Entering Bank File Information

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_BNK_FILE_ENTRY |

Enter bank transactions manually, if a bank file has not already been loaded using the Component Interface or another method of importing the payment transactions into the bank tables. |

If the bank supplies an electronic or flat file, it can be loaded into the bank tables using Excel to CI (PeopleTools Component Interface). You must create an Excel workbook to use with the delivered bank tables. Executing the Excel to CI will render that the same validation and edits are applied as if a user was entering the bank file online.

See PeopleTools: PeopleCode API Reference product documentation.

Use the Bank File Entry page (GP_BNK_FILE_ENTRY) to enter bank transactions manually, if a bank file has not already been loaded using the Component Interface or another method of importing the payment transactions into the bank tables.

Navigation:

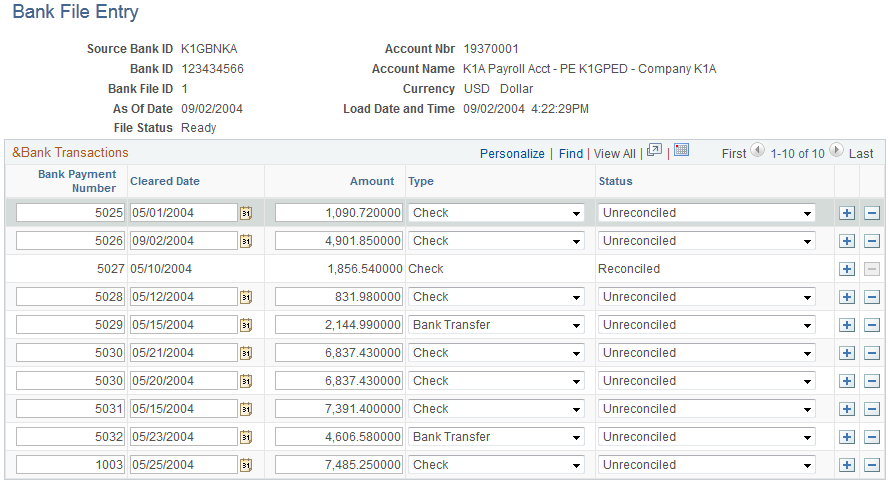

This example illustrates the fields and controls on the Bank File Entry page.

Field or Control |

Description |

|---|---|

Currency Code |

Currency retrieved from the Source Bank ID. This field is display only. |

Bank File ID |

A unique sequence number assigned whether the bank file is loaded using component interface or manually. |

As Of Date |

Enter the day on the bank statement or represents the date on the bank file. |

Load Date and Time |

Defaults to the current date and time when the bank file is entered or loaded through component interface. |

File Status |

There are three valid values: Ready: Assigned when the bank file is first entered manually or loaded using the component interface In Progress: Set if the bank file was previously reconciled and contains exceptions. Complete: Set when all transactions in the bank file have successfully been reconciled. |

Bank Payment Number |

Enter the check number or reference for any bank charges or fees. |

Cleared Date |

Enter the date the checks were presented for payment at the bank. (clear date) |

Amount |

Enter the check or transaction amount that cleared the bank. |

Type |

Enter the type of method of payment. Valid Values are Check , Transfer, and Wire. |

Status |

Enter the status of the transaction. The default value is Unreconciled. The values that are auto-assigned as result of running the payment reconciliation process are: Unreconciled, Reconciled, Amount Difference, Different Pay Method, Duplicate, and Not Found. The remaining values that are user assigned if there is a manual reconciliation are: Stop Payment, Re-Numbered, Expired, Unclaimed, Void, and Date Difference. Note: When a transaction status is manually changed from Unreconciled to Reconciled a warning is issued. This warning alerts the user that a transaction is being reconciled only on the bank side to a transaction on the system side. A user changing the status of a bank transaction only allows the completion of the reconciliation process (the file status changes from In Progress to Complete). Reconciling a bank transaction without matching it to a system transaction brings the bank file and general ledger out of balance , it is the user's responsibility to journalize this type of transaction in their general ledger. When the status of a transaction is set to Reconciled it becomes display only and users can no longer modify it. Users can also set this status manually on the Manual Reconciliation page. |