Understanding Country Setup

This section discusses:

Pay process flow.

Variables and categories.

Rounding rules.

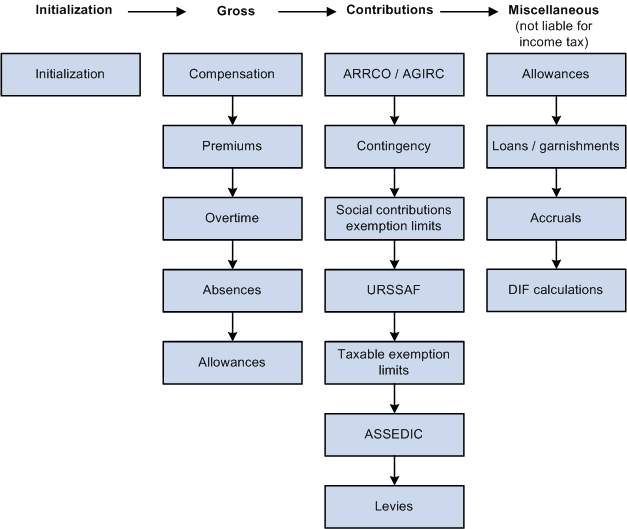

This diagram illustrates the pay process flow in Global Payroll for France

The following steps describe the pay process in Global Payroll for France:

Initialization.

The system executes formulas, arrays, dates, durations, and earnings in order to populate elements such as variables, accumulators, and formulas. These elements are needed by most of the other processes.

The system processes the Gross, which is made up of numerous earnings and deductions (compensation, premiums, overtime pay, absences, and allowances).

The system processes contributions, which are types of deductions (ARRCO/AGIRC, contingency funds, social contributions exemption limits, URSSAF, taxable exemption limits, ASSEDIC, and levies).

The system processes miscellaneous earnings and deductions that are not subject to income taxes, such as allowances, loans, garnishments, accruals, and DIF earnings.

A specific section manages the negative net-to-pay. This section is placed just before the accruals section. Other sections also appear at the end of the process list. Some sections are used to fill writable arrays, while others perform calculations to generate data for the absence process.

At the end of the calculation, several processes are completed to prepare data for different reports and processes.

These processes and reports include:

The DUCS preparation (by populating the writable array (REP WA DU CONTS).

The DADS preparation (by populating several payroll elements like variable or accumulators and the writable array DAS WA SITUAT S41).

The ASSEDIC certificate preparation (by populating the writable array REP WA AA ELMT).

The 2483 report preparation (by populating the writable array FOR WA 2483).

The employee survey report preparation (by populating the writable array BSO WE PAIE).

See Global Payroll for France Reports: A to Z.

Note: Set up the pay process in the order described so that the system processes the steps sequentially. If you stray from this order, the system may not function correctly.

Note: The pay process flow described here focuses only on the pay process and not on the absence process. For the absence process, different steps are followed and are described in the absence topic.

See Understanding Absence Setup and Management TasksUpdating Elements for Wage Certificates

Global Payroll for France enables you to update many of the delivered variables on the Variables by Category page. You can also define your own variables, assign them to a category, and update them, if necessary, on the Variables by Category page.

|

Category |

Description |

|---|---|

|

A36 |

Article 36 Employee |

|

A4 |

Article 4/4 bis Managers |

|

ASS |

ASSEDIC |

|

CPA |

Paid Vacation |

|

EMPL |

Employee |

|

GEN |

Country Setup Generic Variable |

|

HRS |

Additional and Overtime Hours |

|

IND |

Allowances |

|

LEV |

Levies |

|

PRV |

Contingency Funds |

|

RET |

ARRCO/AGIRC |

|

SAI |

Garnishments |

|

URS |

URSSAF |

|

RTO |

Retro- Elements retrieved in array |

The EMPL, A36, and A4 categories apply only to ARRCO/AGIRC deductions. During processing, they populate the variable ARC VR CATEGORIE, which is an accumulator key on most of the ARRCO/AGIRC accumulators. The deductions associated with the EMPL category are ARC T1 NC S, ARC T1 NC E, ARC T2 NC S, and ARC T2 NC E. When these deductions are processed, the category is retrieved and is used as an accumulator key.

Many of these categories are used to group variables on the Variables by Category page. You can adjust these variables on the individual contributions or directly in the Variables by Category page. For example, you can update the value of an URSSAF variable on the URSSAF Rates page or on the Variables by Category page.

Earnings and deductions provided by Global Payroll France have their results rounded using the rounding rule GP ROUND NEAR 2DEC. For the component elements (unit, base, rate, percent) of the earnings and deductions, the rounding rules applied are the pay group default rounding rules.