considered an effective work day.

Or 0,5 if only half of the absent days are considered as effective work days (designed for a specific leave of absence).

|

TAKE CONFIG2 (key) |

ABS BR ANC-ABS LOI (return column) |

|---|---|

|

MAL |

0 |

|

AT |

1 |

|

ATRCH |

0 |

ABS BR ANC_ABS CC uses the system elements TAKE CONFIG2 and LABOR AGREEMENT as keys. For each combination of these two values it returns one value for the bracket element itself (0 or 1) and one value for the variable ABS VR J PAYES CC (0 or 1).

Possible values returned by the bracket element:

1 if the absence is considered as effective work by the collective agreement.

0 if the absence is not considered as effective work by the collective agreement.

The value returned by ABS VR J PAYES CC is relevant only when the bracket returns a value of 1. Valid values returned by ABS VR J PAYES CC:

1 if the absence is considered as an effective work day only if it is paid.

0 if the absence is considered an effective work day regardless of whether it is paid.

|

TAKE CONFIG2 (key) |

LABOR AGREEMENT (key) |

ABS BR ANC-ABS CC (return column) |

ABS VR J PAYES CC (return column) |

|---|---|---|---|

|

MAL |

AFB |

1 |

1 |

|

AT |

AFB |

1 |

1 |

|

ATRCH |

AFB |

1 |

1 |

The Minimum Work Period

Legally, the minimum work period required before a payee can begin to earn entitlement for paid vacation is one month or four weeks of work. This is equivalent to 28 calendar days, the number that the system uses to determine when a payee meets the minimum work period. This number is stored in the element CPA VR OUV DTS; do not change it.

Fixed-Term Contracts

The delivered entitlement rules for paid vacation take into account the requirements specific to persons with fixed-term contracts (CDD). The system identifies these employees through the contract information maintained in PeopleSoft HR.

Accumulation Periods for Paid Vacation (CPE CG PAYES)

|

Period |

Period Name |

Comments |

|---|---|---|

|

Current reference period |

A+1 |

Current period of accumulation. |

|

Current period (for taking vacation). |

A |

Entitlement calculated in A+1 is transferred to A each 31 May or 1 June. |

|

The period before the previous period. |

A-1 |

The balance for the current period is transferred to A-1 each 31 May or 1 June. |

|

The period before A-1. |

A-2 |

The balance for A-1 is transferred to A-2 each 31 May or 1 June. |

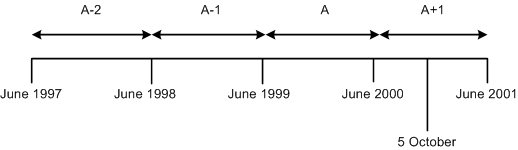

Example: Assume today is 5 October 2000. If the reference period is 1 June to 31 May, then the relevant accumulation periods appear in the following diagram:

Global Payroll for France tracks four totals for each accumulation period: entitlement earned, entitlement balance, take, and adjustments. For each, the accumulation period is set to Year To Date. By default, the Begin Option date is 1 June, meaning that the accumulation period runs from 1 June to 31 May of the following year.

Change the beginning month of the reference period by updating the variable CPA VR MOIS DEB REF. The Begin Option field refers to CPA VR MOIS DEB REF for the month. So, if the variable is set to 1, the accumulation period begins in January; if it is set to 5, the period begins in May, and so on.

Note: If you change the reference year by updating the variable element CPA VR MOIS DEB REF, the system automatically updates the accumulator periods for CPE CG PAYES.

Paid Vacation In-Lieu Allowance: Upon leaving a company, a payee is entitled to compensation in-lieu of any unused paid vacation days. Global Payroll for France automatically calculates the correct earnings for terminated payees, generating earnings for each day of unused paid vacation, seniority paid vacation, split vacation days, and other paid vacation days for which the employee is entitled to receive compensation.

Generation control triggers the calculation of allowances for paid vacation in-lieu. The system can generate up to four earnings for each period of paid vacation (if any days remain in the previous periods): A-2, A-1, A, and A+1. (The four accumulation periods are described in the previous topic.)

The system does not pay entitlement earned during the current reference period (A+1) when you select Termination in the Action/Reason field in Job Data, and then select misconduct (CON) or gross misconduct (GMI).