Understanding PAS

PAS (Prélèvement à la Source) is the tax payment system in France where the tax is deducted at the source. Employer withholds the tax when the income is paid to the tax payer based on the tax rate received from authorities and reports it through DSN.

PeopleSoft Global Payroll for France reads the incoming inbound DSN file, calculates PAS and reports the PAS details through DSN.

Tax Authorities communicate the rate to be applied for the Deduction at Source to the company via an Inbound DSN file and the employer uploads the inbound file into a predefined location. Once the file is uploaded, PeopleSoft reads this xml file and stores the employee tax rate along with other relevant information as a new record. As part of calculating Deduction at Source, tax rate is applied to each employee and the tax to be deducted at source for the selected period is calculated.

PAS processing steps include:

Tax Authorities communicate the tax rate to be used for PAS calculation to the employer via an Inbound DSN file in xml format. Employer needs to apply this tax rate and deduct the tax from each employee before paying them the salary. This tax rate is applied on the net taxable amount of the salary.

Employer can use this tax rate for PAS calculation for two months following its transmission, if no other updates are received from the authorities. If no updates on rates are received after two months, it is considered as absence of rates and a neutral tax rate is applied.

Note: Employer needs to make sure that the uploading file is in xml format and have a file name that comply with DSN norms. File name format should be YYYY-MM-DDThhmmss.

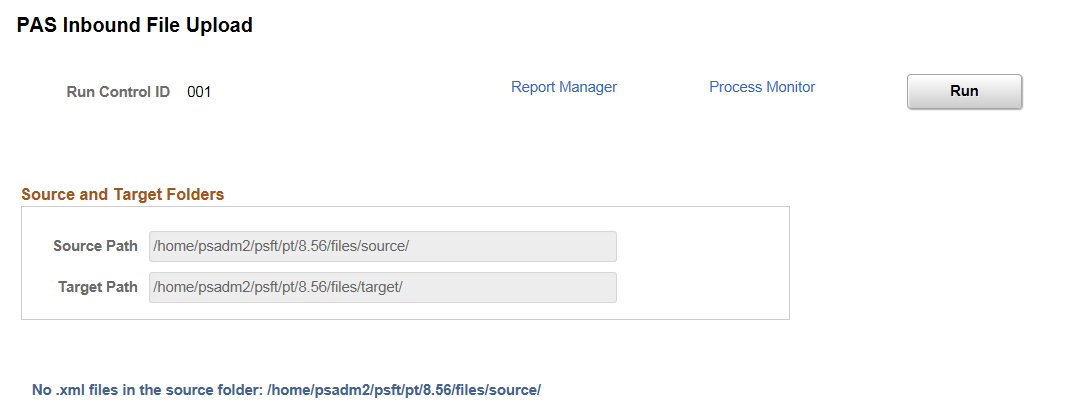

Use the PAS Inbound File Upload page (GPFR_PAS_RATE_LOAD) to upload the inbound DSN file to PeopleSoft. The inbound file should be in xml format.

Navigation:

This example illustrates the PAS Inbound File Upload Page.

The source and target path are defined under DSN Application Parameter.

It is in the source path where the user stores the file when they receive it from authorities and target path is where the system saves the file after it reads and puts the data into the record.

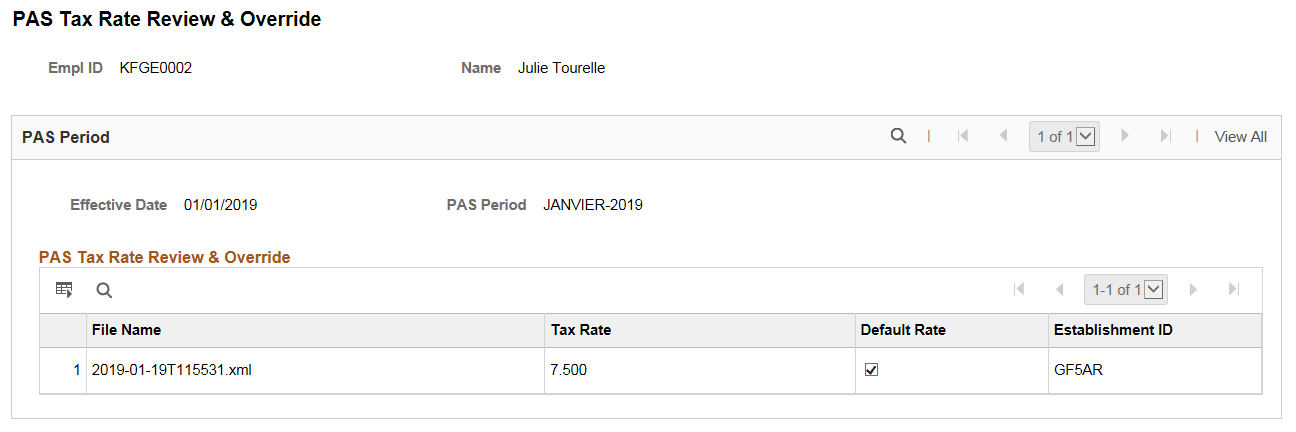

Once the PAS Inbound File Upload process is complete, use the PAS Tax Rate Review & Override page ( GPFR_PAS_RV_TAX_RT ) to review the received PAS tax rate for each employee.

Navigation:

This example illustrates the PAS Tax Rate Review & Override Page.

For some employees, there can be multiple tax rates available for the same period. In such scenario, the PAS Tax Rate Review & Override page lists the rates in multiple rows. If there are more than one rate received for an employee for the same period, by default, system selects the first one in the file. You can select the other rate if required.

Once you save the file, the tax rate will be stored employee wise.

For calculating PAS, PeopleSoft has delivered three deductions elements.

This table describes the delivered deduction elements associated with PAS. A (gc) in the row indicates that the deduction has a generation control.

|

Deduction Element |

Description |

Deduction Calculation Rule |

|---|---|---|

|

PAS (gc) |

This deduction is made by the employer when the income is paid to the employee. |

Base* Percent |

|

PAS REGUL BS |

This deduction is used for Base regularization. |

Base* Percent |

|

PAS REGUL RT |

This deduction is used for Rate regularization. |

Base* Percent |

For more information on PAS REGUL BS and PAS REGUL RT, see Regularizing the Deduction for PAS

As a payroll administrator, you can update values for the following variables using SOVR (Supporting Element Override) option.

|

Variable |

Description |

|---|---|

|

PAS VR ELIGIBLE |

This variable indicates if the employee is eligible for PAS deduction. If the value of the variable is blank, then the employee is eligible for PAS deduction. If any value is entered for the variable PAS VR ELIGIBLE, then the employee is not eligible for PAS deduction. Default value of this variable will be blank. |

|

PAS VR REDUCTION |

This variable is used to store the percentage of reduction from the Fiscal Net. The value for this variable will be at the employee level and a payroll administrator can enter a new value via SOVR (Supporting Element Override). Default value of the this variable will be zero (0). |

As a payroll administrator, you might need to correct the previously processed PAS data of employees as indicated by the administration. PeopleSoft supports regularization of the base value and rate value for PAS. When there is a regularization, the deduction gets processed based on the delivered deduction elements (PAS REGUL BASE and PAS REGUL RT).

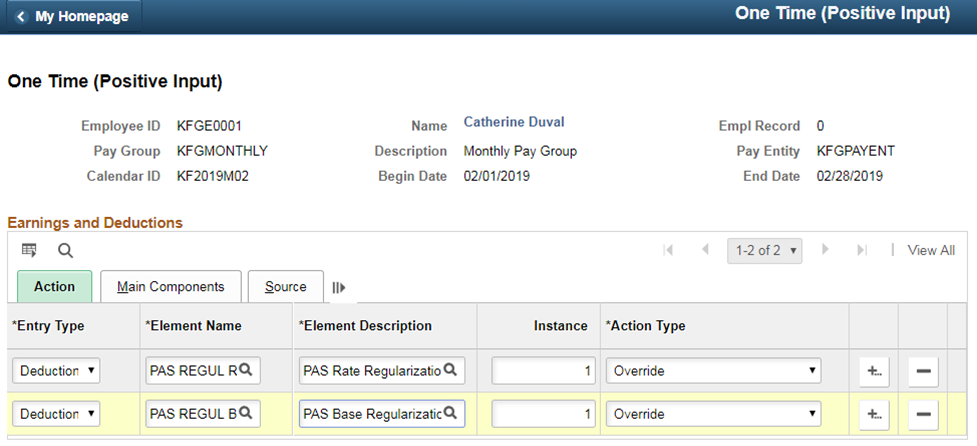

Use the One Time (Positive Input) Page to regularize base and/or rate value for any of the previously processed period.

This example illustrates the One Time (Positive Input) Page.

If the rate needs to be corrected (regularized), select the deduction element as PAS REGUL RT. If the Base needs to be corrected (regularized), select the deduction element as PAS REGUL BS.

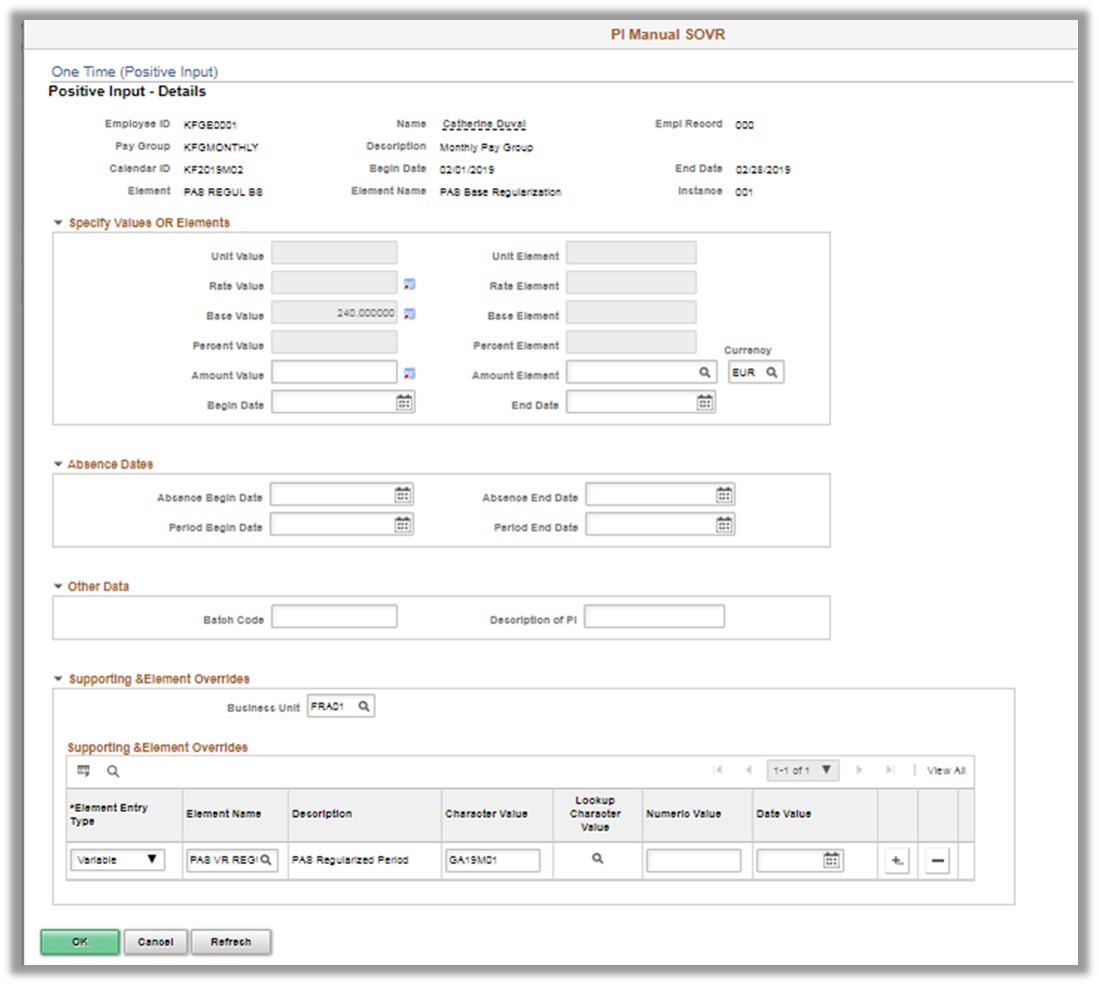

Use the Positive Input - Details page (GP_PI_MNL_SEC) to enter regularized Base and Rate values. For PAS REGUL BS, enter the base value and for PAS REGUL RT, enter the rate value.

Note: Ensure that you enter only a delta value.

This example illustrates the Positive Input - Details Page.

In the Supporting & Element Overrides section, select the period corresponding to the variable, PAS VR REGUL RATE, in which the base and/or rate value of the PAS deduction needs to be corrected.

During the current period payroll run, after deducting the PAS for the current period, system calculates the regularized deduction ( PAS REGUL BS and PAS REGUL RT) for the specified period (PAS VR REGUL RATE) based on the positive input and supporting element override information provided.

Employer reports PAS to authorities via DSN.

PeopleSoft has delivered the additional DSN nodes and attributes added by the DSN authorities to report PAS information. After processing the payroll, based on these nodes, PAS is reported in DSN.

For more information, see DSN Reporting