Setting Up Public Housing Fund and Social Insurance Data

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCN_CONT_COUNTRY |

Used by Benefit Administrators to set up country PHF/SI data. |

|

|

GPCN_CONT_COU_SEP |

Used by Benefit Administrators to define return values for HUKOU types and Working & Living permits for country contribution areas at the country level. |

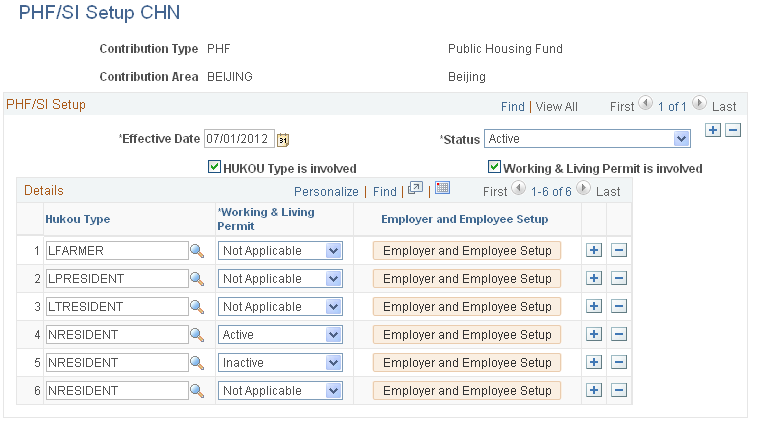

Benefit Administrators use the PHF/SI Setup CHN (GPCN_CONT_COUNTRY) page to set up country PHF/SI data.

Navigation:

This example illustrates the fields and controls on the PHF/SI Setup CHN page.

Note: Currently, no established rules exist for supplementary medical insurance for the Tianjin contribution area. Therefore, PeopleSoft Global Payroll for China does not deliver the supplementary medical insurance (SUP MEDICAL) contribution type for the TIANJIN contribution area. If you want to assign the SUP MED_EE deduction to a payee in the Tianjin contribution area, you must select Add a New Value for the PHF/SI Setup CHN or Company PHF/SI Setup CHN pages to create it yourself. Otherwise, the system will not calculate the assigned SUP MED_EE deduction during a payroll run.

Field or Control |

Description |

|---|---|

HUKOU Type is involved |

Select this check box is to require a HUKOU type for this combination of contribution type and contribution area. Clear it to prevent HUKOU types for the contribution type and area combination. The system selects the check box by default. Note: The system will not calculate an assigned PHF/SI deduction if the payee to which you assigned it does not have a specified Hukou type. You can specify a payee's Hukou type using the Hukou Type field on the Regional page, or by creating a supporting element override (SOVR) for the CN VR HUKOU variable. |

Working & Living Permit is involved |

Select this check box to require a Working & Living permit for this combination of contribution type and contribution area. Clear it to prevent Working & Living permits for this contribution type and area combination. The system selects the check box by default. |

HUKOU Type |

(Appears only if the HUKOU Type is involved check box is selected.) Identify each HUKOU type to allow for this combination of contribution type and contribution area. |

Working & Living Permit |

(Appears only if the Working & Living Permit is involved check box is selected.) Select a Working & Living permit status for each HUKOU type. The default value is Not Applicable |

Employer and Employee Setup |

Select this button to access the Employer and Employee Setup page where you can define return values for the HUKOU and Working & Living permit combination. The page opens in a new pop-up window. |

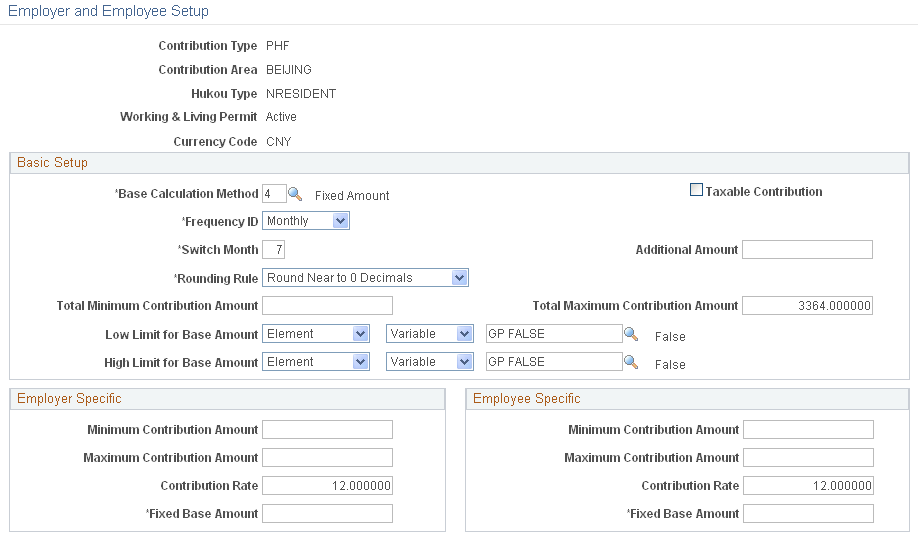

Benefit Administrators use the PHF/SI Setup CHN - Employer and Employee Setup page (GPCN_CONT_COU_SEP) to define return values for HUKOU types and Working & Living permits at the country level.

Navigation:

Select the Employer and Employee Setup button on the PHF/SI Setup CHN page.

This example illustrates the fields and controls on the PHF/SI Setup CHN - Employer and Employee Setup page.

Field or Control |

Description |

|---|---|

Base Calculation Method |

Select the base calculation method to use to calculate PHF/SI deductions. Values are:

|

Frequency ID |

Select the frequency, by which to calculate the deduction, either Annual or Monthly. If Annual is selected, the Contribution Month field appears, where you must specify the month in which to calculate the deduction each year. |

Switch Month |

Enter the number of the month in which to recalculate the base amount. Note: A payee must have a full year of payroll results to be eligible for this recalculation. |

Rounding Rule |

Select the rule to use to specify an upper or lower limit for a deduction. If the base amount is outside those limits, the system will reset the base amount to the appropriate upper or lower limit based on the rule you specify. |

Fixed Base Amount |

This field appears in the Employer Specific and Employee Specific group boxes only when the Base Calculation Method field is set to 4 (Fixed Amount). You must enter the fixed amount to save the page. |

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCN_CONT_COMPANY |

Used by Benefit Administrators to set up company PHF/SI data. |

|

|

GPCN_CONT_COM_SEP |

Used by Benefit Administrators to define return values for HUKOU types and Working & Living permits for company contribution areas at the company level. |

Benefit Administrators use the Company PHF/SI (GPCN_CONT_COMPANY) page to set up company PHF/SI data.

Navigation:

This example illustrates the fields and controls on the Company PHF/SI Setup CHN page.

Fields and controls on this page are similar to those on the PHF/SI Setup CHN Page (GPCN_CONT_COUNTRY), except as follows:

Field or Control |

Description |

|---|---|

Company |

Shows the company name that you entered to access the page. |

Load Default Country Setups |

Select this button to override any current country settings and load the default country settings for the combination of Contribution Type, Contribution Area, Effective Date, and Status that you’ve selected. Note: To successfully load country defaults, the PHF/SI Setup CHN page must be completed, and the effective date from country setup must be closest to but no later than the effective date on the PHF/SI Setup CHN page. |

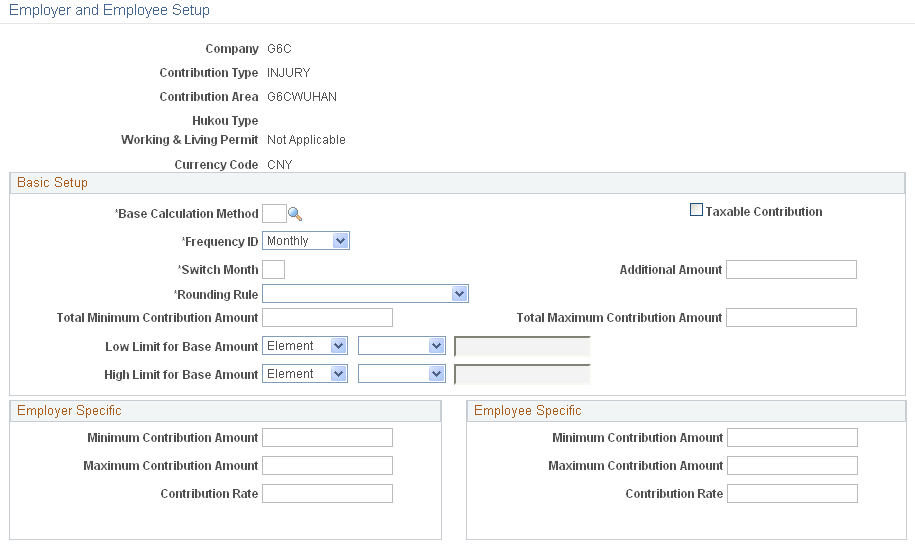

Benefit Administrators use the Company PHF/SI Setup CHN - Employer and Employee Set (GPCN_CONT_COM_SEP) page to define return values for HUKOU types and Working & Living permits for company contribution areas.

Navigation:

Select the Employer and Employee Setup button on the Company PHF/SI Setup CHN page.

This example illustrates the fields and controls on the Company PHF/SI Setup CHN - Employer and Employee Setup page.

Fields and controls on this page are similar to those on the PHF/SI Setup CHN - Employer and Employee Setup Page(GPCN_CONT_COU_SEP), except as follows:

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Mapping PHF/SI Cont Area CHN Page (mapping PHF/SI contribution area) |

GPCN_CONT_A_LOC |

Used by Benefit Administrators to map locations to PHF/SI contribution areas. |

|

GPCN_TAX_A_LOC |

Used by Payroll Administrators to map locations to PHF/SI tax areas. |

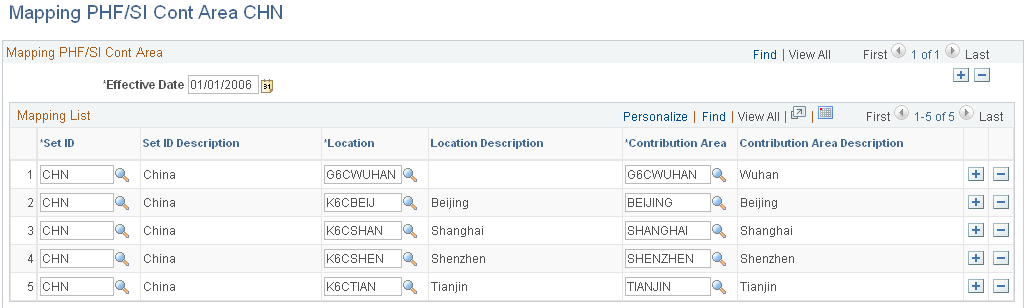

Benefit Administrators use the Mapping PHF/SI Cont Area CHN page (GPCN_CONT_A_LOC) to map locations to PHF/SI contribution areas.

Navigation:

This example illustrates the fields and controls on the Mapping PHF/SI Cont Area CHN (Mapping PHF/SI Contribution Area) page.

Field or Control |

Description |

|---|---|

Location |

Enter the code for the location that you want to map to the contribution area. |

Contribution Area |

Enter the code for the PSH/SI contribution area. |

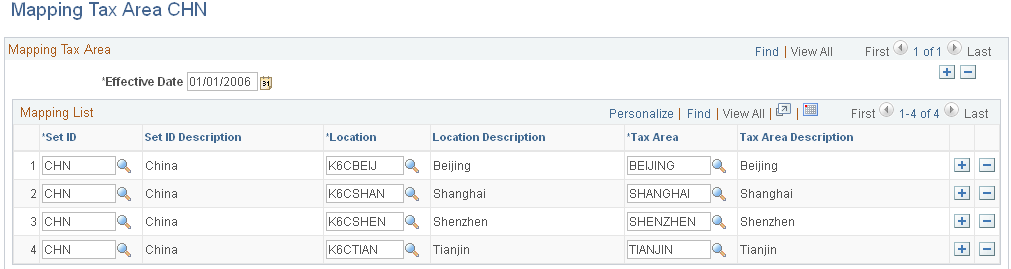

Payroll Administrators use the Mapping Tax Area CHN (GPCN_TAX_A_LOC) page to map locations to PHF/SI tax areas.

Navigation:

This example illustrates the fields and controls on the Mapping Tax Area CHN page.

Field or Control |

Description |

|---|---|

Location |

Enter the code for the location that you want to map to the PHF/SI tax area. |

Tax Area |

Enter the code for the PHF/SI tax area. |

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCN_CONT_A_SAL |

Used by Benefit Administrators to set up salary guideline for PHF/SI contribution areas in different years. |

|

|

GPCN_TAX_A_SAL |

Used by Payroll Administrators to set up salary guidelines for PHF/SI tax areas in different years. |

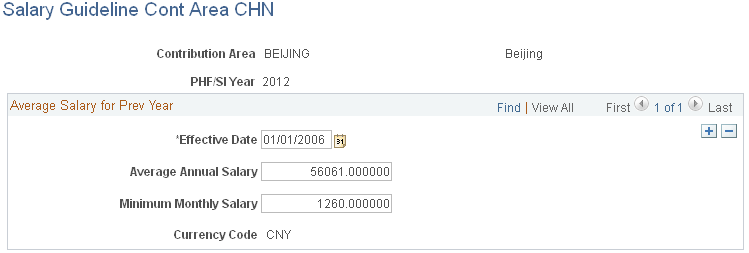

Benefit Administrators use the Salary Guideline Cont Area CHN (GPCN_CONT_A_SAL) page to set up salary guidelines for contribution areas in different years.

Navigation:

This example illustrates the fields and controls on the Salary Guideline Cont Area CHN page.

Field or Control |

Description |

|---|---|

Average Annual Salary |

Enter the average annual salary amount for the PHF/SI contribution area. |

Minimum Monthly Salary |

Enter the minimum monthly salary amount for the PHF/SI contribution area. |

Payroll Administrators use the Salary Guideline Tax Area CHN (GPCN_TAX_A_SAL) page to set up salary guidelines for PHF/SI tax areas in different years.

Navigation:

This example illustrates the fields and controls on the Salary Guideline Tax Area CHN page.

Field or Control |

Description |

|---|---|

Average Annual Salary |

Enter the average annual salary for the PHF/SI tax area. |

Minimum Monthly Salary |

Enter the minimum monthly salary for the PHF/SI tax area. |

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCN_PHFSI_REGT |

Define PHF/SI registration information for pay entities. |

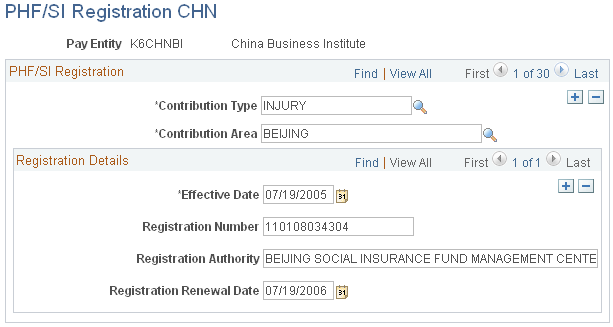

Use the PHF/SI Registration CHN page (GPCN_PHFSI_REGT) to define PHF/SI registration information for pay entities.

Navigation:

This example shows the fields and controls on the PHF/SI Registration CHN page.

In Global Payroll for China, you enter PHF/SI registration information at the pay entity level. You must enter registration details for each combination of contribution type and contribution area. For example, you define registration information for work-related injury insurance contributions in Beijing separately from the registration information for the same type of contribution in Shanghai.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCN_CONT_T_SEQ |

Used by Benefit Administrators to define the sequence of appearance of contribution type pages in the Payee PHF/SI Setup CHN component. |

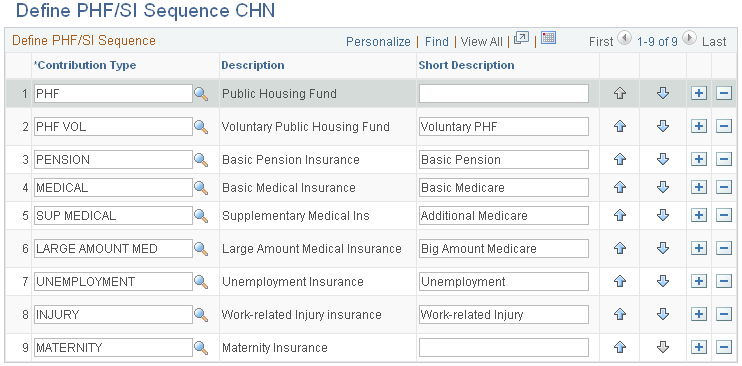

Benefit Administrators use the Define PHF/SI Sequence CHN (GPCN_CONT_T_SEQ) page to define the sequence of appearance of PHF/SI contribution types in the PHF/SI Setup CHN component.

Navigation:

This example illustrates the fields and controls on the Define PHF/SI Sequence CHN page.

Manage the rows of contribution types here to control what pages and in which sequence pages appear on the PHF/SI Setup CHN component.

Note: The Short Description field entry is limited to a maximum of 20 characters.